Succinic Acid Market Key Insights:

To Get More Information on Succinic Acid Market - Request Sample Report

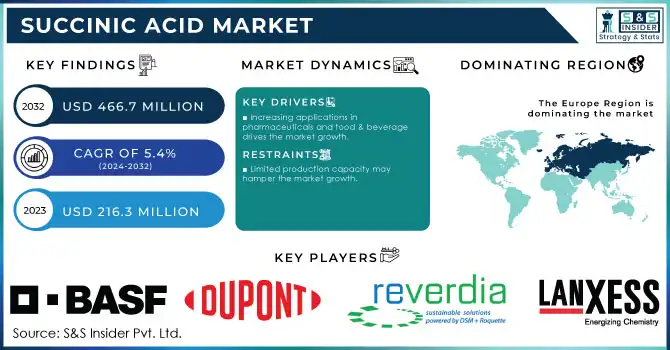

The Succinic Acid Market size was valued at USD 216.3 Million in 2023. It is expected to grow to USD 466.7 Million by 2032 and grow at a CAGR of 5.4% over the forecast period of 2024-2032.

The increasing adoption of biodegradable plastics has made succinic acid a key ingredient in polybutylene succinate, a bio-degradable and sustainable alternative to traditional petroleum-based plastics. PBS is strong and shelters biodegradability characteristics, which makes it suitable for the production of items for packaging, agriculture, and single-use products. Global environmental concerns regarding plastic pollution and its adverse effects on ecological systems are in search of biodegradable solutions, which drives the need for PBS. The transition is most pronounced in areas with strict plastic waste and declining virgin plastic input policies that promote or require green materials.

Hence, with reorienting production in line with these environmentally friendly trends, manufacturers are exhibiting high demand for using succinic acid for PBS as a raw material. In applications like food packaging and agricultural films, where biodegradability can reduce plastic pollution in the environment, PBS also provides an advantage. This shift towards sustainable materials is not only creating a new need for succinic acid to enable biodegradable plastics but also further driving innovations for greener solutions in multiple industries.

The EU’s Directive on Single-Use Plastics (SUP) aims to reduce plastic waste by requiring member states to cut single-use plastic consumption by 50% by 2025 and 80% by 2030. This has accelerated the shift toward biodegradable plastics like polybutylene succinate (PBS), which uses succinic acid as a base component.

Growing utilization of succinic acid as an important intermediate in coatings & resins in industrial applications is benefitting the market growth. Succinic acid is used in the production of alkyd resins, coatings, and plasticizers, thereby enabling improved performance, durability, and adhesion, thereby catering to the construction and automotive sectors. With these sectors consistently growing, especially in developing nations across the Asia-Pacific and Latin America, the demand for top-notch coatings and resins is increasing. In construction, coatings play a critical role in protecting various surfaces from the elements, corrosion, and abrasion, ultimately extending the life of infrastructure and lowering maintenance costs. In the same manner, the automotive sector also became dependent on high-performance coatings for exterior finishes, protective films, and component applications in which durability and aesthetics are key points. Succinic acid has gained traction as a building block to create a variety of resins, which can be customized for these applications, making it a target for manufacturers to achieve sustainability, strength, and performance demanded by the industry.

According to the U.S. Census Bureau, construction spending in the United States reached over USD 1.7 trillion in 2022, highlighting a steady increase in demand for materials that enhance durability and longevity, including advanced coatings and resins.

Succinic Acid Market Dynamics

Drivers

-

Increasing applications in pharmaceuticals and food & beverage drives the market growth.

The growing industrial applications of succinic acid in pharmaceutical and food & beverage industries are driving the growth of the succinic acid market. As a multifunctional additive in the food & beverage industry, it is used as to flavor, pH regulator, and preservative, which is bringing its extensive application in processed food, beverage, and confectionery. This is like escalation since the masses of buyers favor systematic toppings over synthetic options, or more to the point that another finding yields money found it has to be bio-based succinic acid can floss. The pharmaceutical industry is also attracting attention for some succinic acid as an important element that appears in drug formulations, especially as a drug excipient that enhances drug stability and activity. This is the main factor that makes it a versatile starting material for many drug compounds but also makes it a safe compound for metabolic processes hence it will be used in antibiotics, and anti-inflammatory drugs, and it can be used in vitamin production. The simultaneous market utilization of succinic acid in these industries will continue to promote its market expansion, as the respective industries continue to grow due to increased consumer health-based trends and desires for natural and effective ingredients in the healthcare and personal care industries.

According to the U.S. Food and Drug Administration (FDA), the global pharmaceutical industry’s value exceeded USD 1.2 trillion in 2022, with an estimated annual growth rate of 4-5%. This growth is largely driven by an increasing demand for more stable, bio-compatible excipients in drug formulations. Government initiatives, such as the European Medicines Agency's (EMA) push for sustainable and safe excipients, have also encouraged the adoption of bio-based compounds like succinic acid in drug formulations.

