To get more information on Software Defined Radio (SDR) Market - Request Free Sample Report

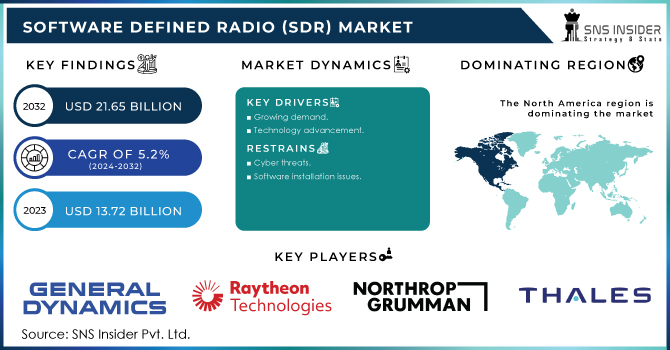

The Software Defined Radio (SDR) Market Size was valued at USD 13.72 billion in 2023 and is expected to reach USD 21.65 billion by 2032 with an emerging CAGR of 5.2% over the forecast period 2024-2032.

A rise in defense spending to improve defense communication systems is driving the demand for Software Defined Radio systems. The worldwide Software Defined Radio sector has risen dramatically as a result of the increased demand for communication equipment that is more flexible and software programmable. Furthermore, SDR is widely utilized in space communication because it improves satellite performance and enables precise operation across a wide range of frequency bands. SDR enables users to receive signals from many mobile protocols, such as WiMAX and GSM. Mobile carriers are using SDRs to fulfil the increasing demand for greater data speeds, which entails more hardware expenses on the core network. Furthermore, significant development in the telecommunications industry/market is expected to boost market growth.

Furthermore, numerous advances, including as the creation of next-generation internet protocol systems that can be adapted to 4G and wireless spectrums, are contributing to the market's upbeat outlook. Furthermore, SDR is increasingly being applied in the 3.5 GHz and 25 GHz spectrum bands for 5G mobile network testing, which is projected to create a profitable opportunity for industry participants. Another driver of growth is the quick transition from analogue to digital SDR. SDR is designed to be the basic technology for transmitting telecommunications services such as digital television, radio broadcasts, and video streaming channels. Other factors, such as the integration of the Internet of Things with wireless devices, as well as active R&D in the telecommunications sector, are likely to boost the market even further. The majority of its functionality is implemented in the radio system by software running on an embedded device or a personal computer. As a result, there will always be the possibility of software attacks. This issue is predicted to stymie market growth during the forecast period. Furthermore, for a simple work, basic SDR tends to need more power. As a result, it can only be used in extremely low-power devices.

MARKET DYNAMICS

KEY DRIVERS

Growing demand

Technology advancement

RESTRAINTS

Cyber threats

Software installation issues

OPPORTUNITIES

Enhanced IP-Radio system demand

CHALLENGES

Interoperability of several communication technologies

IMPACT OF COVID-19

The COVID 19 epidemic is spreading like wildfire and has had a profound effect on the economic activity of various growing industries in various parts of the world. The SDR system, as well as subsystem management was severely affected and disrupted due to the spread of the epidemic. However, the production of SDRs to meet the requirements of the military application is very important and steps are being taken to reduce disruption to the same supply chain management. Restarting the production and production process depends largely on the manifestation of the epidemic, the level of production of production units, the tolerance of restrictions, and, the import and export permit by government regulations. However, production and production units are active and take orders regardless of the adjustment of operating schedules. According to industry experts, the defense sector is increasing its focus on sectors that play an important role in securing national interests. The supply chain market has a moderate impact. However, measures to deal with the current situation are being taken to control the market demand in the balance by providing delivery funds before the specified period.

The software defined radio market is divided into four platforms: land, airborne, naval, and space. During the predicted period, the land segment is expected to rises at the fastest CAGR. The usage of software-defined radios in military and commercial applications is covered in the land platform category. The land section covers both fixed and mobile unit installation. The increasing need for SDRs used in military vehicles and cellular sites is projected to promote land sector growth in the coming years. The US Joint Tactical Radio System programme produced one of the military software defined radios for ground platforms. The software defined radio market has been divided into components such as general-purpose processors, digital signal processors, field programmable gate arrays, application-specific integrated circuits, amplifiers, converters, software, and others. Because of the increasing use of software to boost interoperability of software defined radio systems with new communication standards, the software segment is predicted to develop at a faster CAGR. Software defined radios offer the advantage of being upgradeable, which lowers their replacement costs. They are easily upgraded to accommodate new communication standards by downloading new system files with the software included with their operating systems. The enhancements allow software defined radios to adapt to new communication protocols and military waveforms.

The technology is generally recognized in the defense industry since it includes multi-mode/multi-band pre-emptive radio sets that allow for speech and data transmission in warfighter. Based on Software Communications Architecture 4.0, open-source programming forms an integral part of JTRS. JTRS program of the U.S Department of Defense it also promotes the growth of the JTRS component.

Terrestrial Trunked Radio is an open digital radio platform in the international market. Contains high performance for emergency services and is suitable for large commercial radio users. TETRA specifies specific areas of interaction such as a virtual interface, terminal equipment, direct mode operation, and in-app virtual interface to work effectively in the multivendor market. TETRA is the largest mobile radio standard that provides spectrum efficiency and critical communication features such as short call setup time, security, high-speed data resources, and voice-enabled voice feature and site reduction.

By Frequency Band

HF

VHF

UHF

By Application

Defense

Commercial

By Type

General Purpose Radios

Cognitive/Intelligent Radio

Terrestrial Trunked Radio

By Platform

Land

Airborne

Naval

Space

By Component

Transmitter

Receiver

Software

Auxiliary System

REGIONAL ANALYSIS

The North American market is expected to have the largest SDR market. precisely, the American market is expected to take the market to growing areas. The US region has emerged as a pioneer in the development of SDRs. These systems may support the operation of advanced radios. Many American companies have been contracted by the US military to develop radio programs that will be used on social media. These contracts are likely to be made for 5 years or more and include development, as well as production. Also, companies are committed to supporting up to 5000 radio stations in total. Apart from this, the software component operating in other major areas such as the APAC region is expected to achieve higher CAGR growth. The reason for this is an increase in software implementation that will increase the power of these programs to establish a better way of communication standards.

Need any customization research on Software Defined Radio (SDR) Market - Enquiry Now

REGIONAL COVERAGE:

North America

USA

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

The Netherlands

Rest of Europe

Asia-Pacific

Japan

south Korea

China

India

Australia

Rest of Asia-Pacific

The Middle East & Africa

Israel

UAE

South Africa

Rest of Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

The Major Players are General Dynamics Corporation, Raytheon Technologies Corporation, Northrop Grumman Corporation, Thales, Leonardo Company, BAE Systems, L3Harris Technologies, Inc, Elbit Systems Ltd., and other players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 13.72 Billion |

| Market Size by 2032 | US$ 21.65 Billion |

| CAGR | CAGR of 5.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Frequency Band (HF, VHF, UHF) • By Application (Defense, Commercial) • By Type (General Purpose Radios, Cognitive/Intelligent Radio, Terrestrial Trunked Radio) • By Platform (Land, Airborne, Naval, Space) • By Component (Transmitter, Receiver, Software, Auxiliary System) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | General Dynamics Corporation, Raytheon Technologies Corporation, Northrop Grumman Corporation, Thales, Leonardo Company, BAE Systems, L3Harris Technologies, Inc, Elbit Systems Ltd., and other players. |

| DRIVERS | • Growing demand • Technology advancement |

| RESTRAINTS | • Cyber threats • Software installation issues |

The market size of the Software Defined Radio Market is expected to reach USD 19.58 billion by 2030.

The growth rate of the Software Defined Radio Market is 5.2% during the forecast period.

General Dynamics Corporation, Raytheon Technologies Corporation, Northrop Grumman Corporation, Thales, Leonardo Company, BAE Systems, L3Harris Technologies, Inc, and Elbit Systems Ltd. are leading players in the Software Defined Radio Market.

Growing demand for the software defined radios and technological advancement are the driving factors of the Software Defined Radio Market.

North America region dominated the Software Defined Radio Market.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 COVID-19 Impact Analysis

4.2 Impact of Ukraine- Russia War

4.3 Impact of Ongoing Recession

4.3.1 Introduction

4.3.2 Impact on major economies

4.3.2.1 US

4.3.2.2 Canada

4.3.2.3 Germany

4.3.2.4 France

4.3.2.5 United Kingdom

4.3.2.6 China

4.3.2.7 Japan

4.3.2.8 South Korea

4.3.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Software Defined Radio Market Segmentation, By Frequency Band

8.1 HF

8.2 VHF

8.3 UHF

9. Software Defined Radio Market Segmentation, By Application

9.1 Defense

9.2 Commercial

10. Software Defined Radio Market Segmentation, By Type

10.1 General Purpose Radios

10.2 Cognitive/Intelligent Radio

10.3 Terrestrial Trunked Radio

11. Software Defined Radio Market Segmentation, By Platform

11.1 Land

11.2 Airborne

11.3 Naval

11.4 Space

12. Software Defined Radio Market Segmentation, By Component

12.1 Transmitter

12.2 Receiver

12.3 Software

12.4 Auxiliary System

13. Regional Analysis

13.1 Introduction

13.2 North America

13.2.1 USA

13.2.2 Canada

13.2.3 Mexico

13.3 Europe

13.3.1 Germany

13.3.2 UK

13.3.3 France

13.3.4 Italy

13.3.5 Spain

13.3.6 The Netherlands

13.3.7 Rest of Europe

13.4 Asia-Pacific

13.4.1 Japan

13.4.2 South Korea

13.4.3 China

13.4.4 India

13.4.5 Australia

13.4.6 Rest of Asia-Pacific

13.5 The Middle East & Africa

13.5.1 Israel

13.5.2 UAE

13.5.3 South Africa

13.5.4 Rest

13.6 Latin America

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of Latin America

14 Company Profiles

14.1 Raytheon Technologies Corporation

14.1.1 Financial

14.1.2 Products/ Services Offered

14.1.3 SWOT Analysis

14.1.4 The SNS view

14.2 General Dynamics Corporation

14.3 Northrop Grumman Corporation

14.4 Thales

14.5 Leonardo Company

14.6 BAE Systems

14.7 L3Harris Technologies, Inc

14.8 Elbit Systems Ltd.

15. Competitive Landscape

15.1 Competitive Benchmarking

15.2 Market Share Analysis

15.3 Recent Developments

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Integrated Marine Automation System Market Size was valued at USD 5.55 Billion in 2023 and is expected to reach USD 12.24 Billion by 2032 and grow at a CAGR of 9.2% over the forecast period 2024-2032.

The Combat Management System Market Size was valued at US$ 378.6 million in 2023 and is expected to reach USD 520.9 million by 2032 with a growing CAGR of 3.61% over the forecast period 2024-2032.

The Defense Integrated Antenna Market size was USD 583.34 million in 2023 and is expected to reach USD 957.67 million by 2032, growing at a CAGR of 5.7% over the forecast period of 2024-2032.

The Marine Electric Vehicle Market Size was valued at USD 10.0 billion in 2023 and is expected to reach USD 32.3 billion by 2032 and grow at a CAGR of 13.9% over the forecast period 2024-2032.

The Marine Battery Market size was recorded at USD 1.10 Billion in 2023 and is projected to reach USD 5.59 Billion by 2032, growing at a CAGR of 19.8% during the forecast period 2024-2032.

The Aerospace Valves Market Size was valued at USD 12.88 billion in 2023 and is expected to reach USD 19.14 billion by 2032 with a growing CAGR of 4.5% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone