Get E-PDF Sample Report on Sodium Benzoate Market - Request Sample Report

The Sodium Benzoate Market size was valued at USD 1.3 Billion in 2023. It is expected to grow to USD 2.3 Billion by 2032 and grow at a CAGR of 6.4% over the forecast period of 2024-2032.

The sodium benzoate market is driven by the rising demand for processed and packaged food products, especially in developing economies. The convenience and longer shelf life offered by these products have made them increasingly popular among consumers. Additionally, the expanding beverage industry, including carbonated drinks, juices, and energy drinks, has further fueled the demand for sodium benzoate. In Europe, the European Food Safety Authority (EFSA) regulates sodium benzoate usage and considers it generally safe when used within specified limits, typically up to 0.1% in foods. The EFSA conducts periodic assessments to ensure that levels remain within safe limits and considers factors such as increased processed food consumption when setting these regulations.

Sodium benzoate, a chemical compound widely used as a preservative in various industries, has become an essential ingredient in the food and beverage sector. This compound effectively inhibits the growth of bacteria, yeast, and fungi, thereby extending the shelf life of products. In recent times, there has been a growing concern among consumers regarding the safety of food and beverage products. In 2023, when Tate & Lyle, a global leader in food ingredients and solutions, announced the launch of a new line of sodium benzoate-based preservatives specifically designed for the food and beverage industry.

The sodium benzoate demand is increasing in pet food industry due to it’s a preservative quality in the pet food product. The trend results from the increasing concerns of preserving and making pet food products safe. Continually, the market is influenced by customers taking more concern in pet food nutrition and safety. Also, the process has been encouraged by the available regulations that support the use of safe preservatives.

The pet market, especially in the North American region, undergoing massive expansion has increased the demand for preservatives like sodium benzoate. For instance, pet food accounted for the largest share of the USD123.6 billion estimated U.S pet spending in 2021, according to the American Pet Products Association.

Rising awareness among consumers regarding food safety testing

Growing demand for processed food and beverages drives the market growth.

The main factors driving the growth of the sodium benzoate market is the increasing demand for processed food and beverages. Sodium benzoate is a widely used preservative that has become indispensable for extending the shelf life of many foods, thus ensuring their safety. People’s fast-paced lifestyles and focus on convenience have led to a significant growth of the processed food sector, especially in North America and Europe. According to the U.S. Department of Agriculture study, processed foods constitute nearly 70% of Americans’ diets. As demand for processed food and beverages grows, the manufacturers increase the usage of preservatives, including sodium benzoate, to ensure customers’ expectations for safety and durability are satisfied.

Furthermore, urbanization and the shortage of free time have increased the need for ready-to-eat meals, thus pushing the processed food market, especially in developing countries where the growing disposable income nourishes the trend. Thus, sodium benzoate plays a role in compliance with the current safety regulations and provides people with the convenience they seek, ensuring that their newly found taste for the ready-to-eat meals remains satisfied.

Potential health risks associated with consumption of sodium benzoate

Sodium benzoate, a commonly used food preservative, has been linked to certain health concerns. Studies have suggested that when combined with certain ingredients, such as vitamin C, sodium benzoate can form benzene, a known carcinogen. This has raised concerns among consumers and regulatory bodies regarding its safety. The presence of potential health risks has led to a decline in the demand for sodium benzoate in various industries, including food and beverages. Consumers are becoming increasingly conscious of the ingredients they consume and are seeking alternatives that are perceived as safer and healthier.

Increasing demand for clean-label products and natural preservatives

In recent years, there has been a notable shift in consumer preferences towards natural and healthier food products. As a result, the food and beverage industry has witnessed a surge in the demand for preservatives derived from natural sources. Sodium Benzoate offers several advantages over its synthetic counterparts. It not only effectively inhibits the growth of bacteria, yeast, and molds but also extends the shelf life of food and beverage products. Additionally, it does not alter the taste, color, or texture of the preserved items, ensuring that the original quality is maintained. The Sodium Benzoate Market has witnessed a significant upsurge due to these factors.

By Form

The powder form segment dominated the sodium benzoate market with the highest revenue share of about 61.4% in 2023. The powder segment's dominance is attributed to the convenience and ease of use. It can be effortlessly mixed with other ingredients, ensuring a seamless integration into various products. The powder form's ability to prolong the shelf life of perishable goods contributes significantly to its market dominance.

The granules segment is expected to grow at a highest CAGR of about 6.6% over the forecast period. Sodium benzoate granules are in white color. Also, it is used as a preservative in food such as fruit juices, pickles, salad dressings, carbonated drinks, jams, etc. Sodium benzoate is used as an antifungal as it balances the pH inside individual cells, increasing the overall acidity of a product and making it more difficult for fungi to grow and reproduce. Fungi that are punctual of spoil food and these balances to kept it fresh, otherwise it can trim down its shelf life substantially.

By Application

The food and beverage end-user segment dominated the sodium benzoate market with a revenue share of about 46.8% in 2023. Increasing demand for convenience foods and ready-to-drink beverages has propelled the growth of the food and beverage end-user segment. As consumers seek quick and easy meal options, manufacturers have responded by incorporating sodium benzoate into their products to ensure their longevity and safety. This has led to an increased demand for natural and organic preservatives. However, sodium benzoate continues to dominate the market due to its effectiveness, affordability, and wide availability.

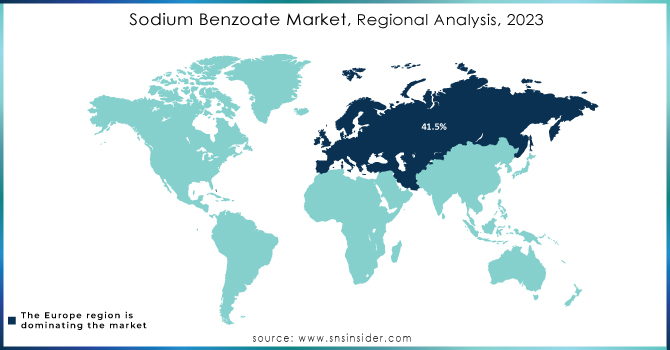

Europe dominated the sodium benzoate market with a revenue share of about 41.5% in 2023. Europe's strong regulatory framework and stringent quality standards have played a pivotal role in establishing its dominance. The European Union has implemented rigorous regulations regarding food safety and additives, including sodium benzoate. These regulations ensure that only products meeting the highest quality standards are allowed in the market, giving European manufacturers a competitive edge. Moreover, growing awareness among consumers regarding the importance of food safety and the harmful effects of microbial contamination has also contributed to the increased adoption of sodium benzoate in the region. According to the European Food Safety Authority the EFSA reaffirmed the acceptable daily intake (ADI) for sodium benzoate at 0-5 mg/kg body weight, emphasizing its safety when used within regulated limits. This standard reflects the strict regulatory environment in Europe concerning food additives and underscores consumer protection.

The Asia Pacific region is expected to grow with the highest CAGR of about 6.2% during the forecast period of 2024-2032. The Asia Pacific region boasts a burgeoning population, coupled with increasing disposable incomes. As a result, there is a rising demand for processed food and beverages, which often utilize sodium benzoate as a preservative. This trend is further fueled by changing lifestyles and a preference for convenience foods. Moreover, the Asia Pacific region is witnessing rapid urbanization and industrialization, leading to the establishment of numerous food and beverage manufacturing facilities. These industries rely heavily on sodium benzoate to extend the shelf life of their products and maintain their quality during transportation and storage.

Get Customised Report as per Your Business Requirement - Enquiry Now

Key Players

Lanxess AG

PENTA CHEMICALS

Merck KGaA

Avantor Inc.

Tulstar Products Inc.

Wuhan Youji Industries Co. Ltd.

FBC Industries Inc.

Aldon Corporation

Shandong Jinhe Industrial Co., Ltd.

Kraton Corporation

Nantong Yongyu Chemical Co., Ltd.

Hubei Greenhome Chemical Co., Ltd.

Jiangshan Chemical Co., Ltd.

Jiangsu Shuchang Chemical Co., Ltd.

Guangdong Jialin Pharmaceutical Co., Ltd.

Zhejiang Xinhai Technology Co., Ltd.

Wuxi Huashun Chemical Co., Ltd.

In March 2023, LANXESS, a leading specialty chemicals company, showcased its extensive range of preservatives, multifunctional, and fragrances for cosmetics and personal care products at the prestigious In-Cosmetics event held in Barcelona from March 28 to 30.

In July 2022, LANXESS successfully completed the acquisition of the microbial control business unit of the renowned U.S. group, International Flavors & Fragrances Inc. (IFF). This strategic acquisition was valued at approximately USD 1.3 billion.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.3 Bn |

| Market Size by 2032 | US$ 2.27 Bn |

| CAGR | CAGR of 6.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Form (Granules, Powder, Flakes, and Others) • By Application (Antimicrobial Agent, Antifungal Agent, Preservative, Rust and Corrosion Inhibitor, and Others) • By End-user (Cosmetics, Pharmaceuticals, Food & Beverages, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | DuPont de Nemours Inc., Lanxess AG, PENTA CHEMICALS, Merck KGaA, Avantor Inc., Foodchem International Corporation, Tulstar Products Inc., Wuhan Youji Industries Co. Ltd., Spectrum Chemicals, FBC Industries Inc. |

| Key Drivers | • Growing demand for processed food and beverages • Rising awareness among consumers regarding food safety |

| Market Restraints | • Potential health risks associated with consumption of sodium benzoate |

Ans: The Sodium Benzoate Market was valued at USD 1.34 billion in 2023.

Ans: The expected CAGR of the global Sodium Benzoate Market during the forecast period is 6.3%.

Ans: The pharmaceutical industry has also emerged as a significant consumer of sodium benzoate. The compound is used as an excipient in various medications, ensuring their stability and extending their shelf life. The increasing prevalence of chronic diseases and the growing pharmaceutical sector are expected to drive the demand for sodium benzoate in the coming years.

Ans: The revenue share of the Asia Pacific region for the Sodium Benzoate Market is about 17.5% in 2023.

Ans: Yes, you can buy reports in bulk quantity as per your requirements. Check Here for more details.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

3.1 Market Driving Factors Analysis

3.1.2 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 PESTLE Analysis

3.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Sodium Benzoate Market Segmentation, by Form

7.1 Chapter Overview

7.2 Granules

7.2.1 Granules Market Trends Analysis (2020-2032)

7.2.2 Granules Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Powder

7.3.1 Powder Market Trends Analysis (2020-2032)

7.3.2 Powder Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Flakes

7.4.1 Flakes Market Trends Analysis (2020-2032)

7.4.2 Flakes Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Sodium Benzoate Market Segmentation, by Application

8.1 Chapter Overview

8.2 Cosmetics

8.2.1 Cosmetics Market Trends Analysis (2020-2032)

8.2.2 Cosmetics Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Pharmaceuticals

8.3.1 Pharmaceuticals Market Trends Analysis (2020-2032)

8.3.2 Pharmaceuticals Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Food & Beverages

8.4.1 Food & Beverages Market Trends Analysis (2020-2032)

8.4.2 Food & Beverages Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Others

8.5.1 Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Sodium Benzoate Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.2.4 North America Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.2.5.2 USA Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.2.6.2 Canada Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.2.7.2 Mexico Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Sodium Benzoate Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.3.1.5.2 Poland Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.3.1.6.2 Romania Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Sodium Benzoate Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.3.2.4 Western Europe Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.3.2.5.2 Germany Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.3.2.6.2 France Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.3.2.7.2 UK Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.3.2.8.2 Italy Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.3.2.9.2 Spain Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.3.2.12.2 Austria Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Sodium Benzoate Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.4.4 Asia Pacific Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.4.5.2 China Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.4.5.2 India Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.4.5.2 Japan Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.4.6.2 South Korea Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.2.7.2 Vietnam Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.4.8.2 Singapore Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.4.9.2 Australia Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Sodium Benzoate Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.5.1.4 Middle East Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.5.1.5.2 UAE Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Sodium Benzoate Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.5.2.4 Africa Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Sodium Benzoate Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.6.4 Latin America Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.6.5.2 Brazil Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.6.6.2 Argentina Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.6.7.2 Colombia Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Sodium Benzoate Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Sodium Benzoate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 DuPont de Nemours Inc.

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Product / Services Offered

10.1.4 SWOT Analysis

10.2 Lanxess AG

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Product / Services Offered

10.2.4 SWOT Analysis

10.3 Penta Chemicals

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Product / Services Offered

10.3.4 SWOT Analysis

10.4 Merck KGaA

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Product / Services Offered

10.4.4 SWOT Analysis

10.5 Avantor Inc.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Product / Services Offered

10.5.4 SWOT Analysis

10.6 Foodchem International Corporation,

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Product / Services Offered

10.6.4 SWOT Analysis

10.7 Tulstar Products Inc.

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Product / Services Offered

10.7.4 SWOT Analysis

10.8 Wuhan Youji Industries Co. Ltd.

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Product / Services Offered

10.8.4 SWOT Analysis

10.9 Spectrum Chemicals

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Product / Services Offered

10.9.4 SWOT Analysis

10.10 FBC Industries Inc.

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Product / Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Form

Granules

Powder

Flakes

Others

By Application

Cosmetics

Pharmaceuticals

Food & Beverages

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Sulfur Fertilizer Market size was USD 4.49 Billion in 2023 and is expected to reach USD 6.08 Billion by 2032, growing at a CAGR of 3.42% from 2024 to 2032.

The Sustainable Apparel Market Size was valued at USD 11.20 billion in 2023 and will reach USD 24.53 billion by 2032, & grow at a CAGR of 9.1% by 2024-2032.

The Long-chain Polyamide Market size was USD 2.1 billion in 2023 and is expected to reach USD 3.2 billion by 2032 and grow at a CAGR of 5.0% over the forecast period of 2024-2032.

The Chondroitin Sulfate Market Size was valued at USD 1.3 Billion in 2023 and is expected to reach USD 1.7 Billion by 2032 and grow at a CAGR of 3.4% over the forecast period 2024-2032.

Biogas Market Size was valued at USD 63.91 billion in 2023 and is expected to reach USD 95.80 billion by 2032, growing at a CAGR of 5.01% from 2024 to 2032.

Electric Vehicle Adhesives Market was valued at USD 1.93 billion in 2023 and is expected to reach USD 38.11 billion by 2032 at a CAGR of 39.30% by 2024-2032.

Hi! Click one of our member below to chat on Phone