Space Launch Services Market Report Scope & Overview:

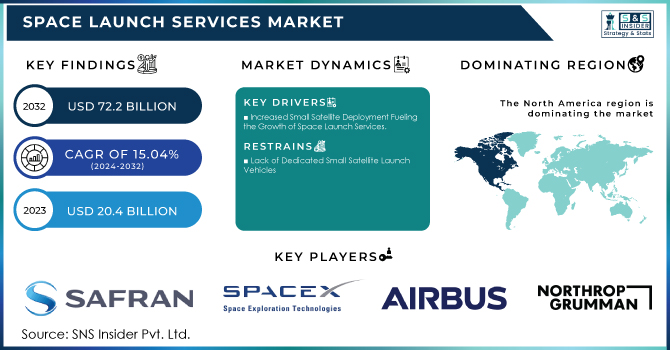

The Space Launch Services Market was valued at USD 20.4 billion in 2023 and is expected to reach USD 72.2 billion by 2032, growing at a CAGR of 15.04% over the forecast period of 2024-2032.

To get more information on Space Launch Services Market - Request Free Sample Report

The operations of space launch service providers are related to the market for space launch services. It consists of several events, including ordering, conversion, construction, stacking and assembly, payload integration, and launch. Private launch service providers' involvement has resulted in lower launch costs and the introduction of new technology, ushering in a new era in the sector.

The increased number of satellite and testing probe launches is driving the expansion of the space launch services market. Furthermore, greater government investments and private capital have a substantial impact on market growth. The high initial expenses connected with the launch services, on the other hand, function as a market restraint. Furthermore, organisations' interoperability concerns stifle market expansion. Another factor impeding market expansion is a lack of skilled labour and opposition to adaption to new technologies. Meanwhile, attempts to minimise the cost of launch services provide a lucrative opportunity for market participants in the space launch services business. The space launch services market study takes into account all of the driving variables responsible for the global expansion of the space launch services industry. In addition, the market for space launch services is expected to grow from 2023 to 2030.

MARKET DYNAMICS

KEY DRIVERS

-

Increased Small Satellite Deployment Fueling the Growth of Space Launch Services

-

Significant investments by venture firms are fueling an increase in space exploration missions.

RESTRAINTS

-

Lack of Dedicated Small Satellite Launch Vehicles

-

A lack of procedures for disposing of orbital debris

OPPORTUNITY

-

Technological Upgradation in Space Industry Leading to Low Cost of Spacecraft Launches

CHALLENGES

-

Scarce Intellectual Assets in Many Countries Hindering the Expansion of the Space Launch Services Market

IMPACT OF COVID-19

The current COVID-19 outbreak has had a significant impact on the global economy. Because of the rapid spread of the sickness, a few countries are seeking to take drastic measures to control the spread of the illness. The extreme procedures implemented to stop the spread of the illnesses have limited organisations globally involved in Space Launch Services programmes. The pandemic has had a negative impact on companies in the Space Launch Services Market due to postponements in proposed satellite projects. Organizations make efforts to recover from financial disasters. However, government associations throughout the world will appear beneficial for boosting the Space Launch Services Market in the future.

Payload, launch platform, service type, launch vehicle, end-user, and area are the many segments of the space launch services sector. Small and big satellites, manned spacecraft, freight, testing probes, and strotallites are the payload categories. There are three types of launch platforms: land, air, and water. It is divided into two types of services: pre-launch and post-launch. It is divided into two categories based on the launch vehicle: tiny and heavy. The end-user group is classified into two categories: government and military, and commercial. It is examined regionally across the United States, Russia, Other European Countries, China, India, Japan, New Zealand, and the Rest of the World.

In terms of payload, the small satellites and cargo segment has the largest market share in 2021. The commercial uses of satellites in communication and Earth observation for accurate and relevant data collection provide greater growth potential in the satellite market.

The land platform has the biggest market share for space launch services, followed by the sea platform. During the projection period, however, enhanced R&D activities and innovations in sea launch for alternate launch methods via moveable launch platforms are expected to grow. In comparison to other platforms, the land platform is more cost-effective and technologically advanced.

The service type segment is divided into two parts: pre-launch and post-launch services. Pre-launch services have a substantial market share and will maintain this position during the forecast period.

The launch vehicle segment is further subdivided into small vehicles capable of lifting less than 300 tonnes and large vehicles capable of lifting more than 300 tonnes. Heavy launch vehicles have the largest market share and will continue to dominate the industry due to their use from the beginning and larger presence.

The end-user market is separated into two categories: government and military, and commercial. Because of rising investments in exploration activities, particularly in probe missions for military applications and manned spacecraft for future deep space exploration programmes, the government and military sectors dominate the market. As the commercialization of numerous satellites and cargo activities grows, the commercial segment is the fastest-increasing section. The segment's growth is being driven by increased communication and earth observation satellites for precise and relevant data collecting. In terms of launch service providers, the United States has the largest market share in the commercial segment, with European countries coming in second. This is due to the presence of the first launch vehicle family in Russia, as a result of the country's early development.

KEY MARKET SEGMENTATION

by Launch Platform

-

Land

-

Air

-

Sea

by Service Type

-

Pre-Launch

-

Post-Launch

by Launch Vehicle

-

Small

-

Heavy

by End-User

-

Government & Military

-

Commercial

by Payload

-

Satellite

-

Human Spaceflight

-

Cargo

-

Testing Probes

-

Stratollite

REGIONAL ANALYSIS

North America surpassed the Space Launch Services Market in 2020 and is expected to remain the largest geographical market during the forecast period due to significant investments by space agencies and commercial enterprises in developing advanced satellites. Europe is expected to be the second-largest region in the market for Space Launch Services. This can be attributed to space exploration exercises in Russia, Germany, the United Kingdom, and France. Arianespace, Eurockot Launch Services, and ISC Kosmotras are among the key LSPs promoting business sector development in the region.

Need any customization research on Space Launch Services Market - Enquiry Now

REGIONAL COVERAGE

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are China Aerospace Science And Technology Corporation, Safran Sa, Space Exploration Technologies Corp. (SpaceX), Starsem, Airbus S.A.S, Antrix Corporation Limited, Northrop Grumman Corporation, Rocket Lab USA, Lockheed Martin Corporation, Mitsubishi Heavy Industries & Other Players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 20.4 Billion |

| Market Size by 2032 | US$ 72.2 Billion |

| CAGR | CAGR of 15.04% From 2023 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Launch Platform (Land, Air, and Sea) • By Service Type (Pre-Launch and Post-Launch) • By Launch Vehicle (Small [Less than 300 ton] and Heavy [Above 300 ton]) • By End-User (Government & Military and Commercial) • By Payload (Satellite, Human Spaceflight, Cargo, Testing Probes, and Stratollite) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | China Aerospace Science And Technology Corporation, Safran Sa, Space Exploration Technologies Corp. (Spacex), Starsem, Airbus S.A.S, Antrix Corporation Limited, Northrop Grumman Corporation, Rocket Lab USA, Lockheed Martin Corporation, Mitsubishi Heavy Industries. |

| DRIVERS | • Increased Small Satellite Deployment Fueling the Growth of Space Launch Services • Significant investments by venture firms are fueling an increase in space exploration missions. |

| RESTRAINTS | • Lack of Dedicated Small Satellite Launch Vehicles • A lack of procedures for disposing of orbital debris |