Get More Information on Stretch Sleeve & Shrink Sleeve Labels Market - Request Sample Report

The Stretch Sleeve & Shrink Sleeve Labels Market size was USD 15.22 billion in 2023 and is expected to Reach USD 27.51 billion by 2031 and grow at a CAGR of 6.80 % over the forecast period of 2024-2031.

The stretch label can be applied immediately to various container shapes, and is easy to adjust. It's also good for the environment, in addition to its aesthetic appeal. The stretch labels do not stick, do not heat up, and depend only on their elasticity in order to maintain the shape of the container. The stretch sleeve label is more cost effective as compared with standard shrink sleeve and this should be a positive impact on demand in the future.

The disadvantages of stretch packaging labelling are that it takes a lot longer to apply than shrink sleeve labelling, usually less than 150 containers per minute. Where the product is commonly packaged at higher processing speeds of up to 800 containers in a minute, shrink wrap labels are an excellent option for package labelling.

KEY DRIVERS:

By enhancing consumer confidence and product security, anticounterfeiting and tamper detection features embedded on stretch and shrink sleeve labels act as a key driver.

These characteristics safeguard the authenticity of goods, prevent unauthorised replications and display visible evidence of interference in order to protect consumer integrity and brand reputation.

360-Degree graphics capability of shrink and stretch sleeves labels

RESTRAIN:

Dependence on raw materials to affect the market negatively

The availability of raw materials, such as plastics and adhesives, has a bearing on the market for stretch sleeve & shrink sleeve labels. The market can be affected by any disruption in the supply of these materials.

OPPORTUNITY:

There is a compelling opportunity to reduce the overall cost of labelling

As they require fewer labels per product and stretch can be applied to a wider range of surfaces, sleeve & shrink sleeve labels can offer a cost-effective alternative to traditional labels. Businesses can use digital printing to further reduce their costs of labels, enabling them to save on the price of plates and inks.

It can be a valuable opportunity to provide specialized shrink and stretch sleeves that comply with strict regulatory requirements in the pharmaceutical and healthcare sector.

CHALLENGES:

Environmental concerns related to pollution caused due to the use of plastics

There may be a negative impact on the environment when producing stretch or shrink sleeve labels. This is because of the use of plastics as well as a variety of resources not derived from renewable sources.

The impact on the stretch and shrink labels market is expected to be negative due to the conflict between Russia and Ukraine. The war has had a negative effect on the supply chains, increased commodity prices and caused market instability. This growth rate is expected to slow by 1.5% as a result of the war. The supply chain for stretch and shrink sleeve labels was damaged in many ways during the war. Firstly, raw materials for stretch & shrink sleeve labels such as paper, plastics and adhesives are mainly produced in Russia and Ukraine. These prices have increased as a result of the war, which is making it more difficult for manufacturers to make labels. The cost of paper has risen by as a result of the war. Paper imports, which were priced at INR 70,000 per tonne before the war, have now risen to INR 1,00,000 per tonne. There was a 5% increase in plastics prices.

The stretch and shrink label market is estimated to be negatively impacted by the current recession. Due to the economic downturn, companies are cutting costs, which may lead to less demand for elastic and shrink labels. This growth is expected to decelerate by 1.5% in the course of the recession. A survey carried out by the National Retail Federation revealed that in 2023, 70% of retailers plan to reduce their marketing budgets. In June 2023, the Consumer Confidence Index of the Conference Board fell to 98.7, its lowest level since February 2020. In June 2023, the United States' unemployment rate climbed to 3.6%, reaching its highest level since April 2020. The recession could also give rise to increased competition on the stretch and shrink sleeve label markets, taking into account these factors. It might be more probable that companies will switch to cheap, low-cost suppliers when they are looking for savings. This may result in price and margin pressure on the market.

By Polymer Film

OPS

PVC

PE

PETG

Others

By polymer film segment, PVC is the dominating segment, due to the high strength and durability of the PVC. The PVC segment holds around 45% of the total market share and is growing at the CAGR of 7.5%.

By Ink Type

UV

Water Based

Solvent Based

By Printing Technology

Digital Printing

Flexography

Gravure

By Embellishing Type

Cold Foil

Hot Foil

Others

By Application

Healthcare

Food & Beverages

Wine & Spirit

Beauty & Personal Care

Others

Based on the Application, food & beverage segment holds the major share. The food &beverage segment is expected to create the growth of the US $ 3.8 Billion over the forecast period.

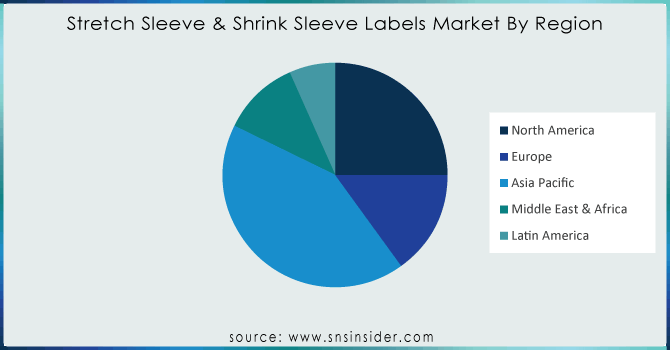

Asia Pacific is the largest market and will be the fastest growing market over the forecast period. The use of stretch sleeves and shrink sleeves has been increased in this region due to the easy availability of raw materials, and cost effectiveness. The increasing demand from the end use industries has also given growth in this region. China’s stretch sleeves market is expected to reach around US $ 1.8 Billion from 2022 to 2030. There was a rise of 14% in China’s beverage output in the year 2022.

The North American market for shrink films and stretch film is estimated to be worth USD 4.62 billion in 2022. In North American region the US is projected to be the dominant market for stretch sleeves labels market. The US market is expected to grow at the CAGR of 6.5%.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Some major key players in the Stretch Sleeve & Shrink Sleeve Labels market are CCL Industries Inc, Berry Global Inc, Fuji Seal International, D&L Packaging, Fort Dearborn Company, Polysack Flexible Packaging Company Ltd, WestRock Company, The Dow Chemical Company, Klockner Pentaplast Group, Cenveo Group and other players.

EcoStretch, a sustainable stretch sleeve option that will be recycled at the company's plant in Austria and returned to the manufacturing process in a completely closed production loop, has been launched by CCL Label.

| Report Attributes | Details |

| Market Size in 2023 | US$ 15.22 Bn |

| Market Size by 2031 | US$ 27.51 Bn |

| CAGR | CAGR of 6.80 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Polymer Film (OPS, PVC, PE, PETG, Others) • by Ink Type (UV, Water Based, Solvent Based) • by Printing Technology (Digital Printing, Flexography, Gravure) • by Embellishing Type (Cold Foil, Hot Foil, Others) • by Application (Healthcare, Food & Beverages, Wine & Spirit, Beauty & Personal Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | CCL Industries Inc, Berry Global Inc, Fuji Seal International, D&L Packaging, Fort Dearborn Company, Polysack Flexible Packaging Company Ltd, WestRock Company, The Dow Chemical Company, Klockner Pentaplast Group, Cenveo Group |

| Key Drivers | • By enhancing consumer confidence and product security, anticounterfeiting and tamper detection features embedded on stretch and shrink sleeve labels act as a key driver. • 360-Degree graphics capability of shrink and stretch sleeves labels |

| Key Restraints | • Dependence on raw materials to affect the market negatively. |

Ans: The Stretch Sleeve & Shrink Sleeve Labels Market is expected to grow at a CAGR of 6.80%.

Ans: The Stretch Sleeve & Shrink Sleeve Labels Market size was USD 15.22 billion in 2023 and is expected to Reach USD 27.51 billion by 2031.

Ans: By enhancing consumer confidence and product security, anticounterfeiting and tamper detection features embedded on stretch and shrink sleeve labels act as a key driver.

Ans: Dependence on raw materials to affect the market negatively.

Ans: The Asia Pacific region held the largest market and will continue to dominate the market.

TABLE OF CONTENT

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact Of Russia-Ukraine war

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

4.3 Supply Demand Gap Analysis

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Stretch Sleeve & Shrink Sleeve Labels Market Segmentation, By Polymer Film

8.1 OPS

8.2 PVC

8.3 PE

8.4 PETG

8.5 Others

9. Stretch Sleeve & Shrink Sleeve Labels Market Segmentation, By Ink Type

9.1 UV

9.2 Water Based

9.3 Solvent Based

10. Stretch Sleeve & Shrink Sleeve Labels Market Segmentation, By Printing Technology

10.1 Digital Printing

10.2 Flexography

10.3 Gravure

11. Stretch Sleeve & Shrink Sleeve Labels Market Segmentation, By Embellishing Type

11.1 Cold Foil

11.2 Hot Foil

11.3 Others

12. Stretch Sleeve & Shrink Sleeve Labels Market Segmentation, By Application

12.1 Healthcare

12.2 Food & Beverages

12.3 Wine & Spirit

12.4 Beauty & Personal Care

12.5 Others

13.1 Introduction

13.2 North America

13.2.1 North America Stretch Sleeve & Shrink Sleeve Labels Market By Country

13.2.2 North America Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.2.3 North America Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.2.4 North America Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.2.5 North America Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.2.6 North America Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.2.7 USA

13.2.7.1 USA Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.2.7.2 USA Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.2.7.3 USA Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.2.7.4 USA Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.2.7.5 USA Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.2.8 Canada

13.2.8.1 Canada Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.2.8.2 Canada Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.2.8.3 Canada Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.2.8.4 Canada Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.2.8.5 Canada Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.2.9 Mexico

13.2.9.1 Mexico Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.2.9.2 Mexico Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.2.9.3 Mexico Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.2.9.4 Mexico Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.2.9.5 Mexico Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.3 Europe

13.3.1 Eastern Europe

13.3.1.1 Eastern Europe Stretch Sleeve & Shrink Sleeve Labels Market By Country

13.3.1.2 Eastern Europe Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.3.1.3 Eastern Europe Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.3.1.4 Eastern Europe Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.3.1.5 Eastern Europe Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.3.1.6 Eastern Europe Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.3.1.7 Poland

13.3.1.7.1 Poland Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.3.1.7.2 Poland Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.3.1.7.3 Poland Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.3.1.7.4 Poland Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.3.1.7.5 Poland Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.3.1.8 Romania

13.3.1.8.1 Romania Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.3.1.8.2 Romania Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.3.1.8.3 Romania Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.3.1.8.4 Romania Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.3.1.8.5 Romania Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.3.1.9 Hungary

13.3.1.9.1 Hungary Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.3.1.9.2 Hungary Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.3.1.9.3 Hungary Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.3.1.9.4 Hungary Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.3.1.9.5 Hungary Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.3.1.10 Turkey

13.3.1.10.1 Turkey Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.3.1.10.2 Turkey Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.3.1.10.3 Turkey Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.3.1.10.4 Turkey Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.3.1.10.5 Turkey Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.3.1.11 Rest of Eastern Europe

13.3.1.11.1 Rest of Eastern Europe Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.3.1.11.2 Rest of Eastern Europe Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.3.1.11.3 Rest of Eastern Europe Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.3.1.11.4 Rest of Eastern Europe Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.3.1.11.5 Rest of Eastern Europe Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.3.2 Western Europe

13.3.2.1 Western Europe Stretch Sleeve & Shrink Sleeve Labels Market By Country

13.3.2.2 Western Europe Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.3.2.3 Western Europe Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.3.2.4 Western Europe Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.3.2.5 Western Europe Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.3.2.6 Western Europe Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.3.2.7 Germany

13.3.2.7.1 Germany Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.3.2.7.2 Germany Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.3.2.7.3 Germany Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.3.2.7.4 Germany Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.3.2.7.5 Germany Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.3.2.8 France

13.3.2.8.1 France Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.3.2.8.2 France Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.3.2.8.3 France Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.3.2.8.4 France Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.3.2.8.5 France Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.3.2.9 UK

13.3.2.9.1 UK Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.3.2.9.2 UK Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.3.2.9.3 UK Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.3.2.9.4 UK Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.3.2.9.5 UK Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.3.2.10 Italy

13.3.2.10.1 Italy Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.3.2.10.2 Italy Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.3.2.10.3 Italy Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.3.2.10.4 Italy Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.3.2.10.5 Italy Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.3.2.11 Spain

13.3.2.11.1 Spain Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.3.2.11.2 Spain Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.3.2.11.3 Spain Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.3.2.11.4 Spain Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.3.2.11.5 Spain Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.3.2.12 The Netherlands

13.3.2.12.1 Netherlands Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.3.2.12.2 Netherlands Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.3.2.12.3 Netherlands Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.3.2.12.4 Netherlands Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.3.2.12.5 Netherlands Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.3.2.13 Switzerland

13.3.2.13.1 Switzerland Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.3.2.13.2 Switzerland Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.3.2.13.3 Switzerland Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.3.2.13.4 Switzerland Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.3.2.13.5 Switzerland Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.3.2.14 Austria

13.3.2.14.1 Austria Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.3.2.14.2 Austria Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.3.2.14.3 Austria Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.3.2.14.4 Austria Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.3.2.14.5 Austria Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.3.2.15 Rest of Western Europe

13.3.2.15.1 Rest of Western Europe Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.3.2.15.2 Rest of Western Europe Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.3.2.15.3 Rest of Western Europe Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.3.2.15.4 Rest of Western Europe Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.3.2.15.5 Rest of Western Europe Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.4 Asia-Pacific

13.4.1 Asia Pacific Stretch Sleeve & Shrink Sleeve Labels Market By Country

13.4.2 Asia Pacific Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.4.3 Asia Pacific Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.4.4 Asia Pacific Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.4.5 Asia Pacific Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.4.6 Asia Pacific Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.4.7 China

13.4.7.1 China Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.4.7.2 China Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.4.7.3 China Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.4.7.4 China Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.4.7.5 China Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.4.8 India

13.4.8.1 India Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.4.8.2 India Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.4.8.3 India Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.4.8.4 India Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.4.8.5 India Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.4.9 Japan

13.4.9.1 Japan Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.4.9.2 Japan Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.4.9.3 Japan Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.4.9.4 Japan Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.4.9.5 Japan Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.4.10 South Korea

13.4.10.1 South Korea Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.4.10.2 South Korea Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.4.10.3 South Korea Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.4.10.4 South Korea Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.4.10.5 South Korea Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.4.11 Vietnam

13.4.11.1 Vietnam Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.4.11.2 Vietnam Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.4.11.3 Vietnam Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.4.11.4 Vietnam Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.4.11.5 Vietnam Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.4.12 Singapore

13.4.12.1 Singapore Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.4.12.2 Singapore Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.4.12.3 Singapore Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.4.12.4 Singapore Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.4.12.5 Singapore Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.4.13 Australia

13.4.13.1 Australia Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.4.13.2 Australia Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.4.13.3 Australia Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.4.13.4 Australia Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.4.13.5 Australia Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.4.14 Rest of Asia-Pacific

13.4.14.1 APAC Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.4.14.2 APAC Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.4.14.3 APAC Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.4.14.4 APAC Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.4.14.5 APAC Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.5 The Middle East & Africa

13.5.1 Middle East

13.5.1.1 Middle East Stretch Sleeve & Shrink Sleeve Labels Market By country

13.5.1.2 Middle East Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.5.1.3 Middle East Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.5.1.4 Middle East Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.5.1.5 Middle East Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.5.1.6 Middle East Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.5.1.7 UAE

13.5.1.7.1 UAE Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.5.1.7.2 UAE Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.5.1.7.3 UAE Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.5.1.7.4 UAE Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.5.1.7.5 UAE Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.5.1.8 Egypt

13.5.1.8.1 Egypt Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.5.1.8.2 Egypt Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.5.1.8.3 Egypt Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.5.1.8.4 Egypt Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.5.1.8.5 Egypt Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.5.1.9 Saudi Arabia

13.5.1.9.1 Saudi Arabia Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.5.1.9.2 Saudi Arabia Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.5.1.9.3 Saudi Arabia Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.5.1.9.4 Saudi Arabia Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.5.1.9.5 Saudi Arabia Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.5.1.10 Qatar

13.5.1.10.1 Qatar Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.5.1.10.2 Qatar Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.5.1.10.3 Qatar Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.5.1.10.4 Qatar Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.5.1.10.5 Qatar Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.5.1.11 Rest of Middle East

13.5.1.11.1 Rest of Middle East Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.5.1.11.2 Rest of Middle East Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.5.1.11.3 Rest of Middle East Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.5.1.11.4 Rest of Middle East Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.5.1.11.5 Rest of Middle East Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.5.2 Africa

13.5.2.1 Africa Stretch Sleeve & Shrink Sleeve Labels Market By Country

13.5.2.2 Africa Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.5.2.3 Africa Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.5.2.4 Africa Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.5.2.5 Africa Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.5.2.6 Africa Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.5.2.7 Nigeria

13.5.2.7.1 Nigeria Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.5.2.7.2 Nigeria Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.5.2.7.3 Nigeria Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.5.2.7.4 Nigeria Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.5.2.7.5 Nigeria Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.5.2.8 South Africa

13.5.2.8.1 South Africa Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.5.2.8.2 South Africa Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.5.2.8.3 South Africa Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.5.2.8.4 South Africa Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.5.2.8.5 South Africa Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.5.2.9 Rest of Africa

13.5.2.9.1 Rest of Africa Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.5.2.9.2 Rest of Africa Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.5.2.9.3 Rest of Africa Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.5.2.9.4 Rest of Africa Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.5.2.9.5 Rest of Africa Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.6 Latin America

13.6.1 Latin America Stretch Sleeve & Shrink Sleeve Labels Market By Country

13.6.2 Latin America Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.6.3 Latin America Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.6.4 Latin America Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.6.5 Latin America Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.6.6 Latin America Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.6.7 Brazil

13.6.7.1 Brazil Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.6.7.2 Brazil Africa Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.6.7.3Brazil Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.6.7.4 Brazil Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.6.7.5 Brazil Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.6.8 Argentina

13.6.8.1 Argentina Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.6.8.2 Argentina Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.6.8.3 Argentina Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.6.8.4 Argentina Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.6.8.5 Argentina Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.6.9 Colombia

13.6.9.1 Colombia Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.6.9.2 Colombia Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.6.9.3 Colombia Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.6.9.4 Colombia Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.6.9.5 Colombia Stretch Sleeve & Shrink Sleeve Labels Market By Application

13.6.10 Rest of Latin America

13.6.10.1 Rest of Latin America Stretch Sleeve & Shrink Sleeve Labels Market By Polymer Film

13.6.10.2 Rest of Latin America Stretch Sleeve & Shrink Sleeve Labels Market By Ink Type

13.6.10.3 Rest of Latin America Stretch Sleeve & Shrink Sleeve Labels Market By Printing Technology

13.6.10.4 Rest of Latin America Stretch Sleeve & Shrink Sleeve Labels Market By Embellishing Type

13.6.10.5 Rest of Latin America Stretch Sleeve & Shrink Sleeve Labels Market By Application

14 Company Profile

14.1 CCL Industries Inc

14.1.1 Company Overview

14.1.2 Financials

14.1.3 Product/Services Offered

14.1.4 SWOT Analysis

14.1.5 The SNS View

14.2 Berry Global Inc

14.2.1 Company Overview

14.2.2 Financials

14.2.3 Product/Services Offered

14.2.4 SWOT Analysis

14.2.5 The SNS View

14.3 Fuji Seal International

14.3.1 Company Overview

14.3.2 Financials

14.3.3 Product/Services Offered

14.3.4 SWOT Analysis

14.3.5 The SNS View

14.4 D&L Packaging

14.4.1 Company Overview

14.4.2 Financials

14.4.3 Product/Services Offered

14.4.4 SWOT Analysis

14.4.5 The SNS View

14.5 Fort Dearborn Company

14.5.1 Company Overview

14.5.2 Financials

14.5.3 Product/Services Offered

14.5.4 SWOT Analysis

14.5.5 The SNS View

14.6 Polysack Flexible Packaging Company Ltd

14.6.1 Company Overview

14.6.2 Financials

14.6.3 Product/Services Offered

14.6.4 SWOT Analysis

14.6.5 The SNS View

14.7 WestRock Company

14.7.1 Company Overview

14.7.2 Financials

14.7.3 Product/Services Offered

14.7.4 SWOT Analysis

14.7.5 The SNS View

14.8 The Dow Chemical Company

14.8.1 Company Overview

14.8.2 Financials

14.8.3 Product/Services Offered

14.8.4 SWOT Analysis

14.8.5 The SNS View

14.9 Klockner Pentaplast Group

14.9.1 Company Overview

14.9.2 Financials

14.9.3 Product/Services Offered

14.9.4 SWOT Analysis

14.9.5 The SNS View

14.10 Cenveo Group

14.10.1 Company Overview

14.10.2 Financials

14.10.3 Product/Services Offered

14.10.4 SWOT Analysis

14.10.5 The SNS View

15. Competitive Landscape

15.1 Competitive Bench marking

15.2 Market Share Analysis

15.3 Recent Developments

15.3.1 Industry News

15.3.2 Company News

15.3.3 Mergers & Acquisitions

16. USE Cases and Best Practices

17. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Sustainable Plastic Packaging Market size was valued at USD 91.25 billion in 2023 and is expected to Reach USD 138.95 billion by 2031 and grow at a CAGR of 5.4% over the forecast period of 2024-2031.

The Construction Tapes Market size was USD 3.02 billion in 2023 and is expected to Reach USD 4.34 billion by 2031 and grow at a CAGR of 4.64% over the forecast period of 2024-2031.

The Tube Packaging Market size was valued at USD 11.53 billion in 2023 and is expected to Reach USD 19.81 billion by 2032 and grow at a CAGR of 6.20% over the forecast period of 2024-2032.

The Cross-Border B2C E-Commerce Market size was valued at USD 948.27 Bn in 2022 and is expected to reach USD 6112 Bn by 2030 and grow at a CAGR of 26.23% over the forecast period 2023-2030.

The Rigid Plastic Packaging Market size was USD 147282.50 million in 2023 and is expected to Reach USD 224324.15 million by 2031 and grow at a CAGR of 5.4 % over the forecast period of 2024-2031.

The Biodegradable Water Bottles Market size was USD 2.41 billion in 2023 and is expected to Reach USD 3.5 billion by 2031 and grow at a CAGR of 4.8% over the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone