Software as a Service (SaaS) Market Report Scope & Overview:

Get more information on Software as a Service (SaaS) Market - Request Sample Report

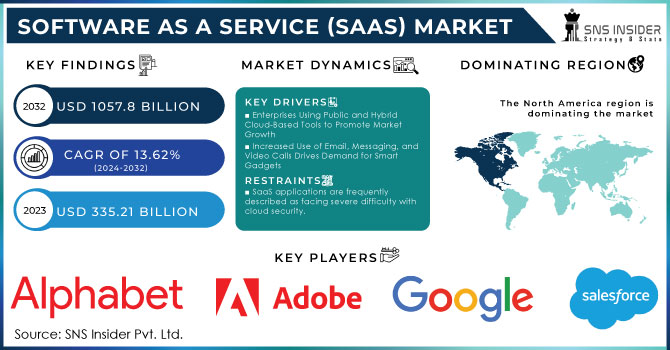

The Software as a Service (SaaS) Market size was recorded at USD 335.21 billion in 2023 and is expected to reach USD 1057.8 billion by 2032, growing at a CAGR of 13.62 % over the forecast period of 2024-2032.

The widespread popularity of public cloud services across all industries is driving a surge in demand for traffic management. Companies are swiftly transitioning from on-premises Software-as-a-Service models due to the exorbitant costs of on-premises software deployment, which is poised to significantly boost the market. The utilization of cloud-based services, particularly cloud application service/software-as-a-service, has increased to USD 195 billion in 2023, with an anticipated global revenue of approximately 245 billion US dollars by the end of the year.

The global Software-as-a-Service (SaaS) market is expected to continue growing as businesses of all sizes adopt SaaS solutions for various operations such as web hosting, e-commerce, enterprise resource planning (ERP), and customer relationship management (CRM). For example, private SaaS companies experienced a growth rate of approximately 35%, surpassing the growth rate of public SaaS companies, which was around 23% in 2023.

The increasing use of emails, instant messaging, and video calls is driving the demand for smart devices among end-users, which in turn is expected to boost the growth of the Software-as-a-Service market. Additionally, organizations are turning to CRM SaaS solutions more and more to reduce IT costs and scale more easily. Businesses can now customize their CRM systems more easily and make them more accessible. For example, in December 2022, AppOmni announced a collaboration with Veeva Systems to provide added security for Veeva CRM and Veeva Vault. With this launch, life sciences customers can now utilize AppOmni's complete threat detection and configuration management capabilities to better operationalize best practices.

In the dynamic Software-as-a-Service market, the utilization of artificial intelligence (AI), internet of things (IoT) to comprehend customer behavior stands out as a significant trend. This involves customizing products, services, and content to specifically meet the individual needs of customers based on collected information. Furthermore, the implementation of Machine Learning (ML) for automated customer inquiry handling through chatbots demonstrates a clear advancement. Additional trends include the adoption of Vertical SaaS, migration to Platform-as-a-Service (PaaS), and the use of Application Programming Interface (API) connections.

The Software-as-a-Service (SaaS) market operates through three primary types of cloud computing: Platform as a Service (PaaS) and Infrastructure as a Service (IaaS). These applications are utilized by various IT specialists, commercial users, and private users. A wide range of products are available, from consumer electronics like Netflix to advanced IT tools. SaaS products typically target both business-to-business (B2B) and business-to-consumer (B2C) users, unlike IaaS and PaaS. For example, the B2B SaaS market has demonstrated the highest medium growth rate with annual recurring revenue of less than $1 million.

Market Dynamics

Drivers

-

Enterprises Using Public and Hybrid Cloud-Based Tools to Promote Market Growth

-

The usage of email, instant messaging, and video calls has significantly increased, which stimulates end-user demand for smart gadgets is drives the market.

Public and hybrid cloud-based solutions are increasingly being adopted by businesses, increasing system resilience and advancing the new realities imposed by the epidemic. Additionally, more businesses are converting to hybrid clouds, which combine on-premises and public cloud solutions. For the sake of future market expansion, some major companies are encouraging and promoting the use of cloud-based solutions. For Instance, the U.S SaaS market has shown rapid growth by supporting various startups in this field such as InVideo, LinkTree, etc.

Restrains

-

SaaS applications are frequently described as facing severe difficulty with cloud security.

-

Sensitive data not secure enough to support market expansion

Professionals use SaaS-based platforms to store both their personal and business-sensitive data. Security has thus always been a top priority for security experts. Misconfigured SaaS is the main issue, according to several businesses in the sector.

The setup of internal applications is also turning into a significant difficulty for security personnel. Misconfigurations cause sensitive data to be lost and hesitant application programming interfaces cause sensitive data to be disclosed without authorization.

Opportunities

-

Increased availability of secure internet servers in China, Japan, and India during the forecast period contributed to the market's expansion.

Key Market Segmentation:

By Component Type:

Software held over 80% of total revenue in 2023. The global crisis accelerated the penetration of flexible working time and work elsewhere, which changed employee expectations. Thus several businesses are now using SaaS solutions for simple communication, business productivity, and remote teamwork. These offer cloud storage, video chat, and project views. Additionally, The demand for SaaS solutions that provide automation to streamline workflows and increase productivity while delivering AI-based insights is also increasing. With the accelerated digital transformation across industries, companies are increasingly relying on data to speed up their processes and get a deeper insight into consumers or users. Investment in SaaS solutions powered by analytics has increased as a result.

By Deployment Type:

With a revenue share above 43% in 2023, the private cloud segment dominated the SaaS Market. Enterprises can get improved speed and reduced latency by combining private cloud infrastructure with SaaS application deployment at the network's edge, in addition to gaining more control and security over data. Additionally, by employing a private cloud architecture, making sure legal standards are met, and lowering the risk of data breaches, enterprises may keep more control over their data. All things considered, integrating edge computing with the private cloud can offer a strong foundation for providing SaaS applications that satisfy the requirements of contemporary enterprises.

By Enterprise-size:

Large enterprises were the largest enterprise size segment of this market in 2023 with a global share exceeding 61% during that year. Different Ways Large businesses can benefit from SaaS, even large-scale businesses tend to have certain benefits from using this software which includes schemes of flexibility, scalability, and cost. Major companies will also adopt platform-as-a-service (PaaS) solutions. PaaS solutions provide more abstraction than SaaS solutions, enabling companies to focus on creating and deploying applications rather than the upkeep of dedicated infrastructures. They allow large businesses to avail of lower development costs, quicker time-to-market, and better creativity & flexibility. For Instance, the top PaaS providers of the companies are AWS Elastic Beanstalk, Engine Yard, Google App engine, etc.

By Application:

In Application type segmentation, the other categories which include Media, Entertainment, BFSI, and Automobile led the market with a revenue share of over 43% in 2023. The Banks are using the Saas application to provide best customer service through virtual assistance. Like the same, Media and entertainment use the software for marketing and balancing financial coverage, and also for protecting the customer's data and security. For Instance, the popular apps used in these domains are Salesforce, PowerBI, Simens PML, Oracle, etc.

The remaining areas include supply chain management, edge computing, AI as a service, IoT as a service, unified communications as a service, and operations management. The rise of new technologies like artificial intelligence (AI), cloud computing, and robotic process automation (RPA) may bring about a revolution in the supply chain software business.

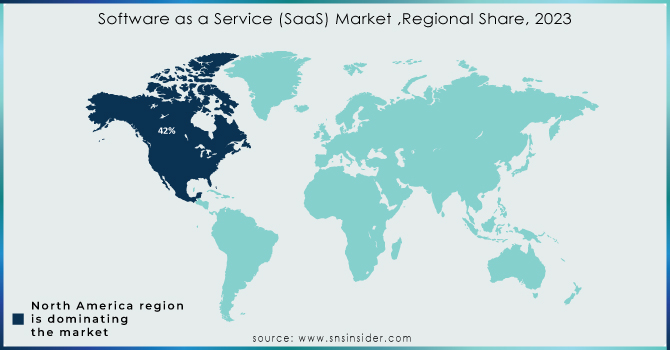

Regional Analysis

North America led the Software-as-a-Service market with more than 42% of the market share in 2023. The U.S. is helping the market revenue to increase favorably. One of the elements promoting market expansion is the existence of established industry players. Additionally, the region's well-developed IT infrastructure facilitates the quick deployment of cloud-based virtual services, further boosting its sizeable share of the world's software as a service (SaaS) market. The large market share was also aided by the massive investment in cloud infrastructure and the availability of numerous secure internet servers. For Instance, the top U.S.-based SaaS companies are Adobe, Salesforce, ServiceNow, Shopify, etc. which are ruling the market with huge market capital.

In the future period, Asia Pacific is expected to have the fastest CAGR. Due to the increased demand for outsourcing cloud-based software and the increasing number of small and medium-sized businesses outsourcing throughout the region, China and India are positively influencing the market's growth. To lower the cost of deploying software on-premises, SMEs heavily outsource cloud-based software platforms. Furthermore, it is anticipated that the market will have plenty of opportunities due to the IT sector's significant growth.

Need any customization research/data on Software as a Service (SaaS) Market - Enquiry Now

Key Players:

The major players in Market are IBM, Alphabet Inc., Google LLC, Salesforce, Inc., Adobe Inc, Oracle, Alibaba Cloud, SAP SE, Rackspace Technology, Inc., ServiceNow, Inc, VMware Inc., Cisco Systems, Inc., IONOS Cloud Inc. Atlassian, Microsoft Corporation, Hewlett Packard Enterprise Company. And others in the final report.

Recent development

-

D2L and MDF COMMERCE is expanding their software market with the current acquisition. MDF Commerce, a Montreal-based company, is buying up EcoInteractive, a software startup, and at the same time, D2L, has purchased H5P Group, a startup specializing in creating interactive content, for USD 25.6 million.

-

A US investment company called STG has bought Eka Software Solutions, an Indian tech firm. Eka specializes in helping businesses manage commodities, especially those related to agriculture and energy.

| Report Attributes | Details |

| Market Size in 2023 | US$ 335.21 Bn |

| Market Size by 2032 | US$ 1057.8 Bn |

| CAGR | CAGR of 13.62% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Deployment Type (Public, Private, Hybrid) • By Component (Software, Service) • By Enterprise-size (Small & Medium Enterprises, Large Enterprises) • By Application (Customer Relationship Management (CRM), Enterprise Resource Planning (ERP), Content, Collaboration & Communication, BI & Analytics, Human Capital Management, Others) • By Industry (IT & Telecom, BFSI, Retail & Consumer Goods, Healthcare, Education, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM, Alphabet Inc., Google LLC, Salesforce, Inc., Adobe Inc, Oracle, Alibaba Cloud, SAP SE, Rackspace Technology, Inc., ServiceNow, Inc, VMware Inc., Cisco Systems, Inc., IONOS Cloud Inc. Atlassian, Microsoft Corporation, Hewlett Packard Enterprise Company |

| Key Drivers | • Enterprises Using Public and Hybrid Cloud-Based Tools to Promote Market Growth • The usage of email, instant messaging, and video calls has significantly increased, which stimulates end-user demand for smart gadgets is drive the market. |

| Market Opportunities | • Increased availability of secure internet servers in China, Japan, and India during the forecast period contributed to the market's expansion. |