Get More Information on Super app Market - Request Sample Report

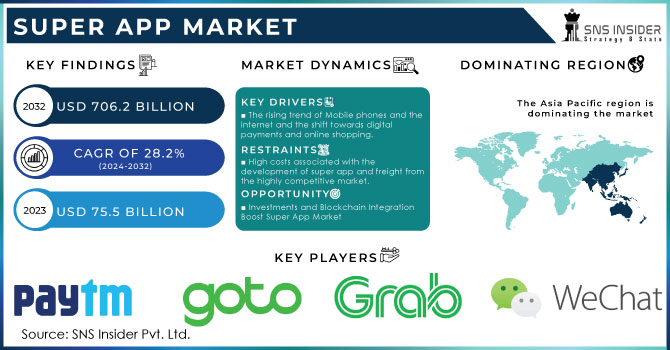

The Super app Market size was recorded at USD 75.5 Bn in 2023 and is expected to reach USD 706.2 Bn by 2032, growing at a CAGR of 28.2 % over the forecast period 2024-2032.

The affordable rate of the Internet and the variety in choices of smartphones, as well as the increasing popularity of integration of advanced features such as AI in mobiles, and increasing use of e-commerce and digital payments, are some of the factors driving the growth of Super app market. According to the study on the sales of the smartphone market, the no. of smartphones shipped is around 1.2 Billion in 2024. The market growth is also supported by growing demand for seamless, efficient experiences with payments, online shopping, Entertainment, and study purposes across the globe. Therefore, the growing demand for cashless commerce and financial inclusion has a positive impact on the market. Additionally, an increase in technological advancements such as the integration of AI in mobile functionality and improvement in the app features to signify the user’s experience offer drastic growth opportunities for investors in this industry.

The increasing rate of downloading multifunctional apps and efficient browsing has increased the screen timing of people. According to the market study on the rate of use of mobile apps, the largest number of installed apps on phones are recorded in the age categories of the Generation Millennials (defined as those born between 1981 and 1996). In Line With that, the younger ones, are seen having more screen time using mobile apps, as Compared to the elder generation. The people of the age group between 18 to 24 years old spent around 114-115 hours on the phone, playing games, scrolling shopping apps, or on entertainment sites each month.

Additionally, there is a growth in the use of mobile wallets and QR code payments, which are examples of cashless payment methods that are becoming more popular. For Instance, the popular apps that are mostly used by the young generation globally are, WeChat, Whatsapp, Paytm, GooglePay, Alipay (fintech app), Grab (used to order foods), PhonePay, Uber, etc. In March 2024, according to the Chinese Multi-functional social media platform, the active WeChat monthly active users are around 1.35 Billion. In Addition to that, WhatsApp is also becoming more popular among various age groups, and the revenue generated by the WhatsApp Business is more than $ 380 Million, in 2023.

Some top companies that influence the super app market are GoTo, Alibaba Cloud, LINE Corporation, Tata Group, AgileTech Vietnam, GeneXus, Cisco Systems Inc., IBM Corporation, Elluminati Inc., and Huawei Technologies Co., Ltd.

Moreover, the Government also provides grants to the companies for the development of super apps. And also promotes the collaboration of super app with service providers to ease the user’s experience. For Instance, An Indian government-supported app, India's Unified Mobile Application for New-age Governance (UMANG) is a mobile-based platform providing over 20,000 public services with the help of different applications here. Another, LifeSG in Singapore is a government super app offering various citizen services. Indonesia will cut down multiple government apps to eight super-apps for private & public services integrations.

MARKET DYNAMICS:

KEY DRIVERS

The rising trend of Mobile phones and the internet and the shift towards digital payments and online shopping.

With smartphones, connectivity, and all that online shuffle of money & shopping - the super App market is in demand. Smartphones are cheaper, and the Internet is more common, which means there is a huge number of people who bypassed desktop computers entirely in favor of using mobile apps for their day-to-day tasks. Super apps can conduct frictionless transactions directly with their customers, due to digital payments and online shopping further promote this activity. Furthermore, end-to-end commerce technology has been adopted by marketplaces and merchants to facilitate seamless online shopping and payment through e-commerce platforms, allowing customers to shop from anywhere.

MobiCash's white paper highlights that excellent applications can provide merchants with an easy and cost-effective way to engage in m-commerce and enable seamless personal e-commerce that helps increase conversion rates. This shows how the integration of e-commerce and digital payments with super-apps is a key factor in their growth.

According to an ECS Payments article, the rise of super wallets or super apps in emerging markets is fueled by the demand for digital payment solutions that can function beyond banks and other payment processing companies. This further strengthens the link between the adoption of digital payments and the growth of the premium software market.

RESTRAINT

High costs associated with the development of super app and freight from the highly competitive market.

OPPORTUNITY

Growing public and private investments in the super app market and integration of Blockchain technology to provide secure and efficient services.

Greater amounts of capital are being invested into super apps, from both companies and governments. This investment is how super apps can introduce new functionality, bring themselves to new customers, and provide more services. The investment brings new features or new tools in banking, shopping, or various fields. For Instance, Fierce (in 2023), has raised funds of around $10 Million, to provide customers with an efficient banking service platform through super app development. Some amount of government support can come into play too, in enabling super apps to reach the unbanked.

Moreover, by facilitating seamless DeFi integration, safe and instantaneous transactions, lower costs, quicker settlements, greater confidence and transparency, and wider financial inclusion, the incorporation of blockchain technology into super applications can improve transaction management. These advantages create fresh chances for the market for super apps to expand.

By Device:

Smartphone

Tablets

Others

In this segmentation, the smartphone segment led the market with more than 75% of the revenue share in 2023. Because smartphones are much smaller than tablets, they can be transported more easily. In addition to the above, smartphones give good communication features, as well as we can send and receive messages or make phone calls, without having many disruptions. In line with that, users prefer to pay a bill at the local grocery store using super app services such as making QR code payments on their smartphones. Also, Users have a choice in every budget range for smartphones as compared to Tabs.

Other device segments such as desktops, MacBooks, smartwatches, and other wearable devices are growing at a significant rate. The trend of smartwatches and related devices is growing among young generations due to the integration of smart features such as GPS, Health tracking devices, and so on.

By Platform:

iOS

Android

Others

In this segmentation, the Android segment led the market with more than 60% of the market share in 2023. Due to the lower cost of Android phones, it is the dominant choice globally, with some regions like Asia Pacific and Latin America having a higher adoption rate. Individuals with lower income levels in these countries have much cheaper options than Apple Inc.'s iPhones. In addition, Android is open-source software and offers customization options. Android is for all corporate smartphones except Apple, while iOS is only for Apple Inc.'s iPhone and iPad.

According to the study on the Android market, in the overall Tablet market, nearly 46% of the market was occupied by the Android version, and the most used version in 2023, is the Andriod 13 which is around 21% as compared to others.

By Application:

E-commerce

Financial Services

Transportation & Logistics Services

Social Media & Messaging

Others

In this segmentation, the social media & Messaging segment led the market with around more than 28 % of the revenue share in 2023. Messaging, social media, and games are the most commonly used forms of entertainment apps. Simform, an American technology company, discovered that games, social media, and messaging were the top three application categories used. In addition, users spend the most time on social media, averaging 140 minutes per week. Therefore, great apps generate most of their revenue through this segment of apps.

The U.S. is at the top of the Gaming market, generated around $ 6 billion in 2023, and occupies up to 27% of the market share. In Addition to that, the Indian Gaming market is also booming at a significant rate. According to the Entertainment Council report of Winzo, India earned revenue of around $ 3.1 billion in 2023.

By End-users:

Consumers

Business

In this segmentation, the Business segment led the market with more than 60% of the revenue share in 2023. Through a B2B monetization model, Super Apps generate revenue through advertising fees, commissions, and other means. Ads generate significant revenue for premium apps. For instance, there are many super apps developed in 2023-24, which boosts the revenue of the market and customer’s attraction towards the app. Walmart Go (U.S), provides various functions such as product scanning, payment, grocery delivery etc. In addition to that, Klarna (Swedish payment app), and Rappi (Latin America), offer various services with one platform such as food delivery, courier service, etc., and Tencent (China), has numerous business and personal blogs on its platform and generates significant revenue from blogs linked to public accounts.

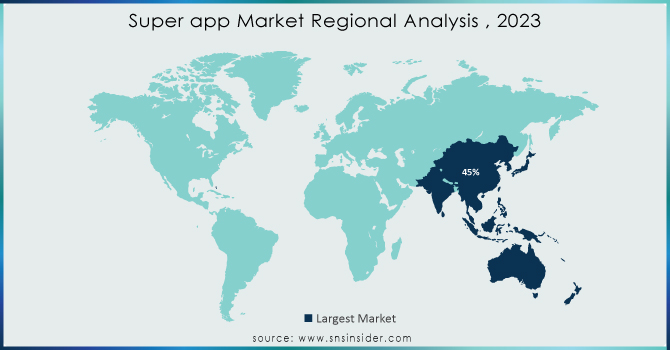

REGIONAL ANALYSIS:

Asia Pacific holds the dominant position in the Super app market with more than 45% of the market share in 2023, due to the massive population and expanding internet consumption and smartphone penetration.

In countries like India where the super apps market players are also supported by the government, which helps them to establish the market in various domains. The Ministry of Agriculture and Farmers Welfare announced in March 2022 that the Indian government would be launching an app for farmers amalgamating existing mobile apps/digital resources. The Indian government is also set to introduce an expansive electric car app (even as the govt has put in place 479 charging stations under FAME phase I by July 2022). In Addition, the Indian government plans to launch a great app for electric cars in August 2022 (as the government has installed 479 charging stations under FAME phase 1 by July 2022. In addition, 50 charging stations have been commissioned and installed Under FAME phase 2. Such government initiatives should promote the implementation of super programs in different countries.

Need any customization research on Super app Market - Enquiry Now

For Instance, apps such as PhonePay & Patym (India), Alipay (China), and Kakao Corp. (South Korea) are some key players that are providing services with the best features and customer satisfaction.

The major key players are Paytm, Gojek tech (goto), WeChat (Tencent), Grab, Rappi Inc., Revolut Ltd, LINE Corporation, Alipay (Ant Group CO., Ltd.); PhonePe (Flipkart.com), Kakao Corp.,Tata Neu (Tata Sons Private Limited); GeneXus, Alibaba Cloud, Cisco Systems Inc., AgileTech Vietnam, Huawei Technologies Co., Ltd., GoTo, Elluminati Inc., Tata Group, LINE Corporation, IBM Corporation and others in the final report.

Paytm-Company Financial Analysis

Recent Developments:

Mahindra Finance and IBM have announced their collaboration to develop a super app in the field of finance, which will provide, a single digital interface to operate multiple businesses within Mahindra Finance.

On July 15, PlaysOut, a global gaming technology company (CUMA), will utilize the Tencent Cloud Mini Program Platform (TCMPP) to become the first mover in driving content ecosystems for global super apps. According to the release, that alliance seeks to jump-start entertainment, gaming, and other sectors of the global digital industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 75.5 billion |

| Market Size by 2031 | US$ 706.2 Billion |

| CAGR | CAGR of 28.2 % From 2023 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device (smartphone, Tablet, others) • By Platform (Android,iOS, other) • By Application (E-commerce,Financial Services,Transportation & Logistics Services, Social Media & Messaging,Others) • By End-User (Business, Consumers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Paytm, Gojek tech (goto), WeChat (Tencent), Grab, Rappi Inc., Revolut Ltd, LINE Corporation, Alipay (Ant Group CO., Ltd.); PhonePe (Flipkart.com), Kakao Corp.,Tata Neu (Tata Sons Private Limited); GeneXus, Alibaba Cloud, Cisco Systems Inc., AgileTech Vietnam, Huawei Technologies Co., Ltd., GoTo, Elluminati Inc., Tata Group, LINE Corporation, IBM Corporation |

| Key Drivers | • The rising trend of Mobile phones and the internet and the shift towards digital payments and online shopping. |

| RESTRAINTS | •High costs associated with the development of super app and freight from the highly competitive market. |

Ans: The Asia-Pacific region led the Super App Market with the highest revenue share in 2023.

Ans: High costs associated with the development of super apps and freight from the highly competitive market, can restrict the growth of the Super App Market.

Ans: The Smartphone segment led the market in the device type segmentation of the Super App Market from 2024-2032.

Ans: The expected CAGR of the global Super App Market during the forecast period is 28.2%

Ans: The Super App Market was valued at USD 75.5 Bn in 2023.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Super App Market Segmentation, By Device

7.1 Introduction

7.2 Smartphone

7.3 Tablets

7.4 Others

8. Super App Market Segmentation, By Platform

8.1 Introduction

8.2 iOS

8.3 Android

8.4 Others

9. Super App Market Segmentation, By Application

9.1 Introduction

9.2 E-commerce

9.3 Financial Services

9.4 Transportation & Logistics Services

9.5 Social Media & Messaging

9.6 Others

10. Super App Market Segmentation, By End-users

10.1 Introduction

10.2 Consumers

10.3 Business

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 Trend Analysis

11.2.2 North America Super App Market by Country

11.2.3 North America Super App Market By Device

11.2.4 North America Super App Market By Platform

11.2.5 North America Super App Market By Application

11.2.6 North America Super App Market By End-users

11.2.7 USA

11.2.7.1 USA Super App Market By Device

11.2.7.2 USA Super App Market By Platform

11.2.7.3 USA Super App Market By Application

11.2.7.4 USA Super App Market By End-users

11.2.8 Canada

11.2.8.1 Canada Super App Market By Device

11.2.8.2 Canada Super App Market By Platform

11.2.8.3 Canada Super App Market By Application

11.2.8.4 Canada Super App Market By End-users

11.2.9 Mexico

11.2.9.1 Mexico Super App Market By Device

11.2.9.2 Mexico Super App Market By Platform

11.2.9.3 Mexico Super App Market By Application

11.2.9.4 Mexico Super App Market By End-users

11.3 Europe

11.3.1 Trend Analysis

11.3.2 Eastern Europe

11.3.2.1 Eastern Europe Super App Market by Country

11.3.2.2 Eastern Europe Super App Market By Device

11.3.2.3 Eastern Europe Super App Market By Platform

11.3.2.4 Eastern Europe Super App Market By Application

11.3.2.5 Eastern Europe Super App Market By End-users

11.3.2.6 Poland

11.3.2.6.1 Poland Super App Market By Device

11.3.2.6.2 Poland Super App Market By Platform

11.3.2.6.3 Poland Super App Market By Application

11.3.2.6.4 Poland Super App Market By End-users

11.3.2.7 Romania

11.3.2.7.1 Romania Super App Market By Device

11.3.2.7.2 Romania Super App Market By Platform

11.3.2.7.3 Romania Super App Market By Application

11.3.2.7.4 Romania Super App Market By End-users

11.3.2.8 Hungary

11.3.2.8.1 Hungary Super App Market By Device

11.3.2.8.2 Hungary Super App Market By Platform

11.3.2.8.3 Hungary Super App Market By Application

11.3.2.8.4 Hungary Super App Market By End-users

11.3.2.9 Turkey

11.3.2.9.1 Turkey Super App Market By Device

11.3.2.9.2 Turkey Super App Market By Platform

11.3.2.9.3 Turkey Super App Market By Application

11.3.2.9.4 Turkey Super App Market By End-users

11.3.2.10 Rest of Eastern Europe

11.3.2.10.1 Rest of Eastern Europe Super App Market By Device

11.3.2.10.2 Rest of Eastern Europe Super App Market By Platform

11.3.2.10.3 Rest of Eastern Europe Super App Market By Application

11.3.2.10.4 Rest of Eastern Europe Super App Market By End-users

11.3.3 Western Europe

11.3.3.1 Western Europe Super App Market by Country

11.3.3.2 Western Europe Super App Market By Device

11.3.3.3 Western Europe Super App Market By Platform

11.3.3.4 Western Europe Super App Market By Application

11.3.3.5 Western Europe Super App Market By End-users

11.3.3.6 Germany

11.3.3.6.1 Germany Super App Market By Device

11.3.3.6.2 Germany Super App Market By Platform

11.3.3.6.3 Germany Super App Market By Application

11.3.3.6.4 Germany Super App Market By End-users

11.3.3.7 France

11.3.3.7.1 France Super App Market By Device

11.3.3.7.2 France Super App Market By Platform

11.3.3.7.3 France Super App Market By Application

11.3.3.7.4 France Super App Market By End-users

11.3.3.8 UK

11.3.3.8.1 UK Super App Market By Device

11.3.3.8.2 UK Super App Market By Platform

11.3.3.8.3 UK Super App Market By Application

11.3.3.8.4 UK Super App Market By End-users

11.3.3.9 Italy

11.3.3.9.1 Italy Super App Market By Device

11.3.3.9.2 Italy Super App Market By Platform

11.3.3.9.3 Italy Super App Market By Application

11.3.3.9.4 Italy Super App Market By End-users

11.3.3.10 Spain

11.3.3.10.1 Spain Super App Market By Device

11.3.3.10.2 Spain Super App Market By Platform

11.3.3.10.3 Spain Super App Market By Application

11.3.3.10.4 Spain Super App Market By End-users

11.3.3.11 Netherlands

11.3.3.11.1 Netherlands Super App Market By Device

11.3.3.11.2 Netherlands Super App Market By Platform

11.3.3.11.3 Netherlands Super App Market By Application

11.3.3.11.4 Netherlands Super App Market By End-users

11.3.3.12 Switzerland

11.3.3.12.1 Switzerland Super App Market By Device

11.3.3.12.2 Switzerland Super App Market By Platform

11.3.3.12.3 Switzerland Super App Market By Application

11.3.3.12.4 Switzerland Super App Market By End-users

11.3.3.13 Austria

11.3.3.13.1 Austria Super App Market By Device

11.3.3.13.2 Austria Super App Market By Platform

11.3.3.13.3 Austria Super App Market By Application

11.3.3.13.4 Austria Super App Market By End-users

11.3.3.14 Rest of Western Europe

11.3.3.14.1 Rest of Western Europe Super App Market By Device

11.3.3.14.2 Rest of Western Europe Super App Market By Platform

11.3.3.14.3 Rest of Western Europe Super App Market By Application

11.3.3.14.4 Rest of Western Europe Super App Market By End-users

11.4 Asia-Pacific

11.4.1 Trend Analysis

11.4.2 Asia-Pacific Super App Market by Country

11.4.3 Asia-Pacific Super App Market By Device

11.4.4 Asia-Pacific Super App Market By Platform

11.4.5 Asia-Pacific Super App Market By Application

11.4.6 Asia-Pacific Super App Market By End-users

11.4.7 China

11.4.7.1 China Super App Market By Device

11.4.7.2 China Super App Market By Platform

11.4.7.3 China Super App Market By Application

11.4.7.4 China Super App Market By End-users

11.4.8 India

11.4.8.1 India Super App Market By Device

11.4.8.2 India Super App Market By Platform

11.4.8.3 India Super App Market By Application

11.4.8.4 India Super App Market By End-users

11.4.9 Japan

11.4.9.1 Japan Super App Market By Device

11.4.9.2 Japan Super App Market By Platform

11.4.9.3 Japan Super App Market By Application

11.4.9.4 Japan Super App Market By End-users

11.4.10 South Korea

11.4.10.1 South Korea Super App Market By Device

11.4.10.2 South Korea Super App Market By Platform

11.4.10.3 South Korea Super App Market By Application

11.4.10.4 South Korea Super App Market By End-users

11.4.11 Vietnam

11.4.11.1 Vietnam Super App Market By Device

11.4.11.2 Vietnam Super App Market By Platform

11.4.11.3 Vietnam Super App Market By Application

11.4.11.4 Vietnam Super App Market By End-users

11.4.12 Singapore

11.4.12.1 Singapore Super App Market By Device

11.4.12.2 Singapore Super App Market By Platform

11.4.12.3 Singapore Super App Market By Application

11.4.12.4 Singapore Super App Market By End-users

11.4.13 Australia

11.4.13.1 Australia Super App Market By Device

11.4.13.2 Australia Super App Market By Platform

11.4.13.3 Australia Super App Market By Application

11.4.13.4 Australia Super App Market By End-users

11.4.14 Rest of Asia-Pacific

11.4.14.1 Rest of Asia-Pacific Super App Market By Device

11.4.14.2 Rest of Asia-Pacific Super App Market By Platform

11.4.14.3 Rest of Asia-Pacific Super App Market By Application

11.4.14.4 Rest of Asia-Pacific Super App Market By End-users

11.5 Middle East & Africa

11.5.1 Trend Analysis

11.5.2 Middle East

11.5.2.1 Middle East Super App Market by Country

11.5.2.2 Middle East Super App Market By Device

11.5.2.3 Middle East Super App Market By Platform

11.5.2.4 Middle East Super App Market By Application

11.5.2.5 Middle East Super App Market By End-users

11.5.2.6 UAE

11.5.2.6.1 UAE Super App Market By Device

11.5.2.6.2 UAE Super App Market By Platform

11.5.2.6.3 UAE Super App Market By Application

11.5.2.6.4 UAE Super App Market By End-users

11.5.2.7 Egypt

11.5.2.7.1 Egypt Super App Market By Device

11.5.2.7.2 Egypt Super App Market By Platform

11.5.2.7.3 Egypt Super App Market By Application

11.5.2.7.4 Egypt Super App Market By End-users

11.5.2.8 Saudi Arabia

11.5.2.8.1 Saudi Arabia Super App Market By Device

11.5.2.8.2 Saudi Arabia Super App Market By Platform

11.5.2.8.3 Saudi Arabia Super App Market By Application

11.5.2.8.4 Saudi Arabia Super App Market By End-users

11.5.2.9 Qatar

11.5.2.9.1 Qatar Super App Market By Device

11.5.2.9.2 Qatar Super App Market By Platform

11.5.2.9.3 Qatar Super App Market By Application

11.5.2.9.4 Qatar Super App Market By End-users

11.5.2.10 Rest of Middle East

11.5.2.10.1 Rest of Middle East Super App Market By Device

11.5.2.10.2 Rest of Middle East Super App Market By Platform

11.5.2.10.3 Rest of Middle East Super App Market By Application

11.5.2.10.4 Rest of Middle East Super App Market By End-users

11.5.3 Africa

11.5.3.1 Africa Super App Market by Country

11.5.3.2 Africa Super App Market By Device

11.5.3.3 Africa Super App Market By Platform

11.5.3.4 Africa Super App Market By Application

11.5.3.5 Africa Super App Market By End-users

11.5.3.6 Nigeria

11.5.3.6.1 Nigeria Super App Market By Device

11.5.3.6.2 Nigeria Super App Market By Platform

11.5.3.6.3 Nigeria Super App Market By Application

11.5.3.6.4 Nigeria Super App Market By End-users

11.5.3.7 South Africa

11.5.3.7.1 South Africa Super App Market By Device

11.5.3.7.2 South Africa Super App Market By Platform

11.5.3.7.3 South Africa Super App Market By Application

11.5.3.7.4 South Africa Super App Market By End-users

11.5.3.8 Rest of Africa

11.5.3.8.1 Rest of Africa Super App Market By Device

11.5.3.8.2 Rest of Africa Super App Market By Platform

11.5.3.8.3 Rest of Africa Super App Market By Application

11.5.3.8.4 Rest of Africa Super App Market By End-users

11.6 Latin America

11.6.1 Trend Analysis

11.6.2 Latin America Super App Market by Country

11.6.3 Latin America Super App Market By Device

11.6.4 Latin America Super App Market By Platform

11.6.5 Latin America Super App Market By Application

11.6.6 Latin America Super App Market By End-users

11.6.7 Brazil

11.6.7.1 Brazil Super App Market By Device

11.6.7.2 Brazil Super App Market By Platform

11.6.7.3 Brazil Super App Market By Application

11.6.7.4 Brazil Super App Market By End-users

11.6.8 Argentina

11.6.8.1 Argentina Super App Market By Device

11.6.8.2 Argentina Super App Market By Platform

11.6.8.3 Argentina Super App Market By Application

11.6.8.4 Argentina Super App Market By End-users

11.6.9 Colombia

11.6.9.1 Colombia Super App Market By Device

11.6.9.2 Colombia Super App Market By Platform

11.6.9.3 Colombia Super App Market By Application

11.6.9.4 Colombia Super App Market By End-users

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Super App Market By Device

11.6.10.2 Rest of Latin America Super App Market By Platform

11.6.10.3 Rest of Latin America Super App Market By Application

11.6.10.4 Rest of Latin America Super App Market By End-users

12. Company Profiles

12.1 Paytm

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 The SNS View

12.2 Gojek tech

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 The SNS View

12.3 WeChat

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 The SNS View

12.4 Grab, Rappi Inc.

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 The SNS View

12.5 Revolut Ltd

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 The SNS View

12.6 LINE Corporation

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 The SNS View

12.7 Alipay

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 The SNS View

12.8 PhonePe

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 The SNS View

12.9 Kakao Corp.

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 The SNS View

12.10 Tata Neu

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 The SNS View

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Device:

By Platform:

By Application:

By End-users:

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

Europe

Asia Pacific

Middle East & Africa

Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Enterprise Social Software Market was valued at USD 17.56 billion in 2023 and is expected to reach USD 92.19 billion by 2032, growing at a CAGR of 20.30% from 2024-2032.

The Video Conferencing Software Market size was USD 1.38 billion in 2023 and is expected to Reach USD 2.85 billion by 2031 and grow at a CAGR of 8.4 % over the forecast period of 2024-2032.

The Enterprise Resource Planning Software Market was valued at USD 62.49 billion in 2023 and is expected to reach USD 175.63 billion by 2032 & CAGR of 12.23% by 2032.

The Data Center Construction Market Size was valued at USD 219.02 Billion in 2023 and will reach USD 388.92 Billion by 2032 and grow at a CAGR of 6.7% by 2032.

The Smart Warehousing Market Size was USD 22.7 billion in 2023 and is expected to reach USD 75.7 billion by 2032 and grow at a CAGR of 14.3% by 2024-2032.

The Field Service Management (FSM) Market size was valued at USD 4.31 Billion in 2023 and is expected to grow to USD 13.68 Billion by 2032 and grow at a CAGR of 13.7 % over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone