Get more information on Textile Chemicals Market - Request Sample Report

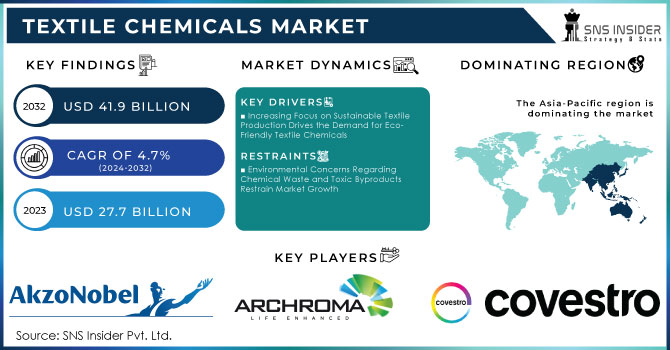

The Textile Chemicals Market Size was valued at USD 27.7 billion in 2023 and is expected to reach USD 41.9 billion by 2032 and grow at a CAGR of 4.7% over the forecast period 2024-2032.

Dynamic changes are occurring in the textile chemicals market, which is driven by increased demand from rising consumers for sustainable and eco-friendly solutions and also pressure to meet stringent environmental regulations. Therefore, bio-based chemicals become more prominent because producers are focusing on efforts to reduce environmental impacts from textile production. For example, in July 2024, leading textile chemical companies began exploring bio-based feedstocks as an alternative to traditional petrochemical inputs for greener alternatives. This trend also aligns with rising attention to the circular economy model as well as decreasing chemical waste from initiatives within various industries around the globe. Other drives in demand for sustainable options include consumer awareness and policies implemented by governmental bodies encouraging manufacturers to use non-polluting, renewable chemicals in their textile production processes.

Notable recent developments from industry leaders support this evolving direction toward sustainability. For instance, in January 2024, ERCA Group unveiled a new line of textile chemical solutions to enable the acceleration of the circular revolution in textile manufacturing. This entire effort centers around waste reduction and reutilization of resources as part of an industry movement toward the closing of the loop in textile production. Thus, ERCA Company, like other such organizations, seems to be trying increasingly hard to get the innovations of the company to be aligned with the principles of a circular economy not just to decrease the environmental footprint but also to enhance cost-effectiveness. The same line was also observed when the company, Fibre2Fashion, saw its portfolio expand in February 2024, offering solutions that could contribute to efficiency and sustainability in textile chemical production. This thirst for more extensive services manifests the ever-growing demand for chemical efficiency in the textile industry, an industry in which environmental sustainability has been the primary imperative that ensures the successful assimilation of innovation.

The other notable development was when the government and the industry were on discussion terms to find a solution to the problems resulting from this industry. In October 2022, for example, it was a summit of several countries manufacturing textiles together, united under one aim, to minimize the chemical wastes generated in the manufacturing of textiles. This collaboration was geared toward stronger handling of chemical waste management and the establishment of the use of environment-friendly chemicals, partly in line with an international campaign that targets reducing adverse environmental impacts resulting from textile production. This work of most countries worldwide showcases more concerted efforts toward global cooperation over the responsible use of sustainable chemicals in textile production.

Investments in the textile chemical sector are unrelenting, and multinational companies are staunch contributors to the growth of the market. This January, 10 multinational companies announced a total investment of Tk 2000 crore in the textile chemicals market, further investing in the process of achieving enhanced production capacities and scaling up sustainable chemical solutions. These investments reflect the major players' confidence in the future of textile chemicals, particularly in developing countries, where much of the manufacturing takes place. The large-scale investments support the innovation for chemical formulations and show longer-term commitments to improving sustainability across the entire textile value chain. These trends altogether represent the quick transformation of the textile chemical market in reaction to pressures from the environment and industry-led initiations.

KEY DRIVERS:

Increasing Focus on Sustainable Textile Production Drives the Demand for Eco-Friendly Textile Chemicals

The regulation pressure coupled with consumer demand, more and more, makes the textile industry shift toward sustainable production practices. Textile chemicals are important for enhancing the quality and functionality of fabrics. However, the pollution caused by the use of chemical products has created concern over these chemicals' impact on the environment. Manufacturers have developed bio-based and biodegradable chemicals to ensure that pollution is kept at the lowest level, thereby reducing the carbon footprint of this industry. The increased severity of government regulations within regions such as Europe and North America has also helped drive the adoption of green textile chemicals. These regulations are directly related to corporate social responsibility while also providing an avenue through which businesses may comply with international standards on environmental concerns. This much broader focus on sustainability has opened up new possibilities for innovation and product development by chemical companies. With products geared towards the concept of the circular economy, for instance, with water-efficient dyes and non-toxic coatings, this trend has led to accelerated growth in the textile chemicals market.

Technological Advancements in Textile Chemical Formulations Enhance Fabric Quality and Durability

Advances in the formulating of chemicals for textiles have led to innovations in high performance chemicals that dramatically improve the durability, colorfastness, and quality of fabrics. Nanotechnology-based chemicals and smart coatings offer opportunities to create functional textiles that possess such characteristics as water repellency, UV protection, and antimicrobial functionalities. Since high-performance fabrics are exactly what these industries need, such innovations are presently being widely applied in sportswear, healthcare, and automotive textiles. Moreover, durable and functional textiles have enabled manufacturers to meet changing demands for high-quality and durable products from consumers. In addition, resource efficiency can be achieved by fewer times of washing, a lesser amount of water usage, and longer lifecycles of textiles. Advanced chemicals that enhance the performance of the fabric have been a boon in their own right for the textile chemicals market.

RESTRAIN:

Environmental Concerns Regarding Chemical Waste and Toxic Byproducts Restrain Market Growth

Although many innovations have been made in sustainable textile chemicals, the core problems of this industry are its disposal of chemical wastes and the management of toxic by-products. Most of these textile chemicals contain elements that pose dangers to humans and the environment. Improper means of dealing with and disposing of the chemicals have caused pollution of water and soil, hence increased regulatory scrutiny. However, since the environmental regulations of developing regions may not be strict, and in many cases are probably quite lax, these problems are compounded, which makes the problem even worse. In response to this, manufacturers are pressured to create waste management systems that have a more minimal impact on the environment in which their processes take place. These costs related to safe disposal, besides the adoption of greener alternatives, have been the major growth inhibitors of this market, especially for small players who do not have adequate funds to invest in green solutions.

OPPORTUNITY:

Surging demand for functional and high-performance textiles opens up opportunities for innovation in chemical applications in textile fabrics.

Functional textiles, such as fabrics having flame-retardant properties, water-resistance, and antimicrobial action-open up major opportunities for innovation in textile chemicals. More sectors - constructive, military, sportswear, and healthcare areas - use high-performance textiles where specific functionalities are more critical. Antimicrobial fabrics, for example, gained increased demand because of raised hygiene requirements, especially in the healthcare sector, which has become tougher after the recent global health challenges. Simultaneously, through the demand for durable and weather-resistant textiles in the outdoor apparel and construction industries, developments of advanced chemical treatments in fabrics are being made. This growing interest in functional textiles provides opportunities for innovation in the development of specialized products specifically tailored to meet the requirements of various industries. The key to the successful exploitation of such emerging opportunities will be the ability to produce chemicals that improve fabric performance with environmental sustainability.

CHALLENGES:

Stringent Environmental Regulations Pose Challenges for Traditional Textile Chemical Manufacturers

The most challenging task for the textile chemicals market derives from increasingly stringent environmental regulations nowadays. Due to the environment, governments in regions such as Europe and North America, as well as parts of Asia, are imposing more stringent rules on the production, use, and disposal of textile chemicals, especially hazardous ones to the environment. These regulations, therefore, make the manufacturer think about their processes of manufacturing and move towards greener alternatives, which will be relatively expensive and time-consuming. Updating their standards to meet these regulations for traditional chemical manufacturers who have enjoyed the supply chains of conventional, petrochemical-based products for years requires a good amount of investment in research and development. Even the process of regulatory compliance is complicated by the presence of several certification and audit agencies and increases the operational costs. The biggest challenge in the textile chemicals market is that of balancing regulatory compliance with profitability requirements, particularly for firms that still rely on traditional chemical formulations.

By Fiber Type

In 2023, synthetic fiber dominated the textile chemicals market. With a market share of more than 60% of the market. This can be attributed to high usage of synthetic fibers, especially polyester, nylon, and acrylic, in various industrial applications such as clothing, automotive, and home textiles. Synthetic fibers are most desired for excellent durability and resistance to shrinkage and retention of color as well as shape even when exposed to multiple washes, thereby making them highly essential in high-performance applications. Besides, synthetic fibers face less environmental degradation than natural fibers, which in turn increase demand for such fibers. Synthetic fibers treated with advanced chemicals have thus been widely used by sportswear industries that assure moisture-wicking and antimicrobial properties to fabrics for providing high functionality, comfort, and freshness. Besides the domination of synthetic fibers in the textile chemicals market, the only advantage this has over the natural fibers is that synthetic fibers are a better product than their natural competitors since synthetic fibers outperform them in terms of cost-effectiveness.

By Product Type

The colorants & auxiliaries segment dominated the textile chemicals market, accounting for more than 35% of the market share in 2023. This is primarily on account of the rising demand for bright, rich, and high-quality dyes in the fashion and apparel industry. Colorants are required for fabrics, which serve to provide hard-wearing and long-lasting vibrant shades, and auxiliaries help facilitate dye penetration and also fabric treatment to ensure uniform coloring. Advanced colorant usage has largely increased in the fashion industry due to its aesthetic appeal and fast-fashion trends. However, with the rising trend of using eco-friendly and non-toxic dyes, innovation in this domain is equally on the upswing. For example, water-efficient and bio-based dyeing processes are becoming increasingly popular these days, mainly in textile hubs like India and China which are among the largest consumers of colorants and auxiliaries.

By Application

In 2023, the apparel segment dominated the textile chemicals market, accounting for an estimated 45% market share. The sustenance of this position is supported by the continued growth of the global fashion industry besides increasing demand for high-quality functional as well as sustainable clothing amongst consumers. Some commonly used textile chemicals in the manufacturing of apparel include colorants, finishing agents, and surfactants, thereby enhancing the durability, appearance, and performance of fabrics. The current rise in fast fashion and athleisure has further pushed the need for more advanced chemicals in textiles that can achieve stretchable, moisture-wicking, and stain-resistant clothing. Currently, chemical treatments are gaining increasing prevalence in wrinkle-free and antimicrobial clothing products aligned with consumer demands for convenient, hygienic, and low-maintenance garment wear. In contrast, the new thrust in environmentally friendly fashion has pushed more pressure for developments in sustainable chemicals for textile apperceiving.

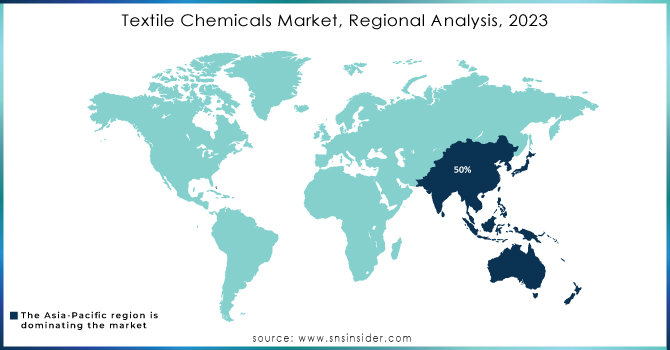

The Asia-Pacific region dominated textile chemicals in 2023, accounting for more than 50% market share. This is mainly attributed to being a strong base for textile production in countries such as China, India, Bangladesh, and Vietnam. The region is one of the largest textile and apparel exporting blocks in the world. Therefore, the demand for textile chemicals arises from the need for chemicals in dyeing, finishing, and fabric treatments. China being one of the world's biggest producers of textiles, is making heavy use of chemicals that ensure quality along with international standards for the produced fabrics. Cheap labor and raw materials available in the region itself have made it the top for textile manufacturing, and this also increases its consumption of textile chemicals. For example, the PLI scheme initiated for textiles by the government of India has supplemented growth in the industry and multiplied their requirement for textile chemicals.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

AkzoNobel NV (Interpon powder coatings, Bonderite chemical pretreatment)

Archroma (Livaqua dyes, Smartrepel Eco water repellents)

Covestro (Desmophen polyols, Bayhydur crosslinkers)

Croda International Plc (Crodasurf surfactants, Crodapearl emulsifiers)

DowDuPont (DOWSIL silicone additives, BETASEAL adhesives)

Evonik Industries (TEGO textile additives, AEROSIL fumed silica)

FCL (FCL Textile Dyes, FCL Auxiliaries)

Huntsman International LLC (Avalon dyes, Syntheton textile chemicals)

Indofil (IndoPrint dyes, Indosperse dispersing agents)

Kemin Industries (Kemin Dyestuff, Kemin Textile Treatments)

OMNOVA Solutions Inc (Nexis functional additives, VITEL thermoplastic elastomers)

Rudolf GmbH (Rudolf Group Textile Finishing Agents, Eco-Pearl water repellents)

TANATEX Chemicals B.V. (Tanatex Textile Auxiliaries, Tanacoat finishing agents)

GIOVANNI BOZZETTO S.p.A. (Bozzetto dyes, Bozzetto finishing agents)

BASF SE (BASF textile dyes, Ecolab cleaning agents)

Clariant International Ltd (Clariant dyes, Clariant textile chemicals)

Dystar Group (DyStar dyes, Texapret textile auxiliaries)

Sarex Chemicals (Sarex dyes, Sarex finishing agents)

Wacker Chemie AG (Wacker silicone emulsions, Wacker textile finishing agents)

Zschimmer & Schwarz (Zschimmer textile dyes, Zschimmer & Schwarz auxiliaries)

Raw Material Suppliers in the Textile Chemicals Market

BASF SE

DowDuPont

Evonik Industries

SABIC

Solvay

Clariant International Ltd

Eastman Chemical Company

Wacker Chemie AG

Huntsman International LLC

Chemtura Corporation

Users in the Textile Chemicals Market

Apparel Manufacturers

Home Textile Manufacturers

Automotive Textile Suppliers

Technical Textile Producers

Fashion Brands

Interior Decor Companies

Sporting Goods Manufacturers

Hospitality Industry (Hotels, etc.)

Medical Textile Companies

Textile Retailers

April 2024: BASF SE announced the company's portfolio of polyamides for the textile industry. The company's sustainable polyamide PA6 and PA6.6 product range have been certified under the Recycled Claim Standard -Textile applications. This certification gives the right to BASF SE to market textiles produced using recycled raw materials.

October 2024: Researchers developed water-proof coatings from textile waste, thereby inducting sustainability into the textile chemicals industry.

January 2023: Ten multinational companies invested Tk 2,000 crore to textile chemicals showing a robust commitment toward increasing production capacity and sustainability to the industry.

| Report Attributes | Details |

| Market Size in 2023 | US$ 27.7 Billion |

| Market Size by 2032 | US$ 41.9 Billion |

| CAGR | CAGR of 4.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Fiber Type (Natural Fiber, Synthetic Fiber) •By Product Type (Coating & Sizing Agents, Colorants & Auxiliaries, Finishing Agents, Surfactants, Desizing Agents, Bleaching Agents, Denim Finishing Agents, Others) •By Application (Apparel, Home Textile, Technical Textile, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Archroma, DowDuPont, Evonik Industries, TANATEX Chemicals B.V., GIOVANNI BOZZETTO S.p.A., Kemin Industries, Covestro, OMNOVA Solutions Inc, FCL, Indofil, Huntsman International LLC, Wacker Chemie AG, Rudolf GmbH, AkzoNobel NV, Croda International Plc and other key players |

| Key Drivers | • Increasing Focus on Sustainable Textile Production Drives the Demand for Eco-Friendly Textile Chemicals • Technological Advancements in Textile Chemical Formulations Enhance Fabric Quality and Durability |

| RESTRAINTS | • Environmental Concerns Regarding Chemical Waste and Toxic Byproducts Restrain Market Growth |

Ans: The Asia Pacific region dominated the Textile Chemicals market holding the largest market share of about 50% during the forecast period.

Ans: Stringent Environmental Regulations Pose Challenges for Traditional Textile Chemical Manufacturers

Ans: Surging demand for functional and high-performance textiles opens up opportunities for innovation in chemical applications in textile fabrics

Ans: The Textile Chemicals Market Size was valued at USD 27.7 billion in 2023 and is expected to reach USD 41.9 billion by 2032.

Ans: The Textile Chemicals Market is expected to grow at a CAGR of 4.7%

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Feedstock Prices Analysis by Region

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Textile Chemicals Market Segmentation, by Fiber Type

7.1 Chapter Overview

7.2 Natural Fiber

7.2.1 Natural Fiber Market Trends Analysis (2020-2032)

7.2.2 Natural Fiber Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Synthetic Fiber

7.3.1 Synthetic Fiber Market Trends Analysis (2020-2032)

7.3.2 Synthetic Fiber Market Size Estimates and Forecasts to 2032 (USD Million)

8. Textile Chemicals Market Segmentation, by Product Type

8.1 Chapter Overview

8.2 Coating & Sizing Agents

8.2.1 Coating & Sizing Agents Market Trends Analysis (2020-2032)

8.2.2 Coating & Sizing Agents Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Colorants & Auxiliaries

8.3.1 Colorants & Auxiliaries Market Trends Analysis (2020-2032)

8.3.2 Colorants & Auxiliaries Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Finishing Agents

8.4.1 Finishing Agents Market Trends Analysis (2020-2032)

8.4.2 Finishing Agents Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Surfactants

8.5.1 Surfactants Market Trends Analysis (2020-2032)

8.5.2 Surfactants Market Size Estimates and Forecasts to 2032 (USD Million)

8.6 Desizing Agents

8.6.1 Desizing Agents Market Trends Analysis (2020-2032)

8.6.2 Desizing Agents Market Size Estimates and Forecasts to 2032 (USD Million)

8.7 Bleaching Agents

8.7.1 Bleaching Agents Market Trends Analysis (2020-2032)

8.7.2 Bleaching Agents Market Size Estimates and Forecasts to 2032 (USD Million)

8.8 Denim Finishing Agents

8.8.1 Denim Finishing Agents Market Trends Analysis (2020-2032)

8.8.2 Denim Finishing Agents Market Size Estimates and Forecasts to 2032 (USD Million)

8.9 Others

8.9.1 Others Market Trends Analysis (2020-2032)

8.9.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9. Textile Chemicals Market Segmentation, by Application

9.1 Chapter Overview

9.2 Apparel

9.2.1 Apparel Market Trends Analysis (2020-2032)

9.2.2 Apparel Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Home Textile

9.3.1 Home Textile Market Trends Analysis (2020-2032)

9.3.2 Home Textile Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Technical Textile

9.4.1 Technical Textile Market Trends Analysis (2020-2032)

9.4.2 Technical Textile Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Others

9.5.1 Others Market Trends Analysis (2020-2032)

9.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Textile Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.2.4 North America Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.2.5 North America Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.2.6.2 USA Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.2.6.3 USA Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.2.7.2 Canada Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.2.7.3 Canada Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.2.8.2 Mexico Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.2.8.3 Mexico Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Textile Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.3.1.6.2 Poland Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.1.6.3 Poland Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.3.1.7.2 Romania Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.1.7.3 Romania Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.3.1.8.2 Hungary Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.1.8.3 Hungary Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.3.1.9.2 Turkey Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.1.9.3 Turkey Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Textile Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.3.2.4 Western Europe Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.2.5 Western Europe Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.3.2.6.2 Germany Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.2.6.3 Germany Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.3.2.7.2 France Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.2.7.3 France Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.3.2.8.2 UK Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.2.8.3 UK Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.3.2.9.2 Italy Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.2.9.3 Italy Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.3.2.10.2 Spain Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.2.10.3 Spain Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.3.2.13.2 Austria Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.2.13.3 Austria Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Textile Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.4.4 Asia Pacific Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.4.5 Asia Pacific Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.4.6.2 China Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.4.6.3 China Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.4.7.2 India Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.4.7.3 India Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.4.8.2 Japan Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.4.8.3 Japan Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.4.9.2 South Korea Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.4.9.3 South Korea Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.4.10.2 Vietnam Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.4.10.3 Vietnam Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.4.11.2 Singapore Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.4.11.3 Singapore Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.4.12.2 Australia Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.4.12.3 Australia Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Textile Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.5.1.4 Middle East Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.5.1.5 Middle East Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.5.1.6.2 UAE Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.5.1.6.3 UAE Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.5.1.7.2 Egypt Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.5.1.7.3 Egypt Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.5.1.9.2 Qatar Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.5.1.9.3 Qatar Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Textile Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.5.2.4 Africa Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.5.2.5 Africa Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.5.2.6.2 South Africa Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.5.2.6.3 South Africa Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Textile Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.6.4 Latin America Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.6.5 Latin America Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.6.6.2 Brazil Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.6.6.3 Brazil Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.6.7.2 Argentina Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.6.7.3 Argentina Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.6.8.2 Colombia Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.6.8.3 Colombia Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Textile Chemicals Market Estimates and Forecasts, by Fiber Type (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Textile Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Textile Chemicals Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11. Company Profiles

11.1 Archroma

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 DowDuPont

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Evonik Industries

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 TANATEX Chemicals B.V.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 GIOVANNI BOZZETTO S.p.A.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Kemin Industries

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Covestro

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 OMNOVA Solutions Inc

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 FCL

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Indofil

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Fiber Type

Natural Fiber

Synthetic Fiber

By Product Type

Coating & Sizing Agents

Colorants & Auxiliaries

Finishing Agents

Surfactants

Desizing Agents

Bleaching Agents

Denim Finishing Agents

Others

By Application

Apparel

Home Textile

Technical Textile

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The 2-Ethyl-3,4-ethylenedioxythiophene Market size was USD 20.55 million in 2023 and is expected to reach USD 29.25 million by 2032 and grow at a CAGR of 4.00% over the forecast period of 2024-2032.

Enzyme Substrates Market Size was valued at USD 14.3 Billion in 2023 and is expected to reach USD 26.1 Billion by 2032 and grow at a CAGR of 6.9% over the forecast period 2024-2032.

The Dimer Acid Market Size was valued at USD 3.0 billion in 2023, and is expected to reach USD 5.2 billion by 2032, and grow at a CAGR of 6.4% over the forecast period 2024-2032.

Photocatalytic Coatings Market was valued at USD 0.91 Billion in 2023 and is expected to reach USD 2.05 Billion by 2032, at a CAGR of 9.53% from 2024-2032.

The Biochar Market size was valued at USD 536.8 Million in 2023 and is expected to reach USD 1764.1 Million by 2032 and grow at a CAGR of 14.1% over the forecast period of 2024-2032.

The Offshore Lubricants Market Size was valued USD 170.1 Billion in 2023 and will reach USD 236.4 billion by 2032, growing at a CAGR of 3.8% by 2024-2032.

Hi! Click one of our member below to chat on Phone