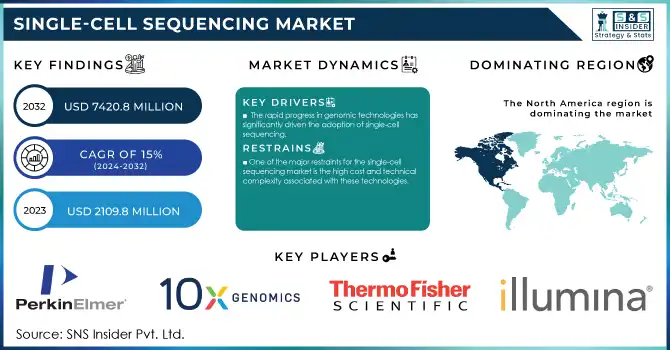

The Single-Cell Sequencing Market was valued at USD 2109.8 million in 2023 and is expected to reach USD 7420.8 million by 2032, growing at a CAGR of 15% from 2024-2032.

To get more information on Single-Cell Sequencing Market - Request Free Sample Report

The single-cell sequencing market is growing due to advances in genomic research and the increasing demand for personalized medicine. The market is expected to grow significantly as applications expand into cancer research, immunology, neurology, and developmental biology.

Single-cell sequencing will enable researchers to understand cellular heterogeneity and disease mechanisms at the molecular level by analyzing individual cells. The ability of single-cell sequencing to identify rare cell populations and track cell evolution makes it highly valuable in discovering novel biomarkers and therapeutic targets, especially in oncology and immune-related diseases. The growing use of this technology in academic and clinical settings, supported by considerable funding and technological improvements, is further driving the growth of the market.

This further indicates recent advances in the market of single-cell sequencing and the continuation of innovation. As an example, 10x Genomics, in 2023, announced its Chromium X instrument, designed for higher throughput and efficiency concerning single-cell RNA sequencing. Also, companies such as Illumina introduce novel platforms for sequencing, which help improve scalability while cutting costs to provide single-cell sequencing as a valuable option for institutions doing research and clinical labs.

The healthcare sector is moving toward more tailored treatments, and single-cell sequencing plays a crucial role in understanding the genetic and epigenetic diversity within tissues, which will allow for more accurate disease diagnosis and treatment planning. These technological advancements, coupled with increasing funding in genomics, are expected to drive sustained growth in the single-cell sequencing market over the coming years.

Drivers

The rapid progress in genomic technologies has significantly driven the adoption of single-cell sequencing.

The swift advancement of genomic technologies has greatly propelled the use of single-cell sequencing. Advancements in sequencing technologies, including enhancements in throughput, precision, and cost-effectiveness, are rendering single-cell sequencing increasingly attainable and scalable. This has broadened its uses across various research areas, such as cancer biology, immunology, and neurology. The creation of advanced tools, including microfluidics and droplet-based methods, has enabled the sequencing of individual cells with unmatched accuracy, revealing cellular diversity that was previously obscured. As scientists and medical professionals keep investigating the genetic foundations of diseases, single-cell sequencing is emerging as a vital resource for comprehending intricate biological mechanisms and creating more tailored therapies.

According to NCBI, Over the last forty years, sequencing technologies have developed into three generations. Sanger sequencing, as the first generation, preceded DNA sequencing, and the second generation consisted of massively parallel sequencing on the Illumina and Ion Torrent platforms that supported high-throughput sequencing. The third generation comprises PacBio and Nanopore, as the most advanced long-read and single-molecule sequencing technologies.

The increasing emphasis on personalized medicine is the key driver of the single-cell sequencing market.

The increasing need for personalized medicine and targeted therapies has driven the expansion of the single-cell sequencing market. Personalized medicine aims to customize treatments according to unique genetic profiles, leading to greater effectiveness and fewer side effects. Single-cell sequencing allows for accurate characterization of cellular and genetic diversity in tissues, enhancing the understanding of disease development and helping to identify possible therapeutic targets. This is especially important in oncology, as the intricacy of the tumor microenvironment frequently hinders treatment advancement. Single-cell sequencing is crucial in promoting targeted therapies and precision medicine strategies by offering insights into rare cell populations and their interactions, which drives its extensive use in research and clinical settings.

Restraint

One of the major restraints for the single-cell sequencing market is the high cost and technical complexity associated with these technologies.

Single-cell sequencing needs sophisticated equipment, specific reagents, and expertise, resulting in a costly procedure. The requirement for careful management of samples, data examination, and computational resources further increases the expense, which may restrict its availability, particularly for smaller research laboratories and organizations with constrained funding. Moreover, the technical intricacy of these techniques, necessitating specialized expertise in bioinformatics and data analysis, presents a hurdle for broad acceptance. Consequently, even with the increasing demand, these elements could hinder the market's expansion, especially in areas with inadequate infrastructure or financial means.

Data Complexity and Analysis Challenges restraining the single Cell sequencing market.

The amount of data generated from single-cell sequencing is huge, and it requires sophisticated computational tools and expertise in bioinformatics for its analysis. This can become a major bottleneck as the data are difficult to interpret, involving handling variability and noise in the information coming from individual cells. The lack of suitable tools for analyzing the data, together with the necessity for very specialized knowledge, forms a major barrier for researchers to tap the full potential of single-cell sequencing technologies.

By Technology

In 2023, the NGS segment dominated the market of single-cell sequencing with a market share of 45% due to its unmatched capability in sequencing efficiency and precision. It has revolutionized genomic research, allowing for the full-scale analysis of single-cell transcriptomics, epigenomics, and genomics. Moreover, it is cost-effective nowadays, especially with the advent of more advanced platforms such as Illumina's NovaSeq and Oxford Nanopore's PromethION, enabling large-scale studies at high accuracy.

Adaptability to all sorts of research needs, from cancer to developmental biology; compatibility with multi-omics approaches; continuous innovation, such as single-molecule real-time (SMRT) sequencing and CRISPR-enabled technologies, further strengthens NGS as the leader.

By Application

In 2023, The cancer research segment dominated the market with a market share of 36%, driven by the increasing worldwide prevalence of cancer and the essential function of single-cell sequencing in revealing tumor diversity, immune evasion strategies, and resistance to treatments. The knowledge acquired from this technology is crucial in creating personalized cancer treatments, immunotherapies, and liquid biopsies. The application is additionally bolstered by worldwide efforts like the Cancer Moonshot program and partnerships between academia and industry in cancer research.

The drug discovery and development segment is experiencing the fastest growth, as single-cell sequencing allows for the identification of new drug targets and biomarkers. The uptake of single-cell technologies by pharmaceutical firms is fast-tracking the creation of precision therapies. For instance, research involving patient-derived organoids and in vitro drug testing utilizing single-cell sequencing is revolutionizing drug development processes. The rise in collaborations between technology suppliers and pharmaceutical companies is driving this expansion.

By End User

Academic and research organizations segment dominated the market with a 74% market share in 2023, because of their prominence in promoting essential and translational single-cell research. Substantial financial backing from government and non-government entities, including the National Institutes of Health (NIH) and the European Research Council (ERC), aids their initiatives in extensive genomic projects and partnerships. The presence of cutting-edge facilities and specialized knowledge further solidifies their standing.

The biotechnology and pharmaceutical companies segment experiencing the fastest growth due to incorporating single-cell sequencing technologies into their research and development processes. This expansion is fueled by their emphasis on discovering drugs, identifying biomarkers, and creating personalized medicine. Businesses are utilizing single-cell data to improve the design of clinical trials and patient grouping, allowing for more effective and precise therapeutic strategies. Moreover, alliances with educational institutions and tech developers are promoting the uptake of single-cell sequencing in industrial uses.

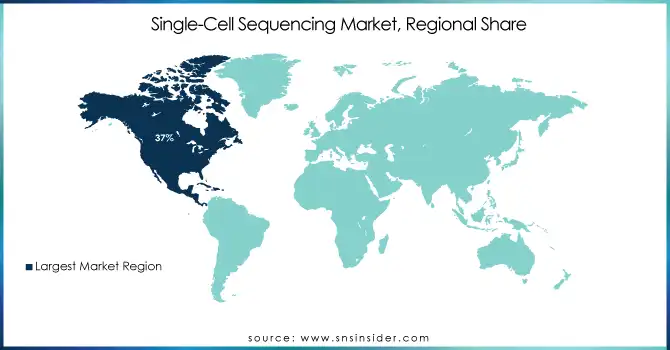

North America dominated the market with a 37% market share of the single-cell sequencing market, primarily due to the presence of major market players, advanced healthcare infrastructure, and high adoption rates of genomic technologies. The region benefits from a well-established healthcare sector and significant investments in research and development, further strengthening its market dominance. Europe also maintains a strong position in the market, driven by similar factors, including robust healthcare infrastructure and substantial research investments. The region's unwavering commitment to scientific research and development has contributed to its significant share in the single-cell sequencing market, although North America remains the leading region.

The Asia-Pacific region is experiencing the fastest growth in the single-cell sequencing market with a 20.16% CAGR, driven by increasing investments in healthcare and research, a rising number of academic and research institutions, and a growing emphasis on personalized medicine. Countries like China and India are making significant strides in genomic research and healthcare infrastructure, contributing to the region's accelerated market expansion. Additionally, government initiatives and collaborations with international organizations are playing a pivotal role in advancing genomic research and applications, further fueling the rapid growth of the market in this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Illumina, Inc. (NovaSeq 6000 System, MiSeq System)

Thermo Fisher Scientific, Inc. (Ion Torrent Genexus System, QuantStudio 6 and 7 Pro Real-Time PCR Systems)

10x Genomics, Inc. (Chromium Single Cell Gene Expression Solution, Visium Spatial Gene Expression)

Becton, Dickinson, and Company (BD Biosciences) (BD Rhapsody Single-Cell Analysis System, BD FACSMelody Cell Sorter)

Fluidigm Corporation (Now Standard BioTools) (C1 Single-Cell Auto Prep System, Hyperion Imaging System)

Agilent Technologies (SureSelect Target Enrichment, Bravo NGS Workstation)

PerkinElmer, Inc. (LabChip GX Touch System, NEXTFLEX Single Cell RNA-Seq Kit)

Pacific Biosciences (PacBio) (Sequel IIe System, SMRTbell Library Preparation Kit)

Takara Bio, Inc. (SMARTer Single-Cell RNA-Seq Kit, ICELL8 Single-Cell System)

Bio-Rad Laboratories, Inc. (ddSEQ Single-Cell Isolator, QX200 Droplet Digital PCR System)

QIAGEN N.V. (QIAseq Single Cell RNA Library Kits, GeneGlobe Data Analysis Center)

Merck KGaA (MilliporeSigma) (GenomePlex Single Cell Whole Genome Amplification Kit, Smartflare RNA Detection Probes)

Sony Biotechnology (SH800 Cell Sorter, SP6800 Spectral Analyzer)

Dolomite Bio (Nadia Instrument, Nadia Innovate)

Oxford Nanopore Technologies (MinION Sequencer, GridION Sequencer)

GenScript Biotech (CytoFLEX Flow Cytometer, CloneSelect Single-Cell Printer)

Mission Bio (Tapestri Platform, Tapestri Designer Software)

Roche Sequencing and Life Science (KAPA RNA HyperPrep Kits, LightCycler 480 System)

Sartorius AG (CellCelector Single-Cell Isolation System, iQue Advanced Flow Cytometry Platform)

Bruker Corporation (MALDI Biotyper, TimsTOF Pro Mass Spectrometer)

Key suppliers

These suppliers provide a range of products that enable advancements in single-cell sequencing technology across different workflows, including gene expression, genomic analysis, and single-cell isolation.

Illumina, Inc.

Thermo Fisher Scientific, Inc.

10x Genomics, Inc.

Becton, Dickinson and Company (BD Biosciences)

Fluidigm Corporation (Now Standard BioTools)

Agilent Technologies

PerkinElmer, Inc.

Pacific Biosciences (PacBio)

Takara Bio, Inc.

QIAGEN N.V.

Recent Developments

In July 2024, Illumina acquired Fluent BioSciences, a leader in single-cell technology, to enhance its DNA sequencing capabilities. The acquisition aims to drive advancements in single-cell genomics, positioning Illumina for further growth in the field.

May 2024, Thermo Fisher Scientific highlights the rise of Next-Generation Sequencing (NGS)-based companion diagnostics (CDx) for oncology. Their Ion Torrent Genexus System offers quicker turnaround times, delivering results in 24 hours compared to the usual 2-3 week wait.

In May 2024, QIAGEN introduced QCI Secondary Analysis, a cloud-based SaaS solution designed for high-throughput secondary analysis of clinical NGS data. This service integrates with QIAGEN’s clinical variant interpretation software to streamline workflows in oncology and inherited disease applications.

May 2024, GenScript Biotech has broadened its in vitro transcription (IVT) RNA synthesis portfolio with self-amplifying RNA (saRNA). This addition supports applications in vaccine development, cancer immunotherapy, and gene therapy, further solidifying GenScript's leadership in RNA technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2190.8 million |

| Market Size by 2032 | US$ 7240.8 million |

| CAGR | CAGR of 15.00% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Next-Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), Mass Spectrometry, Microarray, Other Technologies) • By Workflow (Single-Cell Isolation, Sample Preparation, Genomic Analysis) • By Application (Cancer Research, Immunology Research, Neurobiology Research, Stem Cell Research, Drug Discovery and Development, Other Applications) • By End User (Academic and Research Laboratories, Biotechnology and Pharmaceutical Companies, Hospitals and Diagnostic Laboratories, Other End Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Illumina, Inc., Thermo Fisher Scientific, Inc., 10x Genomics, Inc., Becton, Dickinson, and Company (BD Biosciences), Fluidigm Corporation (now Standard BioTools), Agilent Technologies, PerkinElmer, Inc., Pacific Biosciences (PacBio), Takara Bio, Inc., Bio-Rad Laboratories, Inc., QIAGEN N.V., Merck KGaA (MilliporeSigma), Sony Biotechnology, Dolomite Bio, Oxford Nanopore Technologies, GenScript Biotech, Mission Bio, Roche Sequencing and Life Science, Sartorius AG, Bruker Corporation, and other players. |

| Key Drivers | •The rapid progress in genomic technologies has significantly driven the adoption of single-cell sequencing. •The increasing emphasis on personalized medicine is the key driver of the single-cell sequencing market. |

| Restraints | •One of the major restraints for the single-cell sequencing market is the high cost and technical complexity associated with these technologies. |

Ans- The Single-Cell Sequencing Market was valued at USD 2109.8 million in 2023 and is expected to reach USD 7420.8 million by 2032.

Ans – The CAGR rate of the Single-Cell Sequencing Market during 2024-2032 is 15%.

Ans- The cancer research segment dominated the market by 36%

Ans- North America held the largest revenue share by 37%.

Ans- Asia Pacific is the fastest-growing region in the Single-Cell Sequencing Market.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence of Target Diseases (2023)

5.2 Research Funding and Grants, by Region (2023)

5.3 Number of Academic and Research Labs Adopting Single-Cell Sequencing (2020-2032)

5.4 Healthcare and Genomics Spending, by Region (2023)

5.5 Collaborations and Partnerships in Single-Cell Sequencing (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Single-Cell Sequencing Market Segmentation, by Technology

7.1 Chapter Overview

7.2 Next-Generation Sequencing (NGS)

7.2.1 Next-Generation Sequencing (NGS) Market Trends Analysis (2020-2032)

7.2.2 Next-Generation Sequencing (NGS) Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Polymerase Chain Reaction (PCR)

7.3.1 Polymerase Chain Reaction (PCR) Market Trends Analysis (2020-2032)

7.3.2 Polymerase Chain Reaction (PCR) Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Mass Spectrometry

7.4.1 Mass Spectrometry Market Trends Analysis (2020-2032)

7.4.2 Mass Spectrometry Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 Microarray

7.5.1 Microarray Market Trends Analysis (2020-2032)

7.5.2 Microarray Market Size Estimates and Forecasts to 2032 (USD Million)

7.6 Other Technologies

7.6.1 Other Technologies Market Trends Analysis (2020-2032)

7.6.2 Other Technologies Market Size Estimates and Forecasts to 2032 (USD Million)

8. Single-Cell Sequencing Market Segmentation, by Workflow

8.1 Chapter Overview

8.2 Single-Cell Isolation

8.2.1 Single-Cell Isolation Market Trends Analysis (2020-2032)

8.2.2 Single-Cell Isolation Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Sample Preparation

8.3.1 Sample Preparation Market Trends Analysis (2020-2032)

8.3.2 Sample Preparation Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Genomic Analysis

8.4.1 Genomic Analysis Market Trends Analysis (2020-2032)

8.4.2 Genomic Analysis Market Size Estimates and Forecasts to 2032 (USD Million)

9. Single-Cell Sequencing Market Segmentation, by Application

9.1 Chapter Overview

9.2 Cancer Research

9.2.1 Cancer Research Market Trends Analysis (2020-2032)

9.2.2 Cancer Research Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Immunology Research

9.3.1 Immunology Research Market Trends Analysis (2020-2032)

9.3.2 Immunology Research Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Neurobiology Research

9.4.1 Neurobiology Research Market Trends Analysis (2020-2032)

9.4.2 Neurobiology Research Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Stem Cell Research

9.5.1 Stem Cell Research Market Trends Analysis (2020-2032)

9.5.2 Stem Cell Research Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Drug Discovery and Development

9.6.1 Drug Discovery and Development Market Trends Analysis (2020-2032)

9.6.2 Drug Discovery and Development Market Size Estimates and Forecasts to 2032 (USD Million)

9.7 Other Applications

9.7.1 Other Applications Market Trends Analysis (2020-2032)

9.7.2 Other Applications Market Size Estimates and Forecasts to 2032 (USD Million)

10. Single-Cell Sequencing Market Segmentation, by End User

10.1 Chapter Overview

10.2 Academic and Research Laboratories

10.2.1 Academic and Research Laboratories Market Trends Analysis (2020-2032)

10.2.2 Academic and Research Laboratories Market Size Estimates and Forecasts to 2032 (USD Million)

10.3 Biotechnology and Pharmaceutical Companies

10.3.1 Biotechnology and Pharmaceutical Companies Market Trends Analysis (2020-2032)

10.3.2 Biotechnology and Pharmaceutical Companies Market Size Estimates and Forecasts to 2032 (USD Million)

10.4 Hospitals and Diagnostic Laboratories

10.4.1 Hospitals and Diagnostic Laboratories Market Trends Analysis (2020-2032)

10.4.2 Hospitals and Diagnostic Laboratories Market Size Estimates and Forecasts to 2032 (USD Million)

10.5 Other End Users

10.5.1 Other End Users Market Trends Analysis (2020-2032)

10.5.2 Other End Users Market Size Estimates and Forecasts to 2032 (USD Million)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Single-Cell Sequencing Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.2.3 North America Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.2.4 North America Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.2.5 North America Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.2.6 North America Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.2.7 USA

11.2.7.1 USA Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.2.7.2 USA Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.2.7.3 USA Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.2.7.4 USA Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.2.8 Canada

11.2.8.1 Canada Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.2.8.2 Canada Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.2.8.3 Canada Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.2.8.4 Canada Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.2.9 Mexico

11.2.9.1 Mexico Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.2.9.2 Mexico Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.2.9.3 Mexico Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.2.9.4 Mexico Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Single-Cell Sequencing Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.1.3 Eastern Europe Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.1.4 Eastern Europe Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.3.1.5 Eastern Europe Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.6 Eastern Europe Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.1.7 Poland

11.3.1.7.1 Poland Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.1.7.2 Poland Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.3.1.7.3 Poland Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.7.4 Poland Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.1.8 Romania

11.3.1.8.1 Romania Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.1.8.2 Romania Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.3.1.8.3 Romania Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.8.4 Romania Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.1.9.2 Hungary Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.3.1.9.3 Hungary Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.9.4 Hungary Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.1.10.2 Turkey Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.3.1.10.3 Turkey Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.10.4 Turkey Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.1.11.2 Rest of Eastern Europe Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.3.1.11.3 Rest of Eastern Europe Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.11.4 Rest of Eastern Europe Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Single-Cell Sequencing Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.2.3 Western Europe Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.4 Western Europe Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.3.2.5 Western Europe Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.6 Western Europe Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.7 Germany

11.3.2.7.1 Germany Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.7.2 Germany Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.3.2.7.3 Germany Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.7.4 Germany Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.8 France

11.3.2.8.1 France Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.8.2 France Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.3.2.8.3 France Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.8.4 France Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.9 UK

11.3.2.9.1 UK Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.9.2 UK Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.3.2.9.3 UK Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.9.4 UK Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.10 Italy

11.3.2.10.1 Italy Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.10.2 Italy Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.3.2.10.3 Italy Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.10.4 Italy Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.11 Spain

11.3.2.11.1 Spain Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.11.2 Spain Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.3.2.11.3 Spain Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.11.4 Spain Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.12.2 Netherlands Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.3.2.12.3 Netherlands Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.12.4 Netherlands Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.13.2 Switzerland Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.3.2.13.3 Switzerland Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.13.4 Switzerland Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.14 Austria

11.3.2.14.1 Austria Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.14.2 Austria Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.3.2.14.3 Austria Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.14.4 Austria Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.15.2 Rest of Western Europe Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.3.2.15.3 Rest of Western Europe Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.15.4 Rest of Western Europe Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Single-Cell Sequencing Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.4.3 Asia Pacific Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.4 Asia Pacific Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.4.5 Asia Pacific Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.6 Asia Pacific Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.7 China

11.4.7.1 China Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.7.2 China Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.4.7.3 China Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.7.4 China Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.8 India

11.4.8.1 India Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.8.2 India Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.4.8.3 India Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.8.4 India Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.9 Japan

11.4.9.1 Japan Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.9.2 Japan Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.4.9.3 Japan Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.9.4 Japan Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.10 South Korea

11.4.10.1 South Korea Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.10.2 South Korea Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.4.10.3 South Korea Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.10.4 South Korea Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.11 Vietnam

11.4.11.1 Vietnam Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.11.2 Vietnam Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.4.11.3 Vietnam Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.11.4 Vietnam Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.12 Singapore

11.4.12.1 Singapore Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.12.2 Singapore Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.4.12.3 Singapore Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.12.4 Singapore Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.13 Australia

11.4.13.1 Australia Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.13.2 Australia Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.4.13.3 Australia Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.13.4 Australia Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.14.2 Rest of Asia Pacific Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.4.14.3 Rest of Asia Pacific Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.14.4 Rest of Asia Pacific Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Single-Cell Sequencing Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.1.3 Middle East Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.1.4 Middle East Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.5.1.5 Middle East Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.6 Middle East Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.1.7 UAE

11.5.1.7.1 UAE Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.1.7.2 UAE Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.5.1.7.3 UAE Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.7.4 UAE Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.1.8.2 Egypt Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.5.1.8.3 Egypt Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.8.4 Egypt Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.1.9.2 Saudi Arabia Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.5.1.9.3 Saudi Arabia Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.9.4 Saudi Arabia Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.1.10.2 Qatar Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.5.1.10.3 Qatar Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.10.4 Qatar Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.1.11.2 Rest of Middle East Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.5.1.11.3 Rest of Middle East Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.11.4 Rest of Middle East Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Single-Cell Sequencing Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.2.3 Africa Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.2.4 Africa Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.5.2.5 Africa Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.2.6 Africa Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.2.7.2 South Africa Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.5.2.7.3 South Africa Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.2.7.4 South Africa Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.2.8.2 Nigeria Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.5.2.8.3 Nigeria Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.2.8.4 Nigeria Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.2.9.2 Rest of Africa Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.5.2.9.3 Rest of Africa Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.2.9.4 Rest of Africa Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Single-Cell Sequencing Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.6.3 Latin America Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.6.4 Latin America Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.6.5 Latin America Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.6 Latin America Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.6.7 Brazil

11.6.7.1 Brazil Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.6.7.2 Brazil Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.6.7.3 Brazil Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.7.4 Brazil Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.6.8 Argentina

11.6.8.1 Argentina Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.6.8.2 Argentina Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.6.8.3 Argentina Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.8.4 Argentina Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.6.9 Colombia

11.6.9.1 Colombia Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.6.9.2 Colombia Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.6.9.3 Colombia Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.9.4 Colombia Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Single-Cell Sequencing Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.6.10.2 Rest of Latin America Single-Cell Sequencing Market Estimates and Forecasts, by Workflow (2020-2032) (USD Million)

11.6.10.3 Rest of Latin America Single-Cell Sequencing Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.10.4 Rest of Latin America Single-Cell Sequencing Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

12. Company Profiles

12.1 Illumina, Inc.

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Thermo Fisher Scientific, Inc.

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 10x Genomics, Inc.

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Becton, Dickinson, and Company (BD Biosciences)

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Fluidigm Corporation

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Agilent Technologies

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 PerkinElmer, Inc.

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Pacific Biosciences

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Bio-Rad Laboratories, Inc.

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 QIAGEN N.V.

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Technology

Next-Generation Sequencing (NGS)-dominating

Polymerase Chain Reaction (PCR)

Mass Spectrometry

Microarray

Other Technologies

By Workflow

Single-Cell Isolation

Sample Preparation

Genomic Analysis

By Application

Cancer Research-dominating

Immunology Research

Neurobiology Research

Stem Cell Research

Drug Discovery and Development-fastest growing

Other Applications

By End User

Academic and Research Laboratories-dominating

Biotechnology and Pharmaceutical Companies

Hospitals and Diagnostic Laboratories

Other End Users

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization to meet the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Tissue Engineering Market was valued at USD 16.8 Billion in 2023 and will reach USD 56.2 Billion by 2032, with a CAGR of 14.3% from 2024-2032.

The global Single-Cell Analysis Market, valued at USD 3.43 Billion in 2023, is projected to reach USD 10.27 Billion by 2032, growing at a compound annual growth rate (CAGR) of 13.61% during the forecast period.

The global 3D Cell Culture Market, valued at USD 1.4 billion in 2023 and projected to reach USD 4.0 billion by 2032, growing at a CAGR of 12.4% by 2032.

The Digital Diabetes Management Market Size was valued at USD 18.8 billion in 2023, and is expected to reach USD 59.7 billion by 2032, and grow at a CAGR of 13.7% over the forecast period 2024-2032.

The medical clothing market size was valued at USD 104.26 Billion in 2023 and is expected to reach a valuation of USD 196.25 Billion by 2032 expanding at a CAGR of 7.28% during 2024-2032.

The Protein Labeling Market size was estimated at USD 2.39 billion in 2023 and is expected to reach USD 4.83 billion by 2032 at a CAGR of 8.14% during the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone