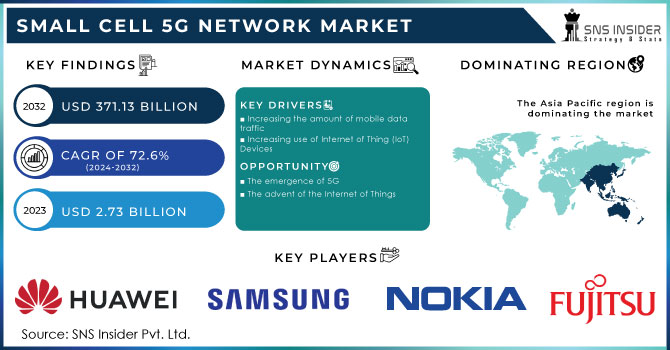

The Small Cell 5G Network Market was valued at USD 3.02 billion in 2023 and is expected to reach USD 176.78 billion by 2032, growing at a CAGR of 57.22% from 2024-2032. This report encompasses insights into emerging technologies adoption rates and investment trends, as well as funding opportunities fueling the growth in the market. It also encompasses cost structure analysis, which can be considered a detailed breakdown of expenditures up and down the value chain. Further, the report outlines bandwidth and capacity usage, focusing on the specifics about how increased demand for high-speed data drives the necessity for advanced small cell network solutions.

Get more information on Small Cell 5G Network Market - Request Sample Report

Increased demand for high-speed data drives the need for small cell 5G networks to enhance connectivity and performance.

Data-intensive applications for instance, high-definition video streaming, online gaming, as well as cloud computing, continue to surge. Consequently, network connections need to increase in terms of speed and reliability. As such, these applications require high bandwidth and low latency. Dense areas are characterized by the inability of traditional macro cell networks to provide such requirements. Small cells ensure the challenges are addressed as 5G network performance will improve, hence speeding up data transfer. The improvement of its network capacity and coverage allows the small cell to provide the much-needed infrastructure in the present trend of growing data demand, ensuring seamless connectivity to support the advance technological wave that has emerged in the IoT and smart city wave.

High initial deployment costs hinder the rapid expansion of small cell 5G networks due to significant infrastructure investments.

The deployment of small cell networks involves substantial upfront costs, including the purchase of hardware, installation, and preparation of physical sites. These expenses can be particularly challenging for network operators, especially when scaling across large geographic areas. Unlike traditional macro cells, which require fewer installation sites, small cells need to be densely deployed to ensure robust coverage, leading to higher operational and capital expenditures. Additionally, the cost of securing appropriate locations in urban or congested areas adds another layer of financial strain. This high initial investment may slow down the pace of small cell rollouts, potentially hindering the rapid adoption and expansion of 5G networks across various regions.

Small cell 5G networks enable the widespread deployment of IoT devices and support the development of smart city infrastructure.

The rapid growth in IoT devices with the demand in smart city infrastructures further creates an additional demand for fast and reliable connectivities in all densely populated environments. Small cells are very adequate for such environments as they augment coverage and offer more capacity and areas where traditionally macro cells fall short. In return, small cells deployment would enable network operators to offer dense connectivity that is required for IoT networks starting with traffic management systems and environmental sensors down to complete seamless communication across smart cities. The connection, in turn, enhances efficiency and functionality in other smart city projects, for example, smart lighting, waste management, and public safety. This would mean a significant opportunity for small cells to meet the ever-increasing data demands of these technologies in the 5G network market.

Securing suitable locations and navigating strict zoning regulations in urban areas slow down small cell 5G network deployments.

The main challenge to securing appropriate locations for small cell deployments is that space is usually limited in urban areas, and zoning regulations are strict. In most cases, these regulations demand detailed approvals and compliance with local laws, which may delay the installation process. Moreover, identifying locations that offer optimal coverage without interfering with existing infrastructure complicates site selection. Often, deployment timelines are delayed because operators must negotiate with property owners or local authorities. The process is long and expensive and may not support rapid scaling of 5G networks in the densest population areas to keep pace with ever-growing connectivity needs.

By Component

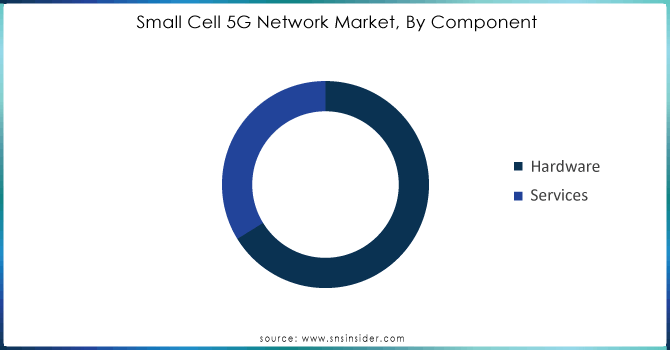

The Hardware segment dominated the Small Cell 5G Network Market in 2023, capturing about 75% of the revenue share due to the high demand for advanced small cell infrastructure, including radios, antennas, and other essential equipment. The Services segment is expected to grow at the fastest CAGR of 59.87% from 2024-2032, driven by the increasing need for installation, maintenance, and network optimization services to support small cell deployments and ensure optimal 5G performance.

By Network Model

The Non-Standalone segment dominated the Small Cell 5G Network Market in 2023, accounting for about 78% of the revenue share, as it leverages existing 4G infrastructure, making it more cost-effective and quicker to deploy. The Standalone segment is expected to grow at the fastest CAGR of 59.58% from 2024-2032, driven by the increasing adoption of fully independent 5G networks that offer improved performance, low latency, and scalability without reliance on 4G networks.

Need any customization reseaech on Small Cell 5G Network Market - Enquiry Now

By Application

The Indoor segment dominated the Small Cell 5G Network Market in 2023, with about 78% of the revenue share, due to the high demand for enhanced indoor coverage in areas like offices, malls, and stadiums. The Outdoor segment is expected to grow at the fastest CAGR of 60.83% from 2024-2032, driven by the increasing need for outdoor 5G coverage in urban spaces and high-traffic areas to support dense networks and high user volumes.

By End Use

The Commercial segment dominated the Small Cell 5G Network Market in 2023, with about 31.23% of the revenue share, due to the increasing demand for reliable and high-speed connectivity in business environments like offices, retail spaces, and commercial buildings. The Smart City segment is expected to grow at the fastest CAGR of 63.61% from 2024-2032, driven by the rising adoption of 5G to support smart infrastructure, IoT applications, and enhanced urban connectivity.

By Frequency Type

The Mid-band segment dominated the Small Cell 5G Network Market in 2023, capturing about 46% of the revenue share, due to its balanced performance in terms of coverage, speed, and capacity, making it ideal for urban and suburban deployments. The Millimeter Wave segment is expected to grow at the fastest CAGR of 60.20% from 2024-2032, driven by its ability to provide extremely high-speed data transfer and support dense network environments with low latency.

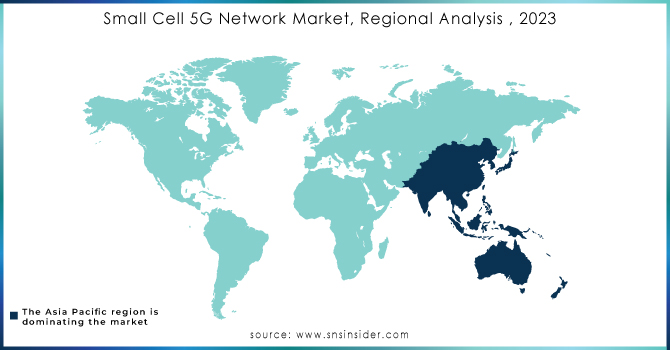

Asia Pacific held the highest market share in terms of revenue during 2023, at about 43%. It is a leader, spurred by fast urbanization, ever-growing mobile data traffic, and the adoption of early 5G deployment across China, South Korea, and Japan. High-speed, reliable connectivity demands have spurred small-cell deployments within this region to become smarter, more sustainable, and economically feasible, making it its strong position.

North America is poised to grow at the fastest CAGR of 60.57% from 2024 to 2032. The strong investment in 5G infrastructure is a primary reason, mainly in the U.S. This is due to the government's nationwide 5G deployment push and the support it provides for small cell technology. Also, the increasing demand for seamless connectivity in urban and suburban areas places North America at the top as a rapidly growing hub for small cell deployments.

Huawei Technologies Co., Ltd. (5G Small Cell, CloudRAN)

Samsung Electronics Co., Ltd. (5G Small Cell, Network Solutions)

Nokia Corporation (AirScale, 5G RAN Solutions)

Ericsson (5G Radio, Ericsson Radio System)

ZTE Corporation (5G Small Cell, ZTE 5G CPE)

Fujitsu Limited (5G Radio, Virtualized RAN)

CommScope Inc. (5G Small Cell, Small Cell Solutions)

Comba Telecom Systems Holdings Ltd. (5G Small Cell, Distributed Antenna Systems)

Altiostar (Open RAN, Virtualized Radio Access Network)

Airspan Networks (5G Small Cell, OpenRAN Solutions)

Ceragon (5G Small Cell, Wireless Backhaul Solutions)

Contela (5G Small Cell, Cloud RAN)

Corning (Small Cell Solutions, Optical Network Products)

Baicells Technologies (5G Small Cell, CPE Products)

Sterlite Technologies Limited (Fiber Optic Solutions, 5G Small Cell Products)

Cisco Systems, Inc. (Small Cell Gateway, 5G Mobile Core Solutions)

NEC Corporation (Small Cell, Cloud RAN Solutions)

Radisys Corporation (5G Small Cell, OpenRAN Solutions)

CommAgility (Small Cell Solutions, 5G RAN Software)

Qualcomm (5G Modem, Small Cell Chipsets)

Octasic (5G ASIC Solutions, Small Cell Processors)

PC-TEL (Antenna Solutions, Small Cell Solutions)

Microsemi (5G RF Front-End, Timing Solutions)

In September 2024, Ericsson unveiled its strategy for enterprise-driven 5G network adoption, introducing a portfolio that includes the Radio Dot System and small cell radios for both indoor and outdoor deployments, supporting 5G expansion across enterprise environments.

In February 2024, Ericsson's Mobility Report Business Review highlighted 5G business opportunities for Communication Service Providers (CSPs), focusing on the growing success of Fixed Wireless Access (FWA) and its role in expanding 5G connectivity for broadband services

In May 2023, Nokia and Chunghwa Telecom validated 25G PON technology for 5G fronthaul, demonstrating its capability to support the high capacity and low latency demands required for Small Cell 5G Networks

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.02 Billion |

| Market Size by 2032 | USD 176.78 Billion |

| CAGR | CAGR of 57.22% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Services) • By Network Model (Standalone, Non-standalone) • By Application (Indoor, Outdoor) • By Frequency Type (Low band, Mid band, Millimeter Wave) • By End Use (Residential, Commercial, Industrial, Smart City, Transportation & Logistics, Government & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., Nokia Corporation, Telefonaktiebolaget LM Ericsson, ZTE Corporation, Fujitsu Limited, CommScope Inc., Comba Telecom Systems Holdings Ltd., Altiostar, Airspan Networks, Ceragon, Contela, Corning, Baicells Technologies, Sterlite Technologies Limited, Cisco Systems, Inc., NEC Corporation, Radisys Corporation, CommAgility, Qualcomm, Octasic, PC-TEL, Microsemi. |

ANS: The Small Cell 5G Network Market was valued at USD 3.02 billion in 2023 and is expected to reach USD 176.78 billion by 2032, growing at a CAGR of 57.22% from 2024-2032.

ANS: The Hardware segment dominated, capturing about 75% of the revenue.

ANS: The Non-Standalone segment dominated with about 78% of the revenue.

ANS: The Indoor segment dominated with about 78% of the revenue.

ANS: Asia Pacific held about 43% of the market share.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Investment and Funding

5.3 Cost Structure Analysis

5.4 Bandwidth and Capacity Usage

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Small Cell 5G Network Market Segmentation, By Component

7.1 Chapter Overview

7.2 Hardware

7.2.1 Hardware Market Trends Analysis (2020-2032)

7.2.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Picocell

7.2.3.1 Picocell Market Trends Analysis (2020-2032)

7.2.3.2 Picocell Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Femtocell

7.2.4.1 Femtocell Market Trends Analysis (2020-2032)

7.2.4.2 Femtocell Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Microcell

7.2.5.1 Microcell Market Trends Analysis (2020-2032)

7.2.5.2 Microcell Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Services

7.3.1 Services Market Trends Analysis (2020-2032)

7.3.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Consulting

7.3.3.1 Consulting Market Trends Analysis (2020-2032)

7.3.3.2 Consulting Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Deployment & Integration

7.3.4.1 Deployment & Integration Market Trends Analysis (2020-2032)

7.3.4.2 Deployment & Integration Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.5 Training And Support & Maintenance

7.3.5.1 Training And Support & Maintenance Market Trends Analysis (2020-2032)

7.3.5.2 Training And Support & Maintenance Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Small Cell 5G Network Market Segmentation, By Application

8.1 Chapter Overview

8.2 Indoor

8.2.1 Indoor Market Trends Analysis (2020-2032)

8.2.2 Indoor Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3 Outdoor

8.3.1 Outdoor Market Trends Analysis (2020-2032)

8.3.2 Outdoor Market Size Estimates And Forecasts To 2032 (USD Billion)

9. Small Cell 5G Network Market Segmentation, By End Use

9.1 Chapter Overview

9.2 Residential

9.2.1 Residential Market Trends Analysis (2020-2032)

9.2.2 Residential Market Size Estimates And Forecasts To 2032 (USD Billion)

9.3 Commercial

9.3.1 Commercial Market Trends Analysis (2020-2032)

9.3.2 Commercial Market Size Estimates And Forecasts To 2032 (USD Billion)

9.4 Industrial

9.4.1 Industrial Market Trends Analysis (2020-2032)

9.4.2 Industrial Market Size Estimates And Forecasts To 2032 (USD Billion)

9.5 Smart City

9.5.1 Smart City Market Trends Analysis (2020-2032)

9.5.2 Smart City Market Size Estimates And Forecasts To 2032 (USD Billion)

9.6 Transportation & Logistics

9.6.1 Transportation & Logistics Market Trends Analysis (2020-2032)

9.6.2 Transportation & Logistics Market Size Estimates And Forecasts To 2032 (USD Billion)

9.7 Government & Defense

9.7.1 Government & Defense Market Trends Analysis (2020-2032)

9.7.2 Government & Defense Market Size Estimates And Forecasts To 2032 (USD Billion)

9.8 Others

9.8.1 Others Market Trends Analysis (2020-2032)

9.8.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

10. Small Cell 5G Network Market Segmentation, By Network Model

10.1 Chapter Overview

10.2 Standalone

10.2.1 Standalone Market Trends Analysis (2020-2032)

10.2.2 Standalone Market Size Estimates And Forecasts To 2032 (USD Billion)

10.3 Non-standalone

10.3.1 Non-standalone Market Trends Analysis (2020-2032)

10.3.2 Non-standalone Market Size Estimates And Forecasts To 2032 (USD Billion)

11. Small Cell 5G Network Market Segmentation, By Frequency Type

11.1 Chapter Overview

11.2 Low band

11.2.1 Low band Market Trends Analysis (2020-2032)

11.2.2 Low band Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3 Mid band

11.3.1 Mid band Market Trends Analysis (2020-2032)

11.3.2 Mid band Market Size Estimates And Forecasts To 2032 (USD Billion)

11.4 Millimeter Wave

11.4.1 Millimeter Wave Market Trends Analysis (2020-2032)

11.4.2 Millimeter Wave Market Size Estimates And Forecasts To 2032 (USD Billion)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America Small Cell 5G Network Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.2.3 North America Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.2.4 North America Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.5 North America Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.2.6 North America Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.2.7 North America Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.2.8 USA

12.2.8.1 USA Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.2.8.2 USA Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.8.3 USA Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.2.8.4 USA Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.2.8.5 USA Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.2.9 Canada

12.2.9.1 Canada Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.2.9.2 Canada Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.9.3 Canada Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.2.9.4 Canada Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.2.9.5 Canada Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.2.10 Mexico

12.2.10.1 Mexico Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.2.10.2 Mexico Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.10.3 Mexico Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.2.10.4 Mexico Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.2.10.5 Mexico Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe Small Cell 5G Network Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.1.3 Eastern Europe Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.4 Eastern Europe Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.5 Eastern Europe Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.3.1.6 Eastern Europe Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.3.1.7 Eastern Europe Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.3.1.8 Poland

12.3.1.8.1 Poland Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.8.2 Poland Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.8.3 Poland Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.3.1.8.4 Poland Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.3.1.8.5 Poland Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.3.1.9 Romania

12.3.1.9.1 Romania Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.9.2 Romania Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.9.3 Romania Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.3.1.9.4 Romania Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.3.1.9.5 Romania Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.3.1.10 Hungary

12.3.1.10.1 Hungary Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.10.2 Hungary Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.10.3 Hungary Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.3.1.10.4 Hungary Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.3.1.10.5 Hungary Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.3.1.11 Turkey

12.3.1.11.1 Turkey Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.11.2 Turkey Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.11.3 Turkey Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.3.1.11.4 Turkey Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.3.1.11.5 Turkey Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.3.1.12 Rest Of Eastern Europe

12.3.1.12.1 Rest Of Eastern Europe Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.12.2 Rest Of Eastern Europe Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.12.3 Rest Of Eastern Europe Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.3.1.12.4 Rest Of Eastern Europe Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.3.1.12.5 Rest Of Eastern Europe Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe Small Cell 5G Network Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.2.3 Western Europe Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.4 Western Europe Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.5 Western Europe Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.3.2.6 Western Europe Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.3.2.7 Western Europe Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.3.2.8 Germany

12.3.2.8.1 Germany Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.8.2 Germany Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.8.3 Germany Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.3.2.8.4 Germany Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.3.2.8.5 Germany Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.3.2.9 France

12.3.2.9.1 France Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.9.2 France Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.9.3 France Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.3.2.9.4 France Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.3.2.9.5 France Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.3.2.10 UK

12.3.2.10.1 UK Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.10.2 UK Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.10.3 UK Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.3.2.10.4 UK Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.3.2.10.5 UK Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.3.2.11 Italy

12.3.2.11.1 Italy Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.11.2 Italy Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.11.3 Italy Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.3.2.11.4 Italy Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.3.2.11.5 Italy Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.3.2.12 Spain

12.3.2.12.1 Spain Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.12.2 Spain Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.12.3 Spain Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.3.2.12.4 Spain Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.3.2.12.5 Spain Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.13.2 Netherlands Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.13.3 Netherlands Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.3.2.13.4 Netherlands Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.3.2.13.5 Netherlands Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.14.2 Switzerland Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.14.3 Switzerland Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.3.2.14.4 Switzerland Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.3.2.12.5 Switzerland Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.3.2.15 Austria

12.3.2.15.1 Austria Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.15.2 Austria Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.15.3 Austria Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.3.2.15.4 Austria Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.3.2.15.5 Austria Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.3.2.16 Rest Of Western Europe

12.3.2.16.1 Rest Of Western Europe Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.16.2 Rest Of Western Europe Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.16.3 Rest Of Western Europe Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.3.2.16.4 Rest Of Western Europe Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.3.2.16.5 Rest Of Western Europe Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.4 Asia Pacific

12.4.1 Trends Analysis

12.4.2 Asia Pacific Small Cell 5G Network Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.4.3 Asia Pacific Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.4 Asia Pacific Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.5 Asia Pacific Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.4.6 Asia Pacific Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.4.7 Asia Pacific Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.4.8 China

12.4.8.1 China Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.8.2 China Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.8.3 China Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.4.8.4 China Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.4.8.5 China Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.4.9 India

12.4.9.1 India Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.9.2 India Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.9.3 India Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.4.9.4 India Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.4.9.5 India Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.4.10 Japan

12.4.10.1 Japan Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.10.2 Japan Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.10.3 Japan Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.4.10.4 Japan Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.4.10.5 Japan Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.4.11 South Korea

12.4.11.1 South Korea Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.11.2 South Korea Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.11.3 South Korea Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.4.11.4 South Korea Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.4.11.5 South Korea Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.4.12 Vietnam

12.4.12.1 Vietnam Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.12.2 Vietnam Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.12.3 Vietnam Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.4.12.4 Vietnam Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.4.12.5 Vietnam Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.4.13 Singapore

12.4.13.1 Singapore Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.13.2 Singapore Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.13.3 Singapore Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.4.13.4 Singapore Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.4.13.5 Singapore Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.4.14 Australia

12.4.14.1 Australia Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.14.2 Australia Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.14.3 Australia Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.4.14.4 Australia Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.4.14.5 Australia Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.4.15 Rest Of Asia Pacific

12.4.15.1 Rest Of Asia Pacific Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.15.2 Rest Of Asia Pacific Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.15.3 Rest Of Asia Pacific Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.4.15.4 Rest Of Asia Pacific Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.4.15.5 Rest Of Asia Pacific Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.5 Middle East And Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East Small Cell 5G Network Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.1.3 Middle East Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.4 Middle East Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.5 Middle East Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.5.1.6 Middle East Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.5.1.7 Middle East Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.5.1.8 UAE

12.5.1.8.1 UAE Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.8.2 UAE Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.8.3 UAE Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.5.1.8.4 UAE Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.5.1.8.5 UAE Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.5.1.9 Egypt

12.5.1.9.1 Egypt Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.9.2 Egypt Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.9.3 Egypt Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.5.1.9.4 Egypt Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.5.1.9.5 Egypt Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.10.2 Saudi Arabia Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.10.3 Saudi Arabia Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.5.1.10.4 Saudi Arabia Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.5.1.10.5 Saudi Arabia Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.5.1.11 Qatar

12.5.1.11.1 Qatar Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.11.2 Qatar Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.11.3 Qatar Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.5.1.11.4 Qatar Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.5.1.11.5 Qatar Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.5.1.12 Rest Of Middle East

12.5.1.12.1 Rest Of Middle East Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.12.2 Rest Of Middle East Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.12.3 Rest Of Middle East Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.5.1.12.4 Rest Of Middle East Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.5.1.12.5 Rest Of Middle East Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa Small Cell 5G Network Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.2.3 Africa Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.4 Africa Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.5 Africa Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.5.2.6 Africa Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.5.2.7 Africa Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.5.2.8 South Africa

12.5.2.8.1 South Africa Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.8.2 South Africa Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.8.3 South Africa Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.5.2.8.4 South Africa Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.5.2.8.5 South Africa Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.9.2 Nigeria Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.9.3 Nigeria Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.5.2.9.4 Nigeria Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.5.2.9.5 Nigeria Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.5.2.10 Rest Of Africa

12.5.2.10.1 Rest Of Africa Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.10.2 Rest Of Africa Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.10.3 Rest Of Africa Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.5.2.10.4 Rest Of Africa Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.5.2.10.5 Rest Of Africa Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America Small Cell 5G Network Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.6.3 Latin America Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.4 Latin America Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.5 Latin America Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.6.6 Latin America Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.6.7 Latin America Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.6.8 Brazil

12.6.8.1 Brazil Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.8.2 Brazil Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.8.3 Brazil Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.6.8.4 Brazil Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.6.8.5 Brazil Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.6.9 Argentina

12.6.9.1 Argentina Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.9.2 Argentina Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.9.3 Argentina Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.6.9.4 Argentina Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.6.9.5 Argentina Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.6.10 Colombia

12.6.10.1 Colombia Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.10.2 Colombia Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.10.3 Colombia Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.6.10.4 Colombia Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.6.10.5 Colombia Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

12.6.11 Rest Of Latin America

12.6.11.1 Rest Of Latin America Small Cell 5G Network Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.11.2 Rest Of Latin America Small Cell 5G Network Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.11.3 Rest Of Latin America Small Cell 5G Network Market Estimates And Forecasts, By End Use(2020-2032) (USD Billion)

12.6.11.4 Rest Of Latin America Small Cell 5G Network Market Estimates And Forecasts, By Network Model (2020-2032) (USD Billion)

12.6.11.5 Rest Of Latin America Small Cell 5G Network Market Estimates And Forecasts, By Frequency Type (2020-2032) (USD Billion)

13. Company Profiles

13.1 Huawei Technologies Co., Ltd.

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.2 Samsung Electronics Co., Ltd.

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.3 Nokia Corporation

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.4 Ericsson

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.5 ZTE Corporation

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.6 Fujitsu Limited

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.7 CommScope Inc.

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.8 Comba Telecom Systems Holdings Ltd.

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.9 Altiostar

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.10 Airspan Networks

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Component

Hardware

Picocell

Femtocell

Microcell

Services

Consulting

Deployment & Integration

Training And Support & Maintenance

By Network Model

Standalone

Non-standalone

By Application

Indoor

Outdoor

By Frequency Type

Low band

Mid band

Millimeter Wave

By End Use

Residential

Commercial

Industrial

Smart City

Transportation & Logistics

Government & Defense

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Law Enforcement Software Market was valued at USD 15.5 billion in 2023 and will reach USD 36.9 Billion by 2032, growing at a CAGR of 10.13% by 2032.

Carbon Footprint Management Market Size was valued at USD 10.68 Billion in 2023 and is expected to reach USD 31.02 Billion by 2032 and grow at a CAGR of 12.60 % over the forecast period 2024-2032.

The Computer Vision Market was valued at USD 21.2 Billion in 2023 and is expected to reach USD 190.9 Billion by 2032, growing at a CAGR of 27.69% from 2024-2032.

The System Integration Market size was valued at USD 434.47 Billion in 2023 and is expected to reach USD 1046.9 Billion by 2032 and grow at a CAGR of 9.61% over the forecast period 2024-2032.

Small Language Model Market was valued at USD 7.9 billion in 2023 and is expected to reach USD 29.64 billion by 2032, growing at a CAGR of 15.86% by 2032.

3D Printing Market Size was valued at USD 21.1 billion in 2023 and is expected to reach USD 118.9 billion by 2032, growing at a CAGR of 21.2 % over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone