Get more information on Sleep Disorder Treatment Market - Request Free Sample Report

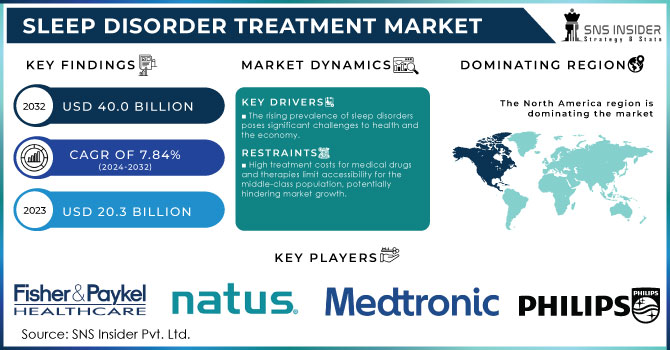

The Sleep Disorder Treatment Market Size was valued at USD 20.3 Billion in 2023 and is expected to reach USD 40.0 Billion by 2032 and grow at a CAGR of 7.84% over the forecast period 2024-2032.

The sleep disorder treatment market is growing at a rapid pace. The factor facilitating this growth in the market is the increasing prevalence of sleep apnea, the rise in the geriatric population, and a growing awareness of sleep disorders among the general public, especially in developing countries. It is noted that the risk for sleep disorders is much higher among the aged and older adults have high susceptibility to conditions such as insomnia and sleep apnea. According to the latest Helsestart data, it appears that half of U.S. adults suffer from sleeplessness at least once a month, while 59% of adults in all Western countries report some type of insomnia throughout their lifetime. Cautionary warning: Japan, Taiwan, and Sweden topped the list for reported efforts at combating insomnia, while Norway does the most searching for melatonin.

Sleep Disorder Treatment Methods Overview:

| Treatment Category | Description | Common Applications | Advantages |

|---|---|---|---|

| Cognitive Behavioral Therapy | Psychological therapy aimed at improving sleep hygiene | Insomnia | Non-invasive, long-term efficacy |

| Continuous Positive Airway Pressure (CPAP) | A device that provides continuous air pressure | Sleep Apnea | Effective for moderate to severe apnea |

| Medications | Prescription drugs (e.g., sedatives, stimulants, melatonin) | Insomnia, Narcolepsy | Immediate relief, a variety of options |

| Lifestyle & Behavioral Changes | Sleep hygiene, stress management, exercise, diet modification | All sleep disorders | No side effects, holistic benefits |

| Surgical Procedures | Invasive methods like UPPP (Uvulopalatopharyngoplasty) | Severe Sleep Apnea | The long-term solution for structural issues |

With this growing awareness of sleep disorders, there is now a rising tide of patients coming out seeking their solution - insomnia, narcolepsy, and sleep without pattern among others. The governments are indeed becoming attuned to this matter, and they are taking action to curb the rising incidence of sleep disorders, which anyway is associated with other mental health disorders like anxiety, depression, and post-traumatic stress disorder. Second, treatment technologies are emerging in the market with recent innovations in continuous positive airway pressure (CPAP) therapy. For example, as happened recently, new approvals for drugs, such as those related to Idorsia's Quviviq for insomnia in January 2022, illustrate a huge potential in this market, much like that relating to the more recent approval JAZZ Pharmaceuticals took on Xywav for idiopathic hypersomnia.

The rapidly growing trend of telemedicine is helping patients receive sleep disorder treatments from their bedroom comfort. This trend is further increasing the demand for diagnostics and therapeutics in addition to the rising levels of insurance coverage for sleep disorder treatments. Sleep Disorders Estimated 50 million to 70 million people suffer from sleep disorders in the United States according to the American Sleep Association, and this is a mammoth problem that needs urgent solutions.

Yet, the market still sees pressures from several quarters, especially in strict regulatory frameworks for governance that regulate the diagnosis and therapy apparatuses for sleep disorders. They fall under Class II, by the FDA, which has broad preclinical and clinical tests to undertake before getting any approval to sell in the market. Despite all these considerations, the overall market prospect is encouraging, mainly with growing awareness and developing treatment options.

Regional Distribution of Sleep Disorder Treatment Adoption:

| Region | Common Sleep Disorders | Adopted Treatments | Government Initiatives |

|---|---|---|---|

| North America | Sleep Apnea, Insomnia | CPAP Devices, Medications | Public health campaigns, reimbursement policies |

| Europe | Insomnia, Restless Leg Syndrome | Behavioral Therapy, Medications | National health insurance coverage |

| Asia-Pacific | Sleep Apnea, Insomnia | CPAP Devices, Herbal Supplements | Increased focus on mental health |

| Latin America | Narcolepsy, Insomnia | Medications, Lifestyle Changes | Limited access to advanced treatments |

| Middle East & Africa | Sleep Apnea, Insomnia | CPAP Devices, Behavioral Therapy | Rising awareness and healthcare investment |

Drivers

The rising prevalence of sleep disorders poses significant challenges to health and the economy.

Recent studies have established that the prevalence of sleep disorders is increasing to the extent that between 50 to 70 million adults are affected. Such increases in medical conditions are said to be influenced by lifestyle and technological advancement, including sleep apnea, insomnia, and restless legs syndrome (RLS). Around 30 percent of the adult population globally suffers from insomnia, while environmental factors such as noise and light pollution worsen the problem. Urbanization and loss of biodiversity are some of the major causes behind it. As sleep disorders increase in numbers, the business prospects of the providers of healthcare services and medical device manufacturers will also rise, which will gradually benefit the global sleep disorder treatment market.

This has led to increased awareness among healthcare professionals, organizations, and governments on sleep disorders and their health-related adverse implications, thus spreading education. With sleep disorders, it is not only the health aspect that is hit but also the economy because it contributes to the decline in productivity in various sectors. Increased awareness of how a sleep disorder could have a direct impact on one's life makes the patient seek treatment at an early stage; such increased demand will propel the growth of the sleep disorder treatment market among various healthcare service providers.

Restraints

High treatment costs for medical drugs and therapies limit accessibility for the middle-class population, potentially hindering market growth.

Technological advancements in developed regions are often accompanied by increased expenses, making treatments less affordable.

Insufficient inclusion of sleep disorder treatments in health insurance policies may restrict the number of patients seeking necessary care.

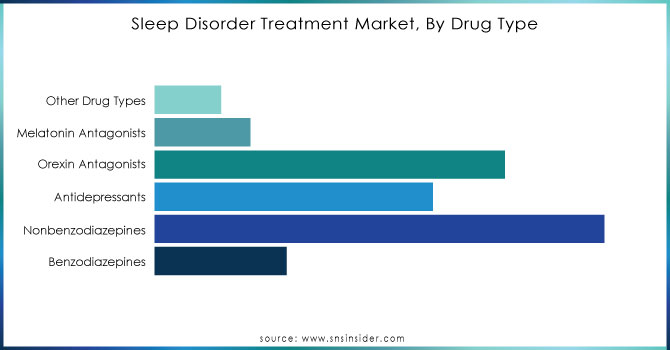

By Drug Type

In 2023, nonbenzodiazepines were the largest drug category in the sleep disorder treatment market, accounting for around 35.0% of its total share. They are more sought after than other drugs, primarily benzodiazepines, because of their efficacy in promoting sleep with significantly lower reactivity to dependency, such as that associated with benzodiazepines, in drugs like Zolpidem and Eszopiclone. Due to a favorable side-effect profile and swift onset of action, these drugs are becoming increasingly popular among healthcare providers and patients who require relief from insomnia and other sleep disorders. As awareness continues to increase regarding the dangers of long-term use of traditional benzodiazepines, demand for nonbenzodiazepines should continue to grow.

The orexin antagonist is the drug type that is growing the fastest since it is expected to grow more than 12% during the forecast period. The medication lemborexant and others were shown effective in the treatment of insomnia, acting via blockade of the orexin system, which is the key mediator of wakefulness. Their novel mechanism of action and lower risk for residual daytime sedation make orexin antagonists a tempting alternative for patients and trigger their rapid expansion in the market.

Need any customization research on Sleep Disorder Treatment Market - Enquiry Now

By Application

The sleep disorder treatment market was dominated by the insomnia segment in 2023, holding approximately 40.0% of its share. The high prevalence of insomnia due to rising factors like stress, changes in lifestyle, and awareness about the disorder is increasingly enhancing the demand for effective treatment and solutions among patients. Of late, people diagnosed with poor quality of sleep are increasingly seeking solutions through various therapeutic areas such as drugs, cognitive behavioral therapy, and lifestyle. This rising awareness of the impact of insomnia on health and lifestyle fuels the supremacy of the segment.

Application to sleep apnea is seeing the highest growth rate during the forecast period with a projected CAGR of about 10% during the next several years. The rising epidemiological rates, more so in the geriatric demographic and the comorbidities of obesity and hypertension, are fueling demand for treatment options. The growing awareness among patients about the health conditions related to sleep apnea, including cardiovascular and metabolic disorders, is increasing the demand for patients seeking diagnoses and treatments. Hence, this is driving the demand in the therapy area.

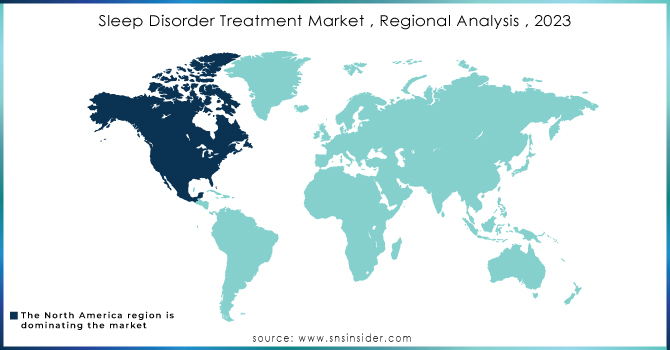

North America dominated the sleep disorder treatment market with a 46.8% share in the year 2023. This was mainly due to the increased prevalence of sleep disorders and awareness as well as a growing demand for treatments in the United States and Canada, combined with high healthcare expenditure in this region. These factors will drive market growth: favorable reimbursement policies for therapeutic products, a strong pipeline of clinical, and the growing level of stress in the population. Adults reported an average level of 5.0 out of 10 for the year 2020; Gen Z adults increased their level of stress to 6.1 for the same period according to this American Psychological Association survey.

According to the American Academy of Sleep Medicine, stress is identified as a trigger that causes adjustment insomnia that affects 20% of the U.S. population yearly, aside from other factors. Behavioral insomnia also describes children who fail to develop good sleep habits and is found in about 30% of the pediatric population. In 2021, nearly 51% of Americans reported using sleep aids during the COVID-19 pandemic, which indicates rising awareness of sleep medications among Americans. This increased awareness and usage of sleep treatment will further facilitate substantial growth in the market in the forecast period. Due to the rising level of awareness and the higher demand for effective treatments of sleep disorders, North America will remain a key geographical region for the growth of the market.

Key Players in the Sleep Disorder Treatment Market Based on Their Offerings

Sleep Apnea Devices

Fisher & Paykel Healthcare

ResMed Inc.

Philips Healthcare

Invacare Corporation

BMC Medical Co., Ltd

Inspire Medical Systems

Sleep Monitoring and Diagnostic Devices

Natus Medical Inc.

Nihon Kohden Corporation

Advanced Brain Monitoring

SleepMed Inc.

NovaSom, Inc.

Drug Therapies and Treatment Solutions

Medtronic plc

DeVilbiss Healthcare

Cardinal Health

Overall Healthcare and Medical Devices

Koninklijke Philips N.V.

Becton, Dickinson, and Company

Recent Developments

In June 2024, Recent research published in the New England Journal of Medicine highlighted the positive effects of tirzepatide in adults with obesity and moderate-to-severe obstructive sleep apnea (OSA). The study found that tirzepatide significantly decreased the apnea-hypopnea index (AHI), body weight, high-sensitivity C-reactive protein (hs-CRP) levels, hypoxic burden, and systolic blood pressure, while also enhancing patient-reported sleep-related outcomes compared to a placebo.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 20.3 Billion |

| Market Size by 2032 | USD 40.0 Billion |

| CAGR | CAGR of 7.84% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Type (Benzodiazepines, Nonbenzodiazepines, Antidepressants, Orexin Antagonists, Melatonin Antagonists, Other Drug Types) • By Application (Insomnia, Sleep Apnea, Narcolepsy, Circadian Disorders, Other Applications) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fisher & Paykel Healthcare, ResMed Inc., Philips Healthcare, Invacare Corporation, Teleflex Inc., BMC Medical Co., Ltd, Inspire Medical Systems, Natus Medical Inc., Nihon Kohden Corporation, Compumedics Limited, Advanced Brain Monitoring, SleepMed Inc., NovaSom, Inc., Medtronic plc, DeVilbiss Healthcare, Cardinal Health, Koninklijke Philips N.V., Itamar Medical Ltd., Becton, Dickinson, and Company |

| Key Drivers | • The rising prevalence of sleep disorders poses significant challenges to health and the economy. |

| Restraints | • High treatment costs for medical drugs and therapies limit accessibility for the middle-class population, potentially hindering market growth. • Technological advancements in developed regions are often accompanied by increased expenses, making treatments less affordable. • Insufficient inclusion of sleep disorder treatments in health insurance policies may restrict the number of patients seeking necessary care. |

The Sleep Disorder Treatment Market size was valued at USD 20.3 Billion in 2023.

The Sleep Disorder Treatment Market is to grow at a CAGR of 7.84% during the forecast period 2024-2032.

The use of non-pharmacological therapies for sleep disturbances is widespread, indeed. CBT-I, or cognitive behavioural therapy, is a potent non-pharmacological treatment for insomnia. Non-pharmacological therapy approaches can include relaxation methods, sleep hygiene education, and lifestyle changes.

A few natural therapies and way of life adjustments can aid with sleep quality. Maintaining a regular sleep schedule, developing a soothing bedtime ritual, abstaining from stimulants like caffeine and electronics before bed, establishing a cosy sleeping environment, and exercising frequently are a few examples.

The kind of sleep problem and its underlying causes will determine how it is managed. Even while certain sleep problems can be successfully controlled and their symptoms reduced, a full recovery isn't always achievable. A common therapy objective is to increase overall wellbeing, minimise symptoms, and improve sleep quality.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends (2023), by Region

5.3 Device Volume, by Region (2020-2032)

5.4 Healthcare Spending, by Region (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Service Benchmarking

6.3.1 Service specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Service launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Sleep Disorder Treatment Market Segmentation, by Drug Type

7.1 Chapter Overview

7.2 Benzodiazepines

7.2.1 Benzodiazepines Market Trends Analysis (2020-2032)

7.2.2 Benzodiazepines Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Nonbenzodiazepines

7.3.1 Nonbenzodiazepines Market Trends Analysis (2020-2032)

7.3.2 Nonbenzodiazepines Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Antidepressants

7.4.1 Antidepressants Market Trends Analysis (2020-2032)

7.4.2 Antidepressants Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 Orexin Antagonists

7.5.1 Orexin Antagonists Market Trends Analysis (2020-2032)

7.5.2 Orexin Antagonists Market Size Estimates and Forecasts to 2032 (USD Million)

7.6 Melatonin Antagonists

7.6.1 Melatonin Antagonists Market Trends Analysis (2020-2032)

7.6.2 Melatonin Antagonists Market Size Estimates and Forecasts to 2032 (USD Million)

7.7 Other Drug Types

7.7.1 Other Drug Types Market Trends Analysis (2020-2032)

7.7.2 Other Drug Types Market Size Estimates and Forecasts to 2032 (USD Million)

8. Sleep Disorder Treatment Market Segmentation, by Application

8.1 Chapter Overview

8.2 Insomnia

8.2.1 Insomnia Market Trends Analysis (2020-2032)

8.2.2 Insomnia Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Sleep Apnea

8.3.1 Sleep Apnea Market Trends Analysis (2020-2032)

8.3.2 Sleep Apnea Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Narcolepsy

8.4.1 Narcolepsy Market Trends Analysis (2020-2032)

8.4.2 Narcolepsy Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Circadian Disorders

8.5.1 Circadian Disorders Market Trends Analysis (2020-2032)

8.5.2 Circadian Disorders Market Size Estimates and Forecasts to 2032 (USD Million)

8.6 Other Applications

8.6.1 Other Applications Market Trends Analysis (2020-2032)

8.6.2 Other Applications Market Size Estimates and Forecasts to 2032 (USD Million)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Sleep Disorder Treatment Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.2.3 North America Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.2.4 North America Sleep Disorder Treatment Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.5 USA

9.2.5.1 USA Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.2.5.2 USA Sleep Disorder Treatment Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.6 Canada

9.2.6.1 Canada Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.2.6.2 Canada Sleep Disorder Treatment Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.7 Mexico

9.2.7.1 Mexico Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.2.7.2 Mexico Sleep Disorder Treatment Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Sleep Disorder Treatment Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.1.3 Eastern Europe Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.3.1.4 Eastern Europe Sleep Disorder Treatment Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.5 Poland

9.3.1.5.1 Poland Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.3.1.5.2 Poland Sleep Disorder Treatment Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.6 Romania

9.3.1.6.1 Romania Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.3.1.6.2 Romania Sleep Disorder Treatment Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.3.1.7.2 Hungary Sleep Disorder Treatment Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.3.1.8.2 Turkey Sleep Disorder Treatment Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.3.1.9.2 Rest of Eastern Europe Sleep Disorder Treatment Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Sleep Disorder Treatment Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.2.3 Western Europe Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.3.2.4 Western Europe Sleep Disorder Treatment Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.5 Germany

9.3.2.5.1 Germany Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.3.2.5.2 Germany Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.3.2.6 France

9.3.2.6.1 France Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.3.2.6.2 France Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.3.2.7 UK

9.3.2.7.1 UK Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.3.2.7.2 UK Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.3.2.8 Italy

9.3.2.8.1 Italy Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.3.2.8.2 Italy Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.3.2.9 Spain

9.3.2.9.1 Spain Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.3.2.9.2 Spain Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.3.2.10.2 Netherlands Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.3.2.11.2 Switzerland Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.3.2.12 Austria

9.3.2.12.1 Austria Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.3.2.12.2 Austria Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.3.2.13.2 Rest of Western Europe Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Sleep Disorder Treatment Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.4.3 Asia Pacific Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.4.4 Asia Pacific Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.4.5 China

9.4.5.1 China Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.4.5.2 China Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.4.6 India

9.4.5.1 India Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.4.5.2 India Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.4.5 Japan

9.4.5.1 Japan Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.4.5.2 Japan Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.4.6 South Korea

9.4.6.1 South Korea Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.4.6.2 South Korea Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.4.7 Vietnam

9.4.7.1 Vietnam Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.2.7.2 Vietnam Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.4.8 Singapore

9.4.8.1 Singapore Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.4.8.2 Singapore Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.4.9 Australia

9.4.9.1 Australia Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.4.9.2 Australia Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.4.10.2 Rest of Asia Pacific Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Sleep Disorder Treatment Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.1.3 Middle East Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.5.1.4 Middle East Sleep Disorder Treatment Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.5 UAE

9.5.1.5.1 UAE Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.5.1.5.2 UAE Sleep Disorder Treatment Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.5.1.6.2 Egypt Sleep Disorder Treatment Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.5.1.7.2 Saudi Arabia Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.5.1.8.2 Qatar Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.5.1.9.2 Rest of Middle East Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Sleep Disorder Treatment Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.2.3 Africa Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.5.2.4 Africa Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.5.2.5.2 South Africa Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.5.2.6.2 Nigeria Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Sleep Disorder Treatment Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.6.3 Latin America Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.6.4 Latin America Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.6.5 Brazil

9.6.5.1 Brazil Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.6.5.2 Brazil Sleep Disorder Treatment Market Estimates and Forecasts, by Application(2020-2032) (USD Million)

9.6.6 Argentina

9.6.6.1 Argentina Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.6.6.2 Argentina Sleep Disorder Treatment Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.7 Colombia

9.6.7.1 Colombia Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.6.7.2 Colombia Sleep Disorder Treatment Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Sleep Disorder Treatment Market Estimates and Forecasts, by Drug Type (2020-2032) (USD Million)

9.6.8.2 Rest of Latin America Sleep Disorder Treatment Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10. Company Profiles

10.1 Fisher & Paykel Healthcare

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 ResMed Inc.

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Philips Healthcare

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Invacare Corporation

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Teleflex Inc.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 BMC Medical Co., Ltd

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Natus Medical Inc.

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Nihon Kohden Corporation

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Compumedics Limited

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Advanced Brain Monitoring

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segmentation

By Drug Type

Benzodiazepines

Nonbenzodiazepines

Antidepressants

Orexin Antagonists

Melatonin Antagonists

Other Drug Types

By Application

Insomnia

Sleep Apnea

Narcolepsy

Circadian Disorders

Other Applications

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Hospital Services Market size was estimated at USD 4.38 trillion in 2023 and is expected to reach USD 6.74 trillion by 2032 at a CAGR of 5.08% during the forecast period of 2024-2032.

Canine orthopedics Market Size was valued at USD 367.9 million in 2023 and is expected to reach USD 765.07 million by 2032, growing at a CAGR of 8.5% over the forecast period 2024-2032.

Cleanroom Robots in the Healthcare Market is projected to reach USD 4189.14 million by 2032 and grow at a CAGR of 25.85% from 2024 to 2032.

The Inflation Devices Market was USD 577.91 million in 2023 and is expected to reach USD 937.09 million by 2032, growing at a CAGR of 5.01% by 2024-2032.

The Sleep Apnea Devices Market size was valued at USD 5.25 billion in 2023 and is projected to reach USD 9.43 billion by 2032 growing at a CAGR of 6.74%.

First Aid Market Size was valued at USD 4.66 Billion in 2023 and is expected to reach USD 6.9 billion by 2032, growing at a CAGR of 4.48% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone