Sulphur Pastilles Market Report Scope & Overview

The Sulfur Pastilles Market size was worth USD 1.30 billion in 2024 and is expected to reach USD 1.82 billion by 2032 growing at a CAGR of 4.26% over the forecast period of 2025-2032.

To Get more information on Sulfur Pastilles Market - Request Free Sample Report

The increasing the soil sulphur deficiency drives the sulphur pastilles market growth. This increase is driven by the rising sulphur deficiency in soils globally, but more in Asia Pacific and Africa, which is pushing the government and companies to focus and adopt sulphur pastilles with some customized formulation, further propelling the market growth.

For instance, according to the Food and Agriculture Organization, and various national soil health reports reveal that over 45% of the agricultural soils in India are sulphur deficient, as reported in the All India Coordinated Research Project on Micro and Secondary Nutrients and Pollutant Elements in Soils and Plants (AICRP-MSPE), 2022 report.

Moreover, it is a preferred solution as it provides a slow and continuous release of sulphur in line with the crop nutrient uptake over the growth cycle. Because of their uniform size, they are easy to handle, and their release characteristics are controllable to mix them into tailor-made nutrient formulations specifically for soils deficient in sulphur.

As per the African Fertilizer and Agribusiness Partnership (AFAP) and Africa Soil Information Service (AfSIS) 2023 findings, approximately 37% of soils across Sub-Saharan Africa are critically low in sulphur, contributing to reduced crop productivity. Therefore, raising this problem may increase the sulphur pastilles market expansion.

Market Dynamics:

Drivers:

-

Growing Demand for High-Purity Sulphur Forms Drive Market Growth

The increasing needs of the high-purity sulphur products, with particular reference to their release in agricultural operations, manufacturing of chemical projects, and rubber manufacture, are anticipated to boost the sulphur pastilles market growth. High-purity sulphur is necessary in the production of sulphur pastilles with high quality and stability, with exact segregation for fertilizers and industrial applications. High-grade melted sulphur is required for proper release of nutrients in agriculture for better quality and yield of food grains, especially in areas with sulphur-deficient soils. The chemical industry requires purified sulphur for the production of sulphuric acid, which is an important primary material for various chemical processes.

As per the U.S. Geological Survey (USGS) 2024 Sulphur Mineral Commodity Summary, the production of recovered elemental sulphur from the U.S. has exceeded 8.1 million metric tons in 2023, mainly high-purity forms for fertilizer and industrial applications. A 2% increase over last year is attributed primarily to expanding agricultural sulphur demand and more demanding specifications for quality. Advanced sulphur recovery at refineries and gas plants is also progressing, with technologies yielding more pure sulphur and lower selenium and arsenic contamination, key for premium-grade sulphur pastille production.

Meanwhile, in December 2023, Gazprom Neftekhim Salavat reported that it would be expanding its capabilities in regional sulphur pastille production to a low-dust, high-purity sulphur pastille to be used in the agricultural and chemical sectors. As demand for precision agriculture and specialty industrial uses has increased, the company implemented advanced pastillation technology to tighten control over purity levels.

Restraints:

-

Competition from Alternative Fertilizers and Materials May Impede Market Expansion

Such competition of alternative fertilizers and materials acts as a major restraint to the growth of the sulphur pastilles market. Alternative fertilizers, including organic fertilizers, controlled-release fertilizers, and slow-release nitrogen fertilizers, are increasingly being considered as viable alternatives to our conventional fertilizer practices as the agricultural industry continues to search for sustainable and realistic solutions for crop nutrition. Such alternatives, however, provide many benefits, such as low environmental impact, better nutrient use efficiency, and long-term soil health. Many of these alternatives also reduce sulphur-driven environmental problems such as soil acidification, so they are beneficial in areas where sulphur buildup is becoming an issue.

Furthermore, there is a growing focus on bio-based fertilizers and other sustainable materials that improve soil quality without the negative impacts caused by conventional sulphur fertilizers. This is highly likely to lead farmers to prefer sulphur alternatives, such as sulphur pastilles, particularly in regions where greater attention is being paid to sustainable agricultural practices and the ecological footprint of agriculture.

Opportunities:

-

Advancements in Sulfur Pastille Technology Create Opportunities for Market Expansion

The sulphur pastilles industry has benefited immensely from the technological advancements associated with sulphur pastille technology. Continuous research and innovation in formulations with sulphur pastilles over the last several years have resulted in formulations with such desired properties due to increased solubility, rapid oxidation in the soil, greater purity, and improved uniformity. Sulphur pastilles are being re-engineered to release nutrients in a more temperature-controlled manner with the intent of extending nutrient availability to crops at one time, reducing application frequency, and increasing efficiencies.

For instance, in January 2024, the Berndorf Band Group introduced the BernDrop AD200 feeding device to revolutionize the solidification of sulphur and fertilizer for the Berndorf Band Group. The raised-shell concept is designed to improve pastille quality while minimizing maintenance with no refeed bars and no external seals, while providing accelerated production speeds.

Segmentation Analysis:

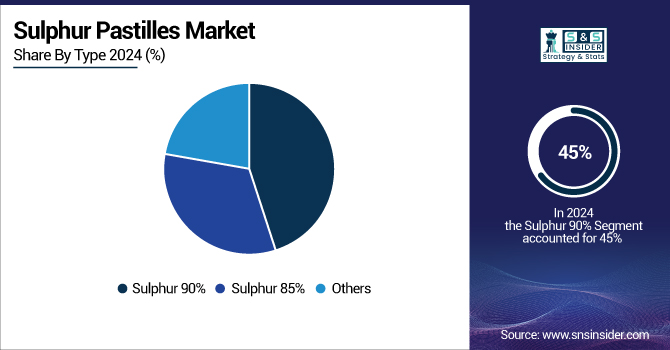

By Type

Sulphur 90% held the largest market share of around 45% in 2024. It is the best trade-off in terms of purity, performance, and costs. It has 90% sulphur content, which provides a better efficiency for agricultural and industrial applications, and, encouragingly, it is one of the most popular grades of sulphur that is widely used in fertilizer, especially for sulphur-deficient soils. Sulphur content is high, making it more effective for agricultural nutrient delivery, especially in those areas where sulphur deficiency is common.

Sulphur 85% held the significant sulphur pastilles market share and fastest growing segment during the forecast period. The segment’s growth is driven by its high sulphur content and high use in several industries. In agriculture, sulphur 85% is often utilized in manufacturing fertilizers since it presents a cheaper alternative for soil amendment while providing sufficient efficacy due to its low sulphur concentration relative to sulphur 90%.

By Process

Prilling/Pelletizing segment held the largest market share of approximately 42% in 2024 owing to the prevalence of high-quality, uniform granules of sulphur, which are relatively easy to handle, store, and transport over larger distances. The method consists of melting sulphur and then forming it into even, small, uniform pellets or prills. The pellets are ideal for fertilizers as they have a base number, dimension, soft surface, and stability.

Extrusion segment held a significant market share and is expected to be the fastest-growing segment during the forecast period. The segment’s growth is driven by the shapes and sizes of sulphur products varying for various purposes, and hence, controlled shapes are essential for a particular industrial application. In one process, molten sulphur is forced into a die, and continuous, linear sections are created, which can be cut to the desired size. They have multiple benefits over traditional processes, including enhanced production rates and manufacturing capabilities of shapes and sizes of sulphur pastilles to meet special application requirements.

By End-Use Industry

Agriculture segment held the dominant market share of approximately 32% in 2024. The growth is driven by the importance of sulphur for soil, without which fertility & crop yield are severely compromised. Sulphur is a valid nutrient for plants, and the lack of sulphur in the soil can hamper the growth and productivity of crops. As sulphur-deficient soils are common in many parts of North America, Asia Pacific, and Africa, there is an increasing need for sulphur-based fertilizers, which in turn is propelling the growth of this segment.

The sulphuric acid production segment held a significant market share. It is owing to the high utilization of sulphur pastilles as an essential raw material for the production of sulphuric acid, which is among the most commonly produced industrial chemicals in the world. Sulphuric acid is required for several specific uses, such as fertilizer industries, especially phosphate fertilizers, chemical industries, petroleum refinery, sewage treatment, and metal processing.

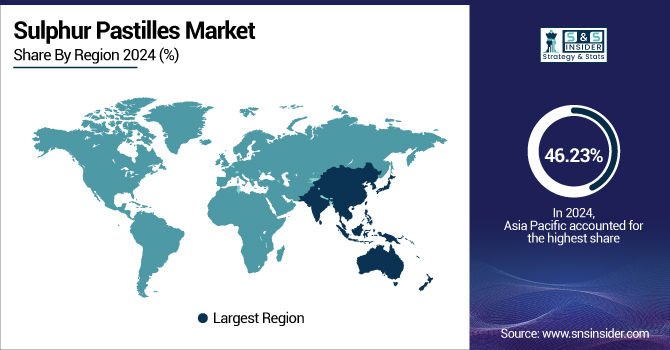

Regional Analysis:

Asia Pacific held the largest share of around 46.23% in the market for suphur pastilles owing to the larger agricultural sector in the region, growing demand for sulphur-based fertilizers, and existing centers for concentrated production of Sulphuric acid. China and India are the leading regions in the sulphur pastilles market owing to continuous depletion of sulphurous materials in soils, particularly in the case of highly intensive cultivated lands. Increasing awareness regarding soil health and demand for adapted nutrient delivery in crops are the major factors supporting the growth of the market for sulphur pastilles.

For instance, in China, the Xaimc Sulphur Pastillator is a specialized machine designed for the efficient production of sulphur pastilles, which are essential in various industries, such as agriculture, chemical processing, and rubber manufacturing. This equipment utilizes advanced technology to ensure uniform size and quality of the sulphur pastilles, enhancing their effectiveness and ease of application.

North America is the fastest-growing segment due to the increased industrial demand, agriculture, sulphur production facilities, and infrastructure. North America, especially in the U.S. and Canada, is a major contributor of sulphur-based fertilizers due to the boost in agriculture by the revival of soil and better crop yields. In North America, sulphur pastilles are extensively used in the agricultural sector to supplement sulphur deficiency in the soil for crops, such as corn, wheat, and canola. Additionally, the market growth is also supported by government initiatives promoting sustainable farming practices and the rising use of slow-release fertilizers. For instance, the U.S. Department of Agriculture (USDA) increasingly pushing for the need for sulphur supplementation to balance soil nutrient disparity.

Europe held a significant market share. The growth is driven by its strong manufacturing sector, high demand for sulphur for agricultural usage, and strict environmental rules. The chemical and fertilizer industries are already well established in the region, especially in countries, such as Germany, France, and the U.K., which are important consumers of sulphur pastilles for the production of sulphuric acid and fertilizers (phosphate fertilizers).

For instance, in 2023, HGS Bioscience formed a collaboration with Tiger-Sul Products LLC to promote the manufacturing and selling of sulphur pastilles. Their goal was to supply high-quality sulphur-based fertilizers to achieve sustainable agricultural development while increasing agricultural productivity in the required regions. It also boosts the company's growth in the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The key players competing in the sulphur pastilles market are Tiger-Sul Products LLC, Deepak Fertilizers and Petrochemicals Corporation Limited (DFPCL), H.J. Baker & Bro, LLC, Jaishil Sulphur & Chemical Industries, Coogee Chemicals, Akzo Nobel N.V., Grupa Azoty S.A., Bentonite Performance Minerals LLC (A Halliburton Company), National Fertilizers Limited (NFL), and Winstone Sulphur Products.

Recent Development:

-

In February 2024, Suncor Energy introduced advanced sulphur recovery technologies at its sites to increase high-quality sulphur pastille output while reducing waste and emissions. The company further worked with industrial customers to create bespoke sulphur pastille formulations geared towards industrial processes.

-

In January 2023, Nutrien added a new sulphur pastilles product developed for precision agriculture that integrates digital technologies for precise nutrient management and application. The company introduced educational movements to call attention to the positive impacts of sulphur pastilles on soil composition and crop cultivation.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.30 Billion |

| Market Size by 2032 | USD 1.82 Billion |

| CAGR | CAGR of4.26% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Sulphur 90%, Sulphur 85%, Others) • By Process (Prilling/Pelletizing, Extrusion, Others) • By Application (Agriculture, Chemical Processing, Rubber Processing, Pharmaceuticals, Sulphuric Acid Production, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Showa Denko Materials Co., Ltd., Furukawa Electric Co., Ltd., SKC, Tiger-Sul Products LLC, Deepak Fertilizers and Petrochemicals Corporation Limited (DFPCL), H.J. Baker & Bro, LLC, Jaishil Sulphur & Chemical Industries, Coogee Chemicals, Akzo Nobel N.V., Grupa Azoty S.A., Bentonite Performance Minerals LLC (A Halliburton Company), National Fertilizers Limited (NFL), Winstone Sulphur Products. |