Get More Information on Sterilized Packaging Market - Request Sample Report

The Sterilized Packaging Market Share was valued at USD 31.78 Billion in 2023 and is expected to reach USD 50.27 Billion by 2032, growing at a CAGR of 5.24 % during 2024-2032.

Sterilized packaging includes disposable plastic shells, coverings, and different packing materials that are subjected to terminal sterilization to eradicate all Materials of microbial life, guaranteeing the safety and effectiveness of medical devices, instruments, and other items. This kind of packaging is crucial in preserving sterility by stopping contamination while being stored and transported. Per the International Organization for Standardization (ISO), ensuring patient safety relies heavily on sterilizing medical devices, making properly sterilized packaging crucial for infection control effectiveness. Sterilized packaging offers advantages to patients, manufacturers, and healthcare providers. For patients, the guarantee of cleanliness lowers the chance of infections and complications after surgery. Manufacturers gain improved market reputation and reduced liability, while healthcare providers gain confidence in products meeting strict safety standards. Aseptic packaging is crucial in the food market as it needs to retain its shape after sterilization to achieve expected benefits. It not only prolongs the shelf life of food products but also improves their portability, allowing for broader distribution and higher profits for processors by minimizing spoiling and waste. The increasing need for sterilized packaging in medical and food industries emphasizes its crucial role in ensuring quality, safety, and efficiency in contemporary supply chains, underscoring its significance in boosting consumer trust and operational efficiency.

The growing use of sterile and disinfected packaging in industries like medical device manufacturing, food and beverage, and pharmaceuticals is due to the increased cases of viral infections from non-sterile tools. As the recognition of the dangers associated with non-sterile products increases, there is also a rising need for sterilized packaging options. Sterilization not only guarantees the safety of medical tools and equipment but also prolongs their shelf life, particularly when using aseptic packaging techniques.The growing use of clean and sanitized packaging in various industries like medical device manufacturing, food and beverage, pharmaceuticals, is due to the increased occurrence of viral infections linked to non-sterile tools. With the increasing recognition of the dangers presented by non-sterile items, the need for sterilized packaging options is also on the rise. Sterilization not only guarantees the safety of medical devices and equipment but also prolongs their shelf life, particularly when aseptic packaging techniques are employed. The need for products that stay fresh for longer is a major factor driving the growth of this market, especially in the food and beverage market, as consumers prefer items with extended shelf life. The FDA stresses how crucial efficient packaging is for preserving the safety and quality of food items, highlighting the demand for advanced sterilized packaging options. The advancement of technology, including the creation of new sterilization methods and materials, has further supported the expansion of the market. For example, improvements in aseptic processing and packaging technologies enable manufacturers to create and package items in a clean environment, reducing the chances of contamination. Moreover, strict government rules about product safety and hygiene standards, particularly in healthcare and food industries, further strengthen the requirements.

Drivers

The intersection of environmentally friendly practices and growth in the Sterilized Packaging market leads to sustainable solutions

The sterilized packaging market is set to experience substantial growth, in line with the increasing focus on eco-friendly packaging options and sustainability in the overall packaging sector. The rise is driven by a growing emphasis on safety and hygiene, especially in healthcare and food industries, as well as an increasing need for environmentally friendly packaging choices. Examples of companies such as Ecolean in Sweden demonstrate this change through the development of lightweight packaging that reduces the amount of raw materials used while still ensuring the quality of the product. Ecolean's method boosts production efficiency with sealed, sterilized packages while also cutting down on the carbon footprint linked to regular packaging methods. Utilizing environmentally-friendly materials and practices in sterilized packaging is in accordance with regulations like the EU Packaging and Packaging Waste Directive, which strives to advance sustainability in the packaging sector. With changing global trade dynamics, packaging system suppliers are adjusting their strategies to meet regulations, increasing the need for sterilized packaging solutions that are efficient and environmentally friendly. Additionally, the rise in e-commerce and the need for safe and green packaging choices are also contributing to the expansion of the market. The sterilized packaging market is growing because of increased health safety worries and a push for sustainability in the packaging market to lower carbon emissions and environmental effects, all while satisfying consumer demands for safety and quality.

Restraints

The difficulties of plastic waste in the Sterilized Packaging market pose a challenge when navigating the environmental dilemma.

The increasing worries about the environment are expected to hinder the expansion of the sterilized packaging Market in the upcoming years. The healthcare sector significantly impacts environmental pollution, making up around 4 to 5 percent of worldwide greenhouse gas emissions, with supply chains contributing 82% of this amount. The significant use of disposable polypropylene for sterilizing surgical instruments creates a large amount of plastic waste, with an approximate annual production of 115 million kilograms in the U.S. alone. Frequently utilized packaging materials, such as PET, PE, and PP, are frequently combined with barrier materials like oPA and EVOH, which play a part in this problem. Items constructed from polyethylene are usually utilized just once, which worsens waste issues due to their decomposition period of over 400 years. Regrettably, just around ten percent of polyethylene is recycled, causing substantial pollution and damage to wildlife habitats. In addition, the manufacture of polypropylene results in an astonishing 1.3 billion tons of carbon dioxide being released into the atmosphere. Therefore, although sterilized packaging is essential for safety and cleanliness, the use of plastics creates major obstacles in balancing sterility needs with sustainability objectives, increasing the need to tackle carbon emissions and climate change.

By Material

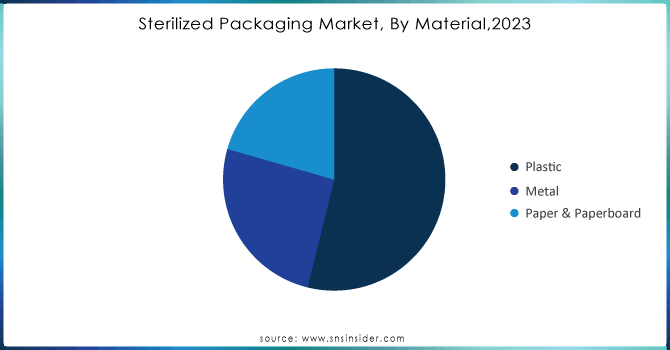

In 2023, plastic became the primary material in the sterilized packaging market, representing a significant 53.89% of the total revenue. The main reason for plastic's extensive use is its versatility, lightweight qualities, and ability to act as a barrier, which is perfect for preserving the sterility of medical devices and food items. Top companies are constantly coming up with new ideas in this area. For example, Amcor introduced its Eco-Tite® range, which has advanced barrier features and sustainable designs to meet the increasing need for eco-friendly packaging options. Likewise, Sealed Air Corporation launched its Bubble Wrap® brand with added antimicrobial features for increased defense against contamination while in transit and in storage. The Cardinal Health brand has broadened its product range by introducing specially designed sterile, single-use polyethylene packaging for surgical instruments, meeting safety and hygiene requirements in healthcare environments. These advancements highlight the market's move to more effective and secure plastic packaging options that also adhere to strict regulatory requirements. With the increasing need for sterilized packaging, particularly in healthcare and food industries, plastic will continue to be a crucial material that fuels innovation and progress in sterilized packaging technologies.

Need any customization research on Sterilized Packaging Market - Enquiry Now

By End User

In 2023, the Medical & Pharmaceutical was the leading sector in the sterilized packaging market, contributing to an impressive 54.44% of the overall revenue. The rise is fueled by the growing need for safety, cleanliness, and adherence to regulations in medical and pharmaceutical fields. Major corporations are actively engaging in innovation to address these demands. BD has recently released a new series of BD Vacutainer® blood collection tubes, which include improved sterile packaging for safe sample collection and transport. At the same time, AptarGroup, Inc. launched its Pharma Pack solutions, created to enhance drug safety and effectiveness through offering packaging that is tamper-evident and resistant to moisture. Moreover, Cardinal Health broadened its range of products with SureSeal™ sterile barrier packaging for medical devices, highlighting the significance of preserving sterility while in transit and storage. Medline Industries has also been driven by the emphasis on sustainable practices to offer eco-friendly sterilized packaging options in line with environmental objectives. With the healthcare market changing due to new technologies and more regulations, the need for advanced sterilized packaging options for medical and pharmaceutical uses will help maintain its position as a top choice, guaranteeing the safety and efficacy of important healthcare items.

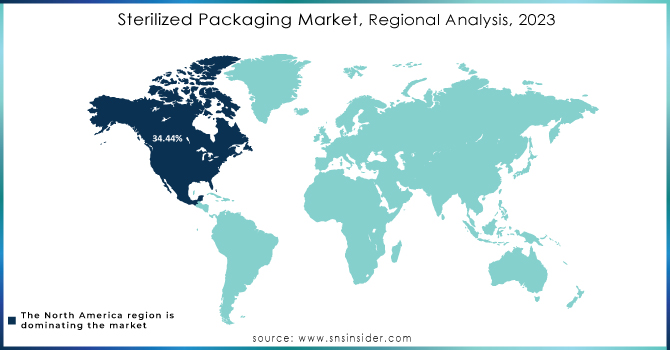

In 2023, North America dominated the sterilized packaging market, securing a substantial 34.44% of the revenue. The region's sophisticated healthcare facilities, strict regulations, and growing focus on safety and cleanliness in medical and pharmaceutical uses are responsible for this expansion. Businesses in North America are making significant advancements in product innovation in order to meet this growing demand. As an example, Amcor, a top provider of eco-friendly packaging solutions, introduced the Amcor Rigid Plastics range, specifically catering to sterile packaging for pharmaceuticals and medical devices to improve safety and prolong shelf life.Sterigenics, a well-known company offering sterilization services, has enlarged its operations in the United States to meet the growing need for sterilized medical goods by increasing its ethylene oxide sterilization capabilities. West Pharmaceutical Services, a company specializing in pharmaceutical packaging solutions, unveiled its new *Westar® sterilized packaging products with upgraded barrier properties. These products are crafted to adhere to the strict standards set by the FDA and other regulatory authorities. The increase in investments in sterilized packaging technologies is being driven by the U.S. government's efforts to enhance healthcare safety and compliance, as well as the growing elderly population. North America's positioning as its innovative product releases and supportive regulatory environments strengthen a key player in the global sterilized packaging market, leading to sustained growth and development in the region.

By 2023, the Asia-Pacific region had become the top market for sterilized packaging due to quick industrial growth, a growing healthcare market, and rising consumer interest in safe and clean products. Nations such as China, India, and Japan are leading the way in this growth, driven by the growth in pharmaceutical manufacturing capabilities and an increased emphasis on healthcare safety standards. China has seen notable progress, with companies such as Daiichi Sankyo introducing cutting-edge sterilized packaging solutions designed for biologics and injectable, guaranteeing conformity with strict regulatory standards. Furthermore, Amcor grew its presence in the Indian market by launching a new range of sterile flexible pouches for food and pharmaceutical use, catering to the demand for safe and convenient packaging.Sundaram Medical Devices in India introduced the Steripak™ line of sterilized packaging for surgical tools, focusing on simplicity and improved safety during surgeries. Moreover, Sealed Air Corporation has advanced in the area by improving its Bubblestone™ packaging solutions for the medical device market, with a focus on boosting protection from contamination.

Japan's strict emphasis on safety rules has resulted in a higher need for cutting-edge sterilized packaging technologies. Mitsubishi Chemical Holdings has launched the innovative Mitsubishi SteriPack, which uses advanced barrier materials to preserve sterility during the supply chain process.with the growing healthcare demands, government support, and more investments in innovative packaging technologies, the Asia-Pacific region is becoming a key player in the global sterilized packaging market, ensuring ongoing growth and progress in the future.

Some of the key players in the sterilized packaging market, along with their notable products & Offering:

Amcor (Flexibles for medical devices and pharmaceuticals)

DuPont (Tyvek® medical packaging)

Placon Corporation (Thermoform packaging for medical devices)

Wipak (Wipak Medical – sterile barrier packaging)

TekniPlex (Tekni-Fil™ sterile barrier packaging)

Wihuri Group (Wipak’s sterile flexible packaging solutions)

SteriPack Contract Manufacturing (Custom sterile packaging solutions)

Riverside Medical Packaging Ltd (Bespoke sterilization packaging)

Anqing Kangmingna Packaging Co., Ltd. (Plastic sterile packaging solutions)

Nelipak Healthcare Packaging (Custom rigid and flexible packaging solutions)

West Pharmaceutical Services, Inc. (Westar® and NovaPure® packaging solutions)

MediPak (Sterilization pouches and wraps)

Schott AG (Pharmaceutical vials and syringes)

Berry Global, Inc. (Medical packaging products including bags and pouches)

BASF (High-performance polymer films for medical packaging)

Klockner Pentaplast (KP Films for sterile medical packaging)

CSP Technologies, Inc. (Active packaging solutions for pharmaceuticals)

Sealed Air Corporation (Bubble wrap and other cushioning materials)

SABIC (Sterilization-grade materials for medical devices)

Huhtamaki Group (Protective packaging for the food and healthcare sectors), Others

On May 2024 Sharp Services has announced the expansion of its Macungie, PA site to increase production capacity for sterile injectables secondary packaging. This move supports rising demand in the sterilizable packaging market, enhancing Sharp’s ability to serve pharmaceutical clients with advanced sterile packaging solutions.

On April 2024 – SIG has officially launched the Prime 55 In-Line Aseptic, a cutting-edge filling machine specifically designed for pre-made, spouted aseptic pouches. This innovative system offers in-line sterilization, streamlining the supply chain and significantly reducing production costs.

June 2023 - Oliver Healthcare Packaging, a supplier of sterile barrier flexible packaging, acquired EK-Pack Folien, a foil and film technology manufacturer. The acquisition gives excellent control over the supply chain and allows the company to innovate new products to meet customer needs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 31.78 Billion |

| Market Size by 2032 | USD 50.27 Billion |

| CAGR | CAGR of 5.24% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Plastic, Metal, Paper & Paperboard) • By Type (Trays, Pouches, Clamshell, Others) • By End User (Medical & Pharmaceutical, Cosmetic & Personal Care, Food & Beverage) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amcor, DuPont, Placon Corporation, Wipak, TekniPlex, Wihuri Group, SteriPack Contract Manufacturing, Riverside Medical Packaging Ltd, Anqing Kangmingna Packaging Co., Ltd., Nelipak Healthcare Packaging, West Pharmaceutical Services, Inc., MediPak, Schott AG, Berry Global, Inc., BASF, Klockner Pentaplast, CSP Technologies, Inc., Sealed Air Corporation, SABIC, and Huhtamaki Group & Others |

| Key Drivers | • The intersection of environmentally friendly practices and growth in the Sterilized Packaging market leads to sustainable solutions |

| RESTRAINTS | • The difficulties of plastic waste in the Sterilized Packaging industry pose a challenge when navigating the environmental dilemma. |

Ans: The Sterilized Packaging Market grow at a CAGR of 5.24 %over the forecast period of 2024-2032.

Ans: The Sterilized Packaging Market was valued at USD 31.78 Billion in 2023 and is expected to reach USD 50.27 Billion by 2032, growing at a CAGR of 5.24 % during 2024-2032.

Ans: A major growth factor of the sterilized packaging market is the increasing demand for safety and hygiene in healthcare and food industries, driven by rising concerns over contamination and infection prevention.

Ans: The Plastic segment dominated the Sterilized Packaging Market.

Ans: North America dominated the Sterilized Packaging Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Material Usage Trends, by Material Type, by Region, 2023

5.2 Upcoming Projects, by Region, by Type (Residential, Commercial, Industrial)

5.3 Building Permit Issuances, by Region, 2023

5.4 Labor Market Statistics, by Region, 2023

5.5 Technology Adoption, by Technology Type

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Sterilized Packaging Market Segmentation, by Material

7.1 Chapter Overview

7.2 Plastic

7.2.1 Plastic Market Trends Analysis (2020-2032)

7.2.2 Plastic Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Metal

7.3.1 Metal Market Trends Analysis (2020-2032)

7.3.2 Metal Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Paper & Paperboard

7.4.1 Paper & Paperboard Market Trends Analysis (2020-2032)

7.4.2 Paper & Paperboard Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Sterilized Packaging Market Segmentation, by Type

8.1 Chapter Overview

8.2 Trays

8.2.1 Trays Market Trends Analysis (2020-2032)

8.2.2 Trays Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Pouches

8.3.1 Pouches Market Trends Analysis (2020-2032)

8.3.2 Pouches Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Clamshell

8.4.1 Clamshell Market Trends Analysis (2020-2032)

8.4.2 Clamshell Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Others

8.5.1 Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Sterilized Packaging Market Segmentation, by End User

9.1 Chapter Overview

9.2 Medical & Pharmaceutical

9.2.1 Medical & Pharmaceutical Market Trends Analysis (2020-2032)

9.2.2 Medical & Pharmaceutical Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Cosmetic & Personal Care

9.3.1 Cosmetic & Personal Care Market Trends Analysis (2020-2032)

9.3.2 Cosmetic & Personal Care Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Food & Beverage

9.4.1 Food & Beverage Market Trends Analysis (2020-2032)

9.4.2 Food & Beverage Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Sterilized Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.2.4 North America Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.5 North America Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.2.6.2 USA Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.6.3 USA Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.2.7.2 Canada Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.7.3 Canada Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.2.8.2 Mexico Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.8.3 Mexico Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Sterilized Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.1.6.2 Poland Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.6.3 Poland Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.1.7.2 Romania Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.7.3 Romania Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Sterilized Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.4 Western Europe Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.5 Western Europe Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.6.2 Germany Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.6.3 Germany Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.7.2 France Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.7.3 France Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.8.2 UK Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.8.3 UK Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.9.2 Italy Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.9.3 Italy Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.10.2 Spain Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.10.3 Spain Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.13.2 Austria Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.13.3 Austria Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Sterilized Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.6.2 China Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.6.3 China Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.7.2 India Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.7.3 India Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.8.2 Japan Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.8.3 Japan Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.9.2 South Korea Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.9.3 South Korea Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.10.2 Vietnam Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.10.3 Vietnam Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.11.2 Singapore Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.11.3 Singapore Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.12.2 Australia Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.12.3 Australia Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Sterilized Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.1.4 Middle East Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.5 Middle East Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.1.6.2 UAE Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.6.3 UAE Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Sterilized Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.2.4 Africa Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.5 Africa Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Sterilized Packaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.6.4 Latin America Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.5 Latin America Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.6.6.2 Brazil Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.6.3 Brazil Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.6.7.2 Argentina Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.7.3 Argentina Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.6.8.2 Colombia Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.8.3 Colombia Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Sterilized Packaging Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Sterilized Packaging Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Sterilized Packaging Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11. Company Profiles

11.1 Amcor

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 DuPont

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Placon Corporation

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Wipak

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 TekniPlex

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Wihuri Group

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 SteriPack Contract Manufacturing

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Riverside Medical Packaging Ltd

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Anqing Kangmingna Packaging Co., Ltd.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Nelipak Healthcare Packaging

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Material

Plastic

Metal

Paper & Paperboard

By Type

Trays

Pouches

Clamshell

Others

By End User

Medical & Pharmaceutical

Cosmetic & Personal Care

Food & Beverage

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Flexible Packaging Market size was valued at USD 257.14 billion in 2023 and is expected to Reach USD 411.78 billion by 2032 and grow at a CAGR of 5.37% over the forecast period of 2024-2032.

The Bamboo Cosmetic Packaging Market Size was valued at USD 0.34 billion in 2023 and is projected to reach USD 0.62 billion by 2032 and grow at a CAGR of 6.85% over the forecast periods 2024 -2032.

The Transportation Management Systems (TMS) Market Size was valued at USD 13.5 billion in 2023 and is expected to reach USD 49.04 billion by 2031 and grow at a CAGR of 17.5% over the forecast period 2024-2031.

The Blow-Fill-Seal Technology Market size was USD 3.04 billion in 2023 and is expected to Reach USD 5.97 billion by 2031 and grow at a CAGR of 8.94 % over the forecast period of 2024-2031.

The Beverage Cartons Market size was USD 17.30 billion in 2023 and is expected to Reach USD 24.42 billion by 2031 and grow at a CAGR of 4.4 % over the forecast period of 2024-2031.

The Pharmaceutical Plastic Bottles Market Size was valued at USD 36.5 billion in 2023 and is expected to reach USD 82.01 billion by 2031 and grow at a CAGR of 10.65 % over the forecast period 2024-2031.

Hi! Click one of our member below to chat on Phone