Space Mining Market Size & Growth:

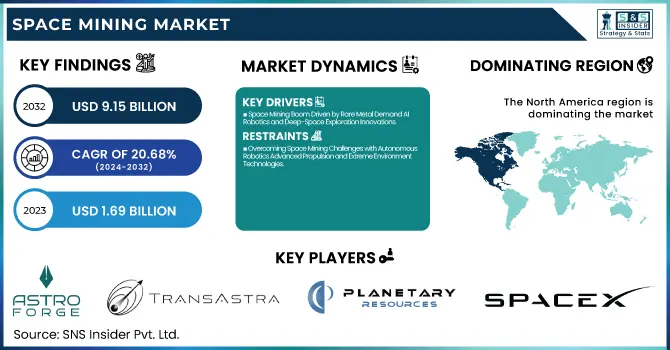

The Space Mining Market Size was valued at USD 1.69 billion in 2023 and is expected to reach USD 9.15 billion by 2032, growing at a CAGR of 20.68% over the forecast period 2024-2032. The U.S. space mining industry is rapidly maturing as technological developments, private sector investment, and government initiatives promoting space resource development have all helped to support the emergence of the commercial space mining sector. Beyond Earth, firms are looking at mining asteroids and the moon for scarce metals and extracting water to service deep-space exploration.

To Get more information on Space Mining Market - Request Free Sample Report

Active research and development into In-Situ Resource Utilization are underway through NASA's Artemis program and partnerships with commercial firms, to ultimately facilitate sustainable operations beyond LEO. Nonetheless, policy and ethical issues regarding space resource extraction remain on the table. With increasing competition, the U.S. is going all-in to become a leader in space mining, focusing on innovation, infrastructure, and durability for the long haul.

U.S. Space Mining Market size was valued at USD 0.50 Billion in 2023 and the total Space Mining revenue is expected to grow at a CAGR of 20.6% from 2024 to 2032. Increasing government and private sector investments, advancements in asteroid exploration, and growing interest in space-based resources for energy and technology are the major factors driving the growth of the planetary defense market.

Space Mining Market Dynamics

Key Drivers:

-

Space Mining Boom Driven by Rare Metal Demand AI Robotics and Deep-Space Exploration Innovations

Demand for rare metals and minerals used in high-fidelity gadgets such as semiconductors, batteries, and aviation hardware is fueling the market for space mining. Not only are Earth's resources being depleted but with access to eutectic materials such as platinum, nickel and rare earth elements limited, governments and private companies are setting their sights on asteroid mining. Further, the advancements in space exploration tools and robotic mining systems coupled with artificial intelligence-based asteroid detection systems boost the market growth. A list of leading space agencies, like NASA, ESA, and CNSA, are fueling investments, while private players, including SpaceX, Blue Origin, and firms like AstroForge for prospecting asteroids, are pushing new frontiers of research. Additionally, increasing efforts for in-situ resource utilization (ISRU) for deep-space exploration and permanent lunar settlements are bolstering the market opportunity.

Restrain:

-

Overcoming Space Mining Challenges with Autonomous Robotics Advanced Propulsion and Extreme Environment Technologies

The technological and engineering hurdles of extracting resources from asteroids, the Moon, and other bodies of the solar system represent one of the most significant challenges of space mining. These mining technologies are mostly for planetary bodies and will be a challenge to obtain original ones for use in microgravity, extreme temperatures, and vacuum. One of the major challenges is the development of autonomous robotic mining systems that can go to asteroid bases and mine rich resources of metals without human intervention in the harsh environmental conditions of space. We need new or adapted propulsion and cargo handling technologies to safely return mined materials to Earth, or, to use them in space.

Opportunity:

-

Space Mining Unlocks New Era of Space Economy Fuel Production 3D Printing and Infrastructure Development

Tapping the mined materials for space infrastructure will open a great deal of opportunities i.e. a new epoch of space economy to capitalize. As we are planning for Moon and Mars missions, the mined resources such as water ice can also be transformed into hydrogen fuel, decreasing reliance on Earth-based supplies. Emerging economies such as India and the UAE have started to invest in space mining projects and further expand the market scope. Turning the mined resources into platform technology, 3D printing offers promising potential for building both space stations and habitats.

Challenges:

-

Regulatory Uncertainty Geopolitical Tensions and Environmental Concerns Challenge the Future of Space Mining

Regulatory and legal uncertainty over ownership and export mining rights is another key restraint. International treaties such as the Outer Space Treaty (1967) forbid national sovereignty over celestial bodies, but there are no treaties prohibiting private companies from owning and using space resources. The absence of universal policies may lead to conflicts between countries and corporations, therefore stirring geopolitical conflict over those matters. Additionally, there are environmental issues related to space junk and the potential damage from mining operations on the various celestial bodies. Solving these issues will mean efforts on Earth and timely drafting of policies governing responsible space miners.

Space Mining Market Segment Analysis

By Asteroid Type

C-type (carbonaceous) asteroids received the largest share of the space mining market in 2023, holding approximately 72.5% of the total share. Asteroids are the most popular and also contain great wealth in water, organics, and gas volatiles that are great for in-situ resource utilization (ISRU). Because they are so watery, they are great sources for making hydrogen and oxygen, which is what one would need to fuel rockets and survive the long haul. Moreover, the great accessibility of these planets and their scientific importance are the keys to continued exploration.

The S-type asteroids are expected to see the highest CAGR from 2024 to 2032. Valuable metals such as nickel, iron, and magnesium silicates are abundant in these, which makes them desirable for manufacturing and construction in space. Due to the development of better asteroid mining technology, the ability to mine metals from S-type asteroids will grow shortly, as upon demand for building more infrastructure in space, and the need for deep-space missions too.

By Phase

The spacecraft design segment of the space mining market is expected to witness significant growth, owing to increasing demand for mining spacecraft, robotic extractors, and asteroid landers, and led the market with a share of about 45.3% in 2023. Propulsion system and automated drilling technologies supported by investment generating rotational separation-specific manufacture-oriented spacecraft for extracting resources. Assembling robust and efficient drones to operate in inhospitable and unfriendly environments above terrestrial soil for days, weeks, or months while performing often complex mining processes is an obvious priority of leading space agencies and private companies.

Over the forecast period from 2024 to 2032, the operations segment is projected to have the highest CAGR growth. Soon, as space mining missions move from concept to reality, the need for real-time tracking of asteroids, autonomous robotic systems, and space-to-Earth transport systems will increase. Demand for mission control, remote monitoring, and space-based resource processing will grow. In addition, improvements in AI, robotics, and comms systems will be essential to enable space mining as a sustainable commercial industry.

Space Mining Market Regional Outlook

North America accounted for 39.7% of the space mining market in 2023 due to the presence of considerable space organizations and private companies investing in asteroid and lunar mineral extraction in this region. Technologies for mining asteroids and other bodies have a boost from NASA's Artemis program of NASA's partnerships with commercial firms such as SpaceX, Blue Origin, and Astrobotic. TransAstra is developing asteroid capture and mining techniques, while Colorado-based Lunar Outpost focuses on excavation systems on the Moon. The Commercial Space Launch Competitiveness Act, for instance, also helps facilitate the private sector and turn grow the market.

The region that is expected to see the fastest CAGR from 2024 to 2032 is Asia Pacific, with rising investments driven by China, India, and Japan. China’s Deep Space Exploration Laboratory (DSEL) is reportedly developing technologies for lunar and asteroid mining, while the Chinese National Space Administration (CNSA) is jointly examining methods to obtain resources from the Moon for its Chang’e exploration missions. While ISRO and private firms such as Pixxel continue to step into space with a broader focus to exploit existing resources, Just RAPIDLY-Retrieved Samples Of Tough Asteroid RyuguProves The Tech For Japan’s Hayabusa2 Space-Mining Mission. At the same time, the Asia Pacific region is set to become a major space resource extraction player, bolstered by firm government backing and growing private sector activity.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Space Mining Market are:

-

AstroForge (Asteroid Mining Missions)

-

TransAstra (Mini Bee Asteroid Mining Tug)

-

Planetary Resources (Arkyd-6 Satellite)

-

Deep Space Industries (DSI) (Xplorer Spacecraft)

-

OffWorld (AI-Powered Robotic Miners)

-

ispace (HAKUTO-R Lunar Lander)

-

Blue Origin (Blue Moon Lander)

-

SpaceX (Starship for Lunar Missions)

-

NASA (Artemis Lunar Resource Utilization)

-

European Space Agency (ESA) (PROSPECT Lunar Mining System)

-

JAXA (Hayabusa2 Asteroid Sample Return)

-

CNSA (Chang’e Lunar Exploration Program)

-

Lunar Outpost (Lunar Resource Extraction Systems)

-

Helios (Oxygen Extraction from Lunar Regolith)

-

Orbit Fab (Space Fuel Depot for Mining Missions)

Recent Trends

-

In January 2025, AstroForge has selected asteroid 2022 OB5 for its Odin mission, set to launch next month aboard a SpaceX Falcon 9. The spacecraft will conduct a flyby to assess the asteroid's potential for space mining.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.69 Billion |

| Market Size by 2032 | USD 9.15 Billion |

| CAGR | CAGR of 20.68% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Asteroid Type (C-type, S-type, M-type) • By Phase (Spacecraft Design, Launch, Operation) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AstroForge, TransAstra, Planetary Resources, Deep Space Industries (DSI), OffWorld, ispace, Blue Origin, SpaceX, NASA, European Space Agency (ESA), JAXA, CNSA, Lunar Outpost, Helios, Orbit Fab. |