Tax Management Software Market Report Scope & Overview:

Get More Information on Tax Management Software Market - Request Sample Report

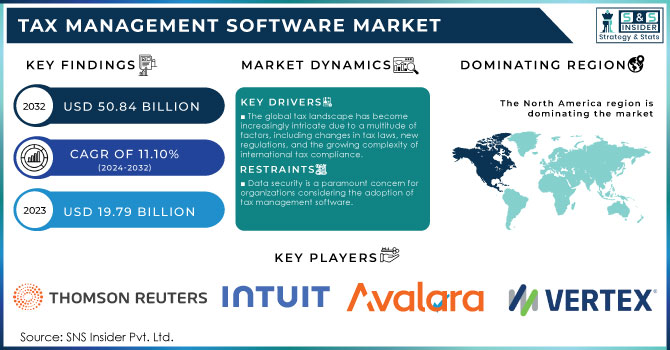

The Tax Management Software Market Size was valued at USD 19.79 Billion in 2023 and is expected to reach USD 50.84 Billion by 2032, growing at a CAGR of 11.10% over the forecast period 2024-2032.

With the globalization of businesses, tax compliance has become more intricate due to diverse regulations across different countries. For example, tax compliance in the United States involves navigating a complex landscape of regulations at the federal, state, and local levels. At the federal level, individuals and corporations must file income tax returns using forms such as 1040 or 1120, respectively, while employers are responsible for withholding and remitting payroll taxes, including Social Security and Medicare, through forms like 941 and 940. Additionally, excise taxes on specific goods require compliance through Form 720, and self-employed individuals must pay estimated taxes quarterly using Form 1040-ES. Information reporting is also crucial, with forms like 1099 for independent contractors and W-2 for employees. This has led to an increased demand for tax management software that can cater to multi-jurisdictional needs. Companies operating in multiple regions often need to comply with various tax codes, value-added tax (VAT) regulations, and international financial reporting standards. Tax management software addresses these challenges by offering a centralized platform where organizations can manage their tax obligations across different regions, ensuring compliance with varying local tax laws.

One of the significant applications of tax management software is in the e-commerce industry. Approximately 2.71 billion people worldwide are embracing online shopping, with 20.1% of retail purchases expected to occur online in 2024, a figure projected to climb to 22.6% by 2027. As e-commerce sales are anticipated to exceed USD 6.3 trillion in 2024, the sheer volume of online transactions is staggering. With over 26.6 million e-commerce stores operating globally, competition is fierce. As e-commerce continues to expand globally, online businesses are increasingly required to adhere to complex tax regulations across different jurisdictions. For instance, online retailers must collect and remit sales taxes for transactions made across state lines or international borders. Tax management software simplifies this process by automatically calculating the correct tax amounts based on the customer’s location and ensuring compliance with the respective tax regulations. This has made it a vital tool for e-commerce companies that want to focus on growth without being bogged down by intricate tax procedures.

Tax Management Software Market Dynamics

Drivers

-

The global tax landscape has become increasingly intricate due to a multitude of factors, including changes in tax laws, new regulations, and the growing complexity of international tax compliance.

Governments across the globe are constantly revising their tax regulations to reflect economic shifts, ensure equality, and eliminate loopholes. This fast-paced setting poses major obstacles for companies, regardless of their size. As a result, companies must navigate through a complicated system of rules that differ not just between countries, but also within states or regions. Consequently, companies are more and more relying on tax management software as a vital tool to efficiently handle compliance. These software programs offer important resources for companies to automate tax calculations, handle filings, and ensure adherence to local, national, and international laws. They assist in providing immediate notifications on regulatory alterations, allowing companies to quickly adjust their tax plans. Furthermore, failing to comply can result in significant financial consequences such as fines, penalties, and harm to reputation. Through the utilization of tax management software, companies can reduce these risks and create more streamlined procedures for managing their tax responsibilities. Automation decreases the dependency on manual procedures, which are frequently susceptible to mistakes, thereby decreasing the chance of errors that might result in compliance problems.

-

The rapid growth of e-commerce and digital transactions has transformed the way businesses operate and interact with customers.

This change has resulted in a notable rise in the intricacy of tax responsibilities, requiring strong tax management solutions. With the rise of online shopping, companies face numerous tax laws concerning sales tax, value-added tax (VAT), and other transaction-related taxes. Tax management software is crucial for e-commerce companies to maintain adherence to different tax mandates. In the United States, sales tax rules differ among states, with some states taxing online sales and others not. E-commerce platforms face difficulties in accurately determining and gathering sales tax according to the buyer's location when automated systems are not utilized. Tax management software streamlines this procedure by automatically implementing accurate tax rates using current data, guaranteeing adherence to state and local laws. Moreover, the worldwide scope of online commerce creates added difficulties regarding adhering to tax regulations. Global transactions could contain various tax jurisdictions, each having distinct rules and regulations. Tax management software allows businesses to handle these challenges by offering customized solutions for meeting international tax regulations. This skill is crucial for businesses seeking to grow their presence worldwide.

Restraints

-

Data security is a paramount concern for organizations considering the adoption of tax management software.

Because these systems manage important financial information like tax filings, revenue numbers, and employee data, companies are understandably cautious about possible data breaches and the consequences of revealing such information. The impact of a data breach can be catastrophic. Organizations are at risk of financial losses, reputational damage, and legal consequences if sensitive data is breached. Strict data protection laws are frequently enforced by regulatory authorities, and failing to comply can lead to significant fines. Therefore, companies need to make data security a top priority when assessing tax management software options. Numerous businesses have concerns regarding the security protocols implemented by software providers. Organizations require confirmation that their selected tax management software provider enforces strong security measures to prevent unauthorized access and data breaches. This involves using methods like encryption, multi-factor authentication, and routine security audits. If companies feel that information about data security practices is not clear, they might hesitate to put money into tax management solutions.

Tax Management Software Market Segmentation Overview

By Component

The software segment dominated the tax management software market in 2023 with over 75% market share. The software is highly beneficial for businesses as it streamlines intricate tax regulations and provides immediate updates on legal modifications. This section is popular for its capacity to simplify processes, minimize errors made by humans, and decrease the time and expenses related to manual tax management. Some companies that provide tax management software are Intuit with TurboTax and Vertex, which offer extensive software options for indirect tax and compliance management.

The professional services segment is anticipated to witness the fastest CAGR during 2024-2032. With the evolving tax regulations, companies are turning to expert guidance more often to improve their tax management strategies and stay compliant. Professional services are essential for businesses that require specialized solutions designed to meet their requirements. Instances such as Deloitte and PwC offer consulting and advisory services to enhance tax processes and facilitate the smooth integration of tax management software in organizational systems.

By Tax Type

The direct tax sector held a market share of 55% in 2023 and dominated the market, because of the increasing challenges related to tax laws and compliance that businesses are dealing with. Income tax, corporate tax, and property tax are examples of direct taxes imposed on individuals and organizations based on their earnings or profits. This request is also driven by the increasing popularity of digital transformation in finance and accounting departments. Notable instances of software applications in this category are Intuit ProConnect and H&R Block Tax Software, providing extensive resources for handling direct tax adherence and optimizing tax deductions.

The indirect tax is projected to become the fastest-growing segment during 2024-2032, fueled by the rising popularity of Goods and Services Tax (GST) and Value Added Tax (VAT) systems on a global scale. Businesses involved in trade and e-commerce rely on indirect taxes, which are imposed on goods and services instead of income or profits. With the expansion of global trade and changes in regulations, companies are searching for effective methods to manage taxes to meet requirements and reduce financial obligations. Companies like such as Avalara and Thomson Reuters ONESOURCE, offer sophisticated tools for handling indirect tax compliance and streamlining transaction reporting.

By Deployment

The on-premise segment dominated the tax management software market in 2023 with a 53% market share, and this trend will continue with the segment becoming the fastest-growing during 2024-2023. This control is maintained by organizations wanting to keep a hold on their financial information and follow strict rules. On-site solutions provide improved security, customization, and compatibility with current legacy systems, appealing to bigger corporations and heavily regulated sectors. Furthermore, companies can customize the software to meet specific business requirements for best performance when using on-premise deployment. Thomson Reuters UltraTax CS and Sage Intacct are popular on-premise tax management software options that offer strong capabilities for tax calculation, reporting, and compliance. They help businesses efficiently handle their tax responsibilities while keeping data secure and confidential.

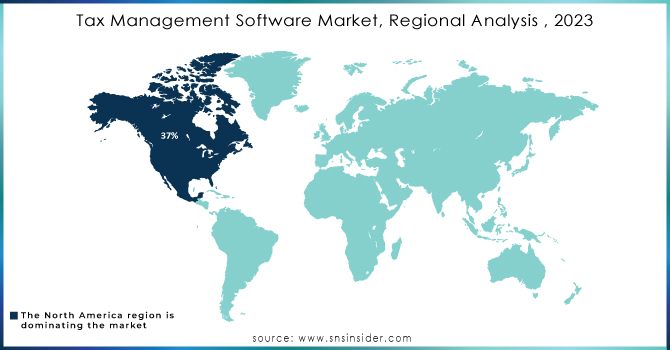

Tax Management Software Market Regional Analysis

North America led the tax management software market with 37% in 2023, mainly because of established financial and accounting companies, advanced technology infrastructure, and robust regulations. The U.S. and Canada have experienced substantial investment in tax technology solutions due to the growing complexity of tax laws and the requirement for adherence. Key industry leaders like Intuit, Thomson Reuters, and Wolters Kluwer provide a variety of tax management options designed for companies of any scale.

The APAC region is anticipated to become the fastest-growing with a rapid CAGR during 2024-2032, due to rapid economic growth, higher tax compliance requirements, and a growing uptake of digital solutions by SMEs. Nations such as India, China, and Japan are experiencing an increase in the need for automated tax software as companies aim to simplify processes and comply with changing regulations. Major companies like H&R Block, CCH Tagetik, and Zoho are increasing their influence in the area by offering creative solutions for a variety of tax requirements.

Do You Need any Customization Research on Tax Management Software Market - Enquire Now

Key Players in Tax Management Software Market

The major key players in the Tax Management Software Market are:

-

Thomson Reuters (ONESOURCE, UltraTax CS)

-

Intuit Inc. (TurboTax, QuickBooks)

-

Avalara (AvaTax, CertCapture)

-

Wolters Kluwer N.V. (CCH Axcess, ATX)

-

H&R Block (BlockWorks, Tax Pro Go)

-

Sovos Compliance LLC (Taxify, Sovos Intelligent Compliance Cloud)

-

Vertex Inc. (Vertex O Series, Vertex Cloud)

-

Xero Limited (Xero Tax, Hubdoc)

-

SAP SE (SAP Tax Compliance, SAP S/4HANA for advanced compliance reporting)

-

ADP, Inc. (ADP SmartCompliance, ADP Tax Filing)

-

Deloitte Touche Tohmatsu Limited (Tax@Hand, GlobalAdvantage)

-

Ernst & Young (EY) (EY Global Tax Platform, EY EDGE)

-

Oracle Corporation (Oracle Tax Reporting Cloud Service, Oracle ERP Cloud)

-

TaxJar (TaxJar API, TaxJar SmartCalcs)

-

Drake Software (Drake Tax, Drake Accounting)

-

CCH Incorporated (ProSystem fx Tax, CCH iFirm)

-

ClearTax (ClearTax GST, ClearTax e-Invoicing)

-

Sage Group plc (Sage Intacct, Sage Business Cloud Accounting)

-

TaxAct, Inc. (TaxAct Professional, TaxAct Business)

-

Zoho Corporation Pvt. Ltd. (Zoho Books, Zoho Expense)

Suppliers Providing Software to These Key Players:

-

Intel Corporation

-

Dell Technologies

-

Hewlett Packard Enterprise (HPE)

-

Western Digital

-

Micron Technology

-

Cisco Systems

-

Samsung Electronics

-

IBM Corporation

-

Broadcom Inc.

-

NVIDIA Corporation

Recent Development

-

September 2024: The GSTN has developed the Invoice Management System (IMS) on the GST portal to ease invoice correction and correct ITC claims.

-

July 2024: Wolters Kluwer, a global leader in information, software, and services for professionals announced its launch of CCH Tagetik Tax Provision & Reporting. This new solution assists companies looking to simplistically streamline group tax provision and accounting processes by combining and bridging the gap between financial and tax reporting.

-

September 2024: VRGL announced the launch of its new Tax Transition feature. This functionality allows advisors to migrate client portfolios from their existing state into a desired investment strategy while maximizing particular tax budgets.

-

August 2024: Holistiplan, the financial advisor-focused and comprehensive tax planning software solution, and PreciseFP, Docupace's award-winning client engagement and data-gathering platform today announced a new integration partnership to enhance the connection between their two platforms.

| Report Attribute | Details |

|---|---|

| Market Size in 2023 | USD 19.79 Billion |

| Market Size by 2032 | USD 50.84 Billion |

| CAGR | CAGR of 11.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Professional Services) • By Type (Corporate Tax Software, Professional Tax Software, Tax Preparer Software, Tax Compliance Software, Others) • By Tax Type (Indirect Tax, Direct Tax) • By Deployment (Cloud, On-premise) • By End User (Large Enterprises, Small & Medium Enterprises (SMEs)) • By Vertical (BFSI, Healthcare, Retail, Manufacturing, Real Estate, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thomson Reuters, Intuit Inc., Avalara, Inc., Wolters Kluwer N.V., H&R Block, Sovos Compliance LLC, Vertex Inc., Xero Limited, SAP SE, ADP, Inc., Deloitte Touche Tohmatsu Limited, Ernst & Young (EY), Oracle Corporation, TaxJar, Drake Software, CCH Incorporated, ClearTax, Sage Group plc, TaxAct, Inc., Zoho Corporation Pvt. Ltd. |

| Key Drivers | • The global tax landscape has become increasingly intricate due to a multitude of factors, including changes in tax laws, new regulations, and the growing complexity of international tax compliance. • The rapid growth of e-commerce and digital transactions has transformed the way businesses operate and interact with customers. |

| RESTRAINTS | • Data security is a paramount concern for organizations considering the adoption of tax management software. |