Single-cell Omics Market Report Scope & Overview:

Get More Information on Single-Cell Omics Market - Request Sample Report

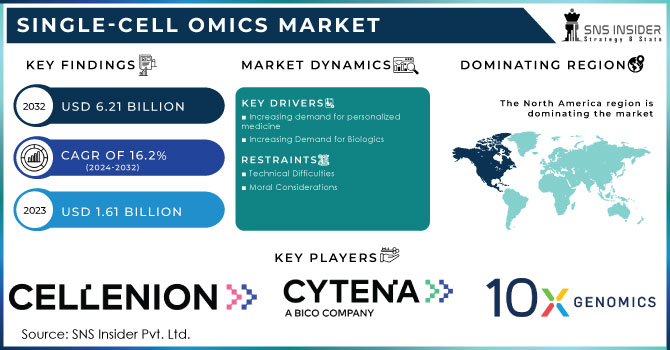

The Single-cell Omics Market size was estimated at USD 1.61 billion in 2023 and is expected to reach USD 6.21 billion by 2032 with a growing CAGR of 16.2% during the forecast period of 2024-2032.

Single-cell omics is a new field of study that looks at individual cells to acquire a better knowledge of cellular processes, heterogeneity, and disease pathology. Technologies in this industry include single-cell genomics, transcriptomics, proteomics, and epigenomics.

For example, in October 2022, Illumina Inc., a pioneer in DNA sequencing and array-based technologies, and GenoScreen, a cutting-edge genomics company, announced a cooperation to accelerate the global campaign to eradicate tuberculosis (TB). As a result of the agreement, tuberculosis-affected countries will be better able to identify and treat drug-resistant tuberculosis (MDR-TB). This will help the World Health Organization's objective to end the global TB pandemic by 2035.

MARKET DYNAMICS

DRIVERS

-

Increasing demand for personalized medicine

Individual cell molecular analysis can provide crucial insights into disease causes, leading to more accurate and individualized treatments. Furthermore, rapid technological improvements have made single-cell omics more accessible and affordable. For example, owing of the development of high throughput sequencing technology, researchers can now examine hundreds of single cells at once, swiftly producing a large amount of data. Furthermore, because of their increasing prevalence, there is a greater interest in understanding the molecular pathways at the core of chronic diseases such as cancer and neurological problems. It provides researchers with a powerful tool for studying disease pathophysiology at the single-cell level.

-

Increasing Demand for Biologics

According to the FDA, the Center for Drug Evaluation and Research (CDER) approved 37 innovative pharmaceuticals in 2022, either as new molecular entities (NMEs) via New Drug Applications (NDAs) or as new therapeutic biological products via Biologics License Applications (BLAs). Single-cell omics can help with the selection and optimization of cell lines for biologics production.

RESTRAIN

-

Technical Difficulties

Complex processes and data processing approaches are required for single-cell omics analysis, which necessitates the use of powerful bioinformatics tools and computer resources. Single-cell technology adoption may be hampered by technical issues such as data integration and interpretation.

-

Moral Considerations

Privacy, informed consent, and the exploitation of human material are among ethical considerations raised by single-cell omics technologies. Addressing these challenges and putting in place regulatory frameworks are critical for the ethical use of single-cell omics data.

OPPORTUNITY

-

The creation of new diagnostic tests and medicines

Biomarkers for illness diagnosis, prognosis, and therapy response can be identified using single-cell omics. This could pave the way for novel diagnostic tests and medicines. Single-cell omics can aid in the discovery of new therapeutic targets and pathways, as well as the evaluation of medication efficacy and toxicity. This could result in the development of more effective and safer medications. Single-cell omics can assist increase crop output and quality while also improving food safety and traceability. This could lead to more secure and sustainable food systems.

CHALLENGES

-

The Technique of Single-Cell Omics Is Expensive

Specialized equipment, reagents, and data analytic resources are required, which raises the entire cost. The affordability and cost-effectiveness of single-cell omics technologies are critical considerations for their wider adoption, particularly in resource-constrained contexts or for small research institutes.

-

Technical Complications Associated with the Research

-

Lack of Standardized Protocols and Benchmark Datasets.

IMPACT OF RUSSIA-UKRAINE WAR

It is becoming increasingly challenging to keep active cancer trial locations in Ukraine. To maintain the validity of clinical trial results, a regulated and consistent environment must be in place across foreign sites. Ukraine and Russia make substantial contributions to worldwide cancer clinical research. The impact of Ukraine's conflict on clinical trials may vary, but will primarily be related to the closure of treatment facilities, internal displacement, and forced migration. The conflict is also expected to have an impact on the contribution of Russian clinical trial sites. All clinical investigations are planned around specific time points to allow for unambiguous and uniform data gathering and analysis. There is no information available on the number of local and international clinical trials that may be threatened in the two nations currently involved in this conflict (Ukraine and Russia). The purpose of this narrative study was to explain the current landscape of systemic cancer clinical trials in Ukraine and Russia, as well as to estimate how many cancer clinical trials are in jeopardy due to the conflict.

KEY MARKET SEGMENTATION

By Product Type

-

Single-Cell Genomics

-

Single-Cell Transcriptomics

-

Single-Cell Proteomics

-

Single-Cell Metabolomics

In 2023, the single-cell Genomics segment is expected to held the highest market share of 45.9% during the forecast period due to the factors such as the rising demand from a diverse variety of end-users, prospective therapeutic uses of single-cell genomics platforms, and technological improvements. Microfluidics, high-throughput sequencing tools, and droplet-based approaches enabled researchers to examine cellular heterogeneity at unprecedented resolution.

By Application

-

Oncology

-

Cell Biology

-

Neurology

-

Immunology

In 2023, the oncology segment is expected to dominate the market growth of 55.2% during the forecast period. The rising worldwide cancer burden, rapid innovation of single-cell analysis techniques, and rising usage of omics-based tools to research cancer progression are expected to support a large segment market share.

By End User

-

Pharmaceutical & Biotechnology Companies

-

Academic and Research Organizations

-

Hospital and Diagnostic Laboratories

-

Others

In 2023, the academic and research organizations segment is expected to dominate the market growth of 42.9% during the forecast period. The increasing use of technology on college campuses, increased research efforts to develop novel modeling tools, and increased research investigations by various research institutes to investigate multiple applications of cellular biology are expected to fuel segment expansion. Furthermore, researchers are investigating several applications of single-cell technologies in domains such as transcriptomics, genomics, proteomics, epigenomics, and metabolomics. Schmidt Futures, for example, gave USD 550 million to a new research facility focused on creating single-cell proteomics technologies in March 2023.

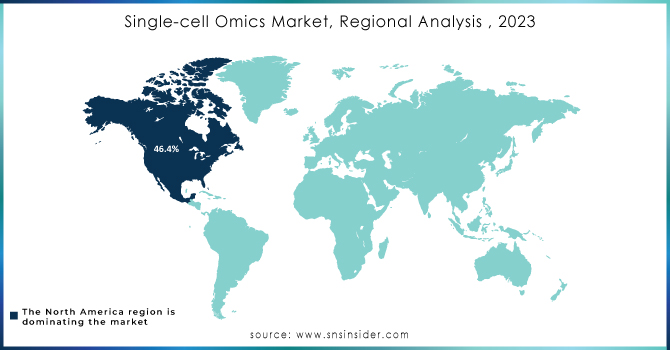

REGIONAL ANALYSES

North America held a significant market share of 46.4% in 2023. Several market participants' presence and varied innovations are some of the primary drivers driving regional growth. Furthermore, the existence of advanced healthcare and increasing R&D activities for the development of breakthrough technologies are driving the regional market. Furthermore, favorable government regulations, the expanding importance of cellular therapies, and the growing tendency toward precision medicine are bolstering the regional industry. For example, the United States has launched the Precision Medicine Initiative to enhance health and treat ailments.

Asia-Pacific is witness to expand fastest CAGR rate of 17.8% during the forecast The region's single-cell omics market is expected to be driven by factors such as the increasing burden of target illness and increased need for enhanced therapies. The growing interest of market players in capturing untapped market potential, as well as their increasing investments in the region, is enabling the region's market expansion. Furthermore, expanding agreements among organizations to strengthen their market outlets is another possible element driving the regional market. For example, Mission Bio and SequMed entered a deal in December 2021 that allowed Mission Bio to utilize its offerings in China.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The major players are Danaher Corporation, CYTENA GmbH, 10x Genomics, BD, CELLENION, PerkinElmer Inc., ANGLE plc, Illumina, Inc., Bio-Rad Laboratories, Inc., Mission Bio, Standard Bio Tools Inc., and Others.

RECENT DEVELOPMENTS

In February 2023, BD unveiled a new single-cell multi-omics analysis tool. It enables researchers to conduct high-throughput investigations without jeopardizing sample integrity, potentially speeding up the pace of discovery in a wide range of domains.

In June 2021, CellenCHIP 384 for single-cell omics sample preparation has been released by SCIENION and Cellenion as a consumable in the new cellenCHIP 384 - 3'RNA-seq Kit for scalable, nanoliter volume library development of single cells.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 1.61 billion |

|

Market Size by 2032 |

US$ 6.21 billion |

|

CAGR |

CAGR of 16.2% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

By Product Type (Single-Cell Genomics, Single-Cell Transcriptomics, Single-Cell Proteomics, Single-Cell Metabolomics), By Application (Oncology, Cell Biology, Neurology, Immunology), By End User (Pharmaceutical & Biotechnology Companies, Academic and Research Organizations, Hospital and Diagnostic Laboratories, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

|

Company Profiles |

Danaher Corporation, CYTENA GmbH, 10x Genomics, BD, CELLENION, PerkinElmer Inc., ANGLE plc, Illumina, Inc., Bio-Rad Laboratories, Inc., Mission Bio, Standard Bio Tools Inc. |

|

Key Drivers |

•Increasing demand for personalized medicine •Increasing Demand for Biologics |

|

Market Restrain |

•Technical Difficulties •Moral Considerations |