Solar Control Window Film Market Analysis & Overview:

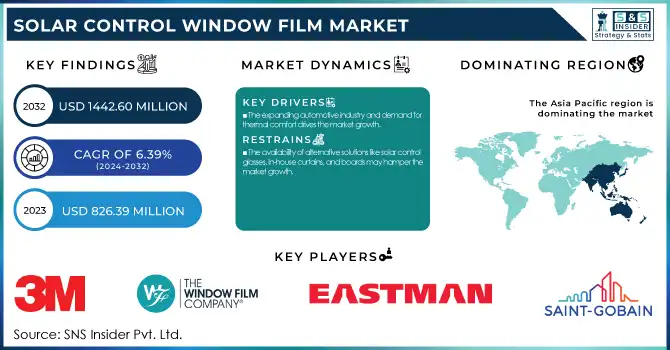

The Solar Control Window Film Market size was valued at USD 826.39 million in 2023 and is expected to reach USD 1442.60 million by 2032, growing at a CAGR of 6.39% over the forecast period of 2024-2032. The report provides a comprehensive analysis of key market dynamics shaping the industry. The report covers production capacity and utilization trends across major manufacturing hubs, segmented by film type, offering insights into supply chain efficiency and market availability. It also presents an in-depth evaluation of raw material price trends, including fluctuations in PET, metal coatings, and ceramic particles across different countries, helping stakeholders assess cost structures. Additionally, the report highlights the regulatory landscape and compliance requirements across regions, examining the impact of energy efficiency policies such as LEED and ENERGY STAR on market adoption. Environmental metrics such as energy efficiency improvements and carbon footprint reduction are analyzed, showcasing how solar control window films contribute to sustainability goals by reducing HVAC energy consumption.

Get E-PDF Sample Report on Solar Control Window Film Market - Request Sample Report

Solar Control Window Film Market Analysis

Drivers

The expanding automotive industry and demand for thermal comfort drives the market growth.

The growth of the solar control window film market can be attributed to the growing automotive industry and the introduction of thermal comfort demand. At the same time that production and sales of vas vehicles, particularly in the developing economies of the world such as China, India, and Brazil, are increasing, demands for sophisticated heat management solutions are also mounting. Solar control window films filter out infrared radiation, minimizing demand on air conditioning systems by keeping interior temperatures sufficiently cool. It results in better fuel economy in internal combustion engine vehicles and better battery performance in electric vehicles (EVs) by reducing the load of energy consumption by cooling. Moreover, these films cut down glare and UV exposure, leading to better comfort for passengers as well as protecting the car interior from fading and wear. The increasing focus of car manufacturers on enhancing fuel economy and comfort of the vehicle along with stringent regulations on automotive glass tinting alternatives has resulted in the growing demand for solar control window films in automotive applications.

Restraint

The availability of alternative solutions like solar control glasses, in-house curtains, and boards may hamper the market growth.

Availability of other solutions such as solar control glass, curtains, and boards in-house are major restraints to solar control window film market growth. Solar control glass is heat-reflective glass with coatings that are incorporated during the manufacturing stage; it provides a long-term energy-efficient benefit and UV protection and decreases the necessity for retro-fitted window films. Furthermore, it is a low-cost and easily adaptable solution for controlling heat and glare in dwellings or industrial structures, utilizing drapes and shades. In addition, new products such as insulating boards and smart glass technologies that provide greater thermal (temperature-related) and privacy regulation features- are gaining more attention. This makes them attractive to the end-user, as these competing solutions are typically more durable and cheaper to maintain than window films.

Opportunities

Advancements in smart and nanotechnology-based films create an opportunity for the market.

Smart and nanotechnology-based films are some of the advanced films that have a high growth potential in the solar control window film market. Dynamic smart films, like photochromic, thermochromic, and electrochromic films, could enhance their energy efficiency and user-friendliness by adapting their transparency dynamically to exposure to sunlight or an electrical input source. They help to achieve controlled heat and glare with automation, which makes them ideally suited for contemporary residential, commercial, and automotive applications. Moreover, nanotechnology-based films feature better heat rejection, UV protection, and durability as compared to traditional films. Ceramic-infused and multi-layer nanocoatings are an excellent choice for high-end architectural and auto applications with high clarity and infrared-blocking properties. Rapid industry shifts toward energy-saving, comfort-enhancement, and aesthetic, high-end value solutions by consumers and businesses are pushing manufacturers towards development, paving the way for innovative, high-performance, advanced products and benefits through market segmentation and expansion, especially with increasing demand for smart and nano-technology type solar control films.

Challenges

The scarcity of raw materials used to make solar control window films may challenge market growth.

The limited availability of raw materials for producing solar control window films is expected to restrict the market growth during the forecast period. High-performance materials like polyethylene terephthalate (PET), metal coatings (silver, aluminum), and ceramic nanoparticles play a critical role in increasing the film's heat resistance, UV protective ability, and durability. On the flip side, representational shifts in the production stream powered by the geo-political waterproof tensions, trade sanctions, and fluctuating base buildings are fueling creation expense rises and offering supply aggravations. The pressure from PET and specialty coatings in other sectors (packaging and electronics) demanding these same resources. The availability of quality raw materials is also affected by environmental regulations on plastic production and extraction of metals This creates difficulties for manufacturers in achieving stable production and competitive pricing, which can hinder market growth, especially when solar control window films in price-sensitive regions strive to be affordable.

Solar Control Window Film Market Segmentation Outlook

By Product Type

Vacuum Coated held the largest market share around 47% in 2023. This is a stepwise process of depositing thin metal coatings, using the vacuum deposition method on a PET substrate material, using metal coatings such as silver, aluminum, or titanium. The end result is a highly effective film with unparalleled solar heat rejection with maximum visible light transmission, suitable for automotive residential, and commercial use. Even more, vacuum-coated uses make a further improvement in UV protection, blocking approximately 99 percent of the harmful rays, to aid in protecting against fading and problems to the skin. With their long life and non-fading quality, they are even more popular. Due to the growing demand for high-performance energy-efficient solutions, vacuum-coated films are dominating the market in regions with stringent energy regulations and places where there are extreme climatic conditions that mandate the need for advanced solar control solutions.

By Technology

Tinted held the largest market share around 34% in 2023. The films are further inexpensive and easy to install, which makes them high utility in automotive, residential, and commercial applications. Tinted films, too, are offered in a variety of seasoning or shades and colors, deliberately made to offer aesthetic solutions to complement building facades or vehicle exteriors. Though not as effective as ceramic or vacuum-coated films in rejecting infrared heat, they strike a good balance of acceptable performance and price, as well as good UV protection, which makes them widely sought, especially among price-sensitive markets where energy efficiency and sun protection are of great importance.

By Application

The construction segment held the largest market share around 56% in 2023. It is due to increasing energy-efficient buildings, rapid urbanization, and established government regulations about energy consumption. Increasing awareness regarding heat gain, glare reduction as well as UV protection has propelled the demand for solar control window films across residential, commercial, and industrial buildings, which play a key role in improving thermal comfort and reducing the cooling bill. Building energy efficiency is promoted through solar control solutions by regulatory agencies, the U.S. Department of Energy (DOE), and the European Union Energy Performance of Buildings Directive (EPBD). Besides, green building certifications are boosting the demand for high-performance window films due to their contribution towards sustainable building practices, such as LEED (Leadership in Energy and Environmental Design).

Solar Control Window Film Market Regional Analysis

Asia Pacific held the largest market share around 52% in 2023. The growth in infrastructure development and the advent of smart cities in China, India, Japan, and South Korea are expected to further boost the market demand for solar control window films in Asia-Pacific (APAC) region. Furthermore, the dominantly hot and humid weather in diverse Asia-Pacific countries prompts the application of heat-reducing window films as thermal comfort-boosting staples that also enable the reduction of cooling expenses rate in residential buildings and commercial buildings. China is the biggest vehicle producer in the world and the region is the world’s largest market for automotive manufacturing. Increasing sales of luxury cars and EVs also propel the demand for high-performance solar control films that provide fuel efficiency benefits and enhance the comfort level of the interior environment. In addition, a government strategy that encourages energy conservation and sustainable building practices such as the Green Building Evaluation Standard in China and the Energy Conservation Building Code (ECBC) in India is also expected to drive the market.

The solar control window film market in North America is expected to witness significant growth over the forecast period, driven by rising energy efficiency regulations, increasing demand for green buildings, and a strong automotive sector as the North American market is one of the largest automotive. The U.S. and Canadian governments continue to pursue aggressive energy conservation policies like the Building Energy Codes Program through the U.S. Department of Energy (DOE) on the U.S. side and Energy Efficiency Regulations in Canada, which drive installation of solar control window films in both buildings to lower cooling costs and carbon footprint.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

3M (Prestige Series, Night Vision Series)

-

The Window Film Company (Solar Control Silver 20, Frostbite)

-

Eastman Chemical Company (LLumar IRX, SunTek Carbon Series)

-

Garware Suncontrol (Icecool Shield, Classic Natural)

-

Avery Dennison Corporation (NR Pro, Reflective Silver Series)

-

Saint Gobain (Solar Gard Sentinel, Panorama Hilite)

-

Madico Inc. (Sunscape Starlite, Charcool)

-

Solar Screen International SA (Spectra 40 C, Vision Blue 70 C)

-

XPEL Inc. (Vortex IR, PRIME XR PLUS)

-

Purlfrost (Solar Reflective Film, Heat Reduction Film)

-

Polytronix Inc. (Polyvision Switchable Film, Smart Glass Film)

-

Johnson Window Films (InsulatIR, NightScape)

-

Hanita Coatings (SolarZone Silver, OptiTune)

-

V-KOOL (V-KOOL 70, V-KOOL 40)

-

Reflectiv (Mirror Solar Film, Static Cling Tinted Film)

-

Global Window Films (Nano Ceramic, Ultra Shield IR)

-

Huper Optik (Select Series, Ceramic Series)

-

Nano-Tech Coatings (Nano-IR Series, Solar Shield)

-

CoolVu (Transition Window Film, UV Blocking Film)

-

SunTek (SymphonyDS, InfinityDS)

Recent Development:

-

In 2024, 3M introduced the Prestige Series PR 70, a multi-layer optical film that offers high visible light transmission while rejecting up to 97% of infrared light, enhancing energy efficiency in buildings.

-

In 2024, Saint-Gobain's Solar Gard division launched the Ecolux™ 70 Low-E film, aimed at improving insulation and energy efficiency. The film helps regulate indoor temperatures by reducing heat loss in winter and heat gain in summer. It is designed for both residential and commercial buildings, promoting sustainable energy use.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 826.39 Million |

| Market Size by 2032 | USD 1442.60 Million |

| CAGR | CAGR of 6.39% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Clear, Dyed, Vacuum Coated) •By Technology (Tinted, Polymer Dispersed Liquid Crystals, Suspended Particle Device, Others) •By Application (Construction, Automotive, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M, The Window Film Company, Eastman Chemical Company, Garware Suncontrol, Avery Dennison Corporation, Saint Gobain, Madico Inc., Solar Screen International SA, XPEL Inc., Purlfrost, Polytronix Inc., Johnson Window Films, Hanita Coatings, V-KOOL, Reflectiv, Global Window Films, Huper Optik, Nano-Tech Coatings, CoolVu, SunTek |