Surfactants Market Size & Overview:

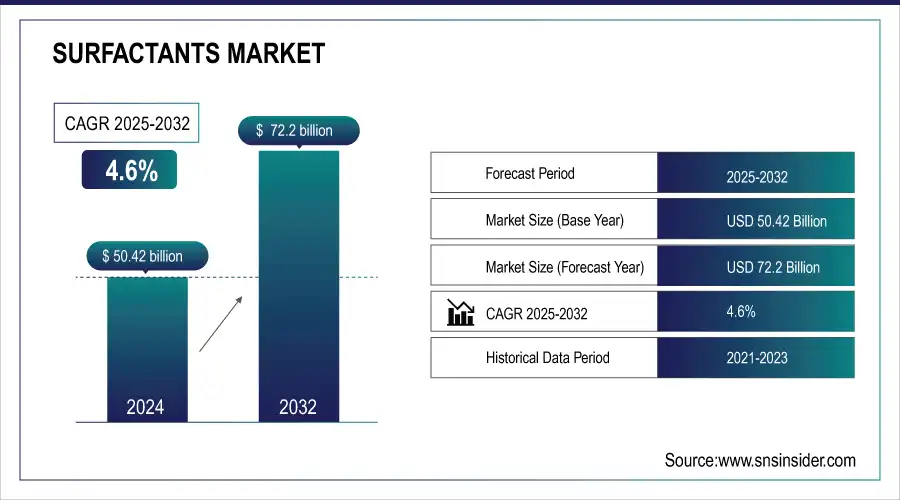

The Surfactants Market Size was valued at USD 50.42 billion in 2024 and is expected to reach USD 72.2 billion by 2032 and grow at a CAGR of 4.6% over the forecast period 2025-2032.

The surfactants market is very dynamic with changing demand for sustainable products, pressure from regulatory mechanisms for eco-friendly formulations, and innovation in application technologies. High-performance surfactants continue to grow in the wake of growing personal care, household care, and agriculture industries. In addition, the shift to the development of biodegradable and non-toxic surfactants is a single trend supportive of the global theme of sustainability of lifestyle, providing opportunities to companies that can innovate and be more responsive to new trends preferred by consumers.

Get More Information on Surfactants arket - Request Sample Report

Surfactants Market Size and Forecast:

-

Market Size in 2024: USD 50.42 Billion

-

Market Size by 2032: USD 72.2 Billion

-

CAGR: 4.6% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

key trends for the Surfactants Market:

-

Rising demand for bio-based and eco-friendly surfactants due to sustainability and regulatory pressures.

-

Increased use of surfactants in personal care, cosmetics, and household cleaning products.

-

Growth in industrial applications, including agrochemicals, paints, and coatings, driving surfactant adoption.

-

Development of multifunctional surfactants for enhanced performance in formulations.

-

Rising demand for high-efficiency and low-foaming surfactants in detergents and cleaning agents.

-

Expansion of the home care and fabric care markets boosting surfactant consumption.

-

Focus on cost-effective and renewable raw materials for surfactant production.

-

Adoption of advanced formulation technologies for better solubility and stability.

-

Growth in emerging economies driving industrial and consumer surfactant demand.

-

Strategic partnerships and acquisitions among key players to expand product portfolios.

Changes in the agricultural industry are also portrayed in the development of new surfactant solutions. Such innovations improve formulations of pesticides, thereby achieving better spread and adhesion properties of active ingredients on plant surfaces, improving pest control, and lowering the dosage level. The development of surfactants formulated specifically for agrochemical applications becomes increasingly important as farmers try to achieve more efficient and environmentally friendly agricultural practices. That integration of the surfactant into pesticide formulations elevates effectiveness and contributes to the growing pattern of integrated pest management strategies, ensuring an environmental-friendly crop protection mechanism.

Research and development in the companies are also done to develop more specialized surfactants that work with the different needs of each industry. Such developments in the formulation of surfactants with improved ability to work at low energies are coming with huge momentum, driven by a search for energy efficiency in cleaning applications. As the market for surfactants continues to evolve, research collaboration and manufacturer collaboration will be the key to unlocking new technologies and materials that can drive performance goals while advancing sustainability. A collaborative approach would, therefore, ensure these surfactants were efficient but responsible while meeting consumers' needs as well as the environment, thus paving the way for the growth of the surfactants market.

Surfactants Market Drivers:

-

The increasing consumer preference for sustainable and biodegradable products drives the demand for eco-friendly surfactants across various industries, including personal care, household cleaning, and agriculture.

