Spirometer Market Size & Trends:

Get More Information on Spirometer Market - Request Sample Report

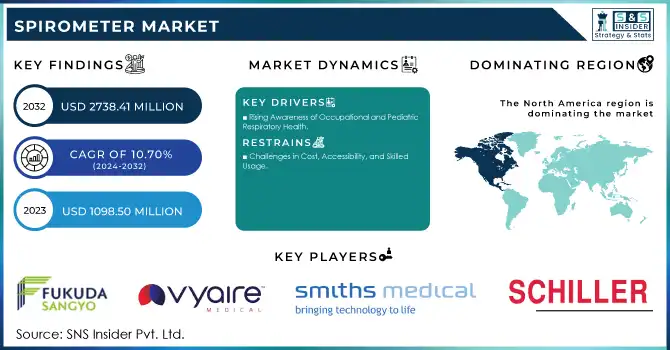

The Spirometer Market size was valued at USD 1098.50 million in 2023 and is expected to reach USD 2738.41 million by 2032, growing at a CAGR of 10.70% over the forecast period 2024-2032.

The spirometer market is growing significantly, driven by advancements in technology, increasing respiratory disease prevalence, and a greater emphasis on preventive healthcare. Chronic respiratory conditions such as asthma and chronic obstructive pulmonary disease are key factors fueling demand, with COPD affecting over 380 million people worldwide and asthma impacting 300 million individuals, according to the World Health Organization.

Portable spirometers, which offer convenience and ease of use, have seen a 30% rise in adoption over the past five years. Devices integrated with digital platforms and mobile applications enable real-time data analysis and sharing, enhancing diagnostic efficiency and patient monitoring. Furthermore, the use of artificial intelligence in spirometry has been shown to improve diagnostic accuracy by 15-20%, ensuring timely detection and management of respiratory conditions.

The focus on home-based healthcare solutions has also contributed to market expansion. Portable spirometers designed for home use are becoming increasingly popular, accounting for a significant portion of the market. Studies reveal that the demand for home-use devices surged by 40% during the COVID-19 pandemic, as patients sought convenient ways to monitor respiratory health and assess post-infection lung function.

Regulatory standards and guidelines from organizations like the American Thoracic Society and European Respiratory Society have ensured the reliability and accuracy of spirometry tests. These standards, combined with growing awareness of the importance of early diagnosis, boost the adoption of spirometers in clinical settings.

The market continues to thrive with over 100 million spirometry tests conducted annually worldwide. However, challenges such as limited access to skilled professionals, device affordability, and disparities in healthcare infrastructure in lower-income regions persist. Addressing these barriers through innovation and targeted initiatives will be crucial to sustaining growth and improving global respiratory health outcomes.

Market Dynamics

Drivers

-

Adoption of Pulmonary Function Testing in Preventive Care

Spirometry is increasingly being integrated into routine healthcare check-ups and wellness programs as healthcare providers prioritize early detection of respiratory conditions. Preventive diagnostics using spirometers help reduce long-term healthcare costs and improve patient outcomes by identifying issues like asthma and COPD before they progress. This proactive approach has solidified spirometry as a key tool in respiratory health management and routine screenings.

-

Rising Awareness of Occupational and Pediatric Respiratory Health

Mandatory spirometry testing is gaining traction in industries such as mining, construction, and chemical manufacturing, where workers are exposed to respiratory hazards. Stricter workplace safety regulations and employer initiatives to protect employee health are driving this trend. Simultaneously, the growing prevalence of childhood respiratory conditions like asthma has led to increased demand for pediatric-specific spirometers. These age-adapted devices provide accurate assessments for younger patients, addressing the unique diagnostic needs of children.

-

Technological Integration and Sustainability in Spirometry

The integration of spirometers with advanced imaging tools and diagnostic systems enables comprehensive evaluations of complex respiratory conditions, enhancing their clinical utility. Additionally, manufacturers are prioritizing environmental sustainability by developing spirometers with reusable components to reduce medical waste. These innovations align with broader eco-friendly healthcare practices, making spirometry not only a highly effective diagnostic solution but also a greener one for the global market.

Restraints

-

Challenges in Cost, Accessibility, and Skilled Usage

The spirometer market faces hurdles such as the high cost of advanced devices, limiting their accessibility in low- and middle-income regions. Many healthcare facilities in these areas lack the resources to invest in sophisticated tools. Additionally, the shortage of trained professionals to administer tests and interpret results further constrains the effective use of spirometers, particularly in rural and underserved locations. Patient discomfort during testing, which can lead to unreliable results and competition from alternative diagnostic tools like peak flow meters and imaging technologies, also pose challenges to widespread adoption. Addressing these barriers is essential for the market's sustained growth.

Spirometer Market Segmentation Overview

By Product

In 2023, Devices dominated the spirometer market, accounting for 60% of the market share. The growth of this segment is driven by the increasing adoption of advanced spirometry devices in healthcare settings, as well as their rising use for home healthcare. Devices such as handheld and desktop spirometers play a crucial role in diagnosing and managing respiratory conditions like COPD and asthma. The demand for portable, easy-to-use devices is also growing, especially with the shift toward home-based healthcare solutions.

The Software segment emerged as the fastest-growing, fueled by the integration of digital platforms and cloud-based systems for remote monitoring and data analysis. Software solutions that work in conjunction with spirometers provide real-time diagnostics and facilitate remote monitoring of patients, enhancing the accessibility and accuracy of respiratory health management. As telemedicine continues to grow, this segment is experiencing significant demand, with more healthcare providers opting for AI-driven software solutions that optimize the diagnostic process.

By Mechanism

In 2023, Flow-Sensing Spirometers held a dominant position, representing around 75% of the spirometer market share. Their precision in measuring airflow rates is key to accurately diagnosing and managing conditions like COPD and asthma. These spirometers are preferred in clinical and home healthcare settings due to their reliability and high level of accuracy in assessing pulmonary function.

The Peak Flow Meters segment is anticipated to be the fastest-growing throughput in the forecast period, largely driven by the increasing demand for cost-effective and portable diagnostic tools. Peak flow meters are especially popular for asthma management, as they allow patients to monitor their lung function at home. With the rising focus on home healthcare and self-management of chronic conditions, this segment is expected to continue expanding rapidly.

By Application

The COPD application segment dominated the market in 2023, comprising around 50% of the market share. COPD remains one of the most common chronic respiratory diseases globally, which increases the demand for spirometers for diagnosis, monitoring, and disease management. As the global aging population grows and environmental factors such as pollution rise, the incidence of COPD is increasing, further driving the use of spirometry in managing this condition.

The Asthma application segment is expected to be the fastest growing in 2024-2032, driven by the rising global prevalence of asthma and the growing awareness of the importance of early diagnosis and regular monitoring. As asthma, especially in children, continues to be a major public health issue, there is increased demand for spirometry testing to manage the condition. The rising focus on home-based monitoring solutions for asthma has further boosted the growth of this segment.

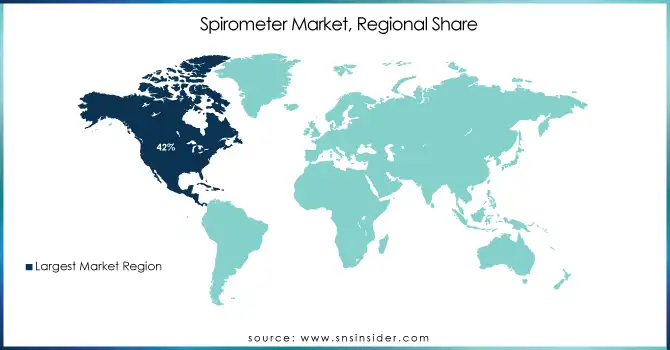

Regional Analysis :

North America led the spirometer market, holding a 42% share due to its advanced healthcare infrastructure, widespread technology adoption, and substantial government investments in healthcare. The rising prevalence of respiratory conditions such as COPD and asthma, coupled with a strong emphasis on preventive healthcare, is fueling ongoing demand for spirometry devices in the region. The United States, in particular, plays a pivotal role with its extensive use of clinical and home-use spirometers.

Europe is also experiencing notable growth, driven by increasing awareness of respiratory diseases and stringent healthcare regulations that promote early diagnosis and monitoring. Countries like Germany and the UK are seeing heightened demand for spirometry in clinical diagnostics and wellness programs, with expectations for continued growth as healthcare systems integrate more advanced technologies.

Asia Pacific is the fastest-growing region for the spirometer market, spurred by rising healthcare investments, worsening pollution levels, and a large patient population affected by respiratory ailments. The demand for affordable diagnostic tools is driving market growth in countries like China, India, and Japan, where chronic respiratory diseases are becoming more common due to rapid urbanization and changing lifestyles. Additionally, ongoing improvements in healthcare infrastructure are expected to drive further market expansion in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

-

SP-10, SpiroBank Smart, SpiroScout

-

-

Smiths Medical

-

Vitalograph Alpha Spirometer, Viva Pro

-

-

-

Vyntus SPIRO, SpiroPro, Vyaire Vmax

-

-

SDI Diagnostics

-

SDI Spirometer, SDI Spirometer 100

-

-

nSpire Health Inc.

-

EasyOne Pro, EasyOne Air, EasyOne Connect

-

-

Fukuda Sangyo Co. Ltd.

-

Spirotest Series, S-720 Spirometer

-

-

-

Sibelmed SpiroSift, Sibelmed Spirometer SP100

-

-

-

Vitalograph Alpha, Vitalograph Pneumotrac, Vitalograph Digital Spirometer

-

-

Geratherm Respiratory AG

-

Geratherm Spirometer, Geratherm FlowMeter

-

-

Koninklijke Philips N.V.

-

Philips Respironics EasyOne, Philips Spirometer

-

-

Welch Allyn (Hill-Rom, Inc.)

-

Welch Allyn Spirometer, Spirolab II

-

-

Midmark Corp.

-

Midmark Spirometry System, Midmark 290 Spirometer

-

-

Futuremed

-

Futuremed Spirometer, Futuremed FlowMetr

-

-

COSMED

-

Cosmed MicroSpiro, Cosmed Quark PFT

-

-

MGC Diagnostics Corporation

-

MGC Diagnostics Spirometer, ZAN 600 Spirometer

-

-

Medical International Research (MIR)

-

MIR Spirolab IV, MIR Spirodoc

-

-

ndd Medical Technologies

-

EasyOne Pro, EasyOne Air, Spirare

-

-

Jones Medical Instrument Company

-

Spirocard 8, Spirocard Flex

-

-

Medline

-

Medline Spirometer, Medline Micro Spirometer

-

-

Teleflex

-

Teleflex Spirometer, Flextouch Spirometer

-

-

CONTEC

-

Contec CMS-50 Spirometer, Contec SP-30 Spirometer

-

-

Fysiomed

-

Fysiomed Spirometer

-

-

Medikro

-

Medikro Spiro USB Spirometer, Medikro Handheld Spirometer

-

-

CHEST M.I.

-

CHEST M.I. Spirometer, CHEST M.I. Pneumotrac

-

-

Clarity Medical

-

Clarity Spirometer

-

-

Guangzhou Medsinglong Medical Equipment Co., Ltd.

-

Medsinglong Digital Spirometer, Medsinglong Portable Spirometer

-

Recent Development

In Oct 2024, Theravance published an area under the curve spirometry analysis of YUPELRI (revefenacin) in the International Journal of Chronic Obstructive Pulmonary Disease. This study provides further insights into the drug’s performance in treating COPD, marking a significant advancement in respiratory medicine.

In Jan 2024, NuvoAir Medical received FDA 510(k) clearance for its Air Next Spirometer, enabling its use as a full spirometer for in-home applications. This approval allows NuvoAir to broaden its clinical operations, ensuring comprehensive care for patients with heart and lung conditions.

In Sept 2023, Pune-based startup Alveofit (Roundworks Technologies Private Limited) received US FDA clearance for its alveoair spirometer, marking a significant milestone in its mission to provide affordable, digital respiratory care solutions. This approval and strategic partnerships like the one with AstraZeneca pave the way for expanded international presence, especially in the US and emerging markets.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1098.50 Million |

| Market Size by 2032 | US$ 2738.41 Million |

| CAGR | CAGR of 10.70% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Consumables & Accessories, Devices (PC- Based Spirometer, Portable Spirometer, Table-Top Spirometer), Software] • By Mechanism (Flow-Sensing Spirometer, Peak Flow Meters) • By Application (COPD, Asthma, Other Applications) • By End User (Hospitals, Clinical Laboratories, Homecare Settings, Industrial Settings) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Schiller, Smiths Medical, Vyaire Medical, SDI Diagnostics, nSpire Health Inc., Fukuda Sangyo Co. Ltd., Sibelmed, Vitalograph, Geratherm Respiratory AG, Koninklijke Philips N.V., Welch Allyn (Hill-Rom, Inc.), Midmark Corp., Futuremed, COSMED, MGC Diagnostics Corporation, Medical International Research (MIR), ndd Medical Technologies, Jones Medical Instrument Company, Medline, Teleflex, CONTEC, Fysiomed, Medikro, CHEST M.I., Clarity Medical, and Guangzhou Medsinglong Medical Equipment Co., Ltd. |

| Key Drivers | • Adoption of Pulmonary Function Testing in Preventive Care |

| Restraints | • Challenges in Cost, Accessibility, and Skilled Usage |