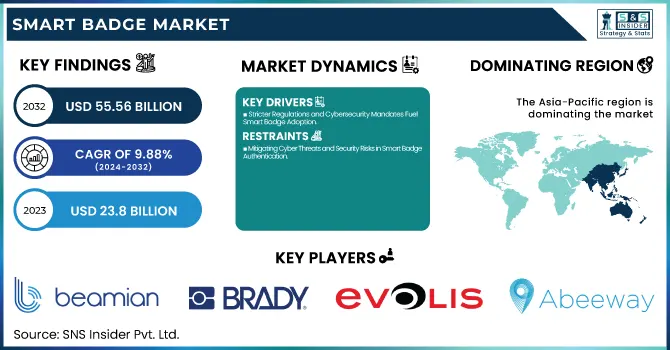

The Smart Badge Market was valued at USD 23.8 billion in 2023 and is projected to reach USD 55.56 billion by 2032, growing at a CAGR of 9.88% from 2024 to 2032. Market growth is driven by rising security concerns and increasing penetration of biometric devices in government and healthcare, along with growing demand for contactless authentication are some of the factors driving the market growth. IoT, AI-powered biometric authentication, and real-time tracking are also enhancing smart badge functionalities.

To Get more information on Smart Badge Market - Request Free Sample Report

More and more companies in the business world and retail sector are valuing these solutions for employee management, visitor monitoring, or access control while also ensuring security services. Demand is also being driven by strict regulatory compliance on identity verification and cybersecurity. In the U.S., the market valued at USD 4.31 billion in 2023 and is expected to reach USD 10.36 billion by 2032, growing at a CAGR of 10.23%. The shift toward secure, frictionless, and AI-integrated authentication solutions continues to drive consumer preference and market expansion.

Drivers:

Stricter Regulations and Cybersecurity Mandates Fuel Smart Badge Adoption

Regulatory compliance and cybersecurity mandates are getting stricter and are driving the adoption of smart badges across industries. Around the world, governments are instituting strict laws for identity verification processes, data protection, and cybersecurity to prevent unauthorized access and data leaks. GDPR compliance (Europe), CCPA (U.S.), and other global cybersecurity mandates need secure authentication mechanisms, including access control, encrypted authentication, and real-time tracking, all of which need smart badges. Healthcare, finance and defense are governed by stringent data security requirements that increase the demand for biometric-enabled and encrypted smart badges. The rise in cyber threats, identity fraud, and workplace security concerns has also pushed many businesses to adopt multi-factor authentication (MFA) and blockchain-based security features. In order to determine if this is indeed the case, organizations are investing in AI-based authentication, tamper-proof designs, and cloud-based identity management solutions as compliance frameworks become increasingly rigorous. Interestingly, businesses that maintain robust compliance protocols experience 27% fewer data breaches, highlighting the importance of smart badges as a component of the contemporary security ecosystem.

Restraints:

Mitigating Cyber Threats and Security Risks in Smart Badge Authentication

Smart badges, while enhancing authentication and access control, are increasingly vulnerable to cyber threats, hacking, and identity theft, requiring stringent security measures. Attackers can exploit weak encryption, unpatched firmware, and RFID/NFC interception to duplicate credentials, gaining unauthorized access to sensitive systems. Phishing attacks, malware, and skimming techniques further heighten security risks, compromising personal and corporate data. Organizations must adopt multi-layered security approaches, including biometric authentication, end-to-end encryption, AI-driven anomaly detection, and blockchain-based verification, to prevent breaches. Additionally, frequent software updates, compliance with global regulations (GDPR, CCPA), and network security enhancements are crucial for safeguarding credentials. Companies implementing robust cybersecurity frameworks and multi-factor authentication (MFA) experience a significant reduction in data breaches and fraud incidents. As cybercriminal tactics evolve, businesses must prioritize proactive threat detection, real-time monitoring, and tamper-proof smart badge designs to ensure secure authentication, seamless access control, and data integrity across industries.

Opportunities:

Enhancing Smart Badge Security with Blockchain and Multi-Factor Authentication

The integration of blockchain security and MFA is revolutionizing the smart badge market, offering enhanced identity verification, fraud prevention, and data protection. Normal operation yield 98% authentication successes with 99% resilience scores and response times down to 150ms. Biometric authentication performance is fairly worse as they take little longer due to processing but OTP authentication in reach 95% success while hardware tokens have 97% success with high response time. The potential technological obstacles in industrial Iot deployments in networks, security concern such as network congestion with threatens, but solving industrial IoT challenges led to implementing load balancing and resource allocation and data compression for scalability support. While blockchain and MFA do introduce minor processing time and latency overhead, they significantly boost application security through cryptographic safeguards. AI-Driven Smart Badges Shape the Future of Secure Identity Management With increasing adoption rates in finance, healthcare, and defense.

Challenges:

Despite enhanced security, smart badges remain vulnerable to hacking, data breaches, and identity theft, requiring continuous updates and advanced encryption to mitigate these risks.

Cybercriminals exploit weaknesses in authentication mechanisms, data transmission, and storage systems, necessitating continuous security updates and advanced encryption protocols. Without robust cybersecurity measures, unauthorized access to sensitive data and systems can lead to severe financial and reputational damage. Organizations must implement end-to-end encryption, tamper-resistant hardware, and real-time threat monitoring to mitigate these risks. Compliance with global regulations like GDPR and CCPA further drives the need for secure authentication frameworks. As cyber threats evolve, integrating blockchain-based identity verification and AI-powered anomaly detection will be crucial in fortifying smart badge security. Businesses must prioritize regular security audits, software patching, and user education to minimize vulnerabilities. Ensuring a proactive cybersecurity approach will be essential in maintaining trust and reliability in smart badge deployments across critical industries such as healthcare, finance, and defense.

By Communication

The contact badges segment holds the largest share of the smart badge market, accounting for approximately 64% of the total revenue in 2023. Contact-based smart badges are widely used in several sectors, including government, healthcare, corporate, and events for secure identification, access control, and authentication, which is a factor driving its significant share. Contact badges, equipped with embedded microchips, enable data transmission through direct contact with a reader, making them a more consistent and secure form of communication among users. They are very popular in organizations with high security needs as they integrate well with existing infrastructure and are relatively easy to use. Contact badges are also often used for access control in sensitive areas such as government buildings, hospitals, and corporate offices. So, contact badges still hold a strong market share considering the reliability, cost-effectiveness, and compliance with the higher requirements of corporate security standards.

The contactless badges segment is the fastest-growing in the smart badge market from 2024 to 2032, owing to the increasing requirement for improved security and operational efficiency through access control systems. Contactless badges utilize technologies such as NFC (Near Field Communication) and RFID (Radio Frequency Identification) to seamlessly grant access without contact, providing users with a faster and more convenient experience. These badges find extensive application in places where having quick and secure access is a must like healthcare, corporate & conference facilities. Contactless Badges Offer Convenience in Authentication Organizations need to prioritize security, compliance and operational efficiency; via reducing wait times and providing a frictionless authentication process for users, a contactless badge is the perfect solution. Furthermore, the advancements of latest technologies including IoT, and cloud-based management possess the ability to contactless badges thus fuelling their rapid adoption across various sectors. This segment is expected to grow substantially as businesses increase their investment in smart access technology.

By Type

The Smart Badges without Display segment dominated the largest share of the revenue in the smart badge market, accounting for around 69% in 2023. These badges offer a compact, lightweight solution for secure identification and access control without the added complexity or cost of a display. Widely utilized across various sectors, they provide an efficient and cost-effective way to manage access, track attendance, and enforce security protocols. The simplicity of these badges, combined with their functionality, makes them highly attractive to organizations seeking reliable, easy-to-use security solutions without the need for advanced display features. As security demands continue to rise, smart badges without displays remain a popular choice for their practicality and ease of integration into existing systems.

The Smart Badges with Display segment is expected to grow the fastest over the forecast period from 2024 to 2032. These badges combine enhanced functionality with real-time information display, providing users with more interactive features. With integrated displays, they enable features such as dynamic content updates, identification, notifications, and alerts, making them ideal for high-security environments, visitor management, and real-time employee communication. The growing demand for personalized, versatile solutions across industries like healthcare, finance, and hospitality is driving this growth. Their ability to improve user engagement, streamline workflows, and enhance security protocols makes them an attractive option for organizations looking for next-generation identification solutions. As technology advances, the segment's growth is also fueled by improvements in display technology, battery life, and integration with IoT systems, further boosting their appeal in various sectors.

By Application

The Government and Healthcare segment dominated the largest share of revenue in the smart badges market, accounting for around 40% in 2023. This proliferation is attributed to the growing demand for robust access control, identity verification, and data protection in these highly regulated sectors. The application of smart badges in government facility is critical for secure access, employee tracking, and compliance with security standards. In healthcare, smart badges protect sensitive patient data, improve workflows, and monitor healthcare professionals’ access in sensitive areas. Although between Biometric features, RFID and NFC technology where smart badges can ensure the safety and effectiveness level, smart badges have become an absolute necessity for ensuring patient privacy and increased operational efficiency. The both sectors are stringent regulatory requirements, There is a constant demand for secure and reliable identification solutions. The ongoing need for secure, efficient, and compliant systems ensures the continued growth of this segment in the smart badge market.

The retail and hospitality sectors are experiencing the fastest growth in the smart badge market from 2024 to 2032, owing to the need for improved customer service, secure access and personalized experiences. Smart badges can be employed in retail to ensure optimized employee management, access control, customer engagement with real-time tracking and analytics. In hospitality, they enable guest room access, staff coordination and loyalty programs, enhancing efficiency and providing connected service. As the two industries are innovating customer experience and workforce productivity, smart badges are gained tremendous adoption. NFC and RFID systems enhance utilize contactless access, providing an extra layer of security in addition to improving the user experience of the technologies.

In 2023, the Asia-Pacific region held the largest share of revenue in the smart badges market, accounting for approximately 40%. This dominance can be attributed to the rapid digitalization and the growing demand for secure, efficient identification solutions across various industries in countries like China, Japan, India, and South Korea. The increasing adoption of smart badges in sectors such as healthcare, government, and corporate enterprises is a key driver of market growth. In healthcare, smart badges are used for secure access control to sensitive areas, while government organizations leverage them for secure identification and authentication. Additionally, the rise of smart cities, advancements in IoT, and greater focus on employee management in corporate environments have contributed to the region's dominance, positioning Asia-Pacific as a leader in the smart badge market.

The North American region is expected to be the fastest-growing in the smart badges market from 2024 to 2032. This growth is driven by several factors, including the increasing demand for secure access control, identity management, and digitalization across industries such as healthcare, government, corporate offices, and education. The region's strong emphasis on security and the need for efficient workforce management solutions are key drivers for smart badge adoption. In the healthcare sector, smart badges are utilized for patient data protection and employee access control, while government institutions are leveraging them for secure identity verification. Furthermore, the rise of cloud-based identity management systems, along with continuous advancements in biometric technology, is contributing to market expansion. As organizations focus on enhancing security protocols and operational efficiency, the adoption of smart badge solutions in North America is expected to grow significantly during this period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the Major Players in Smart Badge Market along with their product:

Beamian (Portugal): Smart badge solutions, visitor management systems, event and conference technology.

Brady Worldwide, Inc. (United States): Identification products, smart badges, industrial labeling, RFID solutions.

Evolis (France): Card printers, smart card solutions, badge customization, card management systems.

Abeeway (France): Geolocation and IoT solutions, smart badges, RFID and sensor solutions for asset tracking.

Aioi-Systems Co., Ltd. (Japan): RFID solutions, smart badges, wireless communication systems.

ASSA ABLOY (Sweden): Access control systems, smart locks, electronic access solutions, smart badges.

CardLogix Corporation (United States): Smart card solutions, secure credentialing, biometric authentication systems.

Cisco (United States): Networking solutions, identity management, smart badge solutions for secure access.

Dorma+Kaba Holdings AG (Switzerland): Electronic locks, access control systems, biometric solutions, smart badges.

Sber (Russia): Digital identification systems, smart card solutions, secure access technologies.

Zebra Technologies Corporation (United States): Barcode printers, RFID solutions, asset tracking, smart badge systems.

Global Net Solutions (GNS) (United States): Smart badge systems, access control solutions, RFID tracking.

BEAM (United States): Smart badge solutions for event management and networking.

Blendology (United States): Smart badges for networking and event management, event tracking solutions.

IDEMIA (France): Biometric authentication, smart cards, digital ID solutions, smart badges.

Giesecke+Devrient GmbH (Germany): Secure smart card solutions, mobile security, digital identity solutions, smart badges.

Brady Worldwide, Inc. (United States): Industrial labeling systems, smart badge solutions, RFID products, identification products.

Hierstar Corp (South Korea): RFID solutions, smart badge technology, asset tracking.

List of suppliers providing raw materials and components for the smart badges market:

3M (United States)

NXP Semiconductors (Netherlands)

Broadcom Inc. (United States)

STMicroelectronics (Switzerland)

Infineon Technologies (Germany)

Murata Manufacturing (Japan)

Texas Instruments (United States)

Smartrac (Germany)

Avery Dennison (United States)

Zebra Technologies (United States)

IDEMIA (France)

Giesecke+Devrient (Germany)

Tego (United States)

CardLogix Corporation (United States)

On October 2, 2024, Smart #1 and Smart #3 earned five-star ANCAP safety ratings, marking the first in 16 years for the Smart brand. The vehicles, assessed under 2023-2025 criteria, demonstrated strong occupant protection, though a poor result was noted in the oblique pole test due to occupant-to-occupant contact.

On August 28, 2024, Smart unveiled the #5, its largest model ever, aiming to compete with the Tesla Model Y. The electric crossover will debut in China and Europe in 2025, featuring rear- and all-wheel drive versions, including a 638 hp Brabus model.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 23.8 Billion |

| Market Size by 2032 | USD 55.56 Billion |

| CAGR | CAGR of 9.88% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Communication (Contact Badges, Contactless Badges) • By Type (Smart Badges with Display, Smart Badges without Display) • By Application (Government and Healthcare, Corporate, Event and Entertainment, Retail and Hospitality, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Beamian (Portugal), Brady Worldwide, Inc. (United States), Evolis (France), Abeeway (France), Aioi-Systems Co., Ltd. (Japan), ASSA ABLOY (Sweden), CardLogix Corporation (United States), Cisco (United States), Dorma+Kaba Holdings AG (Switzerland), Sber (Russia), Zebra Technologies Corporation (United States), Global Net Solutions (GNS) (United States), BEAM (United States), Blendology (United States), IDEMIA (France), Giesecke+Devrient GmbH (Germany), Brady Worldwide, Inc. (United States), and Hierstar Corp (South Korea) provide smart badge solutions, access control, and RFID technologies. |

Ans: The Smart Badge Market is expected to grow at a CAGR of 9.88% during 2024-2032.

Ans: The Smart Badge Market was USD 23.8 Billion in 2023 and is expected to Reach USD 55.56 Billion by 2032.

Ans: The key drivers of the Smart Badge Market include rising security concerns, increasing adoption in government and healthcare, growing demand for contactless solutions, and advancements in IoT and wireless technology.

Ans: The “Contact Badges” segment dominated the Smart Badge Market.

Ans: Asia-Pacific dominated the Smart Badge Market in 2023

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rate

5.2 Authentication Success Rate

5.3 Security Breach Reduction

5.4 Compliance Rate

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Smart Badge Market Segmentation, by Communication

7.1 Chapter Overview

7.2 Contact Badges

7.2.1 Contact Badges Market Trends Analysis (2020-2032)

7.2.2 Contact Badges Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Contactless Badges

7.3.1 Contactless Badges Market Trends Analysis (2020-2032)

7.3.2 Contactless Badges Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Smart Badge Market Segmentation, by Type

8.1 Chapter Overview

8.2 Smart Badges with Display

8.2.1 Smart Badges with Display Market Trends Analysis (2020-2032)

8.2.2 Smart Badges with Display Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Smart Badges without Display

8.3.1 Smart Badges without Display Market Trends Analysis (2020-2032)

8.3.2 Smart Badges without Display Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Smart Badge Market Segmentation, by Application

9.1 Chapter Overview

9.2 Government and Healthcare

9.2.1 Government and Healthcare Market Trends Analysis (2020-2032)

9.2.2 Government and Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Corporate

9.3.1 Corporate Market Trends Analysis (2020-2032)

9.3.2 Corporate Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Event and Entertainment

9.4.1 Event and Entertainment Market Trends Analysis (2020-2032)

9.4.2 Event and Entertainment Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Retail and Hospitality

9.5.1 Retail and Hospitality Market Trends Analysis (2020-2032)

9.5.2 Retail and Hospitality Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Others

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Smart Badge Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.2.4 North America Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.5 North America Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.2.6.2 USA Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.6.3 USA Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.2.7.2 Canada Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.7.3 Canada Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.2.8.2 Mexico Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.8.3 Mexico Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Smart Badge Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.3.1.6.2 Poland Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.6.3 Poland Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.3.1.7.2 Romania Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.7.3 Romania Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Smart Badge Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.3.2.4 Western Europe Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.5 Western Europe Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.3.2.6.2 Germany Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.6.3 Germany Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.3.2.7.2 France Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.7.3 France Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.3.2.8.2 UK Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.8.3 UK Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.3.2.9.2 Italy Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.9.3 Italy Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.3.2.10.2 Spain Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.10.3 Spain Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.3.2.13.2 Austria Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.13.3 Austria Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Smart Badge Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.4.6.2 China Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.6.3 China Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.4.7.2 India Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.7.3 India Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.4.8.2 Japan Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.8.3 Japan Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.4.9.2 South Korea Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.9.3 South Korea Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.4.10.2 Vietnam Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.10.3 Vietnam Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.4.11.2 Singapore Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.11.3 Singapore Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.4.12.2 Australia Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.12.3 Australia Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Smart Badge Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.5.1.4 Middle East Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.5 Middle East Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.5.1.6.2 UAE Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.6.3 UAE Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Smart Badge Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.5.2.4 Africa Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.5 Africa Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Smart Badge Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.6.4 Latin America Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.5 Latin America Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.6.6.2 Brazil Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.6.3 Brazil Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.6.7.2 Argentina Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.7.3 Argentina Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.6.8.2 Colombia Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.8.3 Colombia Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Smart Badge Market Estimates and Forecasts, by Communication (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Smart Badge Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Smart Badge Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 Beamian

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Brady Worldwide, Inc.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Evolis

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Abeeway

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Aioi-Systems Co., Ltd.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 ASSA ABLOY

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 CardLogix Corporation

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Cisco

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Dorma+Kaba Holdings AG

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Sber

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Communication

Contact Badges

Contactless Badges

By Type

Smart Badges with Display

Smart Badges without Display

By Application

Government and Healthcare

Corporate

Event and Entertainment

Retail and Hospitality

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The 3D Projector Market was valued at USD 3.8 Billion in 2023 and is expected to reach USD 7.6 Billion by 2032, growing at a CAGR of 7.88%% from 2024-2032.

The Collision Avoidance Sensors Market Size was valued at USD 5.65 billion in 2023 and is expected to grow at 13.61% CAGR to reach USD 17.8 billion by 2032.

The Remote Sensing Technology Market size was valued at USD 19.45 billion in 2023 and is expected to grow at 11.32% CAGR to grow to USD 51.04 billion by 2032.

The Smart Lighting Market Size was valued at USD 11.95 billion in 2023, and is expected to reach USD 40.09 billion by 2032, and grow at a CAGR of 14.44% over the forecast period 2024-2032.

The Behavioral Biometrics Market Size was valued at USD 1.66 Billion in 2023 and is expected to grow at 26.77% CAGR to reach USD 14.00 Billion by 2032.

The Telecom Power System Market Size was valued at USD 3.95 Billion in 2023 and is expected to reach USD 9.60 Billion by 2032 and grow at a CAGR of 10.4% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone