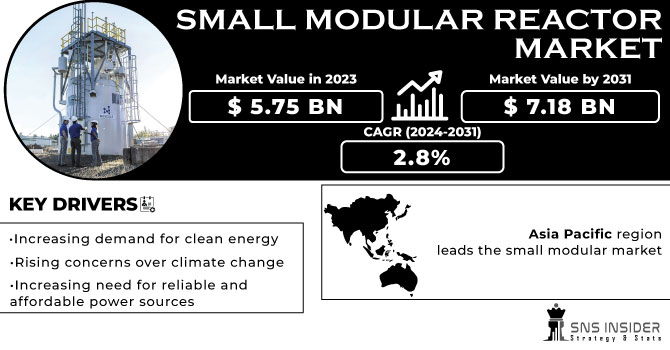

The Small Modular Reactor Market size was valued at USD 5.75 billion in 2023 and is expected to grow to USD 7.37 billion by 2032 and grow at a CAGR of 2.8% over the forecast period of 2024-2032.

The Small Modular Reactor (SMR) market is a rapidly growing industry that is gaining traction in the energy sector. SMRs are a type of nuclear reactor that is smaller in size and has a lower power output than traditional nuclear reactors. SMRs are typically less than 300 megawatts in capacity, which makes them easier to transport and install in remote locations. They are designed to be more flexible and cost-effective, making them an attractive option for countries and companies looking to diversify their energy portfolios. They use advanced technologies such as passive cooling systems and advanced fuel designs to reduce the risk of accidents and improve overall performance.

Get More Information on Small Modular Reactor Market - Request Sample Report

One of the main advantages of SMRs is their flexibility. They can be used to power small communities, remote industrial sites, or even military bases. They can also be used to supplement existing power grids during peak demand periods. One of the key advantages of SMRs is their ability to be deployed in remote locations, providing power to areas that may not have access to traditional energy sources. They are also designed to be safer and more secure than traditional nuclear reactors, with advanced safety features and built-in security measures. As the demand for clean energy continues to grow, the SMR market is poised to play a significant role in meeting this demand. With their smaller size, flexibility, and cost-effectiveness, SMRs offer a promising solution for countries and companies looking to transition to a more sustainable energy future. Despite their many advantages, SMRs are still a relatively new technology and there are some challenges that need to be addressed. These include regulatory hurdles, high upfront costs, and public perception issues. However, as the demand for clean, reliable energy continues to grow, SMRs are likely to play an increasingly important role in the global energy mix.

Drivers

Increasing demand for clean energy

Rising concerns over climate change

Increasing need for reliable and affordable power sources

The small modular reactor market is experiencing growth due to the increasing demand for reliable and affordable power sources. This trend is driven by the need for sustainable energy solutions that can meet the growing energy demands of modern society. As a result, the market for small modular reactors is expanding rapidly, with many companies investing in research and development to create innovative and efficient solutions. This growth is expected to continue in the coming years, as more countries and industries recognize the benefits of small modular reactors for meeting their energy needs.

Restrain

Regulatory hurdles associated with the small modular reactor market

High capital costs are required for the

Opportunities

Expansion of the small modular reactor market into new regions

Emergence of new applications for small modular reactors

The innovative applications are expanding the potential uses for small modular reactors beyond traditional power generation. As the demand for clean energy continues to grow, small modular reactors are becoming an increasingly attractive option due to their flexibility, scalability, and cost-effectiveness. These reactors can be used in a variety of settings, including remote locations, industrial processes, and even for desalination. Furthermore, the modular design of these reactors allows for easier construction and maintenance, making them a more practical option for many organizations. This, in turn, is driving the growth of the small modular market and creating new opportunities for businesses and investors alike.

Challenges

Competition from other energy sources

Need for greater investment in research and development

Lack of public awareness and acceptance

Many people are not familiar with the concept of small modular reactors and may not fully understand their benefits. As a result, there may be a reluctance to invest in or support this technology. This factor is expected to hinder the growth of this market in the future. To address this challenge, it is important to educate the public about the advantages of small modular reactors. These reactors are more flexible and cost-effective than traditional nuclear power plants, and they can be used in a variety of settings, including remote locations and areas with limited infrastructure. Additionally, small modular reactors are safer and more secure than older nuclear technologies, which can help to alleviate concerns about nuclear accidents and terrorism.

The modular reactor market has faced a significant challenge in the form of supply chain disruptions. The COVID-19 pandemic has caused a ripple effect, leading to delays in the transportation of goods and materials, ultimately resulting in project delays and increased costs for manufacturers. This has been a major setback for the industry, which has been striving to meet the growing demand for modular reactors. Moreover, the pandemic has also led to reduced demand for energy. With the decrease in economic activity, there has been a decline in energy consumption, which has affected the demand for modular reactors and other forms of energy. The economic slowdown during the pandemic has also resulted in decreased investment in the small modular reactor market. This has created a threat of slow growth for the industry in the future.

The Russian invasion of Ukraine affected various industries including the small modular reactor market. This market, which is focused on the development and deployment of small, modular nuclear reactors, has been affected by the political and economic instability in the region. The Russia-Ukraine war has led to a decrease in investment in the small modular reactor market, as investors are hesitant to invest in a market that is affected by political instability. Additionally, the conflict has led to a decrease in demand for small modular reactors in the region, as many countries are focused on other priorities, such as national security and economic stability.

Impact of Recession:

SMRs are a promising technology that offers a more flexible and cost-effective alternative to traditional nuclear power plants. However, the recession has slowed down the growth of this market, as many countries have cut back on their investments in nuclear energy. One of the main challenges facing the SMR market is the lack of funding. The recession has made it difficult for companies to secure the necessary capital to develop and commercialize their SMR technologies. This has resulted in delays in the deployment of SMRs, as well as a slowdown in research and development activities. Another factor that has affected the SMR market is the decline in demand for energy. The recession has led to a decrease in industrial activity and a reduction in consumer spending, which has resulted in lower demand for electricity. This has made it difficult for SMR companies to find customers for their products, as there is less demand for energy overall.

By Reactor Type

Heavy Water Reactor (HWR)

Light Water Reactor (LWR)

High-Temperature Reactor (HTR)

Molten Salt Reactor (MSR)

Fast Neutron Reactor (FNR)

By Coolant

Water

Gases

Molten Salt

Heavy liquid Metals

By Connectivity

Off-Grid

Grid-Connected

By Deployment

Single-Module Power Plant

Multi-Module Power Plant

By Location

Marine

Land

By Application

Desalination

Power Generation

Process Heat

Industrial

Hydrogen Production

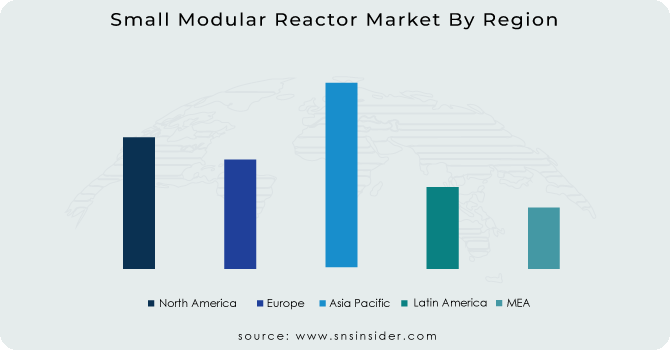

The Asia Pacific region leads the small modular market reactor and is expected to dominate the small modular reactor (SMR) owing to the region’s high demand for energy, and SMRs offer a reliable and cost-effective solution to meet this demand. Additionally, the region has a growing population and economy, which further increases the need for energy. Moreover, the Asia Pacific region has a strong focus on reducing carbon emissions and transitioning to clean energy sources. SMRs are a promising technology that can help achieve these goals, as they produce significantly less carbon emissions compared to traditional power plants. Furthermore, several countries in the region, such as China, South Korea, and Japan, have already invested heavily in SMR research and development. This has led to the creation of advanced SMR designs and technologies, giving the region a competitive advantage in the market.

Europe is projected to experience the highest CAGR during the forecast period in the small modular reactor market. Increasing demand for clean energy sources and the implementation of favorable government policies are the driving factors for the region’s growth. Additionally, the region's advanced technological infrastructure and skilled workforce provide a conducive environment for the development and deployment of small modular reactors. As a result, Europe is expected to remain a key player in the global small modular reactor market, driving innovation and growth in the industry.

Need any customization research on Small Modular Reactor Market - Enquiry Now

REGIONAL COVERAGE:

North America

USA

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

The Netherlands

Rest of Europe

Asia-Pacific

Japan

South Korea

China

India

Australia

Rest of Asia-Pacific

The Middle East & Africa

Israel

UAE

South Africa

Rest of the Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

The major players are NuScale Power LLC., GE Hitachi Nuclear Energy, Moltex Energy, X-energy, Rolls-Royce, Ultra-safe Nuclear, Westinghouse Electric Corporation, Terristrial Energy Inc., Toshiba Energy Systems and Solutions, General Atomics, and other players

In May of 2023, NuScale Power released new research that highlights the advanced capabilities of their small modular reactors (SMRs) in reducing emissions in industrial sectors. This is a crucial step in meeting global climate goals and demonstrates the potential for SMRs to revolutionize the energy industry.

In March of 2021, Moltex Energy received a substantial investment of $50.5 million from the Government of Canada’s Strategic Innovation Fund and Atlantic Canada Opportunities Agency. This funding helped in advancing their project to design and commercialize a molten salt reactor and spent fuel recycling facility, which has the potential to transform the nuclear energy industry.

In March of 2023, Rolls-Royce secured funding of $3.18 million from the UK Space Agency for the development of a modular nuclear reactor for the UK’s lunar mission. This exciting project demonstrates the versatility of nuclear energy and its potential to power space exploration.

| Report Attributes | Details |

| Market Size in 2023 | US$ 5.75 Bn |

| Market Size by 2032 | US$ 7.37 Bn |

| CAGR | CAGR of 2.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Reactor Type (Heavy Water Reactor (HWR), Light Water Reactor (LWR), High-Temperature Reactor (HTR), Molten Salt Reactor (MSR), and Fast Neutron Reactor (FNR)) • By Coolant (Water, Gases, Molten Salt, and Heavy liquid Metals) • By Connectivity (Off-Grid and Grid-Connected) • By Deployment (Single-Module Power Plant and Multi-Module Power Plant) • By Location (Marine and land) • By Application (Desalination, Power Generation, Process Heat, Industrial, and Hydrogen Production) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | NuScale Power LLC., GE Hitachi Nuclear Energy, Moltex Energy, X-energy, Rolls-Royce, Ultra-safe Nuclear, Westinghouse Electric Corporation, Terristrial Energy Inc., Toshiba Energy Systems and Solutions, General Atomics |

| Key Drivers | • Increasing demand for clean energy • Rising concerns over climate change |

| Market Opportunities | • Expansion of the small modular reactor market into new regions • Emergence of new applications for small modular reactors |

Ans: The market size of the Small Modular Reactor Market is valued at USD 5.75 billion in 2023.

Ans: The expected CAGR of the global Small Modular Reactor Market during the forecast period is 2.8%

Ans: The major key players in the Small Modular Reactor Market are NuScale Power LLC., GE Hitachi Nuclear Energy, Moltex Energy, X-energy, Rolls-Royce, Ultra-safe Nuclear, Westinghouse Electric Corporation, Terristrial Energy Inc., Toshiba Energy Systems and Solutions, and General Atomics.

Ans: Asia Pacific region contributes major to the Small Modular Reactor Market.

Ans: Small Modular Reactor Market is bifurcated into 6 major segments: 1. By Reactor Type 2. By Coolant 3. By Connectivity 4. By Deployment 5. By Location 6. By Application

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 COVID-19 Impact Analysis

4.2 Impact of Ukraine- Russia War

4.3 Impact of Ongoing Recession

4.3.1 Introduction

4.3.2 Impact on major economies

4.3.2.1 US

4.3.2.2 Canada

4.3.2.3 Germany

4.3.2.4 France

4.3.2.5 United Kingdom

4.3.2.6 China

4.3.2.7 Japan

4.3.2.8 South Korea

4.3.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Small Modular Reactor Market Segmentation, By Reactor Type

8.1 Heavy Water Reactor (HWR)

8.2 Light Water Reactor (LWR)

8.3 High-Temperature Reactor (HTR)

8.4 Molten Salt Reactor (MSR)

8.5 Fast Neutron Reactor (FNR)

9. Small Modular Reactor Market Segmentation, By Coolant

9.1 Water

9.2 Gases

9.3 Molten Salt

9.4 Heavy liquid Metals

10. Small Modular Reactor Market Segmentation, By Connectivity

10.1 Off-Grid

10.2 Grid-Connected

11. Small Modular Reactor Market Segmentation, By Deployment

11.1 Single-Module Power Plant

11.2 Multi-Module Power Plant

12. Small Modular Reactor Market Segmentation, By Location

12.1 Marine

12.2 Land

13. Small Modular Reactor Market Segmentation, By Application

13.1 Desalination

13.2 Power Generation

13.3 Process Heat

13.4 Industrial

13.5 Hydrogen Production

14. Regional Analysis

14.1 Introduction

14.2 North America

14.2.1 North America Small Modular Reactor Market by Country

14.2.2North America Small Modular Reactor Market by Reactor Type

14.2.3 North America Small Modular Reactor Market by Coolant

14.2.4 North America Small Modular Reactor Market by Connectivity

14.2.5 North America Small Modular Reactor Market by Deployment

14.2.6 North America Small Modular Reactor Market by Location

14.2.7 North America Small Modular Reactor Market by Application

14.2.8 USA

14.2.8.1 USA Small Modular Reactor Market by Reactor Type

14.2.8.2 USA Small Modular Reactor Market by Coolant

14.2.8.3 USA Small Modular Reactor Market by Connectivity

14.2.8.4 USA Small Modular Reactor Market by Deployment

14.2.8.5 USA Small Modular Reactor Market by Location

14.2.8.6 USA Small Modular Reactor Market by Application

14.2.9 Canada

14.2.9.1 Canada Small Modular Reactor Market by Reactor Type

14.2.9.2 Canada Small Modular Reactor Market by Coolant

14.2.9.3 Canada Small Modular Reactor Market by Connectivity

14.2.9.4 Canada Small Modular Reactor Market by Deployment

14.2.9.5 Canada Small Modular Reactor Market by Location

14.2.9.6 Canada Small Modular Reactor Market by Application

14.2.10 Mexico

14.2.10.1 Mexico Small Modular Reactor Market by Reactor Type

14.2.10.2 Mexico Small Modular Reactor Market by Coolant

14.2.10.3 Mexico Small Modular Reactor Market by Connectivity

14.2.10.4 Mexico Small Modular Reactor Market by Deployment

14.2.10.5 Mexico Small Modular Reactor Market by Location

14.2.10.6 Mexico Small Modular Reactor Market by Application

14.3 Europe

14.3.1 Europe Small Modular Reactor Market by Country

1.3.3.2 Europe Small Modular Reactor Market by Reactor Type

14.3.3 Europe Small Modular Reactor Market by Coolant

14.3.4 Europe Small Modular Reactor Market by Connectivity

14.3.5 Europe Small Modular Reactor Market by Deployment

14.3.6 Europe Small Modular Reactor Market by Location

14.3.7 Europe Small Modular Reactor Market by Application

14.3.8Germany

14.3.8.1 Germany Small Modular Reactor Market by Reactor Type

14.3.8.2 Germany Small Modular Reactor Market by Coolant

14.3.8.3 Germany Small Modular Reactor Market by Connectivity

14.3.8.4 Germany Small Modular Reactor Market by Deployment

14.3.8.5 Germany Small Modular Reactor Market by Location

14.3.8.6 Germany Small Modular Reactor Market by Application

14.3.9 UK

14.3.9.1 UK Small Modular Reactor Market by Reactor Type

14.3.9.2 UK Small Modular Reactor Market by Coolant

14.3.9.3 UK Small Modular Reactor Market by Connectivity

14.3.9.4 UK Small Modular Reactor Market by Deployment

14.3.9.5 UK Small Modular Reactor Market by Location

14.3.9.6 UK Small Modular Reactor Market by Application

14.3.10 France

14.3.10.1 France Small Modular Reactor Market by Reactor Type

14.3.10.2 France Small Modular Reactor Market by Coolant

14.3.10.3 France Small Modular Reactor Market by Connectivity

14.3.10.4 France Small Modular Reactor Market by Deployment

14.3.10.5 France Small Modular Reactor Market by Location

14.3.10.6 France Small Modular Reactor Market by Application

14.3.11 Italy

14.3.11.1 Italy Small Modular Reactor Market by Reactor Type

14.3.11.2 Italy Small Modular Reactor Market by Coolant

14.3.11.3 Italy Small Modular Reactor Market by Connectivity

14.3.11.4 Italy Small Modular Reactor Market by Deployment

14.3.11.5 Italy Small Modular Reactor Market by Location

14.3.11.6 Italy Small Modular Reactor Market by Application

14.3.12 Spain

14.3.12.1 Spain Small Modular Reactor Market by Reactor Type

14.3.12.2 Spain Small Modular Reactor Market by Coolant

14.3.12.3 Spain Small Modular Reactor Market by Connectivity

14.3.12.4 Spain Small Modular Reactor Market by Deployment

14.3.12.5 Spain Small Modular Reactor Market by Location

14.3.12.6 Spain Small Modular Reactor Market by Application

14.3.13 The Netherlands

14.3.13.1 Netherlands Small Modular Reactor Market by Reactor Type

14.3.13.2 Netherlands Small Modular Reactor Market by Coolant

14.3.13.3 Netherlands Small Modular Reactor Market by Connectivity

14.3.13.4 Netherlands Small Modular Reactor Market by Deployment

14.3.13.5 Netherlands Small Modular Reactor Market by Location

14.3.13.6 Netherlands Small Modular Reactor Market by Application

14.3.14 Rest of Europe

14.3.14.1 Rest of Europe Small Modular Reactor Market by Reactor Type

14.3. 14.2 Rest of Europe Small Modular Reactor Market by Coolant

14.3. 14.3 Rest of Europe Small Modular Reactor Market by Connectivity

14.3. 14.4 Rest of Europe Small Modular Reactor Market by Deployment

14.3. 14.5 Rest of Europe Small Modular Reactor Market by Location

14.3. 14.6 Rest of Europe Small Modular Reactor Market by Application

14.4 Asia-Pacific

14.4.1 Asia Pacific Small Modular Reactor Market by Country

14.4.2 Asia Pacific Small Modular Reactor Market by Reactor Type

14.4.3 Asia Pacific Small Modular Reactor Market by Coolant

14.4.4Asia Pacific Small Modular Reactor Market by Connectivity

14.4.5Asia Pacific Small Modular Reactor Market by Deployment

14.4.6 Asia Pacific Small Modular Reactor Market by Location

14.4.7 Asia Pacific Small Modular Reactor Market by Application

14.4.8 Japan

14.4.8.1 Japan Small Modular Reactor Market by Reactor Type

14.4.8.2 Japan Small Modular Reactor Market by Coolant

14.4.8.3 Japan Small Modular Reactor Market by Connectivity

14.4.8.4 Japan Small Modular Reactor Market by Deployment

14.4.8. 5 Japan Small Modular Reactor Market by Location

14.4.8. 6 Japan Small Modular Reactor Market by Application

14.4.9 South Korea

14.4.9.1 South Korea Small Modular Reactor Market by Reactor Type

14.4.9.2 South Korea Small Modular Reactor Market by Coolant

14.4.9.3 South Korea Small Modular Reactor Market by Connectivity

14.4.9.4 South Korea Small Modular Reactor Market by Deployment

14.4.9.5 South Korea Small Modular Reactor Market by Location

14.4.9.6 South Korea Small Modular Reactor Market by Application

14.4.10 China

14.4.10.1 China Small Modular Reactor Market by Reactor Type

14.4.10.2 China Small Modular Reactor Market by Coolant

14.4.10.3 China Small Modular Reactor Market by Connectivity

14.4.10.4 China Small Modular Reactor Market by Deployment

14.4.10.5 China Small Modular Reactor Market by Location

14.4.10.6 China Small Modular Reactor Market by Application

14.4.11 India

14.4.11.1 India Small Modular Reactor Market by Reactor Type

14.4.11.2 India Small Modular Reactor Market by Coolant

14.4.11.3 India Small Modular Reactor Market by Connectivity

14.4.11.4 India Small Modular Reactor Market by Deployment

14.4.11.5 India Small Modular Reactor Market by Location

14.4.11.6 India Small Modular Reactor Market by Application

14.4.12 Australia

14.4.12.1 Australia Small Modular Reactor Market by Reactor Type

14.4.12.2 Australia Small Modular Reactor Market by Coolant

14.4.12.3 Australia Small Modular Reactor Market by Connectivity

14.4.12.4 Australia Small Modular Reactor Market by Deployment

14.4.12.5 Australia Small Modular Reactor Market by Location

14.4.12.6 Australia Small Modular Reactor Market by Application

14.4.13 Rest of Asia-Pacific

14.4.13.1 APAC Small Modular Reactor Market by Reactor Type

14.4.13.2 APAC Small Modular Reactor Market by Coolant

14.4.13.3 APAC Small Modular Reactor Market by Connectivity

14.4.13.4 APAC Small Modular Reactor Market by Deployment

14.4.13.5 APAC Small Modular Reactor Market by Location

14.4.13.6 APAC Small Modular Reactor Market by Application

14.5 The Middle East & Africa

14.5.1 The Middle East & Africa Small Modular Reactor Market by Country

14.5.2 The Middle East & Africa Small Modular Reactor Market by Reactor Type

14.5.3 The Middle East & Africa Small Modular Reactor Market by Coolant

14.5.4 The Middle East & Africa Small Modular Reactor Market by Connectivity

14.5.5 The Middle East & Africa Small Modular Reactor Market by Deployment

14.5.6 The Middle East & Africa Small Modular Reactor Market by Location

14.5.7 The Middle East & Africa Small Modular Reactor Market by Application

14.5.8 Israel

14.5.8.1 Israel Small Modular Reactor Market by Reactor Type

14.5.8.2 Israel Small Modular Reactor Market by Coolant

14.5.8.3 Israel Small Modular Reactor Market by Connectivity

14.5.8.4 Israel Small Modular Reactor Market by Deployment

14.5.8.5 Israel Small Modular Reactor Market by Location

14.5.8.6 Israel Small Modular Reactor Market by Application

14.5.9 UAE

14.5.9.1 UAE Small Modular Reactor Market by Reactor Type

14.5.9.2 UAE Small Modular Reactor Market by Coolant

14.5.9.3 UAE Small Modular Reactor Market by Connectivity

14.5.9.4 UAE Small Modular Reactor Market by Deployment

14.5.9.5 UAE Small Modular Reactor Market by Location

14.5.9.6 UAE Small Modular Reactor Market by Application

14.5.10 South Africa

14.5.10.1 South Africa Small Modular Reactor Market by Reactor Type

14.5.10.2 South Africa Small Modular Reactor Market by Coolant

14.5.10.3 South Africa Small Modular Reactor Market by Connectivity

14.5.10.4 South Africa Small Modular Reactor Market by Deployment

14.5.10.5 South Africa Small Modular Reactor Market by Location

14.5.10.6 South Africa Small Modular Reactor Market by Application

14.5.11 Rest of Middle East & Africa

14.5.11.1 Rest of Middle East & Asia Small Modular Reactor Market by Reactor Type

14.5.11.2 Rest of Middle East & Asia Small Modular Reactor Market by Coolant

14.5.11.3 Rest of Middle East & Asia Small Modular Reactor Market Connectivity

14.5.11.4 Rest of Middle East & Asia Small Modular Reactor Market by Deployment

14.5.11.5 Rest of Middle East & Asia Small Modular Reactor Market by Location

14.5.11.6 Rest of Middle East & Asia Small Modular Reactor Market by Application

14.6 Latin America

14.6.1 Latin America Small Modular Reactor Market by Country

14.6.2 Latin America Small Modular Reactor Market by Reactor Type

14.6.3 Latin America Small Modular Reactor Market by Coolant

14.6.4 Latin America Small Modular Reactor Market by Connectivity

14.6.5 Latin America Small Modular Reactor Market by Deployment

14.6.6 Latin America Small Modular Reactor Market by Location

14.6.7 Latin America Small Modular Reactor Market by Application

14.6.8 Brazil

14.6.8.1 Brazil Small Modular Reactor Market by Reactor Type

14.6.8.2 Brazil Africa Small Modular Reactor Market by Coolant

14.6.8.3 Brazil Small Modular Reactor Market by Connectivity

14.6.8.4 Brazil Small Modular Reactor Market by Deployment

14.6.8.5 Brazil Small Modular Reactor Market by Location

14.6.8.6 Brazil Small Modular Reactor Market by Application

14.6.9 Argentina

14.6.9.1 Argentina Small Modular Reactor Market by Reactor Type

14.6.9.2 Argentina Small Modular Reactor Market by Coolant

14.6.9.3 Argentina Small Modular Reactor Market by Connectivity

14.6.9.4 Argentina Small Modular Reactor Market by Deployment

14.6.9.5 Argentina Small Modular Reactor Market by Location

14.6.9.6 Argentina Small Modular Reactor Market by Application

14.6.10 Rest of Latin America

14.6.10.1 Rest of Latin America Small Modular Reactor Market by Reactor Type

14.6.10.2 Rest of Latin America Small Modular Reactor Market by Coolant

14.6.10.3 Rest of Latin America Small Modular Reactor Market by Connectivity

14.6.10.4 Rest of Latin America Small Modular Reactor Market by Deployment

14.6.10.5 Rest of Latin America Small Modular Reactor Market by Location

14.6.10.6 Rest of Latin America Small Modular Reactor Market by Application

15. Company Profile

15.1 NuScale Power LLC.

15.1.1 Market Overview

15.1.2 Financials

15.1.3 Product/Services/Offerings

15.1.4 SWOT Analysis

15.1.5 The SNS View

15.2 GE Hitachi Nuclear Energy

15.2.1 Market Overview

15.2.2 Financials

15.2.3 Product/Services/Offerings

15.2.4 SWOT Analysis

15.2.5 The SNS View

15.3 Moltex Energy

15.3.1 Market Overview

15.3.2 Financials

15.3.3 Product/Services/Offerings

15.3.4 SWOT Analysis

15.3.5 The SNS View

15.4 X-energy

15.4.1 Market Overview

15.4.2 Financials

15.4.3 Product/Services/Offerings

15.4.4 SWOT Analysis

15.4.5 The SNS View

15.5 Rolls-Royce

15.5.1 Market Overview

15.5.2 Financials

15.5.3 Product/Services/Offerings

15.5.4 SWOT Analysis

15.5.5 The SNS View

15.6 Ultra-safe Nuclear

15.6.1 Market Overview

15.6.2 Financials

15.6.3 Product/Services/Offerings

15.6.4 SWOT Analysis

15.6.5 The SNS View

15.7 Westinghouse Electric Corporation

15.7.1 Market Overview

15.7.2 Financials

15.7.3 Product/Services/Offerings

15.7.4 SWOT Analysis

15.7.5 The SNS View

15.8 Terristrial Energy Inc

15.8.1 Market Overview

15.8.2 Financials

15.8.3 Product/Services/Offerings

15.8.4 SWOT Analysis

15.8.5 The SNS View

15.9 Toshiba Energy Systems and Solutions

15.9.1 Market Overview

15.9.2 Financials

15.9.3 Product/Services/Offerings

15.9.4 SWOT Analysis

15.9.5 The SNS View

15.10 General Atomics

15.10.1 Market Overview

15.10.2 Financials

15.10.3 Product/Services/Offerings

15.10.4 SWOT Analysis

15.10.5 The SNS View

16. Competitive Landscape

16.1 Competitive Benchmarking

16.2 Market Share Analysis

16.3 Recent Developments

17. USE Cases and Best Practices

18. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Axial Flow Pump Market size was valued at USD 29.5 billion in 2022 and is expected to grow to USD 41.95 billion by 2030 and grow at a CAGR of 4.5 % over the forecast period of 2023-2030.

The Lithium-Ion Batteries (Li-Ion) Market size was valued at USD 57.90 billion in 2023 and is expected to grow to USD 250.03 billion by 2032 and grow at a CAGR of 17.65% over the forecast period of 2024-2032.

The Distribution Transformer Market size was valued at USD 25.31 billion in 2023 and is expected to grow to USD 42.89 billion by 2032 and grow at a CAGR of 6.2% over the forecast period of 2024-2032.

The Power Distribution Component Market size was valued at USD 122.56 billion in 2023 and is expected to grow to USD 212.40 billion by 2032 with a growing CAGR of 6.3% over the forecast period of 2024-2032.

The Nuclear Power Plant Equipment Market size was valued at USD 15.96 billion in 2023 and is expected to grow to USD 21.35 billion by 2031 with a growing CAGR of 3.7 % over the forecast period of 2024-2031.

The LPG Tanker Market size was valued at USD 185.22 million in 2022 and is expected to grow to USD 282.10 million by 2030 with a growing CAGR of 5.4% over the forecast period of 2023-2030.

Hi! Click one of our member below to chat on Phone