Get more information on System Integrator Market - Request Sample Report

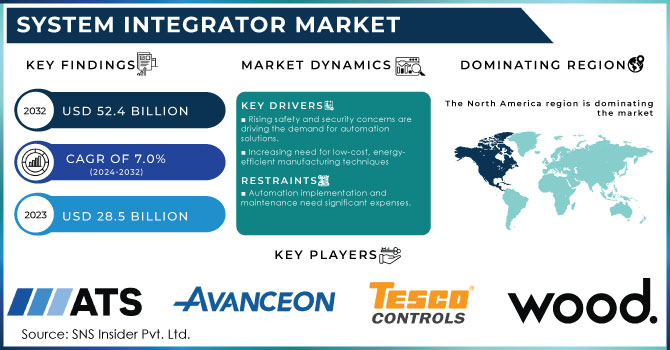

The System Integrator Market Size was valued at USD 28.5 Billion in 2023. It is expected to grow to USD 52.4 Billion by 2032 and grow at a CAGR of 7.0% over the forecast period of 2024-2032.

The widespread IoT integration is reshaping industries like manufacturing, healthcare, and smart cities and presents system integrators with huge opportunities. With the growing number of IoT devices, companies are switching to comprehensive solutions to keep their devices connected and effective. In line with this trend, system integrators are in need because it is they who design and deploy systems that make various devices interconnected. For example, thanks to system integrators, IoT devices can be interconnected, and vast volumes of data can be collected and analyzed by devices. This analysis can help businesses obtain valuable data through them to facilitate their businesses’ operations and decision-making. In the case of production, sensors incorporated in the devices can analyze the equipment data in real-time and predict the malfunction and the exact time for the maintenance of the equipment and avoid downtime.

In healthcare, patients can be monitored through their devices, and the results can be analyzed by systems connecting all devices and an alert can be sent on the required degree of interventions. The same goes for the smart city project, where resources such as energy, traffic, and waste are all monitored and managed. In all these cases, the role of system integrators is in their expertise to design, develop, and deploy effective IoT systems that satisfy the needs and specifications of one or another company and bring the anticipated benefits helping to stay competitive.

According to the U.S. Department of Commerce, the adoption of IoT technologies in manufacturing could add up to USD 1.4 trillion in value to the sector by 2025 through increased operational efficiencies and improved productivity.

The trend towards cloud computing has a considerable impact on the job of system integrators, as more and more identify the need to elaborate on the set of solutions related to cloud integrations. As more and more businesses adopt cloud solutions and recognize their benefits, such as scalability, flexibility, and cost-effectiveness, organizations are interested in rapidly switching their operations to the cloud. The focus on the cloud introduces a set of challenges that should be addressed in terms of introducing the cloud services to already present on-premise technologies and systems. Cloud integration is aimed at delivering the advanced flow of relevant information to businesses via the existing systems. System integrators may be able to use their skills and knowledge to develop a specific architecture for the usage of both cloud and on-premises applications to support the communication between the two and advance the cloud experience.

According to the U.S. National Institute of Standards and Technology (NIST), the cloud computing market is expected to reach USD 832 billion by 2025, driven by increasing demand for scalable and flexible solutions across various industries.

Drivers

Rising safety and security concerns are driving the demand for automation solutions.

Increasing need for low-cost, energy-efficient manufacturing techniques

The adoption of the Internet of Things (IoT) and cloud computing in industrial automation is growing.

The emergence of the Internet of Things and cloud computing in industrial automation pertaining to the desire of organizations to enhance their operational efficiency and productivity. Modern companies tend to accept the importance of related devices and systems that can be easily connected and collect real-time data for better decision-making. On the one hand, such devices as sensors and actuators in IoT are highly beneficial for manufacturers as they can monitor equipment and environmental parameters constantly. Thus, predictive and preventive maintenance is highly facilitated, which reduces downtime. On the other hand, cloud computing in combination provides IoT with handy scalable storage and processing solutions to work with a considerable amount of data. It allows for developing memory-intensive neural networks and, thus, empowers modern enterprises to optimize their systems and streamline production.

Moreover, it adjusts businesses to work with more flexibility and develop rapid responses to internal needs or market changes. Finally, it ensures better innovative processes with easier access to understanding the necessities of production. Overall, it is evident that industries face the requirement of financial issues reduction and productivity increase. In such a context, the emergence of IoT in combination with cloud computing is highly beneficial and, to some extent, a driving force in related changes.

Restraint

Automation implementation and maintenance need significant expenses.

The drop in crude oil prices has an impact on investments in infrastructure automation.

The drop in the cost of crude oil has a significant impact on investment in infrastructure automation. First of all, it serves as a limiting factor, since oil and gas sector companies earn less revenue. The reduction in oil prices automatically leads to a decrease in the profit margin and budgets of related enterprises, which leads to a reassessment of the priorities of capital expenditures for modernization and innovative developments. Thus, investments in more advanced technologies of infrastructure automation, namely, the introduction of IoT systems, artificial intelligence, and robotic technologies, are being postponed or canceled in favor of urgent operational needs or maintenance. For this reason, companies are postponing or abandoning automation projects that could optimize spending, personnel structure, and other resources in the long run in favor of projects aimed at short-term survival. In addition, a drop in oil prices increases the unpredictability and risks of the outcome of IPOs and the fundraising associated with infrastructure automation projects. Thus, the reduction in funding opportunities is directly related to the reduction in oil prices, which weakens automation.

Opportunity

Healthcare has increased the demand for remote operations.

Industry 4.0 and digitization provide new opportunities.

Industry 4.0 and the accompanying processes of digitization have the potential to significantly change the approaches to various sectors by boosting the levels of efficiency, flexibility, and innovation in the field of manufacturing and industry. Specifically, companies need to adopt the use of the Internet of Things technologies and artificial intelligence, apply big data analytics, and make use of robotics to develop smart factories. As a result, the end enterprise acquires an asset that can provide feedback, inform itself on the issue of production based on real-time data, and automate its processes. The technical capacity to do so contributes to higher levels of operational output by cutting waste and preserving or even raising the quality of production while drastically reducing lost time due to predictive maintenance and downscale adjustments.

By Type

The hardware market segment accounted for the largest market share of over 44% as of 2023. It is primarily attributed to the growing demand for advanced infrastructure across different industries, such as telecommunications, BFSI, healthcare, or education. As companies adopt interconnection systems, networking hardware, servers, and data storage solutions are experiencing increased demand. Furthermore, IoT, AI, and cloud advancements have facilitated the demand for new hardware to support specific technologies. In the UAE and KSA, the hardware purchase services market segment is experiencing increased demand, as these regions have been investing in smart cities

The services market segment is anticipated to experience rapid growth throughout the forecast period. It is primarily caused by the increasing complexity of IT systems and the emergence of digitalization within various industries. As companies seek to adjust to cloud-based platforms, as well as to adopt such solutions as IoT and AI, services, including consulting, implementation, customization, or support are in high demand. Qatar is characterized by a considerable demand for system integration services, as it pursues the Smart Qatar Program, TASMU. Similar initiatives oriented toward IT infrastructure modernization, cybersecurity, and real-time analytics are observed in the BFSI and healthcare sectors, thus causing increased demand for comprehensive integration services.

By Organization Size

Large enterprises held the largest market share around 54% in 2023. Large enterprises often lead in terms of investment capacity, access to resources, and the ability to implement complex digital transformation initiatives on a broader scale. Their established infrastructure allows them to integrate advanced technologies like artificial intelligence, big data analytics, and the Internet of Things (IoT) more effectively. These companies can leverage their scale to optimize operations, improve supply chain management, and enhance customer experiences, making them frontrunners in the competitive landscape.

By End-Use

IT & Telecom segment dominated the market with over 25% of the overall revenue gains within the given timeframe. It implies that the IT & Telecom segment within the market displays notable upward progress, primarily caused by the high pace of the digitalization of numerous businesses and the growing use of cloud-centric solutions. As a result of companies transitioning to cloud computing and focusing on the growth of their networks, the demand for system integrators, who will work on the complicated IT infrastructure to ensure that the legacies and the new options are closely aligned, is increasing. In addition, the pressure caused by the rapid expansion of the 5G telecommunications segment and the necessity to ensure strong cybersecurity solutions has indicated that telecom companies are starting to collaborate with system integrators to simplify deployment and improve general network management and connectivity to ensure that the performance is kept at a high level of quality.

Need any customization research/data on System Integrator Market - Enquiry Now

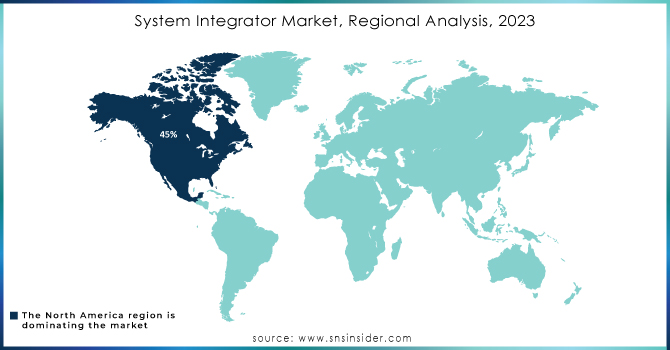

North America held the largest market share around 45% in 2023. The largest market share in the sphere of Industry 4.0 and digitization belongs to North America. Its leading position can be explained by the existing technical infrastructure, economic power, and focus on innovations in the region. North America is known for its leading technology brands, such as Apple, Google, and Microsoft, and research organizations that are already actively implementing such advanced technologies as IoT, AI, and automation systems. A high level of investment in research and workforce training also plays a vital role in the industry’s development of manufacturing automation and smart manufacturing processes.

According to the U.S. Federal Communications Commission (FCC), the U.S. ranks first globally in broadband adoption, with approximately 93% of households having access to high-speed internet, a critical enabler for Industry 4.0 technologies.

John Wood Group (Wood Group's Integrated Solutions)

ATS Automation (ATS Digital Factory)

Avanceon Limited (Avanceon Smart Factory Solutions)

JR Automation (JR Automation Industrial Solutions)

Tesco Controls, Inc. (Tesco SCADA Solutions)

Burrow Global LLC (Burrow Automation Services)

Prime Controls LP (Prime Controls Automation Solutions)

MAVERICK Technologies (MAVERICK Manufacturing Operations Management)

Barry-Wehmiller (BW Integrated Systems)

INTECH Process Solutions (INTECH Automation Services)

Emerson Electric Co. (Emerson Process Management)

Honeywell International Inc. (Honeywell Process Solutions)

Rockwell Automation (FactoryTalk Software)

Schneider Electric (EcoStruxure Architecture)

Siemens AG (Siemens Digital Industries Software)

KUKA AG (KUKA Robotics Solutions)

FANUC Corporation (FANUC Robotics Automation)

ABB Ltd. (ABB Ability Digital Solutions)

Yokogawa Electric Corporation (Yokogawa Industrial Automation)

Mitsubishi Electric Corporation (Mitsubishi Electric Factory Automation)

BP (British Petroleum)

Tesla

PepsiCo

Procter & Gamble

Nestlé

ExxonMobil

Valero Energy Corporation

Coca-Cola

Heineken

Johnson & Johnson

Shell

Dow Chemical

Ford Motor Company

Apple Inc.

In 2023, Launched ATS Digital Factory 2.0, offering enhanced analytics and AI-driven insights for manufacturing efficiency.

In 2023, Burrow Global LLC launched Burrow AI, a cutting-edge suite of AI-powered solutions designed specifically for predictive maintenance in the energy sector. This innovative platform leverages advanced machine learning algorithms and data analytics to analyze equipment performance, predict potential failures, and optimize maintenance schedules.

In 2023, Mitsubishi's e-F@ctory, a comprehensive solution for integrating factory automation with IoT technologies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 28.5 Billion |

| Market Size by 2032 | US$ 45.4 Billion |

| CAGR | CAGR 7% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Services (Infrastructure Integration, Application Integration, and Consulting) • by End-use (IT & Telecom, Defense & Security, BFSI, Oil & Gas, Healthcare, Transportation, Retail, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | John Wood Group, ATS Automation, Avanceon Limited, JR Automation, Tesco Controls, Inc., Burrow Global LLC, Prime Controls LP, MAVERICK Technologies, Barry-Wehmiller, and INTECH Process |

| Key Drivers | • Rising safety and security concerns are driving the demand for automation solutions. • Increasing need for low-cost, energy-efficient manufacturing techniques |

| Market Restraints | • Automation implementation and maintenance need significant expenses. • The drop in crude oil prices has an impact on investments in infrastructure automation. |

Ans: - The System Integrator Market size was valued at USD 28.5 Billion in 2023.

Ans: - System interoperability is a significant difficulty for system integrators.

Ans: - The segments covered in the System Integrator Market report for study are on the basis of services and end-use.

Ans. The primary growth tactics of System Integrator market participants include merger and acquisition, business expansion, and product launch.

Ans: - Key Stakeholders Considered in the study are Raw material vendors, Regulatory authorities, including government agencies and NGOs, Commercial research, and development (R&D) institutions, Importers and exporters, etc.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. System Integrator Market Segmentation, by Type

7.1 Chapter Overview

7.2 Hardware

7.2.1 Hardware Market Trends Analysis (2020-2032)

7.2.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Software

7.3.1 Software Market Trends Analysis (2020-2032)

7.3.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Services

7.4.1 Services Market Trends Analysis (2020-2032)

7.4.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. System Integrator Market Segmentation, by Organization Size

8.1 Chapter Overview

8.2 SMEs

8.2.1 SMEs Market Trends Analysis (2020-2032)

8.2.2 SMEs Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Large Enterprises

8.3.1 Large Enterprises Market Trends Analysis (2020-2032)

8.3.2 Large Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

9. System Integrator Market Segmentation, by End-User

9.1 Chapter Overview

9.2 IT & Telecom

9.2.1 IT & Telecom Market Trends Analysis (2020-2032)

9.2.2 IT & Telecom Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Defense & Security

9.3.1 Defense & Security Market Trends Analysis (2020-2032)

9.3.2 Defense & Security Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 BFSI

9.4.1 BFSI Market Trends Analysis (2020-2032)

9.4.2 BFSI Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Oil & Gas

9.5.1 Oil & Gas Market Trends Analysis (2020-2032)

9.5.2 Oil & Gas Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Healthcare

9.6.1 Healthcare Market Trends Analysis (2020-2032)

9.6.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Transportation

9.7.1 Transportation Market Trends Analysis (2020-2032)

9.7.2 Transportation Market Size Estimates and Forecasts to 2032 (USD Billion)

9.8 Retail

9.8.1 Retail Market Trends Analysis (2020-2032)

9.8.2 Retail Market Size Estimates and Forecasts to 2032 (USD Billion)

9.9 Others

9.9.1 Others Market Trends Analysis (2020-2032)

9.9.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America System Integrator Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.4 North America System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.2.5 North America System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.6.2 USA System Integrator Market Estimates and Forecasts, by organization Size (2020-2032) (USD Billion)

10.2.6.3 USA System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.7.2 Canada System Integrator Market Estimates and Forecasts, by organization Size (2020-2032) (USD Billion)

10.2.7.3 Canada System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.8.2 Mexico System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.2.8.3 Mexico System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe System Integrator Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.1.6.3 Poland System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.1.7.3 Romania System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.1.8.3 Hungary System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.1.9.3 Turkey System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe System Integrator Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.5 Western Europe System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.6.3 Germany System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.7.2 France System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.7.3 France System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.8.2 UK System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.8.3 UK System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.9.3 Italy System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.10.3 Spain System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.13.3 Austria System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific System Integrator Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.5 Asia Pacific System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.6.2 China System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.6.3 China System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.7.2 India System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.7.3 India System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.8.2 Japan System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.8.3 Japan System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.9.2 South Korea System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.9.3 South Korea System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.10.3 Vietnam System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.11.2 Singapore System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.11.3 Singapore System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.12.2 Australia System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.12.3 Australia System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East System Integrator Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.4 Middle East System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.1.5 Middle East System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.1.6.3 UAE System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.1.7.3 Egypt System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.1.9.3 Qatar System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa System Integrator Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.4 Africa System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.2.5 Africa System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.2.6.3 South Africa System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America System Integrator Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.4 Latin America System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.6.5 Latin America System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.6.2 Brazil System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.6.6.3 Brazil System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.7.2 Argentina System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.6.7.3 Argentina System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.8.2 Colombia System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.6.8.3 Colombia System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America System Integrator Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America System Integrator Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America System Integrator Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11. Company Profiles

11.1 John Wood Group

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Product / Services Offered

11.1.4 SWOT Analysis

11.2 ATS Automation

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Product / Services Offered

11.2.4 SWOT Analysis

11.3 Avanceon Limited

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Product / Services Offered

11.3.4 SWOT Analysis

11.4 JR Automation

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Product / Services Offered

11.4.4 SWOT Analysis

11.5 Tesco Controls, Inc.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Product / Services Offered

11.5.4 SWOT Analysis

11.6 Burrow Global LLC

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Product / Services Offered

11.6.4 SWOT Analysis

11.7 Prime Controls LP

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Product / Services Offered

11.7.4 SWOT Analysis

11.8 MAVERICK Technologies

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Product / Services Offered

11.8.4 SWOT Analysis

11.9 Barry-Wehmiller

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Product / Services Offered

11.9.4 SWOT Analysis

11.10 INTECH Process

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Product / Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Hardware

Software

Services

By Organization Size

SMEs

Large Enterprises

By End-Use

IT & Telecom

Defense & Security

BFSI

Oil & Gas

Healthcare

Transportation

Retail

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Digital Banking Market was valued at USD 9.3 billion in 2023 and is expected to reach USD 26.5 billion by 2032, growing at a CAGR of 12.32% from 2024-2032.

Privileged Access Management Market was valued at USD 2.69 billion in 2023 and is expected to reach USD 17.42 billion by 2032, growing at a CAGR of 23.13% from 2024-2032.

Plant Asset Management Market was valued at USD 6.59 billion in 2023 and is expected to reach USD 21.21 billion by 2032, growing at a CAGR of 13.91% from 2024-2032.

The Video Streaming Software Market was valued at USD 12.05 billion in 2023 and is expected to reach USD 46.97 billion by 2032, growing at a CAGR of 16.37% from 2024-2032

Explainable AI Market was valued at USD 6.82 billion in 2023 and is expected to reach USD 33.20 billion by 2032, growing at a CAGR of 19.29% by 2032.

Neuromorphic Computing market size was valued at USD 86.9 Million in 2023. It is expected to Reach USD 9356.4 Million by 2032 and grow at a CAGR of 68.27% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone