Tequila Market Report Scope & Overview:

Get More Information on Tequila Market - Request Sample Report

The Tequila Market size was valued at USD 10.45 billion in 2023. It is projected to reach USD 17.21 billion by 2032 and grow at a CAGR of 6.50% over the forecast period of 2024-2032.

Tequila is a distilled liquor that is largely produced in the region around Tequila, 65 km to the northwest of Guadalajara, and in the Jaliscan Highlands of the state of Jalisco in central-western Mexico.

The market is segmented as Reposado, Blanco, Anejo, and Others based on Type. Due to its characteristics, the Blanco sector had the biggest revenue share in the tequila market in 2022. The Blanco varieties generate the majority of the segment's revenue. For instance, Tequila Blanco production in Mexico increased from 11.91 million liters in May 2021 to over 13.9 million liters in July 2022, according to Statista. In just thirteen months, this suggests an increase of more than 2 million liters.

Blanco has the largest market share since its varieties are frequently utilized in numerous beverages, including palomas and margaritas. consumers are becoming more open-minded and eager to try new flavors, anejo and reposado varieties have been very popular in the recent past.

MARKET DYNAMICS

KEY DRIVERS

-

The growing interest of consumers in new and Exotic Flavours

Tequila is originally manufactured from the blue agave plant, but flavored tequilas have become popular in recent years. These tequilas have been infused with fruits, spices, or herbs, giving them a distinct and delectable flavor character. According to the Distilled Spirits Council of the US, the vendor's value of spirits will increase by 4.9% in 2022 to a record $38 billion, accounting for 43% of the beverage alcohol market compared to 42% for beer. Customers seek flavor sensations that are different from the ordinary.

RESTRAIN

-

Increasing trend for low or non-alcoholic beverages

Low- and no-alcohol beverages are becoming increasingly popular as customers become more health-conscious. This could lead to a drop in demand for alcoholic beverages, especially tequila. This trend may lead to a decrease in demand for conventional alcoholic beverages such as tequila.

OPPORTUNITY

-

Expanding market in emerging economies

-

Rising demand for a premium spirit

Tequila, a distilled alcoholic beverage created from the blue agave plant, has grown in popularity around the world, particularly in the luxury market. Consumers are becoming pickier in their spirits selection, preferring high-quality and premium goods. According to ISWR, premium-and-above spirits, which include cocktails and pricey sipping spirits, will have a 14% worldwide volume market share by 2024 as consumers continue to favor quality over quantity. People are more inclined to discover and appreciate the unique flavors and features given by premium tequila brands as their understanding of tequila grows.

CHALLENGES

-

Government regulations

-

Presence of counterfeit tequila

Counterfeit tequila is produced illegally or without the required authority. It is frequently manufactured with subpar ingredients and may be unsafe to consume. The reputation of authentic tequila brands can also be harmed by counterfeit tequila. This is becoming more common, and if consumers are aware of this, they may be less likely to purchase tequila. Counterfeit tequila is frequently manufactured using subpar components, such as methanol, which is toxic to the body. Consumers who consume fake tequila may suffer from health issues such as blindness, seizures, or even death.

IMPACT OF RUSSIA UKRAINE WAR

Russia Ukraine war has impacted the tequila market. Russia is a large tequila market, as well as a consumer and supplier of tequila. The war has reduced demand for tequila in Russia. The economic sanctions imposed on Russia have made purchasing tequila more difficult and expensive for Russian customers. Tequila shipments to Russia declined by 26% in the first quarter of 2022, according to the Tequila Regulatory Council (CRT). This has resulted in a rise in tequila prices, which has indirectly resulted in a decline in tequila sales.

IMPACT OF ONGOING RECESSION

During the recession, prices of tequila rose due to disruption in the supply chain. A recession might reduce demand for tequila because customers have less discretionary income to spend on luxury things. This is especially true for premium tequilas; which consumers are more likely to purchase during periods of economic boom. According to the IWSR Drinks Market Analysis, the worldwide tequila market is predicted to increase by 3.5% in 2023, but this growth will drop to 2.5% in 2024.

KEY MARKET SEGMENTATION

By Type

-

Blanco

-

Reposado

-

Anejo

-

Others

By Grade

-

Value

-

Premium

-

High-end Premium

-

Super Premium

By Distribution Channel

-

Off-Trade

-

On-Trade

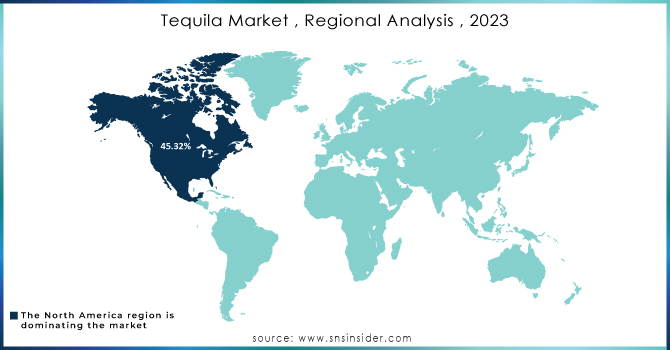

REGIONAL ANALYSIS

North America has the largest share of the tequila market around 45.32% in 2023. In recent years, tequila has become increasingly well-liked in the United States. More than 29 million 9-liter bottles of tequila were sold in the American market in 2022, an 11.5% rise over the year before. According to the International Wine and Spirits Research (IWSR), tequila is the beverage category that is expanding the quickest in the area. This growth may also be attributable to trends toward premiumization and the region's expanding Hispanic population.

Europe has a growth at a CAGR of 4.43% market for tequila in the forecasting period. This is due to the rising popularity of artisanal spirits in countries like The United Kingdom, Germany, Spain, and France are the leading markets for tequila in Europe. The growth of the tequila market in Europe is being driven by the increasing popularity of Mexican cuisine and culture, and the growing awareness of tequila among consumers.

In the Asia Pacific spirits have gained recognition among consumers, especially in China, India, and Japan are the leading markets for tequila in Asia Pacific. The growth of the tequila market in Asia Pacific is being driven by the increasing disposable income of consumers and the growing popularity of tequila cocktails among young people.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Bacardi and Company Ltd, Diageo PLC, Pernod Ricard, Constellation Brands, Inc, Suntory Holdings Limited, Brown-Forman Corporation, Proximo, Ambhar Global Spirits, LLC, Eastside Distilling, California Tequila Inc, Becel, and other key players are mentioned in the final report.

RECENT DEVELOPMENTS

In 2023, Pernod Ricard is expanding its wine portfolio due to rising demand and bringing its international tequila brands to India

In 2023, La Caza Tequila announced that, just three months after its initial introduction, it has moved into its third market and is now available throughout the state of Ohio. La Caza Tequila is pleased to announce the opening of a new office in Cleveland as part of this development.

In 2022, Tres Generaciones, a brand of tequila owned by Suntory Holdings Limited, debuted aejo Cristalino, a new ultra-premium product.

| Report Attributes | Details |

| Market Size in 2023 | US$ 10.45 Billion |

| Market Size by 2032 | US$ 17.21 Billion |

| CAGR | CAGR of 6.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Blanco, Reposado, Anejo, and Others) • By Grade (Value, Premium, High-end Premium, and Super Premium) • By Distribution Channel (Off-Trade and On-Trade) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Bacardi and Company Ltd, Diageo PLC, Pernod Ricard, Constellation Brands, Inc, Suntory Holdings Limited, Brown-Forman Corporation, Proximo, Ambhar Global Spirits, LLC, Eastside Distilling, California Tequila Inc, Becel |

| Key Drivers | • The growing interest of consumers in new and Exotic Flavours |

| Market Opportunity | • Expanding market in emerging economies • Rising demand for a premium spirit |