Thermal Management Technologies Market Size & Trends:

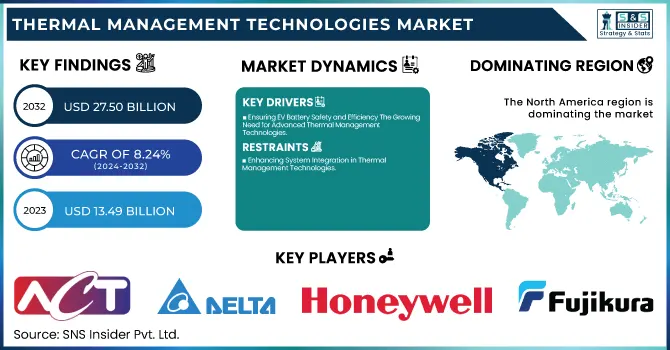

The Thermal Management Technologies Market Size was valued at USD 13.49 Billion in 2023 and expected to reach USD 27.50 Billion by 2032, growing at a CAGR of 8.24% during 2024-2032. Increased need for effective cooling solutions across data centers, consumer electronics, electric vehicles, and aerospace sectors is driving growth of the market. According to the report, North America remains the largest market for quantum computing, while Europe is growing at the fastest rate owing to increased investments in high-performance computing (HPC) and AI-based systems.

To Get more information on Thermal Management Technologies Market - Request Free Sample Report

As previously mentioned, the reduction of thermal resistance is still one of the key focuses, and phase change material has undergone several innovations in recent times, along with liquid cooling, and advanced heat sinks adding to the heat dissipation capacity. The heat density in HPC environments is increasing and requires effective cooling solution. There are also efficiency improvements in the sector, which enhances energy savings and card performance results. The next generation of thermal management solutions is driven by continuous R&D efforts on nanomaterials, two-phase cooling, and 3D-IC thermal modeling.

Thermal Management Technologies Market Dynamics:

Drivers:

-

Ensuring EV Battery Safety and Efficiency The Growing Need for Advanced Thermal Management Technologies

The rapid expansion of the electric vehicle (EV) market, driven by increasing lithium-ion battery production and stringent safety regulations, the electric vehicle (EV) Industry is rapidly expanding, pushing towards innovative thermal management technologies. Next-generation design BTMS using PCM implement in metal-foam embedded PCM-foam with liquid cooling can save up to 53% in system weight and around 90% in terms of total cooling power consumption according to studies. Moreover, the AI engine with CNN-LSTM-based control strategies can drive thermal stability enhancement by 40–43% and maintains temperature control at ±0.3°C, as well as improving energy efficiency by 2.1% to guarantee the most favorable battery performance. With electric vehicle (EV) batteries that possess great energy densities, uncontrolled thermal events can liberate six-fold electrochemical energy causing hazardous thermal runaway conditions. The integrated thermal management systems (ITMS) not only vastly reduce compressor energy consumption, but also enhance the exergy efficiency by 1.8%, which highlights the value of these technologies. Global regulatory frameworks promote fire prevention and sustainability; as a result, manufacturers are focusing on thermal solutions that enable longer battery life, lower lifecycle cost, and optimum fast-charging capabilities — making thermal management an essential enabler for the future of EVs.

Restraints:

-

Enhancing System Integration in Thermal Management Technologies

Integrating thermal management systems into modern electronic and automotive architectures requires precise engineering to ensure seamless compatibility and efficiency. More advanced cooling solutions like liquid cooling and phase change materials (PCM) need to be strategically designed to maximize heat dissipation while minimizing weight and energy consumption. From electric vehicles (EV) battery temperature regulation is vital to safety and can impact the longevity of the vehicle, leading to an equation that juggles aerodynamics and power efficiency. High-performance computing and semiconductor applications require ultra-compact cooling solutions that deliver lower thermal resistance with minimal disruption to system operation. While focusing on reducing the weight, they are adopting high-efficiency hard and software models driven by AI to optimize temperature without drawing much power from the nest. Key to streamlining these advancements and widespread adoption is the establishment of standardized integration protocols across industries.

Opportunities:

-

Expanding EV Market Drives Demand for Next-Generation Thermal Management Technologies

The increasing adoption of electric vehicles (EVs) and advancements in battery technology compounds the need for advanced thermal management solutions to improve battery safety, lifespan, and efficiency. Next, we are optimizing next-gen thermal interface materials (TIMs) with ultra-low thermal resistance and low heat-dissipation. Companies like Novolinc to develop more complex TIMs that are critical for heat management are securing large investments. Furthermore, AI-derived thermal management solutions are being integrated into systems like battery cooling systems, guaranteeing accurate temperature regulation with low energy usage. Multi-die designs are forecasted to be in the overwhelming majority of new high-performance computing (HPC) chips by 2025, and with this transformation comes an opportunity for advanced thermal-management solutions to help usher in the transition. These innovations set the thermal management industry up for continued growth as EV and AI markets continue to grow.

Challenges:

-

Optimizing Thermal Management Without Increasing Power Consumption

Thermal management technologies need to achieve heated dissipation efficiency without consuming more power which is a challenge. While liquid cooling and phase change materials (PCM) solutions have gained traction, these methods can consume more energy, ultimately leading to decreased efficiency across the system. EVs rely on their thermal management systems to ensure battery safety and performance without impacting driving range. Excessive power and energy consumption have negative consequences in data centers and high-performance computing as well, with increased operational expenses and environmental footprint. Solutions to this dilemma are on the way, with innovations like AI-based thermal control, thermoelectric cooling and enhanced heat spreaders promising efficiency with less energy consumption Achieving the right balance between cooling performance and power consumption is critical for the future of thermal management technologies.

Thermal Management Technologies Market Segment Analysis:

By Material

In 2023, the adhesive material segment dominated the thermal management technologies market, accounting for approximately 65% of the total market share. Adhesive materials such as thermal interface adhesives and conductive pastes are crucial for improved heat dissipation performance across applications such as electric vehicles, consumer electronics, and high-performance computing. Unlike traditional thermal pads and greases, adhesive materials offer strong bonding, high thermal conductivity, and easy application. As electronic components continue to get more miniaturized while increasingly high thermal loads, demand for advanced adhesive materials continues to grow. Market expansion is also driven by innovations in nanomaterial-infused adhesives and phase-change adhesives that lead to increased thermal performance and overall durability for the technology.

The non-adhesive material segment is the fastest-growing category in the thermal management technologies market, projected to expand significantly during the forecast period from 2024 to 2032. The growth is driven by increasing demand for alternative cooling solutions such as phase change materials , thermal interface films, and advanced metal-based heat spreaders, which offer superior heat dissipation without the respective limitations of adhesive-based solutions. Non-adhesive materials are increasingly adopted in high-performance computing, electric vehicles, and renewable energy applications where efficient heat management is crucial for overall system reliability and longevity. Moreover, advancements in nanotechnology and composite materials are improving the thermal conductivity and enhancing mechanical stability in non-adhesive products.

By Device

The conduction cooling device segment accounted for approximately 51% of the thermal management technologies market in 2023, making it the dominant category. The increase is fueled by their ability to OEMs and devices able to achieve extremely high-efficiency per electricity given in direct contact with the energy loss and the high efficiency of heat transfer to the electromagnetic field. Conduction cooling solutions like heat sinks, heat pipes and vapor chambers find application in a wide range of industries, including consumer electronics, electric vehicles (EVs) or high-performance computing, where reliable and passive cooling mechanisms are crucial. The increasing need for compact and high-performance thermal solutions in semiconductor packaging and AI-infused applications has also propelled the adoption of conduction cooling devices.

The advanced cooling device segment is projected to be the fastest-growing category in the thermal management technologies market over the forecast period 2024–2032. This expansion is propelled by the rising need for high-performance cooling solutions in electric vehicles (EVs), data centers, and high-performance computing (HPC). Liquid cooling, two-phase cooling, and thermoelectric cooling technologies are more widely adopted since they better manage heat dissipation while enabling squeezed box designs. In particular, AI-powered apps, 5G framework, and next-gen semiconductor gadgets are increasing the demand for a cooler system that can maintain high thermal loads for a lower power utilization.

By Service

The installation & calibration segment held is dominated the largest share revenue of approximately 70% in the thermal management technologies market in 2023. This dominance is attributed to the critical role of precise installation and fine-tuned calibration in ensuring the efficiency, reliability, and longevity of thermal management systems across various industries, including electric vehicles (EVs), aerospace, data centers, and high-performance computing (HPC). Proper installation of thermal interface materials, cooling devices, and heat dissipation components is essential to achieving optimal thermal performance and preventing system failures due to overheating. Moreover, calibration is crucial for maintaining accurate temperature control, especially in semiconductor manufacturing, automotive battery systems, and industrial electronics, where even minor deviations can impact performance and safety. The increasing adoption of AI-driven thermal management solutions and automated calibration techniques has further strengthened the segment’s growth. As demand for highly efficient cooling solutions rises, the need for expert installation and precise calibration services is expected to continue driving this segment's market dominance.

The optimization & post-sales service segment is the fastest-growing category in the thermal management technologies market over the forecast period 2024-2032. This expansion results from the expanding sophistication of thermal management schemes in diverse fields, including electric vehicles (EVs), data centers, aerospace, and high-performance computing. Thus, with a drive of companies to be more energy efficient while also prolonging the life of their system performance, continuous performance optimization combined with regular maintenance are now part of the essentials. Increased use of AI-driven predictive maintenance and remote monitoring solutions improve thermal management systems through reduced operational costs and downtime. Expert post-sales services such as system upgrades, re-calibration and trouble shooting keep thermal management solutions up to date and aligned with changing industry norms.

By End-Use

The consumer electronics segment is dominated the largest share revenue of approximately 53% in the thermal management technologies market in 2023. This dominance is driven by the increasing demand for high-performance computing devices, smartphones, gaming consoles, and wearable technology. As electronic components become more compact and powerful, efficient thermal management solutions are crucial to prevent overheating and ensure device longevity. Advanced cooling techniques, such as vapor chambers, heat pipes, and phase change materials, are widely adopted to maintain optimal operating temperatures. Additionally, the rapid expansion of 5G technology and AI-driven applications has further intensified the need for sophisticated cooling solutions. With continuous innovation in semiconductor technology and miniaturization trends, the consumer electronics segment is expected to maintain its strong position, fueling the demand for advanced thermal management systems.

The automotive segment is the fastest-growing segment in the thermal management technologies market over the forecast period 2024-2032. This growth is primarily driven by the increasing adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), both of which require efficient thermal regulation to ensure optimal battery performance and electronic component longevity. The rise of high-performance computing in modern vehicles, including infotainment systems and autonomous driving technologies, further amplifies the need for advanced cooling solutions. Additionally, the push for energy-efficient and lightweight thermal management materials, such as phase change materials (PCM) and liquid cooling systems, is revolutionizing the automotive industry. As EV production accelerates globally, the demand for innovative thermal management solutions in the automotive sector is expected to surge, making it a key driver of market expansion.

Thermal Management Technologies Market Regional Outlook:

North America led the thermal management technologies market in 2023 with a 41% revenue share, due to growing industrialization and advanced R&D in the field, as well as the fact of presence of key companies like Honeywell, 3M, and Parker Hannifin. The U.S. ranks high because of its leadership in EVs, high-performance computing and aerospace, each of which can drive areas of global advantage; Canada is benefitting from government policy supporting sustainable energy and electronics. This is complemented by investments in AI powered cooling, liquid cooling, and phase change materials. Growing need for energy-efficient solutions in data centers, along with stringent regulations on energy use and safety, allows North America to sustain the lead in this market.

Europe is the fastest-growing region in the thermal management technologies market over the forecast period 2024-2032, due to the increase in investments in electric vehicles (EVs), renewable energy infrastructure, and data centers. Tight European Union energy efficiency and CO2 emissions legislation has spurred the uptake of advanced cooling technologies in automotive, aerospace and industrial sectors. For SBTi, the key is 5°C is acceptable, as seen in the EU and UK, while Germany, France, and UK lead in R&D, and these are largely led by well-established companies such as liquid cooling, phase change material, or even AI for thermal solutions. Moreover, government incentives for EV production and high-performance computing advances further accelerate regional growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Some of the Major Players in Thermal Management Technologies Market along with their Product:

-

Advanced Cooling Technologies, Inc. (USA - Heat Pipes, Vapor Chambers, PCM Solutions)

-

Delta Electronics, Inc. (Taiwan - Thermal Modules, Cooling Fans, Liquid Cooling Systems)

-

Honeywell International Inc. (USA - Phase Change Materials, Thermal Interface Materials, Heat Exchangers)

-

Siemens AG (Germany - Industrial Cooling Systems, Heat Recovery Solutions)

-

STMicroelectronics (Switzerland - Power Semiconductor Cooling, Thermal Sensors)

-

Fujikura Ltd. (Japan - Flexible Heat Pipes, Thermal Interface Materials)

-

Boyd Corporation (USA - Liquid Cooling, Heat Sinks, Thermal Insulation Solutions)

-

Aavid Thermalloy, LLC (USA - Heat Sinks, Liquid Cooling, Thermal Management Systems)

-

Vertiv Holdings Co (USA - Data Center Cooling, Precision Air Conditioning)

-

Wakefield-Vette, Inc. (USA - Extruded Heat Sinks, Liquid Cooling Plates)

-

Heatex Inc. (Madison Industries) (USA - Heat Exchangers, Air-to-Air Cooling Solutions)

-

Henkel AG & Co. KGaA (Germany - Thermal Interface Materials, Adhesives, Encapsulation Resins)

-

Laird Thermal Systems Inc. (USA - Thermoelectric Coolers, Liquid Cooling Systems)

-

Momentive Performance Materials Inc. (USA - Silicone-Based Thermal Management Solutions)

-

Parker-Hannifin Corp. (USA - Liquid Cooling Systems, Thermal Control Valves)

-

Thermal Management Technologies (USA - Heat Pipes, Custom Thermal Solutions)

In the Thermal Management Technologies Market, several suppliers provide essential raw materials and components:

-

Hi-Rel Group

-

AMETEK Precision Motion Control (PDT)

-

Arrow Electronics

-

Jamcor Corporation

-

AMS Technologies

-

SGL Carbon

-

Sealing Devices

-

Thermal Control Products

-

Thomasnet

-

Thermacore, Inc.

-

Schaeffler Group USA Inc.

-

Continental Industry

-

Seal Methods Inc.

-

Gamma Technologies

-

Mahle GmbH

-

Eberspächer Group

-

Gentherm Incorporated

-

Birk Manufacturing

-

Marlow Industries

-

GELID Solutions

Recent Development:

-

Feb 12, 2025 – Advanced Cooling Technologies, Inc. (ACT) announced an astounding milestone achievement for its Constant Conductance Heat Pipes (CCHPs) in conjunction with its original space-based thermal management applications:. ACT is further broadening the spaceflight toolbox by developing new, next-generation thermal solutions for high-power satellite payloads and deep-space missions.

-

June 24, 2024 – Siemens Digital Industries Software announced Calibre 3DThermal, a new 3D-IC thermal analysis and verification tool to be used early in design exploration and signoff. The software pairs up with Siemens’ Calibre and Simcenter Flotherm tools to enable accurate thermal modeling and assist designers to address heat dissipation issues within complex 3D chip architectures.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 13.49 Billion |

| Market Size by 2032 | USD 27.50 Billion |

| CAGR | CAGR of 8.24% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Adhesive Material, Non-adhesive Material) • By Device(Conduction Cooling Device, Convention Cooling Device, Advance Cooling Device, Others) • By Service(Installation & Calibration, Optimization & Post Sales Service) • By End-Use(Consumer Electronics, Service & Data Centers, Automotive, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Advanced Cooling Technologies, Inc. (USA), Delta Electronics, Inc. (Taiwan), Honeywell International Inc. (USA), Siemens AG (Germany), STMicroelectronics (Switzerland), Fujikura Ltd. (Japan), Boyd Corporation (USA), Aavid Thermalloy, LLC (USA), Vertiv Holdings Co (USA), Wakefield-Vette, Inc. (USA), Heatex Inc. (Madison Industries) (USA), Henkel AG & Co. KGaA (Germany), Laird Thermal Systems Inc. (USA), Momentive Performance Materials Inc. (USA), Parker-Hannifin Corp. (USA), Thermal Management Technologies (USA). |