System Basis Chip Market Size & Trends:

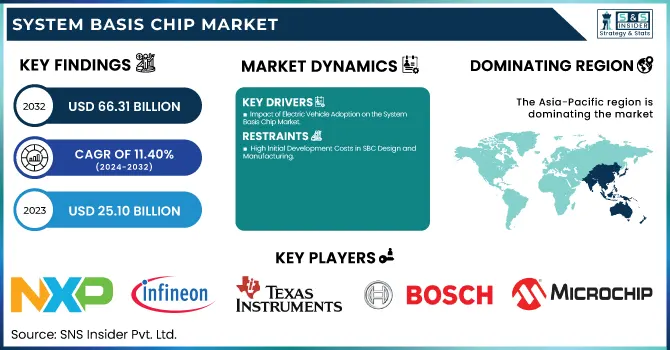

The System Basis Chip Market was valued at USD 25.10 billion in 2023 and is projected to reach USD 66.31 billion by 2032, growing at a CAGR of 11.40% from 2024 to 2032. System Basis Chips (SBC) are vastly gaining traction due to rising demand for smart technologies including IoT, AI, and automation that are being used in consumer and industrial applications. As a result, the demand for SBCs that facilitate smarter, efficient operations is also growing.

To Get more information on System Basis Chip Market - Request Free Sample Report

In the U.S., the SBC market was valued at USD 4.38 billion in 2023 and is projected to reach USD 10.94 billion by 2032, growing at a CAGR of 10.71%, highlighting the strong demand for SBCs in the region Moreover, there is an increasing demand for energy-efficient solutions and sustainability in the market, which is leading manufacturers to design SBCs that comply with eco-friendly standards. The growth of next-gen connectivity technology, such as 5G and Wi-Fi 6, is also aiding in the growth of the SBC market. These technologies are crucial in sectors such as automotive, healthcare and industrial Internet of Things, which requires the rapid and reliable processing and movement of data.

System Basis Chip Market Dynamics:

Drivers:

-

Impact of Electric Vehicle Adoption on the System Basis Chip Market

The growing adoption of electric vehicles (EVs) is a key driver for the expansion of the System Basis Chip (SBC) market. As EVs become more mainstream, there is an escalating demand for energy-efficient SBCs to handle the complex power systems within electric and hybrid vehicles. Technological advancements, such as the integration of gallium nitride (GaN) and silicon carbide (SiC) in power electronics, are improving the performance and efficiency of EVs, further increasing the need for specialized SBCs. GaN-based inverters, for example, deliver more than 70% higher efficiency compared to traditional IGBT-based inverters, while also reducing size and weight, making EVs more efficient and increasing their driving range. With EV sales growing globally, including a 14% rise in 2019 and a record 6.6 million EVs sold in 2021, the demand for SBCs continues to rise.

Restraints:

-

High Initial Development Costs in SBC Design and Manufacturing

The design and manufacturing of System Basis Chips (SBCs) demand significant investment in research and development (R&D) as well as advanced infrastructure, making it challenging for smaller players to enter the market. This investment is crucial for creating energy-efficient, high-performance chips that meet the specific demands of automotive, industrial, and other applications. However, the high costs associated with the development process can restrict competition, leaving established companies with a competitive advantage while limiting innovation from smaller or new entrants. The substantial upfront financial commitment needed for SBC production may deter some companies from pursuing this market, despite its growth potential.

Opportunities:

-

The integration of 5G connectivity and IoT systems creates new opportunities for SBCs to manage seamless connectivity and enhance data processing capabilities.

The integration of 5G connectivity offers substantial growth opportunities for the System Basis Chip (SBC) market. With the rise of 5G networks, SBCs play a pivotal role in supporting high-speed data transmission, real-time communication, and efficient data processing across various sectors. in automotive use cases, SBCs are instrumental in delivering connected vehicle systems and are responsible for developing ADAS, infotainment and in-vehicle communication. And within the industrial and healthcare sectors, SBCs are critical to the operate of IoT devices, providing fast, reliable, and secure data transfer. As 5G expands globally, the need for SBCs will grow exponentially, spurring innovation and adoption of smarter, interconnected systems in a wide range of applications.

Challenges:

-

Supply chain disruptions in the global semiconductor industry pose challenges for System Basis Chip production, affecting timelines and causing component shortages.

Supply chain disruptions present a significant challenge for the System Basis Chip (SBC) market, as the global semiconductor supply chain is highly interconnected and sensitive to external factors such as geopolitical tensions, natural disasters, or pandemics. Such disruptions can cause delays in the sourcing and delivery of raw materials, components, and finished products, impacting the manufacturing timelines for SBCs. Moreover, shortages in components, particularly those that are key like semiconductors and special materials can lead to higher costs for SBC producers. These delays and shortages not only affect product availability but also lead to uncertainties in pricing and production schedules, which do not help with the growth of SBC market and its adoption across sectors.

System Basis Chip Market Segment Analysis:

By Vehicle Type

The passenger cars segment is expected to dominate the System Basis Chip market, accounting for approximately 43% of the revenue by 2023. This growth is driven by the increasing demand for advanced automotive technologies, such as electric vehicles (EVs), autonomous driving, and connected systems. As automakers continue to integrate more sophisticated features, including infotainment, ADAS, and power management systems, the need for high-performance SBCs is rising. Furthermore, the shift towards EVs and hybrid vehicles, along with the growing adoption of next-gen connectivity like 5G, is further fueling the demand for SBCs in passenger cars, making it the largest contributor to market growth in the automotive sector.

The Heavy Commercial Vehicles (HCV) segment is poised for the fastest growth from 2024 to 2032 in the System Basis Chip (SBC) market. This growth is driven by the increasing adoption of advanced technologies aimed at improving vehicle performance, safety, and efficiency. With the rising demand for electric and hybrid heavy-duty trucks, the need for energy-efficient SBCs is also expanding. Additionally, the integration of intelligent transportation systems (ITS), advanced driver-assistance systems (ADAS), and telematics is boosting the demand for SBCs in the HCV sector. These systems require robust, high-performance SBCs to handle complex data processing, power management, and connectivity needs, thereby driving the rapid growth of the segment during this period.

By Application

In 2023, the Powertrain segment dominated the System Basis Chip (SBC) market, accounting for around 32% of the total revenue. This dominance is primarily driven by the growing demand for energy-efficient and high-performance SBCs in vehicle powertrain systems. With the shift toward electric and hybrid vehicles, the need for advanced power management, motor control, and energy conversion systems has risen significantly. SBCs play a critical role in ensuring seamless communication between powertrain components, enabling precise control of power distribution and energy efficiency. The increasing focus on reducing carbon emissions and improving fuel efficiency, along with advancements in electric powertrains, is further accelerating the growth of this segment, solidifying its position in the market.

The Body Electronics segment is expected to be the fastest-growing segment in the System Basis Chip (SBC) market from 2024 to 2032. This growth is driven by the increasing integration of advanced electronics in vehicles, focusing on enhancing driver and passenger comfort, safety, and convenience. Key applications in body electronics include lighting systems, door control, climate control, and infotainment. As vehicles become more connected and automated, the demand for SBCs to manage these electronic systems efficiently grows. Furthermore, innovations such as smart lighting, keyless entry, and advanced climate control systems are accelerating the adoption of SBCs in body electronics, making it a crucial area for the automotive industry’s future developments. This trend reflects the broader move toward vehicle electrification and intelligent systems.

System Basis Chip Market Regional Overview:

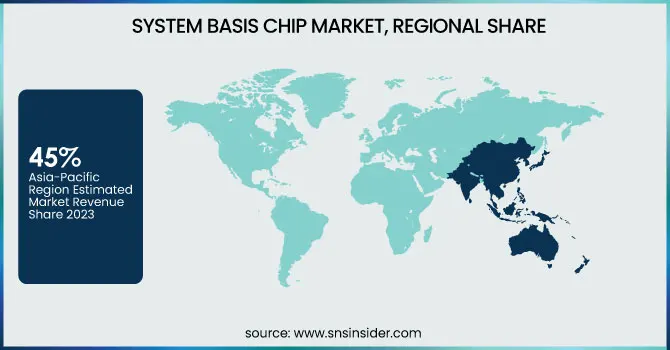

The Asia-Pacific region is projected to dominate the System Basis Chip (SBC) market, accounting for around 45% of the revenue by 2024. This dominance is driven by the region’s rapid automotive industry growth, particularly in countries like China, Japan, and South Korea. The increasing adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) in these countries is fueling the demand for SBCs. Moreover, Asia-Pacific is home to several leading automotive manufacturers and semiconductor companies, driving innovations in SBC technology. The region’s robust manufacturing capabilities and strong supply chain infrastructure further contribute to its significant market share, making it a key player in the global SBC market.

The North America region is anticipated to witness the fastest growth in the System Basis Chip (SBC) market during the forecast period from 2024 to 2032. This growth is primarily driven by the rapid adoption of electric vehicles (EVs) and advancements in automotive technologies such as autonomous driving and connected vehicles. North America’s strong automotive sector, along with the increasing demand for advanced driver-assistance systems (ADAS), plays a significant role in the region’s SBC market expansion. Moreover, the rise of smart technologies like IoT and 5G connectivity is further fueling the demand for high-performance SBCs to support efficient data processing and seamless communication in vehicles.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in System Basis Chip Market are:

-

NXP Semiconductor NV (Netherlands) - Automotive SBCs, ADAS solutions, connectivity chips.

-

Infineon Technologies AG (Germany) - Automotive SBCs, power management ICs, security chips.

-

Texas Instruments, Inc. (U.S.) - Automotive SBCs, power management ICs, communication ICs.

-

Robert Bosch GmbH (Germany) - Automotive SBCs, energy-efficient chips for electric vehicles, telematics solutions.

-

STMicroelectronics NV (Switzerland) - Automotive SBCs, power management ICs, connectivity solutions.

-

ON Semiconductor Corp. (U.S.) - Automotive SBCs, sensor systems, power management ICs.

-

Atmel Corporation (U.S.) (now part of Microchip Technology) - Automotive SBCs, microcontrollers, integrated circuits.

-

Microchip Technology Inc. (U.S.) - Automotive SBCs, microcontrollers, power management ICs.

-

Elmos Semiconductor AG (Germany) - Automotive SBCs, power management ICs, sensor solutions.

-

Melexis Semiconductors (Belgium) - Automotive SBCs, sensor integration chips, power management ICs.

List of key suppliers providing raw materials and components for the System Basis Chip (SBC) market:

-

SK hynix Inc. (South Korea)

-

Micron Technology, Inc. (U.S.)

-

Samsung Electronics Co., Ltd. (South Korea)

-

GlobalFoundries (U.S.)

-

Taiwan Semiconductor Manufacturing Company (TSMC) (Taiwan)

-

ASE Group (Taiwan)

-

Applied Materials, Inc. (U.S.)

-

BASF SE (Germany)

-

DuPont (U.S.)

-

Sumitomo Chemical (Japan)

Recent Development:

-

Feb 11, 2025: NXP Semiconductors has announced its acquisition of US-based AI chip startup Kinara for USD 307 million, aiming to enhance its edge AI capabilities in the industrial and automotive sectors.

-

Nov 13, 2024: Infineon, a leading European chipmaker, is set to capitalize on growing opportunities in automotive electrification, active safety systems, and infotainment, despite facing cyclical demand fluctuations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 25.10 Billion |

| Market Size by 2032 | USD 66.31 Billion |

| CAGR | CAGR of 11.40% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Autonomous Vehicles, Automated Guided Vehicles) • By Application(Powertrain, Safety, Body Electronics, Chassis, Telematics & Infotainment) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NXP Semiconductor NV (Netherlands), Infineon Technologies AG (Germany), Texas Instruments, Inc. (U.S.), Robert Bosch GmbH (Germany), STMicroelectronics NV (Switzerland), ON Semiconductor Corp. (U.S.), Atmel Corporation (U.S.) (now part of Microchip Technology), Microchip Technology Inc. (U.S.), Elmos Semiconductor AG (Germany), and Melexis Semiconductors (Belgium). |