Teeth Whitening Market Size:

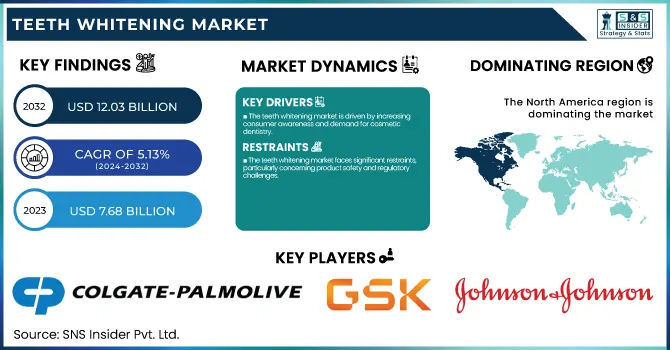

The Teeth Whitening Market Size was valued at USD 7.68 billion in 2023 and is expected to reach USD 12.03 billion by 2032 and grow at a CAGR of 5.13% over the forecast period 2024-2032.

To Get More Information on Teeth Whitening Market - Request Sample Report

This report identifies the prevalence and adoption levels of teeth whitening products, with increasing demand for at-home whitening kits and in-office treatments. The research delves into new product trends, highlighting the trend toward peroxide-free products, LED-based whitening products, and natural ingredient-based products, as well as evaluating pricing and affordability trends that drive consumer purchasing behavior among various income segments. It also explores investment and innovation trends, highlighting developments in formulation technology and the increasing role of digital platforms in product marketing and distribution. Trends in regulation and safety are likewise explored, highlighting changing guidelines and consumer safety issues that affect product formulations and market entry.

The U.S. Teeth Whitening Market Size was valued at USD 8.86 billion in 2023 and is expected to reach USD 11.95 billion by 2032 and grow at a CAGR of 6.34% over the forecast period 2024-2032. In the United States, demand for teeth whitening products is witnessing consistent growth, fueled by rising aesthetic awareness, influencer marketing, and convenient availability through e-commerce and retail platforms. The market is also impacted by changing FDA regulations and consumer desire for safer, non-invasive whitening treatments.

Teeth Whitening Market Dynamics

Drivers

-

The teeth whitening market is driven by increasing consumer awareness and demand for cosmetic dentistry.

With more than 45% of global consumers giving importance to a white smile, teeth-whitening product adoption has increased. The growing influence of social media, where almost 80% of beauty-driven consumers trust online trends, has also fueled product demand. Moreover, new teeth whitening technologies, including peroxide-free whitening gels and LED light kits, have improved product effectiveness and safety. The growth of e-commerce has also contributed significantly, with online retail of oral hygiene products increasing by more than 25% in 2023. In addition, dentists are now more frequently providing in-clinic whitening, thus bringing professional treatments into the market. Increased demand for organic and peroxide-free whitening products, such as those marketed by Hello and Lumineux, has also increased market diversification. Rising disposable incomes and dental tourism in nations such as Thailand and Mexico have driven market growth. In addition, product innovation, such as charcoal toothpaste and blue light whitening technology, has stimulated consumer demand. In general, a mix of beauty trends, technological innovations, and changing consumer behavior continues to propel the teeth whitening market.

Restraints

-

The teeth whitening market faces significant restraints, particularly concerning product safety and regulatory challenges.

Most whiteners use hydrogen peroxide, which, when applied in excess, has the potential to damage tooth enamel and cause sensitivity. The FDA, European Commission, and other regulatory authorities enforce stringent regulations on whiteners, restricting their concentration in OTC whiteners to maintain safety. Professional whiteners are still costly, with in-clinic procedures ranging from USD 300 to USD 1,000 and thus are beyond the reach of many consumers. A further constraint is consumer distrust regarding the efficacy of OTC whitening products since research has shown that more than 30% of consumers fail to get their desired whitening effect. Furthermore, the availability of counterfeit and low-quality products on online shopping sites has caused safety issues, resulting in distrust among potential consumers. The growing awareness of possible long-term side effects, including gum irritation and patchy whitening, has also reduced adoption rates. Moreover, the desire for organic alternatives such as activated charcoal and baking soda has prompted some consumers to shift away from chemical-based whitening products. These conditions together restrict the extensive use of teeth-whitening products, especially among health-oriented consumers and sensitive teeth sufferers.

Opportunities

-

The rising demand for natural and peroxide-free whitening solutions presents a major opportunity for market growth.

With more than 60% of consumers opting for clean-label and organic products, brands are investing in charcoal-based, coconut oil-infused, and fluoride-free whitening products. The growth of at-home whitening kits, especially LED-based systems, has also generated a profitable segment, as consumers want professional-grade results without the expense of dental visits. Another area is personalized whitening products, in which AI-powered apps and intelligent toothbrushes scan oral health to suggest tailored whitening treatments. The boom in direct-to-consumer (DTC) brands like Snow and HiSmile has redefined the market by providing subscription-based whitening products, tapping into the rising e-commerce trend. In addition, the growth of influencer marketing and social media campaigns through partnerships between brands, beauty influencers, and celebrities has also increased product visibility to a great extent. Dental tourism is one more area for growth, as consumers are looking for cost-effective professional whitening treatments in tourist destinations like Mexico, Turkey, and Thailand. Moreover, product innovation in the form of whitening chewing gums and dissolvable whitening strips is likely to target new consumer groups. As the need for sustainable packaging and green formulations continues to grow, those companies that embrace these practices will have an advantage in the changing market.

Challenges

-

One of the biggest challenges in the teeth whitening market is consumer skepticism regarding the effectiveness and long-term safety of whitening products.

Research indicates that almost 40% of users have reported little or inconsistent results, resulting in dissatisfaction and reduced repeat business. A second issue is the high irritation and sensitivity risks from whitening chemicals such as hydrogen and carbamide peroxide, deterring long-term application. Most customers suffer from gum irritation, enamel erosion, and tooth sensitivity, lowering their confidence in chemical-based whitening products. The surge in deceptive marketing practices, where companies overstate outcomes, has also attracted regulatory attention as well as consumers' distrust. Moreover, competition from other whitening alternatives like oil pulling, remineralization toothpaste, and laser whitening procedures is a threat to conventional whitening products. Slow take-up of professional whitening procedures on grounds of cost as well as the absence of dental insurance coverage of cosmetic operations further restricts market growth. Supply chain dislocations, most notably in procuring active whitening ingredients, have also engendered pricing volatility. Finally, strict regulations in some countries, such as peroxide concentration limits in whitening products, remain compliance nightmares for manufacturers and restrict product access in major markets.

Teeth Whitening Market Segmentation Insights

By Product

Whitening toothpaste dominated the teeth whitening market in 2023 with the largest market share of 38.9%. The segment's dominance is due to its affordability, convenience, and everyday use, making it the most convenient teeth-whitening option for consumers. Moreover, the increasing demand for fluoride-infused and enamel-safe whitening products has further fortified its position in the market.

Whitening gels and light-based whitening products were the fastest-growing product category in the forecast period. Increased demand for professional-strength at-home whitening products, accompanied by technical developments in LED light technology, has stimulated demand. Demands for enhanced and longer-lasting effects have spurred this product segment's rapid growth, particularly due to the growing impact of social media and celebrity endorsements promoting at-home whitening kits.

By Distribution Channel

The offline distribution channel commanded the highest revenue share of 69.7% during the year 2023 due to robust sales through supermarkets, pharmacies, and dental clinics. Customers still find in-store shopping for teeth whitening solutions more comfortable because of familiarity with heritage brands, convenience of comparison, and recommendations from dental experts and store staff.

The online category is growing at the fastest rate among teeth whitening distribution channels, fueled by rising demand for convenience and ease of access. E-commerce sites, direct-to-consumer (DTC) company websites, and social media-based purchases have helped register strong growth. Exclusive online promotions, subscription models, and word-of-mouth through reviews have also prompted consumers to make more purchases of teeth-whitening solutions through digital means.

Teeth Whitening Market Regional Analysis

North America led the teeth whitening market in 2023 with high consumer penetration, robust buying power, and extensive coverage of sophisticated whitening products. The region enjoys the presence of major market participants and a good dental care structure, with the United States holding the top positions in product use and professional teeth whitening services. Europe took the second place, aided by increasing aesthetic sensitivity and a good oral care marketplace. Countries like the UK, Germany, and France have experienced growing demand for high-end whitening products, especially among youth consumers.

Asia-Pacific is the most rapidly expanding region in the teeth whitening market, driven by a growing demand fueled by rising disposable incomes, growing beauty awareness, and the growing e-commerce market. In 2023, Asia-Pacific represented a large proportion of new product sales, with markets like China, India, and Japan leading the growth of the market. The power of social media and celebrity endorsements has played a major role in stimulating consumer demand for whitening treatments, particularly in urban regions. The increasing popularity of affordable at-home whitening kits and professional dental care has also fueled market growth in the region, which is the most vibrant market for future growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Teeth Whitening Market Companies

-

Colgate-Palmolive – Colgate Optic White Advanced Toothpaste, Colgate Optic White Express Whitening Pen, Colgate Optic White Overnight Whitening Treatment

-

GlaxoSmithKline Plc – Sensodyne Pronamel Gentle Whitening Toothpaste, Aquafresh Whitening Toothpaste

-

Johnson & Johnson – Listerine Healthy White Mouthwash, REACH Whitening Toothbrush

-

Procter & Gamble – Crest 3D White Strips, Crest Whitening Emulsions, Oral-B 3D White Toothpaste

-

Unilever – Signal White Now Toothpaste, Pepsodent Whitening Toothpaste

-

Church & Dwight Co. – Arm & Hammer Advance White Toothpaste, Arm & Hammer Whitening Booster

-

Brodie & Stone – Beverly Hills Formula Perfect White Black Toothpaste, Beverly Hills Formula Professional White Strips

-

SmileDirectClub – SmileDirectClub Bright On Teeth Whitening Kit, SmileDirectClub Premium Whitening Toothpaste

-

Snow – Snow Teeth Whitening Kit, Snow LED Whitening Electric Toothbrush

-

HiSmile – HiSmile PAP+ Teeth Whitening Kit, HiSmile Whitening Strips

Recent Developments in Teeth Whitening Market

In March 2025, Aspen Dental partnered with GLO Science to offer an advanced teeth whitening solution featuring patented LED and heat technology. This collaboration enables patients to achieve noticeably whiter smiles in under 30 minutes, providing a fast and effective whitening experience.

In Nov 2024, BURST Oral Care introduced Teeth Whitening Breath Strips, a next-gen solution combining advanced whitening technology with breath-freshening benefits. These ultra-thin, quick-dissolving strips offer a convenient, on-the-go approach to daily oral care.

| Report Attributes | Details |

| Market Size in 2023 | USD 7.68 billion |

| Market Size by 2032 | USD 12.03 billion |

| CAGR | CAGR of 5.13% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Whitening Toothpaste, Whitening Gels and Strips, Light Teeth Whitening Device, Other Products] • By Distribution Channel [Online, Offline] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Colgate-Palmolive, GlaxoSmithKline Plc, Johnson & Johnson, Procter & Gamble, Unilever, Church & Dwight Co., Brodie & Stone, SmileDirectClub, Snow, HiSmile. |