Get More Information on Solar Inverter Market - Request Sample Report

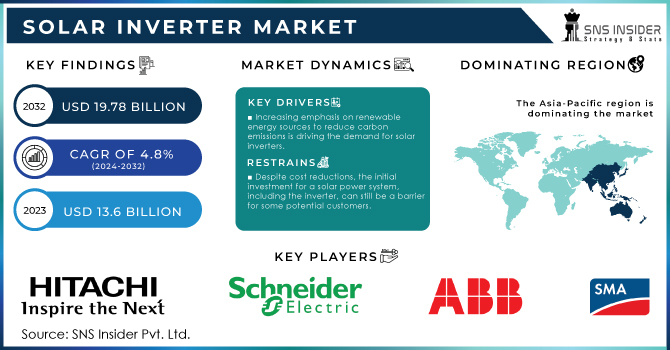

The Solar Inverter Market Size was valued at $13.6 billion in 2023 and is expected to reach $19.78 billion by 2032 and grow at a CAGR of 4.8% by 2024-2032.

The rapid development in the renewable energy sector is a key driver. Governments around the world are setting ambitious renewable energy targets, driving significant investments in solar power generation. According to the International Renewable Energy Agency (IRENA), global solar PV capacity reached a staggering 1,337 Gigawatts (GW) at the end of 2022 [IRENA], and this number is only expected to climb. This surge in solar installations necessitates a proportional increase in solar inverters, the brains of the operation that convert direct current (DC) electricity from solar panels into usable alternating current (AC) for powering homes and businesses. the ease of installation, particularly for string inverters, is another major growth factor.

String inverters are a popular choice for residential and small commercial solar systems due to their affordability and simpler installation process compared to other inverter types. This ease of use makes solar power systems more accessible to a wider range of customers, further accelerating market expansion. Finally, technological advancements are playing a crucial role. Manufacturers are constantly innovating to create more efficient inverters with higher power conversion rates. This translates to increased energy production from solar panels, making solar power systems even more cost-effective. Research by Mercom Capital Group suggests that global solar inverter shipment volume is expected to reach 430 Gigawatts (GW) by 2030, highlighting the anticipated market boom

RESTRAINTS:

Despite cost reductions, the initial investment for a solar power system, including the inverter, can still be a barrier for some potential customers.

Grid Integration Challenges

Integrating large-scale solar power generation with existing electrical grids can pose challenges. Fluctuations in solar energy production require grid operators to implement sophisticated grid management solutions.

OPPORTUNITIES:

The increasing integration of battery storage with solar power systems creates a need for inverters compatible with battery technology.

Growing Demand for Smart Inverters

Smart inverters offer advanced features like remote monitoring, data analysis, and grid communication capabilities. This growing demand for smart functionalities presents an opportunity for manufacturers to develop and market innovative inverter solutions.

CHALLENGES:

The presence of counterfeit inverters can pose a safety risk and negatively impact the market reputation of legitimate manufacturers.

Government Policy Shifts and Shifting Subsidy Structures.

Government policies and subsidies play a crucial role in driving solar power adoption and inverter demand. Changes in government policies can create uncertainty for the market and impact investor confidence. For eg. Trade policies like tariffs or import restrictions on solar inverters can increase production costs and inverter prices for consumers. This can hinder market growth and potentially lead to a shift towards domestically produced inverters, impacting the global supply chain.

The Russia-Ukraine war has had a mixed impact on the solar inverter market. On the one hand, the war has caused disruptions in the supply chain and increase the prices for raw materials like silicon and steel, which are important key materials required in solar inverters. This has slowed down the profit margins for inverter manufacturers and potentially decreased the sales growth. However, the war has also triggered a surge in global energy prices, particularly for natural gas. This has made renewable energy sources like solar power more attractive, which leading to increased demand for solar inverters. Additionally, some countries in Europe are looking to accelerate their shift away from reliance on Russian fossil fuels, which could further boost solar inverter sales. For instance, European governments heavily reliant on Russian energy imports might prioritize renewable energy sources like solar power, potentially leading to increased solar inverter demand in that region.

During economic slowdown, households tend to tighten their budgets, delaying investments in non-essential items like home solar panel systems. This directly leads to a decline in demand for residential solar inverter. Businesses and industries also become more cautious during economic slowdowns, potentially postponing or cancelling new construction projects that might include solar installations. This translates to a decrease in demand for commercial and utility-scale solar inverters.

By System Type

Central Inverter

Micro Inverter

String Inverter

Based on Type, it includes Central-inverter, micro-inverter and string inverter. In 2021, Central-inverter segment held the majority of share approximately 48-53% of the solar inverter market revenue. This is due to the increase in demand for central inverters from major industrial and utility applications worldwide. In the years 2021-2030, it is also expected that the rapid industrialization and development of renewable energy infrastructures in developing countries such as China, India, Japan, etc. will increase the demand for medium inverters.

By System Type

On-Grid

Off-Grid

Based on the system Type, the market for solar inverters is divided into on-grid and off-grid sectors. The grid system holds the largest market share of Solar Inverter. There is an increase in investment in the supply of direct electricity compared to battery storage areas. This will contribute to the growth of the on-grid sector.

By Phase

Single-Phase

Three-Phase

By Application

Residential

Commercial

Utilities

Based on Application, It is segmented into, residential, commercial and utility. And the Utilities segment held the majority share in 2022 around 45%. Urban technology is growing for many reasons, the most important of which are the increase in demand for renewable energy, the cost of solar energy and equipment, and the emergence of government subsidies. The segment is growing due to large players offering their customers market power solutions with their pre-integrated power plants to increase efficiency and reduce system costs.

REGIONAL ANALYSES

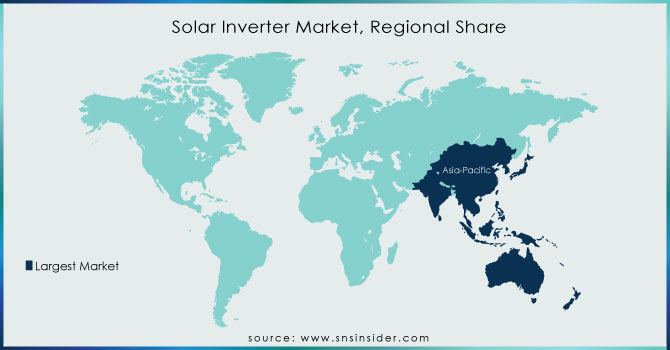

The Asia Pacific region currently dominating the Solar Inverter Market with around 43 to 45% of the global market share. particularly China and India, is experiencing a surge in solar power generation due to factors like government initiatives promoting renewable energy, growing energy demand, and abundant sunshine. This increase in solar installations translates to a proportional increase in demand for solar inverters. Also, The Asian market is price-sensitive, and manufacturers are constantly innovating to create cost-effective inverter solutions. This focus on affordability makes solar power systems more accessible to a wider range of customers in the region. Several leading solar inverter manufacturers, including Huawei, Sungrow, and GoodWe, are headquartered in Asia. This proximity to the rapidly growing market allows them to efficiently cater to regional needs and offer competitive solutions.

Need any customization research on Solar Inverter Market - Enquiry Now

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major key players are Hitachi Hi-Rel Power Electronics Pvt. Ltd, Schneider Electric Co, Power-one Inc, SMA Solar Technology AG, KACO New Energy inc, Canadian Solar Inc, ABB Ltd, SunPower Corporation, Delta Electronics, SolarEdge Technologies Inc, Sineng Electric, Solectria Renewables, and other key players.

In April 12, 2024, SMA Solar Technology AG, a global leader in photovoltaic inverters, announced a collaboration with sonnen, a German battery storage provider. This partnership aims to develop integrated solar and battery storage solutions for residential and commercial customers in Europe.

In March 1, 2024, Huawei, a major player in the solar inverter market, announced it would be showcasing its latest FusionSolar inverters at the SNEC 2024 PV Power Expo. These inverters are designed for utility-scale solar power plants and offer features like high efficiency and intelligent grid management capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 13.6 Billion |

| Market Size by 2032 | US$ 19.78 Billion |

| CAGR | CAGR of 4.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Central Inverter, Micro Inverter, String Inverter) • By System Type (On-Grid, Off-Grid) • By Phase (Single-Phase, Three-Phase) • By Application (Residential, Commercial, Utilities) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | Hitachi Hi-Rel Power Electronics Pvt. Ltd, Schneider Electric Co, Power-one Inc, SMA Solar Technology AG, KACO New Energy inc, Canadian Solar Inc, ABB Ltd, SunPower Corporation |

| Key Drivers | • Globally, there is rapid progress in the field of renewable energy |

| RESTRAINTS | • High input costs, high heat loss on large solar inverters |

Solar Inverter Market size was valued at 13.6 billion in 2023 at a CAGR of 4.8%.

High operating and repairing costs are the challenges for the solar inverter market.

Top-down research, bottom-up research, qualitative research, quantitative research, and Fundamental research.

Yes, and they are Raw material vendors, Distributors/traders/wholesalers/suppliers, Regulatory authorities, including government agencies and NGO, Commercial research & development (R&D) institutions, Importers and exporters, Government organizations, research organizations, and consulting firms, Trade/Industrial associations, End-use industries.

Manufacturers, Consultants, Association, Research Institutes, private and university libraries, suppliers, and distributors of the product.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Solar Inverter Market Segmentation, By Type

9.1 Introduction

9.2 Trend Analysis

9.3 Central Inverter

9.4 Micro Inverter

9.5 String Inverter

10. Solar Inverter Market Segmentation, By System Type

10.1 Introduction

10.2 Trend Analysis

10.3 On-Grid

11.4 Off-Grid

11. Solar Inverter Market Segmentation, By Phase

11.1 Introduction

11.2 Trend Analysis

11.3 Single-Phase

11.4 Three-Phase

12. Solar Inverter Market Segmentation, By Application

12.1 Introduction

12.2 Trend Analysis

12.3 Residential

12.4 Commercial

12.5 Utilities

13. Regional Analysis

13.1 Introduction

13.2 North America

13.2.1 Trend Analysis

13.2.2 North America Solar Inverter Market, by Country

13.2.3 North America Solar Inverter Market, By Type

13.2.4 North America Solar Inverter Market, By System Type

13.2.5 North America Solar Inverter Market, By Phase

13.2.6 North America Solar Inverter Market, By Application

13.2.7 USA

13.2.7.1 USA Solar Inverter Market, By Type

13.2.7.2 USA Solar Inverter Market, By System Type

13.2.7.3 USA Solar Inverter Market, By Phase

13.2.7.4 USA Solar Inverter Market, By Application

13.2.8 Canada

13.2.8.1 Canada Solar Inverter Market, By Type

13.2.8.2 Canada Solar Inverter Market, By System Type

13.2.8.3 Canada Solar Inverter Market, By Phase

13.2.8.4 Canada Solar Inverter Market, By Application

13.2.9 Mexico

13.2.9.1 Mexico Solar Inverter Market, By Type

13.2.9.2 Mexico Solar Inverter Market, By System Type

13.2.9.3 Mexico Solar Inverter Market, By Phase

13.2.9.4 Mexico Solar Inverter Market, By Application

13.3 Europe

13.3.1 Trend Analysis

13.3.2 Eastern Europe

13.3.2.1 Eastern Europe Solar Inverter Market, by Country

13.3.2.2 Eastern Europe Solar Inverter Market, By Type

13.3.2.3 Eastern Europe Solar Inverter Market, By System Type

13.3.2.4 Eastern Europe Solar Inverter Market, By Phase

13.3.2.5 Eastern Europe Solar Inverter Market, By Application

13.3.2.6 Poland

13.3.2.6.1 Poland Solar Inverter Market, By Type

13.3.2.6.2 Poland Solar Inverter Market, By System Type

13.3.2.6.3 Poland Solar Inverter Market, By Phase

13.3.2.6.4 Poland Solar Inverter Market, By Application

13.3.2.7 Romania

13.3.2.7.1 Romania Solar Inverter Market, By Type

13.3.2.7.2 Romania Solar Inverter Market, By System Type

13.3.2.7.3 Romania Solar Inverter Market, By Phase

13.3.2.7.4 Romania Solar Inverter Market, By Application

13.3.2.8 Hungary

13.3.2.8.1 Hungary Solar Inverter Market, By Type

13.3.2.8.2 Hungary Solar Inverter Market, By System Type

13.3.2.8.3 Hungary Solar Inverter Market, By Phase

13.3.2.8.4 Hungary Solar Inverter Market, By Application

13.3.2.9 Turkey

13.3.2.9.1 Turkey Solar Inverter Market, By Type

13.3.2.9.2 Turkey Solar Inverter Market, By System Type

13.3.2.9.3 Turkey Solar Inverter Market, By Phase

13.3.2.9.4 Turkey Solar Inverter Market, By Application

13.3.2.10 Rest of Eastern Europe

13.3.2.10.1 Rest of Eastern Europe Solar Inverter Market, By Type

13.3.2.10.2 Rest of Eastern Europe Solar Inverter Market, By System Type

13.3.2.10.3 Rest of Eastern Europe Solar Inverter Market, By Phase

13.3.2.10.4 Rest of Eastern Europe Solar Inverter Market, By Application

13.3.3 Western Europe

13.3.3.1 Western Europe Solar Inverter Market, by Country

13.3.3.2 Western Europe Solar Inverter Market, By Type

13.3.3.3 Western Europe Solar Inverter Market, By System Type

13.3.3.4 Western Europe Solar Inverter Market, By Phase

13.3.3.5 Western Europe Solar Inverter Market, By Application

13.3.3.6 Germany

13.3.3.6.1 Germany Solar Inverter Market, By Type

13.3.3.6.2 Germany Solar Inverter Market, By System Type

13.3.3.6.3 Germany Solar Inverter Market, By Phase

13.3.3.6.4 Germany Solar Inverter Market, By Application

13.3.3.7 France

13.3.3.7.1 France Solar Inverter Market, By Type

13.3.3.7.2 France Solar Inverter Market, By System Type

13.3.3.7.3 France Solar Inverter Market, By Phase

13.3.3.7.4 France Solar Inverter Market, By Application

13.3.3.8 UK

13.3.3.8.1 UK Solar Inverter Market, By Type

13.3.3.8.2 UK Solar Inverter Market, By System Type

13.3.3.8.3 UK Solar Inverter Market, By Phase

13.3.3.8.4 UK Solar Inverter Market, By Application

13.3.3.9 Italy

13.3.3.9.1 Italy Solar Inverter Market, By Type

13.3.3.9.2 Italy Solar Inverter Market, By System Type

13.3.3.9.3 Italy Solar Inverter Market, By Phase

13.3.3.9.4 Italy Solar Inverter Market, By Application

13.3.3.10 Spain

13.3.3.10.1 Spain Solar Inverter Market, By Type

13.3.3.10.2 Spain Solar Inverter Market, By System Type

13.3.3.10.3 Spain Solar Inverter Market, By Phase

13.3.3.10.4 Spain Solar Inverter Market, By Application

13.3.3.11 Netherlands

13.3.3.11.1 Netherlands Solar Inverter Market, By Type

13.3.3.11.2 Netherlands Solar Inverter Market, By System Type

13.3.3.11.3 Netherlands Solar Inverter Market, By Phase

13.3.3.11.4 Netherlands Solar Inverter Market, By Application

13.3.3.12 Switzerland

13.3.3.12.1 Switzerland Solar Inverter Market, By Type

13.3.3.12.2 Switzerland Solar Inverter Market, By System Type

13.3.3.12.3 Switzerland Solar Inverter Market, By Phase

13.3.3.12.4 Switzerland Solar Inverter Market, By Application

13.3.3.13 Austria

13.3.3.13.1 Austria Solar Inverter Market, By Type

13.3.3.13.2 Austria Solar Inverter Market, By System Type

13.3.3.13.3 Austria Solar Inverter Market, By Phase

13.3.3.13.4 Austria Solar Inverter Market, By Application

13.3.3.14 Rest of Western Europe

13.3.3.14.1 Rest of Western Europe Solar Inverter Market, By Type

13.3.3.14.2 Rest of Western Europe Solar Inverter Market, By System Type

13.3.3.14.3 Rest of Western Europe Solar Inverter Market, By Phase

13.3.3.14.4 Rest of Western Europe Solar Inverter Market, By Application

13.4 Asia-Pacific

13.4.1 Trend Analysis

13.4.2 Asia-Pacific Solar Inverter Market, by Country

13.4.3 Asia-Pacific Solar Inverter Market, By Type

13.4.4 Asia-Pacific Solar Inverter Market, By System Type

13.4.5 Asia-Pacific Solar Inverter Market, By Phase

13.4.6 Asia-Pacific Solar Inverter Market, By Application

13.4.7 China

13.4.7.1 China Solar Inverter Market, By Type

13.4.7.2 China Solar Inverter Market, By System Type

13.4.7.3 China Solar Inverter Market, By Phase

13.4.7.4 China Solar Inverter Market, By Application

13.4.8 India

13.4.8.1 India Solar Inverter Market, By Type

13.4.8.2 India Solar Inverter Market, By System Type

13.4.8.3 India Solar Inverter Market, By Phase

13.4.8.4 India Solar Inverter Market, By Application

13.4.9 Japan

13.4.9.1 Japan Solar Inverter Market, By Type

13.4.9.2 Japan Solar Inverter Market, By System Type

13.4.9.3 Japan Solar Inverter Market, By Phase

13.4.9.4 Japan Solar Inverter Market, By Application

13.4.10 South Korea

13.4.10.1 South Korea Solar Inverter Market, By Type

13.4.10.2 South Korea Solar Inverter Market, By System Type

13.4.10.3 South Korea Solar Inverter Market, By Phase

13.4.10.4 South Korea Solar Inverter Market, By Application

13.4.11 Vietnam

13.4.11.1 Vietnam Solar Inverter Market, By Type

13.4.11.2 Vietnam Solar Inverter Market, By System Type

13.4.11.3 Vietnam Solar Inverter Market, By Phase

13.4.11.4 Vietnam Solar Inverter Market, By Application

13.4.12 Singapore

13.4.12.1 Singapore Solar Inverter Market, By Type

13.4.12.2 Singapore Solar Inverter Market, By System Type

13.4.12.3 Singapore Solar Inverter Market, By Phase

13.4.12.4 Singapore Solar Inverter Market, By Application

13.4.13 Australia

13.4.13.1 Australia Solar Inverter Market, By Type

13.4.13.2 Australia Solar Inverter Market, By System Type

13.4.13.3 Australia Solar Inverter Market, By Phase

13.4.13.4 Australia Solar Inverter Market, By Application

13.4.14 Rest of Asia-Pacific

13.4.14.1 Rest of Asia-Pacific Solar Inverter Market, By Type

13.4.14.2 Rest of Asia-Pacific Solar Inverter Market, By System Type

13.4.14.3 Rest of Asia-Pacific Solar Inverter Market, By Phase

13.4.14.4 Rest of Asia-Pacific Solar Inverter Market, By Application

13.5 Middle East & Africa

13.5.1 Trend Analysis

13.5.2 Middle East

13.5.2.1 Middle East Solar Inverter Market, by Country

13.5.2.2 Middle East Solar Inverter Market, By Type

13.5.2.3 Middle East Solar Inverter Market, By System Type

13.5.2.4 Middle East Solar Inverter Market, By Phase

13.5.2.5 Middle East Solar Inverter Market, By Application

13.5.2.6 UAE

13.5.2.6.1 UAE Solar Inverter Market, By Type

13.5.2.6.2 UAE Solar Inverter Market, By System Type

13.5.2.6.3 UAE Solar Inverter Market, By Phase

13.5.2.6.4 UAE Solar Inverter Market, By Application

13.5.2.7 Egypt

13.5.2.7.1 Egypt Solar Inverter Market, By Type

13.5.2.7.2 Egypt Solar Inverter Market, By System Type

13.5.2.7.3 Egypt Solar Inverter Market, By Phase

13.5.2.7.4 Egypt Solar Inverter Market, By Application

13.5.2.8 Saudi Arabia

13.5.2.8.1 Saudi Arabia Solar Inverter Market, By Type

13.5.2.8.2 Saudi Arabia Solar Inverter Market, By System Type

13.5.2.8.3 Saudi Arabia Solar Inverter Market, By Phase

13.5.2.8.4 Saudi Arabia Solar Inverter Market, By Application

13.5.2.9 Qatar

13.5.2.9.1 Qatar Solar Inverter Market, By Type

13.5.2.9.2 Qatar Solar Inverter Market, By System Type

13.5.2.9.3 Qatar Solar Inverter Market, By Phase

13.5.2.9.4 Qatar Solar Inverter Market, By Application

13.5.2.10 Rest of Middle East

13.5.2.10.1 Rest of Middle East Solar Inverter Market, By Type

13.5.2.10.2 Rest of Middle East Solar Inverter Market, By System Type

13.5.2.10.3 Rest of Middle East Solar Inverter Market, By Phase

13.5.2.10.4 Rest of Middle East Solar Inverter Market, By Application

13.5.3 Africa

13.5.3.1 Africa Solar Inverter Market, by Country

13.5.3.2 Africa Solar Inverter Market, By Type

13.5.3.3 Africa Solar Inverter Market, By System Type

13.5.3.4 Africa Solar Inverter Market, By Phase

13.5.3.5 Africa Solar Inverter Market, By Application

13.5.3.6 Nigeria

13.5.3.6.1 Nigeria Solar Inverter Market, By Type

13.5.3.6.2 Nigeria Solar Inverter Market, By System Type

13.5.3.6.3 Nigeria Solar Inverter Market, By Phase

13.5.3.6.4 Nigeria Solar Inverter Market, By Application

13.5.3.7 South Africa

13.5.3.7.1 South Africa Solar Inverter Market, By Type

13.5.3.7.2 South Africa Solar Inverter Market, By System Type

13.5.3.7.3 South Africa Solar Inverter Market, By Phase

13.5.3.7.4 South Africa Solar Inverter Market, By Application

13.5.3.8 Rest of Africa

13.5.3.8.1 Rest of Africa Solar Inverter Market, By Type

13.5.3.8.2 Rest of Africa Solar Inverter Market, By System Type

13.5.3.8.3 Rest of Africa Solar Inverter Market, By Phase

13.5.3.8.4 Rest of Africa Solar Inverter Market, By Application

13.6 Latin America

13.6.1 Trend Analysis

13.6.2 Latin America Solar Inverter Market, by country

13.6.3 Latin America Solar Inverter Market, By Type

13.6.4 Latin America Solar Inverter Market, By System Type

13.6.5 Latin America Solar Inverter Market, By Phase

13.6.6 Latin America Solar Inverter Market, By Application

13.6.7 Brazil

13.6.7.1 Brazil Solar Inverter Market, By Type

13.6.7.2 Brazil Solar Inverter Market, By System Type

13.6.7.3 Brazil Solar Inverter Market, By Phase

13.6.7.4 Brazil Solar Inverter Market, By Application

13.6.8 Argentina

13.6.8.1 Argentina Solar Inverter Market, By Type

13.6.8.2 Argentina Solar Inverter Market, By System Type

13.6.8.3 Argentina Solar Inverter Market, By Phase

13.6.8.4 Argentina Solar Inverter Market, By Application

13.6.9 Colombia

13.6.9.1 Colombia Solar Inverter Market, By Type

13.6.9.2 Colombia Solar Inverter Market, By System Type

13.6.9.3 Colombia Solar Inverter Market, By Phase

13.6.9.4 Colombia Solar Inverter Market, By Application

13.6.10 Rest of Latin America

13.6.10.1 Rest of Latin America Solar Inverter Market, By Type

13.6.10.2 Rest of Latin America Solar Inverter Market, By System Type

13.6.10.3 Rest of Latin America Solar Inverter Market, By Phase

13.6.10.4 Rest of Latin America Solar Inverter Market, By Application

14. Company Profiles

14.1 Hitachi Hi-Rel Power Electronics Pvt. Ltd

14.1.1 Company Overview

14.1.2 Financial

14.1.3 Products/ Services Offered

14.1.4 SWOT Analysis

14.1.5 The SNS View

14.2 Schneider Electric Co

14.2.1 Company Overview

14.2.2 Financial

14.2.3 Products/ Services Offered

14.2.4 SWOT Analysis

14.2.5 The SNS View

14.3 Power-one Inc

14.3.1 Company Overview

14.3.2 Financial

14.3.3 Products/ Services Offered

14.3.4 SWOT Analysis

14.3.5 The SNS View

14.4 SMA Solar Technology AG

14.4.1 Company Overview

14.4.2 Financial

14.4.3 Products/ Services Offered

14.4.4 SWOT Analysis

14.4.5 The SNS View

14.5 KACO New Energy inc

14.5.1 Company Overview

14.5.2 Financial

14.5.3 Products/ Services Offered

14.5.4 SWOT Analysis

14.5.5 The SNS View

14.6 Canadian Solar Inc

14.6.1 Company Overview

14.6.2 Financial

14.6.3 Products/ Services Offered

14.6.4 SWOT Analysis

14.6.5 The SNS View

14.7 ABB Ltd

14.7.1 Company Overview

14.7.2 Financial

14.7.3 Products/ Services Offered

14.7.4 SWOT Analysis

14.7.5 The SNS View

14.8 SunPower Corporation

14.8.1 Company Overview

14.8.2 Financial

14.8.3 Products/ Services Offered

14.8.4 SWOT Analysis

14.8.5 The SNS View

14.9 Delta Electronics

14.9.1 Company Overview

14.9.2 Financial

14.9.3 Products/ Services Offered

14.9.4 SWOT Analysis

14.9.5 The SNS View

14.10 SolarEdge Technologies Inc

14.10.1 Company Overview

14.10.2 Financial

14.10.3 Products/ Services Offered

14.10.4 SWOT Analysis

14.10.5 The SNS View

15. Competitive Landscape

15.1 Competitive Benchmarking

15.2 Market Share Analysis

15.3 Recent Developments

15.3.1 Industry News

15.3.2 Company News

15.3.3 Mergers & Acquisitions

16. Use Case and Best Practices

17. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Floating Power Plant Market Size was valued at USD 1.5 billion in 2022 and is expected to grow to USD 3.12 billion by 2030 and grow at a CAGR of 9.6 % over the forecast period of 2023-2030.

The Zinc Air Batteries Market size was valued at USD 124.45 million in 2023 and is expected to grow to USD 225.29 million by 2031 with a growing CAGR of 7.7% over the forecast period of 2024-2031.

The Emergency Lighting Market size was valued at USD 7.22 billion in 2023 and is expected to grow to USD 14.32 billion by 2032 with a growing CAGR of 7.91% over the forecast period of 2024-2032.

The Carbon Capture Utilization Market size was valued at USD 1432.22 million in 2022 and is expected to grow to USD 5568.73 million by 2030 with a growing CAGR of 18.5% over the forecast period of 2023-2030.

The Energy as a Service (EaaS) Market size was valued at 66.01 USD billion in 2023 and is expected to grow to 155.39 USD billion by 2032 and grow at a CAGR of 9.98% over the forecast period of 2024-2032.

The Solid oxide fuel cell for CHP application market size was valued at USD 10.97 Million in 2023 and is expected to grow to USD 38.04 Million by 2031 and grow at a CAGR of 16.8% over the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone