To Get More Information on Silent Generator Market - Request Sample Report

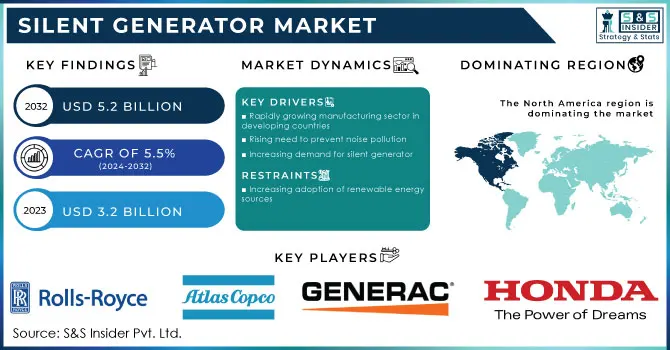

The Silent Generator Market size was valued at USD 3.2 billion in 2023 and is expected to grow to USD 5.2 billion by 2032 with a growing CAGR of 5.5% over the forecast period of 2024-2032.

A silent generator is a type of generator that operates within a soundproof container or generator enclosure to minimize the noise produced by the generator. The generator enclosure contains either layer of hard material that bounce back the sound energy into the soundproof container or enclosure or soft porous material which absorbs the sound energy and then converts it into heat. Higher-frequency sounds are absorbed by the porous material and low-frequency sounds are absorbed by the layers of hard material.

The silent generator produces less than 60 dB noise levels. Silent generators are also called quiet generators. Silent generators are designed to produce minimal sound. This makes them ideal for operating in a residential area and environment-friendly. To fulfill the increasing demand for electricity due to rapid industrialization developing and developed countries have increased the demand for silent generators by many industries across the world.

The global generator market has been adversely affected by the COVID-19 pandemic, as the demand for electricity has decreased worldwide. Industries that rely heavily on electricity have been hit hard, resulting in temporary closures of many companies. This has had a significant impact on the silent generator market during the pandemic. The manufacturing, tourism, and construction sectors have been particularly affected due to strict lockdown conditions, workforce shortages, and supply chain disruptions, which have severely hampered the silent generator market.

As businesses struggle to stay afloat, the demand for electricity has decreased, resulting in a decrease in the demand for generators. This has been particularly challenging for the silent generator market, which relies heavily on industries that require a constant and reliable source of power.

The manufacturing sector has been hit particularly hard, with many factories forced to shut down temporarily due to the pandemic. This has resulted in a significant decrease in the demand for generators, as factories are one of the largest consumers of electricity. Similarly, the tourism and construction sectors have also been severely impacted, with many hotels and construction sites forced to close due to the pandemic.

Drivers

Rapidly growing manufacturing sector in developing countries

Rising need to prevent noise pollution

Increasing demand for silent generator

Fluctuating energy prices

Continuously rising demand for electricity increases the rate of electricity which will drive the market for silent generators. A silent generator does not produce any harsh noise that will lead to noise pollution. It means that the silent generator is environmentally friendly. This factor drives the silent generator market globally. Due to rapid urbanization, the number of manufacturing units is increasing rapidly in developing countries like India. The growth of manufacturing sectors increases the demand for reliable power supply which further propels the growth of the silent generator market.

Restrain

Increasing adoption of renewable energy sources

According to International Energy Agency (IEA), renewable energy sources will become the largest source of energy by overtaking coal energy (fossil Fuel). Renewable energy is clean and will not finish in time and have the capacity to provide the required amount of energy to the population across the world. Therefore, the growing adoption of renewable energy sources and energy storage products will hamper the fuel-based silent generator market.

Opportunities

Increasing trend of distributed energy generation

Increasing electrification in rural areas of developing countries

Challenges

Stringent regulation imposed by the government on using the generator

The ongoing conflict between Russia and Ukraine has had a significant impact on various industries, including the silent generator market. This market, which provides backup power solutions for homes, businesses, and other facilities, has experienced both positive and negative effects as a result of the war.

On the positive side, the increased demand for reliable power sources in Ukraine has led to a surge in sales of silent generators. Many businesses and individuals have invested in these generators as a precautionary measure against power outages and disruptions caused by the conflict. This has resulted in a boost in revenue for manufacturers and suppliers of silent generators.

However, the war has also had negative consequences for the silent generator market. The economic instability and uncertainty caused by the conflict have led to a decrease in demand for these products in Russia. Additionally, the sanctions imposed on Russia by Western countries have made it difficult for Russian manufacturers to export their products to other countries, further impacting the market.

Impact of Recession:

The global economy has been hit hard by the recent recession, and the silent generator market is no exception. The recession has had a significant impact on the demand for silent generators, as businesses and individuals alike have been forced to cut back on their spending. One of the main reasons for the decline in demand for silent generators is the decrease in construction activity. With fewer construction projects underway, there is less need for generators to power tools and equipment on job sites. Additionally, many businesses have had to reduce their operations or shut down entirely, resulting in a decreased need for backup power.

By Sound Level

Super Silent

Silent

By Type

Portable

Stationary

By Phase

Single Phase

Three Phase

By Fuel

Diesel

Natural Gas

Others (Petrol, LPG, Biodiesel, Coal Gas, Producer Gas, Propane Gas)

By Power Rating

Upto 25kVA

25kVA-49kVA

50kVA-99kVA

100kVA-499kVA

Above 500kVA

By Application

Standby and Peak

Prime Mover

By End-use Industry

Residential

Commercial

Industrial

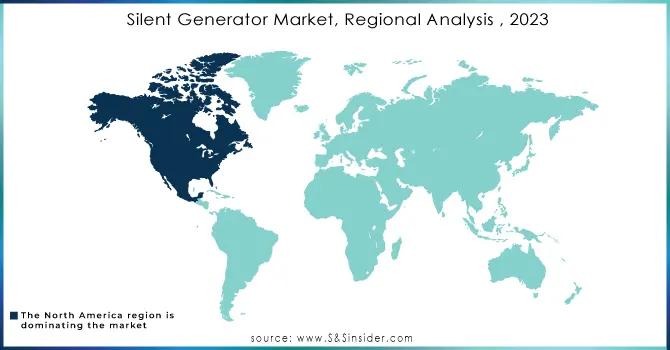

North America region accounted for the largest revenue share of the silent generator market and is expected to grow rapidly during the forecast period. This growth is attributed to the rising demand for backup power solutions, Rapid urbanization rising construction activities, and the rising need for continuous energy supply. The USA is the largest manufacturer of generator in the world which contribute major to the growth of this region.

Asia-Pacific is the second-largest market for silent generators and is estimated to grow with a significant CAGR during the forecast period. Industrialization with rapid development in the residential and commercial sectors is the key factor that drives the silent generator market in this region. The widely growing manufacturing sector in developing countries like India due to fast-paced urbanization propels the market growth significantly in the Asia-Pacific region.

Do You Need any Customization Research on Silent Generator Market - Enquire Now

REGIONAL COVERAGE:

North America

USA

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

The Netherlands

Rest of Europe

Asia-Pacific

Japan

South Korea

China

India

Australia

Rest of Asia-Pacific

The Middle East & Africa

Israel

UAE

South Africa

Rest of the Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

The major players are Cummins Inc., Rolls-Royce plc, Atlas Copco Ltd., Generac Power Systems, Inc, Honda India, MAHINDRA POWEROL., Multiquip Inc., Greaves Cotton Limited., YANMAR HOLDINGS Co., Ltd., Huu Toan, HIMOINSA, Jakson Group, JIANGXI VIGOROUS NEW ENERGY TECHNOLOGY CO., LTD, Kirloskar, Kingsway Group, Yamaha Generators., Constant Power Solutions Ltd, KUBOTA Corporation, Sichuan Yatu Generator Manufacturing Co., Ltd.

| Report Attributes | Details |

| Market Size in 2023 | US$ 3.2 Bn |

| Market Size by 2032 | US$ 5.2 Bn |

| CAGR | CAGR of 5.5 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sound Level (Super Silent and Silent) • By Type (Portable and Stationary) • By Phase (Single Phase and Three Phase) • By Fuel (Diesel, Natural Gas, and Others [Petrol, LPG, Biodiesel, Coal Gas, Producer Gas, Propane Gas]) • By Power Rating (Upto25kVA, 25kVA-49kVA, 50kVA-99kVA, 100kVA-499kVA, and Above 500kVA) • By Application (Standby and Peak and Prime Mover) • By End-use Industry (Residential, Commercial, and Industrial) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Cummins Inc., Rolls-Royce plc, Atlas Copco Ltd., Generac Power Systems, Inc, Honda India, MAHINDRA POWEROL., Multiquip Inc., Greaves Cotton Limited., YANMAR HOLDINGS Co., Ltd., Huu Toan, HIMOINSA, Jakson Group, JIANGXI VIGOROUS NEW ENERGY TECHNOLOGY CO., LTD, Kirloskar, Kingsway Group, Yamaha Generators., Constant Power Solutions Ltd, KUBOTA Corporation, Sichuan Yatu Generator Manufacturing Co., Ltd. |

| Key Drivers | • Rapidly growing manufacturing sector in developing countries • Rising need to prevent noise pollution |

| Market Opportunities | • Increasing trend of distributed power generation • Increasing electrification in rural areas of developing countries |

The expected CAGR of the global Silent Generator Market during the forecast period is 5.5%.

The market size of the Silent Generator Market is USD 3.2 billion in 2023.

The major key players are Cummins Inc., Rolls-Royce plc, Atlas Copco Ltd., Generac Power Systems, Inc, Honda India, MAHINDRA POWEROL., Multiquip Inc., Greaves Cotton Limited., YANMAR HOLDINGS Co., Ltd., Huu Toan, HIMOINSA, Jakson Group, JIANGXI VIGOROUS NEW ENERGY TECHNOLOGY CO., LTD, Kirloskar, Kingsway Group, Yamaha Generators., Constant Power Solutions Ltd, KUBOTA Corporation, Sichuan Yatu Generator Manufacturing Co., Ltd.

North America region dominated the Silent Generator Market.

Rapidly growing manufacturing sector in developing countries, rising need to prevent noise pollution, increasing demand for silent generator, and fluctuating energy prices are the key driving factors of silent generator market.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 COVID-19 Impact Analysis

4.2 Impact of Ukraine- Russia War

4.3 Impact of Ongoing Recession

4.3.1 Introduction

4.3.2 Impact on major economies

4.3.2.1 US

4.3.2.2 Canada

4.3.2.3 Germany

4.3.2.4 France

4.3.2.5 United Kingdom

4.3.2.6 China

4.3.2.7 Japan

4.3.2.8 South Korea

4.3.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Silent Generator Market Segmentation, By Sound Level

8.1 Super Silent

8.2 Silent

9. Silent Generator Market Segmentation, By Type

9.1 Portable

9.2 Stationary

10. Silent Generator Market Segmentation, By Phase

10.1 Single Phase

10.2 Three Phase

11. Silent Generator Market Segmentation, By Fuel

11.1 Diesel

11.2 Natural Gas

11.3 Others (Petrol, LPG, Biodiesel, Coal Gas, Producer Gas, Propane Gas)

12. Silent Generator Market Segmentation, By Power Rating

12.1 Upto 25kVA

12.2 25kVA-49kVA

12.3 50kVA-99kVA

12.4 100kVA-499kVA

12.5 Above 500kVA

13. Silent Generator Market Segmentation, By Application

13.1 Standby and Peak

13.2 Prime Mover

14. Silent Generator Market Segmentation, By End-use Industry

14.1Residential

14.2 Commercial

14.3 Industrial

15. Regional Analysis

15.1 Introduction

15.2 North America

15.2.1 North America Silent Generator Market by Country

15.2.2North America Silent Generator Market by Sound Level

15.2.3 North America Silent Generator Market by Type

15.2.4 North America Silent Generator Market by Phase

15.2.5 North America Silent Generator Market by Fuel

15.2.6 North America Silent Generator Market by Power Rating

15.2.7 North America Silent Generator Market by Application

15.2.8 North America Silent Generator Market by End-use Industry

15.2.9 USA

15.2.9.1 USA Silent Generator Market by Sound Level

15.2.9.2 USA Silent Generator Market by Type

15.2.9.3 USA Silent Generator Market by Phase

15.2.9.4 USA Silent Generator Market by Fuel

15.2.9.5 USA Silent Generator Market by Power Rating

15.2.9.6 USA Silent Generator Market by Application

15.2.9.7 USA Silent Generator Market by End-use Industry

15.2.10 Canada

15.2.10.1 Canada Silent Generator Market by Sound Level

15.2.10.2 Canada Silent Generator Market by Type

15.2.10.3 Canada Silent Generator Market by Phase

15.2.10.4 Canada Silent Generator Market by Fuel

15.2.10.5 Canada Silent Generator Market by Power Rating

15.2.10.6 Canada Silent Generator Market by Application

15.2.10.7Canada Silent Generator Market by End-use Industry

15.2.11 Mexico

15.2.11.1 Mexico Silent Generator Market by Sound Level

15.2.11.2 Mexico Silent Generator Market by Type

15.2.11.3 Mexico Silent Generator Market by Phase

15.2.11.4 Mexico Silent Generator Market by Fuel

15.2.11.5 Mexico Silent Generator Market by Power Rating

15.2.11.6 Mexico Silent Generator Market by Application

15.2.11.7 Mexico Silent Generator Market by End-use Industry

15.3 Europe

15.3.1 Europe Silent Generator Market by Country

1.3.3.2 Europe Silent Generator Market by Sound Level

15.3.3 Europe Silent Generator Market by Type

15.3.4 Europe Silent Generator Market by Phase

15.3.5 Europe Silent Generator Market by Fuel

15.3.6 Europe Silent Generator Market by Power Rating

15.3.7 Europe Silent Generator Market by Application

15.3.8 Europe Silent Generator Market by End-use Industry

15.3.9Germany

15.3.9.1 Germany Silent Generator Market by Sound Level

15.3.9.2 Germany Silent Generator Market by Type

15.3.9.3 Germany Silent Generator Market by Phase

15.3.9.4 Germany Silent Generator Market by Fuel

15.3.9.5 Germany Silent Generator Market by Power Rating

15.3.9.6 Germany Silent Generator Market by Application

15.3.9.7Germany Silent Generator Market by End-use Industry

15.3.10 UK

15.3.10.1 UK Silent Generator Market by Sound Level

15.3.10.2 UK Silent Generator Market by Type

15.3.10.3 UK Silent Generator Market by Phase

15.3.10.4 UK Silent Generator Market by Fuel

15.3.10.5 UK Silent Generator Market by Power Rating

15.3.10.6 UK Silent Generator Market by Application

15.3.10.7 UK Silent Generator Market by End-use Industry

15.3.11 France

15.3.11.1 France Silent Generator Market by Sound Level

15.3.11.2 France Silent Generator Market by Type

15.3.11.3 France Silent Generator Market by Phase

15.3.11.4 France Silent Generator Market by Fuel

15.3.11.5 France Silent Generator Market by Power Rating

15.3.11.6 France Silent Generator Market by Application

15.3.11.7 France Silent Generator Market by End-use Industry

15.3.12 Italy

15.3.12.1 Italy Silent Generator Market by Sound Level

15.3.12.2 Italy Silent Generator Market by Type

15.3.12.3 Italy Silent Generator Market by Phase

15.3.12.4 Italy Silent Generator Market by Fuel

15.3.12.5 Italy Silent Generator Market by Power Rating

15.3.12.6 Italy Silent Generator Market by Application

15.3.12.7 Italy Silent Generator Market by End-use Industry

15.3.13 Spain

15.3.13.1 Spain Silent Generator Market by Sound Level

15.3.13.2 Spain Silent Generator Market by Type

15.3.13.3 Spain Silent Generator Market by Phase

15.3.13.4 Spain Silent Generator Market by Fuel

15.3.13.5 Spain Silent Generator Market by Power Rating

15.3.13.6 Spain Silent Generator Market by Application

15.3.13.7 Spain Silent Generator Market by End-use Industry

15.3.14 The Netherlands

15.3.14.1 Netherlands Silent Generator Market by Sound Level

15.3.14.2 Netherlands Silent Generator Market by Type

15.3.14.3 Netherlands Silent Generator Market by Phase

15.3.14.4 Netherlands Silent Generator Market by Fuel

15.3.14.5 Netherlands Silent Generator Market by Power Rating

15.3.14.6Netherlands Silent Generator Market by Application

15.3.14.7 Netherlands Silent Generator Market by End-use Industry

15.3.15 Rest of Europe

15.3.15.1 Rest of Europe Silent Generator Market by Sound Level

15.3.15.2 Rest of Europe Silent Generator Market by Type

15.3.15.3 Rest of Europe Silent Generator Market by Phase

15.3.15.4 Rest of Europe Silent Generator Market by Fuel

15.3.15.5 Rest of Europe Silent Generator Market by Power Rating

15.3.15.6 Rest of Europe Silent Generator Market by Application

15.3.15.7 Rest of Europe Silent Generator Market by End-use Industry

15.4 Asia-Pacific

15.4.1 Asia Pacific Silent Generator Market by Country

15.4.2 Asia Pacific Silent Generator Market by Sound Level

15.4.3 Asia Pacific Silent Generator Market by Type

15.4.4Asia Pacific Silent Generator Market by Phase

15.4.5Asia Pacific Silent Generator Market by Fuel

15.4.6 Asia Pacific Silent Generator Market by Power Rating

15.4.7 Asia Pacific Silent Generator Market by Application

15.4.8 Asia Pacific Silent Generator Market by End-use Industry

15.4.9 Japan

15.4.9.1 Japan Silent Generator Market by Sound Level

15.4.9.2 Japan Silent Generator Market by Type

15.4.9.3 Japan Silent Generator Market by Phase

15.4.9.4 Japan Silent Generator Market by Fuel

15.4.9. 5 Japan Silent Generator Market by Power Rating

15.4.9. 6 Japan Silent Generator Market by Application

15.4.9. 7 Japan Silent Generator Market by End-use Industry

15.4.10 South Korea

15.4.10.1 South Korea Silent Generator Market by Sound Level

15.4.10.2 South Korea Silent Generator Market by Type

15.4.10.3 South Korea Silent Generator Market by Phase

15.4.10.4 South Korea Silent Generator Market by Fuel

15.4.10.5 South Korea Silent Generator Market by Power Rating

15.4.10.6 South Korea Silent Generator Market by Application

15.4.10.7 South Korea Silent Generator Market by End-use Industry

15.4.11 China

15.4.11.1 China Silent Generator Market by Sound Level

15.4.11.2 China Silent Generator Market by Type

15.4.11.3 China Silent Generator Market by Phase

15.4.11.4 China Silent Generator Market by Fuel

15.4.11.5 China Silent Generator Market by Power Rating

15.4.11.6 China Silent Generator Market by Application

15.4.11.7 China Silent Generator Market by End-use Industry

15.4.12 India

15.4.12.1 India Silent Generator Market by Sound Level

15.4.12.2 India Silent Generator Market by Type

15.4.12.3 India Silent Generator Market by Phase

15.4.12.4 India Silent Generator Market by Fuel

15.4.12.5 India Silent Generator Market by Power Rating

15.4.12.6 India Silent Generator Market by Application

15.4.12.7 India Silent Generator Market by End-use Industry

15.4.13 Australia

15.4.13.1 Australia Silent Generator Market by Sound Level

15.4.13.2 Australia Silent Generator Market by Type

15.4.13.3 Australia Silent Generator Market by Phase

15.4.13.4 Australia Silent Generator Market by Fuel

15.4.13.5 Australia Silent Generator Market by Power Rating

15.4.13.6 Australia Silent Generator Market by Application

15.4.13.7 Australia Silent Generator Market by End-use Industry

15.4.14 Rest of Asia-Pacific

15.4.14.1 APAC Silent Generator Market by Sound Level

15.4.14.2 APAC Silent Generator Market by Type

15.4.14.3 APAC Silent Generator Market by Phase

15.4.14.4 APAC Silent Generator Market by Fuel

15.4.14.5 APAC Silent Generator Market by Power Rating

15.4.14.6 APAC Silent Generator Market by Application

15.4.14.7 APAC Silent Generator Market by End-use Industry

15.5 The Middle East & Africa

15.5.1 The Middle East & Africa Silent Generator Market by Country

15.5.2 The Middle East & Africa Silent Generator Market by Sound Level

15.5.3 The Middle East & Africa Silent Generator Market by Type

15.5.4 The Middle East & Africa Silent Generator Market by Phase

15.5.5 The Middle East & Africa Silent Generator Market by Fuel

15.5.6 The Middle East & Africa Silent Generator Market by Power Rating

15.5.7 The Middle East & Africa Silent Generator Market by Application

15.5.8 The Middle East & Africa Silent Generator Market by End-use Industry

15.5.9 Israel

15.5.9.1 Israel Silent Generator Market by Sound Level

15.5.9.2 Israel Silent Generator Market by Type

15.5.9.3 Israel Silent Generator Market by Phase

15.5.9.4 Israel Silent Generator Market by Fuel

15.5.9.5 Israel Silent Generator Market by Power Rating

15.5.9.6 Israel Silent Generator Market by Application

15.5.9.7 Israel Silent Generator Market by End-use Industry

15.5.10 UAE

15.5.10.1 UAE Silent Generator Market by Sound Level

15.5.10.2 UAE Silent Generator Market by Type

15.5.10.3 UAE Silent Generator Market by Phase

15.5.10.4 UAE Silent Generator Market by Fuel

15.5.10.5 UAE Silent Generator Market by Power Rating

15.5.10.6 UAE Silent Generator Market by Application

15.5.10.7 UAE Silent Generator Market by End-use Industry

15.5.11 South Africa

15.5.11.1 South Africa Silent Generator Market by Sound Level

15.5.11.2 South Africa Silent Generator Market by Type

15.5.11.3 South Africa Silent Generator Market by Phase

15.5.11.4 South Africa Silent Generator Market by Fuel

15.5.11.5 South Africa Silent Generator Market by Power Rating

15.5.11.6 South Africa Silent Generator Market by Application

15.5.11.7 South Africa Silent Generator Market by End-use Industry

15.5.12 Rest of Middle East & Africa

15.5.12.1 Rest of Middle East & Asia Silent Generator Market by Sound Level

15.5.12.2 Rest of Middle East & Asia Silent Generator Market by Type

15.5.12.3 Rest of Middle East & Asia Silent Generator Market Phase

15.5.12.4 Rest of Middle East & Asia Silent Generator Market by Fuel

15.5.12.5 Rest of Middle East & Asia Silent Generator Market by Power Rating

15.5.12.6 Rest of Middle East & Asia Silent Generator Market by Application

15.5.12.7 Rest of Middle East & Asia Silent Generator Market by End-use Industry

15.6 Latin America

15.6.1 Latin America Silent Generator Market by Country

15.6.2 Latin America Silent Generator Market by Sound Level

15.6.3 Latin America Silent Generator Market by Type

15.6.4 Latin America Silent Generator Market by Phase

15.6.5 Latin America Silent Generator Market by Fuel

15.6.6 Latin America Silent Generator Market by Power Rating

15.6.7 Latin America Silent Generator Market by Application

15.6.8 Latin America Silent Generator Market by End-use Industry

15.6.9 Brazil

15.6.9.1 Brazil Silent Generator Market by Sound Level

15.6.9.2 Brazil Africa Silent Generator Market by Type

15.6.9.3 Brazil Silent Generator Market by Phase

15.6.9.4 Brazil Silent Generator Market by Fuel

15.6.9.5 Brazil Silent Generator Market by Power Rating

15.6.9.6 Brazil Silent Generator Market by Application

15.6.9.7 Brazil Silent Generator Market by End-use Industry

15.6.10 Argentina

15.6.10.1 Argentina Silent Generator Market by Sound Level

15.6.10.2 Argentina Silent Generator Market by Type

15.6.10.3 Argentina Silent Generator Market by Phase

15.6.10.4 Argentina Silent Generator Market by Fuel

15.6.10.5 Argentina Silent Generator Market by Power Rating

15.6.10.6 Argentina Silent Generator Market by Application

15.6.10.7 Argentina Silent Generator Market by End-use Industry

15.6.11 Rest of Latin America

15.6.11.1 Rest of Latin America Silent Generator Market by Sound Level

15.6.11.2 Rest of Latin America Silent Generator Market by Type

15.6.11.3 Rest of Latin America Silent Generator Market by Phase

15.6.11.4 Rest of Latin America Silent Generator Market by Fuel

15.6.11.5 Rest of Latin America Silent Generator Market by Power Rating

15.6.11.6 Rest of Latin America Silent Generator Market by Application

15.6.11.7 Rest of Latin America Silent Generator Market by End-use Industry

16. Company Profile

16.1 Cummins Inc.

16.1.1 Market Overview

16.1.2 Financials

16.1.3 Product/Services/Offerings

16.1.4 SWOT Analysis

16.1.5 The SNS View

16.2 Rolls-Royce plc

16.2.1 Market Overview

16.2.2 Financials

16.2.3 Product/Services/Offerings

16.2.4 SWOT Analysis

16.2.5 The SNS View

16.3 Atlas Copco Ltd.

16.3.1 Market Overview

16.3.2 Financials

16.3.3 Product/Services/Offerings

16.3.4 SWOT Analysis

16.3.5 The SNS View

16.4 Generac Power Systems,Inc.

16.4.1 Market Overview

16.4.2 Financials

16.4.3 Product/Services/Offerings

16.4.4 SWOT Analysis

16.4.5 The SNS View

16.5 Honda India

16.5.1 Market Overview

16.5.2 Financials

16.5.3 Product/Services/Offerings

16.5.4 SWOT Analysis

16.5.5 The SNS View

16.6 MAHINDRA POWEROL

16.6.1 Market Overview

16.6.2 Financials

16.6.3 Product/Services/Offerings

16.6.4 SWOT Analysis

16.6.5 The SNS View

16.7 Multiquip Inc.

16.7.1 Market Overview

16.7.2 Financials

16.7.3 Product/Services/Offerings

16.7.4 SWOT Analysis

16.7.5 The SNS View

16.8 Greaves Cotton Limited

16.8.1 Market Overview

16.8.2 Financials

16.8.3 Product/Services/Offerings

16.8.4 SWOT Analysis

16.8.5 The SNS View

16.9 YANMAR HOLDINGS Co., Ltd.

16.9.1 Market Overview

16.9.2 Financials

16.9.3 Product/Services/Offerings

16.9.4 SWOT Analysis

16.9.5 The SNS View

16.10 Huu Toan

16.10.1 Market Overview

16.10.2 Financials

16.10.3 Product/Services/Offerings

16.10.4 SWOT Analysis

16.10.5 The SNS View

16.11 HIMOINSA

16.11.1 Market Overview

16.11.2 Financials

16.11.3 Product/Services/Offerings

16.11.4 SWOT Analysis

16.11.5 The SNS View

16.12 Jakson Group

16.12.1 Market Overview

16.12.2 Financials

16.12.3 Product/Services/Offerings

16.12.4 SWOT Analysis

16.12.5 The SNS View

16.13 Jiangxi Vigorous New Energy Technology Co., Ltd.

16.13.1 Market Overview

16.13.2 Financials

16.13.3 Product/Services/Offerings

16.13.4 SWOT Analysis

16.13.5 The SNS View

16.14 Kirloskar

16.14.1 Market Overview

16.14.2 Financials

16.14.3 Product/Services/Offerings

16.14.4 SWOT Analysis

16.14.5 The SNS View

16.15 Kingsway Group

16.15.1 Market Overview

16.15.2 Financials

16.15.3 Product/Services/Offerings

16.15.4 SWOT Analysis

16.15.5 The SNS View

16.16 Yamaha Generators

16.16.1 Market Overview

16.16.2 Financials

16.16.3 Product/Services/Offerings

16.16.4 SWOT Analysis

16.16.5 The SNS View

16.17 Constant Power Solutions Ltd.

16.17.1 Market Overview

16.17.2 Financials

16.17.3 Product/Services/Offerings

16.17.4 SWOT Analysis

16.17.5 The SNS View

16.18 KUBOTA Corporation

16.18.1 Market Overview

16.18.2 Financials

16.18.3 Product/Services/Offerings

16.18.4 SWOT Analysis

16.18.5 The SNS View

16.19 Sichuan Yatu Generator Manufacturing Co., Ltd.

16.19.1 Market Overview

16.19.2 Financials

16.19.3 Product/Services/Offerings

16.19.4 SWOT Analysis

16.19.5 The SNS View

17. Competitive Landscape

17.1 Competitive Benchmarking

17.2 Market Share Analysis

17.3 Recent Developments

18. USE Cases And Best Practices

19. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Power Distribution Component Market size was valued at USD 122.56 billion in 2023 and is expected to grow to USD 212.40 billion by 2032 with a growing CAGR of 6.3% over the forecast period of 2024-2032.

The Biorefinery Market size was valued at USD 153.07 billion in 2023 and is expected to grow to USD 296.31 billion by 2031 and grow at a CAGR of 8.61% over the forecast period of 2024-2031.

Circuit Breaker Market was valued at USD 17.03 billion in 2023 and is expected to reach USD 31.68 billion by 2032, growing at a CAGR of 7.28% from 2024-2032.

The Recloser Market size was valued at USD 1.1 billion in 2022 and is expected to grow to USD 1.67 billion by 2030 and grow at a CAGR of 5.3% over the forecast period of 2023-2030.

The Pipeline Pigging Services Market size was valued at USD 1.28 million in 2023 and is expected to grow to USD 2.15 million by 2031 and grow at a CAGR of 1.81% over the forecast period of 2024-2031.

The Hydrogen Storage Tanks and Transportation Market size was valued at USD 0.2 Billion in 2023 and is expected to grow to USD 6.0 Billion by 2031 with an emerging CAGR of 53% over the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone