Get More Information on Skid Loaders Market - Request Sample Report

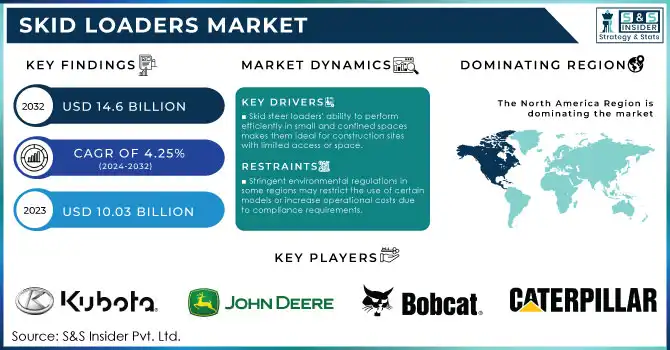

The Skid Loaders Market size was valued at USD 10.03 billion in 2023 and is expected to reach USD 14.6 Billion by 2032, growing at a CAGR of 4.25% over the forecast period of 2024-2032.

The growth of the skid steer loader market is mainly due to the ongoing construction boom, urban expansion, and improvements in technology. Expansion of the construction industry including the residential and commercial infrastructure has increased the demand for skid steer loaders as multi-purpose equipment. They are perfect for applications where inside work means a smaller, yet powerful machine, and include interior demolition, landscaping, and site development. With rapid urbanization and the growing concept of smart cities, the need for skid steer loaders grows, especially for urban maintenance work such as tree planting, soil movement, and park landscaping. The segment trends are mainly focused on technological innovations that are integral growth factors for the market. New electric and hybrid skid steer loaders like Bobcat's S7X introduce new levels of performance, efficiency, and sustainability. For instance, the S7X offers enhanced torque while running at lower sound levels, which is great for the environment and for users near the saw. This move towards electric vehicles also matches the increasing need for green solutions in construction and urban communities. Moreover, actual smart technologies such as machine software solutions have evolved into skid steer loaders from mere tools to full-fledged machines with analytical abilities. This enables superior monitoring and efficient operations that make these machines even more appealing to the industry.

The further expansion of the market is supported by the increasing investment in construction and growing focus towards sustainable construction. Well, the need for compact, multi-functional equipment such as skid steer loaders will only increase as urban development and smart city projects expand. This is because the use of technology in these machines today organizes and automates tasks related to modern construction and urban maintenance. The skid steer loader market is here to stay, with these types of machines being future-proof, as cities continue to evolve and even more complexity of construction projects is needed.

Drivers

Skid steer loaders' ability to perform efficiently in small and confined spaces makes them ideal for construction sites with limited access or space.

Innovations such as electric and hybrid models, like Bobcat’s S7X, offer better performance, sustainability, and reduced environmental impact, attracting more buyers.

The expansion of smart cities and urban maintenance projects, including landscaping and park maintenance, boosts demand for skid steer loaders.

The growing number of smart cities as well as urban maintenance projects further contributes to the increase in demand for skid steer loaders that are primarily used for tasks such as landscaping, park maintenance, and urban development. As smart cities become the new norm with their blend of tech integration and infrastructure efficiency, they will be dependent on sustainable and responsive equipment able to perform optimally in urban areas that are often short on space. Due to their compact size and versatility, skid steer loaders are particularly suited to urban environments, where they can navigate through narrow streets, perform landscaping, and keep urban green spaces in parks and recreation areas.

Although Trimland of cities filled with grass trees are systems are fed urban landscapes are to be initiated as cities pursue a stream of trimland. Lumber clearance, ground leveling, tree planting, and all other landscape-related functions are performed with skid-steer loaders. As smart cities and environmental and aesthetic awareness increase, the role of mobile plant movers in the maintenance of urban parks and landscaping has expanded, too. Likewise, the use of such technologies helps to other climate change projects that smart cities these days are implementing such as tree planting projects, and development of the eco-friendly green spaces in urban areas. Additionally, with the global focus on sustainable development, cities seek even more green, low-emission equipment. Skid steer loaders are also being increasingly offered as electric or hybrid models, which makes them ideal for smart cities that want to lessen their carbon footprints and launch green initiatives. The skid steer loaders can combine power with the precision required in a compact city setting making them must-have equipment in the maintenance and evolution of smart cities.

The increase in the number of infrastructures and urbanization initiatives, especially in smart cities, along with the increasing need for sustainable urban surroundings will boost the demand for skid steer loaders in coming years. These machines have been an integral part of the modern city and becoming how the cities slowly forgetting their own green past.

Restraints

Stringent environmental regulations in some regions may restrict the use of certain models or increase operational costs due to compliance requirements.

The integration of advanced technologies in modern skid steer loaders can lead to complexity in operations and troubleshooting, requiring specialized knowledge or support.

The upfront cost of purchasing skid steer loaders, especially electric or hybrid models, can be a financial barrier for small and medium-sized enterprises (SMEs) and construction firms with limited budgets.

The high initial investment related to the purchase of skid steer loaders (electric and hybrid) is one of the major drawbacks observed among small and medium-sized enterprises (SMEs) and other construction firms with limited financial resources. While these offenses are hard to overcome, those new machines offer more versatility, performance, and environmental benefits really than their diesel-powered brethren, but their cost usually is higher. While electric and hybrid skid steer loaders often have benefits like better fuel economy, less noise, and lower emissions, they also have a higher cost that pushes them out of reach for businesses that don't have the upfront capital to buy one.

The financial bite for SMEs is not just the sticker price, but the continuing costs of maintainability and operation on a daily basis. Although electric versions usually offer low operating costs, thanks to increased fuel efficiency and lower emissions, the high purchase price along with potentially high repair costs from the new technologies make them a stretch for smaller companies.

While traditional diesel-powered skid steer loaders have a lower price point initially, they are not without the inherent financial burden that goes along with them. Additionally, the increasing requirement to provide eco-friendly equipment in the construction market creates an urge for enterprises to provide environment-friendly and costly devices. Nevertheless, for numerous smaller corporations that have less access to cash, staying aggressive in an enterprise that is taking place a gadget that increasingly prizes sustainability, however, is difficult to do. Some manufacturers counter that by offering financing and leasing plans and state governments are throwing in some incentives of their own to help cut the cost of these machines. But the cost pays off, high initial investment is still a big barrier in the face of many smaller companies, hindering them from investing in newer technology to remain competitive in a changing environment.

By Rated Operating Capacity

Over 2,200 Ibs dominated the market, accounting for a 54.23% share in 2023. Skid steer loaders with a higher ROC are indispensable—they can be used for lifting heavier loads, digging, grading, and many other tasks that processing and moving earth on large construction and excavation projects require. From road building to urban development to utility installation, governments and private enterprises across the globe are spending billions on infrastructure projects. When handling such high throughputs and in such extreme environments, skid steer loaders with an ROC over 2,200 lbs are especially suited. The demand for high-capacity skid steer loaders is directly linked to this increased emphasis on infrastructure development.

1,251 to 2,200 Ibs segment is anticipated to grow at a substantial CAGR during the forecast period. The adoption of lightweight construction materials will cater to the need of larger pressure vessels and various MRO equipment, increasing this segment's growth by 2032. Light compact equipment is increasingly in demand in different sectors like: construction, agriculture, landscaping, etc. These industries need equipment that can provide high lifting capacity while being able to navigate tight areas easily. The ROC range between 1,251 lbs to 2,200 lbs strikes the right balance between powerful and size, making it a great fit for applications such as material handling, and digging/excavating, as well as site preparation.

By Application

In 2023, the construction & mining segment dominated the market and represented a significant revenue share. The construction and mining industry demands utmost efficiency with equipment which also works with flexibility since modern construction projects are large scale and complex. Though they can only transport materials a short distance, skid steers are versatile machines that can be used for digging, grading, and lifting. Their small footprint and maneuverability make them perfect for tight spaces and tough job sites, and this is accelerating their use for both residential and commercial construction.

The landscaping & ground maintenance segment is expected to register the highest CAGR during the forecast period. The market demand is proliferated with increasing demand for aesthetic and functional outdoor spaces and skid steer loader versatility. Whether doing residential landscaping or commercial landscaping projects, having high-quality equipment that is efficient and versatile is paramount to grading, digging, and transporting materials around. Skid steer loader attachments are easy to switch out to operate in various conditions, making them the perfect choice for landscapers who work on both detailed and expansive projects.

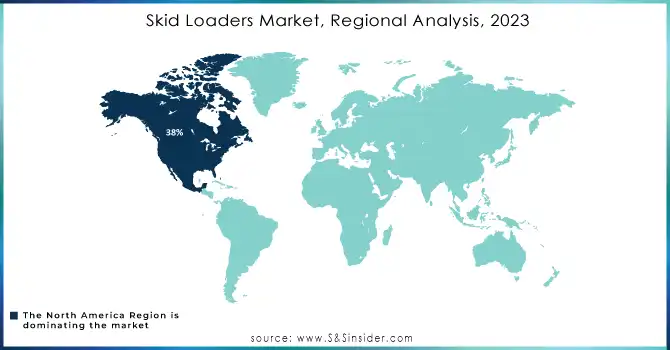

In 2023, North America dominated the market and represented a significant revenue share of 38%. With rapid urbanization and increasing infrastructural activities growing in the region, industry players are on the lookout for earthmover machinery that ensures excellent maneuverability even within constricted spaces but does not compromise on performance. Skid steer loaders are known for their agility, which makes them ideal for tight job sites. Moreover, with the advent of new technology, Efficient engines, and hydraulic systems resulted in low operational costs and high productivity. As the construction industry continues to move toward automation, skid steers fitted with telematics and remote control are also seeing an increase in usage.

The Asia Pacific skid steer loaders market is anticipated to register the fastest-growing CAGR throughout the forecast period. Countries like China and India are seeing mass urbanization and infrastructure growth and they are driving the need for multi-purpose construction equipment. Skid steer loaders are also widely used in the many infrastructure related projects part of China’s Belt and Road Initiative (BRI) in which they also play a crucial role in tasks like excavation, grading, and material handling [8]. Likewise, India is undertaking large-scale urban renewal projects and Smart Cities Mission which will only lead to greater demand for versatile and efficient construction equipment.

The Indian skid steer loaders market is anticipated to exhibit massive growth over the coming years. India is experiencing rapid urbanization and metropolitan area expansion, which is increasing the demand for construction machinery that is not only versatile but also efficient. The need for skid steer loaders has grown in a significant way due to major infrastructure projects such as the Delhi-Mumbai Expressway and the extension of Mumbai's Metro network.

Need Any Customization Research On Skid Loaders Market - Inquiry Now

The major key players along with one product are

Caterpillar – CAT 262D Skid Steer Loader

Bobcat – Bobcat S570 Skid-Steer Loader

John Deere – 332G Skid Steer Loader

Case Construction – Case 570N Tractor Loader

Kubota – Kubota SCL1000

New Holland – New Holland L218 Skid Steer Loader

Terex – Terex PT-30 Compact Track Loader

Volvo Construction Equipment – Volvo EC950F Crawler Excavator

JCB – JCB 175 Skid Steer Loader

Manitou – Manitou 4200RT Skid Steer Loader

Mahindra – Mahindra 275 DI Skid Steer Loader

Takeuchi – Takeuchi TL10V2 Skid Steer Loader

SANY – SANY SW405K Skid Steer Loader

Doosan – Doosan DX85R-3 Skid Steer Loader

Ford – Ford 4630 Skid Steer Loader

Bobcat Company – Bobcat E165 Large Skid Steer Loader

Bobcat – Bobcat S650 Skid Steer Loader

Gehl – Gehl 250 Skid Steer Loader

Wacker Neuson – Wacker Neuson 5055 Skid Steer Loader

Kubota – Kubota KX080-4 Skid Steer Loader

In February 2024, Caterpillar showcased advancements in their skid steer models with enhanced fuel efficiency and a focus on eco-friendly features. They are also incorporating more smart technologies for better machine operation control.

John Deere unveiled its new range of skid steers in January 2024, integrating smart creep software that enables more precise machine control and efficiency for various tasks, including site development and landscaping.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.03 Billion |

| Market Size by 2032 | USD 15.6 Billion |

| CAGR | CAGR of 4.25% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Rated Operating Capacity (Upto 1,250 lbs, 1,251 to 2,200 lbs, More than 2,200 lbs) • By Application (Construction & Mining, Landscaping & Ground Maintenance, Agriculture) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Caterpillar, Bobcat, John Deere, Case Construction, Kubota, New Holland, Terex, Volvo Construction Equipment, JCB, Manitou, Mahindra, Takeuchi, SANY, Doosan |

| Key Drivers | • Skid steer loaders' ability to perform efficiently in small and confined spaces makes them ideal for construction sites with limited access or space. • Innovations such as electric and hybrid models, like Bobcat’s S7X, offer better performance, sustainability, and reduced environmental impact, attracting more buyers. |

| Restraints | • Stringent environmental regulations in some regions may restrict the use of certain models or increase operational costs due to compliance requirements. • The integration of advanced technologies in modern skid steer loaders can lead to complexity in operations and troubleshooting, requiring specialized knowledge or support. |

Ans- Skid Loaders Market was valued at USD 10.03 billion in 2023 and is expected to reach USD 15.6 Billion by 2032, growing at a CAGR of 4.25% from 2024-2032.

Ans- the CAGR of the Skid Loaders Market during the forecast period is 4.25% from 2024-2032.

Ans- North America dominated the market and represented a significant revenue share in 2023

Ans- one main growth factor for the Skid Loaders Market is

Ans- Challenges in the Skid Loaders Market are

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Vehicle Production and Sales Volumes, 2020-2032, by Region

5.2 Emission Standards Compliance, by Region

5.3 Vehicle Technology Adoption, by Region

5.4 Consumer Preferences, by Region

5.5 Aftermarket Trends (Data on vehicle maintenance, parts, and services)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Skid Steer Loader Market Segmentation, by Rated Operating Capacity

7.1 Chapter Overview

7.2 Upto 1,250 lbs

7.2.1 Upto 1,250 lbs Market Trends Analysis (2020-2032)

7.2.2 Upto 1,250 lbs Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 1,251 to 2,200 lbs

7.3.1 1,251 to 2,200 lbs Market Trends Analysis (2020-2032)

7.3.2 1,251 to 2,200 lbs Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 More than 2,200 lbs

7.3.1 More than 2,200 lbs Market Trends Analysis (2020-2032)

7.3.2 More than 2,200 lbs Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Skid Steer Loader Market Segmentation, by Application

8.1 Chapter Overview

8.2 Construction & Mining

8.2.1 Construction & Mining Market Trends Analysis (2020-2032)

8.2.2 Construction & Mining Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3Landscaping & Ground Maintenance

8.3.1Landscaping & Ground Maintenance Market Trends Analysis (2020-2032)

8.3.2Landscaping & Ground Maintenance Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Agriculture

8.4.1Agriculture Market Trends Analysis (2020-2032)

8.4.2Agriculture Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Skid Steer Loader Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.2.4 North America Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.2.5.2 USA Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.2.6.2 Canada Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.2.7.2 Mexico Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Skid Steer Loader Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.3.1.5.2 Poland Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.3.1.6.2 Romania Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Skid Steer Loader Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.3.2.4 Western Europe Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.3.2.5.2 Germany Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.3.2.6.2 France Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.3.2.7.2 UK Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.3.2.8.2 Italy Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.3.2.9.2 Spain Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.3.2.12.2 Austria Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Skid Steer Loader Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.4.4 Asia Pacific Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.4.5.2 China Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.4.5.2 India Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.4.5.2 Japan Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.4.6.2 South Korea Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.2.7.2 Vietnam Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.4.8.2 Singapore Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.4.9.2 Australia Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Skid Steer Loader Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.5.1.4 Middle East Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.5.1.5.2 UAE Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Skid Steer Loader Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.5.2.4 Africa Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Skid Steer Loader Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.6.4 Latin America Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.6.5.2 Brazil Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.6.6.2 Argentina Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.6.7.2 Colombia Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Skid Steer Loader Market Estimates and Forecasts, by Rated Operating Capacity (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Skid Steer Loader Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 Caterpillar

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Bobcat

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 John Deere

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Case Construction

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Kubota

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 New Holland

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Terex

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Volvo Construction Equipment

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 JCB

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Manitou

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segmentation

By Rated Operating Capacity

Upto 1,250 lbs

1,251 to 2,200 lbs

More than 2,200 lbs

By Application

Construction & Mining

Landscaping & Ground Maintenance

Agriculture

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Automotive Cybersecurity Market Size was USD 3.37 Billion in 2023 and will reach USD 16.24 Billion by 2032 and grow at a CAGR of 19.11% by 2024-2032.

The Motor Grader Market size was valued at USD 3.71 Bn in 2023 and is expected to reach USD 5.69 Bn by 2031, with a CAGR of 5.5% over the forecast period of 2024-2031.

The Automotive Camera Market size was valued at $7.96 billion in 2023 and will reach to $19.95 billion by 2031 and grow at a CAGR of 10.75% by 2024-2032.

The Electric Vehicle Battery Charger Market Size was USD 11.9 billion in 2023 and will reach USD 73 billion by 2032 and grow at a CAGR of 22.4% by 2024-2032.

The Automotive Robotics Market Size was valued at USD 9.56 billion in 2023 & will reach USD 24.70 billion by 2031 and grow at a CAGR of 12.6% by 2024-2031

The Automotive Metal Stamping Market Size was valued at USD 108.41 Bn in 2023 and will reach USD 163.90 Bn by 2032 and grow at a CAGR of 4.7% by 2024-2032

Hi! Click one of our member below to chat on Phone