Thermal Systems Market Report Scope & Overview:

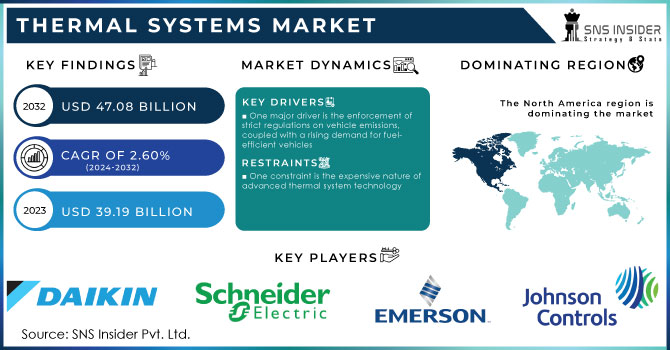

The Thermal Systems Market was valued at USD 38.73 billion in 2023 and is expected to reach USD 47.71 billion by 2032, growing at a CAGR of 2.37% over the forecast period 2024-2032. The Thermal Systems Market is changing with different technological developments such as heat transfer efficiency, energy consumption, sustainability compliance, etc. Raw material availability, manufacturing automation, and geopolitical trade policies influence supply chain dynamics. Market intelligence encompasses competitive technology innovation, strategic mergers, and R&D investments to gain favorable business positioning. Rising demand for eco-friendly, cost-effective solutions among consumers coupled with growing inclination towards smart thermal systems that are integrated with IoT and prevailing Internet of Things technology by end-users will continue to drive the market growth. Though the adoption of phase change materials is growing within HVAC, automotive, and industrial applications due to regulatory standards, government incentives, and the global transition toward energy-efficient and renewable thermal management solutions, market penetration differs widely across industries.

Get More Information on Thermal Systems Market - Request Sample Report

Market Dynamics

Key Drivers:

-

Rising Demand for Energy-Efficient Thermal Systems Driven by EV Growth, Emission Regulations, and Innovation

The availability of thermal systems is certainly building up while the market is driven by robust demand for better quality energy-efficient products, especially in terms of automotive HVAC systems. The global push towards cleaner and more fuel-efficient mobility along with stringent emission regulations has forced automakers to adopt an advanced thermal management solution to improve fuel efficiency and reduce carbon footprint. Moreover, the increasing penetration of electric and hybrid vehicles along with the growing demand for electric battery cooling systems to boost performance and durability will further escalate the market share. In addition, the increasing demand for high-quality cabin comfort and cabin climate control systems is expected to propel the growth of the automotive thermal system market. In addition, the advancement of powertrain cooling technologies and the use of lightweight materials also drive the market.

Restrain:

-

High Costs, Regulations, and Integration Challenges Hinder Growth of Advanced Thermal Systems in Healthcare

A key challenge is the expense of advanced Thermal Systems, particularly in wearables and implants. Very high-precision sensors are costly for both healthcare providers and end users as they need huge investments in terms of research, miniaturization, and regulatory compliance. Although medical devices are lucrative; stringent regulatory approvals in different regions, make them challenging for the market players as compliance with different international standards may delay product launches and raise the cost of launching the device. Similarly, practical adoption is limited due to integration complexities with existing healthcare infrastructure and electronic health record (EHR) systems.

Opportunity:

-

EV Growth Drives Demand for Advanced Thermal Management, Smart Cooling, and Eco-Friendly Refrigerant Innovations

The growing electrification of the automotive industry is creating opportunities in the thermal systems market The shift to electric mobility is creating an urgent need for advanced thermal management technologies, including liquid cooling and phase change materials, to maximize battery efficiency and mitigate pack overheating. Intelligent control of thermal management solutions, part of the IoT/AI space, could unlock huge growth potential. Furthermore, rising investment in research and development concerning sustainable, eco-friendly refrigerants will offer new prospects for market players in the future to utilize emerging environmental regulations and green technology initiatives.

Challenges:

-

EV Thermal Management Challenges Hinder Battery Optimization, Standardization, and Adoption in Developing Markets

The major area of concern is electric vehicle thermal management complexity. EVs have a performance need for some thermal management of the battery compared to internal combustion engine (ICE) vehicles but this need is a major challenge when it comes to battery optimization processes, which need to be run in a wide range of settings in the vehicle, without compromising the vehicle range. Still, the absence of uniform thermal management solutions across various EV platforms further complicates design work and integration for OEMs. In addition, the lack of charging infrastructure in terms of volume in developing regions limits the volume of EV adoption, which indirectly impacts the demand for advanced thermal management solutions in such markets.

Segments Analysis

By Component

HVAC held the largest market share of 39.1% in 2023 and is projected to be the fastest-growing component from 2024 to 2032. Market revenue growth is rising due to growing demand for energy-efficient heating, ventilation, and air conditioning (HVAC) systems. In addition, growing industrialization, urbanization, and the tightening of governmental legislation on energy consumption are also contributing to the adoption of advanced HVAC solutions. Thanks to the combination of smart technologies like IoT and AI, HVAC systems become more sustainable by being more efficient and controlling their operations. Besides this, the expanding construction industry, especially in residential and commercial buildings, provides a boost to market growth. Manufacturers are working on developing eco-friendly refrigerants and advanced HVAC (heating, ventilation, and air conditioning) systems that fit sustainability goals. Market players can capitalize on the lucrative opportunities emerging economies provide as they are undergoing infrastructural developments very quickly coupled with climate changes. With the focus on energy efficiency continuing, the HVAC market is due to see significant growth in the upcoming few years.

By Vehicle Type

Passenger vehicles accounted for 58.7% of the market share in 2023, due to growing demand for personal mobility, coupled with the increasing urbanization, and rising disposable income. In addition, the increasing demand for technologically advanced vehicles with high fuel efficiency has also contributed to the growing expansion of the market. Vehicle makers are adding a hunting ground for advanced safety features, connection solutions, and electrification technologies for better performance and a stronger consumer favorite. Besides, the rising incentives by the government on electric and hybrid passenger cars are making their adoption easier.

The segment of commercial vehicles will record the highest CAGR between 2024 and 2032. Market growth is majorly driven by the rapid increase in demand for logistics, e-commerce growth, and growth of infrastructural development. Electric as well as autonomous commercial vehicles, along with stricter emission standards, are prompting manufacturers to innovate, causing rapid evolutions within the sector.

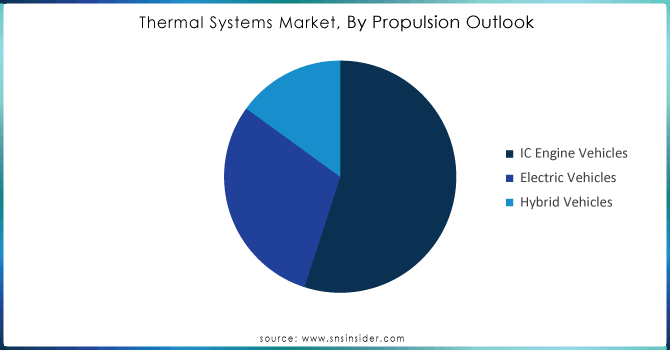

By Propulsion Outlook

The market share of IC Engine vehicles was 51.4% in 2023, primarily due to their availability, infrastructure, and lower cost across different regions. The internal combustion engine (ICE) division stays strong due to taking part in demand in nations with increasing economies, exactly where cars powered by gasoline are the actual selling preference as a result of reduced cost and also sensor facilities. Furthermore, the development of fuel economy and hybrid technologies has only served to strengthen the ICEs market leading position.

The electric vehicle (EV) segment is projected to witness significant growth during the forecast period, at the highest CAGR from 2024 to 2032, owing to increasing focus on environmental safety, government initiatives to promote EVs, and developments in battery technology. He went on to say the global move towards sustainability, decreasing battery prices, and increasing charging infrastructure was driving up sedan EV take-up. Automobile manufacturers are putting in a lot of bangs in research and development to deliver EVs in a more cost-efficient manner.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Regional Analysis

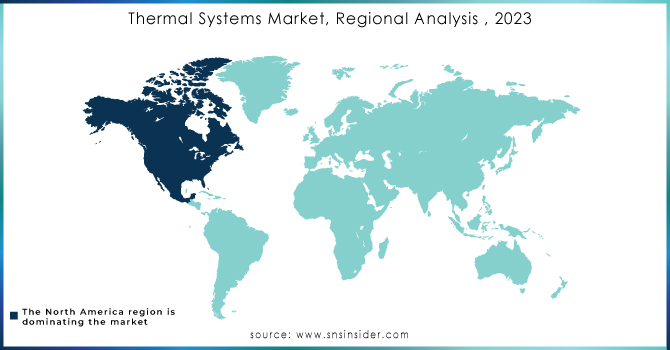

In 2023, North America accounted for the largest market share of 34.7% due to high industrialization, advancement in technology, and well-established automotive and manufacturing sectors. This dominance is attributed to the presence of major market players, high investment in R&D, and favorable government policies to assist innovation. Moreover, the increasing demand for electric vehicles, smart infrastructure, and energy efficiency solutions has contributed to the market growth. This includes Tesla's unabated growth in the U.S. EV space and General Motors' gradual investments in autonomous and electric vehicles. Similarly, organizations such as Carrier and Trane Technologies are pushing developments in HVAC and Energy-effective arrangements, which likewise fortifies North America the business sector place.

The Asia Pacific region is projected to register the fastest CAGR during the forecast period from 2024 to 2032 due to rapid urbanization, increasing industrial activities, and strong government initiatives supporting sustainable technologies. Demand in different sectors, such as automotive, electronics, and infrastructure, is also being driven by the growing population of middle-class consumers and increasing disposable income in the terrain. Take, for example, Chinese dominance in EV production with firms such as BYD and NIO helping to drive expansion. Also, the smart city development initiatives by India along with renewable energy projects investments are contributing to the industry growth.

Key players

Some of the major players in the Thermal Systems Market are:

-

Daikin Industries Ltd (Residential Air Conditioners),

-

Trane (Commercial HVAC Systems),

-

Teledyne FLIR (Thermal Imaging Cameras),

-

Viessmann (Heat Pumps),

-

Vertiv (Liquid Cooling Solutions for Data Centers),

-

Comfort Systems USA (Modular Cooling Units for Data Centers),

-

MGA Thermal (Thermal Energy Storage Blocks),

-

Jaga (Renewable Technology Radiators),

-

Antrax IT (Designer Radiators),

-

Terma (Artistic Radiators),

-

Cinier (Stone Radiators),

-

Tubes Radiatori (Innovative Radiator Designs),

-

Mission (Cooling Hats and Towels),

-

GE Appliances (Advanced Air Handlers),

-

Electrified Thermal Solutions (Conductive Firebricks for Heat Storage).

RECENT DEVELOPMENT

-

In April 2024 The Tesla, Inc., LG Chem involved in the development of electric vehicle battery thermal management systems. The electric vehicle battery thermal management systems market works on solutions to control battery temperature, improving performance, efficiency, and safety in EVs. Growth is driven by more EVs on the road, better battery tech, and rules needing thermal management. These systems use cooling methods, heat exchangers, and insulation to keep batteries at the right temperature, stop them from getting too hot, and make them last longer. Manufacturers provide customized solutions for different EV setups and battery types.

-

In February 2023, Honeywell International Inc. revealed its acquisition of United Technologies Corporation for a sum of $90 billion. United Technologies, renowned for its aerospace and building technologies, notably thermal management solutions, will soon become part of Honeywell. The acquisition is projected to finalize in the latter half of 2023.

-

In June 2023, Parker Hannifin Corporation disclosed its acquisition of Lord Corporation for $4.4 billion. Lord, known for its vibration and motion control products, which include thermal management solutions, will soon be under the umbrella of Parker Hannifin. The acquisition is anticipated to be finalized in the fourth quarter of 2023.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 38.73 Billion |

| Market Size by 2032 | USD 47.71 Billion |

| CAGR | CAGR of 2.37% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Compressor, HVAC, Powertrain Cooling, Fluid Transport) • By Vehicle Type (Passenger Vehicles, Commercial Vehicles) • By Propulsion Outlook (IC Engine Vehicles, Electric Vehicles, Hybrid Vehicles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Daikin, Trane, Teledyne FLIR, Viessmann, Vertiv, Comfort Systems USA, MGA Thermal, Jaga, Antrax IT, Terma, Cinier, Tubes Radiatori, Mission, GE Appliances, Electrified Thermal Solutions. |