Synthetic Fibers Market Key Insights:

Get More Information on Synthetic Fibers Market - Request Sample Report

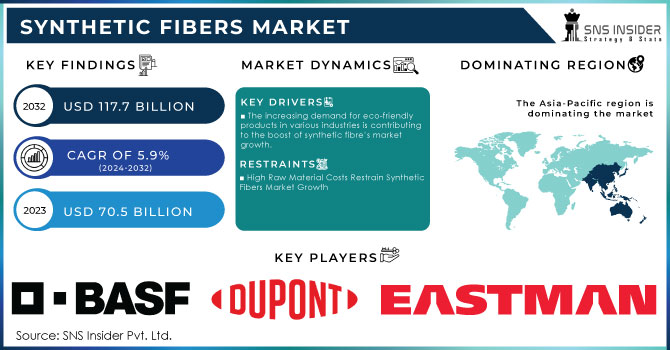

The Synthetic Fibers Market Size was valued at USD 70.5 billion in 2023 and is expected to reach USD 117.7 billion by 2032 and grow at a CAGR of 5.9% over the forecast period 2024-2032.

The Synthetic Fibers Market is dynamically changing due to numerous dynamic factors, such as technological innovation, sustainability trends, and shifting preferences by consumers. Fibers are increasingly significant in a diverse range of applications from textiles to automotive to industrial applications. Pressure on the fashion industry to become more sustainable has led the market to shift toward sustainable synthetic fibers mimicking natural materials. For example, the very innovative materials that have emerged from companies like Patagonia that brands can use in an environmentally friendly yet functional way recently emerged. This provides a chance for the brand to engage with sustainability goals as it targets a fast-rising consumer who will value companies with ethical and responsible production methods.

Recent developments have illustrated how the industry responded to these dynamics. Some of the more established fashion brands, like Nike and Adidas, increased their usage of synthetic fibers in September 2024, since such textiles improve both performance and durability and are cost-effective. Brands are turning to enhancement in the areas of transparency in supply chains and embracing such practices by promoting recycling and circular economy models. The acceptance of synthetic fibers also stems from their durability and versatility appeal to customers as well as manufacturers that seek to innovate in space.

Regulation changes are also affecting the competitive landscape. From June 2024, the debate started going around that the EU plans to set up regulations that would offer an opportunity to the manufacturers of synthetic fibers like Invista and Lycra to have an upper hand if these manufacturers also follow the sustainability standards. This regulatory framework might make companies want to invest more heavily in some form of eco-friendly production processes and materials. In the long run, the EU may well manage to redefine market dynamics by encouraging sustainable practices, thus fostering much more innovation in synthetic fibers that contribute to reduced environmental impact while keeping up with performance standards.

There is also an ongoing development of innovative applications in the use of synthetic fibers that can meet consumer and environmental demands. It is December 2023, and researchers are already pointing out that they could design new sweaters through synthetic fibers that mimic the insulating properties of polar bear fur using companies such as Ecovative. That marks a breakthrough that epitomizes how material science innovations are enabling the development of synthetic fibers that not only perform their intended functions but also respond to environmental challenges. These products suggest that synthetic fibers may meet definite demands by maintaining sustainability standards and hence gain in importance in certain sectors as well.

The development of the Synthetic Fibers Market would likely view the interaction among technological innovations and regulatory frameworks, including consumer preference, as shaping its trajectory. It would be critical to take a sustainable practice and application of innovative materials for spurring growth while meeting the demand base of a conscious consumer base.

Synthetic Fibers Market Dynamics:

Drivers:

-

The increasing demand for eco-friendly products in various industries is contributing to the boost of synthetic fibre’s market growth.

The rise in environmental consciousness and awareness about sustainability among the world's population leads to more demands for friendly-to-environment synthetic fibers. Consumers have become more conscious of the environment than ever before; they get responsible about what they buy. Brands will no longer integrate sustainable practices into their production lines. Companies that invest in innovative synthetic fibers not only provide high performance but mitigate environmental impact, too. For instance, there is Patagonia and Nike, whereby the brand comes forward with synthesized fibers from recycled plastics and organic materials thereby reducing waste and carbon emissions. More than that, regulatory pressures and greater consumer expectations of transparency in a supply chain serve to add forces for change. This has thus led manufacturers to go forward and focus on sustainable methods of production such as renewable energy sources and eco-friendly dyes. Sustainability has been a wave that would most definitely boost brand loyalty and subsequently competitiveness in the marketplace, thus the growth of the synthetic fibers market.

-

Technological Advancements in Synthetic Fiber Production Enhance Efficiency and Performance

The fast pace of technological progress in synthetic fiber production is greatly on the way to increasing efficiency and performance within the market. Advanced spinning techniques, polymer science, and smart textiles are innovating how synthetic fibers are manufactured and applied. Companies have been and are adopting state-of-the-art technologies to improve all properties of synthetic fibers, such as strength, elasticity, and moisture-wicking capacity, among others. For example, the leading front of high-performance synthetic fibers also seems strong yet light and comfortable for athletic wear, industrial applications, or even other uses carried out by Invista and DuPont. Additionally, automation and the integration of data analytics into manufacturing have enhanced processes that improve the efficiency of production, reduce waste, and decrease costs. In this regard, technological advancement fulfills in part the increased consumer demand for synthetic fibers of quality and aims to answer the rising focus on the sustainability aspect. The technology trend can be capitalized upon to produce synthetic fibers that satisfy both performance and environmental standards, furthering market growth.

Restraint:

-

High Raw Material Costs Restrain Synthetic Fibers Market Growth

Even though the demand shows promising growth for synthetic fibers, raw material costs are mainly restraining market growth. Production from fossil feedstocks, mainly based on petroleum, is significantly sensitive to price fluctuations based on changes in the global markets of oil. Due to dependence on fossil fuels, productions of synthetic fibers suffer from higher prices of raw materials, thereby hiking the cost of manufacturing for companies. As far as raw material goes, most of these changes toward more sustainable and eco-friendly alternatives often become expensive in investment and higher costs of initial costs. These higher costs often put small manufacturers in a tight spot concerning their finances because smaller manufacturers might not have the stand to compete with larger companies that can afford to absorb higher prices of raw materials. At this point, profitability is lost, as well as innovation within the industry. Companies must learn how to make their supply chain more efficient, develop alternative raw materials, and increase production intensity as a way of countering the rising raw material costs.

Opportunity:

-

Increasing Focus on Circular Economy Creates Opportunities for Growth in Synthetic Fibers Market

The growing importance of a circular economy offers vast growth opportunities within the synthetic fibers market. A growing requirement is for products to be recyclable, reusable, and repurposed so that waste is minimized and, ultimately, environmental impact: this is not only what industries but also consumers are adopting through sustainability. Industrial companies now come up with innovative solutions that allow closed-loop recycling systems in which synthetic fibers can be collected and reprocessed to make new fibers again. For example, Adidas brands in recent years came up with a campaign of developing shoes from recycled ocean plastic, which has demonstrated the potential of synthetic fibers in the creation of sustainable products. Such a move towards circularity will make the brands more decorative as well as help in adding to the revenues of the manufacturers. As sustainability gradually becomes a goal for the larger array of firms, a market preference to offer eco-friendly synthetic fibers that are recyclable would be among them. The creation of a fully circular economy has the potential to enable more manufacturers in the synthetic fibers industry to tap into the growing populace with environmentally conscious consumers by fostering long-term growth and sustainability.

Challenge:

-

Competition from Natural Fibers Presents Challenges to Synthetic Fibers Market Expansion

The synthetic fibers market is expected to grow, although competition from the increasing popularity of natural fibers will pose major challenges to it. Natural alternatives like cotton, wool, and hemp draw consumers because they seem to have environmental benefits and biodegradable properties. It has become widely seen that natural fibers are comfortable, breathable, and not as threatening to the environment; this creates a competitive landscape for synthetic fibers. However, this increasing demand for sustainable clothing and green products has forced many brands to pay more attention to the offering of more natural materials in their collections. This has placed synthetic fibers under market decay due to their being at war with several consumer preferences allegedly moving towards sustainability. To counter this, producers of synthetic fibers in the market must focus on highlighting the innovations in sustainability and performance of synthetic fibers. This is with the aspect that with innovation on any other aspect such as recyclability, reduction of energy consumption, and lesser emission levels for the production process, synthetic fiber manufacturers should be in a position to slightly gain their market position against the rising demand for natural fibers.

Synthetic Fibers Market Segmentation Analysis

By Type

In 2023, the polyester segment dominated the synthetic fibers market, accounting for around 50% market share. Polyester is widely consumed because of its excellent strength, versatility, and low cost, which favors the product as a preferred choice for diversified applications within the apparel, home textiles, and industrial products sectors. Its wrinkle resistance, shrinkage, and stretch properties make it very attractive to both manufacturers and consumers. It is noted that sportswear giants worldwide like Nike and Adidas have gradually included recycled polyester in their ranges as a result of a growing trend for sustainability. This shift towards material recycling reduces environmental impacts while allowing market growth to be greater. In addition, the increasing popularity of activewear and sportswear that require lightweight moisture-wicking fabrics further helps solidify polyester's dominance in synthetic fibers, keeping with the adaptability required to fill changing consumer demand.

By Form

The filament segment dominated the Synthetic Fibers Market in 2023, with a market share of around 60%. Filament fibers have gained popularity due to their smooth texture, high strength, and versatility, which enables their use in an extensive range of applications that include textiles, automotive interiors, and industrial fabrics. Filament fibers are usually applied to make performance textiles that require toughness and a luxurious feel. This is mainly appreciated in the two realms fashion and sports apparel. It can be followed that Lululemon and Under Armour use filament fibers in their respective athletic wear to provide comfort and moisture-wicking action. Moreover, advanced manufacturing technologies of superior quality have enabled the production of fibers with enhanced filament features like higher elasticity and improved water resistance, which further boosts their demand in various sectors. The performance of these fabrics in various applications reflects the dominance of the filament segment in the synthetic fibers market.

By Application

The Clothing application segment dominated the Synthetic Fibers Market in 2023, holding around 45% of the market share. The clothing application has a significant market share due to the high demand for light, durable, and versatile materials delivered by synthetic fibers. Polyester, nylon, and spandex are used extensively in apparel because of excellent performing characteristics, including moisture-wicking, stretchability, and resistance to wear and tear. In its pursuit of comfort and durability with fast fashion, the leading fashion brands H&M and Zara have introduced synthetic fibers in their collections in increasing amounts. The overall rise in the segment of athleisure wear and activewear has driven the clothing segment forward further as consumers demand high-performance fabrics that respond to both style and functionality. It is seen clearly through the products of brands like Nike and Adidas, which utilized synthetic fibers to develop innovative sports apparel that appeals not only to the fitness enthusiast but also to the fashion-conscious consumer, thus revalidating the clothing segment's dominance in the synthetic fibers market.

By End-Use Industry

The textiles segment dominated the Synthetic Fibers Market, making around 55% market share in 2023. Synthetic fibers find the majority of their applications in the textile industry because the performance properties of durability, versatility, and cost-effectiveness of synthetic fibers allow for the manufacture of an extremely broad range of products, from clothing and home furnishings to technical textiles. Synthetic fibers such as polyester, and nylon are also more popular because of their premium performance properties like resistance to moisture, wrinkles, and fading among others. These fibers are likely to be used both for trendy daily wear as well as some high-performance stuff. For example, sportswear majors like Nike and Adidas have been popularizing synthetic fibers in activewear. It provides superior functionality, such as breathability and stretch. Growing demand for sustainable textiles and a rise in recycled synthetic fibers would support this additional assistance in the activities of companies like Patagonia, which have introduced recycled polyester content into their offerings. Hence, this increasing innovation and sustainability focus in the textile segment would further strengthen it at the present market position in synthetic fibers.

Synthetic Fibers Market Regional Outlook

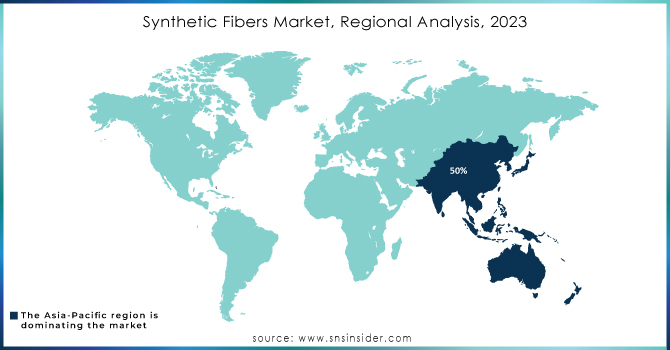

In 2023, Asia-Pacific dominated the Synthetic Fibers Market with nearly 50% market share. This is primarily due to the strong textile manufacturing base of the region, especially in countries like China and India. This region has vast and diversified production capabilities, with China remaining a leader in synthetic fiber production worldwide, meeting both its domestic and international needs. Rapid growth in the apparel and fashion industry in Asia-Pacific, coupled with the growing population and increasing disposable incomes, has led to the resultant increase in synthetic textile consumption. Brand Uniqlo, as well as Li-Ning, have also contributed remarkably to this demand by using synthetic fibers for economical and high-performance clothing. The region is also focusing on innovation in textile technology and sustainable practices, which improves its market position, allowing manufacturers to meet consumer demand in terms of durability and eco-friendliness.

Moreover, North America emerged as the fastest growing region with a CAGR of around 7% in the forecast period of 2024 to 2032. This growth is mostly due to the demand for high-performance synthetic fibers in different applications like automotive and healthcare. The use of synthetic fibers in lightweight but long-lasting material applications has surged particularly in the automobile sector and fuel efficiency with lower emissions. Companies such as Ford and General Motors are investing in advanced composite materials, synthetic fibers included, to satisfy all these needs. Higher consumer sustainability and environmental awareness in North America prompted manufacturers to introduce recycled synthetic fibers into their products. This can be seen through companies like Reebok, which now infuse recycled material into its shoe lines as part of the global industry trend towards sustainability. The region recording the highest growth in synthetic fibers in North America, and this may be attributed to this technology and increasing demand for sustainable products.

Need Any Customization Research On Synthetic Fibers Market - Inquiry Now

Recent Developments

August 2024: Shinkong Synthetic Fibers invested in an Ambercycle facility worth $10m, aiming to create even more sustainable production of fibers with the help of advanced recycling technologies and responding to the demand for greener products.

November 2023: KSG, a Turkish company, announced plans to establish a $500 million factory producing synthetic fibers in Egypt to take the development of local textile industries to a new level and offer more jobs while enhancing the export potential of the country.

Key Players

-

Aditya Birla Group (Liva, Viscose Staple Fiber)

-

BASF SE (Lycra, Elastollan)

-

DuPont (Kevlar, Nomex)

-

Eastman Chemical Company (Tritan, Eastar)

-

Huntsman Corporation (Amodu, Lurex)

-

Invista (a subsidiary of Koch Industries) (Cordura, Supplex)

-

Lenzing AG (Tencel, Lenzing Viscose)

-

Mitsubishi Chemical Corporation (Trevira, S-Polyester)

-

Reliance Industries Limited (Reliance Polyester, Reliance Spandex)

-

SABIC (Saudi Basic Industries Corporation) (SABIC PP, SABIC PS)

-

Solvay S.A. (Solef, Rhodia)

-

Toray Industries, Inc. (Torayca, Toray Nylon)

-

Teijin Limited (Twaron, Teijinconex)

-

Tencate Advanced Composites (TenCate AP, TenCate Cetex)

-

W. L. Gore & Associates, Inc. (GORE-TEX, GORE® Fabric)

-

Hyosung Corporation (Creora, Hyosung Spandex)

-

Asahi Kasei Corporation (Bemberg, Acryl)

-

Clariant AG (Fibran, Clariant Polyester)

-

Chisso Corporation (Chisso Nylon, Chisso Polyester)

-

Kraton Corporation (Kraton G, Kraton D)

Textile Processing Companies:

-

Welspun India Ltd.

-

Hanesbrands Inc.

-

Arvind Limited

-

Kraig Biocraft Laboratories, Inc.

Textile and Apparel Brands:

-

Nike

-

Adidas

-

H&M

-

Zara

-

Under Armour

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 70.5 Billion |

| Market Size by 2032 | USD 117.7 Billion |

| CAGR | CAGR of 5.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Polyester, Nylon (Polyamide), Acrylic, Polypropylene, Others) • By Form (Filament, Staple Fiber, Tow Fiber) • By Application (Clothing, Home Furnishings, Industrial, Medical, Agricultural, Others) • By End-Use Industry (Textiles, Automotive, Construction, Consumer Goods, Healthcare, Geotextiles, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | DuPont, BASF SE, Huntsman Corporation, Aditya Birla Group, Eastman Chemical Company, Toray Industries, Inc., Invista (a subsidiary of Koch Industries), Teijin Limited, Lenzing AG, Mitsubishi Chemical Corporation and other key players |

| Key Drivers | • The increasing demand for eco-friendly products in various industries is contributing to the boost of synthetic fibre’s market growth. • Technological Advancements in Synthetic Fiber Production Enhance Efficiency and Performance |

| Restraints | • High Raw Material Costs Restrain Synthetic Fibers Market Growth |