To get more information on Terminal Automation Market - Request Free Sample Report

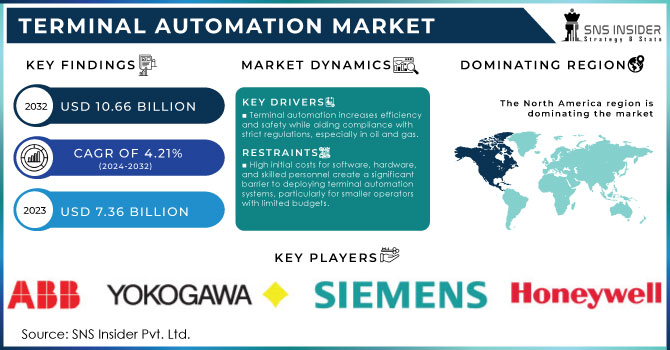

The Terminal Automation Market size was estimated at USD 7.36 billion in 2023 and is expected to reach USD 10.66 billion by 2032 at a CAGR of 4.21% during the forecast period of 2024-2032.

The Terminal Automation Market has been witnessing significant growth owing to the growing demand for efficient and reliable operations, specifically in the oil and gas, bulk-handling, and chemical industries. Terminal automation involves the use of advanced technologies such as Supervisory Control and Data Acquisition (SCADA), Distributed Control Systems (DCS), and Programmable Logic Controllers (PLC) to monitor and regulate vital processes such as product handling, distribution, and safety. With automation, organizations can minimize instances of human errors, reduce operational costs, and enhance safety measures. Furthermore, the increase in the demand for energy and the ongoing trend of digital transformation across industries contribute to the growth of the terminal automation market. The modern-day terminal automation market is also driven by the demand for increased safety and the presence of stringent environmental regulations. As such, there is an increasing need among industries to adopt terminal automation as a measure to improve their operational efficiency as well as to comply with the requirements of the regulatory bodies.

Devices and systems based on cloud computing technology are gradually taking over the Terminal Automation Market, as they provide real-time monitoring and analytics, leading to informed decision-making. With the rising number of cyber threats, there is also an increasing need to focus on Cybersecurity, which protects the vital infrastructure from possible attacks. In the contemporary market, IoT-enabled devices that facilitate increased automation and provide abundant data and information are increasingly being implemented. To cater to these requirements, providers in the market design and develop highly modular and attuned solutions that are also easily scalable.

MARKET DYNAMICS

DRIVERS

Terminal automation enhances operational efficiency and safety by reducing human error, streamlining processes, and helping industries comply with stringent safety regulations, especially in sectors like oil and gas.

Terminal automation significantly boosts operational efficiency and safety by minimizing human error, optimizing processes, and aiding compliance with stringent safety regulations, particularly in sectors like oil and gas. Automation systems, such as those used in terminals, integrate advanced technologies to control and monitor various processes, reducing the reliance on manual operations. This reduction in human intervention lowers the risk of mistakes that can lead to operational disruptions, safety incidents, or costly errors. For instance, automated systems can precisely control the flow of materials, manage inventory, and monitor equipment performance in real-time, ensuring that processes run smoothly and efficiently.

In high-stakes industries like oil and gas, where safety is paramount, terminal automation plays a crucial role in adhering to rigorous safety standards. Automated systems can detect and respond to potential hazards faster than human operators, providing early warnings and activating safety protocols to prevent accidents. Additionally, automation helps in maintaining compliance with regulatory requirements by providing accurate and reliable data for reporting and audits. This ensures that operations not only meet safety standards but also improve overall efficiency by streamlining workflows and reducing operational downtime. In essence, terminal automation enhances both the safety and efficiency of operations, making it an indispensable tool in modern industrial settings.

Technological advancements like IoT, AI, cloud computing, and blockchain are driving terminal automation by enabling real-time monitoring, predictive maintenance, and enhanced security and transparency in operations.

Technological advancements such as the Internet of Things (IoT), Artificial Intelligence (AI), cloud computing, and blockchain are revolutionizing terminal automation by significantly enhancing operational efficiency, security, and transparency. IoT facilitates real-time monitoring by connecting sensors and devices across terminals, allowing for continuous tracking of cargo, equipment status, and environmental conditions. This connectivity enables immediate data collection and analysis, which is critical for optimizing workflows and quickly addressing issues. AI further leverages this data by providing predictive maintenance capabilities; algorithms can analyze historical data to forecast potential equipment failures before they occur, minimizing downtime and reducing repair costs. Cloud computing supports these advancements by offering scalable storage and computing power, enabling seamless integration and analysis of large volumes of data from various sources. It also facilitates remote access and management, improving operational flexibility and responsiveness. Meanwhile, blockchain technology enhances security and transparency by providing a decentralized ledger for recording transactions. This immutable record ensures that all changes are traceable and verifiable, thereby reducing the risk of fraud and errors in terminal operations. Together, these technologies not only streamline processes but also create a more resilient and transparent operational environment, driving efficiency and reliability in terminal automation.

RESTRAIN

High initial costs for software, hardware, and skilled personnel make deploying terminal automation systems a significant barrier, especially for smaller operators with limited budgets.

Deploying terminal automation systems presents a substantial challenge primarily due to the high initial costs associated with software, hardware, and skilled personnel. The investment required for these systems includes purchasing sophisticated automation software, and advanced hardware, and integrating these components seamlessly. Additionally, recruiting and retaining highly skilled personnel who can manage and maintain these systems adds to the financial burden. For smaller operators with limited budgets, these costs can be prohibitive, creating a significant barrier to entry. The substantial upfront investment required can strain financial resources, making it difficult for smaller firms to compete with larger players who have the capital to absorb these costs. As a result, the financial implications of adopting terminal automation systems can hinder the growth and competitiveness of smaller operators within the industry.

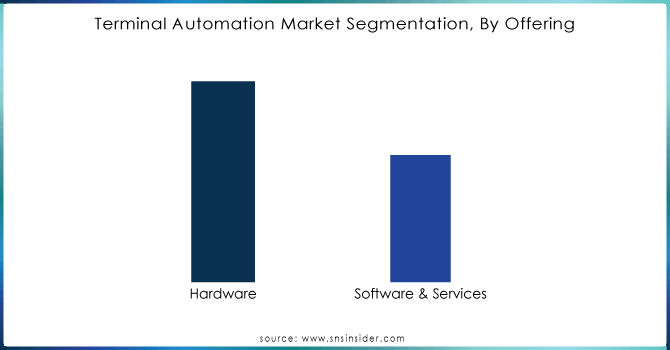

By Offering

The Hardware segment dominated the market share by over 62.14% in 2023, this is because hardware components like controllers, sensors, actuators, and other field devices are essential for automating terminal operations. The demand for reliable and advanced hardware solutions is high, especially in industries like oil & gas, chemicals, and utilities, where operational efficiency and safety are crucial.

Need any customization research on Terminal Automation Market - Enquiry Now

By Vertical

The Oil & Gas segment dominated the market share over 28.08% in 2023. This dominance is due to the critical need for efficient and safe handling, monitoring, and distribution of petroleum products. Terminal automation solutions help ensure operational safety, optimize storage and distribution, and comply with stringent industry regulations. The high volume of global oil & gas production and transport further contributes to the demand for automation in this vertical.

REGIONAL ANALYSES

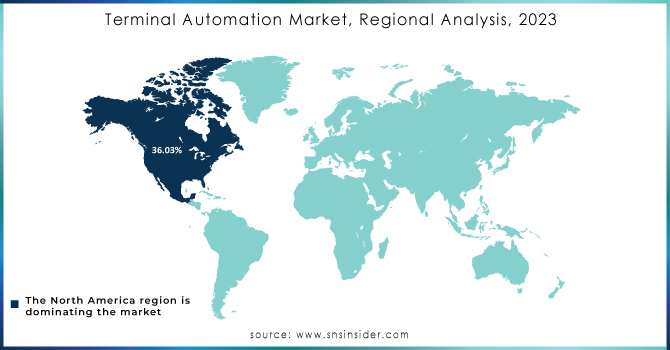

North America led the market share of over 36.03% in 2023, primarily due to the region's advanced infrastructure, high adoption of automation technologies, and significant investments in oil & gas, and chemicals industries. The presence of key players, along with stringent regulations for safety and efficiency, has further solidified North America's leading position in this market.

Asia Pacific region is the fastest-growing in the Terminal Automation Market. This growth is driven by the increasing demand for energy, rapid industrialization, and growing investments in infrastructure, particularly in countries like China and India. The expansion of refineries and the adoption of automation solutions to enhance operational efficiency in the oil & gas sector are key contributors to the rapid market growth in Asia Pacific.

The major key players are Schneider Electric (France), Emerson Electric Co. (U.S.), ABB Lid (Switzerland), Siemens (Germany), Honeywell International Inc (U.S.), TechnipFMC plc (U.K.), Rockwell Automation, Inc. (U.S.), LARSEN & TOUBRO LIMITED. (India), Implico (U.S.), General Electric (U.S.), Endress+Hauser Group Services AG (Germany), Yokogawa India Ltd. (India), Inter Terminals Limited (U.K.), INTECH (U.S.), Varec, Inc. (U.S.)., Chemtrols Industries Pvt. Ltd. (India), MHT Technology (U.K.), Advanced Sys-tek Pvt. Ltd. (India), General Atomics (U.S.) others.

In August 2023: Evergreen Marine Corp., in cooperation with Taiwan International Ports Corporation, launched Terminal 7 at Kaohsiung Port, Taiwan’s first fully-automated container terminal. This terminal is equipped with remote-controlled gantry cranes, 5 berths, etc., that will facilitate the handling of ultra-large container ships.

In July 2024: OPW Engineered Systems announced the launch of a new 8800 Series Overfill and Ground Monitoring System. It is an advanced solution for terminal operators who seek to make the filling processes more intuitive and safer. This series is incorporated with advanced features that can be easily integrated into existing terminal automation systems. It includes LED lights and pictograms that can rapidly communicate the loading status, irrespective of language.

In August 2024: Shanghai International Port Group (SIPG) has officially announced the commencement of operations at Shanghai’s Luojing Container Terminal. This strategic development marks a significant milestone for SIPG, expanding its capacity and efficiency in handling international cargo. The Luojing Terminal is set to enhance Shanghai's position as a global shipping hub, supporting increased trade volumes and fostering economic growth in the region. The new terminal is equipped with state-of-the-art facilities designed to streamline container handling and boost operational productivity.

In March 2024: Kalmar, a leading provider of cargo handling solutions, has recently delivered electric AutoStrads to APM Terminals' Pier 400 LA. This move is part of APM Terminals' commitment to reducing its carbon footprint and enhancing sustainability within its operations. The electric AutoStrads, known for their efficiency and lower emissions compared to traditional diesel-powered models, will support the terminal's efforts in modernizing its equipment and improving operational efficiency. This initiative reflects a growing trend in the industry towards more environmentally friendly technologies.

| Report Attributes | Details |

| Market Size in 2023 | US$ 7.36 Bn |

| Market Size by 2031 | US$ 10.66 Bn |

| CAGR | CAGR of 4.21% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware, Software & Services) • By Project type (Brownfield projects, Greenfield projects) • By Vertical (Oil & Gas, Chemical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Schneider Electric (France), Emerson Electric Co. (U.S.), ABB Lid (Switzerland), Siemens (Germany), Honeywell International Inc (U.S.), TechnipFMC plc (U.K.), Rockwell Automation, Inc. (U.S.), LARSEN & TOUBRO LIMITED. (India), Implico (U.S.), General Electric (U.S.), Endress+Hauser Group Services AG (Germany), Yokogawa India Ltd. (India), Inter Terminals Limited (U.K.), INTECH (U.S.), Varec, Inc. (U.S.)., Chemtrols Industries Pvt. Ltd. (India), MHT Technology (U.K.), Advanced Sys-tek Pvt. Ltd. (India), General Atomics (U.S.) |

| Key Drivers | • Terminal automation enhances operational efficiency and safety by reducing human error, streamlining processes, and helping industries comply with stringent safety regulations, especially in sectors like oil and gas. • Technological advancements like IoT, AI, cloud computing, and blockchain are driving terminal automation by enabling real-time monitoring, predictive maintenance, and enhanced security and transparency in operations. |

| Market Challenges | • High initial costs for software, hardware, and skilled personnel make deploying terminal automation systems a significant barrier, especially for smaller operators with limited budgets. |

Ans: The Terminal Automation Market is expected to grow at a CAGR of 4.21%.

Ans: Terminal Automation Market size was USD 7.36 Billion in 2023 and is expected to Reach USD 10.66 Billion by 2032.

Ans: Hardware segmentation is the dominating segment offering in the Terminal Automation Market.

Ans: Terminal automation enhances operational efficiency and safety by reducing human error, streamlining processes, and helping industries comply with stringent safety regulations, especially in sectors like oil and gas.

Ans: North America is the dominating region in the Terminal Automation Market.

TABLE OF CONTENT

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Manufacturing Output, by Region, (2020-2023)

5.2 Utilization Rates, by Region, (2020-2023)

5.3 Maintenance and Downtime Metrix

5.4 Technological Adoption Rates, by Region

5.6 Export/Import Data, by Region (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Terminal Automation Market Segmentation, By Offering

7.1 Chapter Overview

7.2 Hardware

7.2.1 Hardware Market Trends Analysis (2020-2032)

7.2.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Software & Services

7.3.1 Software & Services Trends Analysis (2020-2032)

7.3.2 Software & Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Terminal Automation Market Segmentation, By Project type

8.1 Chapter Overview

8.2 Brownfield projects

8.2.1 Brownfield Projects Market Trends Analysis (2020-2032)

8.2.2 Brownfield Projects Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Greenfield projects

8.3.1 Greenfield Projects Market Trends Analysis (2020-2032)

8.3.2 Greenfield Projects Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Terminal Automation Market Segmentation, By Vertical

9.1 Chapter Overview

9.2 Oil & Gas

9.2.1 Oil & Gas Market Trends Analysis (2020-2032)

9.2.2 Oil & Gas Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Chemical

9.3.1 Chemical Market Trends Analysis (2020-2032)

9.3.2 Chemical Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Others

9.4.1 Others Market Trends Analysis (2020-2032)

9.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Terminal Automation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.2.4 North America Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.2.5 North America Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.2.6.2 USA Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.2.6.3 USA Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.2.7.2 Canada Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.2.7.3 Canada Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.2.8.2 Mexico Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.2.8.3 Mexico Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Terminal Automation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.1.6.2 Poland Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.3.1.6.3 Poland Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.1.7.2 Romania Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.3.1.7.3 Romania Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Terminal Automation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.2.4 Western Europe Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.3.2.5 Western Europe Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.2.6.2 Germany Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.3.2.6.3 Germany Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.2.7.2 France Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.3.2.7.3 France Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.2.8.2 UK Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.3.2.8.3 UK Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.2.9.2 Italy Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.3.2.9.3 Italy Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.2.10.2 Spain Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.3.2.10.3 Spain Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.2.13.2 Austria Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.3.2.13.3 Austria Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Terminal Automation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.4.6.2 China Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.4.6.3 China Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.4.7.2 India Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.4.7.3 India Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.4.8.2 Japan Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.4.8.3 Japan Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.4.9.2 South Korea Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.4.9.3 South Korea Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.4.10.2 Vietnam Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.4.10.3 Vietnam Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.4.11.2 Singapore Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.4.11.3 Singapore Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.4.12.2 Australia Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.4.12.3 Australia Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Terminal Automation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.5.1.4 Middle East Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.5.1.5 Middle East Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.5.1.6.2 UAE Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.5.1.6.3 UAE Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Terminal Automation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.5.2.4 Africa Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.5.2.5 Africa Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Terminal Automation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.6.4 Latin America Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.6.5 Latin America Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.6.6.2 Brazil Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.6.6.3 Brazil Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.6.7.2 Argentina Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.6.7.3 Argentina Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.6.8.2 Colombia Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.6.8.3 Colombia Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Terminal Automation Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Terminal Automation Market Estimates and Forecasts, By Project type (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Terminal Automation Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11. Company Profiles

11.1 Schneider Electric (France)

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Emerson Electric Co. (U.S.)

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 ABB (Switzerland)

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Siemens (Germany)

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Honeywell International Inc. (U.S.)

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 TechnipFMC plc (U.K.)

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Rockwell Automation, Inc. (U.S.)

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 LARSEN & TOUBRO LIMITED. (India)

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Implico (U.S.)

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 General Electric (U.S.)

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Offering

By Project type

By Vertical

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage

North America

Europe

Asia Pacific

Middle East & Africa

Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

The Renting & Leasing Test and Measurement Equipment Market Size was esteemed at USD 6.35 billion in 2023 and is supposed to arrive at USD 9.61 billion by 2032 with a growing CAGR of 4.71% over the forecast period 2024-2032.

The Ultrasonic Cleaning Equipment Market size was valued at USD 5.50 Billion in 2023 and is now anticipated to grow to USD 9.71 Billion by 2032, displaying a compound annual growth rate of 6.52% during the forecast Period (2024-2032)

The Industrial Boilers Market Size was valued at USD 13.80 Billion in 2023 and is expected to reach USD 20.49 Billion by 2032 and grow at a CAGR of 4.52% over the forecast period 2024-2032.

The Drill Bit Market Size was USD 2.28 billion in 2023 and is supposed to arrive at USD 4.12 billion by 2032 and develop at a CAGR of 6.81% by 2024-2032.

The Fluid Handling Systems Market Size was estimated at USD 74.55 billion in 2023 and is expected to arrive at USD 111.28 billion by 2032 with a growing CAGR of 4.55% over the forecast period 2024-2032.

Water Recycle and Reuse Market was esteemed at USD 16.12 Bn in 2023 and is estimated to reach USD 38.77 Bn by 2032 with a growing CAGR of 10.24% from 2024-2032.

Hi! Click one of our member below to chat on Phone