Get E-PDF Sample Report on Steel Wire Market - Request Sample Report

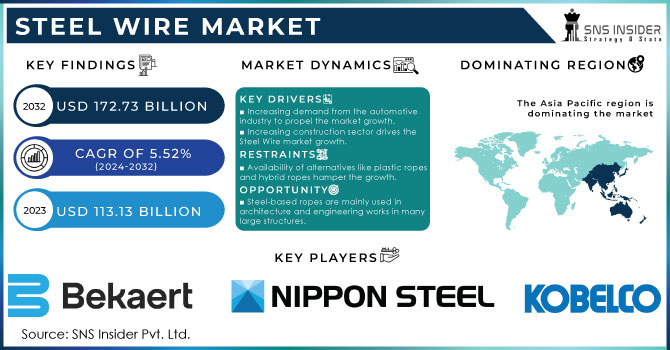

The Steel Wire Market Size was valued at USD 102.1 billion in 2023 and is expected to reach USD 167.4 billion by 2032 and grow at a CAGR of 5.7% over the forecast period 2024-2032.

During the projected period, rising investments in the construction sector are expected to support market expansion. Ropes and strands, which are downstream products of steel wires, are used extensively in the construction sector, including as additional reinforcement in towers and as a means of sustaining suspension bridges. They are widely utilized in the construction of prestressed concrete, which supports large retaining walls, runways, roofs, and floor beams.

The U.S. increasing construction expenditures are expected to increase the nation's need for steel wires. The United States will require more than USD 2600 billion over the course of the next ten years to meet its infrastructure repair needs, according to the American Society of Civil Engineers. In November 2021, the government approved USD 550 billion in funding for infrastructure improvements under the Infrastructure Investment and Jobs Act.

Another significant end-use for steel wire ropes in the market is the automotive sector, where they are used to produce different vehicle parts, move weights, and place equipment. Moreover, radial vehicle tires, wire pads, cables, exhaust lines, fasteners, and wire pads are some additional end uses. It is anticipated that the market will gain from the renewed emphasis on raising auto output.

It is expected that the market's growth will be limited due to the availability of alternatives such as plastic ropes. Some small-scale producers have shifted to using plastic ropes because of factors like cost-effectiveness and sustainability, which come with advantages including lighter products, more stability, and reduced production waste. Thus, over the next several years, it is anticipated that expanding developments in the creation of plastic ropes will obstruct market growth.

Drivers

Increasing demand from the automotive industry to propel the market growth.

One of the primary applications for steel wire in the automotive industry is tire bead reinforcement. It is a substance that is frequently utilized in the automotive industry to give windshields and other components performance, durability, and safety. These wires are employed in the automotive sector as wire strands that are twisted together to create a helix structure, which is then utilized in production lines, hoists, and different kinds of cranes. In military vehicles, wire rope isolators rely heavily on this wire. Wire rope isolators are made to endure harsh conditions and strong vibrations and shocks. They are perfect for military vehicles like tanks, jeeps, and airplanes that are subjected to explosives or difficult terrain because of their functionality.

The market for electric vehicles is increasing quickly. Among the essential parts of electric vehicles is the electric wire harness. In comparison to traditional ICE vehicles, electric vehicles require three times more wire harnesses, which are provided by auto component suppliers. Therefore, businesses in the cables and wires sector should see a rise in production volume due to the growing demand for EVs. During the projected period, the expanding electric vehicle industry is expected to support steel wire market growth.

Increasing construction sector drives the Steel Wire market growth.

Restraint

Availability of alternatives like plastic ropes and hybrid ropes hamper the growth.

Some small-scale producers have switched to using plastic ropes because of its advantages such as high stability, low product weight, and less production waste. Sustainability and affordability are two of these benefits. Because of this, it is projected that the development of plastic ropes will continue to advance, which will limit steel wire market growth. Due to its benefits, the production of plastic and hybrid ropes has increased which hampered the market growth.

Opportunities

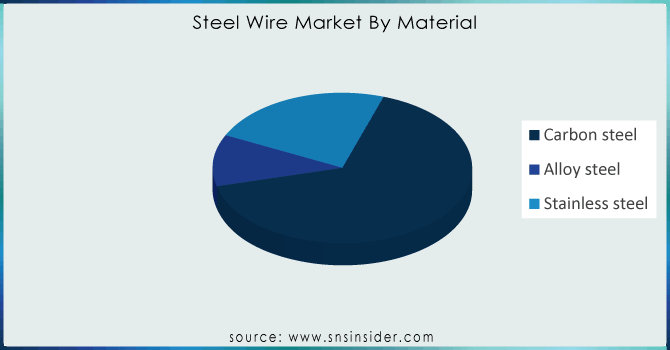

By Material

Carbon steel

Alloy steel

Stainless steel

The carbon steel dominated the steel wire market with the highest revenue share of more than 66% in 2023 and it is projected that this tendency holds throughout the upcoming period. Wires are made from both low- and high-carbon steel and are mostly utilized in the construction, automotive, and military industries. A wide range of diameters, from 0.2 mm to 8 mm, can be drawn into them.

High carbon steel wire is used in cutting silicon ingots for the musical instruments, solar industry, bridge cables and tire reinforcement materials. These have less ductility but are stronger than low carbon. Additional benefits of carbon steel wire are its durability, safety during handling, and recyclable nature. These features, together with the fact that they are widely used in industries like equipment, railroads, construction, and other similar ones, should accelerate the expansion of this market.

Over the course of the projected period, stainless steel is expected to increase at the fastest rate. This material's wires are utilized in hardware, screws, cables, metallic nets, and springs. Because of qualities like strong corrosion resistance, pressure resistance, hygiene, aesthetics, imperviousness to heat and fire, flexibility, and longevity, it is highly demanded in industries like electronics, oil, and kitchenware. Its high cost in comparison to other materials is the reason for its poor market share.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By End User

Automotive

Industrial

Energy

Agriculture

Construction

Other

The construction segment held the highest revenue share of more than 42.54% in 2023. The segment's dominance is expected to be sustained during the forecast period by the widespread usage of steel wire-based ropes, cables, strands, and cords in moving equipment, supporting structures, and other applications in the construction industry.

Over the course of the projection period, energy is expected to increase at the quickest rate of any application segment. Massive investments in the energy sector are being driven by the expanding need for power and its distribution, which is good for market expansion. For instance, in April 2022, Dubai, has invested worth USD 10.9 billion for the following five years. This investment plan covered clean and renewable energy, distribution networks, and water and electricity projects.

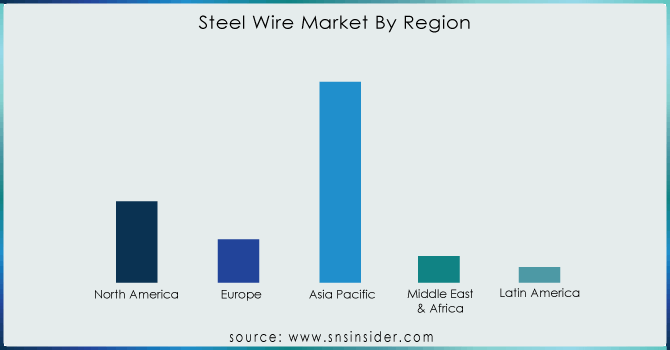

Asia Pacific led the Steel Wire market with the highest revenue share of around 58.45% in 2023. The presence of producers, end users, and raw material suppliers accounts for the region's strength. Asia's manufacturers are producing more to satisfy the needs of their home and international markets. For example, in October 2021, India's Rajratan Global Wire Limited has started a production facility in Chennai, Tamil Nadu with an annual capacity of 60 kilotons to meet domestic demand in the Europe and U.S.

It is projected that the region with the quickest rate of growth in the worldwide market would be North America. Increasing investments in the energy, industrial, and construction sectors are expected to boost product demand in the region during the course of the projected period. In October 2021, for example, the American company WTEC announced that it would be establishing a new production facility in Chamberino, New Mexico. The business manufactures steel wire cables for wind and solar energy systems.

REGIONAL COVERAGE

North America

USA

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

The Netherlands

Rest of Europe

Asia-Pacific

Japan

South Korea

China

India

Australia

Rest of Asia-Pacific

The Middle East & Africa

Israel

UAE

South Africa

Rest of the Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin American

KEY PLAYERS

ArcelorMittal, Bekaert, JFE Steel Holding, Nippon Steel Co, Tianjin Huayuan Metal Wire Products Co. Ltd., VAN MERKSTEIJN INTERNATIONAL. Tata Steel, Kobe Steel Limited, Insteel Industries, WireCo WorldGroup Inc., and other key players are mentioned in the final report.

RECENT DEVELOPMENTS

In 2024, Van Merksteijn has resumed its plans for a new greenfield wire rod factory in the Netherlands, with construction set to begin this year. Production is scheduled to with an estimated investment of USD 344 million.

In July 2023, KOBE Steel has launched Kobenable Steel, and Japan is the first country where autos made of low-CO2 blast furnace steel have chosen to use unique steel wire rods.

In March 2022, VisionTek Engineering Srl has been acquired by Bridon-Bekaert Ropes Group. In order to grow and offer cutting-edge services in the steel wire and rope industry, this acquisition was a crucial strategic move

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 102.1 billion |

| Market Size by 2032 | US$ 167.4 Billion |

| CAGR | CAGR of 5.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Material (Carbon Steel, Alloy Steel, Stainless Steel) • By End User (Automotive, Industrial, Energy, Agriculture, Construction, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ArcelorMittal, Bekaert, JFE Steel Holding, Nippon Steel Co, Tianjin Huayuan Metal Wire Products Co. Ltd., Van Merksteijn International. Tata Steel, Kobe Steel Limited, Insteel Industries, WireCo WorldGroup Inc., and others |

| Key Drivers | • Increasing demand from the automotive industry to propel the market growth |

| Restraints | • Availability of alternatives like plastic ropes and hybrid ropes hamper the growth |

Ans: USD 167.4 Billion is the projected Steel Wire Market size of the market by 2032.

Ans: The expected CAGR of the global Steel Wire Market during the forecast period is 5.7%.

Ans: The carbon steel will grow rapidly in the Steel Wire Market from 2024-2032.

Ans: Factors such as increasing demand from the automotive industry to propel the market growth

Ans: China led the Steel Wire Market in the Asia Pacific region with the highest revenue share in 2023.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Steel Wire Market Segmentation, By Material

7.1 Introduction

7.2 Carbon steel

7.3 Alloy steel

7.4 Stainless steel

8. Steel Wire Market Segmentation, By End-User

8.1 Introduction

8.2 Automotive

8.3 Industrial

8.4 Energy

8.5 Agriculture

8.6 Construction

8.7 Other

9. Regional Analysis

9.1 Introduction

9.2 North America

9.2.1 Trend Analysis

9.2.2 North America Steel Wire Market by Country

9.2.3 North America Steel Wire Market By Material

9.2.4 North America Steel Wire Market By End-User

9.2.5 USA

9.2.5.1 USA Steel Wire Market By Material

9.2.5.2 USA Steel Wire Market By End-User

9.2.6 Canada

9.2.6.1 Canada Steel Wire Market By Material

9.2.6.2 Canada Steel Wire Market By End-User

9.2.7 Mexico

9.2.7.1 Mexico Steel Wire Market By Material

9.2.7.2 Mexico Steel Wire Market By End-User

9.3 Europe

9.3.1 Trend Analysis

9.3.2 Eastern Europe

9.3.2.1 Eastern Europe Steel Wire Market by Country

9.3.2.2 Eastern Europe Steel Wire Market By Material

9.3.2.3 Eastern Europe Steel Wire Market By End-User

9.3.2.4 Poland

9.3.2.4.1 Poland Steel Wire Market By Material

9.3.2.4.2 Poland Steel Wire Market By End-User

9.3.2.5 Romania

9.3.2.5.1 Romania Steel Wire Market By Material

9.3.2.5.2 Romania Steel Wire Market By End-User

9.3.2.6 Hungary

9.3.2.6.1 Hungary Steel Wire Market By Material

9.3.2.6.2 Hungary Steel Wire Market By End-User

9.3.2.7 Turkey

9.3.2.7.1 Turkey Steel Wire Market By Material

9.3.2.7.2 Turkey Steel Wire Market By End-User

9.3.2.8 Rest of Eastern Europe

9.3.2.8.1 Rest of Eastern Europe Steel Wire Market By Material

9.3.2.8.2 Rest of Eastern Europe Steel Wire Market By End-User

9.3.3 Western Europe

9.3.3.1 Western Europe Steel Wire Market by Country

9.3.3.2 Western Europe Steel Wire Market By Material

9.3.3.3 Western Europe Steel Wire Market By End-User

9.3.3.4 Germany

9.3.3.4.1 Germany Steel Wire Market By Material

9.3.3.4.2 Germany Steel Wire Market By End-User

9.3.3.5 France

9.3.3.5.1 France Steel Wire Market By Material

9.3.3.5.2 France Steel Wire Market By End-User

9.3.3.6 UK

9.3.3.6.1 UK Steel Wire Market By Material

9.3.3.6.2 UK Steel Wire Market By End-User

9.3.3.7 Italy

9.3.3.7.1 Italy Steel Wire Market By Material

9.3.3.7.2 Italy Steel Wire Market By End-User

9.3.3.8 Spain

9.3.3.8.1 Spain Steel Wire Market By Material

9.3.3.8.2 Spain Steel Wire Market By End-User

9.3.3.9 Netherlands

9.3.3.9.1 Netherlands Steel Wire Market By Material

9.3.3.9.2 Netherlands Steel Wire Market By End-User

9.3.3.10 Switzerland

9.3.3.10.1 Switzerland Steel Wire Market By Material

9.3.3.10.2 Switzerland Steel Wire Market By End-User

9.3.3.11 Austria

9.3.3.11.1 Austria Steel Wire Market By Material

9.3.3.11.2 Austria Steel Wire Market By End-User

9.3.3.12 Rest of Western Europe

9.3.3.12.1 Rest of Western Europe Steel Wire Market By Material

9.3.2.12.2 Rest of Western Europe Steel Wire Market By End-User

9.4 Asia-Pacific

9.4.1 Trend Analysis

9.4.2 Asia Pacific Steel Wire Market by Country

9.4.3 Asia Pacific Steel Wire Market By Material

9.4.4 Asia Pacific Steel Wire Market By End-User

9.4.5 China

9.4.5.1 China Steel Wire Market By Material

9.4.5.2 China Steel Wire Market By End-User

9.4.6 India

9.4.6.1 India Steel Wire Market By Material

9.4.6.2 India Steel Wire Market By End-User

9.4.7 Japan

9.4.7.1 Japan Steel Wire Market By Material

9.4.7.2 Japan Steel Wire Market By End-User

9.4.8 South Korea

9.4.8.1 South Korea Steel Wire Market By Material

9.4.8.2 South Korea Steel Wire Market By End-User

9.4.9 Vietnam

9.4.9.1 Vietnam Steel Wire Market By Material

9.4.9.2 Vietnam Steel Wire Market By End-User

9.4.10 Singapore

9.4.10.1 Singapore Steel Wire Market By Material

9.4.10.2 Singapore Steel Wire Market By End-User

9.4.11 Australia

9.4.11.1 Australia Steel Wire Market By Material

9.4.11.2 Australia Steel Wire Market By End-User

9.4.12 Rest of Asia-Pacific

9.4.12.1 Rest of Asia-Pacific Steel Wire Market By Material

9.4.12.2 Rest of Asia-Pacific Steel Wire Market By End-User

9.5 Middle East & Africa

9.5.1 Trend Analysis

9.5.2 Middle East

9.5.2.1 Middle East Steel Wire Market by Country

9.5.2.2 Middle East Steel Wire Market By Material

9.5.2.3 Middle East Steel Wire Market By End-User

9.5.2.4 UAE

9.5.2.4.1 UAE Steel Wire Market By Material

9.5.2.4.2 UAE Steel Wire Market By End-User

9.5.2.5 Egypt

9.5.2.5.1 Egypt Steel Wire Market By Material

9.5.2.5.2 Egypt Steel Wire Market By End-User

9.5.2.6 Saudi Arabia

9.5.2.6.1 Saudi Arabia Steel Wire Market By Material

9.5.2.6.2 Saudi Arabia Steel Wire Market By End-User

9.5.2.7 Qatar

9.5.2.7.1 Qatar Steel Wire Market By Material

9.5.2.7.2 Qatar Steel Wire Market By End-User

9.5.2.8 Rest of Middle East

9.5.2.8.1 Rest of Middle East Steel Wire Market By Material

9.5.2.8.2 Rest of Middle East Steel Wire Market By End-User

9.5.3 Africa

9.5.3.1 Africa Steel Wire Market by Country

9.5.3.2 Africa Steel Wire Market By Material

9.5.3.3 Africa Steel Wire Market By End-User

9.5.2.4 Nigeria

9.5.2.4.1 Nigeria Steel Wire Market By Material

9.5.2.4.2 Nigeria Steel Wire Market By End-User

9.5.2.5 South Africa

9.5.2.5.1 South Africa Steel Wire Market By Material

9.5.2.5.2 South Africa Steel Wire Market By End-User

9.5.2.6 Rest of Africa

9.5.2.6.1 Rest of Africa Steel Wire Market By Material

9.5.2.6.2 Rest of Africa Steel Wire Market By End-User

9.6 Latin America

9.6.1 Trend Analysis

9.6.2 Latin America Steel Wire Market by Country

9.6.3 Latin America Steel Wire Market By Material

9.6.4 Latin America Steel Wire Market By End-User

9.6.5 Brazil

9.6.5.1 Brazil Steel Wire Market By Material

9.6.5.2 Brazil Steel Wire Market By End-User

9.6.6 Argentina

9.6.6.1 Argentina Steel Wire Market By Material

9.6.6.2 Argentina Steel Wire Market By End-User

9.6.7 Colombia

9.6.7.1 Colombia Steel Wire Market By Material

9.6.7.2 Colombia Steel Wire Market By End-User

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Steel Wire Market By Material

9.6.8.2 Rest of Latin America Steel Wire Market By End-User

10. Company Profiles

10.1 ArcelorMittal

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 The SNS View

10.2 Bekaert

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 The SNS View

10.3 JFE Steel Holding

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 The SNS View

10.4 Nippon Steel Co

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 The SNS View

10.5 Tianjin Huayuan Metal Wire Products Co. Ltd.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 The SNS View

10.6 Van Merksteijn International

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 The SNS View

10.7 . Tata Steel

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 The SNS View

10.8 Kobe Steel Limited

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 The SNS View

10.9 Insteel Industries

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 The SNS View

10.10 WireCo WorldGroup Inc.

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 The SNS View

11. Competitive Landscape

11.1 Competitive Benchmarking

11.2 Market Share Analysis

11.3 Recent Developments

11.3.1 Industry News

11.3.2 Company News

11.3.3 Mergers & Acquisitions

12. USE Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Battery Coating Market Size was valued at USD 325 million in 2023 and is expected to reach USD 1130 million by 2032 and grow at a CAGR of 14.8% over the forecast period 2024-2032.

The Masterbatch Market Size was valued at USD 12.27 Billion in 2023 and is expected to reach USD 20.40 Billion by 2032, growing at a CAGR of 5.82% over the forecast period of 2024-2032.

The Tire Recycling Market size was USD 6.00 Billion in 2023 and is expected to reach USD 8.21 Billion by 2032, growing at a CAGR of 3.55% from 2024 to 2032.

The Chlorine Dioxide Market size was USD 1.09 Billion in 2023 and is expected to reach USD 1.71 Million by 2032, growing at a CAGR of 5.12 % from 2024-2032.

Explore the Natural Extracts Market, covering trends in food, cosmetics, and pharmaceuticals. Learn about the rising demand for plant-based, eco-friendly ingredients and how natural extracts are driving innovation in flavoring, skincare, and health supple

The Polymer Solar Cells Market size was USD 1.1 Billion in 2023 and is expected to reach USD 5.9 Billion by 2032 and grow at a CAGR of 20.8% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone