Get more information on Synthetic Paper Market - Request Sample Report

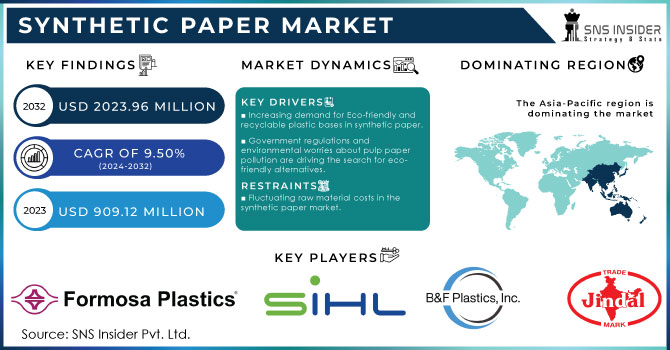

The Synthetic Paper Market Size was valued at USD 909.12 million in 2023 and is expected to reach USD 2023.96 million by 2032 and grow at a CAGR of 9.50% over the forecast period 2024-2032.

The synthetic paper market is becoming popular, driven by environmental awareness and technological advancements. Eco-conscious consumers demand sustainable packaging solutions, and synthetic paper offers a compelling alternative to traditional paper, which often relies on deforestation. Beyond its eco-friendly appeal, synthetic paper boasts superior performance.

For instance, the EU's Circular Economy Action Plan aims to standardize sustainable goods inside the EU. This includes actions to encourage environmentally friendly packaging options and lessen packaging waste. Because synthetic paper is robust and recyclable, it supports these objectives.

In 2023, Yupo focused on sustainable production practices, developing recyclable synthetic paper options and working to reduce the carbon footprint of their manufacturing processes.

Furthermore, it surpasses traditional paper in terms of durability, with exceptional resistance to tearing, chemicals, moisture, and grease. its superior heat sealability, printability, and high strength make it a versatile choice across various industries, including packaging, food and beverage production, consumer goods, transportation, and pharmaceuticals.

The US market is spearheading the adoption of synthetic paper, with a growing preference for eco-friendly alternatives over traditional materials like vinyl. This shift reflects a heightened focus on environmental responsibility. Ongoing research and development focused on reducing production costs will play a crucial role in expanding synthetic paper's market share. Government initiatives promoting sustainability and seeking solutions to reduce waste and increase recyclability perfectly align with the advantages of synthetic paper.

Drivers

Increasing demand for Eco-friendly and recyclable plastic bases in synthetic paper.

Traditional paper is derived from wood pulp, and synthetic paper takes an inorganic approach, utilizing plastics such as polyolefin resin or polypropylene. This shift in material composition facilitates a meticulously controlled manufacturing process that minimizes waste generation and environmental hazards. Furthermore, synthetic paper boasts recyclability, granting it a second life as new plastic resins and significantly reducing its environmental footprint. Industry leaders are actively embracing sustainability practices. For instance, Polyart champions a "4 Rs" philosophy (Recycle, Reuse, Respect, Reduce) to minimize their environmental impact throughout the value chain. Similarly, Nan Ya Plastics leverages an eco-friendly process for creating their patented PEPA product, while Yupo Corporation prioritizes the traditional "3 Rs" (Reuse, Recycle, Repurpose) within their production cycle. By prioritizing sustainability and offering superior performance characteristics, synthetic paper is well-positioned to transform the paper industry.

Government regulations and environmental worries about pulp paper pollution are driving the search for eco-friendly alternatives.

The traditional paper industry, dominated by wood-based pulp paper (around 400 million tons globally), faces growing challenges. These papers, while cheaper, contribute to deforestation and environmental pollution. Stringent government regulations aimed at waste reduction and environmental protection are pushing for more sustainable alternatives. Synthetic paper emerges as a potential solution. Its production process is eco-friendly and does not rely on tree harvesting, helping to preserve natural resources. This focus on sustainability aligns with the growing concerns around deforestation and pollution. However, the higher cost of synthetic paper compared to traditional pulp paper currently limits its market share. Manufacturers are actively pursuing research and development to bring down production costs, making synthetic paper a more viable option.

Restrain

Fluctuating raw material costs in the synthetic paper market.

The prices of key materials like polybutylene, polypropylene, and polyethylene can be volatile. This instability can significantly impact production and product costs, which are already on the higher end. Limited plastic supply further restricts the market's growth potential. Synthetic paper relies on these plastics, and any constraints in their availability can hinder production. Crude oil prices play a double role. Since crude oil is a major source material for PP and PE, price fluctuations in crude oil directly affect the cost of synthetic paper. As crude oil prices are expected to rise in the coming years, the cost of synthetic paper is likely to follow suit. These price fluctuations are a complex issue driven by a combination of factors. The growth of applications demanding synthetic paper will naturally increase demand for raw materials. However, if the availability of these materials doesn't keep pace, prices will continue to rise, potentially hindering the market's overall growth.

By Material Type

The BOPP (Biaxially Oriented Polypropylene) sub-segment dominated the synthetic paper market, capturing a massive 58% of global revenue in 2023. This leadership position can be attributed to the superior strength BOPP offers. This strength makes it the ideal choice for packaging perishable items like snacks, fast food, vegetables, fruits, and confectionery. These products require added protection during transport and storage, and BOPP films are delivered. Beyond its strength advantage, BOPP boasts other desirable properties – it's a versatile performer. This versatility translates to extensive use in packaging a wide range of products, including chemicals, textiles, cosmetics, and of course, food and beverages. BOPP, particularly in emerging economies like India and China. The growth of these key application industries is expected to fuel a surge in demand for BOPP films throughout the Asia Pacific region in the coming years.

By Application

The printing segment held the largest market share around 38.22% in the application segment of the synthetic paper market in 2023. This dominance is fueled by several factors that make synthetic paper an ideal printing substrate. Micro-pores on the surface of synthetic paper create a strong bond with ink, resulting in high-quality printing finishes. Synthetic paper outshines traditional paper in terms of durability, tear resistance, water resistance, and resistance to scratches and abrasions. These superior properties make it a reliable and long-lasting choice for various printing applications. An additional advantage is the low static surface of synthetic paper. This eliminates double feeding, a common issue with traditional paper, and ensures a smoother printing process. This compatibility extends to a wide range of printers, making synthetic paper a versatile option for diverse printing needs.

By End-use

In the End-use segment, industrial held the largest market share in 2023. The industrial segment of the synthetic paper market is experiencing significant growth due to several key factors. Synthetic paper offers superior durability and resistance to harsh environmental conditions, making it ideal for industrial applications such as tags, labels, and safety signs that are exposed to extreme temperatures, moisture, and chemicals. Additionally, the growing emphasis on sustainability within the industrial sector is driving demand for eco-friendly materials like synthetic paper, which can be recycled and has a lower environmental impact compared to traditional paper. Innovations in printing and coating technologies have also enhanced the performance characteristics of synthetic paper, making it suitable for high-quality, durable printing required in industrial settings.

Get Customized Report as per your Business Requirement - Request For Customized Report

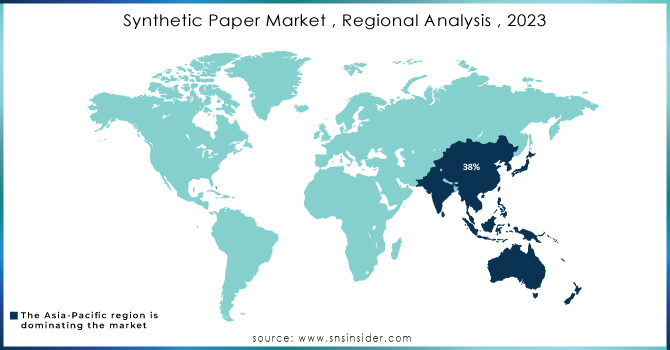

The Asia-Pacific region is leading in the synthetic paper market, claiming a dominant 38% share of global revenue in 2023. This dominance is attributed to several factors fueling demand in the region. key industries like pharmaceuticals, printing & packaging are experiencing significant growth in Asia-Pacific. This translates to a higher demand for synthetic paper as a versatile and durable material. the e-commerce boom in the region is expected to further propel the use of synthetic paper, as its properties make it ideal for packaging products shipped online. The growth story in Asia-Pacific is driven by the rising disposable income and improved living standards of the working class, particularly in developing countries like India and China. This translates to a surge in demand for consumer goods, pharmaceuticals, cosmetics, and food & beverages – industries that all find synthetic paper a valuable asset.

Key Players:

Some of the major players in the Synthetic Paper Market are Formosa Plastics Group, SIHL Group, B & F Plastics, Inc., Jindal Poly Films Ltd., Cosmo Films Ltd., Granwell Products, Inc., Transcendia, Inc., Valéron Strength Film, Toyobo Co., Ltd., TechNova, Yupo Corporation, NAN Ya Plastics Corporation, Hop Industries Corporation, Agfa-Gevaert Group, PPG Industries Inc., and other players.

RECENT DEVELOPMENTS

In April 2024: Cosmo Films' arm, Cosmo Synthetic Paper (CSP), is making waves in the industry. they unveiled 8 new brands focused on durability, printability, and sustainability. This positions CSP as a leader offering innovative solutions for the ever-changing world of printing.

In May 2023: DuPont announced a production capacity expansion for Tyvek, a popular synthetic paper brand, to meet the surging demand in packaging and labeling.

In June 2023: Huhtamaki launched a new line of eco-friendly synthetic paper cups made from compostable plant-based materials.

In July 2023: witnessed Sealed Air Corporation acquired RPC Group's Foodservice Packaging business, solidifying their position as a leader in the synthetic paper foodservice packaging market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 909.12 Million |

| Market Size by 2032 | USD 2023.96 Million |

| CAGR | CAGR of 9.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material (BOPP, HDPE, Others (PVC and PET)) • By Application (Printing, Paper Bags, Labels) • By End-use (Paper, Packaging, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Formosa Plastics Group, SIHL Group, B & F Plastics, Inc., Jindal Poly Films Ltd., Cosmo Films Ltd., Granwell Products, Inc., Transcendia, Inc., Valéron Strength Film, Toyobo Co., Ltd., TechNova, Yupo Corporation, NAN Ya Plastics Corporation, Hop Industries Corporation, Agfa-Gevaert Group, PPG Industries Inc. |

| Drivers | • Increasing demand over Eco-friendly and recyclable plastic base in synthetic paper. |

| Restraints | • Fluctuating raw material costs in the synthetic paper market. |

Ans: The Synthetic Paper Market is expected to grow at a CAGR of 9.50%.

Ans: Synthetic Paper Market size was USD 909.12 million in 2023 and is expected to Reach USD 2023.96 million by 2032.

Ans: Growing consumer demand for sustainable packaging and superior performance of synthetic paper are driving the Synthetic Paper Market.

Ans: Stricter environmental regulations and consumer concerns about traditional paper pollution are creating a demand for eco-friendly alternatives like synthetic paper.

Ans: Asia pacific is expected to hold the largest market share in the global Synthetic Paper Market during the forecast period.

TABLE OF CONTENTS:

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Synthetic Paper Market Segmentation, By Material Type

7.1 Introduction

7.2 BOPP

7.3 HDPE

7.4 PET

7.5 PVC

8. Synthetic Paper Market Segmentation, By Application

8.1 Introduction

8.2 Printing

8.3 Labels & Tags

8.4 Packaging

8.5 Others

9. Synthetic Paper Market Segmentation, By End-Use

9.1 Introduction

9.2 Industrial

9.3 Institutional

9.4Commercial/Retail

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Synthetic Paper Market by Country

10.2.3 North America Synthetic Paper Market By Material Type

10.2.4 North America Synthetic Paper Market By Application

10.2.5 North America Synthetic Paper Market By End-Use

10.2.6 USA

10.2.6.1 USA Synthetic Paper Market By Material Type

10.2.6.2 USA Synthetic Paper Market By Application

10.2.6.3 USA Synthetic Paper Market By End-Use

10.2.7 Canada

10.2.7.1 Canada Synthetic Paper Market By Material Type

10.2.7.2 Canada Synthetic Paper Market By Application

10.2.7.3 Canada Synthetic Paper Market By End-Use

10.2.8 Mexico

10.2.8.1 Mexico Synthetic Paper Market By Material Type

10.2.8.2 Mexico Synthetic Paper Market By Application

10.2.8.3 Mexico Synthetic Paper Market By End-Use

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Synthetic Paper Market by Country

10.3.2.2 Eastern Europe Synthetic Paper Market By Material Type

10.3.2.3 Eastern Europe Synthetic Paper Market By Application

10.3.2.4 Eastern Europe Synthetic Paper Market By End-Use

10.3.2.5 Poland

10.3.2.5.1 Poland Synthetic Paper Market By Material Type

10.3.2.5.2 Poland Synthetic Paper Market By Application

10.3.2.5.3 Poland Synthetic Paper Market By End-Use

10.3.2.6 Romania

10.3.2.6.1 Romania Synthetic Paper Market By Material Type

10.3.2.6.2 Romania Synthetic Paper Market By Application

10.3.2.6.4 Romania Synthetic Paper Market By End-Use

10.3.2.7 Hungary

10.3.2.7.1 Hungary Synthetic Paper Market By Material Type

10.3.2.7.2 Hungary Synthetic Paper Market By Application

10.3.2.7.3 Hungary Synthetic Paper Market By End-Use

10.3.2.8 Turkey

10.3.2.8.1 Turkey Synthetic Paper Market By Material Type

10.3.2.8.2 Turkey Synthetic Paper Market By Application

10.3.2.8.3 Turkey Synthetic Paper Market By End-Use

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Synthetic Paper Market By Material Type

10.3.2.9.2 Rest of Eastern Europe Synthetic Paper Market By Application

10.3.2.9.3 Rest of Eastern Europe Synthetic Paper Market By End-Use

10.3.3 Western Europe

10.3.3.1 Western Europe Synthetic Paper Market by Country

10.3.3.2 Western Europe Synthetic Paper Market By Material Type

10.3.3.3 Western Europe Synthetic Paper Market By Application

10.3.3.4 Western Europe Synthetic Paper Market By End-Use

10.3.3.5 Germany

10.3.3.5.1 Germany Synthetic Paper Market By Material Type

10.3.3.5.2 Germany Synthetic Paper Market By Application

10.3.3.5.3 Germany Synthetic Paper Market By End-Use

10.3.3.6 France

10.3.3.6.1 France Synthetic Paper Market By Material Type

10.3.3.6.2 France Synthetic Paper Market By Application

10.3.3.6.3 France Synthetic Paper Market By End-Use

10.3.3.7 UK

10.3.3.7.1 UK Synthetic Paper Market By Material Type

10.3.3.7.2 UK Synthetic Paper Market By Application

10.3.3.7.3 UK Synthetic Paper Market By End-Use

10.3.3.8 Italy

10.3.3.8.1 Italy Synthetic Paper Market By Material Type

10.3.3.8.2 Italy Synthetic Paper Market By Application

10.3.3.8.3 Italy Synthetic Paper Market By End-Use

10.3.3.9 Spain

10.3.3.9.1 Spain Synthetic Paper Market By Material Type

10.3.3.9.2 Spain Synthetic Paper Market By Application

10.3.3.9.3 Spain Synthetic Paper Market By End-Use

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Synthetic Paper Market By Material Type

10.3.3.10.2 Netherlands Synthetic Paper Market By Application

10.3.3.10.3 Netherlands Synthetic Paper Market By End-Use

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Synthetic Paper Market By Material Type

10.3.3.11.2 Switzerland Synthetic Paper Market By Application

10.3.3.11.3 Switzerland Synthetic Paper Market By End-Use

10.3.3.12 Austria

10.3.3.12.1 Austria Synthetic Paper Market By Material Type

10.3.3.12.2 Austria Synthetic Paper Market By Application

10.3.3.12.3 Austria Synthetic Paper Market By End-Use

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Synthetic Paper Market By Material Type

10.3.3.13.2 Rest of Western Europe Synthetic Paper Market By Application

10.3.3.13.3 Rest of Western Europe Synthetic Paper Market By End-Use

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Synthetic Paper Market by Country

10.4.3 Asia-Pacific Synthetic Paper Market By Material Type

10.4.4 Asia-Pacific Synthetic Paper Market By Application

10.4.5 Asia-Pacific Synthetic Paper Market By End-Use

10.4.6 China

10.4.6.1 China Synthetic Paper Market By Material Type

10.4.6.2 China Synthetic Paper Market By Application

10.4.6.3 China Synthetic Paper Market By End-Use

10.4.7 India

10.4.7.1 India Synthetic Paper Market By Material Type

10.4.7.2 India Synthetic Paper Market By Application

10.4.7.3 India Synthetic Paper Market By End-Use

10.4.8 Japan

10.4.8.1 Japan Synthetic Paper Market By Material Type

10.4.8.2 Japan Synthetic Paper Market By Application

10.4.8.3 Japan Synthetic Paper Market By End-Use

10.4.9 South Korea

10.4.9.1 South Korea Synthetic Paper Market By Material Type

10.4.9.2 South Korea Synthetic Paper Market By Application

10.4.9.3 South Korea Synthetic Paper Market By End-Use

10.4.10 Vietnam

10.4.10.1 Vietnam Synthetic Paper Market By Material Type

10.4.10.2 Vietnam Synthetic Paper Market By Application

10.4.10.3 Vietnam Synthetic Paper Market By End-Use

10.4.11 Singapore

10.4.11.1 Singapore Synthetic Paper Market By Material Type

10.4.11.2 Singapore Synthetic Paper Market By Application

10.4.11.3 Singapore Synthetic Paper Market By End-Use

10.4.12 Australia

10.4.12.1 Australia Synthetic Paper Market By Material Type

10.4.12.2 Australia Synthetic Paper Market By Application

10.4.12.3 Australia Synthetic Paper Market By End-Use

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Synthetic Paper Market By Material Type

10.4.13.2 Rest of Asia-Pacific Synthetic Paper Market By Application

10.4.13.3 Rest of Asia-Pacific Synthetic Paper Market By End-Use

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Synthetic Paper Market by Country

10.5.2.2 Middle East Synthetic Paper Market By Material Type

10.5.2.3 Middle East Synthetic Paper Market By Application

10.5.2.4 Middle East Synthetic Paper Market By End-Use

10.5.2.5 UAE

10.5.2.5.1 UAE Synthetic Paper Market By Material Type

10.5.2.5.2 UAE Synthetic Paper Market By Application

10.5.2.5.3 UAE Synthetic Paper Market By End-Use

10.5.2.6 Egypt

10.5.2.6.1 Egypt Synthetic Paper Market By Material Type

10.5.2.6.2 Egypt Synthetic Paper Market By Application

10.5.2.6.3 Egypt Synthetic Paper Market By End-Use

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Synthetic Paper Market By Material Type

10.5.2.7.2 Saudi Arabia Synthetic Paper Market By Application

10.5.2.7.3 Saudi Arabia Synthetic Paper Market By End-Use

10.5.2.8 Qatar

10.5.2.8.1 Qatar Synthetic Paper Market By Material Type

10.5.2.8.2 Qatar Synthetic Paper Market By Application

10.5.2.8.3 Qatar Synthetic Paper Market By End-Use

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Synthetic Paper Market By Material Type

10.5.2.9.2 Rest of Middle East Synthetic Paper Market By Application

10.5.2.9.3 Rest of Middle East Synthetic Paper Market By End-Use

10.5.3 Africa

10.5.3.1 Africa Synthetic Paper Market by Country

10.5.3.2 Africa Synthetic Paper Market By Material Type

10.5.3.3 Africa Synthetic Paper Market By Application

10.5.3.4 Africa Synthetic Paper Market By End-Use

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Synthetic Paper Market By Material Type

10.5.3.5.2 Nigeria Synthetic Paper Market By Application

10.5.3.5.3 Nigeria Synthetic Paper Market By End-Use

10.5.3.6 South Africa

10.5.3.6.1 South Africa Synthetic Paper Market By Material Type

10.5.3.6.2 South Africa Synthetic Paper Market By Application

10.5.3.6.3 South Africa Synthetic Paper Market By End-Use

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Synthetic Paper Market By Material Type

10.5.3.7.2 Rest of Africa Synthetic Paper Market By Application

10.5.3.7.3 Rest of Africa Synthetic Paper Market By End-Use

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Synthetic Paper Market by country

10.6.3 Latin America Synthetic Paper Market By Material Type

10.6.4 Latin America Synthetic Paper Market By Application

10.6.5 Latin America Synthetic Paper Market By End-Use

10.6.6 Brazil

10.6.6.1 Brazil Synthetic Paper Market By Material Type

10.6.6.2 Brazil Synthetic Paper Market By Application

10.6.6.3 Brazil Synthetic Paper Market By End-Use

10.6.7 Argentina

10.6.7.1 Argentina Synthetic Paper Market By Material Type

10.6.7.2 Argentina Synthetic Paper Market By Application

10.6.7.3 Argentina Synthetic Paper Market By End-Use

10.6.8 Colombia

10.6.8.1 Colombia Synthetic Paper Market By Material Type

10.6.8.2 Colombia Synthetic Paper Market By Application

10.6.8.3 Colombia Synthetic Paper Market By End-Use

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Synthetic Paper Market By Material Type

10.6.9.2 Rest of Latin America Synthetic Paper Market By Application

10.6.9.3 Rest of Latin America Synthetic Paper Market By End-Use

11. Company Profiles

11.1 Formosa Plastics Group,

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 SIHL Group

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 B & F Plastics, Inc.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 Jindal Poly Films Ltd.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 Cosmo Films Ltd.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 Granwell Products Inc.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 Transcendia, Inc.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 TechNova

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 Yupo Corporation

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Hop Industries Corporation

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.4 Industry News

12.5 Company News

12.6 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Material Type

BOPP

HDPE

PET

PVC

By Application

Printing

Labels & Tags

Packaging

Others

By End-Use

Industrial

Institutional

Commercial/Retail

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Surfactants Market Size was valued at USD 48.2 billion in 2023 and is expected to reach USD 72.2 billion by 2032 and grow at a CAGR of 4.6% over the forecast period 2024-2032.

Hydrogel Market Size was valued at USD 28.4 billion in 2023, and is expected to reach USD 50.0 billion by 2032, growing at a CAGR of 6.5% from 2024 to 2032.

The Slurry Oil market size was USD 3.51 Billion in 2023 and is expected to reach USD 5.23 Billion by 2032, growing at a CAGR of 4.53 % from 2024 to 2032.

The Renewable Chemicals Market size was valued at USD 128.3 billion in 2023 and is expected to reach USD 337.8 billion by 2032, growing at a CAGR of 11.4% over the forecast period 2024-2032.

Catalyst Regeneration Market Size was USD 5.77 Billion in 2023 and is expected to reach USD 9.07 Billion by 2032, growing at a CAGR of 5.16 % from 2024-2032.

The Titanium Dioxide Market Size was valued at USD 20.24 billion in 2023 and is expected to reach USD 34.78 billion by 2032, and grow at a CAGR of 6.2% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone