Sterile Medical Packaging Market Report Scope & Overview:

Get More Information on Sterile Medical Packaging Market - Request Sample Report

The Sterile Medical Packaging Market Size was USD 47.70 billion in 2023 and is expected to reach USD 107.95 billion by 2032 and grow at a CAGR of 9.5% over the forecast period of 2024-2032.

Sterile packaging products are crucial in the healthcare industry, providing a non-reusable barrier against microbial transmission. These sterile barrier systems, including wraps, pouches, and containers, protect medical products from external contaminants and ensure product sterility from packaging to use. Their advantageous properties, such as tear resistance, durability, breathability, and superior microbial barriers, are essential for maintaining sterility throughout the product lifecycle. The growing need for these packaging solutions is driven by their ability to prevent contamination and ensure the safety of pharmaceuticals and medical equipment, leading to increased demand in various applications, including in-vitro diagnostics and surgical instruments.

Sterile packaging demand is expected to increase significantly, driven by various factors focusing on safety, health, and quality in different industries. The growing emphasis on healthcare and pharmaceutical products is a major factor, as it is crucial to have packaging that is free of contamination to ensure the effectiveness of life-saving drugs and medical devices. With healthcare systems worldwide placing a higher importance on patient safety and preventing infections, there is projected to be an increase in the need for sterile packaging solutions. Moreover, the increasing knowledge of food safety is important, as stated by the Centers for Disease Control and Prevention (CDC), as they report that foodborne infections lead to 48 million illnesses, 128,000 hospitalizations, and 3,000 deaths each year in the U.S. Consequently, consumers are more mindful about the hygiene of packaging for items that can spoil like fruits, meat, and dairy. This has pushed food producers to look for new sterile packaging options to meet strict safety guidelines. Additionally, the growth of online shopping has increased the demand for sterile packaging to safeguard items while in transit, guaranteeing they reach their destination free from contaminants. Industries like cosmetics, electronics, and hospitality are also adopting sterile packaging to protect delicate parts and uphold a germ-free setting, mirroring a worldwide trend towards improved cleanliness and infection prevention measures in various sectors.

Sterile Medical Packaging Market Dynamics

Drivers

-

Increase in Disposable Medical Supplies Boosts Need for Sterile Packaging

The growing occurrence of infectious illnesses like the flu, TB, and coronaviruses has greatly increased the need for disposable medical devices. In healthcare environments, the use of disposable packaging is becoming more popular as it successfully lowers the chances of infection and contamination. Medical supplies such as syringes, needles, face masks, gloves, applicators, suction catheters, testing kits, and surgical sponges are created for single use, reducing the risk of spreading bacteria from one patient to another. The devices' packaging needs to be very effective in preserving sterility and creating a dependable shield against moisture and chemicals. These packaging options come in different sizes and shapes to cater to specific application requirements, playing a vital role in maintaining the safety and effectiveness of disposable medical items. As a result, the expected increase in the need for disposable medical supplies will greatly boost the sterile packaging market. Healthcare facilities must follow strict infection control measures, such as using sterile packaging, to prevent infections and ensure patient safety, as stated by the CDC.

-

Advances in Safety The Increasing Need for Sterile Medical Packaging.

The sterile medical packaging sector is set to experience substantial expansion, fueled by various interconnected factors in the healthcare field. The growing worldwide population and rising instances of illnesses have raised the need for healthcare services, resulting in an increase in the requirement for efficient sterile packaging systems. Governments are introducing fresh rules to manage the transmission of infectious diseases, increasing the need for advanced packaging solutions that safeguard the safety and effectiveness of medical products.A key factor contributing to the growth of the sterile packaging market is its exceptional ability to block microbes. Sterile packaging is created to keep pharmaceutical and medical products sterile until they are opened for use, preventing contamination and guaranteeing patient safety. The increasing need for strong sterile packaging solutions that can endure tough handling and environmental factors has been driven by the growing demand for injectable pharmaceuticals, especially in oncology and other high-potency drug categories. In addition, it is important to use proper sterile packaging so that healthcare providers can remove contents without risking sterility or harm. As the healthcare sector progresses, the growing emphasis on preventing and controlling infections will increase the need for sterile packaging solutions, fueling market expansion in the foreseeable future. Government data highlights the significance of efficient packaging in healthcare environments. For example, the CDC stresses that HAIs impact 1 in 31 hospital patients daily, underscoring the crucial requirement for reliable sterile packaging to reduce these dangers.

Restraints

-

Effects of strict regulatory standards on the sterile packaging market.

Stringent regulatory standards governing the design and manufacturing of sterile packaging systems significantly impede the market's growth. Manufacturers must follow strict guidelines set by regulatory bodies to ensure the sterility of packed medical devices and instruments until they are used. The EN ISO 11607 is a vital regulation that specifies the validation criteria for medical packaging systems designed for sterilized items. This standard covers important stages like selecting materials, qualifying the design, testing and controlling the design, and validating the process. The validation requirements' complexity can be difficult for manufacturers, who need to ensure compliance throughout the packaging process. This not just raises manufacturing expenses but also prolongs the time required to bring the product to market, potentially limiting innovation and competitiveness in the sector. As healthcare systems place more importance on safety and effectiveness, the focus on meeting strict regulations could place additional pressure on packaging manufacturers' resources. As a result, although these rules are intended to improve patient safety and product dependability, they also serve as a barrier to the expansion of the sterile packaging industry, restricting companies from adapting quickly to changing market needs.

Sterile Medical Packaging MarketSegmentation Overview

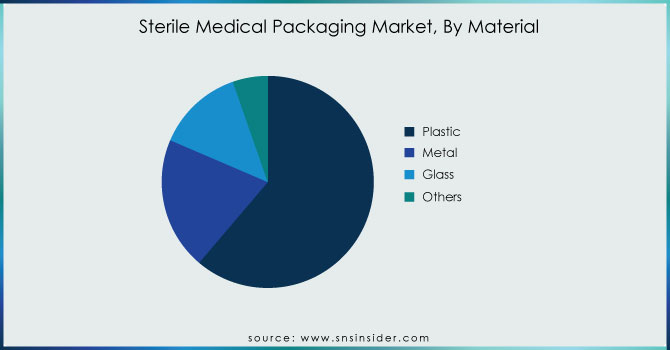

By Material

In the sterile medical packaging market, plastic holds the largest revenue share, accounting for 61.22% in 2023. This dominance is attributed to various advantages that plastic materials offer, including cost-effectiveness, easy moldability, and effective protective properties. Key plastics used in this sector include polyvinyl chloride (PVC), polypropylene (PP), polycarbonate (PC), high-impact polystyrene (HIPS), polyethylene terephthalate (PET), and high-density polyethylene (HDPE). These materials are particularly suited for applications such as thermoformed blister trays, pouches, vials, bottles, and overwraps, safeguarding medical devices and pharmaceuticals against damage and contamination. Noteworthy developments include Amcor's launch of a new line of sustainable plastic pouches designed for sterile medical packaging, which reflects the industry's shift towards environmentally friendly solutions without compromising safety. Additionally, Mediwrap, a leading player in sterile packaging, has introduced a range of biodegradable films made from plant-based materials, aligning with the increasing demand for sustainable options. These innovations underscore the importance of plastic in maintaining the integrity and sterility of medical products while also adapting to evolving market preferences for sustainability. The continuous advancements in plastic materials and their applications are expected to further drive growth in the sterile medical packaging market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Sterilization Method

Based on Sterilization Method, Chemical sterilization holds the majority market share of 54.44% in 2023 in the sterile packaging industry. This technique is preferred for its ability to eradicate a vast array of microorganisms while maintaining the integrity of delicate medical items. Chemical sterilization commonly uses substances such as ethylene oxide (EtO) to effectively sterilize devices and instruments by penetrating intricate packaging. Sterigenics and other top companies have recently improved their EtO sterilization capabilities by expanding their facilities in order to keep up with the increasing need for trustworthy and efficient sterilization methods. 3M has introduced a new line of sterile packaging solutions that make use of sophisticated chemical sterilization techniques to guarantee the safety and effectiveness of maintaining product sterility from start to finish. These advancements are in line with the increasing emphasis on preventing infections and ensuring patient safety in the healthcare field, where the quality of medical devices and medications is crucial. The importance of chemical sterilization in the sterile medical packaging industry highlights its vital role in maintaining sterility and meeting the changing demands of healthcare providers for safe and efficient packaging solutions for surgical instruments and pharmaceuticals.

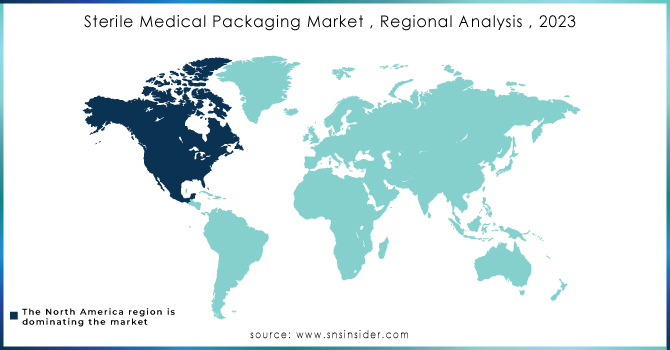

Sterile Medical Packaging Market Regional Analysis

In 2023, North America led the way in the sterile medical packaging market with a significant 43.89% share, propelled by a focus on safety, effectiveness, and innovation in healthcare offerings. The market for sterile medical packaging in the U.S. is experiencing strong growth because of the rising need for generic drugs and improved healthcare services, providing profitable chances for pharmaceutical packaging. Businesses are currently making significant investments in cutting-edge technologies in order to meet the changing demands of the market. An example is when Amcor Group GmbH introduced a new range of eco-friendly sterile packaging options to decrease environmental harm while maintaining product safety. Equivalent to this, DuPont de Nemours Inc. launched Tyvek®, a material with excellent microbial barrier properties for sterile packaging purposes. The Steripack Group Limited has broadened its range of disposable medical devices to meet the increasing need for infection control solutions. The Wipak Group has introduced user-friendly sterile barrier systems that are innovative, made for easy opening and improved safety. In Mexico, the region's market dynamics are being strengthened by a heightened focus on infection control and the increasing use of advanced packaging technologies. The concentration on innovation and quality is driving North America to lead the sterile medical packaging market.

In 2023, the Asia-Pacific region saw a rise as the most rapidly expanding market for sterile packaging due to increased pharmaceutical use and growing concerns about drug safety. Stringent government regulations aimed at ensuring drug quality have greatly strengthened the pharmaceutical packaging market, emphasizing the crucial role of packaging in preserving the safety and effectiveness of medical products. China is at the forefront of the Asia-Pacific sterile medical packaging market, driven by increasing awareness of infection control and a rising need for single-use medical devices. Major companies like MediPack, a branch of MediTech International, have broadened their range of products with the introduction of new sterile packaging solutions meant to simplify sterilization and improve safety.India is expected to experience the most rapid growth in sterile medical packaging because of a rising demand for innovative packaging solutions. Businesses such as GSK Consumer Healthcare are concentrating on sustainable packaging advancements to satisfy consumer desires for environmentally friendly choices, subsequently pushing market expansion. Furthermore, regulations in nations such as Japan and South Korea are changing to improve the safety of medical devices, leading to an increase in the use of advanced sterile packaging technologies.

Key Players in Sterile Medical Packaging Market

Some of the Key Players in Sterile Medical Packaging market who provide product and offering :

- West Pharmaceuticals Services, Inc(Westar® Syringe Systems, SmartDose® Drug Delivery System)

- Amcor Plc (AmLite® Ultra, FlexiTuf™)

- GS Medical Packaging (Sterile Barrier Packaging)

- Sonoco (Sonocare® Blister Packaging, Protective Packaging for Medical Devices)

- Wipak Group (Wipak® Sterile Barrier Systems, Multi-layered Films)

- Nelipak Healthcare (Nelipak® Medical Thermoformed Packaging, Sterilization-Compatible Packaging)

- Oliver Healthcare Packaging (SealSafe® Blister Packaging, Sterile Barrier Systems)

- Orchid Chemicals & Pharmaceuticals Ltd (Orchid's Sterile Packaging Solutions)

- Bemis Company Inc (Bemis® Pouch and Rollstock Products, Ultra-Barrier Films)

- DuPont (Tyvek® Medical Packaging, Invista™ Packaging Solutions)

- Sealed Air Corporation (Cryovac® Medical Packaging, AirCap® Bubble Wrap)

- Berry Global, Inc. (Berry® Medical Pouches, Multi-layer Medical Films)

- MediFlex (MediFlex® Sterile Packaging Solutions, Heat-Sealable Pouches)

- Schott AG (SCHOTT® Vials and Syringes, Glass Packaging Solutions)

- Catalent, Inc. (Catalent® Blister Packaging, OptiMelt™ Drug Delivery Solutions)

- Tegra Medical (Custom Medical Packaging Solutions, Sterile Pouches)

- Paxxo (Paxxo® BioPackaging, Sterile Barrier Systems)

- Kpack (Kpack® Sterile Medical Packaging, Custom Thermoforming)

- VPK Packaging Group (VPK® Medical Paper and Plastic Packaging)

- AptarGroup, Inc. (Aptar® Drug Delivery Systems, Dispensing Solutions for Pharmaceuticals)

- Others

Recent Development

- On May 9, 2024, Berry Global Group made more investments in assets and manufacturing capabilities to boost its healthcare production capacity by as much as 30% at three of its European locations. Berry's Offranville facility is known for producing high-quality standard and customized solutions for pharmaceutical packaging and drug delivery devices, including ophthalmic and nasal products, as well as the Rispharm multi-dose eye dropper. Investments in the Osnago and Sirone sites will help meet the increasing need for oral solutions to prevent and treat infections and respiratory diseases caused by higher air pollution levels. The Osnago site produces throat spray actuators, while the Sirone site manufactures accompanying bottles.

- In February 2024, Eris Lifesciences bought Swiss Parenteral in order to grow in the field of sterile injectables. Swiss Parenteral offers more than 100 dossiers for 190 molecules in Asia Pacific, Latin America, and Africa.

| Report Attributes | Details |

| Market Size in 2023 | US$ 47.70 Billion |

| Market Size by 2032 | US$ 107.95 Billion |

| CAGR | CAGR of 9.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Plastic, Metal, Glass, Others) • by Product Type (Bottles, Thermoform Trays, Flexible Pouches, Others) • by Sterilization Method (Radiation, Chemical, Others) • by End Use (Pharmaceuticals, Surgical Instruments, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | West Pharmaceuticals Services, Inc., Amcor Plc, GS Medical Packaging, Sonoco, Wipak Group, Nelipak Healthcare, Oliver Healthcare Packaging, Orchid Chemicals & Pharmaceuticals Ltd, Bemis Company Inc, DuPont |

| Key Drivers | • The steady growth of the healthcare and pharmaceutical industry • The demand for medical equipment is growing due to the increasing incidence of chronic diseases such as diabetes, cardiovascular and respiratory disease worldwide, increasing market for sterile medical packaging |

| Market Restraints | • Strict rules and regulations act as a restraint • In order to guarantee the sterilization of the products contained, sterilized medical packaging should have a limited shelf life. |