Restraint

-

Limited production capacity may hamper the market growth.

Limited production capacity is a significant restraint in the succinic acid market, particularly for bio-based succinic acid. While the demand for bio-succinic acid is rising due to its eco-friendly appeal and versatility, the production infrastructure is still in its early stages of development. Existing bio-based production facilities are not yet able to meet the growing demand at scale, which leads to supply shortages and higher production costs. This limited capacity hampers market growth, as manufacturers in sectors like packaging, automotive, and chemicals may not have reliable access to a consistent supply of bio-succinic acid. Furthermore, expanding production capacity requires substantial investments in advanced fermentation technology and raw materials, which can deter new companies from entering the market. Until production can be scaled up effectively, this constraint will continue to limit the widespread adoption and growth of bio-based succinic acid in various industries.

Succinic Acid Market Segmentation Analysis

By Type

The Petro-based type held the largest market share around 64% in 2023. Its use is due to replacing adipic acid with Petro-based succinic acid for CO2–based PU manufacture. The petrochemical counterpart is derived from the oxidation of the methyl groups of butane to their corresponding carboxy group. It is used in the manufacture of plasticizers and flavor enhancers in numerous processed food products. Segment growth is anticipated to be driven by growing demand from industrial, personal care, and food & beverage sectors.

The bio-based segment is the fastest-growing segment in 2023. The expanding health awareness among consumers along with the growing awareness of the governmental bodies regarding environmental issues is creating a huge obstacle hindering the Petro-based products market growth. Another factor that is expected to boost the demand for a bio-based product is the increasing preference for succinic acid as compared to butane-based maleic anhydride for producing commonly produced chemicals such as fumaric acid, succinic anhydride, plastics, diethylmaleate, polymers, and glyoxylic acid, that are those being manufactured by the petroleum-based butane.

By End-Use

In 2023, the industrial-use segment accounted for the largest market share, at approximately 42%. Biopolymers in itself are in high demand and used as an additive to enhance the performance and sustainability of products, particularly for the production of biodegradable plastics and coatings. In addition to that, succinic acid is included as raw material in something that the automotive, construction, and agricultural industries also depend on to a large extent. Such industrial sectors sought L-lactic acid because of its application to high-performance material synthesis and because it is or can be a bio-based alternative with a lower ecological footprint. Despite the move for all types of industries to find more sustainable replacements for petchems, the industrial-use segment is anticipated to continue to dominate due to its long history of widely diverse applications and the growing demand for sustainable options.

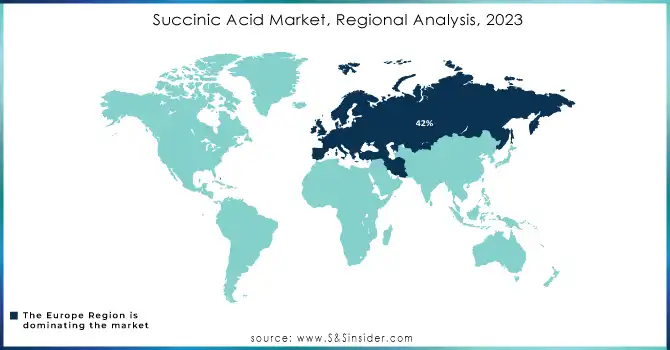

Succinic Acid Market Regional Analysis

Europe region held the highest market share around 42% in 2023. The succinic acid market finds its largest share in the European market owing to various factors such as supportive regulation for sustainable and bio-based chemicals coupled with numerous bio-refinery projects. Policies like the European Green Deal and Circular Economy Action Plan adopted by the European Union it is pushing for an increased use of renewable resources and reducing fossil fuels dependency. As a result, bio-based alternatives have become very important, such as succinic acid, a building block for biodegradable plastic, coating, and other eco-friendly products. In addition, Europe has some of the key biobased succinic acid manufacturers, including fermenting companies (bio-succinic acid manufacturers who prepare the compound, produced from renewable resources). In addition, the existing chemical manufacturing infrastructure of the region with focused innovation and sustainable practices can further drive succinic acid demand in the region. In addition, European consumers and also sectors are concentrating on sustainability and this will lead to a boost in the share of bio-based chemicals, thus providing Europe to be a prominent region in the succinic acid market.

According to a 2022 report from the European Environment Agency (EEA), approximately 62% of new product innovations in the EU focus on sustainability, with a strong preference for bio-based alternatives in manufacturing processes. This trend aligns with the increasing adoption of succinic acid in industries seeking eco-friendly solutions.

Do You Need any Customization Research on Succinic Acid Market - Inquire Now

Key Players

-

BASF SE

-

DuPont

-

GlaxoSmithKline

-

Jiangsu Sopo Chemical Co., Ltd.

-

Reverdia

-

Myriant Corporation

-

Lanxess AG

-

GFBiochemicals

-

Corbion

-

DSM

-

BASF-YPC Co.

-

Cargill

-

SK Chemicals Co., Ltd.

-

Tate & Lyle

-

BioAmber

-

Laxness

-

Novozymes

-

China National Petroleum Corporation (CNPC)

-

Kraton Polymers

-

Emery Oleochemicals

| Company Name | Production Method | Key Applications | Region | Recent Developments |

|---|---|---|---|---|

| BASF SE | Chemical Synthesis, Bio-Based (Fermentation) | Bioplastics, Polyurethanes, Coatings, Packaging | Europe, Global | Expanded bio-based succinic acid production in Spain (2023) |

| DuPont | Chemical Synthesis, Bio-Based | Automotive, Packaging, Pharmaceuticals | Global | Focus on sustainability and bio-based alternatives |

| GlaxoSmithKline | Chemical Synthesis | Pharmaceuticals, Personal Care | Global | Investment in sustainable supply chain solutions |

| Reverdia | Bio-Based (Fermentation) | Bioplastics, Coatings, Food & Beverages | Europe, Global | Expanded production facility in Brazil (2022) |

| Myriant Corporation | Bio-Based (Fermentation) | Polymers, Plastics, Pharmaceuticals | North America | Partnership with global players to expand market presence |

| Lanxess AG | Chemical Synthesis, Bio-Based (Fermentation) | Coatings, Plasticizers, Polymers | Europe, Global | Focus on sustainability in chemical production |

| GFBiochemicals | Bio-Based (Fermentation) | Solvents, Food & Beverages, Packaging | Europe | Expansion of production capacity for bio-based chemicals |

| Corbion | Bio-Based (Fermentation) | Polymers, Pharmaceuticals, Personal Care | Europe, Global | Increase in production capacity for bio-based succinic acid |

| DSM | Bio-Based (Fermentation) | Bioplastics, Automotive, Coatings, Textiles | Europe, Global | Expansion of bio-based production capacity in the Netherlands (2023) |

| Cargill | Bio-Based (Fermentation) | Chemicals, Food & Beverages, Pharmaceuticals | North America, Global | Partnering to strengthen bio-based solutions across sectors |

| SK Chemicals Co., Ltd. | Bio-Based (Fermentation) | Bioplastics, Pharmaceuticals | Asia, Global | Focus on innovation in bio-based succinic acid production |

| Tate & Lyle | Bio-Based (Fermentation) | Food & Beverages, Industrial Chemicals | North America, Europe | Expanding capacity for renewable chemical production |

| BioAmber | Bio-Based (Fermentation) | Polymers, Coatings, Pharmaceuticals | North America, Europe | Joint venture with DuPont Tate & Lyle (2022) for increased production |

| China National Petroleum Corporation (CNPC) | Chemical Synthesis | Chemicals, Fuels | Asia, Global | Focus on expanding chemical production using petrochemical methods |

| Kraton Polymers | Chemical Synthesis, Bio-Based | Polymers, Coatings, Packaging | North America, Europe | Developments in sustainable chemical production |

| Emery Oleochemicals | Bio-Based (Fermentation) | Polymers, Plastics, Personal Care | North America, Europe | Investment in bio-based polymer development |

Recent Developments:

-

In 2023, Reverdia announced the expansion of its production capacity for bio-based succinic acid at its plant in Cassano, Italy. The expansion is in response to the growing demand for sustainable materials across industries such as automotive, packaging, and textiles.

-

In 2023, Genomatica, a leader in bio-based chemical production, successfully commercialized its Bio-BDO (butanediol) production process, which relies on bio-based succinic acid as a precursor. This breakthrough strengthens the role of succinic acid in sustainable chemicals and fuels demand for bio-based alternatives in the plastics and automotive industries.

-

In 2023, BASF announced the expansion of its bio-based succinic acid production capacity at its site in Spain. This expansion is part of BASF’s commitment to increasing the production of sustainable, bio-based chemicals.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 216.3 Million |

| Market Size by 2032 | US$ 466.7 Million |

| CAGR | CAGR of 5.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Petro-based, Bio-based) • By End-Use (Food & Beverages, Pharmaceutical, Coatings, Industrial, Personal Care & Cosmetics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, DuPont, GlaxoSmithKline, Jiangsu Sopo Chemical Co., Ltd., Reverdia, Myriant Corporation, Lanxess AG, GFBiochemicals, Corbion, DSM, BASF-YPC Co., Cargill, SK Chemicals Co., Ltd., Tate & Lyle, BioAmber, Laxness, Novozymes, China National Petroleum Corporation (CNPC), Kraton Polymers, Emery Oleochemicals, and Others |

| Key Drivers | • Increasing applications in pharmaceuticals and food & beverage drives the market growth. |

| Restraints | • Limited production capacity may hamper the market growth. |