Get more information on STD diagnostics Market - Request Sample Report

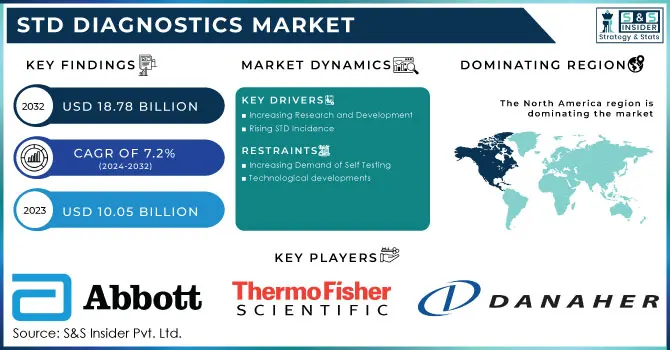

The STD diagnostics Market size was valued at USD 10.05 billion in 2023 and is expected to grow to USD 18.78 billion by 2032 and grow at a CAGR of 7.2% over the forecast period of 2024-2032.

STD stands for sexually transmitted diseases, also known as venereal diseases (VDs), which are typically communicated by the use of contaminated needles for drugs, breastfeeding or giving birth to a baby, blood transfusions, and sexual activity. These illnesses do not have any symptoms and are only discovered through various tests such as blood tests, urine samples, or fluid samples. Antibiotics and antiviral medications can be used to treat STDs brought on by bacteria. Absorbance microplate readers, flow cytometers, scattering machines, and immunochromatographic assays are a few of the tools utilized to identify the condition.

The market for sexually transmitted diseases (STD) testing is expanding as a result of increased public awareness as well as patient education. Additionally, it is projected that a rise in STD prevalence around the globe, patient awareness raised through education programs, and a surge in government initiatives will fuel market expansion. In the last ten years, both the prevalence and the number of STD incidences have significantly increased.

KEY DRIVERS:

Increasing Research and Development

Rising STD Incidence

One of the main factors propelling the STD diagnostics market is the global increase in the prevalence of sexually transmitted illnesses. Unprotected sexual activity, evolving sexual behaviors, ignorance, and a lack of proper healthcare infrastructure are some of the factors that contribute to the increased prevalence of STDs and the need for accurate diagnosis.

RESTRAIN

Increasing Demand of Self Testing

Technological developments

There have been considerable breakthroughs in diagnostic technology that have affected the STD diagnostics market. Nucleic acid amplification tests (NAATs), which offer improved sensitivity and specificity, have supplemented or replaced conventional techniques like culture-based testing. Point-of-care tests (POCTs), which enable quick and practical testing in a variety of healthcare settings, have also gained popularity.

OPPORTUNITY:

Targeted testing solutions

Home Testing Kits

In recent years, the availability of STD testing kits for home use has grown in popularity. With the use of these kits, people can do self-tests in the comfort of their own homes and receive the findings without going to a medical facility. Home testing kits' ease of use and privacy offer a significant possibility for market expansion.

CHALLENGES:

Access to healthcare is restricted

Social Hurdles and Stigma

People may be discouraged from getting tested or receiving treatment due to the stigma attached to STDs, which could have an impact on the market's expansion.

An unprecedented global public health threat, the COVID-19 pandemic is expected to have a detrimental effect on the STD testing market. The prevalence of sexually transmitted infections was high before the pandemic, although it has since dropped as a result of STD testing. Due to difficulties in health care and services for testing for sexually transmitted infections during the early months of the COVID-19 epidemic, there were fewer reports of STIs. To maintain the supply of personal protective equipment and lower the exposure risks for patients and clinical personnel, preventive services were reduced, and many non-urgent visits were severely postponed or switched to virtual platforms.

The World Health Organisation determined that COVID-19 can be classified as a pandemic on March 11, 2020. Additionally, only a small number of vaccinations have been given emergency authorization for the treatment or prevention of COVID-19. As a result, social isolation is seen as the most crucial step in halting the disease's transmission. Furthermore, a few nations around the world have implemented statewide lockdowns to preserve social distancing.

Ukraine has the second-highest incidence of HIV/AIDS in Eastern Europe, with a general prevalence of 1.2 %, a prevalence of 22% among injecting drug users, and a prevalence of 7.6% among males who have sex with other men. During the current crisis, antiretroviral treatment (ART) has become scarce. High-risk behaviors, such as risky drug injection techniques and unsafe sex, may also rise, raising the possibility of developing new HIV infections. The issue on the inflation front is not yet gone due to the uncertainty about how Russia's conflict with Ukraine will play out this year and the war's role in causing global instability. Inflation of food and gasoline will continue to be a significant economic issue. Consumer confidence and spending will be impacted by higher retail inflation.

IMPACT OF ONGOING RECESSION

The government's efforts to control inflation by raising interest rates will limit the creation of new jobs, which will affect economic activity and growth. Because of concerns about inflation and decreased demand, businesses are delaying investments, which will result in lower capital spending. The developed markets appear ready to experience a recession due to weaker growth and excessive inflation.

Contrary to substantial increases for newborns and children under five, there is minimal evidence that youth death rates increase during economic crises. When there is a crisis, young people's general levels of poor health tend to grow, with increases in sexually transmitted illnesses in particular. (STDs) and diseases linked to substance usage. There is some evidence that general health service use is dropping; teenagers and young adults may be particularly affected by this.

By Product

Instruments and Services

Consumables

Software

By Technology

Immunoassay

Others

By Application

CT/NG testing

Syphilis testing

PCR testing

Non-PCR testing

Gonorrhea testing

HSV testing

PCR testing

Non-PCR testing

HPV testing

HIV testing

Ureaplasma & Mycoplasma testing

Trichomonas

VZV testing

PCR testing

Non-PCR testing

By Location of Testing

Laboratory Testing

Commercial/Private labs

Public Health Labs

Point of Care Testing

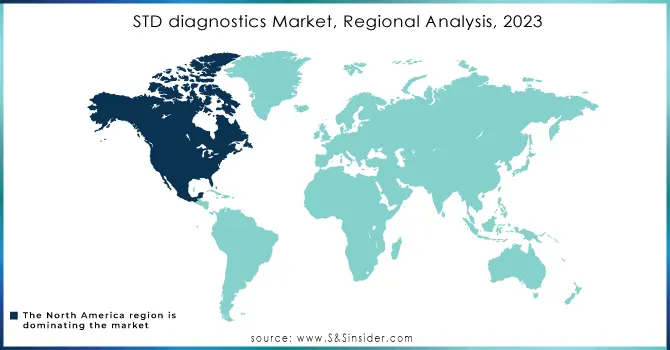

The regions of the STD diagnostics market are North America, Asia-Pacific, Central America, Latin America, the Middle East, and Africa. The regional study indicates that the Asia-Pacific area will probably continue to hold a substantial market share in 2023 and beyond. An increase in STI cases, an increase in the youth population, a lack of knowledge, and growing government activities are driving the Asia-Pacific STD testing market.

In contrast, North America will see significant development over the next several years due to the presence of key companies, the accessibility of cutting-edge products, and the growing use of point-of-care testing.

Need any customization research on STD diagnostics Market - Enquiry Now

REGIONAL COVERAGE:

North America

USA

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

The Netherlands

Rest of Europe

Asia-Pacific

Japan

South Korea

China

India

Australia

Rest of Asia-Pacific

The Middle East & Africa

Israel

UAE

South Africa

Rest of the Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin American

The Major Players are Abbott Laboratories, F. Hoffmann-La Roche Ltd., bioMérieux SA, Thermo Fisher Scientific Inc., Danaher Corporation, Quide! Corporation, Hologic, Inc., Bio-Rad Laboratories, Inc., QIAGEN, DiaSorin S.p.A, Grifols S.A. and other players.

RECENT DEVELOPMENTS

Becton, Dickinson, and Company, a new analytic instrument option for the BD COR System, announced the U.S. introduction of their new Tully automated, high-throughput infectious disease molecular diagnostics platform in May 2022.

The test is a single test that can identify the three non-viral STIs that are most common.

Trichomonas vaginalis (TV), Neisseria gonorrhoeae (GC), and The Chlamydia trachomatis (CT). The poor patient outcomes associated with these three STIs might vary from pregnancy difficulties to an elevated risk of HIV.

| Report Attributes | Details |

| Market Size in 2023 | USD 10.05 Bn |

| Market Size by 2032 | USD 18.78 Bn |

| CAGR | CAGR of 7.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Instruments and Services, Consumables, Software) • By Technology (Immunoassay, Molecular Diagnostics, Other) • By Application (CT/NG testing, Syphilis testing (PCR testing, Non-PCR testing), Gonorrhea testing, HSV testing (PCR testing, Non-PCR testing), HPV testing, HIV testing, Ureaplasma & Mycoplasma testing, Trichomonas, VZV testing (PCR testing, Non-PCR testing)) • By Location of Testing (Laboratory Testing (Commercial/Private labs, Public Health Labs), Point of Care Testing) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Abbott Laboratories (US), F. Hoffmann-La Roche Ltd. (Switzerland), bioMérieux SA (France), Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Quide! Corporation (US), Hologic, Inc. (US), Bio-Rad Laboratories, Inc. (US), QIAGEN (Netherlands), DiaSorin S.p.A (Italy), Grifols S.A. |

| Key Drivers | • Increasing Research and Development • Rising STD Incidence |

| Market Opportunities | • Targeted testing solutions • Home Testing Kits |

Ans: The STD Diagnostics Market is expected to grow at a CAGR of 7.2% by 2031.

Ans: The STD Diagnostics Market size was USD 10.05 billion in 2023 and is expected to Reach USD 17.52 billion by 2031.

Ans: One of the main factors propelling the STD diagnostics market is the global increase in the prevalence of sexually transmitted illnesses.

Ans: There have been considerable breakthroughs in diagnostic technology that have affected the STD diagnostics market.

Ans: The Asia Pacific region holds the largest market share and is expected to maintain its dominance in the coming forecast period.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of COVID-19

4.2 Impact of the Russia-Ukraine War

4.3 Impact of Ongoing Recession

4.4 Introduction

4.4.1 Impact on major economies

4.4.1.1 US

4.4.1.2 Canada

4.4.1.3 Germany

4.4.1.4 France

4.4.1.5 United Kingdom

4.4.1.6 China

4.4.1.7 Japan

4.4.1.8 South Korea

4.4.1.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. STD Diagnostics Market Segmentation, By Product

8.1 Instruments and Services

8.2 Consumables

8.3 Software

9. STD Diagnostics Market Segmentation, By Technology

9.1 Immunoassay

9.2 Molecular Diagnostics

9.3 Others

10. STD Diagnostics Market Segmentation, By Application

10.1 CT/NG testing

10.2 Syphilis testing

10.2.1 PCR testing

10.2.2 Non-PCR testing

10.3 Gonorrhea testing

10.4 HSV testing

10.4.1 PCR testing

10.4.2 Non-PCR testing

10.5 HPV testing

10.6 HIV testing

10.6 Ureaplasma & Mycoplasma testing

10.7 Trichomonas

10.8 VZV testing

10.8.1 PCR testing

10.8.2 Non-PCR testing

11. STD Diagnostics Market Segmentation, By Location of Testing

11.1 Laboratory Testing

11.1.1 Commercial/Private labs

11.1.2 Public Health Labs

11.2 Point of Care Testing

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 North America The STD diagnostics market by Country

12.2.2North America The STD diagnostics market by Type

12.2.3 North America The STD Diagnostics Market by Location of Testing

12.2.4 North America The STD diagnostics market by Testing Device

12.2.5 USA

12.2.5.1 USA The STD diagnostics market by Type

12.2.5.3 USA The STD diagnostics market by Location of Testing

12.2.5.4 USA The STD diagnostics market by Testing Device

12.2.6 Canada

12.2.6.1 Canada The STD diagnostics market by Type

12.2.6.3 Canada The STD diagnostics market by Location of Testing

12.2.6.4 Canada The STD diagnostics market by Testing Device

12.2.7 Mexico

12.2.7.1 Mexico The STD diagnostics market by Type

12.2.7.3 Mexico The STD diagnostics market by Location of Testing

12.2.7.4 Mexico The STD diagnostics market by Testing Device

12.3 Europe

12.3.1 Europe The STD diagnostics market by Country

1.3.3.2 Europe The STD diagnostics market by Type

12.3.3 Europe The STD diagnostics market by Location of Testing

12.3.4 Europe The STD diagnostics market by Testing Device

12.3.5 Germany

12.3.5.1 Germany The STD diagnostics market by Type

12.3.5.2 Germany The STD diagnostics market by Location of Testing

12.3.5.3 Germany The STD diagnostics market by Testing Device

12.3.6 UK

12.3.6.1 UK The STD diagnostics market by Type

12.3.6.2 UK The STD diagnostics market by Location of Testing

12.3.6.3 UK The STD diagnostics market by Testing Device

12.3.7 France

12.3.7.1 France The STD diagnostics market by Type

12.3.7.2 France The STD diagnostics market by Location of Testing

12.3.7.3 France The STD diagnostics market by Testing Device

12.3.8 Italy

12.3.8.1 Italy The STD diagnostics market by Type

12.3.8.2 Italy The STD diagnostics market by Location of Testing

12.3.8.3 Italy The STD diagnostics market by Testing Device

12.3.9 Spain

12.3.9.1 Spain The STD diagnostics market by Type

12.3.9.2 Spain The STD diagnostics market by Location of Testing

12.3.9.3 Spain The STD diagnostics market by Testing Device

12.3.10 The Netherlands

12.3.10.1 Netherlands The STD diagnostics market by Type

12.3.10.2 Netherlands The STD diagnostics market by Location of Testing

12.3.10.3 Netherlands The STD diagnostics market by End-use

12.3.12 Rest of Europe

12.3.12.1 Rest of Europe The STD diagnostics market by Type

12.3.12.2 Rest of Europe The STD diagnostics market by Location of Testing

12.3.12.3 Rest of Europe The STD diagnostics market by Testing Device

12.4 Asia-Pacific

12.4.1 Asia Pacific The STD diagnostics market by Country

12.4.2 Asia Pacific The STD diagnostics market by Type

12.4.3 Asia Pacific The STD diagnostics market by Location of Testing

12.4.4 Asia Pacific The STD diagnostics market by Testing Device

12.4.5 Japan

12.4.5.1 Japan The STD diagnostics market by Type

12.4.5.2 Japan The STD diagnostics market by Location of Testing

12.4.5.3 Japan The STD diagnostics market by Testing Device

12.4.6 South Korea

12.4.6.1 South Korea The STD diagnostics market by Type

12.4.6.2 South Korea The STD diagnostics market by Location of Testing

12.4.6.3 South Korea The STD diagnostics market by Testing Device

12.4.7 China

12.4.7.1 China The STD diagnostics market by Type

12.4.7.2 China The STD diagnostics market by Location of Testing

12.4.7.3 China The STD diagnostics market by Testing Device

12.4.8 India

12.4.8.1 India The STD diagnostics market by Type

12.4.8.2 India The STD diagnostics market by Location of Testing

12.4.8.3 India The STD diagnostics market by Testing Device

12.4.9 Australia

12.4.9.1 Australia The STD diagnostics market by Type

12.4.9.2 Australia The STD diagnostics market by Location of Testing

12.4.9.3 Australia The STD diagnostics market by Testing Device

12.4.10 Rest of Asia-Pacific

12.4.10.1 APAC The STD diagnostics market by Type

12.4.10.2 APAC The STD diagnostics market by Location of Testing

12.4.10.3 APAC The STD diagnostics market by Testing Device

12.5 The Middle East & Africa

12.5.1 The Middle East & Africa The STD diagnostics market by Country

12.5.2 The Middle East & Africa The STD diagnostics market by Type

12.5.3 The Middle East & Africa The STD diagnostics market by Location of Testing

12.5.4 The Middle East & Africa The STD diagnostics market by Testing Device

12.5.6 Israel

12.5.6.1 Israel The STD diagnostics market by Type

12.5.6.2 Israel The STD diagnostics market by Location of Testing

12.5.6.3 Israel The STD diagnostics market by Testing Device

12.5.6 UAE

12.5.6.1 UAE The STD diagnostics market by Type

12.5.6.2 UAE The STD diagnostics market by Location of Testing

12.5.6.3 UAE The STD diagnostics market by Testing Device

12.5.7 South Africa

12.5.7.1 South Africa The STD diagnostics market by Type

Product Type

12.5.7.2 South Africa The STD diagnostics market by Location of Testing

12.5.7.3 South Africa The STD diagnostics market by Testing Device

12.5.8 Rest of Middle East & Africa

12.5.8.1 Rest of Middle East & Asia The STD diagnostics market by Type

12.5.8.2 Rest of Middle East & Asia The STD diagnostics market Location of Testing.

12.5.8.3 Rest of Middle East & Asia The STD diagnostics market by Testing Device

12.6 Latin America

12.6.1 Latin America The STD diagnostics market by Country

12.6.2 Latin America The STD diagnostics market by Type

12.6.3 Latin America The STD diagnostics market by Location of Testing

12.6.4 Latin America The STD diagnostics market by Testing Device

12.6.5 Brazil

12.6.5.1 Brazil The STD diagnostics market by Type

12.6.5.2Brazil The STD diagnostics market by Location of Testing

12.6.5.3 Brazil The STD diagnostics market by Testing Device

12.6.6 Argentina

12.6.6.1 Argentina The STD diagnostics market by Type

12.6.6.2 Argentina The STD diagnostics market by Location of Testing

12.6.6.3 Argentina The STD diagnostics market by Testing Device

12.6.7 Rest of Latin America

12.6.7.1 Rest of Latin America The STD diagnostics market by Type

12.6.7.2 Rest of Latin America The STD diagnostics market by Location of Testing

12.6.7.3 Rest of Latin America The STD diagnostics market by Testing Device

13. Company Profile

13.1 Abbott Laboratories (US)

13.1.1 Market Overview

13.1.2 Financials

13.1.3 Product/Services/Offerings

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 F. Hoffmann-La Roche Ltd. (Switzerland)

13.2.1 Market Overview

13.2.2 Financials

13.2.3 Product/Services/Offerings

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 bioMérieux SA (France)

13.4.1 Market Overview

13.3.2 Financials

13.3.3 Product/Services/Offerings

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 Thermo Fisher Scientific Inc. (US)

13.4.1 Market Overview

13.4.2 Financials

13.4.3 Product/Services/Offerings

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Danaher Corporation (US)

13.5.1 Market Overview

13.5.2 Financials

13.5.3 Product/Services/Offerings

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 Quide! Corporation(US)

13.6.1 Market Overview

13.6.2 Financials

13.6.3 Product/Services/Offerings

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Hologic, Inc. (US).

13.7.1 Market Overview

13.7.2 Financials

13.7.3 Product/Services/Offerings

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 Bio-Rad Laboratories, Inc. (US)

13.8.1 Market Overview

13.8.2 Financials

13.8.3 Product/Services/Offerings

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 QIAGEN (Netherlands)

13.9.1 Market Overview

13.9.2 Financials

13.9.3 Product/Services/Offerings

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 DiaSorin S.p.A (Italy),

13.10.1 Market Overview

13.10.2 Financials

13.10.3 Product/Services/Offerings

13.10.4 SWOT Analysis

13.10.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

15. USE Cases and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Antiperspirants and Deodorants Market Size was valued at USD 62,889 million in 2023 and is expected to reach USD 81,920.89 million by 2031, and grow at a CAGR of 3.36% over the forecast period 2024-2031.

The Biopharmaceutical Excipients Market Size was valued at USD 2.57 billion in 2023 and is expected to reach USD 4.04 billion by 2032 and grow at a CAGR of 5.18% over the forecast period 2024-2032.

The Radiopharmaceutical Injectors Market was valued at USD 27.8 million in 2023 and will reach USD 52.3 million by 2032, with a growing CAGR of 7.2% during the forecast period of 2024-2032.

The PET Scanners Market Size was valued at USD 2.6 Billion in 2023, and is expected to reach USD 4.9 Billion by 2032, and grow at a CAGR of 7.7%.

The Orthopedic Software Market Size was assessed at USD 392.74 million in 2023, and is predicted to increase at a CAGR of 8.1 percent from 2024 to 2031, to reach USD 732.35 million.

The Pancreatic Cancer Treatment Market size was valued at USD 2.8 billion in 2023 and is expected to reach USD 10.53 billion by 2032 and grow at a CAGR of 15.85% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone