To get more information on Space Power Electronics Market - Request Free Sample Report

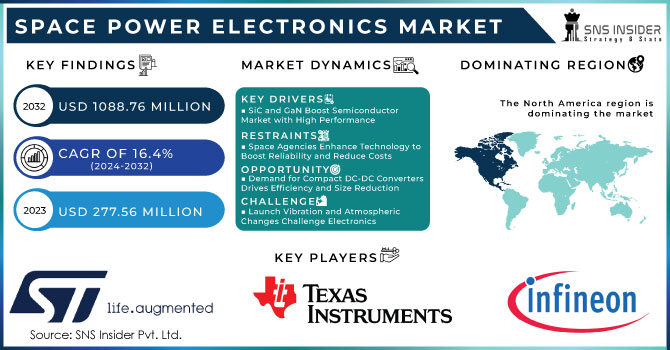

The Space power electronics market size was valued at USD 277.56 million in 2023 and is projected to reach USD 1088.76 million by 2032 with a growing CAGR of 16.4% Over the Forecast Period 2024-2032.

Space power electronics is the use of electronics in satellites, spacecraft, open cars, space stations, and rovers to control and convert electrical energy from one form to another. It is responsible for processing high voltage and currents to deliver power that supports a variety of needs. According to the National Aeronautics and Space Administration, a power system can integrate a modular power electronic subsystem (PESS) connected to a source and load it into its inlet and outlet power holes, respectively. Semiconductor devices such as metal-oxide-semiconductor field-effect transistors (MOSFET), insulated gate bipolar transistors (IGBT), mos-controlled thyristors (MCT), and gate-turn-off thyristors (GTO) are represented. room stone for modem power converters.

KEY DRIVERS

The semiconductor material used to make space cables has made significant strides in the last few decades. The materials used for the wide bandgap semiconductor have a certain interest, which has given a significant improvement in performance beyond the current level, silicon, due to the increased demand for materials such as silicon carbide (SiC) and gallium nitride (GaN). These broad bandgap materials can operate at high temperatures of up to 200 ° C as long as the package cannot withstand this, while silicon is limited to 150 ° C. A wide semiconductor bandgap can handle 10 times more voltage compared to silicon and the switching speed/frequency of SiC and GaN is also 10 times higher than silicon. GaN and SiC electric semiconductors are expected to make significant progress in the energy industry over the next decade and will have a combined 13% share in the semiconductor energy market by 2024.

RESTRAINTS

Many space agencies and nonprofit organizations are trying to improve the technology used in the atmosphere to improve their reliability by improving emissions by reducing energy losses. At the same time, they are trying to reduce the cost of electronic power space. They have developed electromagnetic properties of electromagnetic energy so that they can tolerate strong radioactive environments with better long-term accuracy. Players working in the electronics industry are focused on combining multiple functions into a single chip, leading to a more complex design.

In addition, the design and assembly of complex devices require specialized skills, robust operation, and a set of specific tools, which increase the total cost of devices. Therefore, the high cost of devices is expected to hamper the process of switching to advanced technology equipment. Later, flexible technology creates the need for more performance to integrate into system-on-chips (SoCs), making devices smaller and more efficient. All of these changes in atmospheric energy make their structure more complex and increase the complexity of the assembling process.

OPPORTUNITIES

In the current situation, satellite manufacturers are looking for compact power converters. The combination of converters benefits designers who need a galvanically separated output power or noise reduction in an analog cycle. A smaller version of DC-DC converters will provide much lower noise output with an extended operating temperature, which will result in higher switching frequencies. As a result, converters will deliver higher efficiency. Therefore, market players have the opportunity to reduce device size to make DC-DC converters more efficient

CHALLENGES

The first challenge of atmospheric electronics is the vibration set by the launch car. When a spacecraft leaves Earth's atmosphere there are many local changes such as temperature changes and pressures that need to be handled electronically.

High levels of pollution in the upper areas can contribute to electrostatic emissions. Satellites are also at risk of being charged and charged. Satellite charging is the difference in electrostatic power of a satellite, in relation to the plasma with low-density plasma around the satellite. The charging rate depends on satellite and orbit configurations. Two main mechanisms are responsible for charging plasma bombardment and photoelectric effects. Up to 20,000 V emissions are known to occur on satellites in geosynchronous channels. The atmosphere in LEO is made up of about 96% of atomic oxygen.

THE IMPACT OF COVID-19

The COVID-19 epidemic has wreaked havoc on the world's economic activities. The production of electrical energy in the atmosphere, underground systems, and components has also had an impact. Although satellite systems are very important, disruptions in the supply chain have halted their current production processes. The resumption of production activities depends on the level of exposure to COVID-19, the level at which production operations are performed, and the import and export regulations, among other factors. While companies may still take orders, delivery schedules may not be adjusted.

By Device Type

Power Discrete

Power Module

Power IC

By Application

Satellite

Spacecraft & Launch Vehicle

Rovers

Space stations

By Platform type

Power

Command and data handling

ADCS

Propulsion

TT&C

Structure

Thermal System

By Voltage

Low Voltage

Medium Voltage

High Voltage

By Current

Upto 25A

25-50A

Over 50A

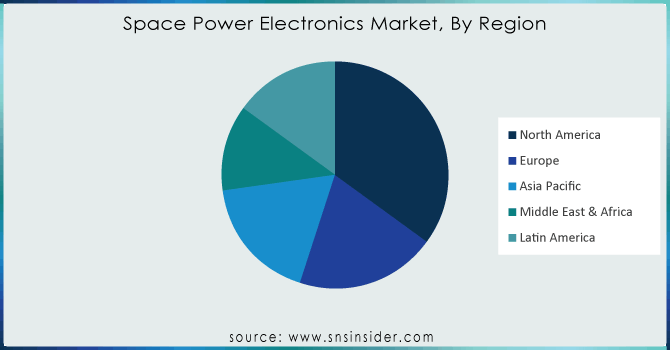

REGIONAL COVERAGE

North America

USA

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

The Netherlands

Rest of Europe

Asia-Pacific

Japan

South Korea

China

India

Australia

Rest of Asia-Pacific

The Middle East & Africa

Israel

UAE

South Africa

Rest of Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

Need any customization research on Space Power Electronics Market - Enquiry Now

The Key Players are Infineon Technologies, Texas Instrument Incorporated, STMicroelectronics, Bonkemi, Renesas Electronics Corporation & Other Players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 277.56 Million |

| Market Size by 2032 | US$ 1088.76 Million |

| CAGR | CAGR of 16.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type (Power Discrete, Power Module, Power IC) • By Application (Satellites, Spacecraft & Launch Vehicles, Space Stations, Rovers) • By Platform • By Voltage • By Current • By Material |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Infineon Technologies, Texas Instrument Incorporated, STMicroelectronics, Bonkemi, and Renesas Electronics Corporation |

Ans: The Space Power Electronics Market is growing at a CAGR of 16.4% Over the Forecast Period 2024-2032.

In the current situation, satellite manufacturers are looking for compact power converters. The combination of converters benefits designers who need a galvanically separated output power or noise reduction in an analog cycle. A smaller version of DC-DC converters will provide much lower noise output with an extended operating temperature, which will result in higher switching frequencies.

The first challenge of atmospheric electronics is the vibration set by the launch car. When a spacecraft leaves Earth's atmosphere there are many local changes such as temperature changes and pressures that need to be handled electronically.

Ans: The Space Power Electronics Market size was valued at US$ 277.56 million in 2023.

North America, Asia-Pacific, The Middle East & Africa, Latin America, Europe are the major five region covered in this report.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 COVID-19 Impact Analysis

4.2 Impact of Ukraine- Russia war

4.3 Impact of ongoing Recession

4.3.1 Introduction

4.3.2 Impact on major economies

4.3.2.1 US

4.3.2.2 Canada

4.3.2.3 Germany

4.3.2.4 France

4.3.2.5 United Kingdom

4.3.2.6 China

4.3.2.7 Japan

4.3.2.8 South Korea

4.3.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Space Power Electronics Market, By Device Type

8.1 Power Discrete

8.2 Power Module

8.3 Power IC

9. Space Power Electronics Market, By Application

9.1 Satellite

9.2 Spacecraft & Launch Vehicle

9.3 Rovers

9.4 Space stations

10. Space Power Electronics Market, By Platform type

10.1 Power

10.2 Command and data handling

10.3 ADCS

10.4 Propulsion

10.5 TT&C

10.6 Structure

10.7 Thermal system

11. Space Power Electronics Market, By Voltage

11.1 Low Voltage

11.2 Medium Voltage

11.3 High Voltage

12. Space Power Electronics Market, By Current

12.1 Upto 25A

12.2 25-50A

12.4 Over 50A

13. Regional Analysis

13.1 Introduction

13.2 North America

13.2.1 USA

13.2.2 Canada

13.2.3 Mexico

13.3 Europe

13.3.1 Germany

13.3.2 UK

13.3.3 France

13.3.4 Italy

13.3.5 Spain

13.3.6 The Netherlands

13.3.7 Rest of Europe

13.4 Asia-Pacific

13.4.1 Japan

13.4.2 South Korea

13.4.3 China

13.4.4 India

13.4.5 Australia

13.4.6 Rest of Asia-Pacific

13.5 The Middle East & Africa

13.5.1 Israel

13.5.2 UAE

13.5.3 South Africa

13.5.4 Rest

13.6 Latin America

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of Latin America

14. Company Profiles

14.1 HITACHI LTD.

14.1.1 Financial

14.1.2 Products/ Services Offered

14.1.3 SWOT Analysis

14.1.4 The SNS view

14.2 AB VOLVO

14.3 CATTERPILLAR INC.

14.4 CNH INDUSTRIAL N.V

14.5 DEERE AND COMPANY

14.6 DOOSAN INFRACOE CO.LTD

14.7 J C BAMFORD EXCAVATORS. LTD.

14.8 KOMATSU LTD.

14.9 Liebherr-international AG

14.10 XCMG GROUP

15. Competitive Landscape

15.1 Competitive Benchmark

15.2 Market Share Analysis

15.3 Recent Developments

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The aircraft docking systems market size was valued at USD 10.03 Billion in 2023 and is expected to reach USD 12.00 Billion by 2032 and grow at a CAGR of 2.02% over the forecast period 2024-2032.

The Agriculture Drone Market size amounted to USD 4.6 Billion in 2023 & is estimated to reach USD 40.40 Billion by 2031 and increase at a compound annual growth rate (CAGR) of 31.2% between 2024 and 2031.

The Commercial Radars Market Size was valued at USD 6.63 Billion in 2023 and will reach USD 12.80 Billion by 2032 and grow at a CAGR of 7.62% by 2024-2032.

The Ground Support Equipment Market Size was valued at US$ 5.92 billion in 2023 and is expected to reach USD 8.99 billion by 2032 with a growing CAGR of 4.75% over the forecast period 2024-2032.

The Air-to-Air Refueling Market Size was valued at USD 691.57 million in 2023, expected to reach USD 1593.7 million by 2032 and grow at a CAGR of 9.72% over the forecast period 2024-2032.

The Military Sensors Market Size was valued at USD 11.25 billion in 2023 and is expected to reach USD 18.20 billion by 2031 and grow at a CAGR of 6.2% over the forecast period 2024-2031.

Hi! Click one of our member below to chat on Phone