To get more information on Smart Sensors Market - Request Sample Report

The Smart Sensors Market Size was valued at USD 50.89 Billion in 2023 and is expected to reach USD 187.41 Billion by 2032, with a growing at CAGR of 15.63% over the forecast period of 2024-2032.

The smart sensors market is surging owing to growing adoption across various sectors with the expansion of the Internet of Things IoT and improvements in artificial intelligence (AI). For IoT-enabled devices, precise real-time data is essential and comes with a need for more communication, which has led to a rise in demand for smart sensors in consumer electronics, Automotive, and industrial applications. So, wearable devices, smart homes, and intelligent sensors in advanced driver-assistance systems (ADAS) in vehicles, for example, rely on smart sensors. Cellular IoT connections as a whole in the industrial sector, continued this trend of growth in 2023 with a YoY increase of 27% in 2023.

The Other Major Catalyst Is The Growing Development Of Smart Cities And Infrastructure Projects Globally

Smart sensors are used in these initiatives for energy management, traffic control, and environmental monitoring applications. Along with this, the booming healthcare market with rising demand for real-time health data and remote patient monitoring has led to increased adoption of smart actuators in diagnostic equipment and wearable health monitors. Further growth of the market can be attributed to the favorable government initiatives encouraging digitization and automation, and decreasing the price of sensors along with increased technological advancement in miniaturization technologies. The IoMT market is expected to reach more than USD 70 billion by 2024, and more than 80% of U.S. hospitals are expected to have implemented remote patient monitoring systems. Also, global government spending will reach USD 5 trillion on digitization and automation between 2023 and 2026, to help support smart sensors in urban and healthcare applications.

KEY DRIVERS:

Predictive Maintenance and Industry 4.0 Driving Smart Sensors Adoption for Enhanced Efficiency and Reliability

Apart from the IoT boom and the increasing use of AI, growing requirements of predictive maintenance in industrial applications are another major factor contributing to the growth of the smart sensors market. For example, machinery fitted with smart sensors will automatically detect key performance indicators in real time, ensuring that abnormal trends and machinery are identified and maintained on time. Transitioning from reactive to predictive maintenance ultimately decreases downtime, lowers repair costs, and enhances operational efficiency in manufacturing, energy, transportation, and other industries. As Industry 4.0 is disrupting production processes, smart sensors have now been an integral part of ever more electronics systems that have automated required production processes with higher throughput, efficiency, and safety. More than 50% of industrial plants will implement AI-powered smart sensors for predictive maintenance by 2024 Such systems can decrease unplanned downtime by 30-50%, reduce maintenance expenses by 20-30%, and enhance the reliability of the machines by up to 40%. Similarly, organizations like Nanoprecise continuously monitor 6 important parameters (vibration, acoustic emissions, speed, temperature, and humidity) to avoid machine failure and increase operational efficiency.

Smart Sensors Driving Environmental Monitoring and Energy Efficiency Innovations for Sustainable Global Development

Smart sensor technologies are gaining traction globally in environmental management as governments and organizations look for innovative solutions to localized issues such as air and water quality monitoring, waste management, and optimizing renewable energy production and use. Smart sensors play a major role here, from pollution detection to smart grid energy usage optimization to solar panel and wind turbine monitoring. With the world sustainability goal and various green initiatives taking place these technologies are slowly penetrating public and private sectors. With increasing environmental awareness, the need for smart sensors will increase, hence ensuring the growth potential of this market in the long run. The smart towns are expected to incorporate air quality sensors at a rate of more than 50% by 2025, leading to the reduction of localized pollution by 35%. In 2025 there will be 10 million sensors introduced globally that help improve the efficiency by 30% in case of detecting water quality issues in the Water Management area. Smart grids will also reduce energy use in city areas by 10-20%, and sensors in solar panels and wind turbines will increase energy output efficiency by up to 30%.

RESTRAIN:

Challenges in Smart Sensors Integration Data Security and Privacy Concerns Slowing Market Adoption

Challenges mentioned in Overview of Smart Sensors In general, smart sensors need to be integrated well with currently deployed systems and networks, which can be particularly difficult if there are communication protocols and data format differences. The required level of engineering and strong standards that ensure interoperability but also system reliability and system trustworthiness are a fence for adoption, especially in sectors working with legacy systems. A second issue comes to data security and privacy-related concerns. Due to the sensitive nature of the data collected by smart sensors, which may include health metrics or industrial performance statistics, such devices also become attractive targets for cyberattacks. Protecting this data while meeting strict laws such as GDPR and HIPAA makes this complex. Additionally, concerns regarding misuse and breach of data may deter certain organizations from using these technologies, causing a slowdown in market penetration.

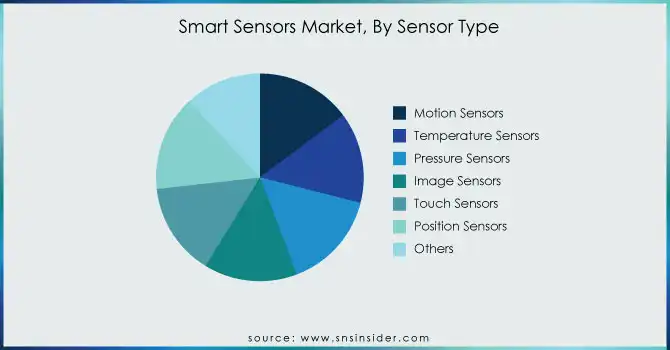

BY SENSOR TYPE

Pressure sensors segment accounted for the highest market share of 34% in 2023 in the smart sensor market and are expected to grow with the fastest CAGR during 2024-2032. The widespread usage of these in automotive, industrial automation, and healthcare domains makes them an essential element of the technology stack globally. Pressure sensors are used in many applications including advanced driver-assistance systems (ADAS), monitoring equipment in industrial machinery, and medical devices such as ventilators, and are capable of providing accurate measurements and safety. Accelerated growth in this sector is driven by ongoing improvements in MEMS (Micro-Electro-Mechanical Systems) that have increased sensor performance, compactness, and affordability. In addition, the increasing penetration of IoT and smart devices, which leverage pressure sensor data for continuous monitoring and to optimize operations, is propelling demand growth. Such a trend can be observed in emerging economies where there is an expansion of industrial automation and healthcare digitization. This makes them integral to the global market, with an extension of features like predictive maintenance and environmental monitoring gaining more attention.

BY TECHNOLOGY TYPE

The MEMS-based smart sensors segment accounted for the highest market share of 52% in 2023 as they are mainly used in consumer electronics, automotive, and industrial applications. The combination of miniaturization, low cost, and high precision has enabled their use in devices, including, but not limited to, accelerometers, gyroscopes, and pressure sensors. Moreover, the ability of MEMS technology to scale supports the integration of more than one element into a single sensor, accelerating the adoption of high-volume applications.

CMOS-based smart sensors will witness the fastest CAGR from 2024 to 2032 for advanced imaging and processing functionalities. CMOS technology is also widely used in applications including digital cameras, medical imaging, and machine vision systems. With the capability of embedding advanced processing elements within the sensor itself, it is well-suited for AI-enabled systems and IoT applications. In addition to this, the increasing need for high-resolution and low-power imaging solutions in applications such as autonomous, security systems as well as augmented reality is likely to stimulate the growth of the CMOS smart sensor market also making it an essential technology soon.

BY COMPONENT

Microcontrollers segment accounted for a dominating market share of 31% in 2023, and are expected to register the highest growth rate during 2024-2032. They have become the leaders responsible for processing and managing the data within smart sensor systems to support real-time monitoring, automation, and connectivity in such applications as IoT devices, industrial automation, and automotive systems. They seem to be on a growth path roughly in line with the increasing implementation of IoT solutions and smart devices around various industries. Amidst growing demand for low-power, high-efficiency operations, microcontrollers (MCUs) form the backbone of wearable electronics, home automation, and healthcare devices. In addition, the microcontroller architecture like integrated AI and machine learning capabilities continues to enhance their availability in autonomous systems, predictive maintenance and utilized in low power or energy-intensive applications. With the Smart Manufactured Evolution of sensor domains within an intelligent and connected environment, the family of microcontrollers shall remain the pioneer.

BY END USE

In 2023, Automotive segment led the market, accounting for a significant share of 32%, owing to the penetration of smart sensors in advanced driver-assistance systems (ADAS), autonomous vehicles, and safety features such as collision detection, lane-keeping systems, and airbag deployment. Rising emphasis on vehicle electrification and adoption of connected or IoT-based systems has further created a demand for the automotive smart sensor market. Key applications in automotive such as advanced driver assistance systems (ADAS), smart vehicles, and in-vehicle infotainment heavily rely on sensors to improve overall vehicle performance, safety, and efficiency, which makes the automotive sector the largest consumer of smart sensor technologies.

The Healthcare segment is expected to witness the highest compound annual growth rate (CAGR) from 2024 to 2032. The growth in this market is fuelled by the increasing adoption of telehealth care based on wearable medical devices and personal health monitoring tools based on smart sensors which represent the high market potential for the growth of the smart sensor market for the health monitoring equipment market which collects real-time data. The rapid rise in healthcare costs across the globe, increased adoption of medical technologies, and the need for advanced personalized healthcare solutions are causing this boom in demand. In addition, the pandemic has also modified telemedicine and connected health solution adoption, making the smart sensor necessary in this field. With healthcare providers focusing more on maximizing efficiency and care quality, the adoption of smart sensors will likely grow substantially.

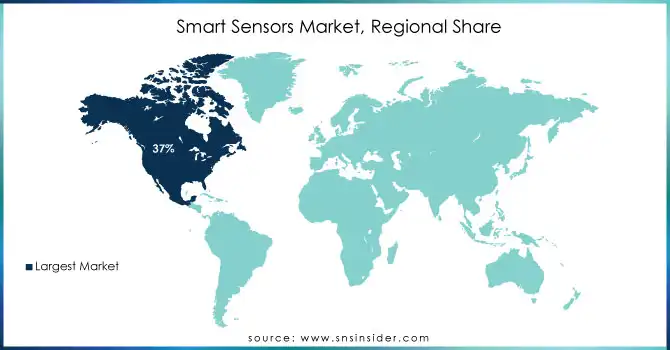

North America led the global market , accounting for 37% of the global smart sensors market in 2023 due to its high adoption of innovative technologies and investment in the IoT infrastructure. A notable instance is the health care industry where, smart sensors are being extensively utilized by smart wearables such as Fitbit and Apple watch that provide real-time information on health metrics including heart rate, oxygen levels, and activity level. Texas Instruments, Analog Devices, and STMicroelectronics are among the companies that drive innovation in sensor solutions for industrial automation and automotive applications. Smart sensors, for example, are used in a multitude of manufacturing environments for predictive maintenance and process optimization. In addition, the demand for smart sensors in transportation energy and other sectors is complemented by the strategic focus of the U.S. government on IoT and smart city projects.

The Asia Pacific region will achieve the fastest CAGR through 2032 driven by accelerating industrialization, ancient consumer electronics demand, and smart cities growth. This growth is driven by a few countries among them China, India, and Japan. To cite an instance, Chinese behemoths like Huawei and Xiaomi assemble innovative sensors in cell phones and wearable gadgets. Japan, known for its automotive industry, makes extensive use of smart sensors to improve safety and efficiency in autonomous and electric vehicles. For instance, initiatives such as Digital India in India and the advancement of smart manufacturing in China incentivize adopting smart sensor technology. For instance, South Korea's Songdo, a global hub for smart city technology, depends heavily on sensor system-based systems for energy efficiency and traffic management.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major players in the Smart Sensors Market are:

Honeywell International (Temperature Sensors, Gas Sensors)

Bosch Sensortec (IMUs, Environmental Sensors)

STMicroelectronics (Motion Sensors, Proximity Sensors)

Analog Devices Inc. (Pressure Sensors, Accelerometers)

Infineon Technologies (Radar Sensors, Magnetic Sensors)

TE Connectivity (Position Sensors, Industrial Sensors)

ABB Ltd. (Flow Sensors, Optical Sensors)

OmniVision Technologies (Image Sensors, AR/VR Sensors)

NXP Semiconductors (Pressure Sensors, RF Sensors)

DENSO Corporation (Automotive Sensors, Temperature Sensors)

Eaton Corporation (Level Sensors, Proximity Sensors)

Emerson Electric Co. (Vibration Sensors, Temperature Sensors)

Vishay Intertechnology (Optical Sensors, Proximity Sensors)

Legrand (Light Sensors, Occupancy Sensors)

AMETEK Inc. (Position Sensors, Flow Sensors)

Microchip Technology Inc. (Mixed-Signal Sensors, Environmental Sensors)

Balluff GmbH (Industrial Sensors, Magnetic Field Sensors)

Siemens AG (Smart Building Sensors, Process Sensors)

Texas Instruments (Environmental Sensors, Motion Sensors)

Alpha MOS (Chemical Sensors, Gas Sensors)

BASF SE

DuPont de Nemours, Inc.

3M Company

LG Chem

Dow Inc.

Solvay S.A.

Asahi Kasei Corporation

TSMC (Taiwan Semiconductor Manufacturing Company)

Sumitomo Electric Industries

SK Hynix Inc

In October 2024, STMicroelectronics unveiled the ST1VAFE3BX, a groundbreaking bio-sensing chip for healthcare wearables like smartwatches and fitness bands, combining biopotential sensing with AI-powered activity detection for improved efficiency and lower power consumption.

In January 2024, Bosch Sensortec used CES 2024 to launch a smart connected sensors platform for full body motion tracking, plus what it claims is the world’s smallest MEMS accelerometers for wearables and wearables.

In August 2024, OMNIVISION launched the OV50M40, a 50-megapixel CMOS image sensor with advanced HDR capabilities and low-light performance, designed for smartphone front, main, ultra-wide, and telephoto cameras.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 50.89 Billion |

| Market Size by 2032 | USD 187.41 Billion |

| CAGR | CAGR of 15.63% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sensor Type (Motion Sensors, Temperature Sensors, Pressure Sensors, Image Sensors, Touch Sensors, Position Sensors, Others) • By Technology Type (MEMS-based Smart Sensors, CMOS-based Smart Sensors, Others) • By Component (Analog-to-Digital Converters (ADC), Digital-to-Analog Converters (DAC), Amplifiers, Microcontrollers, Others) • By End Use (Healthcare, Automotive, Infrastructure, Industrial, Consumer Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Honeywell International, Bosch Sensortec, STMicroelectronics, Analog Devices Inc., Infineon Technologies, TE Connectivity, ABB Ltd., OmniVision Technologies, NXP Semiconductors, DENSO Corporation, Eaton Corporation, Emerson Electric Co., Vishay Intertechnology, Legrand, AMETEK Inc., Microchip Technology Inc., Balluff GmbH, Siemens AG, Texas Instruments, Alpha MOS |

| Key Drivers | • Predictive Maintenance and Industry 4.0 Driving Smart Sensors Adoption for Enhanced Efficiency and Reliability • Smart Sensors Driving Environmental Monitoring and Energy Efficiency Innovations for Sustainable Global Development |

| Restraints | • Challenges in Smart Sensors Integration Data Security and Privacy Concerns Slowing Market Adoption |

Ans: The Smart Sensors Market is expected to grow at a CAGR of 15.96% during 2024-2032.

Ans: Smart Sensors Market size was USD 50.89 billion in 2023 and is expected to Reach USD 187.41 billion by 2032.

Ans: The major growth factor of the Smart Sensors Market is the increasing demand for IoT-enabled devices across various industries, enhancing automation, data collection, and real-time analytics.

Ans: The MEMS-based Smart Sensors segment dominated the Smart Sensors Market in 2023.

Ans: North America dominated the Smart Sensors Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Smart Sensors Adoption Rates by Industry (2023)

5.2 Smart Sensors Price Trends and Cost Efficiency (2023)

5.3 Smart Sensors Technology Adoption Metrics

5.4 Smart Sensors Patent and Innovation Trends

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Smart Sensors Market Segmentation, By Sensor Type

7.1 Chapter Overview

7.2 Motion Sensors

7.2.1 Motion Sensors Market Trends Analysis (2020-2032)

7.2.2 Motion Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Temperature Sensors

7.3.1 Temperature Sensors Market Trends Analysis (2020-2032)

7.3.2 Temperature Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Pressure Sensors

7.4.1 Pressure Sensors Market Trends Analysis (2020-2032)

7.4.2 Pressure Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Image Sensors

7.5.1 Image Sensors Market Trends Analysis (2020-2032)

7.5.2 Image Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Touch Sensors

7.6.1 Touch Sensors Market Trends Analysis (2020-2032)

7.6.2 Touch Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Position Sensors

7.7.1 Position Sensors Market Trends Analysis (2020-2032)

7.7.2 Position Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.8 Others

7.8.1 Others Market Trends Analysis (2020-2032)

7.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Smart Sensors Market Segmentation, By Technology Type

8.1 Chapter Overview

8.2 MEMS-based Smart Sensors

8.2.1 MEMS-based Smart Sensors Market Trends Analysis (2020-2032)

8.2.2 MEMS-based Smart Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 CMOS-based Smart Sensors

8.3.1 CMOS-based Smart Sensors Market Trends Analysis (2020-2032)

8.3.2 CMOS-based Smart Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Others

8.4.1 Others Market Trends Analysis (2020-2032)

8.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Smart Sensors Market Segmentation, By Component

9.1 Chapter Overview

9.2 Analog-to-Digital Converters (ADC)

9.2.1 Analog-to-Digital Converters (ADC) Market Trends Analysis (2020-2032)

9.2.2 Analog-to-Digital Converters (ADC) Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Digital-to-Analog Converters (DAC)

9.3.1 Digital-to-Analog Converters (DAC) Market Trends Analysis (2020-2032)

9.3.2 Digital-to-Analog Converters (DAC) Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Amplifiers

9.4.1 Amplifiers Market Trends Analysis (2020-2032)

9.4.2 Amplifiers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Microcontrollers

9.5.1 Microcontrollers Market Trends Analysis (2020-2032)

9.5.2 Microcontrollers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Others

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Smart Sensors Market Segmentation, By End Use

10.1 Chapter Overview

10.2 Healthcare

10.2.1 Healthcare Market Trends Analysis (2020-2032)

10.2.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Automotive

10.3.1 Automotive Market Trends Analysis (2020-2032)

10.3.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Infrastructure

10.4.1 Infrastructure Market Trends Analysis (2020-2032)

10.4.2 Infrastructure Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Industrial

10.5.1 Industrial Market Trends Analysis (2020-2032)

10.5.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Consumer Electronics

10.6.1 Consumer Electronics Market Trends Analysis (2020-2032)

10.6.2 Consumer Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

10.7 Others

10.7.1 Others Market Trends Analysis (2020-2032)

10.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Smart Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.2.4 North America Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.2.5 North America Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.6 North America Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.2.7.2 USA Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.2.7.3 USA Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.7.4 USA Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.2.8.2 Canada Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.2.8.3 Canada Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.8.4 Canada Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.2.9.2 Mexico Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.2.9.3 Mexico Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.9.4 Mexico Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Smart Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.3.1.7.2 Poland Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.1.7.3 Poland Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.7.4 Poland Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.3.1.8.2 Romania Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.1.8.3 Romania Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.8.4 Romania Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.1.10 turkey

11.3.1.10.1 Turkey Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Smart Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.3.2.4 Western Europe Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.2.5 Western Europe Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.6 Western Europe Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.3.2.7.2 Germany Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.2.7.3 Germany Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.7.4 Germany Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.3.2.8.2 France Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.2.8.3 France Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.8.4 France Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.3.2.9.2 UK Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.2.9.3 UK Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.9.4 UK Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.3.2.10.2 Italy Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.2.10.3 Italy Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.10.4 Italy Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.3.2.11.2 Spain Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.2.11.3 Spain Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.11.4 Spain Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.3.2.14.2 Austria Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.2.14.3 Austria Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.14.4 Austria Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Smart Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.4.4 Asia Pacific Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.4.5 Asia Pacific Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.6 Asia Pacific Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.4.7.2 China Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.4.7.3 China Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.7.4 China Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.4.8.2 India Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.4.8.3 India Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.8.4 India Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.4.9.2 Japan Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.4.9.3 Japan Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.9.4 Japan Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.4.10.2 South Korea Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.4.10.3 South Korea Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.10.4 South Korea Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.4.11.2 Vietnam Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.4.11.3 Vietnam Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.11.4 Vietnam Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.4.12.2 Singapore Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.4.12.3 Singapore Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.12.4 Singapore Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.4.13.2 Australia Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.4.13.3 Australia Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.13.4 Australia Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Smart Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.5.1.4 Middle East Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.5.1.5 Middle East Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.6 Middle East Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.5.1.7.2 UAE Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.5.1.7.3 UAE Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.7.4 UAE Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Smart Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.5.2.4 Africa Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.5.2.5 Africa Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.6 Africa Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Smart Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.6.4 Latin America Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.6.5 Latin America Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.6 Latin America Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.6.7.2 Brazil Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.6.7.3 Brazil Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.7.4 Brazil Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.6.8.2 Argentina Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.6.8.3 Argentina Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.8.4 Argentina Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.6.9.2 Colombia Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.6.9.3 Colombia Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.9.4 Colombia Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Smart Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Smart Sensors Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Smart Sensors Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Smart Sensors Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12. Company Profiles

12.1 Honeywell International

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Bosch Sensortec

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 STMicroelectronics

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Analog Devices Inc.

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Infineon Technologies

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 TE Connectivity

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 ABB Ltd

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 OmniVision Technologies

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 NXP Semiconductors

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 DENSO Corporation

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Sensor Type

Motion Sensors

Temperature Sensors

Pressure Sensors

Image Sensors

Touch Sensors

Position Sensors

Others

By Technology Type

MEMS-based Smart Sensors

CMOS-based Smart Sensors

Others

By Component

Analog-to-digital converters (ADC)

Digital-to-analog converters (DAC)

Amplifiers

Microcontrollers

Others

By End Use

Healthcare

Automotive

Infrastructure

Industrial

Consumer Electronics

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Solar Lighting System Market Size was valued at USD 8.32 billion in 2023 and is growing at a CAGR of 14.96% to reach USD 29.17 billion by 2032.

The Metal-Air Battery Market was valued at USD 555.9 Million in 2023 and is projected to reach USD 1793.5 Million by 2032, growing at a CAGR of 13.90% from 2024 to 2032.

The Hybrid Printing Market Size was valued at USD 5.18 Billion in 2023 and is expected to grow at a CAGR of 13.20% to reach USD 15.81 Billion by 2032.

The Fiber Optics Market Size was valued at USD 8.73 billion in 2023 and is expected to grow at a CAGR of 7.02% to reach USD 16.02 billion by 2032.

The Semiconductor Silicon Wafer Market was valued at USD 14.16 billion in 2023 and is expected to reach USD 22.61 billion by 2032, growing at a CAGR of 5.37% over the forecast period 2024-2032.

The Milking Robots Market size was valued at USD 2.86 billion in 2023. It is estimated to grow to USD 7.2 billion by 2032 and grow at a CAGR of 10.79% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone