Textile Dyes Market Size & Overview:

The Textile Dyes Market size was USD 12.11 billion in 2023 and is expected to reach USD 17.48 billion by 2032 and grow at a CAGR of 4.16% over the forecast period of 2024-2032.

To Get more information on Textile Dyes Market - Request Free Sample Report

This report includes production volume and capacity utilization by dye type and region for 2023, alongside raw material cost trends across major dye-producing countries. The study highlights regulatory compliance data impacting manufacturing and environmental metrics such as wastewater discharge, chemical effluent control, and sustainability initiatives by key players. It also presents innovation and R&D investment levels by dye class, offering a clear picture of technological advancement. Adoption rates of low-impact and bio-based dyes are tracked across regions, along with analysis of key performance features such as color fastness and compatibility with advanced fabrics. These insights collectively offer strategic value to stakeholders, helping to navigate market dynamics and regulatory frameworks.

The United States held the largest share in the Textile Dyes Market in 2023, with a market size of USD 2.55 billion, projected to reach USD 3.85 billion by 2032, growing at a CAGR of 4.67% during 2024–2032. This is due to its well-established textile and apparel industry, coupled with advanced dyeing technologies and high adoption of sustainable practices. The country is home to major textile manufacturers and dye producers that consistently invest in R&D to innovate eco-friendly and high-performance dye solutions. Furthermore, the U.S. benefits from robust environmental regulations set by agencies like the Environmental Protection Agency (EPA), which have encouraged the adoption of low-impact and biodegradable dyes. Strong demand for technical textiles in automotive, healthcare, and home furnishing sectors also contributes significantly to dye consumption. Additionally, increasing consumer preference for vibrant, high-quality, and durable clothing has driven the need for advanced reactive, disperse, and acid dyes in the region. All these factors collectively support the U.S.'s dominant position in the global textile dyes market.

Textile Dyes Market Dynamics

Drivers

-

Rising preference for sustainable and low-impact dyes across apparel and home textile applications boosts the textile dyes market growth.

The growing global focus on environmental sustainability has significantly increased demand for low-impact and eco-friendly textile dyes. Consumers and brands alike are leaning toward products that minimize environmental harm, prompting manufacturers to shift from conventional synthetic dyes to sustainable alternatives such as plant-based, waterless, and low-VOC dye formulations. Regulatory pressure from bodies like the EPA (U.S.) and REACH (Europe) is further reinforcing the adoption of non-toxic dyes in the supply chain. Additionally, textile producers are increasingly investing in cleaner dyeing processes and equipment to improve wastewater treatment and reduce pollution. Sustainable practices not only meet regulatory requirements but also align with consumer values, offering manufacturers a competitive advantage in the eco-conscious market landscape. These trends are fueling innovation and accelerating growth across the global textile dyes market, especially in developed regions.

Restrain

-

Stringent environmental regulations and compliance costs across countries restrain the textile dyes market growth.

Despite rising demand, the textile dyes market faces significant restraints due to strict environmental regulations and associated compliance costs. Regulatory frameworks such as REACH in the EU and environmental norms in countries like China and the U.S. are increasingly restricting the use of certain chemical dyes due to toxicity and ecological impact. Manufacturers are now required to invest heavily in sustainable production technologies, wastewater treatment facilities, and safer chemical alternatives, which increases operational costs significantly. These regulations, while promoting sustainability, often slow down manufacturing output, limit the use of specific dye types, and create barriers for small and mid-sized dye producers. Moreover, the process of reformulating dyes to meet these regulations is time-consuming and expensive, restraining the overall pace of production and limiting profit margins across the global textile dyes industry.

Opportunity

-

Expanding demand for technical textiles in automotive and healthcare sectors creates new opportunities for the textile dyes market.

The growing application of technical textiles in sectors such as automotive, healthcare, and industrial safety is unlocking new opportunities for the textile dyes market. These high-performance textiles require specialized dyes that offer superior durability, colorfastness, heat resistance, and chemical stability. As demand rises for flame-retardant fabrics, antimicrobial medical textiles, and UV-resistant automotive interiors, dye manufacturers are investing in R&D to develop advanced functional dyes tailored for these applications. Furthermore, governments in countries like India and China are promoting domestic production of technical textiles through dedicated schemes, further boosting demand for specialty dyes. This trend is particularly strong in Asia-Pacific, where the manufacturing hub for technical textiles is rapidly expanding. The diversification into high-value applications enables dye producers to increase profit margins while catering to growing, innovation-driven segments of the global textile industry.

Challenge

-

Increasing competition from low-cost alternatives and unregulated dyes challenges the textile dyes market's stability.

The global textile dyes market is facing a serious challenge from the proliferation of low-cost and unregulated dye alternatives, particularly in developing markets. While leading manufacturers invest in high-quality, eco-compliant dyes, smaller, unregulated producers often flood the market with cheaper synthetic dyes that may not meet safety or environmental standards. These products appeal to cost-sensitive textile manufacturers, especially in regions with lax enforcement, undermining quality standards and creating pricing pressures for legitimate players. The presence of counterfeit or sub-standard dyes can also damage the reputation of branded apparel companies, leading to recalls or product failures. Moreover, the uneven implementation of environmental laws across countries allows these low-cost alternatives to thrive, making it difficult for sustainable dye makers to maintain market share and profit margins. This rising competition threatens long-term market stability and trust.

Textile Dyes Market Segmentation Analysis

By Fiber Type

Viscose held the largest market share, around 24%, in 2023. It is due to the high applicability in apparel and home textiles with excellent dye absorption properties. Since viscose is a regenerated cellulose fiber, it has a very high affinity for a wide variety of colors, particularly reactive, direct, and vat dyes, and thus allows vivid shades and good colorfastness. Because of its abundance, affordability, and comfortable properties, it has become a favored option among manufacturers for mass-produced apparel, curtains, upholstery, and the like. Moreover, with the rising demand for biodegradable and semi-synthetic fibers, managed vs cost while addressing sustainability, viscose is gaining momentum in comparison to fully synthetic alternatives. The growth of fast fashion, particularly within developing nations, acts as a catalyst for viscose-related textiles, making it a permanent fixture in the global textile dyes industry.

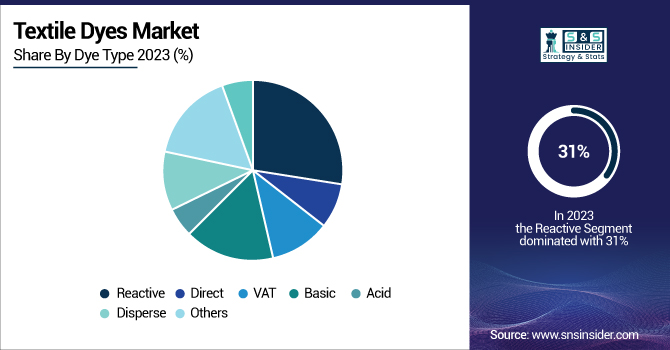

By Dye Type

Reactive held the largest market share, around 31%, in 2023. These dyes are capable of making a covalent bond with the fiber and thus are used to achieve excellent wash fastness and brilliant color that remains bright for years, providing good durability so all desirable requirements from a dye for apparel or home textile manufacturers. Increased consumption of cotton-based textiles at the global level, especially in developing regions such as Asia-Pacific and developed regions such as North America, is projected to result in a higher consumption of reactive dyes. Furthermore, their applicability in various dyeing processes, such as continuous, exhaust, and pad-dry, makes reactive dyes very useful in the industry. In addition, their compatibility with the low-salt and eco-friendly dyeing methods used in cutting-edge modern textile dye nations corresponds favorably with the global trend toward sustainable textile production, supporting their continued dominance.

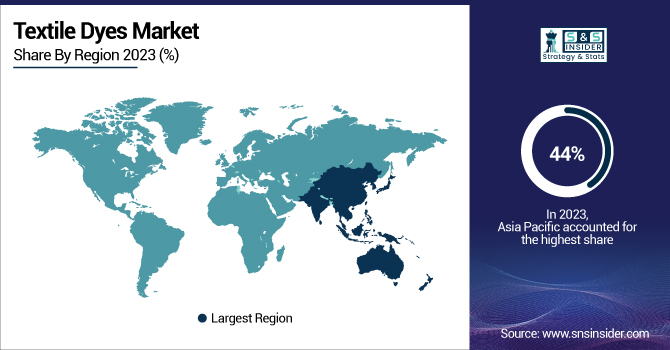

Textile Dyes Market Regional Outlook

Asia Pacific held the largest market share, around 44% in 2023. It is due to a huge textile manufacturing base, including countries such as China, India, Bangladesh, and Vietnam. All these countries are the world leaders in textile production and garment exports due to raw material availability, availability of cheap labor, and support from the government in textile export promotion. In addition, global urbanization, growing per capita incomes, and the developing style pattern are supporting homegrown interest for dyed textiles in developing economies. The high presence of dye manufacturers and suppliers in Asia Pacific guarantees that all supply chains are robust and production economical. Regional investments in environmentally friendly dyeing technologies and infrastructure upgrades are further supporting this market dominance while also spurring its growth amidst stringent environmental standards. These dynamics, combined with a scale of current valuation, position Asia Pacific as the leading region for both consumption and production of textile dyes.

North America held a significant market share. It is owing to demand for high-performance as well as sustainable textiles for an extensive line of end-use industries including fashion, automotive, and home furnishings. The pro-environment regulations are forcing the textile manufacturers to opt for eco-friendly and low-impact dyes (reactive/natural dyes), which in turn has increased the adoption of advanced dyeing technologies. Rising consumer inclination toward organically grown and naturally produced textiles especially in the U.S. has prompted the manufacturers to channelize their resources in developing environment-centric dyeing methods. Growing number of industry players and their continuous R&D on sustainable chemistry have also boosted the market up. With a steadfast commitment to quality, compliance, and innovation, North America enhances its stature as a key player in the global textile dyes landscape.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Archroma (Drimaren, Foron)

-

Huntsman Corporation (Novacron, Terasil)

-

Kiri Industries Ltd. (Remazol, Vinyl Sulfone)

-

Zhejiang Longsheng Group Co., Ltd. (Reactive Blue 19, Disperse Red 60)

-

BASF SE (Helizarin, Basazol)

-

Dystar Group (Levafix, Dianix)

-

Atul Ltd. (Sulphur Black BR, Napthol AS)

-

Bodal Chemicals Ltd. (H Acid, Reactive Black 5)

-

Lanxess AG (Bayronal, Levanyl)

-

Alchemie Technology (DyeScan, Endeavour)

-

Colourtex Industries Pvt. Ltd. (Colorfix, Texbrite)

-

Sumitomo Chemical Co., Ltd. (Sumifix, Sumitone)

-

Jay Chemical Industries Ltd. (Jayzol, Jayanil)

-

Anand International (Anazol, Anacid)

-

Kyung-In Synthetic Corporation (KISCO) (Kisperse, Kisactive)

-

Everlight Chemical Industrial Corp. (Everjet, Everacid)

-

Runtu Co., Ltd. (RT Reactive, RT Disperse)

-

Colorant Ltd. (Colorfast, Ecofix)

-

Aarti Industries (Aarticid, Aartizol)

-

Setas Color Centre (Setalan, Setazol)

Recent Developments:

-

In 2024, DyStar introduced a new range of reactive dyes under its Levafix brand, designed to deliver higher fixation rates while minimizing salt consumption. This advancement supports the textile industry's growing emphasis on sustainability and operational efficiency in dyeing applications.

-

In 2024, Huntsman launched its AVITERA SE dye range, engineered to substantially lower both water and energy usage during textile dyeing. This innovative solution aligns with the increasing industry demand for eco-friendly and sustainable textile processing technologies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 12.11 Billion |

| Market Size by 2032 | USD 17.48 Billion |

| CAGR | CAGR of 4.16% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Fiber Type (Wool, Nylon, Cotton, Viscose, Polyester, Acrylic, Others) •By Dye Type (Direct, Reactive, VAT, Basic, Acid, Disperse, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Archroma, Huntsman Corporation, Kiri Industries Ltd., Zhejiang Longsheng Group Co., Ltd., BASF SE, Dystar Group, Atul Ltd., Bodal Chemicals Ltd., Lanxess AG, Alchemie Technology, Colourtex Industries Pvt. Ltd., Sumitomo Chemical Co., Ltd., Jay Chemical Industries Ltd., Anand International, Kyung-In Synthetic Corporation (KISCO), Everlight Chemical Industrial Corp., Runtu Co., Ltd., Colorant Ltd., Aarti Industries, Setas Color Centre |