SUV MARKET KEY INSIGHTS:

The SUV Market Size was valued at USD 873.98 Billion in 2023 and is expected to reach USD 1549.42 Billion by 2032 and grow at a CAGR of 6.60% over the forecast period 2024-2032.

To get more information on SUV Market - Request Free Sample Report

The growth of the SUV segment is due to changing consumer preferences and technological progress. With urban boundaries growing outward, a spacious SUV that can do it all commutes, errands, and off-highway excursions is enticing to consumers. The compact and mid-size SUV segment is especially booming as consumers demand a family-oriented vehicle with plenty of space, but also prefer to have better band-for-buck with gas mileage. SUVs are also appealing to consumers due to the elevated seating position and safety elements the segment provides, making it popular with a range of demographics as well as across several different geographical regions.

In 2023, SUVs measuring less than 4 meters were accountable for around 50% of total car sales in India, fueled by an increasing number of models such as the Tata Nexon and Mahindra XUV700. However, compact SUVs such as the Honda CR-V and Toyota RAV4 gained 12 percent in the U.S. in 2023. Safety was touted as one of the key features listed by more than 60% of U.S. SUV buyers, citing advanced driver-assistance systems (ADAS) as an important factor in their decision-making. The compact SUVs (the likes of Volkswagen T-Roc and Renault Captur) climbed up to 15% in 2023 in Europe.

At the same time, improvements in automotive technology especially hybrid and electric powertrains are propelling SUV sales even higher. Governments across the globe are providing incentives and subsidies for low-emission vehicles and zero-emission vehicles, which has led manufacturers to double down on electric and hybrid SUVs. Battery technology and charging infrastructure have also matured, making electric SUVs a realistic proposition for buyers seeking lower emissions, and some strong growth forecasts for this segment. All of which dovetails with a wider industry move toward sustainability, so expect the SUV sector to remain well-placed for growth throughout the next decade. Fueling the rapid rise, hybrid and electric vehicle sales gained 55% in the U.S. in 2023, spearheaded by such models as the Toyota RAV4 Prime and Ford Mustang Mach-E. Various government incentives are responsible too. The EU provides as much as Euro 5,000 in EV subsidies, whilst China saw EV sales skyrocket by 90% in 2023.

MARKET DYNAMICS

KEY DRIVERS:

-

SUV Growth Driven by Active Lifestyles and Road Trips as Consumers Seek Versatile All-Purpose Vehicles

The key trends driving SUV market growth are changing lifestyle trends. As more consumers embrace active lifestyles, SUVs provide the space and utility those consumers seem to be demanding. The modern SUV is designed to accommodate hobbies, whether it be camping, fishing, biking, or off-roading, as it usually possesses ample cargo space, towing capacity, and off-road capabilities all features of interest to the adventure-minded consumer. With the popularity of road trips and outdoor recreation, SUVs offer the capability and versatility that sedans or smaller vehicles do not. The resulting change in lifestyle has given SUVs the best-selling title with consumers wanting multi-practicality from their cars. SUVs fueled by active pursuits rose from 2023 to 2024. 20% of U.S. SUV buyers got their vehicles for outdoor pursuits such as camping and biking. 40% of Americans traveled in SUVs for road trips in 2023. In the EU, 40% of new Car Registration SUVs were largely developed for off-road and leisure duties. They emphasize the need for all-purpose vehicles equipped with cargo space, towing, and off-road capability.

-

SUVs Drive Growth with Digitalization and Advanced Safety Features Meeting Consumer Demand for Tech Integration

The second key driver is the trend to significant levels of digitalization and safety content that are now common features in many SUVs. With consumers looking for more convenience and safer, more entertaining technology in their vehicles, SUVs have evolved to feature advanced driver assistance systems (ADAS), smart infotainment platforms, and access to smartphones through dot-matrix screens. Technologies like adaptive cruise control, lane-keeping assist, and collision avoidance systems appeal to tech-focused consumers who are seeking safer driving experiences. Plus, as infotainment and connected services have become key differentiators, SUVs are also a hotbed of high-tech systems that provide a personalized driving experience. This has played a big part in boosting the demand for SUVs since buyers are looking for tech-enabled travel. Between 2023 and 2024, 70% of newly registered SUVs in the U.S. were equipped with ADAS (adaptive cruise control, lane-keeping assist, collision avoidance, among others). Overall, 70% of SUV buyers around the world were at least moderately interested in smart infotainment and connected services like Apple CarPlay and Android Auto. 45% share of SUVs in Europe sold in 2023 featured advanced safety and infotainment technology, proof of strong demand for increasingly digitally integrated vehicles.

RESTRAIN:

-

The SUV Market Faces Environmental and Urbanization Challenges Driving the Need for Cleaner Models and Compact Alternatives

A major challenge for the SUV market is the environmental impact and regulatory pressures due to the high emissions associated with traditional SUVs. Many governments are enacting stricter emissions standards and promoting green policies, which can restrict sales and require manufacturers to develop cleaner models, like electric SUVs, which come with their own technical and infrastructure challenges. This shift puts pressure on automakers to innovate rapidly in emissions-reduction technology and battery advancements to meet both consumer demand and compliance standards. Another restraint is the size and weight of SUVs, which often make them less efficient and harder in densely populated urban areas. Their larger dimensions can limit parking and handling convenience, which can be off-putting for some buyers in city settings. As urbanization grows, consumers may seek more compact alternatives, which could challenge the SUV market. Addressing these factors requires manufacturers to rethink design and functionality to align with evolving consumer preferences and regulatory landscapes.

KEY SEGMENTATION ANALYSIS

BY SEATING CAPACITY

In 2023, the 5-seater SUV had the largest market share of SUV market segments with 64% part of total sales. This segment continues to dominate the market largely because most urban/suburban consumers are looking for the best trade-off between space and efficiency. The Compact and mid-size SUV, generally delivered in five-opening setups, is viable for families and individual drivers who need an adaptable, extensive vehicle at a moderate cost, and while simpler to explore in city conditions.

The >5-seater will grow with the fastest compound annual growth rate in the SUV segment is forecast from 2024 to 2032. Demand for bigger vehicles capable of carrying more people is fueling this growth, with family-oriented and premium SUVs more prevalent in some markets. The introduction of hybrid and electric options in the >5-seater category is also likely to appeal to environmentally conscious consumers, further driving growth.

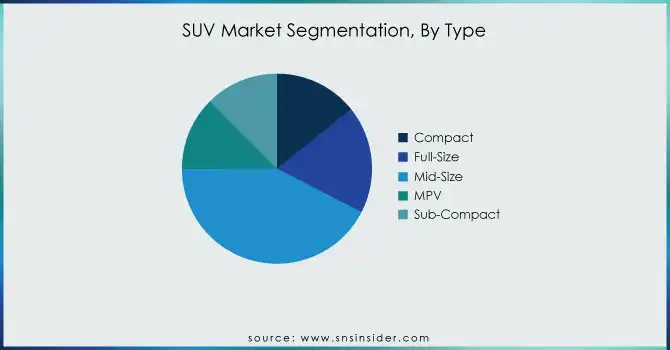

BY TYPE

The mid-size SUVs segment accounted for a dominant market share of 42 % in global SUV market. Mid-size SUVs succeed by mixing interior space, comfort, and performance for families and even commuters seeking practicality. With seating for up to five passengers and plenty of cargo space, these SUVs tend to be just as capable of tackling a daily commute as they are a week-long road saga. Consumers across North America, Europe, and parts of Asia have taken a liking to the mid-size SUV segment thanks to their higher ride, advanced safety features, and improved fuel economy compared to full-size SUVs. Plus, mid-size SUVs span affordable and premium models, expanding their market even further.

Compact SUVs are anticipated to register the fastest growth in the market during the forecast period spanning 2024 to 2032, notably in developed regions where citizens are conscious of urban population density along with environmental concerns. Compact SUVs are built to deliver much of the benefit of larger SUVs in terms of high rides, and high cargo volume all while being cheaper, more fuel-efficient, and easier to drive in a cramped city. As electrification diverts growing attention, compact SUVs are receiving electric and hybrid models as well, making them attractive to green-minded buyers. Features like ADAS and high-tech infotainment are adding to the tech-fresh appeal of this segment while the characteristics of compact SUVs make it irresistible to younger, city-dwelling customers. Coupled with the demand for compact SUVs for superior functional, technological, and environmental offers, this combination will expand the ground for the rapidly growing compact SUV segment until 2032.

BY FUEL TYPE

Gasoline-powered SUVs easily accounted for the largest market share during 2023 as they represented about 54% of the total SUV market thanks to their ubiquity, the existing fueling infrastructure, and the fact that most consumers are familiar with internal combustion engine (ICE) vehicles. For now, gasoline SUVs are still a big market, as they offer unmatched performance and versatility wherever infrastructure hasn’t fully developed for electric charging. That dominance also contours along with consumer preference, in other areas where fuel is cheap and any incentives for electric vehicle uptake are limited. Like any SUV, though, most of these represent a compromise between power, range, and cost that's likely to appeal to traditional SUV buyers who need dependability under varied driving conditions.

Electric SUVs are projected to exhibit the highest compound annual growth rate from 2024 to 2032. This projected growth is due to a few different reasons, such as more stringent emissions standards, significant government incentives, and improved battery technology. One of the greatest attractions for consumers eventually becomes the environmental advantage of electric SUVs, in addition to lower operating costs as charging infrastructure improves across the world. Automakers are pouring resources into electric SUV models with long ranges, rapid charging, and low prices, opening up electric vehicles to a much wider range of buyers. Driving this transition will be mostly in Europe and the Asia-Pacific as philosophies around greener energy policies mature with consumers in these regions.

BY PROPULSION

In 2023, ICE vehicles dominated the SUV space with a 63% market share. Their prevalence is due to availability, general consumer understanding, and the existing fueling infrastructure for gas/diesel cars, particularly in areas where EV charging networks are still nascent. In markets with relatively low fuel costs and less stringent emissions regulations, however, ICE SUVs have always been appreciated for their power, performance, and range provide any basis for serious criticism. However, ICE SUVs remain the choice to serve a wide base of SUV buyers due to their reliability, all-purpose versatility, and lower initial costs than electric SUV models.

Electric vehicles are expected to be the fastest-growing segment from 2024 to 2032, with a high compound annual growth rate. This progress is fueled by stricter emission regulations, rising government incentives, and fast-paced developments in EV technology: major advancements in battery efficiency and charging speed. With more availability of EVs from manufacturers and increasing infrastructure, many consumers will likely make the transition to electrified sport-utility vehicles given their nominal operating costs and greenness. We anticipate that electric SUVs will experience robust demand in several regions around the world, including Europe, North America, and parts of Asia-Pacific, with regional emissions targets and changing passenger vehicle buying behaviors combined to create a completely new automotive landscape. It also puts electric SUVs at the center of the electric vehicle growth story in the industry over the next ten years.

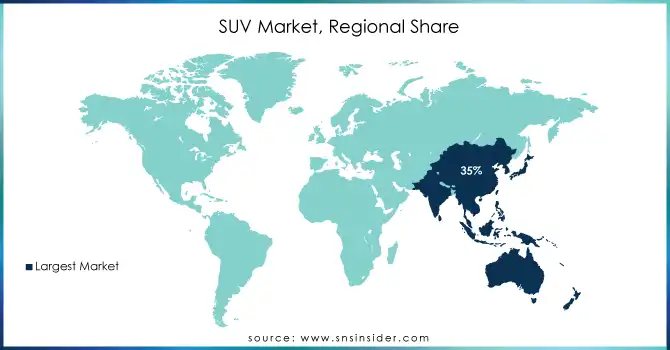

REGIONAL ANALYSIS

The Asia-Pacific region led the global SUV market in 2023 with 35% market share. The increase mainly relates to the economic prosperity growth, urbanization, and middle-class rise in countries like China, India, and Japan. Demand for the compact and mid-size SUV segments is robust in the region, in part due to a sustainable automotive manufacturing base within the region, a major contributor to market dominance. Meanwhile, in China, the world's biggest automotive market, local brands such as Geely and BYD are taking advantage of the rising preference for SUVs, especially among nano-eco-conscious consumers, to market China’s ecologically aware consumer base. India, on the other hand, is seeing a rise in affordability, practicality, and the start of adoption of EVs with vehicles such as the Tata Nexon and Mahindra XUV700.

North America is projected to grow with the rapidest-growing CAGR between 2024 to 2032, owing to both consumer demand and technology acceleration in the SUV segment. Incentives from governments, along with changing consumer demand for sustainable, high-performing vehicles, result in the quick shift to larger SUVs and EV variants within the regions. This trend is especially taking shape in the United States, where automakers like Ford and General Motors (GM) have debuted electric SUVs like the Ford Mustang Mach-E and Chevrolet Equinox EV. The spread of charging infrastructure and the increasing cost of fuel are making EVs a more tempting proposition for North American buyers. Whereas new SUV all-electric remain in their infancy, traditional SUVs are becoming extremely popular making sure a dual purpose for growth via North America as a region to end up being in tow with it.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the SUV Market are:

-

Toyota (RAV4, Highlander)

-

Honda (CR-V, Pilot)

-

Ford (Explorer, Escape)

-

Chevrolet (Tahoe, Equinox)

-

Hyundai (Tucson, Santa Fe)

-

Nissan (Rogue, Pathfinder)

-

BMW (X5, X3)

-

Mercedes-Benz (GLC, GLE)

-

Jeep (Cherokee, Grand Cherokee)

-

Kia (Sorento, Sportage)

-

Audi (Q5, Q7)

-

Volkswagen (Tiguan, Atlas)

-

Subaru (Outback, Forester)

-

Mazda (CX-5, CX-9)

-

Porsche (Cayenne, Macan)

-

Land Rover (Range Rover, Defender)

-

GMC (Yukon, Terrain)

-

Ram (1500, 2500)

-

Mitsubishi (Outlander, Eclipse Cross)

-

Volvo (XC60, XC90)

Some of the Raw Material Suppliers for SUV Companies:

-

ArcelorMittal

-

BASF

-

Alcoa

-

Toray Industries

-

Saint-Gobain

-

3M

-

DuPont

-

SABIC

-

Magna International

-

Nippon Steel Corporation

RECENT TRENDS

-

In November 2024, Škoda Auto India unveiled the Škoda Kylaq, its first model in the popular sub-4-metre SUV segment, which comprises nearly 50% of India's car sales. The Kylaq features Škoda’s new Modern Solid design language, catering to the growing demand for compact SUVs in the country.

-

In November 2024, Mahindra & Mahindra Ltd. achieved its highest-ever SUV sales in India, with 54,504 vehicles sold in the domestic market. This milestone underscores the growing demand for Mahindra’s SUVs, further solidifying its leadership in the segment.

-

In November 2024, Kia India unveiled its highly anticipated SUV, Kia Syros, blending bold design, advanced technology, and mythological heritage.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 873.98 Billion |

| Market Size by 2032 | USD 1549.42 Billion |

| CAGR | CAGR of 6.60% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Seating Capacity (5-Seater, >5-Seater) • by Type (Compact, Full-Size, Mid-Size, MPV, Sub-Compact) • by Fuel Type (Gasoline, Diesel, Electric SUV) • by Propulsion (Electric Vehicles, Hybrid (HEV, PHEV), Internal Combustion Engine) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Toyota, Honda, Ford, Chevrolet, Hyundai, Nissan, BMW, Mercedes-Benz, Jeep, Kia, Audi, Volkswagen, Subaru, Mazda, Porsche, Land Rover, GMC, Ram, Mitsubishi, Volvo. |

| Key Drivers | • SUV Growth Driven by Active Lifestyles and Road Trips as Consumers Seek Versatile All-Purpose Vehicles • SUVs Drive Growth with Digitalization and Advanced Safety Features Meeting Consumer Demand for Tech Integration |

| Restraints | • The SUV Market Faces Environmental and Urbanization Challenges Driving the Need for Cleaner Models and Compact Alternatives |