Stratospheric UAV Payload Technology Market Report Scope & Overview:

To get more information on Stratospheric UAV Payload Technology Market - Request Free Sample Report

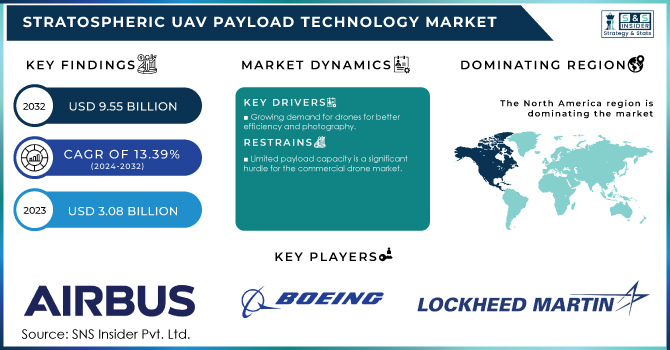

The Stratospheric UAV Payload Technology Market was valued at USD 3.08 billion in 2023 and is expected to reach USD 9.55 billion by 2032, growing at a CAGR of 13.39% over the forecast period of 2024-2032.

Stratospheric UAV are growing popular because they depend on batteries for their power due to several factors. Battery technology's proven reliability and versatility make it a trusted choice, with established charging infrastructure further simplifying operations. Investment in the drone industry fuels research into improving battery life, weight, and efficiency, while advancements in Battery Management Systems enhance their capabilities. The environmental benefits of batteries add another layer of appeal, aligning with the push for sustainability. The current cost advantage over solar and fuel cell technology, both challenged by limitations in sunlight and infrastructure respectively, solidifies batteries as the dominant power source for stratospheric UAV.

MARKET DYNAMICS

KEY DRIVERS:

-

Growing demand for drones for better efficiency and photography.

-

The rise of civil and commercial drone applications in the stratospheric uav payload technology market.

Drones have taken the world of photography and videography, These radio-controlled marvels have become increasingly user-friendly and capture stunning high-quality photos and videos. Drones are now mainstream consumer items, with some priced under $500. Their affordability and ease of operation have opened doors for a variety of research and commercial applications, all leveraging the unique perspective of low-altitude aerial photography. Drones can take both vertical and oblique photos, providing valuable data for diverse fields. From archaeologists uncovering secrets of the past to power line inspectors ensuring safety, these versatile flying cameras are revolutionizing how we see the world. Even oil and gas companies and commercial advertisers are embracing drone technology to capture unique footage.

RESTRAIN:

-

Limited payload capacity is a significant hurdle for the commercial drone market.

This limited capacity restricts the kind of technology a drone can use. A drone that needs to fly longer or carry a heavier load has to grow in size, needing a more powerful engine just to stay airborne. Think of upgrading the camera or adding fancy sensors like LIDAR –that all adds weight, pushing the drone to bulk up to handle it. This payload limitation is a significant hurdle for the commercial drone market. While drones offer incredible potential, their inability to carry more sophisticated equipment hinders their full capabilities.

OPPORTUNITY:

-

Drones are growing popularity for delivering a safer future for military logistics.

Military operations are embracing a new delivery system drones, Unmanned Aerial Vehicles (UAV) are taking on cargo delivery tasks, inspired by the success of commercial giants like Amazon. This shift is driven by a critical need for safer and faster methods of resupplying troops on the battlefield. Currently, ground convoys are the primary mode of transport, exposing soldiers and supplies to enemy attacks. UAV, on the other hand, navigate through the skies, offering a more secure route with less risk of ambush. Furthermore, by eliminating the need for soldiers to man ground vehicles, UAV delivery reduces risk exposure. Their flexible aerial routes can also potentially lead to faster deliveries compared to traditional methods.

CHALLENGES:

-

The criminal use of drones, despite their beneficial applications, poses a growing security threat.

Terrorists exploit their low cost and ease of operation to launch coordinated attacks. Their ability to navigate challenging terrains makes them ideal for accessing restricted areas. Even without military-grade technology, extremist groups can use commercially available components to build weaponized drones, posing a significant risk to civilians and infrastructure. Furthermore, drug cartels are utilizing drones for smuggling activities. The ease of access and potential for weaponization highlight the critical need for regulations to address the growing security concerns surrounding unregulated drone use.

IMPACT OF RUSSIA UKRAINE WAR

The impact of Russia-Ukraine conflict has slowed down the Stratospheric UAV Payload Technology Market. Supply chains majorly affected, and governments might focus spending on other military needs in the short term. The war could also boost demand for military drones for spying and communication, especially in Europe and North America. This could push these countries to make their own drone tech, creating a long-term benefit for domestic manufacturers. The war might even speed up development of new drone tech as militaries seek advantages. So, while the war might hurt the market in the short term, it could lead to a stronger and more advanced market in the long run.

IMPACT OF ECONOMIC SLOWDOWN

Economic downturn has majorly affected the stratospheric UAV payload market . Companies reduce their expenses, leading to less cash for research and development of new UAV tech. Weaker demand also takes flight as businesses focus on core operations, putting fancy drone payloads on hold. Investors get cold feet too, making it harder for startups with fresh UAV ideas to get funding. If stratospheric UAV payloads prove cost-effective, they could gain traction during economic hardship. Companies might see them as a way to cut costs in the long run. The governments might still fund strategic UAV tech for defense or public safety, even during a slowdown.

KEY MARKET SEGMENTS

By Type

-

Telemetry Intelligence

-

Electronic Intelligence

-

Communication Intelligence

By Technology

-

Persistent Communication

-

Direct Broadcast TV & Radio and Imagery & Sensing

By Platform

-

Commercial

-

Scientific

-

Military

The military sub-segment leading the Stratospheric UAV Payload Technology Market in 2024. This dominance is fueled by a surge in global defense spending. These increased budgets are translating into significant investments in UAV technology. Military forces are seeking drones with extended range, increased payload capacity, and cutting-edge communication systems. This financial backing allows for the rapid deployment and integration of UAVs into various military operations, ensuring they stay at the forefront of defense technology.

REGIONAL ANALYSIS

-

North America

-

Europe

-

Asia pacific

-

Middle East & Africa

-

Latin America

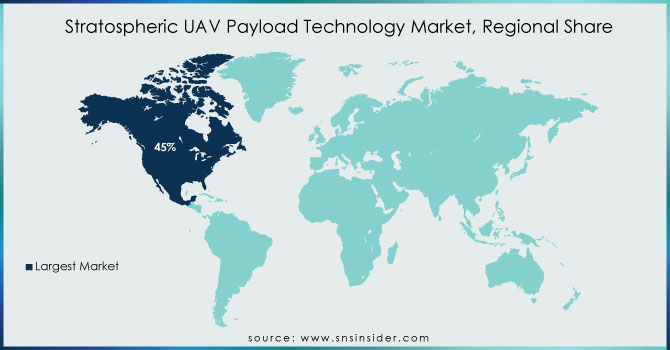

NorthAmerica region is dominating in the Stratospheric UAV Payload Technology Market, capturing over a 45% market share in 2023. This region leads the pack due to the presence of major aerospace and defense players like Lockheed Martin, Boeing, and Northrop Grumman. These giants heavily invest in research and development of advanced UAV payloads, solidifying North America's position. Additionally, strong government funding for military and environmental monitoring programs using stratospheric UAVs fuels demand for this technology. Europe is secound leading aerospace industry with leading players like Airbus and Thales. Stringent environmental regulations in the region also encourage the use of stratospheric UAVs for air quality monitoring and climate research. Moreover, growing interest in border security applications using UAVs contributes to market growth.

Need any customization research on Stratospheric UAV Payload Technology Market - Enquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Some of the major players in the stratospheric UAV payload technology market are Airbus SAS (Netherlands), OpenStratosphere SA (Switzerland), The Boeing Company (US), Near Space Systems, Inc. (the US), Lockheed Martin Corporation (US), AeroVironment, Inc., SZ DJI Technology Co., Ltd., Parrot Drones SAS, Draganfly Inc., and other players.

RECENT DEVELOPMENT

-

In March 2024: Boeing eyeing Spirit AeroSystems in a potential takeover has US defense officials worried. Spirit supplies parts for key military aircraft and politicians fear the deal could impact US defense capabilities.

-

In March 2024: Kratos Defense & Security is celebrating a $57.6 million contract win from the US Department of Defense (DoD). This contract modification expands on a previous agreement and tasks Kratos with producing 70 BQM-177A aerial target drones.

-

In April 2023: Indian startup Solar Industries is making waves in the drone market. Their indigenously developed electric UAV, the Nagastra, secured a contract with the Indian Army, beating out competition from Israel and Poland. Nagastra boasts impressive features like 2-meter precision strikes, 60-minute flight time, and both manual and autonomous operation with a 30km range.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.08 Billion |

| Market Size by 2032 | US$ 9.55 Billion |

| CAGR | CAGR of 13.39% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Telemetry Intelligence, Electronic Intelligence, Communication Intelligence, Signal Intelligence) • By Technology (Persistent Communication, Direct Broadcast TV & Radio, Imagery & Sensing) • By Platform (Commercial, Scientific, Military) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Airbus SAS (Netherlands), OpenStratosphere SA (Switzerland), The Boeing Company (US), Near Space Systems, Inc. (the US), Lockheed Martin Corporation (US), AeroVironment, Inc., SZ DJI Technology Co., Ltd., Parrot Drones SAS, Draganfly Inc. |

| Drivers | • Growing demand for drones for better efficiency and photography. • The rise of civil and commercial drone applications in the stratospheric uav payload technology market. |

| Restraints | • Limited payload capacity is a significant hurdle for the commercial drone market. |