Get More Information on Smart and Connected Office Market- Request Sample Report

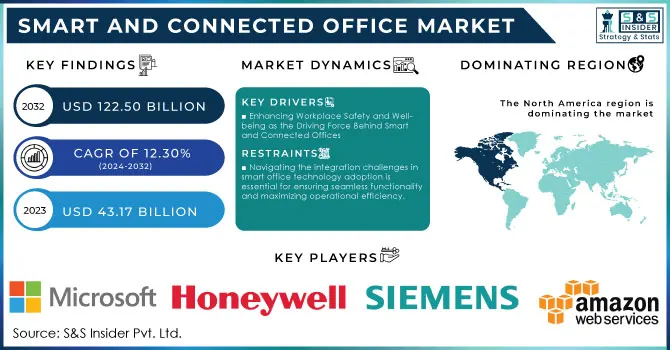

The Smart and Connected Office Market Size was valued at USD 43.17 Billion in 2023 and is expected to grow to USD 122.50 Billion by 2032 and grow at a CAGR of 12.30% over the forecast period of 2024-2032.

The Smart and Connected Office market is experiencing significant transformation, primarily fueled by the increasing adoption of automation technologies that improve workplace efficiency and lower operational expenses. Businesses are now investing in smart devices and IoT solutions, facilitating automated control over essential functions like lighting, climate, and security. This transition not only optimizes energy usage but also fosters comfortable working environments, resulting in substantial improvements in workflow efficiency. For instance, recent reports suggest that intelligent lighting systems can cut energy consumption by as much as 30%, while smart thermostats can provide savings of approximately 10-12% on heating and cooling costs. Furthermore, the integration of cutting-edge technologies such as artificial intelligence and machine learning is reshaping the operational framework of organizations. Industry insights indicate a growing trend, with an estimated 80% of companies expected to adopt automation technologies by 2025, significantly boosting the demand for smart office systems. Additionally, research highlights that smart office implementations lead to enhanced employee satisfaction, which in turn increases productivity. A notable study reveals that organizations employing smart technologies can see employee engagement rise by up to 20%. However, the significance of cybersecurity within this interconnected framework cannot be overlooked. Experts at recent industry events have underscored the need for robust security measures to protect sensitive data and ensure the seamless operation of automated systems. As the Smart and Connected Office market continues to evolve, it paves the way for innovative solutions that enhance efficiency, sustainability, and adaptability in response to the needs of modern workplaces.

The emergence of smart cities presents a promising opportunity, particularly through the integration of the Internet of Things (IoT) in sectors such as energy, waste management, and infrastructure. A crucial component of smart cities is the smart home, which offers numerous advantages. Numerous smart city projects and initiatives are anticipated to be completed by 2025, with projections suggesting the establishment of around 30 global smart cities—half of which are expected to be located in North America and Europe. According to the OECD, these developments are bolstered by substantial global investments, estimated at USD 1.8 trillion from 2010 to 2030, targeting urban infrastructure projects. This investment in digitized infrastructure is anticipated to increase the demand for securing these assets. Moreover, the rising global internet penetration is driving the construction of modern infrastructure at business locations, enhancing luxury and convenience, which in turn fuels market growth. As reported by Data Reportal, over five billion people were using the internet as of April 2022, accounting for 63.1% of the world's population. With an increasing number of companies adopting a smart hybrid working model, the demand for smart workplaces is on the rise. These organizations are focused on integrating physical and virtual spaces, people, and technology to achieve improved and faster outcomes. One pressing concern emerging is monitoring indoor air quality. AI-driven occupancy sensors and beacons collect data on workplace occupancy and the usage of different spaces throughout the day. Connected to the main system, this technology optimizes workspace and energy usage, thereby lowering CO2 levels and emissions. by utilizing smart air purifiers, companies are mitigating the risk of airborne viruses while enhancing worker safety and meeting their sustainability objectives.

Drivers

Enhancing Workplace Safety and Well-being as the Driving Force Behind Smart and Connected Offices

The focus on health and safety in workplaces has emerged as a critical driver for the Smart and Connected Office market, particularly due to recent global health challenges. Organizations are increasingly implementing smart health solutions and monitoring systems for indoor air quality, which have become essential for ensuring employee safety. For instance, smart scales are now offering multiple metrics for measuring health, enhancing workplace wellness programs and encouraging healthy habits among employees. Research shows that about 70% of employees prefer workplaces that prioritize health and well-being, emphasizing the need for smart technologies that enable real-time data collection on various health metrics. According to an article from Forbes, major companies are actively addressing mental health in the workplace, with 73% of employees indicating that mental health support influences their workplace satisfaction. In terms of safety, connected technologies are transforming traditional safety protocols. A report from Gartner indicates that 62% of organizations are now focusing on smart safety solutions, which significantly reduce workplace incidents. Moreover, a Digital Journal study highlights that the integration of smart monitoring systems can lead to a 25% reduction in workplace accidents by effectively managing occupancy and ensuring social distancing. The emphasis on health equity and access is also gaining traction, as indicated by new research from the University of Kansas, which aims to improve health outcomes for underserved communities. This aligns with Cisco's report stating that smart workplaces can enhance employee health, safety, and well-being, leading to 20% higher productivity levels and improving key business performance indicators. With the rise of IoT-enabled devices, employers can monitor space usage and adjust environments accordingly, which is crucial for maintaining a safe working atmosphere. Smart air purifiers are becoming common, as they help reduce airborne viruses while promoting sustainability goals. In summary, the health and safety focus within the Smart and Connected Office market not only mitigates health risks but also significantly contributes to employee satisfaction and productivity.

Restraints

Navigating the integration challenges in smart office technology adoption is essential for ensuring seamless functionality and maximizing operational efficiency.

The complexity of integrating smart technologies within office environments remains a significant restraint in the Smart and Connected Office market. As organizations seek to implement Internet of Things (IoT) solutions for office automation, they encounter various challenges that complicate integration efforts. According to industry reports, many businesses are hindered by the disparate nature of smart devices and platforms, which can lead to compatibility issues. For instance, a study by Siemens indicates that nearly 60% of companies struggle with interoperability among their existing systems and new IoT devices, creating delays in project timelines and increasing operational disruptions. Furthermore, the lack of standardized protocols across different manufacturers exacerbates these integration difficulties. As highlighted in a Forbes article, this fragmentation means that organizations often need to invest additional resources in custom solutions to ensure that all devices work seamlessly together, driving up costs and complicating the deployment process. In fact, a survey by Business Tech Weekly noted that over 50% of IT managers cite integration complexities as a primary barrier to adopting smart office solutions, which can stall digital transformation initiatives. The skills gap in the workforce pose another challenge. Many companies find it difficult to recruit personnel with the necessary expertise to manage and integrate sophisticated smart technologies effectively. As a result, organizations may need to invest in extensive training programs or consult external experts, adding another layer of complexity and cost. Addressing these integration challenges is essential for unlocking the full potential of smart offices, as streamlined systems can lead to enhanced operational efficiency and improved employee experiences. Companies must prioritize overcoming these barriers to realize the benefits of smart technologies fully, ultimately fostering more connected, efficient, and sustainable work environments.

by Type

In the Smart and Connected Office market, the hardware segment has established itself as a key player, accounting for approximately 46% of total revenue in 2023. This prominence is largely due to the critical role hardware plays in developing intelligent workplace environments. Essential components such as sensors, cameras, actuators, and control systems form the backbone of smart office systems, enabling real-time data collection and management to optimize energy use, occupancy, and environmental conditions. Companies like Honeywell and Siemens offer comprehensive hardware solutions that integrate seamlessly into existing infrastructures, enhancing operational efficiency. The rise of advanced hardware solutions, including IoT sensors and smart lighting systems, further automates critical office functions, exemplified by Philips Hue’s lighting products that adjust according to occupancy and natural light, resulting in energy savings and improved comfort. The demand for automation technologies has surged as businesses seek operational efficiency, with companies like Cisco and Crestron leading the development of sophisticated hardware systems for seamless software integration. Additionally, heightened workplace safety concerns have driven investments in surveillance cameras and environmental monitoring devices, with firms like Axis Communications specializing in security solutions. Looking forward, the hardware segment is expected to grow as smart office technologies advance, bolstered by innovations in AI and connectivity. Companies like Lenovo and Dell Technologies are expanding their offerings to meet the evolving demands of smart workplaces. Overall, the hardware segment’s significant market share underscores its essential role in facilitating automation, enhancing functionality, and ensuring workplace safety.

by Office Type

The retrofit segment in the Smart and Connected Office market has become a leading player, capturing approximately 56% of total revenue in 2023. This remarkable share highlights the growing importance of retrofitting existing office spaces with advanced smart technologies. Retrofitting enables organizations to enhance their current infrastructure without undergoing complete renovations, making it a cost-effective solution for modernizing work environments while minimizing disruption. Companies are increasingly recognizing the value of transforming older buildings into efficient smart spaces. For example, Schneider Electric’s EcoStruxure™ Smart Building platform facilitates the integration of smart technology with minimal structural changes. The economic advantages of retrofit solutions are significant, allowing businesses to utilize existing layouts and systems, thus lowering costs associated with new constructions. Honeywell’s Building Management Solutions provide retrofit options that enhance energy efficiency without the need for extensive overhauls. Moreover, as regulatory pressures mount, retrofitting aligns with sustainability goals, helping companies meet environmental compliance while appealing to eco-conscious employees. Johnson Controls’ OpenBlue platform focuses on improving sustainability through advanced energy management systems in retrofitted buildings. The rising demand for smart features, such as occupancy sensors and automated lighting, further propels this segment, with Philips’ Hue Lighting systems exemplifying how easy integration can enhance workplace environments. Looking ahead, the retrofit segment is poised for continued growth, supported by innovations from companies like Cisco that enhance communication and collaboration in smart offices. by capitalizing on these trends, organizations can improve functionality, reduce costs, and promote sustainability in their workspaces.

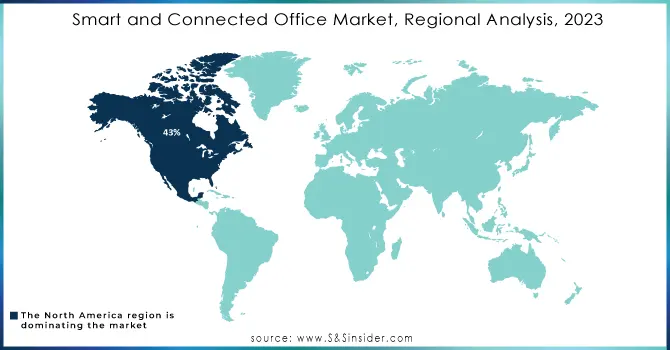

In 2023, North America emerged as the dominant region in the Smart and Connected Office market, accounting for approximately 43% of the total revenue. This leadership position is driven by several critical factors that highlight the region’s dedication to adopting advanced technologies in workplace environments. North America stands out as a hub of technological innovation, supported by a strong ecosystem of tech companies like Cisco, Honeywell, and Microsoft, which continuously invest in research and development to deliver cutting-edge smart office solutions. For instance, Cisco has launched its Webex Suite, incorporating advanced collaboration tools with IoT capabilities to enhance productivity in hybrid work settings. Additionally, there is a rising demand for automated solutions that improve operational efficiency while reducing energy consumption. Organizations increasingly recognize the importance of sustainability, aligning their smart office technologies such as advanced lighting systems and occupancy sensors with corporate social responsibility goals. Companies like Siemens and Schneider Electric have introduced platforms like Desigo CC and EcoStruxure to enhance energy management in office buildings. Significant corporate investments are also evident, with tech giants like Google and Amazon implementing smart technologies in their workplaces to boost employee experience and collaboration. The regulatory landscape further supports this growth, with local governments promoting energy-efficient technologies and smart infrastructure, such as California's energy efficiency regulations that encourage office upgrades. On a country-specific level, the U.S. federal government aims to reduce energy consumption in federal buildings by 20% by 2024, while Canada sees growth driven by initiatives like Deloitte’s Smart Office Experience program. Looking ahead, advancements in IoT, AI, and machine learning promise to drive continued growth in the region, solidifying North America’s leadership in the global Smart and Connected Office market.

In 2023, the Asia-Pacific region emerged as the fastest-growing market for Smart and Connected Offices, driven by rapid urbanization, technological advancements, and a strong emphasis on creating efficient work environments. Countries like China and India are leading this shift, with organizations such as Tata Consultancy Services (TCS) investing heavily in modernizing office spaces to enhance employee productivity. The region is experiencing significant innovations in Internet of Things (IoT) and artificial intelligence (AI), with companies like Alibaba and Tencent developing integrated smart office platforms that utilize cloud computing and data analytics to boost efficiency. Sustainability is also a key focus, as governments in Japan and South Korea implement policies promoting energy-efficient technologies in offices, while initiatives like Singapore's Smart Nation encourage the adoption of smart solutions across various sectors. Rising corporate investments are evident, with major firms like Samsung and Civica deploying advanced technologies to improve workspace functionality and employee engagement. Looking ahead, the Asia-Pacific region is poised for sustained growth in the Smart and Connected Office market, driven by the increasing adoption of hybrid work models and continuous advancements in smart technologies. Overall, this region's dynamic landscape, characterized by technological innovation, a commitment to sustainability, and substantial corporate investments, positions it well for ongoing evolution in the smart office arena.

Need Any Customization Research On Smart and connected office Market - Inquiry Now

Key Players

Some of the key players in Smart and connected office with product and offering:

Cisco Systems, Inc. (Cisco Webex for Collaboration)

Microsoft Corporation (Microsoft Teams for Communication)

Honeywell International Inc. (Honeywell Building Management Solutions)

Siemens AG (Siemens Desigo CC for Building Management)

Johnson Controls International plc (Metasys Building Automation System)

Schneider Electric (EcoStruxure for Smart Buildings)

Philips Lighting (Signify) (HUE Smart Lighting Solutions)

Amazon Web Services (AWS) (AWS IoT Core for Smart Office Solutions)

Google Cloud (Google Workspace for Collaboration)

Knoll Inc. (Knoll Office Furniture Solutions)

IBM Corporation (IBM Watson IoT for Smart Office)

LG Electronics (LG Smart Office Solutions)

Hewlett Packard Enterprise (HPE) (HPE IoT Solutions for Smart Buildings)

Toshiba Corporation (Toshiba Smart Office Solutions)

Crestron Electronics, Inc. (Crestron Room Control Systems)

Deloitte (Deloitte Smart Office Solutions)

Steelcase Inc. (Steelcase WorkSpace Solutions)

Atlassian Corporation Plc (Atlassian Jira for Project Management)

SAP SE (SAP Leonardo IoT for Smart Buildings)

Verizon Communications Inc. (Verizon Smart Building Solutions)

List of companies are integral to the development and implementation of smart office technologies and solutions.

Intel Corporation

Texas Instruments

NXP Semiconductors

Qualcomm Incorporated

Broadcom Inc.

STMicroelectronics

Honeywell International Inc.

Siemens AG

Philips Lighting (Signify)

Digi International

Zebra Technologies

Samsung Electronics

Bosch

Rockwell Automation

Cisco Systems, Inc.

Recent Development

In February 2024, Huawei Technologies Co., Ltd., one of the key companies in the technology industry, launched a new series of products, IdeaHub. The series' smart office portfolio includes IdeaPresence LED, IdeaHub ES2 Plus, IdeaHub ES2, IdeaHub 83, and others. Intelligent collaboration of communication technologies and advanced equipment capabilities is expected to enhance the company’s presence in the smart office industry.

July 19, 2024: Wipro Commercial & Institutional Business inaugurated a new IoT Experience Centre in Pune, showcasing advanced Internet of Lighting™ solutions and smart technologies for modern workplaces. The center features Wipro’s iSense, a wireless IoT solution enabling seamless control of lighting, TVs, and AC units.

February 27, 2024: Smart office tech is reshaping workplace dynamics, enhancing communication for hybrid teams and improving operational efficiency. Startups like Comfy, acquired by Siemens, are pioneering data-driven solutions such as "Flexible Spaces" to support the shift to hybrid work.

May 3, 2024: The City of Raleigh will host the Smart Cities Connect conference from May 7-10, bringing together experts to discuss sustainable urban transformations. The event aims to explore innovative frameworks and collaborative strategies for shaping the future of urban development.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 43.17 Billion |

| Market Size by 2032 | USD 122.50 Billion |

| CAGR | CAGR of 12.30 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hardware, Software, Services) • By Office Type (Retrofit, New Construction) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cisco Systems, Inc., Microsoft Corporation, Honeywell International Inc., Siemens AG, Johnson Controls International plc, Schneider Electric, Philips Lighting (Signify), Amazon Web Services (AWS), Google Cloud, Knoll Inc., IBM Corporation, LG Electronics, Hewlett Packard Enterprise (HPE), Toshiba Corporation, Crestron Electronics, Inc., Deloitte, Steelcase Inc., Atlassian Corporation Plc, SAP SE, and Verizon |

| Key Drivers | • Enhancing Workplace Safety and Well-being as the Driving Force Behind Smart and Connected Offices |

| RESTRAINTS | • Navigating the integration challenges in smart office technology adoption is essential for ensuring seamless functionality and maximizing operational efficiency. |

Ans: Growing need for energy-efficient smart office systems and sensor networks, increasing use of cloud-based technologies and IoT.

Ans: Smart and Connected Office Market size was valued at USD 43.17 Billion in 2023

Ans: Hardware Segment is Dominating in Smart and Connected Office Market.

Ans: North America is dominating the Smart and Connected Office Market.

Ans: Smart and Connected Office Market is anticipated to expand by 12.30% from 2024 to 2032.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Market Growth and Investment Trends, 2020-2032, by Region

5.2 Regulatory Compliance and Standards, by Region

5.3 Technology Adoption Trends, by Region

5.4 Consumer Preferences, by Region

6. Competitive Landscape

6.1 List of Major Companies, by Region

6.2 Market Share Analysis, by Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Smart and Connected Office Market Segmentation, by Type

7.1 Chapter Overview

7.2 Hardware

7.2.1 Hardware Market Trends Analysis (2020-2032)

7.2.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Hardware

7.2.3.1 Security Systems & Controls Market Trends Analysis (2020-2032)

7.2.3.2 Security Systems & Controls Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Smart Lighting & Controls

7.2.4.1 Smart Lighting & Controls Market Trends Analysis (2020-2032)

7.2.4.2 Smart Lighting & Controls Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Energy Management Systems

7.2.5.1Energy Management Systems Market Trends Analysis (2020-2032)

7.2.5.2 Energy Management Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6 HVAC Control Systems

7.2.6.1 HVAC Control Systems Market Trends Analysis (2020-2032)

7.2.6.2 HVAC Control Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2 Audio-Video Conferencing Systems

7.2.1 Audio-Video Conferencing Systems Market Trends Analysis (2020-2032)

7.2.2 Audio-Video Conferencing Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Software

7.3.1 Software Market Trends Analysis (2020-2032)

7.3.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Services

7.4.1 Services Market Trends Analysis (2020-2032)

7.4.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Smart and Connected Office Market Segmentation, by Office Type

8.1 Chapter Overview

8.2 Retrofit

8.2.1 Retrofit Market Trends Analysis (2020-2032)

8.2.2 Retrofit Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 New Construction

8.3.1 New Construction Market Trends Analysis (2020-2032)

8.3.2 New Construction Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Smart and Connected Office Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.4 North America Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.5.2 USA Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.6.2 Canada Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Smart and Connected Office Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Smart and Connected Office Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.6.2 France Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Smart and Connected Office Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 China Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 India Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 Japan Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.9.2 Australia Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Smart and Connected Office Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Smart and Connected Office Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.4 Africa Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Smart and Connected Office Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.4 Latin America Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Smart and Connected Office Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Smart and Connected Office Market Estimates and Forecasts, by Office Type (2020-2032) (USD Billion)

10. Company Profiles

10.1 Cisco Systems, Inc.

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Microsoft Corporation

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Honeywell International Inc.

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Siemens AG

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Johnson Controls International plc

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Schneider Electric

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Philips Lighting (Signify)

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Amazon Web Services (AWS)

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Google Cloud

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Knoll Inc.

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Hardware

Security Systems & Controls

Smart Lighting & Controls

Energy Management Systems

HVAC Control Systems

Audio-Video Conferencing Systems

Software

Services

By Office Type

Retrofit

New Construction

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The RFID Tags Market Size was valued at USD 12.42 Billion in 2023 and is expected to grow at a CAGR of 9.91% to reach USD 29.05 Billion by 2032.

The DNA Data Storage Market was valued at USD 55.25 million in 2023 and is expected to reach USD 13291.51 million by 2032, growing at a CAGR of 83.90% over the forecast period 2024-2032.

The Ion Milling System Market was valued at 2.22 Billion in 2023 and is projected to reach USD 4.78 Billion by 2032, growing at a CAGR of 8.90% from 2024 to 2032.

The Wireless Display Market Size was valued at USD 5.40 Billion in 2023 and is expected to grow at a CAGR of 11.0% to reach USD 13.73 Billion by 2032.

The Programmable Robots Market was valued at USD 3.44 billion in 2023 and is expected to reach USD 13.22 billion by 2032, growing at a CAGR of 16.16% over the forecast period 2024-2032.

The Virtual Sensors Market Size was valued at USD 1.8 Billion in 2023 and is expected to grow at a CAGR of 28.79% to reach USD 18.0 Billion by 2032.

Hi! Click one of our member below to chat on Phone