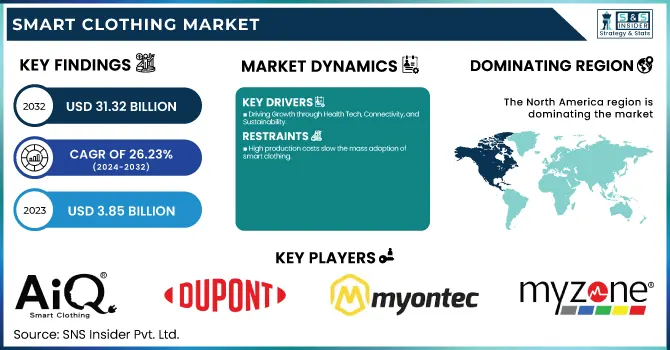

The Smart Clothing Market Size was valued at USD 3.85 Billion in 2023 and is expected to reach USD 31.32 Billion by 2032, growing at a CAGR of 26.23 % from 2024-2032. Increasing adoption in fitness, healthcare, military, and fashion drives the market's rapid growth, usually focusing on features that include biometric tracking, temperature regulation and IoT connectivity. technologies such as AI-based analytics, smart sensors, and flexible electronics are driving innovation. Regulatory compliance (ISO and FDA standards for medical applications) provides safety and reliability. As well, increasing health monitoring awareness and demand for sportswear as well as integration with AI and wearables is facilitating adoption. Growing inclination towards eco-friendly and high-performance textiles also boosts the growth of lifecycle assessment market.

To Get more information on Smart Clothing Market - Request Free Sample Report

Drivers:

Driving Growth through Health Tech, Connectivity, and Sustainability

The rapid integration of AI, IoT, smart sensors, and advanced textiles is revolutionizing the smart clothing market, making garments more functional, connected, and sustainable. A key driver of this transformation is health monitoring, with brands embedding biometric sensors into clothing for real-time tracking of heart rate, hydration, and respiration, benefiting both fitness enthusiasts and individuals with chronic conditions. Additionally, sustainability is gaining momentum, as smart textiles now include self-healing, biodegradable, and solar-powered fabrics, reducing environmental impact. Meanwhile, the IoT revolution in fashion is enabling seamless device integration, allowing users to make payments, unlock devices, and control smart home systems directly from their clothing. As these innovations continue, the smart clothing market is experiencing rapid expansion, with increasing consumer demand across healthcare, military, and everyday fashion segments, positioning it as a major driver of growth in the wearable technology industry.

Restraints:

High production costs slow the mass adoption of smart clothing.

Smart garments are still expensive to manufacture, making them inaccessible to the general public, and they combine AI, IoT, sensors, and advanced fabrics. Smart clothing is vastly different from conventional wearables, as it necessitates special materials, flexible electronic components integrated with embedded biometric sensors, which further increases the complexity of the manufacturing process. However, the challenge of developing and manufacturing new corporations to conductive fabrics, miniaturization of power source, and seamless personalized connectivity is a laborious process, requiring extensive research, resulting in higher R& D expenditure. Moreover, the production process includes complex engineering, thorough testing, and adherence to safety regulations, all adding to expenses. The absence of large-scale production capabilities also prevents economies of scale, leaving prices high for both manufacturers and consumers. Though the costs are likely to be reduced over time, due to improvements in printed electronics and nanotechnology, affordability remains one of the biggest challenges. The ability of the smart clothing market to penetrate other markets will remain a challenge until production is made much more cost effective.

Opportunity:

Next-Gen Printed Electronics Transforming Smart Clothing for Seamless Integration

Advancements in printed electronics are revolutionizing the smart clothing industry by enabling the development of flexible, lightweight, and stretchable circuits that seamlessly integrate with textiles. Traditional rigid electronic components add bulk and stiffness to garments, limiting comfort and wearability. However, flexible printed circuits, created using conductive inks and substrates, allow for smooth embedding of sensors, processors, and connectivity modules without compromising fabric properties. These circuits can be printed directly onto textiles using cost-efficient roll-to-roll manufacturing, reducing material waste and production costs. Additionally, innovations in nanomaterials and organic electronics have enhanced durability, enabling printed circuits to withstand stretching, bending, and repeated washing. By eliminating the need for rigid PCBs and bulky wiring, printed electronics not only make smart clothing more comfortable and aesthetically appealing but also lower manufacturing expenses, paving the way for wider adoption across consumer and industrial applications.

Challenges:

Ensuring Smart Clothing Durability without Compromising Functionality.

Ensuring the durability and wash ability of smart clothing remains a significant challenge due to the integration of delicate electronic components within flexible textiles. Unlike traditional garments, smart clothing embeds sensors, conductive threads, and microchips, which are susceptible to damage from water, detergents, and mechanical stress during washing. Frequent bending, stretching, and exposure to sweat or environmental factors can degrade the functionality of these embedded electronics, leading to reduced lifespan and performance issues. Manufacturers are exploring advanced waterproof coatings, encapsulation techniques, and washable conductive materials to improve resilience, but achieving long-term durability without compromising comfort or performance remains a complex task. Additionally, specialized washing instructions, such as using mild detergents or avoiding high temperatures, may discourage consumer adoption. The need for standardized testing methods and industry-wide durability benchmarks is crucial to ensuring smart textiles meet both technological and everyday usability expectations.

By Textile Type

The Passive Smart segment dominated the smart clothing market in 2023, accounting for approximately 59% of the total market share. Passive smart clothing is the passive versions of smart clothes that include articles of clothing that is made of smart fabric and perform function a standard garment would not be able to especially without the incorporation of embedded electronics or external power supply. Often, these textiles include the likes of moisture-wicking, temperature-regulating, or UV-protective materials and as such, are naturally suited to sportswear, outdoor apparel and healthcare. Passive smart clothing (which is more affordable, easy to use, and durable than active and ultra-smart clothing) is widely adopted. In addition to facilitating seamless integration with electronic components, passive smart textiles do not demand extensive maintenance or unique procedures for laundering, contributing to a more straightforward approach for consumers. Additionally, advancements in nanotechnology and fabric engineering have led to the development of self-cleaning, antimicrobial, and phase-change materials, further increasing their appeal across various industries. As sustainability becomes a key focus, manufacturers are integrating eco-friendly materials into passive smart clothing, catering to growing consumer demand for sustainable and high-performance apparel.

The Ultra Smart segment is projected to be the fastest-growing category in the smart clothing market from 2024 to 2032, due to rapid development of AI, IoT, and biometric sensing technologies. These smart textiles will include elements such as physiological feedback monitoring in real-time, near-instant temperature adapting, and even AI-interactive functions that make them extremely desirable in industries ranging from healthcare to sports, military, and fashion. Imminent advances in flexible electronics, nanotechnology, and printed circuits will make ultra-smart clothing cheaper and more durable, further fueling adoption.. However, challenges such as high production costs and wash ability concerns remain key hurdles. By 2032, the Ultra Smart segment is expected to capture a significant market share, reshaping the future of wearable technology.

By Product Type

The Apparel segment dominated the smart clothing market in 2023, accounting for approximately 54% of the total market share. This dominance is driven by the widespread adoption of smart shirts, jackets, and active wear integrated with sensors, biometric tracking, and temperature regulation features. The growing consumer focus on health monitoring, sports performance enhancement and fashion-tech integration has fueled demand across fitness, military, and healthcare sectors. Additionally, advancements in wearable textiles, IoT connectivity, and AI-driven analytics have enhanced the functionality of smart apparel, making it a preferred choice over other smart clothing types. With continuous technological innovation and increasing consumer awareness, the apparel segment is expected to maintain its leadership in the smart clothing market over the coming years.

The Footwear segment is the third-largest in the smart clothing market and is expected to be the fastest-growing over the forecast period 2024-2032. With rising consumer demand for connected and performance-enhancing shoes, these products are designed as an inseparable part of the shoe with integrated sensors, pressure mapping technology, and AI-driven analytics, providing insights on gait, posture, and overall fitness performance [1]. These developments make smart shoes an attractive proposition for both athletes, healthcare uses, and general consumers. This rapid rise is driven by innovations such as self-lacing technology, energy-harvesting soles and real-time biometric tracking. In addition, enhanced adoption in several sports, rehabilitation and fashion-tech applications will foster the segment expansion and propel the segment as one of the prime cranks in the smart clothing market.

By Distribution Channel

The Offline segment held the largest revenue share of approximately 68% in 2023 in the smart clothing market, driven by strong consumer preference for physical retail stores, brand-exclusive outlets, and specialty sports shops. Many buyers prefer in-store purchases to experience the fit, comfort, and technology integration of smart apparel before making a decision. Additionally, premium and luxury smart clothing brands leverage exclusive offline retail strategies, including personalized consultations and interactive shopping experiences, to attract high-value customers. While e-commerce is rapidly, expanding, brick-and-mortar stores remain dominant due to trust, immediate product access, and after-sales support, ensuring their continued market leadership.

The Online segment is the fastest-growing distribution channel in the smart clothing market from 2024 to 2032, due to the rising penetration of e-commerce platforms, digital payment solutions, and direct-to-consumer (DTC) brand strategies. With technology like virtual try-ons, AI-powered size recommendations, and easy-return policies, consumers continue to pivot toward e-commerce. Plus, sales online are being turbo-charged by discounts, subscription models and influencer-led marketing.” The increasing number of IoT-enabled wearables and smart textiles have also contributed in a positive way to the rising demand for launches of exclusive products online. The quality of global logistics is improving and many companies offer same-day delivery options; hence, the online segment is projected to outpace that of offline retail in terms of growth rate during the forecast period.

By End Use

The mining segment dominated the smart clothing market with a 39% share in 2023 driven by the increasing need of ensuring the worker's safety, real-time health monitoring, and protecting the worker from hazardous environment. Wearable sensors, temperature-regulating fabrics and GPS-enabled garments are some of the types of smart clothing used to keep track of workplace accidents by monitoring workers' location and vital signs in the field or underground. Increasing implementation of regulatory mandates for occupational safety along with the high adoption of IoT-integrated protective gear are positively impacting the growth of this market. To facilitate widespread procurement, enterprises are investing in highly durable and washable smart textiles that withstand even the harshest mining environments. With advancements in AI-powered predictive maintenance and fatigue detection systems, the mining sector will continue driving demand for smart clothing.

The sports & fitness segment is the fastest-growing in the smart clothing market from 2024 to 2032, driven by increasing consumer demand for real-time health tracking, performance optimization, and personalized fitness insights. Smart apparel embedded with biometric sensors, AI-powered analytics, and IoT connectivity is gaining traction among athletes and fitness enthusiasts. Wearable innovations such as smart shirts with ECG monitoring, temperature-regulating fabrics, and posture-correcting apparel are revolutionizing sports training and injury prevention. The growing adoption of connected fitness ecosystems and rising awareness of health and wellness trends are further accelerating market expansion. Enhanced durability, wash ability, and seamless integration with mobile apps will continue fueling this segment's rapid growth.

North America dominated the smart clothing market with a 40% revenue share in 2023, driven by high consumer adoption, strong technological advancements, and presence of leading market players. The region benefits from early adoption of wearable technology, rising demand for fitness and healthcare applications, and significant investments in AI and IoT-integrated apparel. The U.S. and Canada lead the market due to a tech-savvy population, increasing health awareness, and collaborations between tech firms and fashion brands. Additionally, military and industrial applications of smart textiles further contribute to growth. With continuous R&D investments, growing demand for connected wearables, and increasing sports and fitness trends, North America is expected to maintain its dominance over the forecast period.

Asia-Pacific is the fastest-growing region in the smart clothing market from 2024 to 2032, due to rapid technological advancements, increasing disposable income, and rising health awareness. There is a growing focus on the adoption of smart textiles in countries such as China, Japan, South Korea, and India, driven by the expanding fitness and sports industry, the rapid rate of urbanization, and government initiatives to promote innovation in wearable technology. Sol-gel technology has gained significant traction, driven by the low cost of technology and the presence of top electronics and textile manufacturers. The increasing demand for smart uniforms in military and industrial sectors along with the penetration of AI, IoT, and biometric tracking in the apparel is further propelling the adoption. As a result of growing consumer awareness, expanding e-commerce, and significant investments in research and development in smart clothing, Asia-Pacific is expected to register the highest growth in the smart clothing market during the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major players in Smart Clothing Market along with their product:

AiQ Smart Clothing (USA) – (Smart textile cables, bio-sensing wearables)

DuPont (USA) – (Intexar™ smart clothing technology, conductive fibers)

Myontec (Finland) – (EMG-based smart garments for muscle tracking)

Myzone (UK) – (Wearable heart rate monitors, fitness clothing)

Owlet (UK) – (Smart socks for infant health monitoring)

Sensoria (USA) – (Smart textile sensors, bio-sensing technology)

Siren (USA) – (Diabetic foot monitoring socks)

TORAY INDUSTRIES, INC. (Japan) – (Conductive fibers, intelligent textiles)

Vulpes Electronics GmbH (Germany) – (Wearable electronic components, flexible sensors)

Wearable X (Australia) – (Smart yoga wear with haptic feedback)

Cityzen Sciences (France) – (Smart fabrics for biometric monitoring)

Xiaomi (China) – (Smart shoes with fitness tracking sensors)

Adidas (Germany) – (Smart sportswear, connected footwear)

Samsung (South Korea) – (Smart clothing with embedded sensors, wearable textiles)

Dainese (Italy) – (Smart protective wear for motorcyclists and athletes)

List of Key Suppliers Providing Raw Materials and Components for the Smart Clothing Market:

Raw Material Suppliers:

Gore-Tex (USA) – (Waterproof and breathable fabrics for smart textiles)

Teijin Limited (Japan) – (High-performance fibers and conductive textiles)

Kolon Industries (South Korea) – (Conductive yarns, high-tech synthetic fibers)

Hexcel Corporation (USA) – (Advanced composite materials for wearable electronics)

Toray Industries, Inc. (Japan) – (Smart fibers, nano-coatings, and conductive fabrics)

Component Suppliers:

Texas Instruments (USA) – (Microcontrollers, sensors, and power management ICs for wearables)

Analog Devices (USA) – (Biometric sensors, signal processing chips for smart clothing)

STMicroelectronics (Switzerland) – (Flexible and low-power ICs for wearable electronics)

Infineon Technologies (Germany) – (Security and biometric chips for smart textiles)

Sensirion (Switzerland) – (Humidity and temperature sensors for smart garments)

In March 2024 AiQ Smart Clothing launched a cycling jersey featuring integrated heart rate monitoring and smart lighting for improved performance and safety. This is a reflection of AiQ’s focus on merging wearable technology with functional sports apparel.

On August 23, 2024, Xiaomi released the Mijia Smart Clothes Dryer 1C in China with a ceiling mounted motorized unit with dimmable 22W light It allows for HyperOS Connect, Xiao AI voice commands, and fine-tuning through an app for smarter home integration.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.85 Billion |

| Market Size by 2032 | USD 31.32 Billion |

| CAGR | CAGR of 26.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Textile Type (Active Smart, Passive Smart, Ultra Smart) • By Product Type (Apparel, Footwear, Wearable Patches, Others) • By Distribution Channel (Offline, Online) • By End Use (Military & Defence, Sports & Fitness, Fashion & Entertainment, Healthcare, Mining, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AiQ Smart Clothing, DuPont, Myontec, Myzone, Owlet, Sensoria, Siren, TORAY INDUSTRIES, INC., Vulpes Electronics GmbH, Wearable X, Cityzen Sciences, Xiaomi, Adidas, Samsung, and Dainese. |

Ans: The Smart Clothing Market is expected to grow at a CAGR of 26.23% during 2024-2032.

Ans: North America dominated the Smart Clothing Market in 2023

Ans: The “Passive Smart” segment dominated the Smart Clothing Market.

Ans: The key drivers of the Smart Clothing Market include advancements in wearable technology, increasing health and fitness awareness, and growing demand for biometric monitoring.

Ans: North America dominated the Smart Clothing Market in 2023

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rate

5.2 Regulatory & Compliance Data

5.3 Technological Insights

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Smart Clothing Market Segmentation, by Textile Type

7.1 Chapter Overview

7.2 Active Smart

7.2.1 Active Smart Market Trends Analysis (2020-2032)

7.2.2 Active Smart Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Passive Smart

7.3.1 Passive Smart Market Trends Analysis (2020-2032)

7.3.2 Passive Smart Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Ultra Smart

7.4.1 Ultra Smart Market Trends Analysis (2020-2032)

7.4.2 Ultra Smart Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Smart Clothing Market Segmentation, by Product Type

8.1 Chapter Overview

8.2 Apparel

8.2.1 Apparel Market Trends Analysis (2020-2032)

8.2.2 Apparel Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Footwear

8.3.1 Footwear Market Trends Analysis (2020-2032)

8.3.2 Footwear Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Wearable Patches

8.4.1 Wearable Patches Market Trends Analysis (2020-2032)

8.4.2 Wearable Patches Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Others

8.5.1 Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Smart Clothing Market Segmentation, by Distribution Channel

9.1 Chapter Overview

9.2 Offline

9.2.1 Offline Market Trends Analysis (2020-2032)

9.2.2 Offline Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Online

9.3.1 Online Market Trends Analysis (2020-2032)

9.3.2 Online Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Smart Clothing Market Segmentation, by End Use

10.1 Chapter Overview

10.2 Military & Defence

10.2.1 Military & Defence Market Trends Analysis (2020-2032)

10.2.2 Military & Defence Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Sports & Fitness

10.3.1 Sports & Fitness Market Trends Analysis (2020-2032)

10.3.2 Sports & Fitness Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Fashion & Entertainment

10.4.1 Fashion & Entertainment Market Trends Analysis (2020-2032)

10.4.2 Fashion & Entertainment Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Healthcare

10.5.1 Healthcare Market Trends Analysis (2020-2032)

10.5.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Mining

10.6.1 Mining Market Trends Analysis (2020-2032)

10.6.2 Mining Market Size Estimates and Forecasts to 2032 (USD Billion)

10.7 Others

10.7.1 Others Market Trends Analysis (2020-2032)

Smart Clothing Market Report Scope & Overview:

The Smart Clothing Market was valued at USD 3.85 Billion in 2023 and is expected to reach USD 31.32 Billion by 2032, growing at a CAGR of 26.23 % from 2024-2032. Increasing adoption in fitness, healthcare, military, and fashion drives the market's rapid growth, usually focusing on features that include biometric tracking, temperature regulation and IoT connectivity. technologies such as AI-based analytics, smart sensors, and flexible electronics are driving innovation. Regulatory compliance (ISO and FDA standards for medical applications) provides safety and reliability. As well, increasing health monitoring awareness and demand for sportswear as well as integration with AI and wearables is facilitating adoption. Growing inclination towards eco-friendly and high-performance textiles also boosts the growth of lifecycle assessment market.

Smart Clothing Market Dynamics:

Drivers:

The rapid integration of AI, IoT, smart sensors, and advanced textiles is revolutionizing the smart clothing market, making garments more functional, connected, and sustainable. A key driver of this transformation is health monitoring, with brands embedding biometric sensors into clothing for real-time tracking of heart rate, hydration, and respiration, benefiting both fitness enthusiasts and individuals with chronic conditions. Additionally, sustainability is gaining momentum, as smart textiles now include self-healing, biodegradable, and solar-powered fabrics, reducing environmental impact. Meanwhile, the IoT revolution in fashion is enabling seamless device integration, allowing users to make payments, unlock devices, and control smart home systems directly from their clothing. As these innovations continue, the smart clothing market is experiencing rapid expansion, with increasing consumer demand across healthcare, military, and everyday fashion segments, positioning it as a major driver of growth in the wearable technology industry.

Restraints:

Smart garments are still expensive to manufacture, making them inaccessible to the general public, and they combine AI, IoT, sensors, and advanced fabrics. Smart clothing is vastly different from conventional wearables, as it necessitates special materials, flexible electronic components integrated with embedded biometric sensors, which further increases the complexity of the manufacturing process. However, the challenge of developing and manufacturing new corporations to conductive fabrics, miniaturization of power source, and seamless personalized connectivity is a laborious process, requiring extensive research, resulting in higher R& D expenditure. Moreover, the production process includes complex engineering, thorough testing, and adherence to safety regulations, all adding to expenses. The absence of large-scale production capabilities also prevents economies of scale, leaving prices high for both manufacturers and consumers. Though the costs are likely to be reduced over time, due to improvements in printed electronics and nanotechnology, affordability remains one of the biggest challenges. The ability of the smart clothing market to penetrate other markets will remain a challenge until production is made much more cost effective.

Opportunity:

Advancements in printed electronics are revolutionizing the smart clothing industry by enabling the development of flexible, lightweight, and stretchable circuits that seamlessly integrate with textiles. Traditional rigid electronic components add bulk and stiffness to garments, limiting comfort and wearability. However, flexible printed circuits, created using conductive inks and substrates, allow for smooth embedding of sensors, processors, and connectivity modules without compromising fabric properties. These circuits can be printed directly onto textiles using cost-efficient roll-to-roll manufacturing, reducing material waste and production costs. Additionally, innovations in nanomaterials and organic electronics have enhanced durability, enabling printed circuits to withstand stretching, bending, and repeated washing. By eliminating the need for rigid PCBs and bulky wiring, printed electronics not only make smart clothing more comfortable and aesthetically appealing but also lower manufacturing expenses, paving the way for wider adoption across consumer and industrial applications.

Challenges:

Ensuring the durability and wash ability of smart clothing remains a significant challenge due to the integration of delicate electronic components within flexible textiles. Unlike traditional garments, smart clothing embeds sensors, conductive threads, and microchips, which are susceptible to damage from water, detergents, and mechanical stress during washing. Frequent bending, stretching, and exposure to sweat or environmental factors can degrade the functionality of these embedded electronics, leading to reduced lifespan and performance issues. Manufacturers are exploring advanced waterproof coatings, encapsulation techniques, and washable conductive materials to improve resilience, but achieving long-term durability without compromising comfort or performance remains a complex task. Additionally, specialized washing instructions, such as using mild detergents or avoiding high temperatures, may discourage consumer adoption. The need for standardized testing methods and industry-wide durability benchmarks is crucial to ensuring smart textiles meet both technological and everyday usability expectations.

Smart Clothing Market Segment Analysis

By Textile Type

The Passive Smart segment dominated the smart clothing market in 2023, accounting for approximately 59% of the total market share. Passive smart clothing is the passive versions of smart clothes that include articles of clothing that is made of smart fabric and perform function a standard garment would not be able to especially without the incorporation of embedded electronics or external power supply. Often, these textiles include the likes of moisture-wicking, temperature-regulating, or UV-protective materials and as such, are naturally suited to sportswear, outdoor apparel and healthcare. Passive smart clothing (which is more affordable, easy to use, and durable than active and ultra-smart clothing) is widely adopted. In addition to facilitating seamless integration with electronic components, passive smart textiles do not demand extensive maintenance or unique procedures for laundering, contributing to a more straightforward approach for consumers. Additionally, advancements in nanotechnology and fabric engineering have led to the development of self-cleaning, antimicrobial, and phase-change materials, further increasing their appeal across various industries. As sustainability becomes a key focus, manufacturers are integrating eco-friendly materials into passive smart clothing, catering to growing consumer demand for sustainable and high-performance apparel.

The Ultra Smart segment is projected to be the fastest-growing category in the smart clothing market from 2024 to 2032, due to rapid development of AI, IoT, and biometric sensing technologies. These smart textiles will include elements such as physiological feedback monitoring in real-time, near-instant temperature adapting, and even AI-interactive functions that make them extremely desirable in industries ranging from healthcare to sports, military, and fashion. Imminent advances in flexible electronics, nanotechnology, and printed circuits will make ultra-smart clothing cheaper and more durable, further fueling adoption.. However, challenges such as high production costs and wash ability concerns remain key hurdles. By 2032, the Ultra Smart segment is expected to capture a significant market share, reshaping the future of wearable technology.

By Product Type

The Apparel segment dominated the smart clothing market in 2023, accounting for approximately 54% of the total market share. This dominance is driven by the widespread adoption of smart shirts, jackets, and active wear integrated with sensors, biometric tracking, and temperature regulation features. The growing consumer focus on health monitoring, sports performance enhancement and fashion-tech integration has fueled demand across fitness, military, and healthcare sectors. Additionally, advancements in wearable textiles, IoT connectivity, and AI-driven analytics have enhanced the functionality of smart apparel, making it a preferred choice over other smart clothing types. With continuous technological innovation and increasing consumer awareness, the apparel segment is expected to maintain its leadership in the smart clothing market over the coming years.

The Footwear segment is the third-largest in the smart clothing market and is expected to be the fastest-growing over the forecast period 2024-2032. With rising consumer demand for connected and performance-enhancing shoes, these products are designed as an inseparable part of the shoe with integrated sensors, pressure mapping technology, and AI-driven analytics, providing insights on gait, posture, and overall fitness performance [1]. These developments make smart shoes an attractive proposition for both athletes, healthcare uses, and general consumers. This rapid rise is driven by innovations such as self-lacing technology, energy-harvesting soles and real-time biometric tracking. In addition, enhanced adoption in several sports, rehabilitation and fashion-tech applications will foster the segment expansion and propel the segment as one of the prime cranks in the smart clothing market.

By Distribution Channel

The Offline segment held the largest revenue share of approximately 68% in 2023 in the smart clothing market, driven by strong consumer preference for physical retail stores, brand-exclusive outlets, and specialty sports shops. Many buyers prefer in-store purchases to experience the fit, comfort, and technology integration of smart apparel before making a decision. Additionally, premium and luxury smart clothing brands leverage exclusive offline retail strategies, including personalized consultations and interactive shopping experiences, to attract high-value customers. While e-commerce is rapidly, expanding, brick-and-mortar stores remain dominant due to trust, immediate product access, and after-sales support, ensuring their continued market leadership.

The Online segment is the fastest-growing distribution channel in the smart clothing market from 2024 to 2032, due to the rising penetration of e-commerce platforms, digital payment solutions, and direct-to-consumer (DTC) brand strategies. With technology like virtual try-ons, AI-powered size recommendations, and easy-return policies, consumers continue to pivot toward e-commerce. Plus, sales online are being turbo-charged by discounts, subscription models and influencer-led marketing.” The increasing number of IoT-enabled wearables and smart textiles have also contributed in a positive way to the rising demand for launches of exclusive products online. The quality of global logistics is improving and many companies offer same-day delivery options; hence, the online segment is projected to outpace that of offline retail in terms of growth rate during the forecast period.

By End Use

The mining segment dominated the smart clothing market with a 39% share in 2023 driven by the increasing need of ensuring the worker's safety, real-time health monitoring, and protecting the worker from hazardous environment. Wearable sensors, temperature-regulating fabrics and GPS-enabled garments are some of the types of smart clothing used to keep track of workplace accidents by monitoring workers' location and vital signs in the field or underground. Increasing implementation of regulatory mandates for occupational safety along with the high adoption of IoT-integrated protective gear are positively impacting the growth of this market. To facilitate widespread procurement, enterprises are investing in highly durable and washable smart textiles that withstand even the harshest mining environments. With advancements in AI-powered predictive maintenance and fatigue detection systems, the mining sector will continue driving demand for smart clothing.

The sports & fitness segment is the fastest-growing in the smart clothing market from 2024 to 2032, driven by increasing consumer demand for real-time health tracking, performance optimization, and personalized fitness insights. Smart apparel embedded with biometric sensors, AI-powered analytics, and IoT connectivity is gaining traction among athletes and fitness enthusiasts. Wearable innovations such as smart shirts with ECG monitoring, temperature-regulating fabrics, and posture-correcting apparel are revolutionizing sports training and injury prevention. The growing adoption of connected fitness ecosystems and rising awareness of health and wellness trends are further accelerating market expansion. Enhanced durability, wash ability, and seamless integration with mobile apps will continue fueling this segment's rapid growth.

Smart Clothing Market Regional Analysis

North America dominated the smart clothing market with a 40% revenue share in 2023, driven by high consumer adoption, strong technological advancements, and presence of leading market players. The region benefits from early adoption of wearable technology, rising demand for fitness and healthcare applications, and significant investments in AI and IoT-integrated apparel. The U.S. and Canada lead the market due to a tech-savvy population, increasing health awareness, and collaborations between tech firms and fashion brands. Additionally, military and industrial applications of smart textiles further contribute to growth. With continuous R&D investments, growing demand for connected wearables, and increasing sports and fitness trends, North America is expected to maintain its dominance over the forecast period.

Asia-Pacific is the fastest-growing region in the smart clothing market from 2024 to 2032, due to rapid technological advancements, increasing disposable income, and rising health awareness. There is a growing focus on the adoption of smart textiles in countries such as China, Japan, South Korea, and India, driven by the expanding fitness and sports industry, the rapid rate of urbanization, and government initiatives to promote innovation in wearable technology. Sol-gel technology has gained significant traction, driven by the low cost of technology and the presence of top electronics and textile manufacturers. The increasing demand for smart uniforms in military and industrial sectors along with the penetration of AI, IoT, and biometric tracking in the apparel is further propelling the adoption. As a result of growing consumer awareness, expanding e-commerce, and significant investments in research and development in smart clothing, Asia-Pacific is expected to register the highest growth in the smart clothing market during the forecast period.

Smart Clothing Market Key Players:

Some of the major players in Smart Clothing Market along with their product:

List of Key Suppliers Providing Raw Materials and Components for the Smart Clothing Market:

Raw Material Suppliers:

Component Suppliers:

Recent Development

10.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Smart Clothing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.2.4 North America Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.2.5 North America Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.2.6 North America Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.2.7.2 USA Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.2.7.3 USA Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.2.7.4 USA Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.2.8.2 Canada Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.2.8.3 Canada Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.2.8.4 Canada Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.2.9.2 Mexico Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.2.9.3 Mexico Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.2.9.4 Mexico Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Smart Clothing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.3.1.7.2 Poland Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.7.3 Poland Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.1.7.4 Poland Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.3.1.8.2 Romania Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.8.3 Romania Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.1.8.4 Romania Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.3.1.9.2 Hungary Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.3.1.10.2 Turkey Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Smart Clothing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.3.2.4 Western Europe Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.5 Western Europe Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.6 Western Europe Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.3.2.7.2 Germany Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.7.3 Germany Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.7.4 Germany Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.3.2.8.2 France Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.8.3 France Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.8.4 France Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.3.2.9.2 UK Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.9.3 UK Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.9.4 UK Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.3.2.10.2 Italy Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.10.3 Italy Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.10.4 Italy Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.3.2.11.2 Spain Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.11.3 Spain Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.11.4 Spain Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.3.2.14.2 Austria Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.14.3 Austria Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.14.4 Austria Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4 Asia-Pacific

11.4.1 Trends Analysis

11.4.2 Asia-Pacific Smart Clothing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia-Pacific Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.4.4 Asia-Pacific Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.5 Asia-Pacific Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.6 Asia-Pacific Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.4.7.2 China Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.7.3 China Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.7.4 China Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.4.8.2 India Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.8.3 India Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.8.4 India Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.4.9.2 Japan Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.9.3 Japan Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.9.4 Japan Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.4.10.2 South Korea Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.10.3 South Korea Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.10.4 South Korea Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.4.11.2 Vietnam Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.11.3 Vietnam Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.11.4 Vietnam Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.4.12.2 Singapore Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.12.3 Singapore Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.12.4 Singapore Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.4.13.2 Australia Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.13.3 Australia Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.13.4 Australia Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.14 Rest of Asia-Pacific

11.4.14.1 Rest of Asia-Pacific Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.4.14.2 Rest of Asia-Pacific Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia-Pacific Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia-Pacific Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Smart Clothing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.5.1.4 Middle East Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.5 Middle East Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.1.6 Middle East Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.5.1.7.2 UAE Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.7.3 UAE Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.1.7.4 UAE Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.5.1.8.2 Egypt Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.5.1.10.2 Qatar Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Smart Clothing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.5.2.4 Africa Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.2.5 Africa Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.2.6 Africa Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.5.2.7.2 South Africa Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Smart Clothing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.6.4 Latin America Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.6.5 Latin America Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.6.6 Latin America Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.6.7.2 Brazil Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.6.7.3 Brazil Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.6.7.4 Brazil Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.6.8.2 Argentina Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.6.8.3 Argentina Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.6.8.4 Argentina Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.6.9.2 Colombia Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.6.9.3 Colombia Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.6.9.4 Colombia Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Smart Clothing Market Estimates and Forecasts, by Textile Type(2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Smart Clothing Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Smart Clothing Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Smart Clothing Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

12. Company Profiles

12.1 AiQ Smart Clothing

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 DuPont

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Myontec

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Myzone

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Owlet

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Sensoria

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Siren

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 TORAY INDUSTRIES, INC.

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Vulpes Electronics GmbH

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Wearable X

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Textile Type

Active Smart

Passive Smart

Ultra Smart

By Product Type

Apparel

Footwear

Wearable Patches

Others

By Distribution Channel

Offline

Online

By End Use

Military & Defence

Sports & Fitness

Fashion & Entertainment

Healthcare

Mining

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Blockchain Devices Market Size was valued at USD 0.90 Billion in 2023 and is expected to grow at a CAGR of 38.44% to reach USD 16.81 Billion by 2032.

The 4K Technology Market Size was valued at USD 139.10 Billion in 2023 and is expected to grow at a CAGR of 19.5% to reach USD 689.15 Billion by 2032.

The Household Robots Market Size was valued at USD 10.15 Billion in 2023 and is expected to reach USD 48.85 Billion by 2032 and grow at a CAGR of 19.10% over the forecast period 2024-2032.

The Automotive Connector Market Size was valued at USD 7.67 Billion in 2023 and is expected to grow at a CAGR of 6.85% to Reach USD 13.92 Billion by 2032.

The Automotive Backup Camera Market was valued at USD 1.70 billion in 2023 and is expected to grow at a CAGR of 12.50% to reach USD 4.91 billion by 2032.

The Water-based Heating & Cooling Systems Market Size was valued at USD 37.10 Billion in 2023 and is expected to reach USD 73.53 Billion by 2032 and grow at a CAGR of 7.94% over the forecast period 2024-2032

Hi! Click one of our member below to chat on Phone