Market Report Scope & Overview

Get More Information on Sugarcane Fiber Packaging Market - Request Sample Report

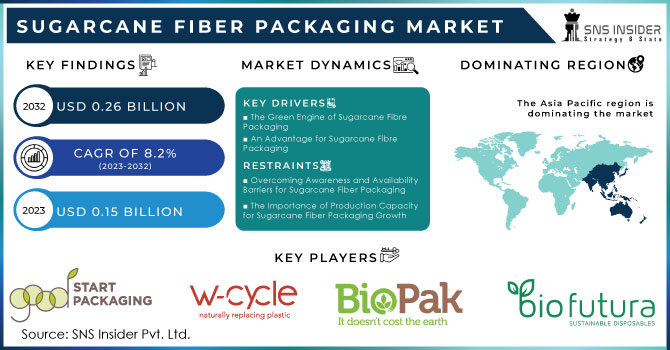

The Sugarcane Fiber Packaging Market was Valued at USD 0.15 Billion in 2023 and is now anticipated to grow to USD 0.26 Billion by 2032, displaying a compound annual growth rate (CAGR) 5.66 % of during the forecast Period 2024 - 2032.

The sugarcane fibre packaging market is driven by a confluence of factors. Consumers are increasingly environmentally conscious, seeking out sustainable solutions in all aspects of their lives, including packaging. Governments around the world are enacting stricter regulations on single-use plastics, further pushing businesses towards eco-friendly alternatives. Sugarcane fibre steps in to meet these demands, offering comparable functionality to traditional options. It can withstand heat, grease, and moisture, making it suitable for a wide range of food and beverage applications. From takeout containers and plates to cups and trays, sugarcane fibre packaging provides a sustainable option without compromising on performance.

Sugarcane fibre packaging is emerging as a game-changer in the packaging industry, offering a sustainable and eco-friendly solution for a wide range of needs. This innovative material, also known as bagasse, is a byproduct of the sugarcane industry, utilizing the leftover fibrous residue after juice extraction. Fueled by the growing emphasis on environmental responsibility and reducing plastic waste, the sugarcane fibre packaging market has seen significant growth. Consumers and businesses alike are driving this demand, seeking eco-friendly alternatives to traditional packaging materials. From food and beverage giants to healthcare and cosmetics companies, even consumer goods manufacturers are embracing sugarcane fibre packaging. This market is further fueled by continuous advancements from key players who are actively investing in research and development to improve the performance and versatility of these products. The process involves transforming sugarcane fibres into a usable material for packaging creation. These processed fibres are then molded into various shapes and sizes, resulting in a diverse range of products including trays, containers, plates, cups, and many more.

When compared to traditional plastic and paper-based packaging that adds to landfill garbage, sugarcane fibre packaging is aesthetically pleasing due to its biodegradability and compo stability. The market for sugarcane fibre packaging is expected to develop because to its eco-friendliness and rising consumer demand, which will open the door for a more sustainable future for the packaging sector.

Market Dynamics

Drivers

The Green Engine of Sugarcane Fibre Packaging

The global Sugarcane Fibre packaging business is transitioning to more sustainable processes, and it is emerging as a leader in this trend, owing to its eco-friendliness. Traditional packaging materials that linger in landfills for years, sugarcane fibre boasts impressive sustainability advantages. Derived from bagasse, a fibrous byproduct of sugarcane processing, sugarcane fibre is a renewable reType . This means it can be replenished at a rapid pace, unlike plastic derived from fossil fuels. Even more compelling is its biodegradability and compostability. Plastic that breaks down into harmful micro plastics, sugarcane fibre decomposes naturally, leaving behind no harmful residues. This significantly reduces environmental impact and contributes to a healthier planet. Sugarcane fibre packaging offers a viable solution that aligns with these values.

An Advantage for Sugarcane Fibre Packaging

Governments around the world are enacting stronger restrictions to combat single-use plastics. This regulation presents a dilemma for enterprises that have long relied on plastic packaging. It gives an excellent opportunity for the sugarcane fibre packaging business. These restrictions essentially force businesses to embrace environmentally friendly alternatives, and sugarcane fibre stands out as a feasible and sustainable option. Businesses that use sugarcane fibre packaging can ensure regulatory compliance and avoid potential penalties. Reduces legal concerns, but also indicates a commitment to environmental responsibility, which may improve their brand image and attract environmentally concerned customers. The regulatory landscape is continually changing, and sugarcane fibre packaging provides a future-proof solution that precisely coincides with the growing emphasis on sustainability. Sugarcane fibre packaging has evolved as a sustainable option for takeout containers, plates, and cups. The market is experiencing extraordinary growth into new territories. Consider environmentally friendly packaging for your favorite lotions, creams, and shampoos! This transition corresponds to rising consumer demand for sustainable beauty solutions. Consumer goods packaging is also taking notice. Sugarcane fibre is being examined for a number of applications, including electronics and toys. This larger applicability allows for a more complete and meaningful approach to sustainable packaging across multiple industries. The future of packaging is looking greener, and sugarcane fibre is set to play a key role in that change.

Restraints

Overcoming Awareness and Availability Barriers for Sugarcane Fiber Packaging

Sugarcane fibre packaging provides a tempting alternative for sustainable packaging, but two major barriers to its wider adoption are limited awareness and availability. Highlighting the environmental benefits of sugarcane fibre compared to traditional packaging can encourage consumers to seek out products with this sustainable option. Availability also presents a challenge. Sugarcane fibre packaging might not be readily available in all regions, especially those with less developed distribution networks. Strengthening these networks is essential to ensure consumers have access to this sustainable choice.

The Importance of Production Capacity for Sugarcane Fiber Packaging Growth

Keeping up with the increasing demand for sugarcane fibre packaging poses an exciting challenge in terms of production capacity. Supply restrictions can appear as the market grows. An essential first step in addressing this is to expand production facilities. Purchasing additional manufacturing facilities will boost sugarcane fibre packaging production satisfying the expanding demands of both consumers and enterprises. Reducing the number of moving parts in current industrial processes can boost productivity and maximize efficiency without requiring major infrastructure modifications. The sugarcane fibre packaging market may capitalize on the rising demand for eco-friendly packaging solutions while ensuring a seamless transition towards a more sustainable future by concentrating on these areas and preventing supply disruptions.

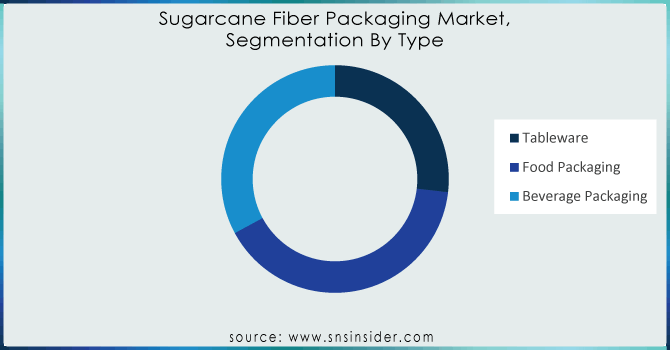

Segmentation Analysis

By Type

Tableware

Food Packaging

Beverage Packaging

Food packaging, with its unparalleled adaptability, is the dominant segment in the sugarcane fibre industry due to its shape-changing properties, sugarcane fibre is the preferred option for a wide range of food products. It meets a variety of demands with its sizzling hot takeout containers, fresh fruit trays, and bakery boxes. Another important asset is functionality while Sugarcane fibre ensures food safety and quality by outperforming conventional materials like plastic and polystyrene in terms of resistance to heat, grease, and moisture. The fact that sugarcane fibre satisfies consumer desire for environmentally friendly products is perhaps its greatest advantage. It is the sustainable leader in food packaging because of its capacity to decompose and biodegrade, which reduces its negative effects on the environment.

Need any customization research on Sugarcane Fiber Packaging Market - Enquiry Now

By Application

Fresh Food

Dry And Frozen Food

Meat Products

Dairy Products

Bakery Products

Beverage

The market for Fresh Food in sugarcane fibre packaging is dominated. In contrast to conventional solutions, sugarcane fibre regulates moisture and permits air circulation, which is essential for maintaining the freshness of fruits, vegetables, and other perishables. Longer shelf lives, less food waste, and perfect synchronization with customer preferences. Sugarcane fibre emerges as the front-runner for fresh food packaging as sustainability gains prominence, providing a mutually beneficial solution for consumers and the environment.

By Manufacturing

Make -to- order Manufacturing

Make-to -Stock Manufacturing

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

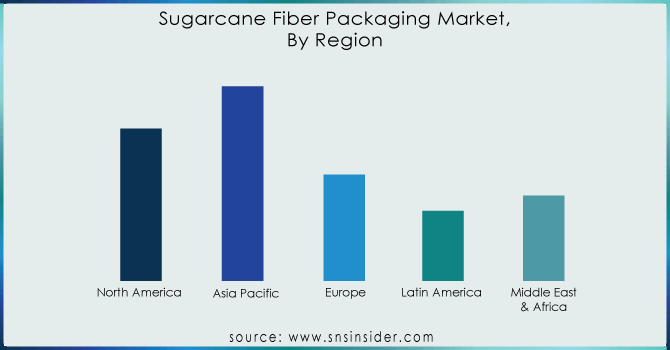

Regional Analysis

Asia-Pacific area driving a convergence of forces to dominate the sugarcane fibre packaging market due to increasing demand for eco-friendly packaging solutions is created by Asia Pacific's large population and growing consumer concern about environmental issues, which is pushing consumers toward sustainable options. Regulations imposed by the regional governments on single-use plastics are also contributing to the adoption of alternatives such as sugarcane fibre by enterprises. The prompt availability and affordability of these eco-friendly packaging materials are further ensured by a robust production base in Asia Pacific. Asia Pacific has the top spot in the sugarcane fibre packaging market at the moment due to a number of factors.

North America Sugarcane fibre packaging is seeing a green rise Customers are requesting sustainable options as they become more environmentally concerned. The government's policies that are in favor of this shift in consumer preferences have created an ideal environment for the market's explosive growth. North American customers are actively looking for eco-friendly packaging choices as they become more conscious of their environmental impact. Government policies are changing to support sustainable alternatives in order to meet this need. These elements working together are driving the sugarcane fibre packaging market in North America and establishing the region as one with enormous growth potential.

Europe is leading the way in the transition to a greener future with packaging made of sugarcane fibre. Businesses are being forced to reconsider their packaging tactics due to strict plastic rules, and sugarcane fibre is an ideal fit because it emphasizes sustainability. Businesses are responding to the eco-consciousness of European consumers by providing sustainable solutions. Regulations forcing them to move away from conventional plastics and a populace favoring environmentally friendly options mean that the European sugarcane fibre packaging industry is expected to grow significantly. In addition to being beneficial for the environment, this turn toward sustainability places European companies at the forefront of the worldwide push for ethical packaging techniques.

Latin America and the Middle East & Africa are about to witness a revolution in sustainable packaging using sugarcane fibre. Despite being regarded as emerging markets, these areas should see rapid growth as a result of increased public awareness of environmental issues. With rising disposable budgets, buyers are growing pickier and more interested in eco-friendly products. This is making the climate more conducive to the spread of sugarcane fibre packaging, along with rising environmental consciousness. These regions' governments will probably follow suit and enact laws that support sustainability, hastening the use of environmentally friendly packaging materials like sugarcane fibre.

Key Players

Some of the major Key Players are Good Start Packaging, Pappco Greenware – Beriwal International, W-cycle, Biopak, Biofutura B.V., Vegware Ltd., Dart Container Corporation, Visfortec Pvt. Ltd., Eco-Products, Inc, Geotegrity, Inc, Detpak India Pvt. Ltd.

Good Start Packaging-Company Financial Analysis

Recent Development

Recent Innovations in Sugarcane Fiber Packaging (June 2024)

Huhtamaki (Finland) collaborated with Danone (France) to create a novel yogurt cup composed of sugarcane fibre and a bio-based barrier, which eliminates the need for typical plastic lining. This innovation improves the cup's recyclability and lowers its environmental footprint.

Vegware (US) introduced a new line of dishwasher-safe sugarcane fibre plates, bowls, and containers. This breakthrough broadens the use of sugarcane fibre packaging beyond single-use solutions, addressing reusability requirements in restaurants and families.

PackTiger (China) has introduced a novel sugarcane fibre thermoforming technology, which enables the fabrication of thinner and lighter packaging choices. This invention saves material usage and decreases the overall carbon footprint of the package.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 0.15 Billion |

| Market Size by 2031 | US$ 0.26 Billion |

| CAGR | CAGR of 5.66 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Type (Tableware, Food Packaging)

|

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Good Start Packaging, Pappco Greenware – Beriwal International, W-cycle, Biopak, Biofutura B.V., Vegware Ltd., Dart Container Corporation, Visfortec Pvt. Ltd., Eco-Products, Inc, Geotegrity, Inc, Detpak India Pvt. Ltd. |

| Key Drivers | • The Green Engine of Sugarcane Fibre Packaging • An Advantage for Sugarcane Fibre Packaging |

| RESTRAINTS | • Overcoming Awareness and Availability Barriers for Sugarcane Fiber Packaging • The Importance of Production Capacity for Sugarcane Fiber Packaging Growth |

Ans: Rising consumer demand for sustainable packaging solutions and stricter regulations on traditional materials are driving the growth of the Sugarcane Fibre Packaging Market.

Ans: The Sugarcane Fibre Packaging Market is expected to grow at a CAGR of 5.66 %

Ans: The Sugarcane Fiber Packaging Market was Valued at USD 0.15 Billion in 2023 and is now anticipated to grow to USD 0.26 Billion by 2032, displaying a compound annual growth rate (CAGR) 5.66 % of during the forecast Period 2024 - 2032.

Ans: The North America region is anticipated to record the Fastest Growing in the Sugarcane Fibre Packaging Market.

Ans: The Fresh Food is leading in the market revenue share in 2023.

Ans: Asia Pacific is expected to hold the largest market share in the Sugarcane Fibre Packaging Market during the forecast period.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Sugarcane Fibre Packaging Market Segmentation, By Type

7.1 Introduction

7.2 Tableware

7.3 Food Packaging

7.4 Beverage Packaging

8. Sugarcane Fibre Packaging Market Segmentation, By Application

8.1 Introduction

8.2 Fresh Food

8.3 Dry and Frozen Food

8.4 Meat Products

8.5 Dairy Products

8.6 Bakery Products

8.7 Beverage

9. Regional Analysis

9.1 Introduction

9.2 North America

9.2.1 Trend Analysis

9.2.2 North America Sugarcane Fibre Packaging Market by Country

9.2.3 North America Sugarcane Fibre Packaging Market By Type

9.2.4 North America Sugarcane Fibre Packaging Market By Application

9.2.5 USA

9.2.5.1 USA Sugarcane Fibre Packaging Market By Type

9.2.5.2 USA Sugarcane Fibre Packaging Market By Application

9.2.6 Canada

9.2.6.1 Canada Sugarcane Fibre Packaging Market By Type

9.2.6.2 Canada Sugarcane Fibre Packaging Market By Application

9.2.7 Mexico

9.2.7.1 Mexico Sugarcane Fibre Packaging Market By Type

9.2.7.2 Mexico Sugarcane Fibre Packaging Market By Application

9.3 Europe

9.3.1 Trend Analysis

9.3.2 Eastern Europe

9.3.2.1 Eastern Europe Sugarcane Fibre Packaging Market by Country

9.3.2.2 Eastern Europe Sugarcane Fibre Packaging Market By Type

9.3.2.3 Eastern Europe Sugarcane Fibre Packaging Market By Application

9.3.2.4 Poland

9.3.2.4.1 Poland Sugarcane Fibre Packaging Market By Type

9.3.2.4.2 Poland Sugarcane Fibre Packaging Market By Application

9.3.2.5 Romania

9.3.2.5.1 Romania Sugarcane Fibre Packaging Market By Type

9.3.2.5.2 Romania Sugarcane Fibre Packaging Market By Application

9.3.2.6 Hungary

9.3.2.6.1 Hungary Sugarcane Fibre Packaging Market By Type

9.3.2.6.2 Hungary Sugarcane Fibre Packaging Market By Application

9.3.2.7 Turkey

9.3.2.7.1 Turkey Sugarcane Fibre Packaging Market By Type

9.3.2.7.2 Turkey Sugarcane Fibre Packaging Market By Application

9.3.2.8 Rest of Eastern Europe

9.3.2.8.1 Rest of Eastern Europe Sugarcane Fibre Packaging Market By Type

9.3.2.8.2 Rest of Eastern Europe Sugarcane Fibre Packaging Market By Application

9.3.3 Western Europe

9.3.3.1 Western Europe Sugarcane Fibre Packaging Market by Country

9.3.3.2 Western Europe Sugarcane Fibre Packaging Market By Type

9.3.3.3 Western Europe Sugarcane Fibre Packaging Market By Application

9.3.3.4 Germany

9.3.3.4.1 Germany Sugarcane Fibre Packaging Market By Type

9.3.3.4.2 Germany Sugarcane Fibre Packaging Market By Application

9.3.3.5 France

9.3.3.5.1 France Sugarcane Fibre Packaging Market By Type

9.3.3.5.2 France Sugarcane Fibre Packaging Market By Application

9.3.3.6 UK

9.3.3.6.1 UK Sugarcane Fibre Packaging Market By Type

9.3.3.6.2 UK Sugarcane Fibre Packaging Market By Application

9.3.3.7 Italy

9.3.3.7.1 Italy Sugarcane Fibre Packaging Market By Type

9.3.3.7.2 Italy Sugarcane Fibre Packaging Market By Application

9.3.3.8 Spain

9.3.3.8.1 Spain Sugarcane Fibre Packaging Market By Type

9.3.3.8.2 Spain Sugarcane Fibre Packaging Market By Application

9.3.3.9 Netherlands

9.3.3.9.1 Netherlands Sugarcane Fibre Packaging Market By Type

9.3.3.9.2 Netherlands Sugarcane Fibre Packaging Market By Application

9.3.3.10 Switzerland

9.3.3.10.1 Switzerland Sugarcane Fibre Packaging Market By Type

9.3.3.10.2 Switzerland Sugarcane Fibre Packaging Market By Application

9.3.3.11 Austria

9.3.3.11.1 Austria Sugarcane Fibre Packaging Market By Type

9.3.3.11.2 Austria Sugarcane Fibre Packaging Market By Application

9.3.3.12 Rest of Western Europe

9.3.3.12.1 Rest of Western Europe Sugarcane Fibre Packaging Market By Type

9.3.2.12.2 Rest of Western Europe Sugarcane Fibre Packaging Market By Application

9.4 Asia-Pacific

9.4.1 Trend Analysis

9.4.2 Asia Pacific Sugarcane Fibre Packaging Market by Country

9.4.3 Asia Pacific Sugarcane Fibre Packaging Market By Type

9.4.4 Asia Pacific Sugarcane Fibre Packaging Market By Application

9.4.5 China

9.4.5.1 China Sugarcane Fibre Packaging Market By Type

9.4.5.2 China Sugarcane Fibre Packaging Market By Application

9.4.6 India

9.4.6.1 India Sugarcane Fibre Packaging Market By Type

9.4.6.2 India Sugarcane Fibre Packaging Market By Application

9.4.7 Japan

9.4.7.1 Japan Sugarcane Fibre Packaging Market By Type

9.4.7.2 Japan Sugarcane Fibre Packaging Market By Application

9.4.8 South Korea

9.4.8.1 South Korea Sugarcane Fibre Packaging Market By Type

9.4.8.2 South Korea Sugarcane Fibre Packaging Market By Application

9.4.9 Vietnam

9.4.9.1 Vietnam Sugarcane Fibre Packaging Market By Type

9.4.9.2 Vietnam Sugarcane Fibre Packaging Market By Application

9.4.10 Singapore

9.4.10.1 Singapore Sugarcane Fibre Packaging Market By Type

9.4.10.2 Singapore Sugarcane Fibre Packaging Market By Application

9.4.11 Australia

9.4.11.1 Australia Sugarcane Fibre Packaging Market By Type

9.4.11.2 Australia Sugarcane Fibre Packaging Market By Application

9.4.12 Rest of Asia-Pacific

9.4.12.1 Rest of Asia-Pacific Sugarcane Fibre Packaging Market By Type

9.4.12.2 Rest of Asia-Pacific Sugarcane Fibre Packaging Market By Application

9.5 Middle East & Africa

9.5.1 Trend Analysis

9.5.2 Middle East

9.5.2.1 Middle East Sugarcane Fibre Packaging Market by Country

9.5.2.2 Middle East Sugarcane Fibre Packaging Market By Type

9.5.2.3 Middle East Sugarcane Fibre Packaging Market By Application

9.5.2.4 UAE

9.5.2.4.1 UAE Sugarcane Fibre Packaging Market By Type

9.5.2.4.2 UAE Sugarcane Fibre Packaging Market By Application

9.5.2.5 Egypt

9.5.2.5.1 Egypt Sugarcane Fibre Packaging Market By Type

9.5.2.5.2 Egypt Sugarcane Fibre Packaging Market By Application

9.5.2.6 Saudi Arabia

9.5.2.6.1 Saudi Arabia Sugarcane Fibre Packaging Market By Type

9.5.2.6.2 Saudi Arabia Sugarcane Fibre Packaging Market By Application

9.5.2.7 Qatar

9.5.2.7.1 Qatar Sugarcane Fibre Packaging Market By Type

9.5.2.7.2 Qatar Sugarcane Fibre Packaging Market By Application

9.5.2.8 Rest of Middle East

9.5.2.8.1 Rest of Middle East Sugarcane Fibre Packaging Market By Type

9.5.2.8.2 Rest of Middle East Sugarcane Fibre Packaging Market By Application

9.5.3 Africa

9.5.3.1 Africa Sugarcane Fibre Packaging Market by Country

9.5.3.2 Africa Sugarcane Fibre Packaging Market By Type

9.5.3.3 Africa Sugarcane Fibre Packaging Market By Application

9.5.2.4 Nigeria

9.5.2.4.1 Nigeria Sugarcane Fibre Packaging Market By Type

9.5.2.4.2 Nigeria Sugarcane Fibre Packaging Market By Application

9.5.2.5 South Africa

9.5.2.5.1 South Africa Sugarcane Fibre Packaging Market By Type

9.5.2.5.2 South Africa Sugarcane Fibre Packaging Market By Application

9.5.2.6 Rest of Africa

9.5.2.6.1 Rest of Africa Sugarcane Fibre Packaging Market By Type

9.5.2.6.2 Rest of Africa Sugarcane Fibre Packaging Market By Application

9.6 Latin America

9.6.1 Trend Analysis

9.6.2 Latin America Sugarcane Fibre Packaging Market by Country

9.6.3 Latin America Sugarcane Fibre Packaging Market By Type

9.6.4 Latin America Sugarcane Fibre Packaging Market By Application

9.6.5 Brazil

9.6.5.1 Brazil Sugarcane Fibre Packaging Market By Type

9.6.5.2 Brazil Sugarcane Fibre Packaging Market By Application

9.6.6 Argentina

9.6.6.1 Argentina Sugarcane Fibre Packaging Market By Type

9.6.6.2 Argentina Sugarcane Fibre Packaging Market By Application

9.6.7 Colombia

9.6.7.1 Colombia Sugarcane Fibre Packaging Market By Type

9.6.7.2 Colombia Sugarcane Fibre Packaging Market By Application

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Sugarcane Fibre Packaging Market By Type

9.6.8.2 Rest of Latin America Sugarcane Fibre Packaging Market By Application

10. Company Profiles

10.1 Good Start Packaging

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 The SNS View

10.2 Pappco Greenware – Beriwal International

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 The SNS View

10.3 W-cycle

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 The SNS View

10.4 Biopak

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 The SNS View

10.5 Biofutura B.V.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 The SNS View

10.6 Vegware Ltd.

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 The SNS View

10.7 Dart Container Corporation

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 The SNS View

10.8 Visfortec Pvt. Ltd.

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 The SNS View

10.9 Eco-Products, Inc,

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 The SNS View

10.10 Geotegrity, Inc,

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 The SNS View

11. Competitive Landscape

11.1 Competitive Benchmarking

11.2 Market Share Analysis

11.3 Recent Developments

11.3.1 Industry News

11.3.2 Company News

11.3.3 Mergers & Acquisitions

12. USE Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Disposable Cups Market size was valued at USD 13.60 billion in 2022 and is expected to Reach USD 23.37 billion by 2030 and grow at a CAGR of 7 % over the forecast period of 2023-2030.

The Cross-Border B2C E-Commerce Market size was valued at USD 948.27 Bn in 2022 and is expected to reach USD 6112 Bn by 2030 and grow at a CAGR of 26.23% over the forecast period 2023-2030.

The Building and Construction Tapes Market size was valued at USD 4.8 billion in 2023 and is expected to Reach USD 7.36 billion by 2031 and grow at a CAGR of 5.5 % over the forecast period of 2024-2031.

The Tube Packaging Market size was valued at USD 11.53 billion in 2023 and is expected to Reach USD 19.81 billion by 2032 and grow at a CAGR of 6.20% over the forecast period of 2024-2032.

The Conical Top Bulk Bag Market was valued at USD 206.92 Billion in 2023 and expected to reach USD 376.51 Billion by 2031 and grow at a CAGR of 7.77% over the forecast period of 2024-2031.

The Plastic Waste Management Market size was valued at USD 37.32 billion in 2023 and is expected to Reach USD 49.55 billion by 2032 and grow at a CAGR of 3.2% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone