Get More Information on Stick Packaging Market - Request Sample Report

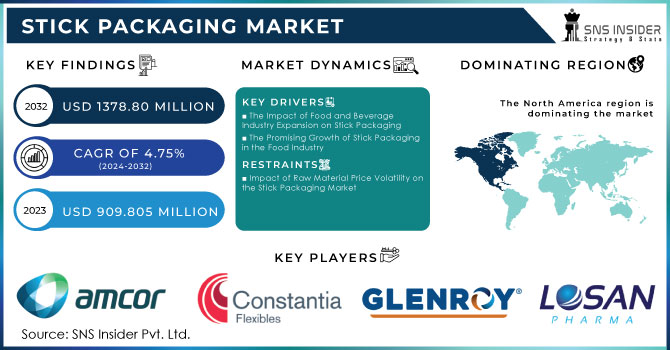

The Stick Packaging Market Size was valued at USD 909.805 million in 2023 and is expected to reach USD 1378.80 million by 2032 and grow at a CAGR of 4.75% over the forecast period 2024-2032.

The stick packaging market is witnessing substantial growth, driven by the rising demand for convenient, single-serve solutions, particularly in the food & beverage, pharmaceutical, and cosmetics sectors. As consumers increasingly favor portability and ease of use, stick packaging offers an ideal format for on-the-go consumption. This shift in consumer preferences aligns with the growing awareness of sustainability, prompting demand for eco-friendly packaging materials. Companies are responding with innovations such as biodegradable and recyclable solutions to meet these environmental concerns. For instance, Tetra Pak's launch of stick packs made from renewable materials reflects the industry's focus on reducing the environmental impact of single-use packaging. Technological advancements are also playing a crucial role in driving market expansion. High-speed packaging machinery and improvements in material barrier properties, such as moisture and oxygen resistance, are enhancing the functionality and appeal of stick packaging. Amcor’s introduction of high barrier stick packs exemplifies this trend, offering extended product protection. These technological innovations, combined with the push towards sustainability, are not only boosting market growth but also transforming the stick packaging landscape, as companies seek to balance consumer convenience with environmental responsibility. The synergy between innovation, consumer demand, and sustainability is propelling the market forward.

The stick packaging market in the United States is poised for significant growth, driven by various factors, including the increasing adoption of stick packaging within the booming pharmaceutical and food & beverage sectors, the rise of e-commerce, and the demand for compact and lightweight packaging solutions. In particular, the food and beverage industry is leveraging stick packaging for its convenience and portability, meeting the needs of consumers who favor on-the-go consumption. This packaging format not only enhances the user experience but also provides substantial benefits for manufacturers and retailers. The airtight and sealed design of stick packs preserves the freshness and potency of products, ensuring consumers receive the nutritional benefits intended. According to the United States Department of Commerce, Bureau of the Census, there were 41,080 food and beverage processing plants in 2021, highlighting a robust infrastructure that supports the stick packaging market. The continuous expansion of these processing plants indicates a sustained increase in demand for innovative packaging solutions that can efficiently deliver products to consumers. Furthermore, the growing trend of e-commerce has accelerated the need for packaging that is not only functional but also suitable for shipping and storage, further amplifying stick packaging's appeal. As businesses seek to streamline their operations and enhance customer satisfaction, the versatility and efficacy of stick packaging position it as a vital solution in today’s marketplace. This correlation between market dynamics, consumer preferences, and industry growth underscores the vital role stick packaging will continue to play in meeting the evolving needs of the American consumer.

Drivers

The Impact of Food and Beverage Industry Expansion on Stick Packaging

The expansion of the food and beverage industry is a primary driver of growth in the stick packaging market, as this sector represents one of the largest consumers of innovative packaging solutions. As of 2021, the United States Department of Commerce, Bureau of the Census reported a significant presence of 41,080 food and beverage processing plants, underscoring the industry’s robust infrastructure that supports packaging innovation. This growth is largely attributed to changing consumer lifestyles, which increasingly favor convenient, single-serve options that stick packs provide. Stick packaging not only enhances consumer convenience and portability but also offers significant advantages for manufacturers and retailers. The airtight and sealed nature of stick packs ensures that products remain fresh and potent throughout their shelf life, preserving essential nutrients and flavors that are critical for consumer satisfaction. This characteristic is particularly valuable for health-conscious consumers seeking nutritional benefits from their food products. Moreover, as the food and beverage market continues to evolve, there is a growing emphasis on sustainable practices, prompting manufacturers to explore eco-friendly stick packaging options. This dual focus on convenience and sustainability aligns perfectly with current consumer trends, further driving the demand for stick packs. As the food and beverage sector continues to flourish, so too does the need for innovative packaging solutions that meet the evolving expectations of both manufacturers and consumers, establishing stick packaging as a vital component in this dynamic industry.

The Promising Growth of Stick Packaging in the Food Industry

The stick packaging market is poised for significant growth, primarily driven by the increasing demand for innovative packaging solutions in the food industry. The rise in online food transactions has heightened the need for flexible, durable, and secure packaging options, positioning stick packaging as a long-term growth candidate. This versatile packaging format is ideal for a variety of products, including ready-mixed spice blends and single-serve beverages like coffee, tea, sugar, and milk, as it effectively preserves freshness and extends shelf life.Moreover, the trend of product launches is further fueling the demand for stick packaging across various food sectors. For instance, in October 2023, Herbaland Naturals introduced Daily Probiotic Powder Sticks, designed for both adults and children aged three and older, featuring easy-melt powders that cater to modern consumer preferences. Similarly, in November 2023, BERRY Global launched a refillable version of their Exclusive stick packaging, promoted as 'perfect' for diverse personal care applications, including deodorants and solid skincare products.

Additionally, the growing popularity of instant healthy food and beverage options, such as bottled water blends, emphasizes convenience, driving consumers toward stick-packaged products. As consumers increasingly gravitate towards easy-to-use and portable options, the stick packaging format is becoming a favored choice. Consequently, the rising demand for stick packaging within the food industry is anticipated to significantly boost market growth in the coming years.

Restraints

Impact of Raw Material Price Volatility on the Stick Packaging Market

Volatility in raw material prices poses a significant challenge for the stick packaging market, particularly in light of the environmental concerns associated with plastic use. According to the World Economic Forum, approximately 8 million tonnes of plastic enter the oceans annually, equating to the contents of one garbage truck being dumped into the sea every minute. This alarming figure is projected to rise to two trucks per minute by 2030 and four per minute by 2050, potentially leading to devastating ecological consequences. Plastic comprises nearly 90% of all marine debris, amplifying the urgency of addressing waste and recycling issues within the packaging industry. As the call for sustainable practices grows louder, recycling has emerged as a critical focus in the stick packaging sector. It not only offers reuse value but also helps mitigate waste production. In response to these challenges, various regulations aimed at promoting eco-friendly packaging solutions have been implemented, such as the European Union's Packaging and Packaging Waste Directive (94/62/EC) and the Federal Trade Commission's (FTC) 16 CFR Section 260. These regulations are tightening restrictions on plastic packaging, which could hinder overall market growth. Consequently, the stick packaging market must adapt by investing in sustainable materials and innovative solutions to navigate these regulatory pressures and meet consumer demand for environmentally friendly options.

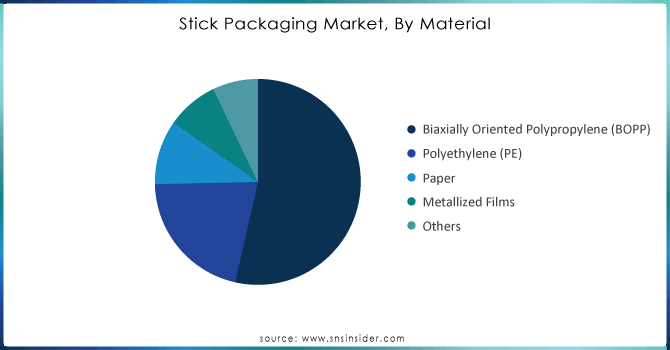

By Material

Based on Material, Biaxially Oriented Polypropylene (BOPP) has emerged as the dominant material in the stick packaging market, capturing an impressive 53.56% of the market share in 2023. This significant share is primarily due to BOPP's exceptional properties, including high tensile strength, excellent clarity, and moisture resistance, which make it ideal for a wide range of applications across various industries. Its lightweight nature and ability to provide a robust barrier against oxygen and moisture ensure that products remain fresh and retain their quality for extended periods. Recently, several companies have recognized the potential of BOPP in stick packaging, leading to innovative product launches and developments. For instance, in 2023, Amcor introduced a new line of BOPP stick packaging solutions specifically designed for the food and beverage sector, enhancing product visibility and ensuring longer shelf life. Additionally, Mondi Group announced the expansion of its BOPP film portfolio with the launch of eco-friendly options that align with growing sustainability trends. These advancements highlight the ongoing commitment of industry leaders to leverage BOPP's advantages while meeting consumer demand for convenience and quality, solidifying its position as the preferred choice in the stick packaging market.

Need any customization research on Stick Packaging Market - Enquiry Now

By End User

In 2023, the Food & Beverages sector emerged as the largest revenue-generating end user in the stick packaging market, capturing a substantial 40.67% market share. This dominance is attributed to the increasing consumer preference for convenient, portable packaging solutions that align with today’s fast-paced lifestyles. Stick packaging provides an ideal format for single-serving products such as sauces, seasonings, and beverage mixes, ensuring freshness and extending shelf life. Companies are actively innovating within this segment to cater to rising consumer demands. For instance, Herbaland Naturals recently launched Daily Probiotic Powder Sticks, aimed at providing health-conscious consumers with easy-to-use, single-serve nutritional options. Similarly, Nestlé has introduced stick packs for its coffee products, enhancing convenience for on-the-go consumers while maintaining product quality. Additionally, BERRY Global has expanded its offerings in the beverage segment by launching stick packaging solutions for instant drink mixes, catering to the growing trend of ready-to-drink products. As consumer preferences continue to shift towards healthier and more convenient food options, the Food & Beverages sector is expected to further drive the stick packaging market's growth, prompting continued innovation and investment in this lucrative segment.

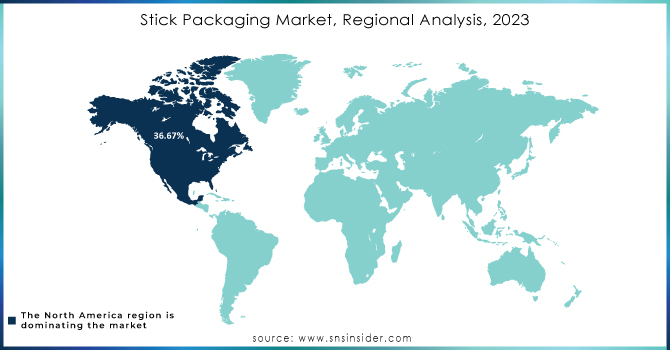

In 2023, North America emerged as the leading region in the stick packaging market, commanding an impressive 36.67% of the market share. This dominance can be attributed to a combination of factors, including the rapid growth of the food and beverage industry, heightened consumer demand for convenient packaging solutions, and increased focus on sustainability. The region's robust infrastructure and innovative packaging technologies have facilitated the widespread adoption of stick packaging across various sectors. Prominent companies are actively developing products to capitalize on this growing trend. For instance, Amcor has introduced a new line of eco-friendly stick packs made from recyclable materials, addressing the increasing consumer demand for sustainable packaging solutions. Meanwhile, Tetra Pak has launched innovative stick packaging options for liquid products, emphasizing convenience and shelf stability, which resonates with North American consumers' fast-paced lifestyles. Additionally, Kraft Heinz has started utilizing stick packaging for its single-serve condiment products, enhancing portability and ease of use. As health-conscious consumers increasingly seek out products that offer both convenience and quality, the North American stick packaging market is poised for continued growth, with companies investing in innovative solutions to meet evolving consumer preferences.

In 2023, the Asia-Pacific region emerged as the fastest-growing market for stick packaging, driven by rapid urbanization, rising disposable incomes, and an increasing preference for convenience-oriented products. This region has witnessed a surge in demand for stick packaging across various industries, particularly in food and beverages, pharmaceuticals, and personal care. Companies are rapidly innovating to cater to this dynamic market. For example, Cargill launched a new line of single-serve stick packs for its flavored oils and vinegars, aimed at health-conscious consumers seeking easy and portable options. Similarly, Nestlé expanded its portfolio with the introduction of stick packs for instant coffee and drink mixes, enhancing convenience for on-the-go consumers in countries like India and China. Moreover, Hindustan Unilever is leveraging stick packaging for its personal care products, allowing consumers to experience single-use applications that reduce waste and improve hygiene. The region's growing e-commerce channels further amplify the demand for flexible packaging solutions, as consumers increasingly seek quick and easy purchasing options. With a focus on convenience, portability, and sustainability, the Asia-Pacific stick packaging market is expected to experience significant growth, driven by continued innovation and strategic product launches from key industry players.

Some of the major key players in Stick Packaging Market who offer their product and offering:

Amcor plc (Eco-friendly stick packs, flexible packaging solutions)

Constantia Flexibles (Multi-layer stick packaging for food and beverage)

Glenroy, Inc. (Stand-up pouches and stick packaging for snacks and condiments)

Losan Pharma (Pharmaceutical stick packs for powders and granules)

Catalent, Inc. (Stick packs for nutraceuticals and pharmaceuticals)

Fres-co System USA, Inc. (Custom stick packaging for coffee and beverage mixes)

GFR Pharma (Stick packaging for dietary supplements and health products)

ARANOW Packaging Machinery, S.L. (Stick pack machines and solutions)

ePac Holdings, LLC (Custom printed stick packs for various products)

Korpack (Flexible stick packaging solutions for food products)

Polynova Industries Inc. (Packaging solutions for personal care products)

Elitefill (Stick packs for liquid products and powders)

FLEXI Srl (Innovative stick packaging for food and pharmaceuticals)

Kimac Industries (Stick packaging for various consumer goods)

CarePac (Pharmaceutical stick packs and dosing solutions)

T.H.E.M. (Custom stick packaging for snacks and food items)

Associated Labels & Packaging (Flexible stick packaging for various applications)

Others

In November 2023, UDG Healthcare invested in digital printing technology for stick packs, enabling on-demand customization and short-run production, which is expected to enhance the market's responsiveness to consumer preferences

In October 2023, Winpak announced a partnership with a major coffee brand to launch single-serve instant coffee sticks, showcasing the versatility and growing popularity of stick packaging in the beverage industry

In September 2023, Sonoco introduced a child-resistant stick pack format for over-the-counter medications, addressing safety concerns for parents and expanding the use of stick packs in the pharmaceutical sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 909.805 Million |

| Market Size by 2032 | USD 1378.80 Million |

| CAGR | CAGR of 4.75 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Biaxially Oriented Polypropylene (BOPP),Polyethylene (PE),Paper ,Metallized Films,Others) • By End User(Food & Beverages ,Pharmaceuticals,Cosmetics ,Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amcor plc, Constantia Flexibles, Glenroy, Inc., Losan Pharma, Catalent, Inc., Fres-co System USA, Inc., GFR Pharma, ARANOW Packaging Machinery, S.L., ePac Holdings, LLC, Korpack, Polynova Industries Inc, Elitefill, FLEXI Srl, Kimac Industries, CarePac, T.H.E.M., Associated Labels & Packaging & Others |

| Key Drivers | • The Impact of Food and Beverage Industry Expansion on Stick Packaging • The Promising Growth of Stick Packaging in the Food Industry |

| RESTRAINTS | • Impact of Raw Material Price Volatility on the Stick Packaging Market |

Ans: The Stick Packaging Market grow at a CAGR of 4.75% over the forecast period of 2024-2032.

Ans: The Stick Packaging Market Size was valued at USD 909.805 million in 2023 and is expected to reach USD 1378.80 million by 2032

Ans: The major growth factor of the Stick Packaging Market is the increasing demand for convenient, single-serve packaging solutions driven by busy lifestyles and the rising popularity of on-the-go products in the food and beverage industry.

Ans: The Biaxially Oriented Polypropylene (BOPP) segment dominated the Stick Packaging Market.

Ans: North America dominated the Stick Packaging Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Material Usage Trends, by Material Type, by Region, 2023

5.2 Upcoming Projects, by Region, by Type (Residential, Commercial, Industrial)

5.3 Building Permit Issuances, by Region, 2023

5.4 Labor Market Statistics, by Region, 2023

5.5 Technology Adoption, by Technology Type

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Stick Packaging Market Segmentation, by Material

7.1 Chapter Overview

7.2 Biaxially Oriented Polypropylene (BOPP)

7.2.1 Biaxially Oriented Polypropylene (BOPP)Market Trends Analysis (2020-2032)

7.2.2 Biaxially Oriented Polypropylene (BOPP)Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Polyethylene (PE)

7.3.1 Polyethylene (PE)Market Trends Analysis (2020-2032)

7.3.2 Polyethylene (PE)Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Paper

7.4.1 Paper Market Trends Analysis (2020-2032)

7.4.2 Paper Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 Metallized Films

7.5.1Metallized Films Market Trends Analysis (2020-2032)

7.5.2 Metallized Films Market Size Estimates and Forecasts to 2032 (USD Million)

7.6 Others

7.6.1 Others Market Trends Analysis (2020-2032)

7.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

8. Stick Packaging Market Segmentation, by End User

8.1 Chapter Overview

8.2 Food & Beverages

8.2.1 Food & Beverages Market Trends Analysis (2020-2032)

8.2.2 Food & Beverages Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Pharmaceuticals

8.3.1 Pharmaceuticals Market Trends Analysis (2020-2032)

8.3.2 Pharmaceuticals Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Cosmetics

8.4.1 Cosmetics Market Trends Analysis (2020-2032)

8.4.2 Cosmetics Market Size Estimates and Forecasts to 2032 (USD Million)

8.5Others

8.5.1 Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Stick Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.2.3 North America Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.2.4 North America Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.2.5 USA

9.2.5.1 USA Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.2.5.2 USA Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.2.6 Canada

9.2.6.1 Canada Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.2.6.2 Canada Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.2.7 Mexico

9.2.7.1 Mexico Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.2.7.2 Mexico Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Smart Irrigation Controllers Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.1.3 Eastern Europe Smart Irrigation Controllers Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.3.1.4 Eastern Europe Smart Irrigation Controllers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3.1.5 Poland

9.3.1.5.1 Poland Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.3.1.5.2 Poland Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3.1.6 Romania

9.3.1.6.1 Romania Smart Irrigation Controllers Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.3.1.6.2 Romania Smart Irrigation Controllers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.3.1.7.2 Hungary Smart Irrigation Controllers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.3.1.8.2 Turkey Smart Irrigation Controllers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.3.1.9.2 Rest of Eastern Europe Smart Irrigation Controllers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Smart Irrigation Controllers Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.2.3 Western Europe Smart Irrigation Controllers Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.3.2.4 Western Europe Smart Irrigation Controllers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3.2.5 Germany

9.3.2.5.1 Germany Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.3.2.5.2 Germany Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3.2.6 France

9.3.2.6.1 France Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.3.2.6.2 France Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3.2.7 UK

9.3.2.7.1 UK Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.3.2.7.2 UK Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3.2.8 Italy

9.3.2.8.1 Italy Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.3.2.8.2 Italy Smart Irrigation Controllers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3.2.9 Spain

9.3.2.9.1 Spain Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.3.2.9.2 Spain Smart Irrigation Controllers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.3.2.10.2 Netherlands Smart Irrigation Controllers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.3.2.11.2 Switzerland Smart Irrigation Controllers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3.2.12 Austria

9.3.2.12.1 Austria Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.3.2.12.2 Austria Smart Irrigation Controllers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.3.2.13.2 Rest of Western Europe Smart Irrigation Controllers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.4 Asia-Pacific

9.4.1 Trends Analysis

9.4.2 Asia-Pacific Stick Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.4.3 Asia-Pacific Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.4.4 Asia-Pacific Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.4.5 China

9.4.5.1 China Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.4.5.2 China Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.4.6 India

9.4.5.1 India Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.4.5.2 India Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.4.5 Japan

9.4.5.1 Japan Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.4.5.2 Japan Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.4.6 South Korea

9.4.6.1 South Korea Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.4.6.2 South Korea Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.4.7 Vietnam

9.4.7.1 Vietnam Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.2.7.2 Vietnam Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.4.8 Singapore

9.4.8.1 Singapore Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.4.8.2 Singapore Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.4.9 Australia

9.4.9.1 Australia Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.4.9.2 Australia Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.4.10 Rest of Asia-Pacific

9.4.10.1 Rest of Asia-Pacific Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.4.10.2 Rest of Asia-Pacific Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Smart Irrigation Controllers Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.1.3 Middle East Smart Irrigation Controllers Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.5.1.4 Middle East Smart Irrigation Controllers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.5.1.5 UAE

9.5.1.5.1 UAE Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.5.1.5.2 UAE Smart Irrigation Controllers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.5.1.6.2 Egypt Smart Irrigation Controllers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.5.1.7.2 Saudi Arabia Smart Irrigation Controllers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.5.1.8.2 Qatar Smart Irrigation Controllers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.5.1.9.2 Rest of Middle East Smart Irrigation Controllers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Smart Irrigation Controllers Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.2.3 Africa Smart Irrigation Controllers Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.5.2.4 Africa Smart Irrigation Controllers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.5.2.5.2 South Africa Smart Irrigation Controllers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.5.2.6.2 Nigeria Smart Irrigation Controllers Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.5.2.7.2 Rest of Africa Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Stick Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.6.3 Latin America Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.6.4 Latin America Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.6.5 Brazil

9.6.5.1 Brazil Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.6.5.2 Brazil Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.6.6 Argentina

9.6.6.1 Argentina Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.6.6.2 Argentina Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.6.7 Colombia

9.6.7.1 Colombia Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.6.7.2 Colombia Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Stick Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

9.6.8.2 Rest of Latin America Stick Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10. Company Profiles

10.1 Amcor plc

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Constantia Flexibles

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Glenroy, Inc.

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Losan Pharma

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Catalent, Inc.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Fres-co System USA, Inc.

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 GFR Pharma

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 ARANOW Packaging Machinery, S.L

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 ePac Holdings ,LLC

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Korpack

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Material

Biaxially Oriented Polypropylene (BOPP)

Polyethylene (PE)

Paper

Metallized Films

Others

By End User

Food & Beverages

Pharmaceuticals

Cosmetics

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia-Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The PET Packaging Market size was valued at USD 77.24 billion in 2023 and is expected to Reach USD 120.85 billion by 2032 and grow at a CAGR of 5.1% over the forecast period of 2024-2032.

The Perfume Packaging Market Size was valued at USD 3.32 billion in 2023 and is expected to reach USD 5.96 billion by 2032 and grow at a CAGR of 6.73% over the forecast period 2024-2032.

The Polystyrene Packaging Market size was USD 23.06 billion in 2023 and is expected to Reach USD 31.32 billion by 2031 and grow at a CAGR of 3.9% over the forecast period of 2024-2031.

The Security Paper Market size was valued at USD 18.19 billion in 2023 and is expected to Reach USD 32.60 billion by 2032 and grow at a CAGR of 6.7 % over the forecast period of 2024-2032.

U.S. Packaged Food Market size was valued at USD 1128 billion in 2023 and will reach USD 1734.95 billion by 2032 and grow at a CAGR of 4.9% by 2024-2032

The Cheese Packaging Market, valued at USD 3.59 billion in 2023, is anticipated to reach USD 5.36 billion by 2032, growing at a CAGR of 4.60% by 2032.

Hi! Click one of our member below to chat on Phone