Steam Autoclaves Market Report Scope & Overview:

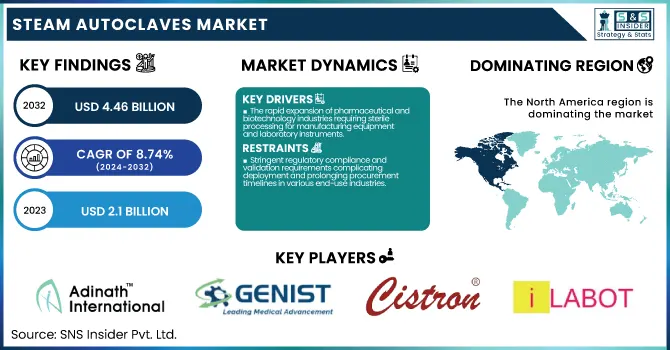

The Steam Autoclaves Market Size was valued at USD 2.1 billion in 2023 and is expected to reach USD 4.46 billion by 2032, growing at a CAGR of 8.74% over the forecast period 2024-2032.

To Get more information on Steam Autoclaves Market - Request Free Sample Report

This report provides key statistical insights and emerging trends shaping the Steam Autoclaves Market within healthcare. The report includes sterilization demand indices, operational efficiency trends, including cycle time and energy usage, and a detailed cost of ownership analysis by autoclave type. It also analyses regional compliance rates with regulations, as well as the effect of certifications on procurement. This section of the study has been designed to provide a comprehensive overview of how the steam sterilization solutions market is performing, along with insights into market dynamics, common user preferences, and potential investment pockets in the steam sterilization solutions market for healthcare applications. Increasing investments in healthcare infrastructure, stringent government regulations for infection control, and high prevalence of healthcare-associated infections (HAIs) have been the primary growth driving factors of the global steam autoclaves market.

The United States steam autoclaves market has been witnessing steady growth from USD 0.59 billion in 2023 to USD 1.23 billion in 2032, attaining a CAGR of 8.52% during the forecast period. This increase is primarily attributed to strict sterilization standards, increasing surgical procedures, and the adoption of advanced autoclave systems in hospital and outpatient settings. Government regulations and infection control also bolster additional demand. According to the World Health Organization, 7 out of every 100 patients in acute-care hospitals in high-income countries develop at least one HAI, compared with 15 per 100 in low- and middle-income countries. This has led governments across the globe to implement tighter sterilization measures in medical and research establishments. In 2023, the National Institutes of Health (NIH in the US) invested an estimated URL 8.96 billion in biotechnology research, a natural extension of the country's ongoing efforts to advance the standards of healthcare safety.

Market Dynamics

Drivers

-

The rapid expansion of pharmaceutical and biotechnology industries requiring sterile processing for manufacturing equipment and laboratory instruments.

Rising demand for high-performance steam autoclaves is largely driven by the expanding global pharmaceutical and biotechnology industries. Sterile environments have become a necessity due to the increasing R&D activities, drug development, and vaccine production. Steam autoclaves play a very important role in the sterilization of various laboratory instruments, glassware, and equipment such as fermentation and bioreactors used in the pharmaceutical manufacturing process. Adoption of advanced autoclaving technologies is encouraged due to regulatory requirements such as Current Good Manufacturing Practices (cGMP) and FDA regulations, which require validated sterilization protocols. The increasing prevalence of biologics and injectable drugs have targeted aseptic processing, leading to greater investment in sterilization infrastructure. Furthermore, the expansion of pharmaceutical production in the Asia-Pacific region by way of government funding and foreign investments has led to higher installation of advanced autoclaves in the region. Improper sterilization may result in contamination in the biotechnology sector, especially in genomic research, stem cell therapy, and tissue engineering, which promotes steam-based systems. CMOs (contract manufacturing organizations) and CROs (contract research organizations) are further growing quickly selecting sterilizers to meet their customer's quality needs. More and more, companies are transitioning to fully automated and programmable autoclave units that fit right into facility control systems, fostering greater productivity and reducing the potential for human error. Moreover, sustainability targets in pharmaceutical companies drive the requirement for energy and water-saving steam autoclaves, aligned with environmental compliance regulations. Incorporating the Internet of Things (IoT) in autoclaves allows for monitoring and data logging in real-time necessary for documentation in audits and inspections. Such developments across the pharmaceutical and biotechnology spaces are leading to continuous demand for modern sterilization systems. The continued expansion along with the essential need for sterile processing in manufacturing facilities will drive the global steam autoclaves market substantially in the coming years.

Restrain

-

Stringent regulatory compliance and validation requirements complicating deployment and prolonging procurement timelines in various end-use industries.

Global and regional sterilization regulations are becoming more stringent, making it challenging for companies to adopt or convert to steam autoclave systems. Healthcare and pharmaceutical facilities are required to perform rigorous sterilization validation by regulatory bodies such as the FDA, ISO, and WHO. These regulations have imposed requirements for detailed documentation, testing, and qualification of sterilization cycles to provide repeatability and efficacy. And achievability of full compliance can be overwhelming to end-users, especially ones without internal quality teams or having experience working within such regulatory frameworks. The requirement of installation qualification (IQ), operational qualification (OQ), and performance qualification (PQ), can lead to the elongation of the procurement timeline, including for facility planning and deployment schedules. In the pharmaceutical sector, each batch produced under a sterilized environment must meet precise sterility assurance levels, further complicating operational workflows and heightening reliance on strict autoclave cycle management. Audits and inspections by health authorities also heighten the need for systems that have been validated and can log complete details, verify each cycle, and ensure full traceability functions not always found on older or budget models. A technical complexity that forces users to invest in training and validate services provided by third parties, increasing effort and costs. Also, changes in standards or protocols can require revalidation, creating operational issues. This complex landscape can be particularly challenging for startups or small biotech companies that have a limited resource or regulatory expertise. Although modern autoclave manufacturers do provide validation support, it can increase overall cost of ownership.

Opportunities

-

Integration of smart technologies and automation features into steam autoclaves enhancing productivity and ensuring compliance with traceability standards.

The rising application of smart technologies in healthcare and industrial equipment is paving lucrative due to the steam autoclaves market. Modern autoclave systems are getting integrated with automation and digital monitoring and connective features that can help streamline operations and enhance the effectiveness of sterilization. The real-time data logging, cycle validation, and auto-reporting features help not just adhere to regulatory standards but also minimize human error in the sterilization process. This is more useful for pharmaceutical manufacturers and large healthcare institutions where maintaining precise forms is very important for audits and quality control. Smart autoclaves can now notify users of performance irregularities, recommend maintenance actions, and even connect to centralized facilities management systems for remote monitoring and diagnostics. The Internet of Things (IoT) integration provides cycle records, temperature logs, and machine status on a computer or smartphone, which gives machine administrators operational transparency that aids their decision-making. They also play a vital role in predictive maintenance, minimizing downtime, and extending the lifespan of equipment. Automation delivers repeatable sterilization cycles with minimal human interference, reducing the processing time and improving throughput and staff productivity. Facilities are realizing productivity improvements via such systems, with hospitals, laboratories, and research centers being high-demand environments in this regard. In industrial settings, such as food processing or biohazard waste treatment, the demand for automated and programmable autoclaves is growing rapidly.

Challenges

-

Rising maintenance complexities and operational downtime limit consistent use across high-volume healthcare and industrial settings.

The demanding maintenance requirements and frequent operating downtime are stifling the widespread use of steam autoclaves, particularly in a sterilization cycle-intensive environment. Steam autoclaves are complex mechanical instruments that need regular recalibrations, descaling, gasket replacements, and standard maintenance. Any disruption in the maintenance schedule can result in compromised the extent of sterilization or entire equipment failure leading to the breakdown of the operational workflow. In hospitals and clinical settings, this could lead to delays in treatments for patients or contamination risks caused by the reuse of improperly sterilized instruments. In addition, industrial users performing large-batch sterilizations, such as pharmaceutical manufacturers or biotech labs, can face significant disruption if one of their autoclave units goes down or requires servicing. Additionally, unplanned downtime increases reliance on backup units which may not always be possible in budget-conscious organizations or smaller sites. Another difficulty lies in the absence of trained personnel capable of providing in-house maintenance for advanced steam autoclaves. Service contracts with third-party vendors can be expensive, and the unavailability of technicians can lead to prolonged downtime. Some institutions remain reluctant to fully embrace or scale their steam autoclave usage, due to this unreliability in continued operation. The need for compliance with regulations compounds the challenge, as malfunctioning autoclaves may lead to audits or violations of health and safety standards.

Segmentation Analysis

By configuration

The vertical segment held the largest revenue share of around 19% in the steam autoclave market in 2023, a position driven by its unique combination of versatility, efficiency, and adaptability to diverse healthcare and laboratory environments. A major advantage of vertical steam autoclaves is their ability to save space and efficiently fit in facilities with limited floor areas such as clinics, diagnostic centers, and research laboratories, all while maintaining optimal performance. They are available in a wide range of capacities from approximately 22 to 200 liters, thus making them a perfect choice for small-scale and medium-capacity sterilization applications like sterilization of surgical instruments, laboratory glassware, culture media, and biohazardous waste. The appeal of vertical autoclaves was further enhanced by technological advancements. Modern designs often include automated controls, multiple pressure relief options, preheating functions, and advanced safety mechanisms including overpressure protection, anti-drying safeguards, and real-time sensor monitoring. These innovations not only improve operational efficiency and user safety but also ensure compliance with stringent regulatory standards in healthcare and research settings.

By application

The medical segment holds the largest share of the steam autoclave market. The leading position has been attributed to the demand for proper sterilization and disinfection in hospital and clinical settings, where controlling the risk of infection is used to be one of the major concerns. Steam autoclaves have become critical for the safety of patients and to meet regulations amidst the rise in hospital-acquired infections and the number of surgical procedures. Furthermore, there is a high demand for autoclaves in the pharmaceutical and biotechnology industries due to the need for a sterile production environment. Compliance with laboratory regulations and the quality of medical supplies have become strict, leading to the development of the laboratory segment of medical supplies, which is also a rapidly growing segment, driven by increased research activities and the demand for untainted supplies in research. Accelerated technological development, including automation and advanced safety measures, is improving the efficiency and accessibility of autoclaves, encouraging widespread adoption in these crucial segments.

Regional Analysis

North America stands as the dominant force in the global steam autoclaves market, accounting for approximately 36% of the market share in 2023. The region maintains this leadership thanks to its advanced healthcare infrastructure, large investments in medical equipment, and high regulatory standards for sterilization. This expansion is propelled primarily by the United States, which boasts significant healthcare spending and a global interest in infection control across healthcare and research environments. In addition, the prevalence of chronic diseases and hospital-acquired infections has increased the demand for sterilization, thus supporting North America’s position in the market.

On the other hand, the Asia Pacific is projected to grow at the fastest rate during the period of 2024 to 2032. Indeed, countries including China and India are leading the way in this expansion, powered by huge investments in healthcare infrastructure and government schemes to improve healthcare quality. Increasing emphasis on medical tourism, technological advancements leading to rapid modernization of hospitals, and the release of novel models of autoclaves suited for varied requirements are some of the key elements driving adoption in the region. As Asia Pacific continues to upgrade its healthcare and research facilities to meet international standards, the demand for steam autoclaves is expected to surge, positioning the region as a major growth engine for the global market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Adinath International (Sliding Door Horizontal Steam Sterilizer, Double Walled Vertical Autoclave)

-

Genist Technocracy (Fully Automatic Horizontal Cylindrical Autoclave, Table Top Autoclaves Sterilizer)

-

Cistron Systems (Steam Sterilizer Machine, ETO Sterilizer)

-

iLabot Technologies (Vertical Autoclave, Horizontal Autoclave)

-

Tuttnauer (Elara 11D Class B Autoclave, 3870EA Fully Automatic Autoclave)

-

Getinge (GSS67H Steam Sterilizer, GSS610H Steam Sterilizer)

-

Belimed (WD 290 IQ Washer-Disinfector, MST-H Series Steam Sterilizer)

-

Steris Corporation (AMSCO 400 Series Medium Steam Sterilizer, Reliance 400 Series Laboratory Glassware Washer)

-

Astell Scientific (Compact Autoclave, Duaclave Twin Chamber Autoclave)

-

Priorclave (QCS Front Loading Autoclave, C60 Benchtop Autoclave)

-

Zirbus Technology (Laboratory Autoclave, Pilot Plant Autoclave)

-

Consolidated Sterilizer Systems (Model 26 Autoclave, Model 3A Autoclave)

-

Shiva Medical Instrument Co., Ltd. (LDZM Vertical Pressure Steam Sterilizer, YXQ-LS-50GZ Portable Autoclave)

-

Systec GmbH (Systec HX-Series Autoclave, Systec VX-Series Autoclave)

-

Panasonic Healthcare Co., Ltd. (MLS-3781L Laboratory Autoclave, MLS-3751L Laboratory Autoclave)

-

Yamato Scientific Co., Ltd. (SM510C Steam Sterilizer, SM300C Steam Sterilizer)

-

Benchmark Scientific (BioClave Mini Autoclave, BioClave 18 Autoclave)

-

Medline Industries, Inc. (Sterilization Wrap, Autoclave Indicator Tape)

-

Thermo Fisher Scientific (Heratherm General Protocol Microbiological Incubator, Forma Steri-Cycle CO2 Incubator)

Recent Developments

-

In July 2023 The Minister for Carriacou, Grenada presented a new steam autoclave to the Hillsborough Smart Health Centre to augment the facility's sterilization capabilities and to also support the government to enhance healthcare quality in that region.

-

The U.S. National Institutes of Health (NIH) increased funding for biotechnology research to USD 8.96 billion in 2024, contributing to the adoption of advanced sterilization technologies used in research and clinical laboratories.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.1 Billion |

| Market Size by 2032 | USD 4.46 Billion |

| CAGR | CAGR of 8.74 From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Configuration (Table Top Autoclaves, Vertical Steam Autoclaves, Horizontal Steam Autoclaves, Floor Standing Steam Autoclaves, High Pressure Steam Autoclaves • By Application (Medical Steam Autoclaves {Hospital Steam Autoclaves, Clinical Steam Autoclaves, Medical Waste Management Steam Autoclaves}, Dental Steam Autoclaves, Laboratory Steam Autoclaves {Pharmaceutical Steam Autoclaves, Bio-hazardous Waste Management Steam Autoclaves}) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Adinath International, Genist Technocracy, Cistron Systems, iLabot Technologies, Tuttnauer, Getinge, Belimed, Steris Corporation, Astell Scientific, Priorclave, Zirbus Technology, Consolidated Sterilizer Systems, Shinva Medical Instrument Co., Ltd., Systec GmbH, Panasonic Healthcare Co., Ltd., Yamato Scientific Co., Ltd., Benchmark Scientific, Medline Industries, Inc., Thermo Fisher Scientific |