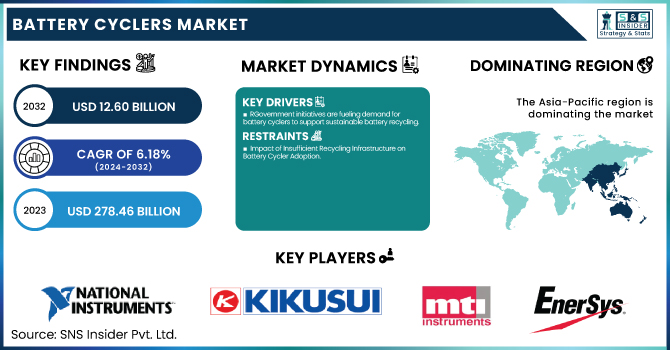

The Battery Cyclers Market was valued at 8.46 Billion in 2023 and is projected to reach USD 12.60 Billion by 2032, growing at a CAGR of 4.53% from 2024 to 2032.

To Get More information about Battery Cyclers Market - Request Free Sample Report

Key drivers fueling this growth include battery lifecycle performance improvements, as battery cyclers enable longer, more efficient battery lifespans through advanced testing. Energy efficiency advancements are also driving demand, with cyclers optimized for reduced energy loss during charge and discharge cycles. In the U.S., the market was valued at USD 1.49 billion in 2023 and is expected to reach USD 2.31 billion by 2032, growing at a CAGR of 4.95%. The demand for high-speed testing is increasing, particularly in industries like electric vehicles (EVs) and renewable energy storage, where rapid performance evaluations are essential. Additionally, battery recycling and reuse are becoming more crucial as the industry sustainable solutions, with battery cyclers helping assess second-life battery viability

Drivers:

Government initiatives are fueling demand for battery cyclers to support sustainable battery recycling.

The growing emphasis on sustainable battery recycling is driving demand for advanced battery cyclers, as industries and governments work toward improving the lifecycle of batteries and reducing environmental impact. Key initiatives include Porsche’s closed-loop EV battery recycling pilot, Panasonic and Sumitomo's efforts in Japan to recycle lithium-ion batteries, and the U.S. Department of Energy’s USD 3 billion investment to boost domestic battery production and recycling capabilities across 14 states. Additionally, Li-Cycle Holdings has secured a USD 475 million loan to establish a major battery processing facility in New York. These projects highlight the increasing focus on creating a sustainable supply of critical materials for electric vehicles (EVs) and other renewable energy applications. The growing need for effective second-life battery assessment and the government’s commitment to enhancing battery recycling infrastructure further intensify the demand for battery cyclers in the market.

Restraints:

Impact of Insufficient Recycling Infrastructure on Battery Cycler Adoption

The limited recycling infrastructure remains a major challenge for the Battery Cyclers Market. The absence of widespread and efficient recycling facilities, along with insufficient collection systems, restricts the ability to process used batteries on a large scale. This infrastructure gap delays the adoption of battery cyclers tailored for recycling, as companies struggle to manage and source end-of-life batteries. Furthermore, without a strong recycling ecosystem, the ability of battery cyclers to evaluate the viability of second-life batteries is hindered, impeding progress toward sustainability goals. Developing a more comprehensive recycling network is crucial to unlocking the full potential of battery cyclers and advancing circular economy initiatives.

Opportunities:

Enhancing Battery Cyclers Performance with IoT and AI Integration

The integration of IoT and AI technologies with battery cyclers creates a significant opportunity to improve testing efficiency and performance in the Battery Cyclers Market. The Internet of Things (IoT) provides real-time connectivity for data transfer and communication of battery cyclers with other devices to monitor and enable real-time monitoring, which also allows the testing process to respond quickly and in auto mode. The role of AI takes this a step further by leveraging this data to predict battery performance, tune testing parameters, and flag issues before they are ever seen. This integration enables predictive analytics at the next level, minimizing downtime and enhancing the accuracy of testing and measurement, crucial in a wide spectrum of industries including electric vehicles, industrial and renewable energy storage and battery recycling. The advancement of battery technologies will necessitate the integration of IoT and AI into battery cyclers to manage operations and improve lifecycle management, providing considerable market growth opportunities.

Challenges:

Impact of Raw Material Shortages on Battery Cycler Production

The shortage of raw materials, particularly lithium and cobalt, poses a significant challenge to the Battery Cyclers Market. These materials are crucial for production of high-performance batteries, and their scarcity can lead to delays and increased manufacturing costs for battery cyclers. As demand for electric vehicles (EVs), renewable energy storage systems, and other battery-powered technologies grows, competition for these raw materials increases. This causes supply chain disruptions and makes it increasingly difficult for battery cycler manufacturers to source the required components in a timely manner. Moreover, the fluctuating costs of raw materials are followed by unpredictable production costs, leading to financial tight spots among manufacturers and reducing the scalability of battery cyclers across multiple industries. Plugging these gaps in skillset need to be ironed out to ensure steady market growth and innovation.

By Technology

The Lithium-Ion segment held the largest market share, accounting for approximately 54% of the Battery Cyclers Market in 2023. This dominance is due to lithium-ion batteries' widespread use in electric vehicles (EVs), renewable energy storage, and consumer electronics, owing to their high energy density, long lifespan, and efficient performance. As industries continue to shift toward cleaner energy and electrification, the demand for lithium-ion batteries is expected to grow rapidly, further driving the adoption of battery cyclers designed for their testing and lifecycle management. Over the forecast period from 2024 to 2032, this segment is anticipated to experience the fastest growth, supported by advancements in battery technologies, increasing EV adoption, and the need for sustainable energy storage solutions. This growth will be driven by technological improvements in battery performance, coupled with increased demand for accurate and efficient battery testing.

By Type

The Multi-Channel segment dominated the Battery Cyclers Market with the largest share, accounting for approximately 46% of the market revenue in 2023. This segment's leadership is attributed to the growing need for advanced testing solutions that can simultaneously monitor multiple battery cells or systems. Multi-channel battery cyclers are essential for applications requiring high throughput and detailed performance analysis, such as in electric vehicles (EVs), renewable energy storage systems, and large-scale battery testing. By offering the capability to conduct parallel testing, multi-channel cyclers reduce testing time and improve efficiency, making them ideal for industries focused on optimizing battery performance and ensuring the reliability of energy storage solutions. The increased adoption of EVs and the expansion of renewable energy projects are key drivers for the demand for multi-channel cyclers.

By Application

The End-of-Line Testing segment held a dominant position in the Battery Cyclers Market, accounting for around 35% of the revenue in 2023. This segment's leadership is driven by the growing demand for quality control and performance validation in the final stages of battery production. End-of-line testing ensures that each battery meets the required specifications before reaching the market, making it essential in industries like electric vehicles (EVs) and consumer electronics. With the increasing focus on safety, efficiency, and reliability in battery-powered products, end-of-line testing is crucial to avoid potential failures and improve customer satisfaction. As the demand for high-performance and durable batteries continues to rise, the End-of-Line Testing segment is expected to maintain its dominance, offering manufacturers a reliable solution for ensuring consistent battery quality and performance.

The Battery Recycling segment is expected to experience significant growth from 2024 to 2032, driven by increasing environmental concerns and the need for sustainable practices in battery disposal. As the demand for batteries, particularly lithium-ion types, rises in industries such as electric vehicles (EVs) and renewable energy storage, recycling plays a crucial role in reducing waste and recovering valuable materials like lithium, cobalt, and nickel. Battery cyclers designed for recycling purposes help assess the viability and performance of second-life batteries, supporting the circular economy. Government regulations and incentives to promote sustainable battery recycling are also contributing to the growth of this segment. As the focus on reducing carbon footprints and enhancing resource efficiency intensifies, the battery recycling market is set for rapid expansion, ensuring a more sustainable and efficient lifecycle for batteries.

The Asia-Pacific region dominated the Battery Cyclers Market in 2033, holding around 50% of the market revenue. This dominance is largely driven by the region's leadership in the production and consumption of lithium-ion batteries, particularly in countries like China, Japan, and South Korea. These countries are home to some of the world's largest manufacturers of electric vehicles (EVs), consumer electronics, and energy storage solutions, all of which heavily rely on efficient and reliable battery testing. Additionally, Asia-Pacific benefits from robust industrial infrastructure, government incentives, and increasing investment in electric mobility and renewable energy, all of which foster the growth of the battery cyclers market. The region's continuous technological advancements and research in battery technologies further solidify its position as a market leader. With strong support for sustainable practices and circular economy models, Asia-Pacific is expected to maintain its dominance in the global battery cycler market, driving innovation and market expansion.

North America, particularly the U.S., is poised to experience the fastest growth in the Battery Cyclers Market from 2024 to 2032. This growth is driven by increasing demand for electric vehicles (EVs), energy storage solutions, and the push for sustainable battery recycling. Government initiatives, such as the significant investments in domestic battery production and recycling facilities, are bolstering the market. The U.S. is focusing on enhancing its energy infrastructure and reducing dependence on foreign materials, which is fueling the adoption of advanced battery testing technologies like battery cyclers. Additionally, the growing emphasis on the development of second-life battery solutions further contributes to the demand for efficient and reliable battery testing in North America. As a result, the region is expected to be a key player in the market's expansion over the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the Major Key Players in Battery Cyclers Market along with their Products:

Kikusui Electronics (Japan) - PBZ Series Battery Cyclers, PFX Series Power Supplies, ACT-3000 Electronic Measurement Instruments.

EnerSys (USA) - Genesis NP Series VRLA Batteries, PowerSafe® SBS Batteries, Battery Cyclers.

Arbin Instruments (USA) - BT-2000 Battery Test System, LBT Series Multi-Channel Battery Testers.

MTI Instruments (USA) - MTI-25 Battery Cycler, Model 5000 Series Battery Testing System.

National Instruments (USA) - PXIe-4139 Battery Testing Modules, NI 4070 Digital Multimeter, NI cDAQ-9172 Data Acquisition System.

Htest (China) - HT-5000 Series Battery Testers, HT-2015 Battery Cycling Systems.

BIT BUDDY (Germany) - Bit Buddy 3-Channel Tester, BIT-TESTER 1000 Battery Tester.

Hyperbat (UK) - Hyperbat 24V & 48V Battery Modules, Battery Management Systems (BMS).

Neware Technology (China) - BTS-5V Series Multi-Channel Battery Testers, BTS-10V Series Battery Test Systems.

Zhengzhou Dazhong Machinery (China) - Battery Testers, Battery Cyclers for Lithium-Ion Testing.

List of the key players providing raw materials and components for the Battery Cyclers Market:

Umicore

BASF

LG Chem

POSCO Chemical

Ganfeng Lithium

Tianqi Lithium

12 March 2025, EnerSys has integrated advanced embedded technology into its DataSafe TPPL batteries, enabling real-time monitoring of battery parameters for improved backup power management in data centres. This innovation enhances performance, reduces downtime, and lowers maintenance costs, ensuring operational continuity in high-demand environments.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 8.46 Billion |

|

Market Size by 2032 |

USD 12.60 Billion |

|

CAGR |

CAGR of 4.53% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Technology (Lithium-Ion, Lead-Acid, Nickel-Based Batteries, Solid-State) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Kikusui Electronics (Japan), EnerSys (USA), Arbin Instruments (USA), MTI Instruments (USA), National Instruments (USA), Htest (China), BIT BUDDY (Germany), Hyperbat (UK), Neware Technology (China), and Zhengzhou Dazhong Machinery (China) |

Ans: The Battery Cyclers Market is expected to grow at a CAGR of 4.53 % during 2024-2032.

Ans: The Battery Cyclers was USD 8.46 Billion in 2023 and is expected to Reach USD 12.60 Billion by 2032.

Ans: Increasing demand for electric vehicles, renewable energy storage, and advancements in battery technology for efficient testing and development.

Ans: The “Lithium-Ion” segment dominated the Battery Cyclers Market.

Ans: Asia-Pacific dominated the Battery Cyclers in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Battery Lifecycle Performance

5.2 Energy Efficiency

5.3 Demand for High-Speed Testing

5.4 Battery Recycling and Reuse

5.5 Impact of Energy Storage Advancements

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Battery Cyclers Market Segmentation, by Technology

7.1 Chapter Overview

7.2 Lithium-Ion

7.2.1 Lithium-Ion Market Trends Analysis (2020-2032)

7.2.2 Lithium-Ion Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Lead-Acid

7.3.1 Lead-Acid Market Trends Analysis (2020-2032)

7.3.2 Lead-Acid Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Nickel-Based Batteries

7.4.1 Nickel-Based Batteries Market Trends Analysis (2020-2032)

7.4.2 Nickel-Based Batteries Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Solid-State

7.5.1 Solid-State Market Trends Analysis (2020-2032)

7.5.2 Solid-State Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Battery Cyclers Market Segmentation, by Type

8.1 Chapter Overview

8.2 Single Channel

8.2.1 Single Channel Market Trends Analysis (2020-2032)

8.2.2 Single Channel Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Multi Channel

8.3.1 Multi Channel Market Trends Analysis (2020-2032)

8.3.2 Multi Channel Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Programmable

8.4.1 Programmable Market Trends Analysis (2020-2032)

8.4.2 Programmable Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Battery Cyclers Market Segmentation, by Application

9.1 Chapter Overview

9.2 Research and Development

9.2.1Research and Development Market Trends Analysis (2020-2032)

9.2.2 Research and Development Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 End-Of-Line Testing

9.3.1 End-Of-Line Testing Market Trends Analysis (2020-2032)

9.3.2 End-Of-Line Testing Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Battery Recycling

9.4.1 Battery Recycling Market Trends Analysis (2020-2032)

9.4.2 Battery Recycling Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Manufacturers

9.5.1 Manufacturers Market Trends Analysis (2020-2032)

9.5.2 Manufacturers Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Battery Cyclers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.4 North America Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.5 North America Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.6.2 USA Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.6.3 USA Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.7.2 Canada Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.7.3 Canada Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.8.2 Mexico Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.8.3 Mexico Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Battery Cyclers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.6.2 Poland Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.6.3 Poland Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.7.2 Romania Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.7.3 Romania Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Battery Cyclers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.4 Western Europe Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.5 Western Europe Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.6.2 Germany Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.6.3 Germany Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.7.2 France Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.7.3 France Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.8.2 UK Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.8.3 UK Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.9.2 Italy Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.9.3 Italy Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.10.2 Spain Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.10.3 Spain Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.13.2 Austria Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.13.3 Austria Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Battery Cyclers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.4 Asia Pacific Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.5 Asia Pacific Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.6.2 China Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.6.3 China Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.7.2 India Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.7.3 India Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.8.2 Japan Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.8.3 Japan Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.9.2 South Korea Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.9.3 South Korea Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.10.2 Vietnam Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.10.3 Vietnam Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.11.2 Singapore Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.11.3 Singapore Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.12.2 Australia Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.12.3 Australia Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Battery Cyclers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.4 Middle East Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.5 Middle East Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.6.2 UAE Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.6.3 UAE Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Battery Cyclers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.4 Africa Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.5 Africa Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Battery Cyclers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.4 Latin America Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.5 Latin America Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.6.2 Brazil Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.6.3 Brazil Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.7.2 Argentina Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.7.3 Argentina Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.8.2 Colombia Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.8.3 Colombia Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Battery Cyclers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Battery Cyclers Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Battery Cyclers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 Kikusui Electronics

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 EnerSys

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Arbin Instruments

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 MTI Instruments

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 National Instruments

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Htest

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 BIT BUDDY

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Hyperbat

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Hyperbat

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Zhengzhou Dazhong Machinery

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Technology

Lithium-Ion

Lead-Acid

Nickel-Based Batteries

Solid-State

By Type

Single Channel

Multi Channel

Programmable

By Application

Research and Development

End-Of-Line Testing

Battery Recycling

Manufacturers

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Spintronics Market Size was valued at USD 1.07 Billion in 2023 and is expected to grow at a CAGR of 35.67% to reach USD 16.64 Billion by 2032.

The Liquid Crystal on Silicon (LCoS) Market size was valued at 1.94 Billion in 2023 and is projected to reach USD 3.42 Billion by 2032 with a growing CAGR of 6.49% Over the Forecast Period of 2024-2032.

The E-Compass Market Size was valued at USD 2.27 Billion in 2023 and is expected to grow at a CAGR of 11.93% to reach USD 6.26 Billion by 2032.

The Sticker Printer Market size was valued at USD 3429.6 Million in 2023 and is expected to grow at a CAGR of 7.50% to reach USD 6571.8 Million by 2032.

The Selective Laser Sintering Equipment Market Size was valued at USD 760 Million in 2023 and is expected to reach USD 5007.08 Million by 2032 and grow at a CAGR of 23.33% over the forecast period 2024-2032.

The Household Robots Market Size was valued at USD 10.15 Billion in 2023 and is expected to reach USD 48.85 Billion by 2032 and grow at a CAGR of 19.10% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone