Get more information on Testing, Inspection, and Certification Market - Request Free Sample Report

The Testing, Inspection, and Certification (TIC) Market Size was valued at USD 302.52 billion in 2023 and is expected to reach USD 427.69 billion by 2032 and grow at a CAGR of 3.94% over the forecast period 2024-2032.

The Testing, Inspection, and Certification (TIC) market plays a crucial role in ensuring the quality, safety, and compliance of products and services across various industries. The market encompasses a wide range of services, including testing of products for performance and safety, inspection of manufacturing processes and facilities, and certification that products or systems meet specific standards or regulatory requirements.

The TIC market has seen significant growth in recent years, driven by the increasing complexity of global supply chains, the rising demand for quality assurance, and the stringent regulatory requirements imposed by governments and industry bodies. In the U.S., the American National Standards Institute (ANSI) certifies organizations for certification services, with more than 800 accredited organizations across various sectors. Over 1.50 million entities worldwide, including numerous U.S. companies, have received the ISO 9001 certification, which is a global standard for quality management systems.

The automotive sector is facing a complicated environment of rules, technological progress, customer demands, international market growth, and sustainability issues, which all require thorough Testing, Inspection, and Certification (TIC) services. Globally, the sector encounters more than 50,000 alterations in regulations annually, leading to a substantial increase in the need for compliance testing. Consumer expectations continue to impact the TIC industry, as 75% of consumers prioritize vehicle safety and reliability. Furthermore, the growth of the international automotive industry, with more than 50 nations having unique regulatory standards, requires thorough TIC services to address various compliance necessities. The significance of sustainability and environmental issues is growing more and more. In 2023, the worldwide green car industry, worth USD 783 billion, underscores the sector's focus on improved emissions and energy efficiency testing.

Drivers

Navigating intricate regulations and ensuring compliance in the TIC market influenced by global trade.

The growth of international trade is a major factor affecting the TIC market. As nations participate in global trade, products must meet various regulations and standards unique to each market. Extensive testing, inspection, and certification are required to ensure compliance with varying country-specific requirements. For instance, a product made in China and meant to be sold in the European Union must adhere to the strict regulations of the EU, which can vary from those in the United States or other areas. Globalization has created an intricate supply chain system, with parts of a solitary product possibly coming from various nations. Every step in the supply chain must undergo a comprehensive review to guarantee quality and meet regulations. For example, a cell phone could contain parts from multiple countries, each following unique regulatory guidelines.

Increasing consumer safety demand is leading to higher investments in TIC services to ensure quality standards are met.

Consumers are increasingly expecting high-quality, safe, and reliable products due to the abundance of information available online. The change in consumer habits is causing businesses to increase their investments in TIC services to guarantee that their products adhere to the highest quality and safety standards. The growth of social media and internet review sites has increased the importance of product quality on brand image. One negative review or safety incident can greatly affect a company's image and financial performance. Consequently, businesses are giving importance to quality assurance and opting for TIC services to reduce the chances of product defects or safety concerns. Consumers are more worried about food safety in the food and beverage sector. This has pushed companies to put more money into stringent testing and certification procedures to guarantee their products are contaminant-free and comply with health and safety regulations.

Restraints

Small and medium-sized testing, inspection, and certification firms embrace sophisticated technologies at a slower pace.

Smaller and medium-sized testing, inspection, and certification (TIC) companies frequently encounter difficulties in implementing advanced technologies because of various factors that affect their speed of integration. A major limitation that these companies face is the restricted financial resources at their disposal. Smaller companies may struggle to allocate the significant capital needed to invest in advanced technologies like automation tools, artificial intelligence, or state-of-the-art testing equipment. Smaller firms may find it difficult to invest financially in these high-risk opportunities that have uncertain returns.

Moreover, the challenge of incorporating new technologies into current systems is significantly difficult. Small and medium-sized TIC companies may not have the required technical knowledge or staff to effectively set up and upkeep complex systems. Providing training for employees on using new technologies and modifying current processes to incorporate these advancements can require a lot of resources and time, leading to increased reluctance.

By Service Type

Testing led the market in 2023 with a market share of more than 42%. It involves a wide range of activities such as product development and manufacturing that are demanded across different industries. Therefore, products and systems are under testing to ensure they meet safety, quality, and legal requirements. To comply with the demand and assure their customers of quality services, companies currently prefer using services of licensed test centers for the safety of their products. Their focus on material durability and strength, as well as functional and operational reliability, has resulted in their dominance in the market.

Inspection is considered to be the fastest-growing segment during 2024-2032 in the TIC market. It is defined by the growth of this segment because of the increased number of government regulations in such industries as construction, energy, and manufacturing. The demand is stated to grow as the risk associated with the in-house inspection of equipment with no standards and regulations for such inspections has also grown. The tendency is maintained because of the growing global trade, stricter government regulations surrounding the development and adoption of unified standards for world trade, and smart inspection technologies that also sustain demand for inspections.

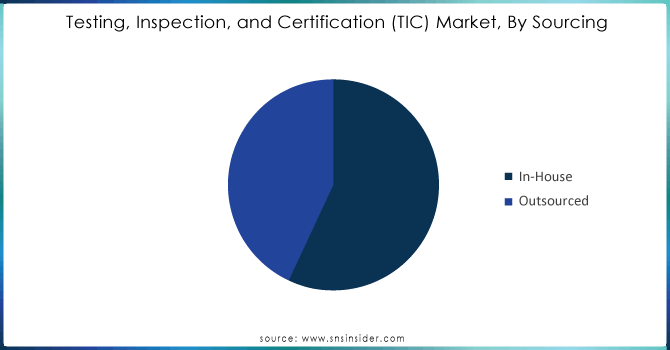

By Sourcing

The In-House segment held a market share of around 56% in 2023 and dominated the market. This approach enables companies to retain control over the quality, speed, and confidentiality of services, which is particularly important in precision and highly regulated industries. Companies utilize In-House TIC services in the pharmaceutical, aerospace, and automotive sectors, among others, because of the high standards and the need for protection of proprietary processes. Given that companies conduct the services in-house, they can appreciate risks effectively, comply with the requirements of complex regulations, and adapt the services to their specific conditions. At the same time, third-party access is limited, meaning that the majority of the risk is mitigated by the organization itself.

The outsourced is the most rapidly growing segment with a faster CAGR between 2024-2032. The situation is conditioned by the expansion of global supply chains and increasing demands, which make it difficult for companies to sustain versatile and specialized TIC services. Companies seek the services of third parties to benefit from providers’ advanced technology, knowledge, and worldwide coverage. The outsourced segment represents an appealing option for smaller entities because they have a varying degree of burden but may not require institutionalization of In-House TIC services.

Need any customization research on Testing, Inspection, And Certification Market - Enquiry Now

By Application

The infrastructure segment led the market with a revenue share of more than 15% in 2023. Increased infrastructural activities in various countries, such as China, India, and some European countries, especially in the development of transportation systems, are expected to enhance the rate of adoption of TIC services and products in these regions, providing a boost to the market. The consumer goods and retail, as well as the agriculture and Medical & Life Science, chemicals, energy & power, education, and government, manufacturing, healthcare, and Chemicals, oil & gas, and petroleum, public sector, automotive, aerospace & defense, supply chain & logistics, and other applications segments also influence the market.

The consumer goods and retail segment are expected to grow at a faster rate during 2024-2032, due to the inspection activities that the companies in this sector carry out. To provide flawless products to its customers, consumer goods companies must comply with various quality regulations and standards. This is the deployment of highly efficient and comprehensive inspection systems and, consequently, the growth in the TIC market. Additionally, companies in the retail sector must provide customers with optimum products and the best possible customer shopping experience, which enhances the penetration of TIC services and technologies and, consequently, drives market growth.

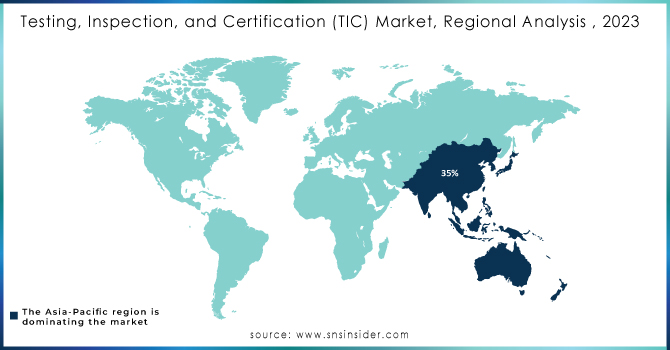

Asia Pacific dominated the market in 2023 with a market share of over 35%. The prime driving factors that contribute to this growth include the expanding industrial base, growing manufacturing activities, and the increasing demand for improved quality and safety by consumers in the region. Additionally, the industrial growth experienced in China, India, and Southeast Asian countries requires these industries to increase their TIC services to ensure their products comply with international standards. The booming construction, electronics, and automotive industries in the region further stimulate the need and the demand for full-service TIC solutions.

Europe is projected to witness a massive growth rate during the forecast period. The presence of established and eminent automotive industries in countries such as Germany and France also makes the seamless deployment of the testing and inspection ecosystem enhance the operations of Europe-based automotive production companies. Similarly, with the presence of exceptional fashion brands and retail and consumer goods corporations based in countries like Italy, Portugal, and the U.K., they nurture and catalyze the growth, nurturing the growth of the local testing and certification market.

The key players in the Testing, Inspection and Certification Market are SGS Group, Bureau Veritas, Eurofins Scientific, Apave International, IRClass, TIC Sera, Element Materials Technology, UL LLC, QR Testing, Hohenstein, Dekra Certification, ALS Limited, Intertek Group plc, SAI Global Limited, MISTRAS Group, Inc and Other.

In June 2024, a leading TIC company, SGS, introduced the SmartSense Environment Monitoring Solution used for real-time environmental monitoring. The advanced IoT sensors are used to provide accurate data of measurements of key environmental parameters and help to comply with environmental rules and norms.

In May 2024, TUV SUD launched AI-driven inspection technology used to increase the accuracy of industrial inspections. By using machine learning algorithms to detect defects and anomalies in the manufacturing processes, this new technology allows to reduce the time needed for inspections.

In April 2024, Bureau Veritas introduced a new cybersecurity certification program developed specifically for the Internet of Things. This type of IoT certification is expected to prove that “connected devices are secured by design and by default”.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 302.52 Billion |

| Market Size by 2032 | USD 427.69 Billion |

| CAGR | CAGR of 3.94% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Testing, Inspection, Certification) • By Sourcing (In-House Sourcing, Outsourced) • By Application (Consumer Goods & Retail, Agriculture & Food, Chemicals, Infrastructure, Energy & Power, Education, Government, Manufacturing, Healthcare, Mining, Oil & Gas and Petroleum, Public Sector, Automotive, Aerospace & Defense, Supply Chain & Logistics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | SGS Group, Bureau Veritas, Eurofins Scientific, Apave International, IRClass, TIC Sera, Element Materials Technology, UL LLC, QR Testing, Hohenstein, Dekra Certification, ALS Limited, Intertek Group plc, SAI Global Limited, MISTRAS Group, Inc. |

| Key Drivers | • Navigating intricate regulations and ensuring compliance in the TIC market influenced by global trade. • Increasing demand from consumers is leading to higher investments in TIC services to ensure quality standards are met. |

| RESTRAINTS | • Small and medium-sized testing, inspection, and certification firms embrace sophisticated technologies at a slower pace. |

Ans: The Testing, Inspection, and Certification (TIC) Market is expected to grow at a CAGR of 3.94% during 2024-2032.

Ans: Testing, Inspection, and Certification (TIC) Market size was USD 302.52 billion in 2023 and is expected to Reach USD 427.69 billion by 2032.

Ans: Increasing consumer safety demand is leading to higher investments in TIC services to ensure quality standards are met.

Ans: The Testing segment dominated the Testing, Inspection, and Certification (TIC) Market.

Ans: Asia Pacific dominated the Testing, Inspection, and Certification (TIC) Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Testing, Inspection, and Certification (TIC) Key Vendors and Feature Analysis, 2023

5.2 Testing, Inspection, and Certification (TIC) Performance Benchmarks, 2023

5.3 Testing, Inspection, and Certification (TIC) Integration Capabilities, by Software

5.4 Usage Statistics, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Testing, Inspection, and Certification (TIC) Market Segmentation, by Service Type

7.1 Chapter Overview

7.2 Testing

7.2.1 Testing Market Trends Analysis (2020-2032)

7.2.2 Testing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Inspection

7.3.1 Inspection Market Trends Analysis (2020-2032)

7.3.2 Inspection Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Certification

7.4.1 Certification Market Trends Analysis (2020-2032)

7.4.2 Certification Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Testing, Inspection, and Certification (TIC) Market Segmentation, by Sourcing

8.1 Chapter Overview

8.2 In-House Sourcing

8.2.1 In-House Sourcing Market Trends Analysis (2020-2032)

8.2.2 In-House Sourcing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Outsourced

8.3.1 Outsourced Market Trends Analysis (2020-2032)

8.3.2 Outsourced Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Testing, Inspection, and Certification (TIC) Market Segmentation, by Application

9.1 Chapter Overview

9.2 Construction & Infrastructure

9.2.1 Construction & Infrastructure Market Trends Analysis (2020-2032)

9.2.2 Construction & Infrastructure Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Agriculture & Food

9.3.1 Agriculture & Food Market Trends Analysis (2020-2032)

9.3.2 Agriculture & Food Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Chemicals

9.4.1 Chemicals Market Trends Analysis (2020-2032)

9.4.2 Chemicals Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Infrastructure

9.5.1 Infrastructure Market Trends Analysis (2020-2032)

9.5.2 Infrastructure Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Energy & Power

9.6.1 Energy & Power Market Trends Analysis (2020-2032)

9.6.2 Energy & Power Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Education

9.7.1 Education Market Trends Analysis (2020-2032)

9.7.2 Education Market Size Estimates and Forecasts to 2032 (USD Billion)

9.8 Government

9.8.1 Government Market Trends Analysis (2020-2032)

9.8.2 Government Market Size Estimates and Forecasts to 2032 (USD Billion)

9.9 Manufacturing

9.9.1 Manufacturing Market Trends Analysis (2020-2032)

9.9.2 Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

9.10 Healthcare

9.10.1 Healthcare Market Trends Analysis (2020-2032)

9.10.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

9.11 Mining

9.11.1 Mining Market Trends Analysis (2020-2032)

9.11.2 Mining Market Size Estimates and Forecasts to 2032 (USD Billion)

9.12 Oil & Gas and Petroleum

9.12.1 Oil & Gas and Petroleum Market Trends Analysis (2020-2032)

9.12.2 Oil & Gas and Petroleum Market Size Estimates and Forecasts to 2032 (USD Billion)

9.13 Public Sector

9.13.1 Public Sector Market Trends Analysis (2020-2032)

9.13.2 Public Sector Market Size Estimates and Forecasts to 2032 (USD Billion)

9.14 Automotive

9.14.1 Automotive Market Trends Analysis (2020-2032)

9.14.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

9.15 Aerospace & Defense

9.15.1 Aerospace & Defense Market Trends Analysis (2020-2032)

9.15.2 Aerospace & Defense Market Size Estimates and Forecasts to 2032 (USD Billion)

9.16 Supply Chain & Logistics

9.16.1 Supply Chain & Logistics Market Trends Analysis (2020-2032)

9.16.2 Supply Chain & Logistics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.17 Others

9.17.1 Others Market Trends Analysis (2020-2032)

9.17.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.2.4 North America Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.2.5 North America Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.2.6.2 USA Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.2.6.3 USA Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.2.7.2 Canada Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.2.7.3 Canada Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.2.8.3 Mexico Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.3.1.6.3 Poland Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.3.1.7.3 Romania Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.3.2.5 Western Europe Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.3.2.6.3 Germany Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.7.2 France Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.3.2.7.3 France Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.3.2.8.3 UK Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.3.2.9.3 Italy Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.3.2.10.3 Spain Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.3.2.13.3 Austria Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.4.5 Asia Pacific Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.6.2 China Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.4.6.3 China Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.7.2 India Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.4.7.3 India Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.8.2 Japan Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.4.8.3 Japan Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.4.9.3 South Korea Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.4.10.3 Vietnam Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.4.11.3 Singapore Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.12.2 Australia Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.4.12.3 Australia Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.5.1.5 Middle East Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.5.1.6.3 UAE Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.2.4 Africa Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.5.2.5 Africa Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.6.4 Latin America Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.6.5 Latin America Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.6.6.3 Brazil Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.6.7.3 Argentina Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.6.8.3 Colombia Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Sourcing (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Testing, Inspection, and Certification (TIC) Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 SGS Group

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Bureau Veritas

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Eurofins Scientific

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Apave International

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 IRClass

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 TIC Sera

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Element Materials Technology

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 UL LLC

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 QR Testing

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Hohenstein

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Service Type

Testing

Inspection

Certification

By Sourcing

In-House

Outsourced

By Application

Consumer Goods & Retail

Agriculture & Food

Chemicals

Infrastructure

Energy & Power

Education

Government

Manufacturing

Healthcare

Mining

Oil & Gas and Petroleum

Public Sector

Automotive

Aerospace & Defense

Supply Chain & Logistics

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Insulation Monitoring Systems Market was valued at USD 741.7 Million in 2023 and is projected to grow at 5.23% CAGR to reach USD 1173.3 Million by 2032.

The Industrial Agitators Market was valued at USD 2.81 billion in 2023 and is expected to reach USD 4.32 billion by 2032, growing at a CAGR of 4.93% over the forecast period 2024-2032.

The Call Control (PBX-IP PBX) Market Size was valued at USD 34.66 billion in 2023, and is expected to reach USD 252.71 billion by 2032 and grow at a CAGR of 24.7% over the forecast period 2024-2032.

The Dry Type Transformer Market was valued at USD 6.52 billion in 2023 and is projected to reach USD 11.45 billion by 2032, growing at a robust CAGR of 6.45% over the forecast period from 2024 to 2032.

The DC Circuit Breaker Market Size was valued at USD 3.57 billion in 2023 and is expected to grow at a CAGR of 7.73% to reach USD 6.96 billion by 2032.

The 3D Metrology Market Size was valued at USD 10.88 Billion in 2023 and is expected to grow at a CAGR of 7.97% to reach USD 21.69 Billion by 2032.

Hi! Click one of our member below to chat on Phone