A new wave of environmental issues awareness among consumers has led to the demand for efficacy as well as a product that has less environmental damage. The change in the pattern of consumer behavior has led manufacturers to innovate and reformulate lines of surfactants to be biodegradable and less toxic. The next development driving this trend is that the growth in regulatory authorities all over the world with stricter regulations about the usage of hazardous chemicals forces companies to invest in greener alternatives. As a result, surfactant manufacturers will focus on creating plant-based and bio-based formulations that meet any sustainability objectives. For instance, companies will experiment with raw materials ranging from vegetable oils to natural sugars to create surfactants that are effective and have environmental properties. The most evident trend is in personal care and household cleaning, where consumers are picking up such products marketed as "natural" and "organic." Life cycle assessments are also being used by industries to assess the environmental burden in the surfactant phase, hence leading to the more environmentally acceptable choice of materials. If surfactant manufacturers can develop their product line up to match this demand, they will truly benefit from such increased demand for more ecologically friendly products.

-

Innovative formulation technologies are enhancing the performance and applications of surfactants, creating new opportunities in various industries.

Surfactants have rapid growth in the market due to faster formulation and production technology. The impact of nanotechnology, micro-emulsion systems, and green chemistry is also enhancing the role of surfactants in introducing efficient and functional surfactants. Nano-surfactants can significantly increase the solubility and dispersion properties of active components in formulations for pharmaceutical and agricultural applications. For instance, sophisticated formulation techniques make possible the design of multi-functional surfactants that could perform several tasks in one single product and, therefore optimize the resource input of one type of surfactant and reduce wastes. This has been the main trend in the personal care and cosmetics segment for a while, especially because consumers have begun to request high-performance ingredients in small sizes. Companies are also developing new surfactant formulations that advance stability in products, introduce foaming capabilities, reduce irritation to the skin, and consequently enhance acceptance by consumers. Innate novel product demand will remain high in the market for surfactants, as manufacturers are further investing in research and development. Therefore, with technological advancement and growing consumer awareness in the next few years, this market is going to explode.

Surfactants Market Restraints:

-

Stricter environmental regulations and compliance requirements can hinder surfactant production, impacting market growth and innovation.

Environmental regulations on the part of the government and other regulatory bodies across the world are increasingly making the surfactants market harder to tread. Most governments and other regulatory agencies are tightening their environmental regulations to drastically check the usage of harmful substances. Environmental regulations prompt the development of safer, sustainable chemical alternatives. Though laws related to public health and the environment must be well-guarded, it is more of a compliance nightmare for surfactant producers. Extensive regulatory frameworks demand huge investments in research and development, testing, and certification processes, which are expensive and time-consuming. In addition, increased sources of ingredients and their declaration add more complexity to the process of manufacture. The small manufacturers would not be able to afford compliance with the regulations and may suffer from market consolidation as larger players absorbed smaller firms that were unable to attain the desired regulatory standards. This could eventually stunt innovation because firms may not be willing to invest in new product development with the uncertainty of whether such new products comply with regulations or not. The supply chains will be disrupted while raising the cost of production, and therefore, reforms of existing products may be necessary. Manufacturers will have to deal with these intricate regulations to become competitive again while keeping up with environmentalist consumption.

Surfactants Market Opportunities:

-

The expanding applications of surfactants in emerging sectors, such as pharmaceuticals and renewable energy, present significant growth opportunities.

Surfactants have great growth potential since they are applied on a mass scale, which is related to the establishment of new industries, such as pharmaceutical, agrochemical, and renewable energy. Pharmacy is one of the areas where surfactants are useful for improving drug delivery systems based on enhancements in the solubility and bioavailability of active ingredients. This new need in surfactant-based advanced therapeutic products requires a significant scope for innovation and development of such products for the pharmaceutical company's requirements by manufacturers of surfactants. The agricultural sector improves the efficiency of pesticides and herbicides, through surfactant incorporation of these chemicals, to enhance their spreadability and adhesion on the plant surface. Increased demand for more sustainable practices and integrated pest management will drive the need for more effective surfactant solutions. Surfactants in biofuel formulation and energy storage systems would form new markets in the renewable energy sector. Leveraging these trends requires companies to invest in R&D to help develop surfactants specifically for emerging applications that require such surfactants. Tap these growth areas, and surfactant manufacturers will find new sources of revenue in reaching long-term success.

Surfactants Market Challenges:

-

The surfactants market faces challenges due to intense competition and fluctuating raw material prices, affecting profitability.

The surfactants market can be considered highly competitive in terms of players who are vying for market share across different segments. This may result in price wars as manufacturers will, by nature, compete on price to win customers. Such price movements can create a large impact on profit margins, and companies may not emerge at even the smallest level of profitability from their bottom lines. The prices of raw materials also have a powerful influence on the surfactant market. Again, factors behind this may be turbulent raw material prices influenced by geopolitical issues, supply chain disruption, or a shift in global demand. For instance, a change in crude oil prices can impact petroleum-based surfactant prices directly, and thus pricing strategies become unpredictable. From this angle of consideration, there is an emerging trend toward bio-based surfactants, especially with how companies are getting more oriented toward the sustainability aspect. The pricing dynamics would probably be different from that of the traditional ones. To transition to more sustainable formulations, manufacturers have had to deal with the complexities of the sourcing of raw materials in alignment with best-practice eco-friendly practices while remaining cost-effective. Balancing competing pressures while offering product quality and performance is a significant challenge a company must address to remain competitive in the surfactants market.

Surfactants Market Segmentation Analysis:

By Type, Anionic Surfactants Lead Market Driven by Household and Industrial Cleaning Demand

Anionic surfactants dominated the surfactants market with a market share of around 40% in 2024. Among the anionic surfactants, LAB surfactants captured as the largest sub-segment accounting for approximately 25% of the total surfactants market. Large sales volumes for anionic surfactants can be easily explained by their much higher demand for household and industrial cleaning agents. Such surfactants are highly appreciated for their good cleaning and foaming abilities. Among LAB surfactants, one should particularly point to their intensive use in laundry detergents and surface cleaners for removing dirt and grease. Thus, LAB surfactants are added to major detergent products to enhance performance with cost competitiveness. The multifunctionality of anionic surfactants and compatibility with other types of surfactants ensure their continued usage in many applications whereby they retain their major position in the surfactants market.

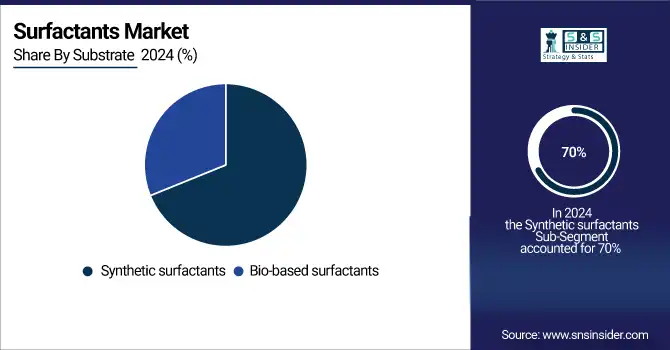

By Substrate, Synthetic Surfactants Dominate with Alkyl Polyglycosides Gaining Popularity in Personal Care

Synthetic surfactants dominated and accounted for a market share of nearly 70% in 2024. Among the synthetic surfactants, Alkyl polyglycosides is the largest sub-segment under synthetic surfactants, accounting for an estimated market share of about 30%. Synthetic surfactants are often chosen due to their performance and economy, especially in industrial applications. APGs are derived from renewable plant materials and are finding extremely high usage in personal care as well as household products because they are mild and biodegradable. They are used extensively in shampoos, shower gels, and dish washings attracting conscious consumers looking for gentle cleaning products yet effective. Brands such as The Honest Company and Ecover are using APGs in their formulations to capitalize on the rising demand for more environmentally friendly products. The persistent demand for quality, versatile, and effective cleaning agents across all consumer and industrial sectors is well indicated by the synthetic surfactants' robust performance, particularly that of APGs.

By Application, Household Detergents Drive Surfactant Market Growth Amid Rising Hygiene Awareness

Household detergents dominated the surfactant market in 2024, with a market share of approximately 35%. The increased significance of this category can be primarily attributed to consumers' steady demand for good cleaning agents that can be used for laundry and general cleaning purposes. Household detergents encompass a broad range of products as liquid and powder detergents, fabric softeners, and multi-purpose cleaners, all of which substantially depend on surfactants to realize cleaning effectiveness. Major companies, including Procter & Gamble and Unilever, have capitalized on this requirement and introduced more advanced products that enhance cleaning with added convenience for consumers. For instance, Procter & Gamble's Tide can boast advanced formulations in the stain-fighting formulation that exploits the properties of surfactants to make more effective stain removal while preserving fabric care. This upward trend in hygiene consciousness, however, especially in the post-COVID period, has also fueled demand for household detergents, thereby again propping up strong leadership in the overall surfactants market.

Surfactants Market Regional Insights:

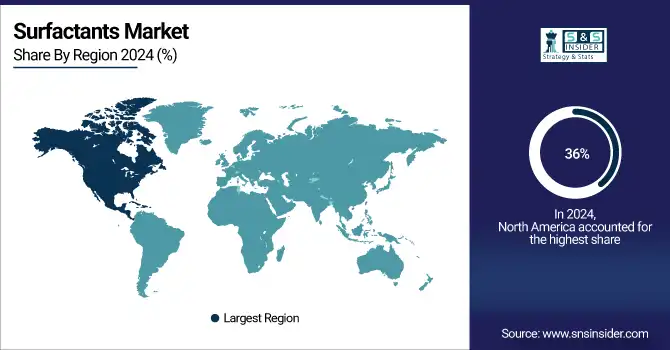

North America Dominates Surfactants Market in 2024

North America is projected to hold around 36% of the surfactants market in 2024 due to significant industrial and household cleaning demand. The region’s mature personal care, detergent, and industrial sectors rely heavily on surfactants for cleaning, foaming, and emulsifying applications. Rising consumer preference for advanced, eco-friendly, and high-performance cleaning products further drives demand. Additionally, strong R&D investments, presence of leading surfactant manufacturers, and regulatory focus on biodegradable formulations support continuous innovation, enhancing product efficiency and maintaining North America’s dominant market position.

Get Customized Report as per Your Business Requirement - Enquiry Now

- United States Leads North America’s Surfactants Market

The U.S. dominates due to its mature personal care, household, and industrial cleaning sectors, which rely heavily on surfactants for effective formulations. Rising consumer demand for advanced detergents, fabric care products, and eco-friendly cleaning solutions drives consistent market growth. Additionally, strong R&D investments and the presence of major surfactant manufacturers like Dow, BASF, and Stepan Company enhance production capacity and innovation. The country’s regulatory framework promoting environmentally safe and biodegradable surfactants further strengthens demand, ensuring the U.S. maintains its leading position in North America’s surfactants market in 2024.

Asia Pacific is the Fastest-Growing Region in Surfactants Market in 2024

Asia Pacific’s surfactants market is expected to grow at a CAGR of 7.1% from 2025 to 2032, fueled by rapid industrialization and urbanization. Increasing household cleaning demand, coupled with rising consumer awareness of hygiene, drives the adoption of detergents and cleaning products. The expanding personal care sector, including shampoos, shower gels, and skincare products, further boosts surfactant consumption. Additionally, cost-effective production, availability of raw materials, and government support for chemical manufacturing strengthen market growth, positioning Asia Pacific as the fastest-growing region in the global surfactants market.

- China Leads Asia Pacific’s Surfactants Market

China dominates due to its large-scale chemical manufacturing base, rapid urbanization, and growing consumer demand for detergents and personal care products. The country is a key hub for surfactant production and export, leveraging cost-effective raw materials and strong industrial infrastructure. Rising investments in hygiene-conscious household products, cleaning agents, and eco-friendly formulations further support demand. Leading local and multinational companies operate production facilities in China, ensuring supply and innovation. Combined with government initiatives for chemical safety and sustainability, China solidifies its position as the top surfactant market in Asia Pacific.

Europe Surfactants Market Insights, 2024

Europe shows steady growth in 2024, supported by rising demand for personal care, household, and industrial cleaning products emphasizing eco-friendly and biodegradable formulations. Germany’s strong chemical, personal care, and household products industries drive higher surfactant demand, resulting in increased market adoption and innovation.

- Germany Leads Europe’s Surfactants Market

Germany dominates due to its advanced chemical manufacturing capabilities, high-quality personal care and household product sectors, and strong focus on sustainability. Companies like BASF and Henkel drive innovation in specialty and bio-based surfactants. Regulatory compliance with EU environmental standards ensures higher adoption of biodegradable and safe surfactants. Growing demand for eco-friendly detergents and industrial cleaners further boosts consumption, maintaining Germany’s leadership position in Europe’s surfactants market in 2024.

Middle East & Africa and Latin America Surfactants Market Insights, 2024

The surfactants market in the Middle East & Africa and Latin America is experiencing steady growth in 2024, driven by expanding household cleaning, personal care, and industrial applications. In the Middle East, countries like Saudi Arabia and the UAE are boosting demand through increasing hygiene awareness and industrial production. In Latin America, Brazil and Mexico lead adoption due to rising detergent, personal care, and fabric care consumption. Growing urbanization, industrialization, and government initiatives to support hygiene and eco-friendly products further sustain market growth across both regions.

Competitive Landscape for the Surfactants Market:

AkzoNobel N.V.

AkzoNobel N.V. is a Netherlands-based global leader in specialty chemicals and surfactants, offering products for personal care, household, and industrial applications. The company develops high-performance surfactants such as Hollisol and Afix, providing cleaning, emulsifying, and foaming solutions. AkzoNobel focuses on sustainability, producing bio-based and eco-friendly surfactants that meet regulatory and environmental standards. Its role in the surfactants market is critical, driving innovation, efficiency, and multifunctional applications across diverse sectors.

-

In 2024, AkzoNobel expanded its product range with advanced biodegradable surfactants designed for detergents and personal care products, enhancing performance while reducing environmental impact.

BASF SE

BASF SE, headquartered in Germany, is a global chemical giant producing a wide range of surfactants, including Ludwigshafen and BioTergent. The company emphasizes sustainable and versatile solutions for household cleaning, personal care, and industrial applications. BASF SE plays a vital role in the surfactants market by combining R&D expertise with scalable production capabilities to deliver innovative, high-quality products.

-

In 2024, BASF launched new eco-friendly surfactants optimized for detergents and industrial cleaning, reinforcing its position as a market leader in sustainable chemical solutions.

CLARIANT AG

CLARIANT AG is a Swiss-based specialty chemicals company offering surfactants such as Hostapon and Emulsogen for personal care, household, and industrial sectors. The company focuses on multifunctional, sustainable solutions that improve cleaning efficiency and formulation stability. CLARIANT’s role in the surfactants market is significant, driving performance, bio-based product development, and global adoption of environmentally responsible surfactants.

-

In 2024, CLARIANT introduced advanced surfactants tailored for mild personal care formulations, targeting eco-conscious consumers and expanding its market footprint.

CRODA INTERNATIONAL PLC

CRODA INTERNATIONAL PLC, headquartered in the U.K., specializes in high-performance surfactants for personal care, household, and industrial applications. Its products, including Crodafos and Crothix, emphasize sustainability, biodegradability, and multifunctionality. CRODA plays a critical role in the surfactants market by providing innovative, high-quality solutions that enhance product performance while supporting eco-friendly initiatives.

-

In 2024, CRODA launched new surfactant solutions for natural and mild formulations in personal care, strengthening its market presence and commitment to sustainable chemistry.

Surfactants Market Key Players:

-

AkzoNobel N.V.

-

BASF SE

-

CLARIANT AG

-

CRODA INTERNATIONAL PLC

-

DOW, INC.

-

Evonik Industries AG

-

Henkel AG & Co. KGaA

-

Huntsman International LLC

-

Kao Corporation

-

Lonza Group AG

-

NOURYON

-

Procter & Gamble Co.

-

Rhodia (part of Solvay)

-

SABIC

-

SC Johnson Professional

-

SILVERLINE CHEMICALS

-

Stepan Company

-

Taminco (part of Eastman Chemical Company)

-

Tetra Chemicals Corp.

-

Wacker Chemie AG

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 50.42 Billion |

| Market Size by 2032 | US$ 72.2 Billion |

| CAGR | CAGR of 4.6% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Cationic Surfactants, Anionic Surfactants {Linear alkyl benzene, Fatty alcohol ether sulfates, Fatty alcohol sulfates, Sulfosuccinates, Others}, Non-ionic Surfactants {Fatty alcohol ethoxylates (FAE), Alkyl phenol ethoxylates (APE), Others}, Amphoteric surfactants, Others) |

| •By Substrate (Synthetic surfactants {Sucrose esters, Alkyl polyglycosides, Fatty acid glucamides, Sorbitan esters}, Bio-based surfactants {Low molecular weight biosurfactants, High molecular weight biosurfactants}) | |

| •By Application (Household Detergents, Personal Care, Industrial & Institutional Cleaners, Food Processing, Oilfield Chemicals, Agricultural Chemicals, Textiles, Plastics, Paints & Coatings, Adhesives, Others) | |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, CRODA INTERNATIONAL PLC, Kao Corporation, STEPAN COMPANY, DOW, INC., Evonik Industries AG, Huntsman International LLC, NOURYON, CLARIANT AG, Lonza Group AG, and other players. |