Get More Information on Sports Composites Market - Request Sample Report

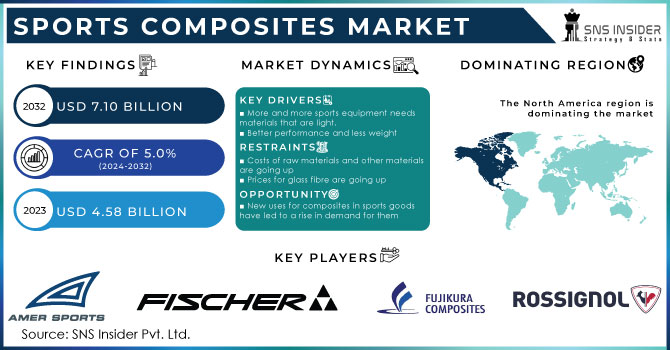

The Sports Composites Market Size was valued at USD 4.58 billion in 2023 and is expected to reach USD 7.10 billion by 2032 and grow at a CAGR of 5.0% over the forecast period 2024-2032.

The factor raising the growth of the sports composites market is the sports industry's growing need for lightweight materials. Sports equipment manufacturers and athletes are always looking for ways to improve performance, and one of the best ways to do so is to lighten the equipment. Increased speed raising, agility, and endurance are possible with lightweight materials all important characteristics in competitive sports. Because composites like carbon fiber and glass fiber offer an extraordinary strength-to-weight ratio, they give the required strength and durability without adding weight they are especially sought after. These properties help to drive the market growth.

For instance, in 2022 Toray Industries partnered with top sports equipment manufacturers to create customized composite solutions. These days, fishing rods, baseball bats, and golf shafts are made from their cutting-edge carbon fiber materials.

Sports and fitness activities are becoming more and more popular as the world places more focus on health and fitness. The need for high-performance sports gear that can improve athletic performance and lower the risk of injury is being driven by this boom in involvement.

Governments in countries such as Germany, the USA, and Japan are investing in the research and development of advanced composite materials. For example, the U.S. Department of Energy has funded various sports project focused on developing lightweight materials for various industries, including sports.

Furthermore, the demand for advanced sports equipment has increased as a result of the growth of professional sports leagues and events around the world, which has greatly enhanced the visibility and popularity of different sports. Professional athletes need equipment that improves performance while lowering the risk of injury, which is pushing the need for novel composite materials with exceptional strength, durability, and lightweight qualities. The sports composites market is expanding as a result of this professional sports demand.

Market Dynamics:

Driver

The rising usage of agile and less-weight sports equipment drives the market growth.

The increasing usage of agile and lightweight sports equipment is a key driver of market growth in sports composites. The need for advanced sports equipment is increased by governments' growing investments in fitness programs and sports infrastructure. For example, significant funding has been provided by the European Union's Horizon 2020 program for the development of novel materials, such as composites, to improve sports performance and safety. Comparably, the National Institute of Standards and Technology in the US has funded advanced composites research to raise the caliber and functionality of athletic equipment. This trend is seen in recent releases from brands like Adidas and Carbon, who unveiled the future craft 4D running shoe with a 3D printed lattice construction for lightweight support. Additionally, Hexcel Corporation's launch in 2021 of lightweight, impact-resistant composite materials for hockey sticks and skis is another example of how the industry is responding to this increasing demand. The need for gear that enables athletes to compete at their highest level has fuelled these developments, highlighting the important role that lightweight, nimble sports equipment plays in the expansion of the market.

Restrain

Production costs are high as compared to traditional products hampering the market growth.

The costly raw materials and complex manufacturing processes are required to produce composites like carbon and glass fiber, which results in increased production expenses. Moreover, the requirement for specialized equipment and trained workers drives up costs even more. Some customers and smaller manufacturers find it difficult to justify switching from traditional materials like metal and wood to advanced composites because of this pricing difference. As a result, increased production costs may prevent widespread adoption, particularly in markets where price fluctuations are significant. The sports composites market may grow more slowly as a result of this economic barrier, even if these materials have obvious performance advantages.

By Resin Type

The epoxy resin segment dominated the sports composites market with the highest revenue share of more than 38.23% in 2023. Because of its exceptional mechanical strength, great adhesive qualities, and resistance to environmental deterioration, epoxy resins are widely used. Moreover, due to its characteristics, epoxy resins are especially well-suited for high-performance sporting goods like skis, tennis rackets, and bicycles. The ultimate composite material is made to be both lightweight and durable thanks to epoxy resin's capacity to create strong bonds with reinforcing fibers like carbon and glass fibers. Furthermore, epoxy resins ‘adaptability to numerous uses makes them more appealing to a wider range of sports business sectors.

By Fiber Type

The carbon fiber held the largest revenue share of around 42.22% in 2023. It is driven by its remarkable strength-to-weight ratio, stiffness, and longevity, carbon fiber is highly valued and is used in high-performance sports equipment. Athletes' speed and agility are improved by its lightweight design, and its high strength offers the required durability to resist heavy use. The supremacy of carbon fiber is further attributed to its resistance to fatigue and environmental variables, as well as its ability to be molded into complicated shapes. This fiber is extensively utilized in many sporting goods, such as hockey sticks, golf clubs, bicycles, and tennis rackets.

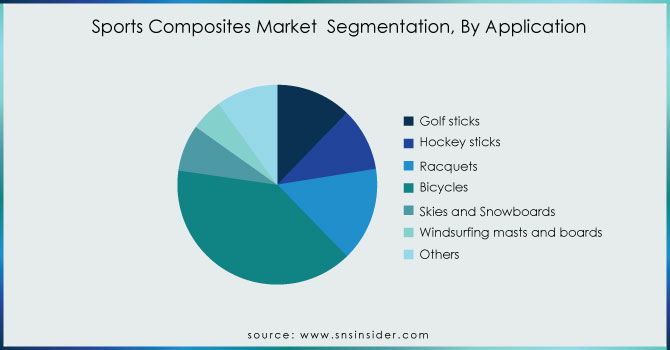

By Application

The bicycle segment held the largest, market share in the application segment of the sports composites market around 39.56% share of the market revenue in 2023. Health and fitness are becoming more and more important in the world, and cycling is acknowledged as a fun and efficient kind of exercise. Bicycles have been more in demand as a result, especially high-performance ones that make use of cutting-edge materials. In this market, carbon fiber composites are highly prized for their remarkable strength-to-weight ratio, which improves cycling performance by lowering the bike's total weight while maintaining the required rigidity and durability. Furthermore, manufacturers are now able to create bicycles with better aerodynamics, vibration dampening, and overall ride quality, making them even more desirable to leisure and competitive riders thanks to technological developments in composite materials.

Get Customized Report as per Your Business Requirement - Request For Customized Report

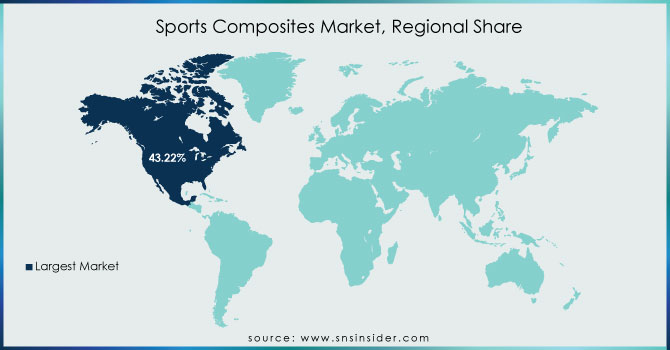

IIn 2023, Asia Pacific held the largest market share of about 43.22% of the total sports composites market. Because of the region's rapid economic expansion, more people can now afford to buy high-performance sporting goods owing to increased disposable income. Sports and fitness activities are booming in nations like China and India thanks to government initiatives and growing public awareness of health and wellness. Sports composites market has also been boosted by Asia-Pacific's substantial investments in sports infrastructure, which include the building of adavanced facilities and the hosting of important athletic events. To take advantage of the burgeoning customer base, major sports brands are also growing their businesses in the area. Asia-Pacific is a dominant force in the sports composites market due to a mix of factors including economic growth, rising sports engagement, and strategic investments. This is indicative of the region's critical position in setting global industry trends.

Rossignol, Ficher Sports, Amer Sports, Fujikura Composites, True Temper, Newell Brands, Topkey Corporation, Callway Golf, ALDILA, Inc., Prokennex, and Other Players.

Recent Development:

In 2023, Shimano made a strategic investment in composite technology, focusing on developing new carbon fiber components for bicycles. This investment is part of their broader strategy to innovate and stay competitive in the high-performance sports equipment market.

In 2023, BMC expanded its product line with the launch of the Teammachine SLR01, which utilizes an innovative carbon fiber layup for improved performance and ride quality. This launch reflects the ongoing trend of incorporating advanced composites into premium bicycles.

In 2023 Giant Manufacturing Co. Ltd, Giant announced a significant expansion of its carbon fiber production facilities in Taiwan. This investment aims to meet the increasing demand for high-performance bicycles and enhance their capability to produce advanced composite material.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.58 Billion |

| Market Size by 2032 | US$ 7.10 Billion |

| CAGR | CAGR of 5.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Resin Type (Polyurethane, Epoxy, Polyamide, Polypropylene, Others) • By Fiber Type (Carbon fiber, Glass fiber, Boron fiber, Others) • By Application (Golf sticks, Hockey sticks, Racquets, Bicycles, Skies and Snowboards, Windsurfing masts and boards, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Rossignol, Ficher Sports, Amer Sports, Fujikura Composites, True Temper, Newell Brands, Topkey Corporation, Callway Golf, ALDILA, Inc., Prokennex, and Other Players. |

| DRIVERS | • The rising usage of agile and less-weight sports equipment drives the market growth. |

| Restraints | •Production costs are high as compared to traditional products hampering the market growth. |

Ans: Primary or secondary type of research done by this reports.

Ans: New uses for composites in sports goods have led to a rise in demand for them are the opportunity for Sports Composites Market.

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: Because of the COVID-19 pandemic, there has been a global lockdown and almost a standstill in business and the economy. Several industries have been hurt badly, and their supply chains have been messed up. Low demand has had a big effect on the market, which has caused manufacturers to cut back on production. The bans on trade and travel around the world have also slowed down the supply chain.

Ans: Sports Composites Market Size was valued at USD 4.58 billion in 2023 and is expected to reach USD 7.10 billion by 2032, and grow at a CAGR of 5.0% over the forecast period 2024-2032.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Sports Composites Market Segmentation, By Resin Type

7.1 Introduction

7.2 Polyurethane

7.3 Epoxy

7.4 Polyamide

7.5 Polypropylene

7.6 Others

8. Sports Composites Market Segmentation, By Fiber Type

8.1 Introduction

8.2 Carbon fiber

8.3 Glass fiber

8.4 Boron fiber

8.5 Others

9. Sports Composites Market Segmentation, By Application

9.1 Introduction

9.2 Golf sticks

9.3 Hockey sticks

9.4 Racquets

9.5 Bicycles

9.6 Skies and Snowboards

9.7 Windsurfing masts and boards

9.8 Others

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Sports Composites Market by Country

10.2.3 North America Sports Composites Market By Resin Type

10.2.4 North America Sports Composites Market By Fiber Type

10.2.5 North America Sports Composites Market By Application

10.2.6 USA

10.2.6.1 USA Sports Composites Market By Resin Type

10.2.6.2 USA Sports Composites Market By Fiber Type

10.2.6.3 USA Sports Composites Market By Application

10.2.7 Canada

10.2.7.1 Canada Sports Composites Market By Resin Type

10.2.7.2 Canada Sports Composites Market By Fiber Type

10.2.7.3 Canada Sports Composites Market By Application

10.2.8 Mexico

10.2.8.1 Mexico Sports Composites Market By Resin Type

10.2.8.2 Mexico Sports Composites Market By Fiber Type

10.2.8.3 Mexico Sports Composites Market By Application

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Sports Composites Market by Country

10.3.2.2 Eastern Europe Sports Composites Market By Resin Type

10.3.2.3 Eastern Europe Sports Composites Market By Fiber Type

10.3.2.4 Eastern Europe Sports Composites Market By Application

10.3.2.5 Poland

10.3.2.5.1 Poland Sports Composites Market By Resin Type

10.3.2.5.2 Poland Sports Composites Market By Fiber Type

10.3.2.5.3 Poland Sports Composites Market By Application

10.3.2.6 Romania

10.3.2.6.1 Romania Sports Composites Market By Resin Type

10.3.2.6.2 Romania Sports Composites Market By Fiber Type

10.3.2.6.4 Romania Sports Composites Market By Application

10.3.2.7 Hungary

10.3.2.7.1 Hungary Sports Composites Market By Resin Type

10.3.2.7.2 Hungary Sports Composites Market By Fiber Type

10.3.2.7.3 Hungary Sports Composites Market By Application

10.3.2.8 Turkey

10.3.2.8.1 Turkey Sports Composites Market By Resin Type

10.3.2.8.2 Turkey Sports Composites Market By Fiber Type

10.3.2.8.3 Turkey Sports Composites Market By Application

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Sports Composites Market By Resin Type

10.3.2.9.2 Rest of Eastern Europe Sports Composites Market By Fiber Type

10.3.2.9.3 Rest of Eastern Europe Sports Composites Market By Application

10.3.3 Western Europe

10.3.3.1 Western Europe Sports Composites Market by Country

10.3.3.2 Western Europe Sports Composites Market By Resin Type

10.3.3.3 Western Europe Sports Composites Market By Fiber Type

10.3.3.4 Western Europe Sports Composites Market By Application

10.3.3.5 Germany

10.3.3.5.1 Germany Sports Composites Market By Resin Type

10.3.3.5.2 Germany Sports Composites Market By Fiber Type

10.3.3.5.3 Germany Sports Composites Market By Application

10.3.3.6 France

10.3.3.6.1 France Sports Composites Market By Resin Type

10.3.3.6.2 France Sports Composites Market By Fiber Type

10.3.3.6.3 France Sports Composites Market By Application

10.3.3.7 UK

10.3.3.7.1 UK Sports Composites Market By Resin Type

10.3.3.7.2 UK Sports Composites Market By Fiber Type

10.3.3.7.3 UK Sports Composites Market By Application

10.3.3.8 Italy

10.3.3.8.1 Italy Sports Composites Market By Resin Type

10.3.3.8.2 Italy Sports Composites Market By Fiber Type

10.3.3.8.3 Italy Sports Composites Market By Application

10.3.3.9 Spain

10.3.3.9.1 Spain Sports Composites Market By Resin Type

10.3.3.9.2 Spain Sports Composites Market By Fiber Type

10.3.3.9.3 Spain Sports Composites Market By Application

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Sports Composites Market By Resin Type

10.3.3.10.2 Netherlands Sports Composites Market By Fiber Type

10.3.3.10.3 Netherlands Sports Composites Market By Application

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Sports Composites Market By Resin Type

10.3.3.11.2 Switzerland Sports Composites Market By Fiber Type

10.3.3.11.3 Switzerland Sports Composites Market By Application

10.3.3.12 Austria

10.3.3.12.1 Austria Sports Composites Market By Resin Type

10.3.3.12.2 Austria Sports Composites Market By Fiber Type

10.3.3.12.3 Austria Sports Composites Market By Application

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Sports Composites Market By Resin Type

10.3.3.13.2 Rest of Western Europe Sports Composites Market By Fiber Type

10.3.3.13.3 Rest of Western Europe Sports Composites Market By Application

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Sports Composites Market by Country

10.4.3 Asia-Pacific Sports Composites Market By Resin Type

10.4.4 Asia-Pacific Sports Composites Market By Fiber Type

10.4.5 Asia-Pacific Sports Composites Market By Application

10.4.6 China

10.4.6.1 China Sports Composites Market By Resin Type

10.4.6.2 China Sports Composites Market By Fiber Type

10.4.6.3 China Sports Composites Market By Application

10.4.7 India

10.4.7.1 India Sports Composites Market By Resin Type

10.4.7.2 India Sports Composites Market By Fiber Type

10.4.7.3 India Sports Composites Market By Application

10.4.8 Japan

10.4.8.1 Japan Sports Composites Market By Resin Type

10.4.8.2 Japan Sports Composites Market By Fiber Type

10.4.8.3 Japan Sports Composites Market By Application

10.4.9 South Korea

10.4.9.1 South Korea Sports Composites Market By Resin Type

10.4.9.2 South Korea Sports Composites Market By Fiber Type

10.4.9.3 South Korea Sports Composites Market By Application

10.4.10 Vietnam

10.4.10.1 Vietnam Sports Composites Market By Resin Type

10.4.10.2 Vietnam Sports Composites Market By Fiber Type

10.4.10.3 Vietnam Sports Composites Market By Application

10.4.11 Singapore

10.4.11.1 Singapore Sports Composites Market By Resin Type

10.4.11.2 Singapore Sports Composites Market By Fiber Type

10.4.11.3 Singapore Sports Composites Market By Application

10.4.12 Australia

10.4.12.1 Australia Sports Composites Market By Resin Type

10.4.12.2 Australia Sports Composites Market By Fiber Type

10.4.12.3 Australia Sports Composites Market By Application

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Sports Composites Market By Resin Type

10.4.13.2 Rest of Asia-Pacific Sports Composites Market By Fiber Type

10.4.13.3 Rest of Asia-Pacific Sports Composites Market By Application

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Sports Composites Market by Country

10.5.2.2 Middle East Sports Composites Market By Resin Type

10.5.2.3 Middle East Sports Composites Market By Fiber Type

10.5.2.4 Middle East Sports Composites Market By Application

10.5.2.5 UAE

10.5.2.5.1 UAE Sports Composites Market By Resin Type

10.5.2.5.2 UAE Sports Composites Market By Fiber Type

10.5.2.5.3 UAE Sports Composites Market By Application

10.5.2.6 Egypt

10.5.2.6.1 Egypt Sports Composites Market By Resin Type

10.5.2.6.2 Egypt Sports Composites Market By Fiber Type

10.5.2.6.3 Egypt Sports Composites Market By Application

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Sports Composites Market By Resin Type

10.5.2.7.2 Saudi Arabia Sports Composites Market By Fiber Type

10.5.2.7.3 Saudi Arabia Sports Composites Market By Application

10.5.2.8 Qatar

10.5.2.8.1 Qatar Sports Composites Market By Resin Type

10.5.2.8.2 Qatar Sports Composites Market By Fiber Type

10.5.2.8.3 Qatar Sports Composites Market By Application

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Sports Composites Market By Resin Type

10.5.2.9.2 Rest of Middle East Sports Composites Market By Fiber Type

10.5.2.9.3 Rest of Middle East Sports Composites Market By Application

10.5.3 Africa

10.5.3.1 Africa Sports Composites Market by Country

10.5.3.2 Africa Sports Composites Market By Resin Type

10.5.3.3 Africa Sports Composites Market By Fiber Type

10.5.3.4 Africa Sports Composites Market By Application

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Sports Composites Market By Resin Type

10.5.3.5.2 Nigeria Sports Composites Market By Fiber Type

10.5.3.5.3 Nigeria Sports Composites Market By Application

10.5.3.6 South Africa

10.5.3.6.1 South Africa Sports Composites Market By Resin Type

10.5.3.6.2 South Africa Sports Composites Market By Fiber Type

10.5.3.6.3 South Africa Sports Composites Market By Application

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Sports Composites Market By Resin Type

10.5.3.7.2 Rest of Africa Sports Composites Market By Fiber Type

10.5.3.7.3 Rest of Africa Sports Composites Market By Application

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Sports Composites Market by country

10.6.3 Latin America Sports Composites Market By Resin Type

10.6.4 Latin America Sports Composites Market By Fiber Type

10.6.5 Latin America Sports Composites Market By Application

10.6.6 Brazil

10.6.6.1 Brazil Sports Composites Market By Resin Type

10.6.6.2 Brazil Sports Composites Market By Fiber Type

10.6.6.3 Brazil Sports Composites Market By Application

10.6.7 Argentina

10.6.7.1 Argentina Sports Composites Market By Resin Type

10.6.7.2 Argentina Sports Composites Market By Fiber Type

10.6.7.3 Argentina Sports Composites Market By Application

10.6.8 Colombia

10.6.8.1 Colombia Sports Composites Market By Resin Type

10.6.8.2 Colombia Sports Composites Market By Fiber Type

10.6.8.3 Colombia Sports Composites Market By Application

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Sports Composites Market By Resin Type

10.6.9.2 Rest of Latin America Sports Composites Market By Fiber Type

10.6.9.3 Rest of Latin America Sports Composites Market By Application

11. Company Profiles

11.1 Rossignol

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 Ficher Sports

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 Amer Sports

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 Fujikura Composites

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 True Temper

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 Newell Brands

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 Topkey Corporation

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 Callway Golf

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 ALDILA, Inc.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Prokennex

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.4 Industry News

12.5 Company News

12.6 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Resin Type

Polyurethane

Epoxy

Polyamide

Polypropylene

Others

By Fiber Type

Glass fiber

Boron fiber

Others

By Application

Golf sticks

Hockey sticks

Racquets

Bicycles

Skies and Snowboards

Windsurfing masts and boards

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Synthetic Rubber Market Size was valued at USD 33.70 Billion in 2023 and is expected to reach USD 51.39 Billion by 2032, at a CAGR of 4.80% from 2024-2032.

The Mulching Materials Market size was valued at USD 3.5 Billion in 2023 & will grow to USD 6.8 Billion by 2032 and grow at a CAGR of 7.7% by 2024-2032.

The Polyethylene Wax Market Size was valued at USD 1.97 billion in 2023 and is expected to reach USD 2.88 billion by 2032 and grow at a CAGR of 4.93% over the forecast period 2024-2032.

Organic Chemicals Market was valued at USD 12.75 billion in 2023 and is expected to reach USD 24.25 billion by 2032, growing at a CAGR of 7.40% from 2024-2032.

The Acid Dyes Market Size was valued at USD 1.5 billion in 2023 and is expected to reach USD 2.5 billion by 2032 and grow at a CAGR of 5.7% from 2024 to 2032.

The Palm Oil Market Size was valued at USD 70.4 billion in 2023 and is expected to reach USD 106.5 billion by 2032, at a CAGR of 4.7% from 2024-2032.

Hi! Click one of our member below to chat on Phone