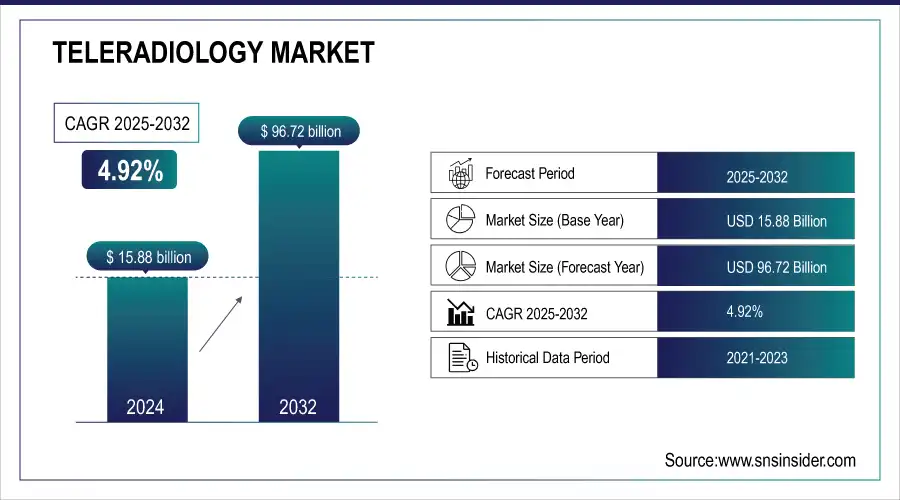

Teleradiology Market Size:

The Teleradiology Market Size was valued at USD 15.88 billion in 2024 and is expected to reach USD 96.72 billion by 2032, growing at a CAGR of 25.36% over the forecast period 2025-2032.

Get more information on Teleradiology Market - Request Free Sample Report

The teleradiology market is growing rapidly, supported by advancements in technology and the rising global need for efficient diagnostic services. Teleradiology enables the secure transmission of radiological images such as X-rays, CT scans, and MRIs for remote interpretation, mitigating the global shortage of radiologists and ensuring timely diagnoses. According to the National Institutes of Health (NIH), chronic diseases like cardiovascular conditions and cancer contribute significantly to the rising demand for diagnostic imaging. The Centers for Disease Control and Prevention (CDC) reports that cardiovascular diseases are responsible for approximately 17.9 million deaths annually worldwide, with diagnostic imaging playing a crucial role in early detection and management. Furthermore, cancer imaging is growing steadily, with the National Cancer Institute (NCI) projecting over 1.9 million new cancer cases in the U.S. alone for 2023, emphasizing the need for scalable diagnostic solutions like teleradiology.

Key Teleradiology Market Trends:

-

Integration of AI and deep learning algorithms enhances diagnostic accuracy, reduces reading times, and supports radiologists in complex cases.

-

Cloud-based teleradiology platforms enable secure remote access to imaging data, improving collaboration between hospitals, clinics, and radiology experts globally.

-

Adoption of advanced imaging modalities like MRI, CT, and PET with remote reporting increases workflow efficiency and patient care quality.

-

Expansion of outpatient and rural imaging centers drives demand for teleradiology services to address radiologist shortages and improve timely diagnosis.

-

Regulatory compliance, data security, and HIPAA adherence are shaping investments in secure tele-imaging platforms and healthcare IT infrastructure.

-

Teleconsultation and cross-border reporting services are rising, facilitating 24/7 diagnostic support and bridging gaps in specialist availability worldwide.

Telehealth adoption, including teleradiology, surged during the COVID-19 pandemic. The U.S. Department of Health and Human Services (HHS) reported a 63-fold increase in telehealth utilization within Medicare, rising from approximately 840,000 visits in 2019 to 52.7 million in 2020. This growth highlighted the importance of remote healthcare solutions in maintaining continuity of care during emergencies.

Compliance with privacy regulations like HIPAA has been a critical enabler for teleradiology. Government-endorsed platforms that meet stringent security and data management standards ensure secure image transmission and storage, addressing patient and provider concerns. Studies reveal that HIPAA-compliant platforms reduce data breaches by 60%, fostering trust and adoption among healthcare providers.

Teleradiology Market Drivers:

-

Technological advancements, increasing healthcare demands, and evolving regulatory frameworks.

A primary driver is the rising global imaging workload, with the American College of Radiology (ACR) estimating that radiologist productivity needs to increase by 30% to meet demand. This gap has been exacerbated by the growing incidence of chronic diseases. For instance, the Global Burden of Disease Study reported a 33% increase in musculoskeletal imaging demand over the last decade, which teleradiology addresses through remote interpretation.

Technological innovations, particularly the integration of 5G and AI, are transforming teleradiology workflows. A study published by the U.S. National Library of Medicine noted that AI tools improve diagnostic accuracy by up to 95% in certain imaging applications, significantly reducing the radiologist's workload. Additionally, 5G networks enhance the speed and reliability of image transmission, enabling real-time consultations.

Regulatory support for telehealth has also accelerated market growth. The U.S. Health Resources and Services Administration (HRSA) reported a 36% increase in funding for telehealth initiatives in 2023, emphasizing the importance of remote healthcare services, including teleradiology. Governments globally are incentivizing digital health adoption, with teleradiology being a priority due to its ability to provide cost-effective solutions for rural and underserved regions.

The rising adoption of cloud-based platforms further supports the market, with HIPAA-compliant systems offering secure storage and quick access to imaging data. Reports show that cloud solutions can reduce operational costs by up to 20%, making them attractive for healthcare providers.

Teleradiology Market Restraints:

-

Data Security and Privacy Concerns

The transmission and storage of sensitive medical imaging data pose significant challenges due to the risk of cyberattacks and data breaches. Despite compliance measures like HIPAA, reports from the U.S. Department of Health and Human Services indicate a 25% increase in healthcare data breaches in 2023, raising concerns about patient confidentiality in teleradiology systems.

-

High Initial Implementation Costs

Establishing a robust teleradiology infrastructure involves substantial investments in technology, secure networks, and training. A report by the American Telemedicine Association highlighted that smaller healthcare facilities often face financial barriers, with implementation costs for teleradiology solutions ranging from USD 100,000 to USD 1 million, limiting adoption in resource-constrained settings.

Teleradiology Market Segmentation Analysis:

By Report Type, Preliminary Reports, Lead Market Share, and Final Reports are Growing Rapidly

Preliminary reports reading was the dominant segment in 2024, contributing approximately 55.0% of the market share. These reports are vital in emergency care settings where rapid diagnostic interpretations are essential for timely clinical interventions. Preliminary reports provide a quick yet accurate assessment of radiological images, ensuring that critical conditions such as fractures, hemorrhages, or infections are identified promptly. The growing deployment of teleradiology systems in emergency departments and urgent care centers, driven by the increasing global radiologist shortage, has significantly bolstered the reliance on preliminary reports. Furthermore, advancements in real-time image transmission technology ensure minimal delays in generating these reports, supporting their widespread adoption.

Final reports reading are experiencing the fastest growth due to the increasing demand for detailed, validated radiological interpretations that comply with clinical and legal standards. These reports undergo rigorous review, offering a comprehensive diagnosis that guides precise treatment planning. Healthcare providers are progressively adopting final reports to ensure diagnostic accuracy, improve patient outcomes, and maintain compliance with healthcare regulations. This trend is particularly pronounced in specialized care settings, such as oncology and neurology, where definitive diagnoses are critical. The use of AI tools in enhancing report accuracy and minimizing discrepancies further fuels the growth of this segment.

By Product, X-Ray Dominates Teleradiology Market; MRI Shows Fastest Growth

X-ray emerged as the most dominant segment in 2024, accounting for approximately 40.0% of the market. X-ray imaging remains the cornerstone of diagnostic radiology due to its affordability, accessibility, and versatility. Its extensive use in diagnosing fractures, lung diseases, infections, and other musculoskeletal conditions has cemented its prominence in the market. Moreover, the increasing burden of respiratory conditions, such as tuberculosis and pneumonia, has further amplified the demand for X-ray-based teleradiology services. The adoption of portable X-ray devices, coupled with the integration of digital imaging and Picture Archiving and Communication Systems (PACS), has enhanced the efficiency of X-ray transmission and interpretation in remote locations, reinforcing its dominance.

MRI is the fastest-growing segment, driven by its advanced imaging capabilities, which are crucial for diagnosing complex conditions. MRI provides detailed visualizations of soft tissues, making it indispensable for detecting neurological disorders, spinal injuries, and cardiovascular diseases. The increasing adoption of high-speed data transmission technologies ensures seamless transmission of large MRI image files, promoting its usage in remote radiological assessments. Additionally, AI-powered tools are transforming MRI interpretation, enabling faster and more accurate analyses, particularly for complex diagnoses. This technological evolution, coupled with growing awareness among healthcare providers about the benefits of MRI teleradiology, is significantly boosting its demand across various healthcare settings.

Teleradiology Market Regional Analysis:

North America Dominates the Teleradiology Market in 2024

North America holds an estimated 40% market share in 2024, driven by advanced healthcare infrastructure, a growing radiologist shortage, and high adoption of digital imaging technologies, which accelerates teleradiology implementation across hospitals and diagnostic centers.

Need any customization research on Teleradiology Market - Enquiry Now

-

United States Leads North America’s Teleradiology Market

The United States dominates due to a mature healthcare ecosystem, significant investment in healthcare IT, and a high prevalence of chronic and acute diseases requiring radiological services. The integration of PACS, high-speed internet, and AI-powered diagnostic tools enables rapid image transmission and interpretation. Furthermore, increasing demand for remote consultations, telehealth adoption, and government incentives supporting digital healthcare solutions reinforce the U.S. as the leading contributor to North America’s teleradiology market growth.

Asia Pacific is the Fastest-Growing Region in the Teleradiology Market in 2024

Asia Pacific is projected to grow at an estimated CAGR of 12.5%, fueled by rising healthcare awareness, increasing chronic disease burden, and government initiatives promoting telemedicine, which boosts adoption of teleradiology solutions.

-

China Leads Teleradiology Market Growth in Asia Pacific

China dominates due to rapid urbanization, a large population requiring timely diagnostic imaging, and government investment in telehealth infrastructure. Widespread adoption of cloud-based teleradiology platforms and AI-assisted imaging solutions enhances accessibility in rural areas. Increasing collaboration between hospitals, diagnostic centers, and technology providers accelerates deployment. Additionally, the rising prevalence of cardiovascular, neurological, and orthopedic conditions increases imaging demand, positioning China as the key hub for teleradiology services in the Asia Pacific region.

Europe Teleradiology Market Insights, 2024

Europe maintains a significant market share, driven by growing demand for remote radiology services, increasing cross-border healthcare, and the adoption of advanced imaging technologies. Germany’s strong healthcare infrastructure and rapid digital healthcare adoption improve diagnostic efficiency, driving teleradiology market expansion. Germany dominates due to its advanced hospital networks, high radiologist availability, and robust IT integration. The government encourages digital healthcare adoption through national e-health initiatives. Advanced PACS implementation and AI-assisted imaging streamline diagnostics, enhance report accuracy, and reduce delays. Germany’s policies, technological infrastructure, and healthcare investments set a benchmark for teleradiology adoption across Europe.

Middle East & Africa and Latin America Teleradiology Market Insights, 2024

The Middle East & Africa and Latin America regions are witnessing steady growth, fueled by telemedicine adoption, increasing private healthcare investments, and rising awareness of early disease diagnosis. Countries like the UAE, Saudi Arabia, Brazil, and Mexico are deploying cloud-based teleradiology platforms and AI-assisted imaging to improve diagnostic efficiency. Expansion of imaging centers, partnerships with international radiology service providers, and initiatives to improve rural healthcare accessibility are driving market adoption. While behind North America, Europe, and the Asia Pacific, these regions are emerging as important growth markets for teleradiology solutions.

Competitive Landscape for the Teleradiology Market companies:

Virtual Radiologic (vRad)

Virtual Radiologic (vRad) is a U.S.-based leader in teleradiology services, providing comprehensive remote radiology interpretations for hospitals, imaging centers, and urgent care facilities. With decades of experience, the company delivers X-ray, MRI, CT, and other diagnostic imaging readings, helping healthcare providers reduce turnaround times and improve patient outcomes. vRad operates a nationwide network of board-certified radiologists and integrates advanced PACS and reporting systems for seamless image sharing and interpretation. Its role in the teleradiology market is vital, as it enables 24/7 radiology support, ensures diagnostic accuracy, and extends healthcare access to remote and underserved areas.

-

In March 2025, vRad expanded its AI-assisted imaging platform, enabling faster detection of critical conditions such as fractures, lung nodules, and neurological abnormalities, enhancing efficiency and diagnostic accuracy.

Agfa-Gevaert Group

Agfa-Gevaert Group is a Belgium-based global provider of medical imaging solutions, including DR 600 digital radiography, PACS, and Enterprise Imaging systems. The company specializes in integrating imaging acquisition, storage, and management workflows, supporting hospitals and clinics in delivering precise and timely diagnostics. Agfa-Gevaert’s advanced imaging software enhances radiologist efficiency, facilitates remote consultations, and promotes interoperability across healthcare networks. Its role in the teleradiology market is central, as it provides the technological backbone for efficient image transmission, storage, and interpretation worldwide.

-

In January 2025, Agfa-Gevaert launched an upgraded PACS module with AI-assisted image analysis, improving radiology workflow efficiency and supporting remote teleradiology services globally.

ONRAD, Inc.

ONRAD, Inc. is a U.S.-based teleradiology company that provides 24/7 remote radiology reading services for hospitals, imaging centers, and specialty clinics. The company offers X-ray, MRI, CT, and ultrasound interpretations, leveraging a network of board-certified radiologists and cloud-based platforms for rapid image access. ONRAD enhances diagnostic accuracy and supports hospitals in managing radiologist shortages, enabling timely clinical decision-making. Its role in the teleradiology market is critical, providing scalable, reliable, and efficient remote imaging services to healthcare providers.

-

In May 2025, ONRAD implemented a cloud-native AI platform for automated preliminary readings, accelerating emergency diagnostics and optimizing radiology workflows across partner facilities.

Everlight Radiology

Everlight Radiology is a U.K.-based teleradiology provider offering remote diagnostic reporting services to hospitals, clinics, and imaging centers worldwide. The company specializes in X-ray, CT, MRI, and mammography interpretations, supported by a team of certified radiologists and integrated PACS systems. Everlight enhances radiology coverage, reduces turnaround times, and ensures consistent diagnostic quality. Its role in the teleradiology market is pivotal, extending healthcare access to remote regions and supporting 24/7 radiology operations.

-

In February 2025, Everlight Radiology introduced AI-powered decision support tools for chest and musculoskeletal imaging, improving reporting accuracy and enabling faster remote diagnostics.

Teleradiology Market Key Players:

Teleradiology Market Companies

-

ONRAD, Inc.

-

Everlight Radiology

-

4ways Healthcare Ltd.

-

RamSoft, Inc.

-

USARAD Holdings, Inc.

-

Koninklijke Philips N.V.

-

Matrix (Teleradiology Division of Radiology Partners)

-

Medica Group PLC

-

Teleradiology Solutions

-

All-American Teleradiology

-

Philips Healthcare

-

GE Healthcare

-

Mednax Services, Inc.

-

Cerner Corporation

-

TeleDiagnostic Solutions, Inc.

-

NightHawk Radiology Services

-

RADNet, Inc.

-

vRad Health Systems

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 15.88 billion |

| Market Size by 2032 | US$ 96.72 billion |

| CAGR | CAGR of 25.36% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Computed Tomography (CT), Ultrasound, X-ray, Nuclear Imaging, Magnetic Resonance Imaging (MRI)) • By Report Type (Preliminary Reports, Final Reports) • By End-Use (Hospital, Radiology Clinics, Ambulatory Imaging Center) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Virtual Radiologic (vRad), Agfa-Gevaert Group, ONRAD, Inc., Everlight Radiology, 4ways Healthcare Ltd., RamSoft, Inc., USARAD Holdings, Inc., Koninklijke Philips N.V., Matrix (Teleradiology Division of Radiology Partners), Medica Group PLC, Teleradiology Solutions, All-American Teleradiology, Philips Healthcare, GE Healthcare, Mednax Services, Inc., Cerner Corporation |